|

Lots of scary statistics get thrown around regarding the negative retirement prospects for current 30-somethings (and even worse for those younger than us), so this week I’ve decided to dig deep. I’ll write a series of 3 articles on retirement: what do that the stats look like in the UK and the US and ultimately, what will it cost you to retire? I will not do an article on retirement stats in Africa because for the most part those statistics are VERY hard to come by. However, I found a fantastical article by the OECD that looks at Pensions In Africa. This is what I assume we all want to know:

When Do You Get A UK State Pension?The retirement age used to be 60 for men and 65 for women. It’s now been equalized to 65 for both. It’s moving up to 66 by 2020, 67 by 2028 and 68 by 2046. I’ll qualify to get a UK state pension at the age 68 in 2051 provided I’ve paid national insurance (NI) taxes or have NI Credits. You can calculate your own pension age here. What does this mean? Those of us that reach retirement age after 6 April 2010 need to have 30 “qualifying years” to get the maximum state pension and at least 10 qualifying years to get anything at all. If you don’t have a National Insurance record before 6 April 2016 you’ll need 35 qualifying years. Qualifying years are years in which:

For instance, if you work abroad or aren’t working for any reason you can pay voluntary contributions to ensure you qualify for a full state pension. I see this as a sort of backup insurance policy and I would definitely do it if I was working abroad. “If you reached the pension age before April 2010, then a woman normally needed 39 qualifying years, and a man needed 44 qualifying years during a regular working life to get the full state pension.” BBC What’s The Amount of The UK State Pension?If you are retiring on or after 6 April 2016 the full state pension you can get is £155.65/week, this is £8,094/year or £675/month. This amount is guaranteed by the government to rise by the higher of:

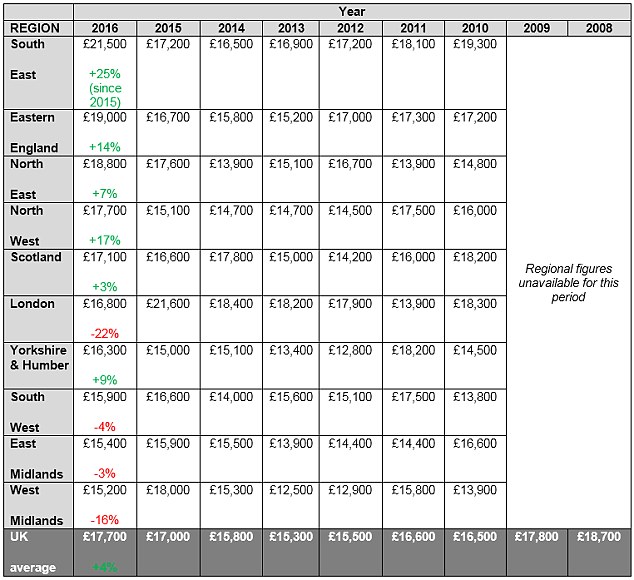

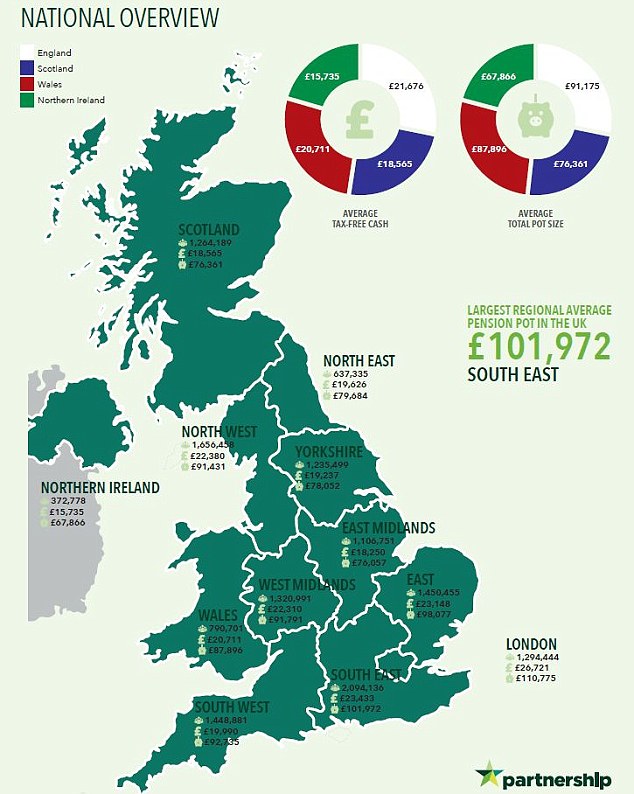

But, of course, government plans do change and this guarantee could fall away if the UK hits problems. There is a lot of press surrounding this possibility right now. How Much Does The Average Pensioner Actually Have In The UK?People retiring in 2016 expected income of £17,700 per annum according to a Prudential survey. They carry out this survey annually and the table below shows the results. This number is actually £1,000 lower than in 2008 but it’s been making a steady recovery: What Do The Pension Savings of Workers In The UK Look Like?According to Partnership the average UK pension pot stood at £87,724 in 2015. There is a lot of variance within the UK, with Essex having the highest pension pots, £125,478, and Shropshire the lowest, £44,336. Check out where your region stands using the image below. With compulsory workplace pensions now in effect pension savings should hopefully rise for a good majority of people. What Proportion Of Pensioners Own Their Home Outright? Property ownership is one of the key determinants of financial independence in old age. Here are stats from the 2011 census carried out by the Office of National Statistics:

The obvious advantage of outright home ownership when you are retired is that you save yourself what is usually a household’s biggest expense. Home ownership is almost necessary to guarantee a comfortable retirement because state pensions rules are changing all the time. Personally, I hope for the best when it comes to state pensions but I certainly won’t depend on the government to look after me in old age. Have a business or life question you want me to answer? Please email it to me with the subject “Question”. Note that all such questions will be answered as a blog post and will be sent to my full email list.

Want to start a business? Check out The Money Spot Program. References Basic State Pension Overview (gov.uk) State Pension Eligibility (gov.uk) State pension: The overhaul and you The pension pot map of the UK revealed Retirees in 2016 expect income of nearly £18k a year Home ownership and renting in England and Wales Number of UK working-age households drops for first time Pensions In Africa

0 Comments

Leave a Reply. |

Heather on WealthI enjoy helping people think through their personal finances and blog about that here. Join my personal finance community at The Money Spot™. Categories

All

Archives

September 2023

|

Heather Katsonga-Woodward, a massive personal finance fanatic.

** All views expressed are my own and not those of any employer, past or present. ** Please get professional advice before re-arranging your personal finances.

RSS Feed

RSS Feed