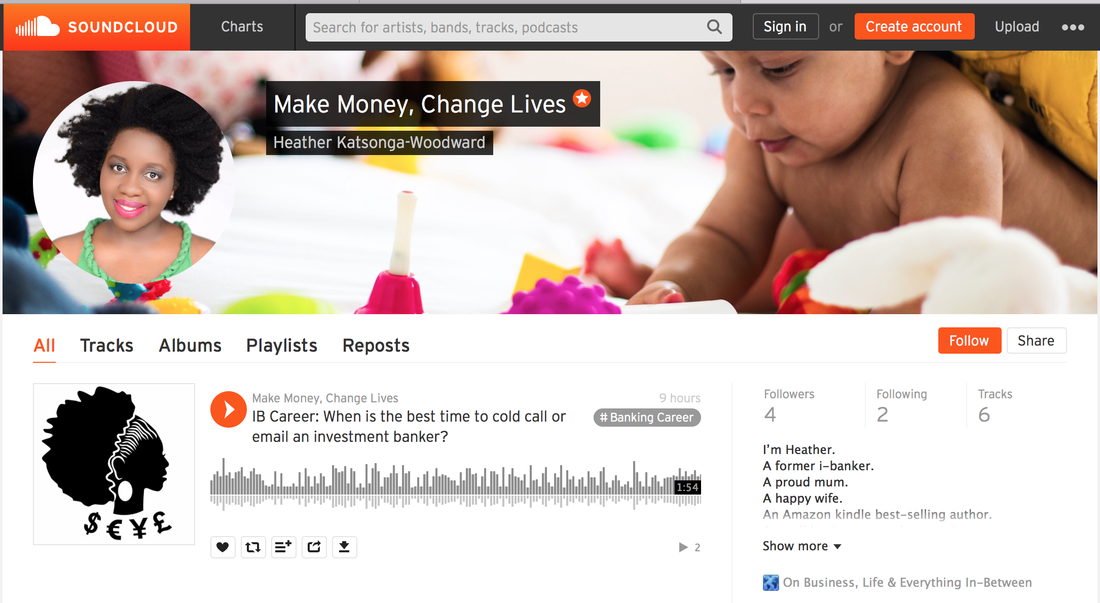

SoundCloud Is The Best Place To Upload Your Podcasts On The Internet. Why I Left AudioAcrobat.9/8/2016 I’ve been uploading podcasts online via AudioAcrobat since 2012 – that is a very, very, long time. I started using the site because an internet marketer I followed at the time recommended it and because I couldn’t find another more suitable platform, I went for it. I didn’t like AudioAcrobat from the start, if I’m honest; the site is slow and not user friendly. Audio Acrobat is also quite pricey. Their plans are:

I chose the Basic Plan, so, considering I joined in about June 2012 I’ve paid $1,050 (that’s £700-750) over those 4 years. One-freaking-thousand dollars. That is messed up, man. Anyhow, by comparison SoundCloud are charging me £75 a year paid upfront. I will have to be on SoundCloud for almost 10 years to pay them the same amount as I did to AudioAcrobat. The most annoying thing about AudioAcrobat’s basic plan is they add $1 to your bill whenever your views exceed your allowed bandwidth by 1GB but they have absolutely zero stats on what listenership looks like. I found that positively ridiculous. To make matters worse they don’t send monthly bills by email; they say their technology doesn’t allow for it, however, I suspect they want you to forget what a bucket load AudioAcrobat costs so they can keep on enjoying your hard-earned money. Call me cynical… Anyhow, last week my friend Fifi from California emails me to say she’s started a podcast – I checked it out and asked which host she was using: SoundCloud, she said. I check out the podcast on iTunes, then swoon over to SoundCloud and I’m like, this is such a fun site to use – where has it been all my life?! Actually, I’ve know about SoundCloud since June-2014 when I was interviewed on The Entrepreneur Dad Podcast but I didn’t spend much time looking at it. Don’t ask me why. To cut a long boring-ass story short, a week ago I started migrating my GirlBanker podcasts to SoundCloud and by this week I was pretty sure I’m not interested in AudioAcrobat anymore so I kicked their ass to the curb. I currently have five, yes you heard right, FIVE podcasts on iTunes. I’m stream-lining my content so I will be completely deleting two accounts and combining the info from three podcasts into one. Oh, and you know that thing about not getting AudioAcrobat bills by email? Well, I would have had absolutely no record of the invoices for tax purposes because as soon as I deactivated my account they locked me out despite the fact that I am a paid up user for two more weeks. Fortunately, because I know how rubbish they are I had saved all my invoices just prior to deactivating the account. IN CONCLUSION... If you want to get your stuff out there through podcasts, sign up to SoundClound. Unlike AudioAcrobat they also have a free plan. The only facility that AudioAcrobat has that SoundCloud does not appear to have is the ability to schedule podcasts to publish later. That was a good feature because it allows you to plan a whole month’s podcasts, say, then forget about it for a while. It’s a minor thing, however, as I’ve found the upload process to be fast and efficient. I won't take too much more of your time, though, there is a follow button below, hit it if you use SoundCloud then head to iTunes and subscribe. Have a business or life question you want me to answer? send me a message.

2 Comments

It’s so easy to take risks when you have very little to lose. However, when you’ve worked hard and accumulated a few resources you can stop yourself from growing even bigger because you’re too scared of losing the little that you have. I am going to stop talking in parables and cut straight through to the point with an example from my own life. When I started working at Goldman Sachs in 2005 I was in the awesome position of having no debt although I also had no money. By the time my first pay cheque arrived there was less than £100 in my bank account. That year, I saved like crazy and by the end of my first year workingI was able to buy my very first property.

Fast forward six years to 2012 and the property value had shot up to over £500,000 so I was sitting on a fair amount of equity especially as the debt had been paid down to about £210,000. To be quite honest, it made me feel rather wealthy and I didn’t want to lose it. I had by now rented out the property and the tenant was effectively paying down my mortgage very nicely. My mortgage interest rate was enviably low and monthly rental were MUCH higher; a very comfortable position to be in.  In early 2013 I realized I would need money to fund a project and getting a bank loan as a solopreneur in Great Britain is extremely difficult. My only options were to release equity in my home or in my first house. In early 2014 an estate agent told me they could easily sell my house for £575-600k. I loved the idea but selling was not an option at all as too much of the money would be eaten by taxes. When you have equity the most efficient way to release it is with a loan. You don’t have to incur the taxes. I avoided making the decision but by late 2012 property prices seemed to have slipped to about £525-550k. That was my wake up call. I made a major realization: If you sit on equity, especially equity trapped in a property, it could be there one day and gone the next. The most financially astute decision is to release it and re-invest in something else. Once you get the extra money via a re-mortgage that equity becomes real money that you can use and grow. The low interest rate made me want to keep the mortgage I had but that’s not a good enough reason because rental income is subject to taxation anyway. It isn’t always possible to get the mortgage you want but I learnt three key lessons:

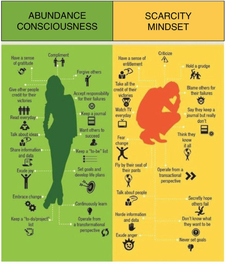

Do you think releasing equity from property and other wealth is crucial to building more wealth?  Want to Build a 6-Figure Beauty Business from the comfort of your sofa? Then my course is designed for YOU! "Beauty" includes a WIDE range of products from the not so obvious non-perishable foods and crafts to the more obvious hair, makeup, fashion, health & fitness.  One of the best things I did in 2014 was to invest in my personal development by taking part in Entrevo’s KPI Coaching Program: a 40 week program aimed at entrepreneurs looking to become a Key Person of Influence (KPI) in their field. The final module, Partnership, taught by Julia Langkraehr had a lot of thought triggering sentiments. There were many things I loved about the session but in the top 3 were the things she said about having an abundance mindset. In order to succeed in life you have to partner with people; it’s the only way if you want to succeed in a big way. The reason many don’t partner with others is that they are fearful of sharing and falsely believe that by sharing there will be less for them. This zero-sum-game philosophy can be eliminated in many ways:

In order to rise, lots of of people think they need to push others down. This is not just down to individuals but also big corporates and politicians. Instead of just highlighting their pros against the competition some take it a step too far and use underhand tactics to sabotage the competition – that’s a scarcity mindset. Anyhow, this discussion got me thinking about my high school days back in Malawi. I distinctly remember having the belief that I was only a great student if I had all the same resources as everyone else and still did better. Due to this point of view I made it a point to help anyone with their work if they asked.  Unfortunately, I was also acutely aware that some of my peers hated the fact that I did well and were not beyond sabotaging me. To protect myself I used to keep my folders in my locker instead of my food and clothes! The only thing that was worth protecting in my opinion was my school notes; everything else was replaceable – no one wants to get to exam week and find that their notes have been stolen. One thing teenagers don’t realize when they say cruel things to each other is that the things they say are remembered for a lifetime. The night before my final Further Maths A-level exam I recall lamenting in trepidation to one of my fellow A-level students. I was the only Further Maths student. The class had started off with 3 people but the other 2 had dropped out because they thought it was too hard. When all was said and done I got a grade B in Further Maths and 3 As in Maths, Biology and Chemistry. It was reported to me that the exact person who knew how nervous I was about the exam said, “It’s good she got a B in Further Maths, she was overconfident.” I always had an inkling that this person did not wish me well despite any help I gave to her. This one statement confirmed her character to me and well over a decade later I know I can never trust her. (And confirms that I do hold a grudge!) She very unfortunately has a scarcity mindset. Her smile is but a veneer. To work with her would mean I would have to be wary. In addition to having an abundance mindset yourself, surround yourself with people who think in the same way. Two heads really are better than one but they have to be the correct two heads. When you start out in business, look out for people you can partner with. Importantly, don’t be overambitious – if you have no email list and a very small social media following don’t get disappointed when those that have worked for ages to develop their own following ignore you when try to partner with them. You have to have something to bring to the partnership. If you have a great brand or a great product you can offer that. Growth takes a significant amount of hard work and time but eventually that hard work does pay off and the partnerships you attract because of it get better and better.  Want to Build a 6-Figure Beauty Business from the comfort of your sofa? Then my course is designed for YOU! "Beauty" includes a WIDE range of products from the not so obvious non-perishable foods and crafts to the more obvious hair, makeup, fashion, health & fitness. |

Heather on WealthI enjoy helping people think through their personal finances and blog about that here. Join my personal finance community at The Money Spot™. Categories

All

Archives

September 2023

|

Heather Katsonga-Woodward, a massive personal finance fanatic.

** All views expressed are my own and not those of any employer, past or present. ** Please get professional advice before re-arranging your personal finances.

RSS Feed

RSS Feed