|

Hi Heather,

Here’s my questions. I'm a single first time buyer, I have just under £10k deposit and i can borrow up to £200K based on some mortgage brokers.. is there any way I can borrow more money to buy a bigger house? What are your thoughts on the "helping hand mortgage" by Nationwide. Are there any other schemes for first time buyers? Second question, my plan is to use the house hacking method to save up faster in order to invest in more BTL properties. What’s your advice on house hacking and is it legal, do i need to inform the lender and would that make them more inclined to raise my interest rate? Third question, do I generally need both council and lender permission to change the structure to the house? Such as extension or loft conversion..etc? And how do I go about it.. where do I start? And are there any zone-ing regulations here in the UK as there is in the US? Finally, I am a foreign national here in the UK on a skilled worker visa, I've lived here for just over 5 years including a year in university, my credit score is very low due to the fact that I am not eligible to register for voting! I spoke to the council and they said they can't do anything. Is there anything I can do..? That's the only reason why my credit score is low. Thanks, Ahmed AND Hi Heather, I want to get into property investment but have very little capital. Is there any advice other than save to help buy properties with little to no capital? Your help is much appreciated. Shahid

0 Comments

When you’re at one point in your life it’s often nearly impossible to imagine having much more than what you’ve got – or maybe that’s just my lack of imagination – anyhow, in this podcast I recount the steps we went through to move from our £385,000 beautiful terraced home to a £1.1m detached bungalow in the same neighbourhood.

We did all this in 2020 but, even as recently as in 2017, when I walked past the homes on the street where we now live, I thought actually living in one of them was pure fantasy for us and at that point, it was. It took getting a proper second income, a stamp-duty holiday and an all-time low 5-year fixed interest rate of 1% to achieve this, oh, and a few consumer loans for a short period. Was it worth it, 100%. One thing I forget to mention in the episode is that one of the key drivers was I saw already expensive properties getting more expensive and mid-priced (like our terrace) to low-priced properties appreciating very little in value or even falling in price – how does that work? I am not sure but I figured there was some kind of bifurcation in the property market with average incomes driving prices on the lower end and something bigger at play with bigger, more expensive properties – they tended to be owned by business people not restricted by average incomes, some people with inheritances and hence large sums to play with and people with much larger incomes…whatever it was, I wanted in. The funny thing is, if we sold our new house right now, we would be in a position to buy our old house mortgage-free AND still have £200,000 to £300,000 in change ALTHOUGH our old house has gone up by about £30-40k! Listen to the episode and let me know if you have questions. Here’s my property course on Udemy.

If you’re over 55 and own your home outright or have significant equity, banks target you for equity release schemes. There are two types: lifetime mortgages and home reversion schemes.

With a lifetime mortgage you generally get a loan based on the value of your house and your age – the higher your home’s value and the older you are the bigger the loan you can get. Then, rather than pay interest monthly, compound interest is charged and accumulates without payment until your death at which point your house is sold to pay off the borrowed money and accumulated interest. Most lifetime mortgages have a ‘no negative equity’ clause which means you can lose the full value of your home if you live long enough but no more – there’s a sexy deal if I ever saw one! With home reversion you part-sell your home with a right to stay in it until you die or move to a car home. Typically, the loan is worth far less than the actual value of your home. So, if you own a £100k home you might be offered £30k for half ownership. Any increase in value is also shared 50-50. In this example, if the house doubles in value from £100k to £200k you’re only entitled to half, i.e. £100k. Most people who enter into these schemes are not fully aware of the risks and I don’t believe financial advisors and banks market them in an appropriate way. My personal opinion is that to go from owning your home outright to releasing equity, you introduce a potential stressor to your life that you previously didn’t have. Getting lodgers or letting rooms on AirBnb or even getting a part time job may well be able to address your financial issues more efficiently than releasing equity. Anyhow, in this episode, I talk about equity release. This is all information and not advice. If you need advice on specifics, speak to a personal financial advisor. Ask me a question.

To round up 2020, I thought some might like to learn a little more about me as an individual. And, because I prefer not to talk about myself I thought I'd share an interview that I had with Alex Sapala who invited me onto his show, the Business, Wealth And Mindset Podcast. Alex is one of the most successful and ambitious Malawians living in Britain today, he's made a massive success of himself in the work place and also with property investing but you would never know because he keeps himself humble.

Alex with Heather who shares her fascinating journey and discusses why she has chosen to be employed in a role that offers her flexibility and the time to undertake the hobbies she loves.

This is a great opportunity to hear from someone who experienced being employed and working for herself before making a conscious choice to be employed. It’s always vital to find out what makes you happy, what is the real you and how to achieve this in life. KEY TAKEAWAYS

BEST MOMENTS

VALUABLE RESOURCES ABOUT THE GUEST Heather Katsonga-Woodward Having spent 7 years in investment banking at Goldman Sachs (Corporate Finance) and HSBC (Corporate Derivatives Structuring) and a further 6 years pursuing her own business interests, Heather is currently a civil servant. She describes it as the best job she’s ever had. Heather is an investor in property, the stock market and as a hobby enjoys creating personal finance digital learning resources that can be found at katsonga.com and on the podcast, The Money Spot™️. Her courses on Udemy (on property and business) had attracted over 10,000 students as at 2020. Heather graduated with First Class Honours in Economics from the University of Cambridge. She has the CFA Charter, the ACCA accounting qualification and the Certificate in Mortgage Advice and Practice (CeMAP). She lives in Birmingham (UK) with her husband and two children. ABOUT THE HOST Alex is a prize-winning chartered accountant with experience in financial markets from trading finance, capital hedging, structural foreign exchange and interest rates to operational risk from the world’s top financial and advisory institutions including Deloitte, RBS and JPMorgan Chase Alex has been involved in property development programmes across different types since 2008, building and managing a portfolio that includes standard buy-to-lets, student accommodation and other houses in multiple occupancy (HMOs). He specialises in raising finance, providing potential investors, investors and joint venture partners with ad hoc (to their specific requirements), hands-free and hassle-free property investments solutions as well as coaching and mentoring Alex aspires to share business and financial knowledge with upcoming entrepreneurs and experienced business minds to learn and master the concepts and mindsets required to succeed, stand-out, have the edge and make a difference. Alex is also a keen traveller, cyclist and photographer. CONTACT METHOD My very best, Heather p.s. subscribe to my podcast and ask me any money question, HERE - do it now!

Building on the last post on 7 things that hold black children back from succeeding. This is the current Economic status of black people in the UK relative to other groups:

ASSETS

On home ownership According to .gov.uk:

On pensions assets: According to a January 2020 report by the People Pension, compared to White ethnic groups,

The average gap between a female pensioner from an ethnic minority group and male pensioner from white ethnic groups is 51% (half). This figure is 27% for an ethnic minority male pensioner. The average ethnic minority pensioner has £3,350 less in annual pension income. Ethnic minorities are also less likely to qualify for auto-enrolment into a work place pension because they are more likely to earn less than the auto-enrolment threshold of £10,000. INCOME According to gov.uk: In the year ending March 2019, the median annual household income in each quintile before housing costs were paid was:

If we look at the bottom two income quintiles, that is the lowest 40% of income earners,

These figures are before housing costs. The picture changes a little bit after housing costs but I chose to present the ‘before housing costs’ picture because there is a degree of discretion with regards to how much a household decides to spend on housing. While there are income disparities that will feed the gap between the assets of the rich and the assets of the poor, I feel as though the reasoning behind the asset differential is very basic and needs further exploration. On job security: Do ethnic minorities just work less and as a result earn less? No! According to gov.uk:

Based on these stats, the employment rate for black people is 8 points lower than the average for the population and 15 points lower than for Whites. In addition, it’s worth noting that Black people and other minorities are more likely to be self-employed, be on zero hours contracts and are generally more likely to be employed in less secure lower income jobs including as part of the gig economy. Two things stand out as definitely missing:

The UK doesn’t have an identical history to the US and certainly I don’t think UK mortgage lenders discriminate according to race directly or indirectly but if someone thinks they do, I’d love to hear their story. Remittances are a key component of economic growth in Africa. According to Pew Research, "money sent by the African diaspora to their home countries in sub-Saharan Africa reached a record $41 billion in 2017...a 10% jump in remittances from the previous year", another source suggests $46 billion was remitted in 2018, that would be the official figures but billions more are remitted via unrecorded channels. Official development aid to Africa was just shy of $52.8 billion in 2017 (OECD 2019 statistic). Provided this money isn't all being used for consumption, wealth accumulation by Africans is underestimated if we look purely at wealth held by the diaspora within the countries they live. In addition, after discussing the issue of low rates of home ownership with my African peers other factors to consider include:

Social mobility According to research from the University of Manchester,

FACTORS THAT COULD HOLD BLACK PEOPLE BACK When it comes to discrimination in the labour market, some of the same things that lead to targeting or discrimination in the formative years (as described in my previous post) can also adversely affect the likelihood of black people getting well paid jobs:

So there you have it. This is a summary of the current wealth and income stats for black people in Britain. I think it raises a lot of questions. I would love for people to contact me and leave a voice message or a note at katsonga.com/coach or as a comment on this post explaining what they think has helped them succeed or what they believe is holding them back from progressing to higher levels in their career and in building wealth. Heather p.s. subscribe to my podcast and ask me any money question, HERE - do it now!

Hey heather, thanks for your podcast, I find it incredibly useful because it's UK specific and everything else I find seems to be geared towards the US.

Anyhow, my name's Dee, I'm in my 50s and have been a military stay-at-home mum all my adult life although I went to university. Being a military wife has exposed me to so many countries and cultures which I love but you do sometimes encounter traumatic things so it's nice to settle in the UK. My family currently rents and all our adult children live at home including one that is dependent. We'd like to get on the property ladder but have been struggling with when and whether to do it. In the past I've left all the money stuff to my husband but now that the children are older I'd also like to start earning an income and I've been considering investment property. I want to gain some financial independence and I'd love to be able to help the children out financially. I am so ready to make up for the time I spent raising children. I don't know if it was stupid not to use my degree sooner but I guess better late than never. Keep helping with your posts! Thanks.

Hi D,

Thank you for this question that covers a very wide range of things. I am also very sorry that you have experienced something traumatic. Your life choices are not stupid, many women find themselves in circumstances that mean they have to stay at home with the kids for whatever reason so your question may well resonate with lots of other mums. Being in my mid to late 30s, you will forgive me for providing what might sound like a slightly optimistic review of your situation. Your question as it is framed requires me to speak to: 1.Providing for your children particularly the dependent child with medical needs; 2.Buying property as a home; 3.Buying property as an investment; 4.Earning an income for yourself; PROVIDING FOR YOUR CHILDREN By letting your adult children to stay at home rent free you are doing plenty. That alone should allow them to save for their own property deposits and is a financial boost many people including myself did not have. If I could have lived at home rent, free, that would have had me on the property ladder a lot sooner. The other thing you could do is direct them to read the type of personal finance books that will give them ideas for how they can be financially responsible so that you don’t need to worry about them. I recommend The Richest Man in Babylon and The Millionaire Next Door as good starting points. Does your child with medical needs financial support from you as well as general support for all their living? I won’t touch too much upon this except to say that make sure that you are accessing all the state benefits you can for the child’s support including the carer’s allowance if it is applicable. BUYING A HOME Firstly, as far as the UK is concerned I always advise that, if you get nothing else right, at least buy your own home. From your message, it’s not clear whether or not you and your husband discuss finances but I am guessing that this may not be the case. Firstly, I would try to get the two of you on the same page. Working as a team when it comes to building wealth can really supercharge your financial health. The UK property market is completely different to the US property market in so many ways so I’d be a little careful before taking advice on property from US authors and podcasters (lots of property advice on the internet tends to be US-focused that’s why I bring this up). To begin with the population density of the UK is 281 per Km2 (727 people per mi2); population density in the United States is 36 per Km2 (94 people per mi2). What does this mean? It means that UK property in many areas doesn’t see price crashes (too many people, too little land) and there is a propensity for house prices to be sticky upwards. In addition, because US mortgages are fixed for the full term of 25 years whereas UK fixed terms are only for 3, 5, 7 or 10 years, interest rates are much lower in the UK compared to the US (almost half). The result of this is that very often the interest you pay on your mortgage is much much lower than rent. As an example, I live on a street where the rents range from £1,200 to £1,500, however, the interest we pay on our mortgage is just £350 (it was a 25% deposit mortgage). The full monthly mortgage payment is almost £1,000 but everything above the interest of £350 is money that will come back to us if we sell our home. So, provided you can get a good deposit together, you will save a lot of money by buying a home rather than renting. In the long run owning where you live will give you a lot of security including the psychological comfort it provides. At 50-something, you are not too old to get a mortgage and may even be able to get a mortgage of 20+ years, however, if you owned property abroad and sold it when you left then it’s worth buying the home outright. State pension Another thing to consider with regard to your financial security is that even the full UK state pension only pays £175/week per person (about £759/month) this would be double for a couple. If you live in a home that’s been completely paid off, no mortgage, then you can survive on the state pension relatively comfortably. However, as you have lived abroad for many years you need to contact HMRC to see how many qualifying years you have. Your UK State Pension will be based on your UK National Insurance record. You need 10 years of UK National Insurance contributions to be eligible for any amount of the new State Pension and for people my age 35 years of credit are needed to get the full entitlement, you may be in the generation that only needs 30 years of credit. You may be able to use time spent abroad to make up the 10 qualifying years. This is most likely if you’ve lived or worked in:

I would contact HMRC as soon as possible (link above) and ask what you need to do or pay to increase your entitlement to the UK state pension. You may get National Insurance credits if you cannot work - for example because of illness or disability, or if you’re a carer or you’re unemployed. You might also be able to pay voluntary National Insurance contributions if you’re not in one of these groups but want to increase your State Pension amount. BUYING AN INVESTMENT PROPERTY I recently read David Tarn’s “The Complete No-Nonsense Guide to Becoming a UK Property Investor: The 1-2-3 on Property Investing” and found it useful on the topic. The author is based in the North of England where property is much cheaper. He is into buying property and letting out the whole house to a single group like a family – so, standard single let properties. In addition, I would recommend The Inside Property Investing podcast. There are over 300 episodes, if you binge listen to the episodes that appear interesting, you will move up the knowledge curve rapidly. The ‘Inside Property Investing’ podcasters are themselves heavily into High Multiple Occupancy properties (this is when you let a single property out to 3 or more unrelated people like students or professionals). However, the beauty of the podcast is that they regularly interview people on the show that follow a variety of different property investment strategies. Don’t pay for any overly expensive property course before you’ve gained all the knowledge that is available for free or almost free – a friend of mine recently paid £24,000 for a property course, she went 50-50 with her daughter and even had to put some of the cost on a credit card! You’ve been warned. For the basics on property investing I have a course up on Udemy for under £50. This will give you all the basic knowledge you need about the property buying process in the UK. EARNING There are many jobs out there. If you just want to boost your confidence and get some money rolling in there are plenty of jobs out there provided you are not too picky about the pay as long as you get your foot in the door. If you want to build a work life for yourself have a look on jobs boards at what’s going and start applying. If you want to build a career within a specific field related to your field of study consider taking a course to freshen up your skills. I have no idea what your salary expectations are but median UK income for 2020 is 30,800 according to the ONS. After tax that would bring home just over £2,000/month; if due to covid etc you secured a job with a salary of £24,000/year, that’s still £1,600/month which definitely isn’t shabby especially if your husband earns too. A GQ article gives an interesting breakdown on age, occupation and the covid-19 pandemic’s impact on earnings. I hope this helps. Far from thinking you are too old. I am feeling soooo excited for you. This is a fresh start and even over a 15 year period you can build an amazing life and financial cushion. Good luck.

Hi Heather,

My husband and I want to buy a house, how can we go about improving our credit score? Chrissy Hi Chrissy, This is an awesome question. I think lots of people come up against this issue at one point or another. Before I get into the detail, straight off the bat I’ll tell you what you don’t need to do, you don’t need to get a credit card. You can build excellent credit without a credit card despite what people say about needing a credit card to build a credit record and strong credit score. Now that I’ve got that off my chest let’s start from the beginning? Firstly, what is a credit score and what’s it trying to achieve? A credit score is a number that’s designed to be an indicator of your creditworthiness. This means that the credit score gives lenders an indication of how good you are at paying your debts and how likely you are to default and not pay them. Lenders only want to lend to people that are likely to repay that money and the credit score is an indicator of your likelihood to repay. Your credit score is built up using all the information a credit reference agency has collected about you over time especially over the last 6 years; information older than 6 years usually doesn’t weigh into your score. The credit reference agencies that you might have heard about are:

You can also go directly to Transunion or Crediva to get a credit report from but they don’t give you a score directly – they only do so via CreditKarma and checkmyfile, respectively. If you want to improve your credit score you need to know what your current score is so you can track it. You can’t improve something if you haven’t measured. Credit scores work in the following way:

How come ClearScore and CreditKarma are free?

Both make money by selling products to their customers. But, in my opinion, the way ClearScore goes about it could land you in unnecessary debt so I wouldn’t recommend them. Under the credit information, there’s a section on ClearScore that asks you “How can I improve my credit score” and one of their pointers if you don’t have a credit card, is that you get one. CreditKarma aren’t so brazen. I feel as though ClearScore keep my score artificially and strategically low to nudge me towards that credit card. So, if you do use ClearScore, know that even if you pay your debts on time, are current on all your bills and are essentially doing everything you should to be classified as financially responsible, you won’t get the top credit score if you don’t have a credit card. I am very anti-credit cards so I would never get one and this one aspect of ClearScore annoys me and stops me from using them. With all this knowledge about the agencies, this is what I recommend you do to improve your credit score: Firstly, get a CheckMyFile credit report and credit score. As I mentioned, CheckMyFile’s score is out of 1,000 and based on information from 4 agencies; you will be able to view a lot of the information that all 4 agencies hold on you. Second, I suggest you check your credit score only (not the credit report) at Experian. Experian have a service where you can view your score anytime for free but you won’t be able to see the full credit report under that service. Because you are getting an Experian report via CheckMyFile there is no need to get it directly from Experian too, at least not in the same month. The reason I am suggesting you get your Experian score (which is out off 999) is that I find their score very responsive to changes in your financial footprint. If you pay off debts and so on, the Experian credit score improves within a month or two and it’s actually possible to get a perfect Experian score of 999, I have had that several times. In my experience, Experian’s credit scoring system is the most legitimate and reliable. Make sure you unsubscribe from CheckMyFile before a month is up because they will start charging you £15 per month after that. This will mean you lose access to credit reports and the checkmyfile score but that’s okay because you will have the Experian score and to check your credit report on a regular basis, just use CreditKarma. The level of detail Credit Karma has is actually very impressive. They actually have financial details on my profile that Experian seem to have missed and yet, outside of the little bits of missing data, Experian is generally the most comprehensive. FYI, Experian is not paying me to say any of this. Okay, so what can you do to improve your credit score?

These are the things that will have a huge negative impact on your credit score:

In summary, what should you do to improve your credit score:

Hope this helps, Chrissy. Have a money question for me?

If you have any personal finance questions send them to [ME] – I will answer whatever piques my fancy via a blog post.

Q&A: If You Want To Diversify From Real Estate, Property & Land, What Should You Invest In?17/8/2016

Dear Heather,

Greetings from Chengdu, China; I love your vlogs and I enjoyed watching your birthing story and recent vlog on how to make money. You are so inspiring and motivating. You inspire me. On the recent vlog you discouraged investing on the stock market. Why was that? My husband and I have invested in properties in America and are looking at buying one in China since we will be here for the next four years. We have also been eyeing property in England. My question for you is since we want to diversify our portfolio from real estate and land what do you recommend? You have the cutest family and gorgeous son. My son is [] months and has been keeping me very busy. Looking forward to hearing from you when you have some free time. Best Regards, Faith

Dearest Faith

Thank you so much for your lovely email. I really appreciate everything you say, it keeps me motivated and keeps me wanting to work. Children do keep you busy but they're so enriching :). The first thing I thought when I received your email last week was, what on earth are you doing in Chengdu, China? (email me for privacy) I am always super intrigued re. what black people do when they’re in Asia but not studying…I’d love to learn more about that. Anyhow, back to property. Firstly, I hope you have made the very low investment in my property course, the price will go up soon so get in while it’s cheap! This is how I think about investing in general. Firstly, I am working towards a given gross rental income per month of £10,000 from a UK/Europe and US portfolio. We don’t currently have anything in Europe or the US but I’m eyeing both up. After mortgages are paid off 90-95% of this will be pure profit. I could easily reach this in the next three years if I include income from rents in Malawi but I discount that income because the country has a lot of political and economic instability and it’s possible that something could happen that completely erodes the rental income. Based on this methodology, we’re roughly half way. If you invest in China you might want to apply a discount too given they’re legal framework may not be as solid as that in the US or UK. That said, they are definitely much more stable than Malawi so invest away. Keep in mind that investing in real estate in different areas and countries is also diversification. There are four main reasons I find property so attractive:

1. Leverage magnifies returns

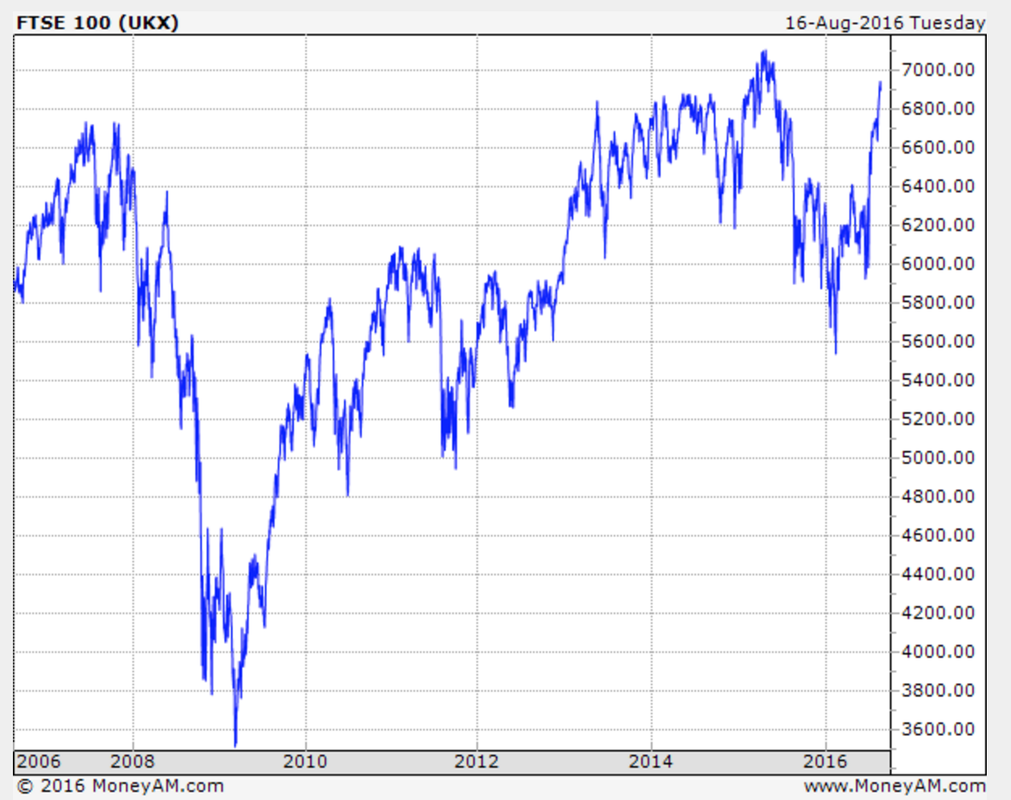

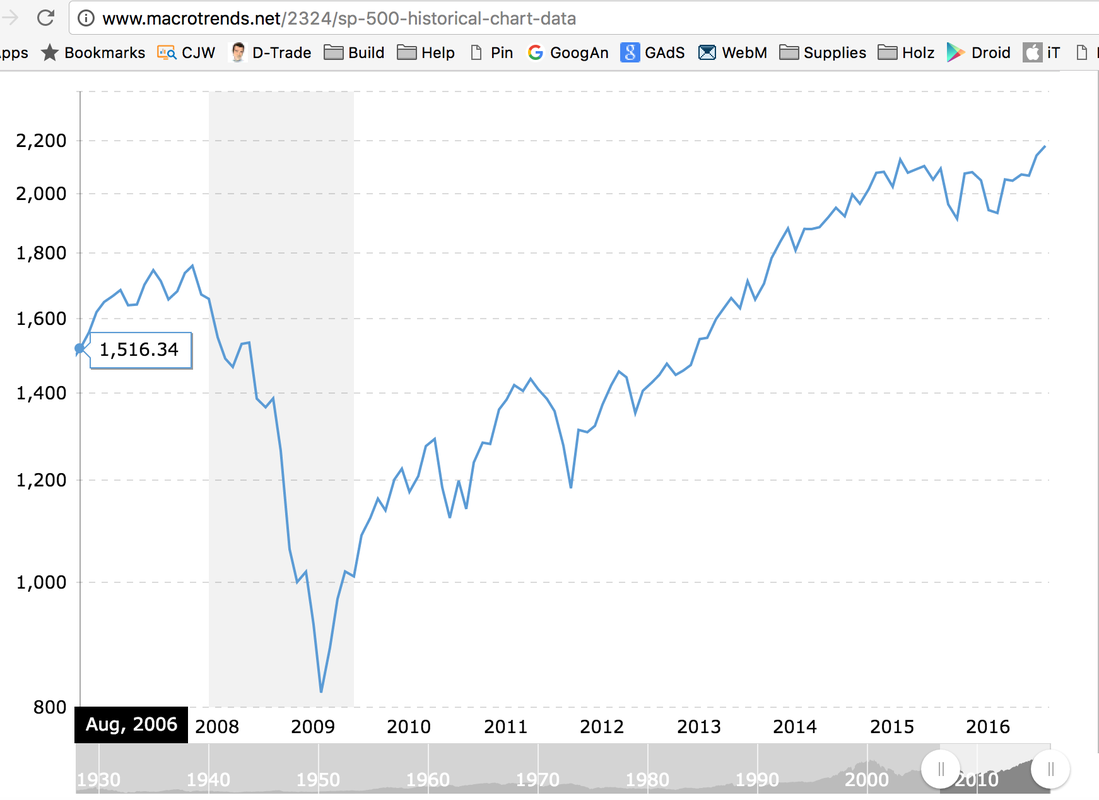

Just to give you an idea of what I mean. The first property I bought cost me £16,500 including a 5% deposit of £12,500. Stamp duty of £2,500 (this is a UK property purchase tax) and about £1,500 in other costs. That was 2006. Fast forward 10 years and the current value of £550,000 meaning a £300,000 capital gain and a gross equity value of £400,000 including what’s been chipped off the mortgage. No other £16,500 investment could have produced that kind of return for me. Firstly, no one would have given me cheap leverage to invest in the stock market and secondly, the returns would have been rubbish – to use a technical term. An investment tracking the FTSE100 would have me worse off; I’d have roughly the same £16,500 today eroded by 10 years of inflation. An investment tracking the S&P500 would have given me £23,700 today, 16,500 x (2178/1516), this is good but certainly far from £400,000. FTSE 100 from 2006 to 2016S&P 500 from 2006 to 2016

2. Reduced saving burden

We don’t spend rental income. This means after interest has been paid off, every month, my tenants are effectively saving for my retirement on my behalf. Currently, that’s about £2,000 worth of savings before tax. Very few investments can do that for you. 3. Easy release of value without impacting the investment I remortgaged this property and took out £80,000 to invest in a business. This doesn’t affect the property’s value in any way and isn’t taxable because it’s a loan not a sale of equity. If you sold some stock to get some money for another investment, firstly, you would have fewer shares so the overall value remaining would be lower and whatever you sold would potentially be subject to capital gains tax. 4. Stability Even accounting for short-term falls in value, property is very stable. Even if you don’t see an increase the value of your real estate investment you would still have the rental incomes. Provided you invest were there is demand for rental properties by tourists, students or families, you have secured an income for yourself in 25-years’ time if not immediately. Now, once I reach my target rental income of £10,000 what will I invest in? STOCK MARKET & ANGEL INVESTING

While I used to invest in single stocks in the past, I no longer do so as I think that long-term investing into diversified index funds is much, much wiser and definitely safer. This view has been informed by tonnes of reading and more experience in investing.

The next few paragraphs written in 2016 illustrate how I used to invest in 2006/7 when I was a newbie with zero experience - I no longer invest in this way but I share this anyway: When I used to invest in the stock market at the beginning of my working like (2005 to 2010), I had no education in investing and my methods were quite time consuming but the time spent made it feel less like gambling and more like investing: I’d download data on the main stock indices from Bloomberg (FTSE, S&P, Hang Seng, etc.) For each share I'd have the following data: 52-week high, 52-week low, P/E ratio, current price and other vital stats to try and identify a company that was undervalued. I’d also think of industries that I thought were growth industries and look at new companies in the sector. For instance, I once invested in a solar company and an Asian company because Asia and renewable energy were/are both growth areas. I sold my investment in the solar company (a German company called Phoenix Solar) when I tripled my money to £3,000. If I still had those shares they would be worth like £300 – the company is down badly. I sold my shares in Citic Pacific (the Asian company) in 2011 just about recovering my money and if I’d held on for 10 years, my £1,000 investment would be worth £750 – 25% down. Single stock investing is very risky especially if investing is not your full time job so you don't have time to go into great deal - reading annual reports and other regulatory filings. Citic Pacific from 2000 to 2016

I made a great investment in Apple in 2006. I sold when I had tripled my money. If I’d held on to my Apple shares until it hit its peak my £1,000 would have reached a £15,000 in value – kaching! That said, if I still had the shares they would be worth about £10,000 today because Apple is down from its peak.

I actually didn’t lose much money investing in the stock market. Citic Pacific and Yahoo were sold roughly were I bought them and Phoenix Solar and Apple were sold after tripling my money. The only complete loss was a bank called Northern Rock. I bought £1,000 when the share price was crashing in the belief that the UK Government wouldn’t let it fail. I was right, the UK Government didn’t let them fail but all shareholders lost all their money. Stock markets go up and down in an unpredictable fashion. This is why I prefer to have a base of rental income from property before dabbling in the stock market. However, if you are investing in the stock market for the very long term 10+ years, and also in well-diversified funds, I think it is a sensible place to keep money safe and earn a decent above-inflation return. BUSINESS

Finally, I invest time and money in creating businesses. Whilst business is also speculative there are many low risk businesses that can bring a stable income.

For example, creating courses online doesn’t cost too much money and once you recover the investment it’s fairly easy to maintain a steady income from the investment. With physical products you might invest more but if the investment fails you normally gain knowledge that will help a future business grow. Business is by nature speculative but the upside is fairly unlimited and you have more control over that upside than you would with an investment in shares. CONCLUSION

My personal strategy is to have enough retirement income coming from property to cover all my needs and some of my luxuries and the rest coming from my stock portfolio. So I focused my early investing on property and started diverting more savings into stock market indices when I was comfortable with the rental income we were generating.

In addition, I love writing, sharing knowledge and business in general so I pump lots of energy into these activities because I believe they produce a good return in the long run and even if they don’t, I thoroughly enjoy engaging in these activities.

Have a business or life question you want me to answer? send me a message.

Lots of scary statistics get thrown around regarding the negative retirement prospects for current 30-somethings (and even worse for those younger than us), so this week I’ve decided to dig deep. I’ll write a series of 3 articles on retirement: what do that the stats look like in the UK and the US and ultimately, what will it cost you to retire? I will not do an article on retirement stats in Africa because for the most part those statistics are VERY hard to come by. However, I found a fantastical article by the OECD that looks at Pensions In Africa. This is what I assume we all want to know:

When Do You Get A UK State Pension?The retirement age used to be 60 for men and 65 for women. It’s now been equalized to 65 for both. It’s moving up to 66 by 2020, 67 by 2028 and 68 by 2046. I’ll qualify to get a UK state pension at the age 68 in 2051 provided I’ve paid national insurance (NI) taxes or have NI Credits. You can calculate your own pension age here. What does this mean? Those of us that reach retirement age after 6 April 2010 need to have 30 “qualifying years” to get the maximum state pension and at least 10 qualifying years to get anything at all. If you don’t have a National Insurance record before 6 April 2016 you’ll need 35 qualifying years. Qualifying years are years in which:

For instance, if you work abroad or aren’t working for any reason you can pay voluntary contributions to ensure you qualify for a full state pension. I see this as a sort of backup insurance policy and I would definitely do it if I was working abroad. “If you reached the pension age before April 2010, then a woman normally needed 39 qualifying years, and a man needed 44 qualifying years during a regular working life to get the full state pension.” BBC What’s The Amount of The UK State Pension?If you are retiring on or after 6 April 2016 the full state pension you can get is £155.65/week, this is £8,094/year or £675/month. This amount is guaranteed by the government to rise by the higher of:

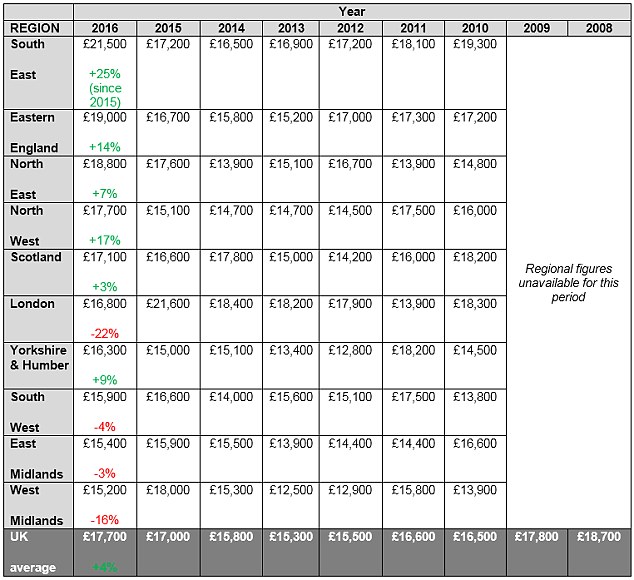

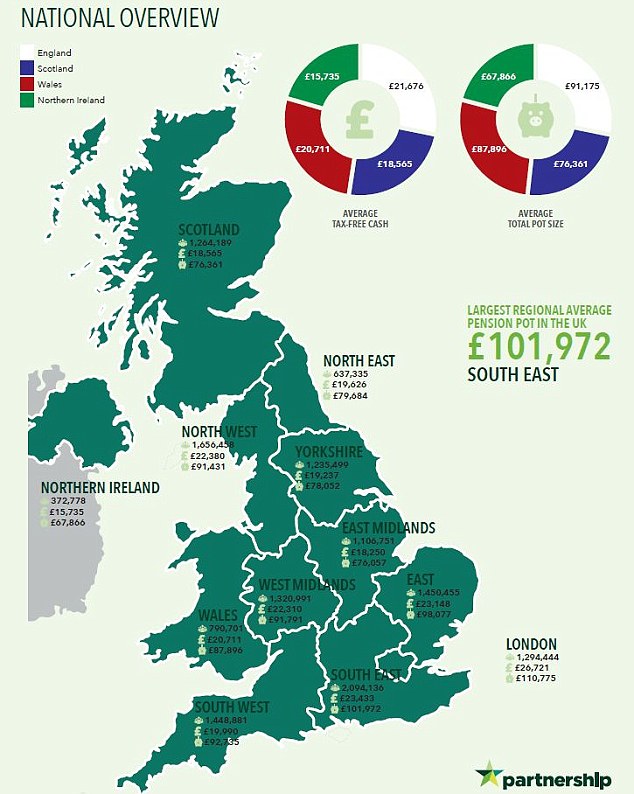

But, of course, government plans do change and this guarantee could fall away if the UK hits problems. There is a lot of press surrounding this possibility right now. How Much Does The Average Pensioner Actually Have In The UK?People retiring in 2016 expected income of £17,700 per annum according to a Prudential survey. They carry out this survey annually and the table below shows the results. This number is actually £1,000 lower than in 2008 but it’s been making a steady recovery: What Do The Pension Savings of Workers In The UK Look Like?According to Partnership the average UK pension pot stood at £87,724 in 2015. There is a lot of variance within the UK, with Essex having the highest pension pots, £125,478, and Shropshire the lowest, £44,336. Check out where your region stands using the image below. With compulsory workplace pensions now in effect pension savings should hopefully rise for a good majority of people. What Proportion Of Pensioners Own Their Home Outright? Property ownership is one of the key determinants of financial independence in old age. Here are stats from the 2011 census carried out by the Office of National Statistics:

The obvious advantage of outright home ownership when you are retired is that you save yourself what is usually a household’s biggest expense. Home ownership is almost necessary to guarantee a comfortable retirement because state pensions rules are changing all the time. Personally, I hope for the best when it comes to state pensions but I certainly won’t depend on the government to look after me in old age. Have a business or life question you want me to answer? Please email it to me with the subject “Question”. Note that all such questions will be answered as a blog post and will be sent to my full email list.

Want to start a business? Check out The Money Spot Program. References Basic State Pension Overview (gov.uk) State Pension Eligibility (gov.uk) State pension: The overhaul and you The pension pot map of the UK revealed Retirees in 2016 expect income of nearly £18k a year Home ownership and renting in England and Wales Number of UK working-age households drops for first time Pensions In Africa Your understanding of money and your friends’ understanding of money are likely to be totally different. Differing views on money, budgeting, investing and so on and so forth is exactly why some people get rich whilst other stay poor. It’s why some people are able to retire whilst other have to get a job at the checkout counter of their local supermarket once they’re too old to be wanted by anyone else but still need to make ends meet. Anyhow, I asked my friend, Oscar how he’d spend a million pounds to see if his answer would bare any resemblance to mine and it was completely different. He said he’d:

Only the investment in the studio is a sure-fire investment here. The money spent on artists is a gamble and of course the gift to his parents would never come back. I said I’d invest every single last penny on building a property portfolio that produced at least £5,000 of rental income per month. In my initial answer I said I’d look for about 6 properties that cost c.£100k each and produced £500 of income per month each. In addition, I’d look for 2 properties that cost c.£200k each and produced £1,000 of income per month each. Having thought about it long and hard I’ve decided I’d go for 5 properties that cost c.£200k each and produced £1,000 of income per month each because the revenue produced by small properties would quickly get chewed up by the fixed costs of managing them. I’ve invested in the stock market in the past and done quite well. However, I no longer believe that shares are a good investment because you can’t borrow money against them to increase your returns. The fact is, with property the returns are amazing because you can borrow against that investment and invest in even more property. After my £1million was fully and carefully invested I could just go to a bank and borrow up to £750,000. I could then invest that in more properties producing even more rental income. Overall, my goal is to own no more than 10 properties because I don’t want to be have to much debt plus I don’t want the hassle of managing an overly large portfolio so I’d probably borrow £500,000 only and stop there. That £500,000 would be invested in 5 more properties of £200k each with £100k of released equity and £100k of fresh mortgage debt. What would I be left with?

Annual costs would be:

That £10,000 set aside for maintenance would allow you to keep the portfolio in tip-top shape. Within that sum you could lease a car and few other borderline personal costs. Total fixed costs: £13,450 Total interest costs: £4,200 x 12 = £50,400 Total costs per year= £63,850 Profit per year: £120,000 - £63,850 = 56,150 I would use the full profit to pay down the £1million mortgage because I don’t need the income right now which means I’d have mortgage free portfolio in under 18 years, less if I didn’t use all the maintenance budget for maintenance. In fact, it would be much less than this because the interest costs would fall every year as I pay down the mortgage debt. At that point profits become £120,000 - £13,450 = £106,550. Probably more because rents tend to rise with time. Could the good husband and I live on this? Like kings! I’d generally let my properties out unfurnished because I’ve found that tenants that bring their own furniture are in it for the long haul. As for taking care of my parents, once the £1million was fully invested I’d take them on a huge holiday. My parents make very good money from their own property investments so they don’t need money from me. But, of course, it’s always great to get gifts from your children so I would send them amazing treats and gifts regularly. I’m good with money because they gave me all the money skills I need so that would be my thanks. Job done - |

Heather on WealthI enjoy helping people think through their personal finances and blog about that here. Join my personal finance community at The Money Spot™. Categories

All

Archives

September 2023

|

Heather Katsonga-Woodward, a massive personal finance fanatic.

** All views expressed are my own and not those of any employer, past or present. ** Please get professional advice before re-arranging your personal finances.

RSS Feed

RSS Feed