Hi Heather,

I want to earn extra income, however I work as a nurse in the NHS which takes up my time, do you have any suggestions on any investment that can make money. I am also interested in the stock market but don’t know where to start. I am interested in both generating extra monthly cash flow now and increasing the amount of money I have in retirement. Denise. Hi Denise, Thanks for this question. I love it because I have two nurses in my immediate family, my mother-in-law was a nurse for a long time and my cousin is still one now. Boosting current income

The, “how can I make a little extra cash now” question is one I asked myself quite recently because I wanted to put extra cash into our household ISAs. There are a few things you can do to boost your cash now:

1. Working extra shifts / locum shifts My mother-in-law says this is not a great idea because being a nurse is hard enough work, as it is. I agree that it is very demanding work but one of the great features of working at the front line of medical services is that you can actually make more money by working more hours, even temporarily. Some jobs don’t offer opportunities to earn more by working more, you’re paid a fixed annual salary and that’s it - no overtime. Overtime either goes uncompensated or is compensated as time back in lieu. You can sign up to a locum agency and do the same type of work for higher pay on your free days. If you want to really juice up your income you can even look at things like working a 4-day week in your regular NHS job (your NHS pension would therefore be lower) and work for a locum agency on the 5th day. The advantage with this strategy is that you will boost your income without working more hours because the hourly rate is higher as a locum nurse. If the extra income is invested wisely it could more than make up for the lower NHS pension. Also, keep your eyes open for higher paying promotions. 2. Do some extra work in another field. If you have another skill that you can monetise you can look into doing extra work in that field. So ask yourself, "what other skills do I have?" I'll give you an example from my own life: In my early 20s when I worked in banking the bonuses were not good one year and to make some extra money I slipped flyers into doors offering massages (for women only) at my house for £25/half-hour. I had someone sign up that very day. I had done a course in therapeutic massage at London College of Massage for fun and when I needed it, that skill helped me boost my income. I didn’t do it for long but it showed me that if I wanted to earn more money I could monetise other skills in my free time. There are some things you can do that don’t even need a new skill such as babysitting. You could sign up at childcare.co.uk or sitters.co.uk and your credentials as a nurse would be very attractive to people that needed a babysitter for nights out or weekends. You haven’t said whether or not you have childcare responsibilities of your own so I don’t know if this is possible for you. If you have skills that you can monetise online then list yourself on freelance websites like upwork or fiverr. There is a wide range of professions people hire for on these sites. I have used these sites myself to buy all manner of things including artwork, copy, copy editing and even voiceovers! Imagine that, all you’d need as a voice over artist is a microphone that records your voice clearly. Some people make serious money side-gigging on these sites. These first two options are not completely aligned with your question as you asked for “investments that you can make” but I decided to add them to give a fuller answer. 3. Invest in or produce products that make cash. Investing in something necessarily involves parting with money in the hope that you’ll earn even more money. You haven’t said how much money you have to invest so here are a few options. Can you make something that people would be interested in buying that you can sell on etsy, eBay, amazon or Facebook marketplace? Make a few samples of what you want to sell and list them on all these sites. I ran a product business myself for almost 6 years mostly using Amazon so I would recommend that you:

I would never discourage anyone from starting a business but having experienced it, I would tell you that it is very hard work. It involves a lot of long hours and is nothing like as glamorous as our culture makes being an “entrepreneur” sound. A business could consume absolutely every free moment you have – evenings and weekends. And all that time might not even produce a profit. Investing in a business comes with a lot of risk – stats vary depending on source, however, 80% to 90% of businesses fail in under 3 years. 4. Teach Could you make money teaching something online? You could create a course and list it on Udemy, Teachable or another similar site. This would take some time to produce well, in the first instance, then you would need to spend some money on marketing your course but you could keep the costs very low. Alternatively if you want to teach a GCSE or A-Level subject (High school level) or even a university course level, you can sign up to places like tutorful (previously, tutora). 5. Invest in property. If you have enough for at least a 25% deposit then it may be worth looking into property investment. Because interest costs on buy-to-let property are no longer fully tax deductible, (that means, you can’t subtract the interest payment from the rent you receive before calculating your tax bill), property is not as attractive an investment as it used to be. That said, if you can buy a place with cash, or if the property produces a high enough profit to clear the mortgage within a reasonable amount of time (I personally target 10 to 15 years) then it could be worth doing. Overall, the option you go for will depend on your risk tolerance and the amount of cash you have to invest. If you are relatively risk averse and don’t have cash to invest then working more to earn more will be more attractive. If you can tolerate some risk and do have some spare cash saved up, then investing in property will provide you with medium risk while investing in a business will be the higher risk option. Boosting retirement/future income

If you’re looking to boost future income then you have two main options:

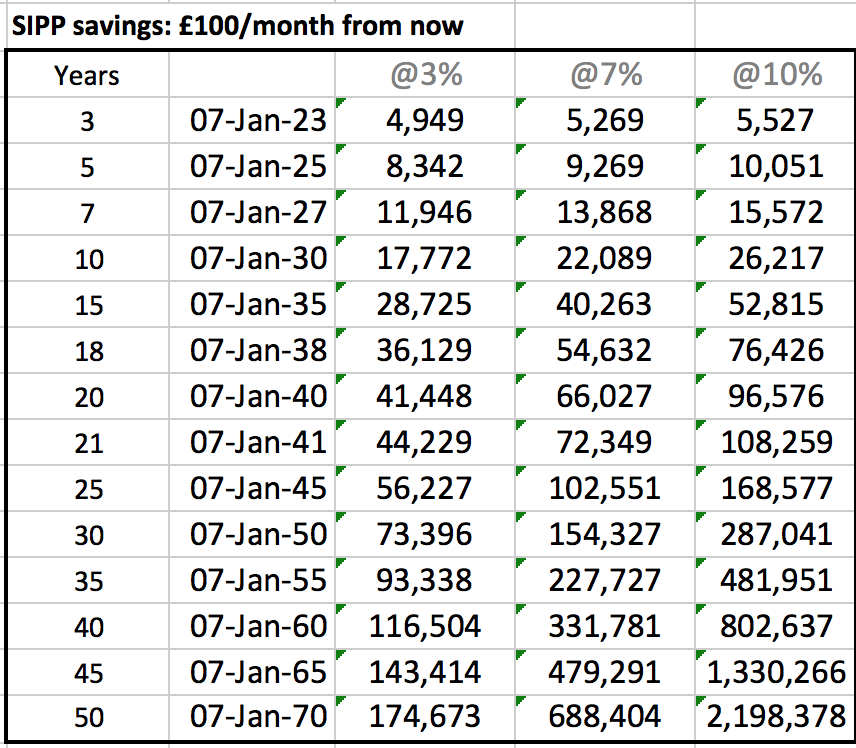

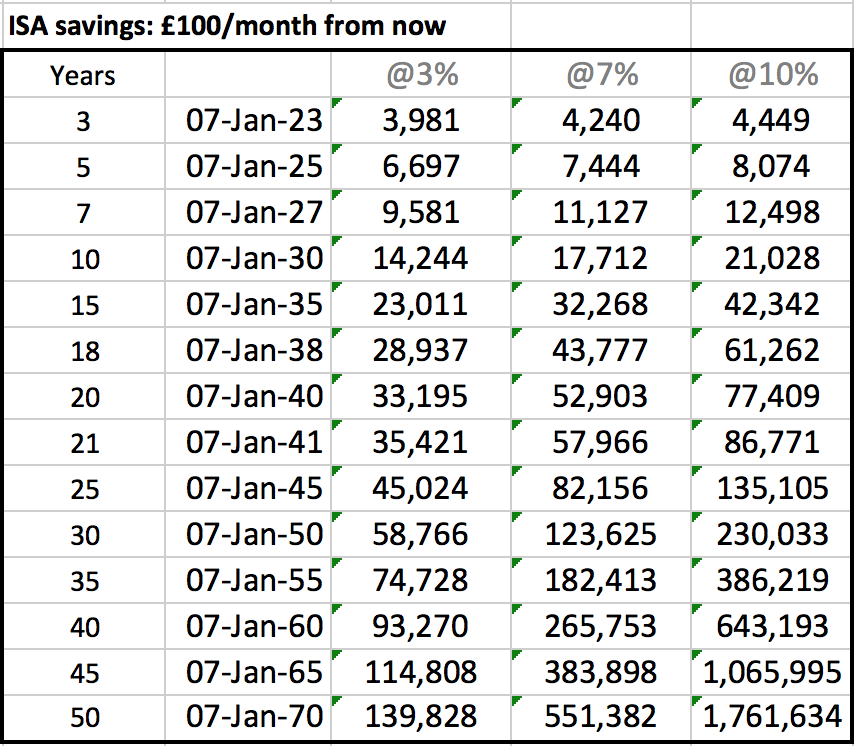

Property investing we've already talked about. The stock market provides a good return over long periods of time; most investment advisors would suggest an investment horizon of 5 years or more. Putting money into the stock market in the hopes of a good return in a year or less is gambling rather than investing, that's why I didn't offer it as an option when we were thinking through how to "boost income now". The most tax efficient options for investing the stock market are investing via an ISA or a SIPP. ISA are individual savings accounts and SIPPs are self-invest pension plans, they are a type of personal pension. If you invest the money via a SIPP then you won’t have access to that money until you are between 55 and 58 years old. The exact age will depend on your age and has been set at the state retirement age minus 10 years. The SIPP is a good option because for every £100 you put in, HMRC pay back £25 of tax and this saving is automatic. It is claimed by the SIPP provider and is shown on your investment account. The maximum you can put into a pension a year is £40,000 or your salary whichever is lower. So, if you earn £30,000/year you can put up to £30,000 into your pension without getting a tax charge. If you earn more than £40,000/year and haven’t reached the lifetime allowance of £1.055m, you can put up to £40,000 into your pension without getting a tax charge/penalty.

I will be writing several blogs on investing over the next few months that should hopefully build your confidence to make the move. In the meanwhile, you might find this useful: What platform should you use for investing and what should you invest in.

I hope this is helpful. Have a question? If you have any personal finance questions send them to [ME] – I will answer whatever piques my fancy via a blog post.

4 Comments

|

Heather on WealthI enjoy helping people think through their personal finances and blog about that here. Join my personal finance community at The Money Spot™. Categories

All

Archives

September 2023

|

Heather Katsonga-Woodward, a massive personal finance fanatic.

** All views expressed are my own and not those of any employer, past or present. ** Please get professional advice before re-arranging your personal finances.

RSS Feed

RSS Feed