|

Hi Heather,

My name’s Barry and I hate budgeting…it’s not so much the budgeting but tracking all my spending; it kind of sucks the joy out of life. I can’t stand having to think through how my money will be spent and not being able to buy what I want just because it wasn’t budgeted for – am I doomed to always be broke because I don’t budget? Do you have any suggestions for me?

Hmmmmm

Barry you raise a very interesting question. In fact, I had to think about whether I actually like budgeting myself or whether it’s just a habit I have got into over time. My answer is that I don’t think anyone loves budgeting or having to watch every single penny but when people see the benefits of operating a budget they get into. When you know your income will last until the next pay day because you’ve planned well you’re less stressed out about your finances. I have a certain friend who puts every single penny that he spends into a spreadsheet, well, it was a spreadsheet back in the day when he told me how he was managing his money, I hope he’s now found some reliable app for that purpose. When I saw his system of managing money I literally lost the will to live and that’s how I came up with what I call the “set and forget budget” or “loose budgeting” for my own money management. I love the quote "A budget is telling your money where to go, instead of wondering where it went." It was first said by John Maxwell but Dave Ramsey popularised it. Anyhow, rather than watch every single penny, the “loose budgeting method” involves creating spending buckets and allocating a fixed amount to each bucket with loose rules around how that money can be spent. If you do it properly, this “set and forget” way of managing money means you will only need to make changes monthly if your income changes a lot from month to month or annually if you are on a stable and fixed income. You might do it a little more frequently at the outset as you’ll need to tweak the different buckets until they are just right. But first, what is the point of the whole ‘set and forget’ budget? The objective, once you’re done dividing your cash into different buckets is to figure out your financial lane so that you can stay in it! You’ll know once done whether your finances can support a daily latte habit or a weekly shopping for clothes habit. You’ll know whether buying lunch every day when you work makes sense for you or not. Once you figure out what lifestyle your finances can support then you can start working building the habits that will help you reach your goals. Step 1: figure out total income after taxes and deductions Before you create the loose budget you need to figure out what you earn annually after tax, pension contributions and any other deductions such as student loan payments. Basically, figure what lands in your bank account. If you are paid a fixed wage this is relatively easy to calculate using listentotaxman.com. If you’re married and manage your income as a single unit, like my husband and I, you’ll need to add up the two incomes. Step 2: decide what will be saved the allocate the other buckets When you have total income deduct the total amount you want to dedicate to saving and the total to any other big expenses you want to commit to like school fees or buying a car. Once you’ve done this you’ll know what total is left for household spending and you’re ready to create buckets. You might need to tweak the savings amount if after doing this exercise you realise you’re over saving and haven’t left enough for household necessities or if you are under saving and could save more. This is what my household’s buckets look like, keep in mind that each bucket is for monthly spending and I track it in Excel because it’s convenient and because with the loose budget you don’t need to track spending so much. My husband and I manage our total earnings as one pot after deducting a little bit of pocket money that we each keep for personal hobbies and such like: Monthly Bills 1. Children’s saving This will be a bucket for some and not for others (podcast episode 2). 2. Your savings Once this is set you’ll set a standing order so that savings leave your account as soon as you are paid. 3. School expenses for yourself or children If you pay any sort of fees it’s best to pay the fees to another current account as soon as you’re paid. For example, if you pay fees 3 times a year spread the cost of fees out across several months so fees don’t come as a shock every time. 4. Mortgage This will be fixed based on your mortgage agreement. Our household rule is to keep mortgage payments low enough so that one person can pay them. So if you’re in a relationship, the loss of one job wouldn’t be devastating because payments are within the means of one earner. I also like Dave Ramsey’s rule of keeping payments to within 25% of household income based on 15-year repayment plan BUT I think a 15-year mortgage is not affordable for many people because the ratio of house prices to income in the UK has gone a little crazy; what might might be a better target is getting mortgage free by age 50 or 55. 5. Council tax This is fixed and unavoidable. 6. Water Pretty fixed and unavoidable if you're not on a meter but if you have a meter you can make cuts. Budget for the maximum water bill you expect. 7. Gas & Electricity Pretty fixed and unavoidable. Budget for the maximum energy bill you expect. 8. Homecare insurance I always have homecare insurance so that unexpected heating and plumbing leaks and breakdowns are covered. 9. Life Insurance or mortgage insurance If you have this it’ll be fixed. 10. Broadband This is relatively fixed but you should shop around for a cheaper deal at least once a year. 11. TV licence This is completely fixed. 12. Groceries Groceries includes food and any basic toiletries and household cleaning products. Set your groceries budget high enough that you can buy treats from the supermarket – by treats I mean the type of high quality foods that will help you avoid spending on takeaways or restaurants meals. Things you really like. It doesn’t make sense not to buy the £10 salmon that will feed a family of 4 and then go out to a restaurant and spend £40 or £50 to eat the same thing. That’s the definition of false economy. 13. Ad hoc expenses The ad hoc account is for annual expenses such car services, car tax, car insurance and MOTs. If you want to do any basic house improvements I would add that here and save up for the full cost. I also use this in case I "run out of money" before the end of the month, for example, because I bought too many things on Amazon which are not individually budget for. This is all the non-negotiable hard-to-cut-back stuff added to the budget. Savings can obviously be amended but if you set a realistic savings goals to begin with, you shouldn’t need to change that. 14. Transport This pot might have flexibility if you can choose between public transport and your own car. 15. Fuel To the extent that you make lots of non-work or childcare-related trips, this is flexible. 16. Cleaner This is the ultimate luxury and if you were strapped for cash would be an obvious thing you could cut out of your life. 17. Meals Out Based on how much money is left after all the important stuff this might have to be zero in some months. Before we had kids my husband and I spent a lot on eating out now we have months when not a penny is spent in eateries including coffee shops. 18. Memberships and subscriptions to magazines, newspapers, Amazon prime, Audible, Netflix, sky or virgin TV, etc. 19. Charity This is flexible in theory but in practice is hard to reduce. 20. Other stuff ... Clothes? Make-up Finally, once I have the total budget I add a cushion of £100 to £200 for unbudgeted expenses like a trip to B&Q for mould remover or household things like spoons all disappearing, you know - life happens! This exercise would get tedious if you were trying to do it all the time but as a one-off it can be quite fun. I have found the money dashboard app helpful for getting an overview of what I spend in various areas. Maybe it can help you too. Once you've done this exercise it will hopeful draw out where you can cut expenses and hopefully it might bring any bad spending habits to light. Because the British tax year goes from April to April I usually pay closest attention to my budget just before the tax year and in November as I prepare for Christmas because that's when i am most likely to lose it with my spending. I hope this helps, Barry. Have a money question for me?

If you have any personal finance questions send them to [ME] – I will answer whatever piques my fancy via a blog post.

0 Comments

Hi Heather,

I’m Melissa. As a full-time entrepreneur myself, I often find a difficulty in deciding how much monthly income to re-invest into my business and not OVERDO IT. This reminds me of why I often lose at the board game "Monopoly", ha! Because I'll spend every last dollar on buying up houses and hotels and when I fall on someone else's property, I don't have the money to pay them. And it's a downward spiral from there, haha. Anyway... I'm sure you know just as well as I do that our businesses are our babies and sometimes we think we aren't feeding them enough to grow as fast as they can. But at times, over-investing can cause immediate problems. What should I do to find a balance between re-investing as a business owner and putting money aside?

Hi Melissa,

The trick to answering this question is uncovering what your goals are for the business and what your goals are for your private life. This will both allow you to decide how much to take out of the business and also when to exit the business, if ever. I ran my own business from 2012 to 2017 and I had to answer this question myself. In the first year of the business I earned very little but I had saved over GBP60,000 because I knew I wouldn't make money from the get go. This is the reality for most businesses but from your question it sounds like you are past this stage and have some cash coming in, well done! You've gone past the first hurdle. So, what kind of business are you running?

I’ll define the three categories: The Lifestyle Business A lifestyle business to me is one where you want to earn enough to support all your needs and a good portion of your wants. You don't hire too many permanent staff - perhaps you have a couple of virtual assistants - for your social media and bookkeeping and use freelancers for everything else. The 'grow and sell' business With a ‘grow and sell business’ you’re a little more focused on the business than on yourself so you’re a little more willing to “suffer” for a period of time by cutting off all wants and just extracting enough for your needs because the business comes first. You want to get a consistent level of year-on-year growth and you want to track several observable metrics that will make it easier to sell your business in a time frame which you set. Sales numbers are the best metric to track but even social media statistics can be something worth measuring: healthy email lists, social media accounts with real followers, that kind of thing. The legacy business A legacy business is one that has to satisfy your income requirements for a prolonged period of time with a view to passing the business on to your children or selling far in the future if your children are not interested in running a business. Once you’ve decided the type of business you’re running, then you need to go through the following process: 1. Figure out how much cash your business needs every month? This is your, “monthly cost of operations” Some people think running an online business is virtually cost free but you and I both know it isn't so. Sit down and calculate the minimum amount of cash the business needs to have just to keep chugging along. This should include the cost of all your tools: email marketing software, social media software, graphics tools, website hosts, budget for freelancers and other staff costs, advertising! Back in 2012 when I started my business you could get a decent level of exposure for free, Facebook posts on pages were actually shown to people that had liked the page and you could monetise that exposure. Nowadays you have to spend money to get even low levels of exposure. You probably also need a budget for taking courses that will help you grow your business. The marketing techniques that work are constantly changing and you will need to keep on top of marketing intelligence to grow your business. So, it really is worth sitting down to figure these costs out. Once you have the number, you’ll know the minimum level of money you need to leave in your business bank account every month. Divide annual costs by 12 so that you have a reliable monthly cost of operations figure. 2. Figure out how much you need to live. This is your “monthly cost of living” If you are fortunate enough to have your living costs mostly met by your parents or your partner then this won't be a large number. My husband supported us for a good portion of my self-employment but I paid myself enough to cover my lifestyle costs: beauty products, going to cafes with friends, clothes, that type of thing and when we had our son, I made sure that the business covered his nursery costs too because the only reason he was going to nursery was because I needed to work. Ultimately, this meant I took out about £600/month to cover four half-days of nursery each week and £670/month for myself. The amount I paid myself wasn’t random: my accountant set my wage level just low enough not to have to pay national insurance tax. You will have to consider the tax impacts for yourself. That threshold moves every year. You could pay yourself more through dividends but speak to an accountant to get the balance right because if you pay dividends too often the taxman could say it looks like a salary and should therefore be taxed at the higher earned income tax rates. If you can live on less than the sort of figure I am suggesting, even better. If you're not living in a supported situation and have to pay all your own bills then this number could be much larger. So, having done steps 1 and 2 you will know the minimum amount you need to keep the business going and plus the minimum amount the business needs to make to keep you going too. Is your business producing at least this much? I hope so. 3. How much do you want to save? The next step is one I regret not having given enough focus when I was self-employed. I didn't save much at all for the household in that entire time. In fact, the only person that built up any savings is our son who had about £12,000 by the time I ditched the business and went back to work. In fairness, the business was not making enough for me to save but if I think back I could probably have managed to put away £300-500/month for the family if I really wanted to. I didn't suddenly start earning more when my son was born so the fact that we managed to find over £300/month to grow his savings shows the money was there. To decide on the ideal amount of money to save every month, project how much money you want to have at the age when you want to retire then using an online retirement calculator to figure out how much you ought to be saving every month. I found a good UK pension calculator on PensionBee.com and a good US retirement calculator on vanguard.com.

If you are running a lifestyle or legacy business and the business is generating not only enough to support operations but enough to save and live. Fab!

So, how's this different for a 'grow and flip' business? If you are building a 'grow and flip' business then I wouldn't worry too much about the savings elements. If you can sustain operations and yourself then you can continue running the business and ploughing all excess money back into it in the hope that you will sell the business for a good lump-sum in say, 5 to 7 years. Because this is a higher risk strategy you need to decide when you will quit the business. You can't continue running a business that doesn't allow you to put money into savings and investments indefinitely. You need to decide for yourself the point at which you will decide it isn't work. In summary: What you take out of the business depends on: 1. What the business needs to keep going. 2. What you need to live. 3. What you need and want to save. To attach some numbers to this discussion: Example 1 If your business is generating at least £1,500 every month (for example purposes) and it needs £800 to just keep moving then there's £700 left for you to either take for yourself or re-invest in the business. If £700/month isn't enough to meet your living costs then you need to figure out how long your savings can support you while you give the business a chance to grow. Example 2 If your business is generating at least £5,000 or more every month and it needs £1,000 per month to sustain operations and you need another £2,000 for yourself then there's still £2,000 to play with. In this scenario, even if I was running a 'grow and flip' business I would save to hedge myself against the risk that my business isn't sellable. A final thought. Ultimately, I left my business because it produced lower profits than I could earn in "regular job" and fortunately for me, I discovered that I actually love the routine of going to work and communing with my colleagues. If over a two to three year period the business is generating you, say, £30,000/year and you know you could earn £50,000, £60,000 or even £100,000/year working, have a deep think through whether the long hours of building the business are worth it. Many glamorise entrepreneurship but we both know the hours can be long and hard and the returns inconsistent from month to month and year to year. For knowledge workers (Economists, lawyers, researchers etc. – desk-type jobs), the in-work flexibility is unreal nowadays and you could pretty much set up your life to be more flexible than an entrepreneurial life, with much more free time and real holidays where you actually leave your laptop at home! Sorry if any of this last bit sound discouraging but I promised myself that when I blog about business I will always give people a real sense of what it's like. There are enough blogs out there pretending every 'trep is a millionaire when the reality is that the average self-employed person in both the UK and the US earns less than the average worker – shocking, right? Hope this helps, Melissa. Have a money question for me?

If you have any personal finance questions send them to [ME] – I will answer whatever piques my fancy via a blog post.

Hi Heather,

My husband and I want to buy a house, how can we go about improving our credit score? Chrissy Hi Chrissy, This is an awesome question. I think lots of people come up against this issue at one point or another. Before I get into the detail, straight off the bat I’ll tell you what you don’t need to do, you don’t need to get a credit card. You can build excellent credit without a credit card despite what people say about needing a credit card to build a credit record and strong credit score. Now that I’ve got that off my chest let’s start from the beginning? Firstly, what is a credit score and what’s it trying to achieve? A credit score is a number that’s designed to be an indicator of your creditworthiness. This means that the credit score gives lenders an indication of how good you are at paying your debts and how likely you are to default and not pay them. Lenders only want to lend to people that are likely to repay that money and the credit score is an indicator of your likelihood to repay. Your credit score is built up using all the information a credit reference agency has collected about you over time especially over the last 6 years; information older than 6 years usually doesn’t weigh into your score. The credit reference agencies that you might have heard about are:

You can also go directly to Transunion or Crediva to get a credit report from but they don’t give you a score directly – they only do so via CreditKarma and checkmyfile, respectively. If you want to improve your credit score you need to know what your current score is so you can track it. You can’t improve something if you haven’t measured. Credit scores work in the following way:

How come ClearScore and CreditKarma are free?

Both make money by selling products to their customers. But, in my opinion, the way ClearScore goes about it could land you in unnecessary debt so I wouldn’t recommend them. Under the credit information, there’s a section on ClearScore that asks you “How can I improve my credit score” and one of their pointers if you don’t have a credit card, is that you get one. CreditKarma aren’t so brazen. I feel as though ClearScore keep my score artificially and strategically low to nudge me towards that credit card. So, if you do use ClearScore, know that even if you pay your debts on time, are current on all your bills and are essentially doing everything you should to be classified as financially responsible, you won’t get the top credit score if you don’t have a credit card. I am very anti-credit cards so I would never get one and this one aspect of ClearScore annoys me and stops me from using them. With all this knowledge about the agencies, this is what I recommend you do to improve your credit score: Firstly, get a CheckMyFile credit report and credit score. As I mentioned, CheckMyFile’s score is out of 1,000 and based on information from 4 agencies; you will be able to view a lot of the information that all 4 agencies hold on you. Second, I suggest you check your credit score only (not the credit report) at Experian. Experian have a service where you can view your score anytime for free but you won’t be able to see the full credit report under that service. Because you are getting an Experian report via CheckMyFile there is no need to get it directly from Experian too, at least not in the same month. The reason I am suggesting you get your Experian score (which is out off 999) is that I find their score very responsive to changes in your financial footprint. If you pay off debts and so on, the Experian credit score improves within a month or two and it’s actually possible to get a perfect Experian score of 999, I have had that several times. In my experience, Experian’s credit scoring system is the most legitimate and reliable. Make sure you unsubscribe from CheckMyFile before a month is up because they will start charging you £15 per month after that. This will mean you lose access to credit reports and the checkmyfile score but that’s okay because you will have the Experian score and to check your credit report on a regular basis, just use CreditKarma. The level of detail Credit Karma has is actually very impressive. They actually have financial details on my profile that Experian seem to have missed and yet, outside of the little bits of missing data, Experian is generally the most comprehensive. FYI, Experian is not paying me to say any of this. Okay, so what can you do to improve your credit score?

These are the things that will have a huge negative impact on your credit score:

In summary, what should you do to improve your credit score:

Hope this helps, Chrissy. Have a money question for me?

If you have any personal finance questions send them to [ME] – I will answer whatever piques my fancy via a blog post.

What's the point of saving? What's the point of saving?

Hi Heather,

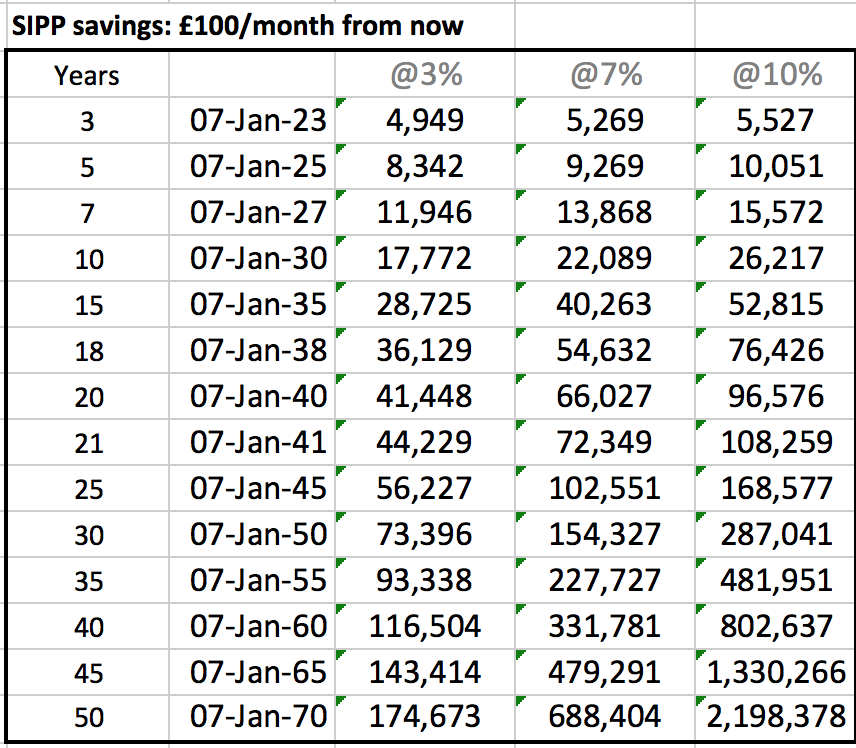

Based on the things you told us about investing, my husband and I started putting £125 per month each into our SIPP pension. I hope this isn’t a silly question but what are these savings for? When can we expect to start spending that money and should we try to spend it in specific ways or on specific things? Both my husband and I are 30, we don’t plan on having children and our jobs have fixed pension benefits. Thanks Flora Hey Flora, That’s a great question. While everyone has a different value system, there are two main reasons that I strongly recommend that people put money into a self-invested pension plan or SIPP a) flexibility and b) security including funds to help pay a mortgage off early. A SIPP can be better than a stocks and shares ISA, in some cases, because you effectively pay less tax and because you can’t use the money until you are about 58 so it forces you to save. Let’s talk about each reason in turn: The first reason: is flexibility over when to retire In the past, a lot of work-based pensions (aka defined benefit pension plans) used to allow early retirement from between the ages of 55 and 60, most of these type of scheme are being completely phased out and are instead being linked to the state retirement age which for you is currently expected to be 68. There is talk of moving this to age 70, so this is a future possibility. Whatever happens, the funds that you build up in your SIPP can be taken from 10 years before the state retirement age. This means if the state retirement age moves to 70 you will still be able to use money that’s sitting in your SIPP from the age of 60. If you and your husband are putting £125 each into a SIPP then when you are 55 years old, you and your husband’s combined pot of savings would be worth £135,000 if the pot of money only grows fast enough to keep up with inflation of about 3%; if you get growth equivalent to the average stock market return of 7% then you would have £250,000 at the age of 55 and if you get an average stock market return of 10% you would have £410,000 saved up. At age 60 the figures would be £180,000 @ 3%, £375,000 @ 7% and £700,000 @ 10%. These sort of returns aren’t cuckoo. According thebalance.com, “the S&P 500 Index, delivered its worst twenty-year return of 6.4% a year over the twenty years ending in May 1979. The best twenty-year return of 18% a year occurred over the twenty years ending in March 2000.” Various sources suggest the S&P 500 has returned 10% before inflation if you buy and hold the money you invest into it. But of course, it’s useful to remember that this past success doesn’t guarantee that future returns will be as good. Right now you would struggle to find a bank account that gives you an interest rate of 1.5%. Back to flexibility on when you retire, however, unless you believe the US has no room for growth, then this total of £250/month you are saving could amount to a lot of money over a 25 to 30 year period and this would allow you to retire with a decent income well before the state retirement age. If your mortgage is fully paid off by the time you retire then your cost of living could be low enough that even a modest growth in the SIPP would provide a comfortable income before your state pensions and work-place pensions kick in. The second reason: to save the money is the added security from having extra retirement income Having money in a SIPP means you can top up your retirement income. Having the SIPP would mean you have 5 sources of income:

If the pension income from your jobs is lower than your final salary having access to extra funds will mean you can more or less maintain your lifestyle. This will be especially important if one person lives a lot longer than the other. There is one special feature that the SIPP has but all the other 4 pensions do not: and that’s the fact that if you or your husband dies the state pension stops coming through and the work-place pension either stops completely or is massively reduced. However, whatever money is outstanding in the SIPP would fully transfer to the spouse without penalty. Just to be clear, I will make that point twice: a work-place pension either dies with the person and at that point the spouse receives nothing or, from that point, the spouse gets a heavily reduced benefit – usually 50% or one-third of the amount that was being received before their spouse died. A LOT OF PEOPLE forget this about SIPPs and other defined contribution pensions. I won’t go into the differences between defined benefit and defined contribution pension plans here but if someone is interested go to themoneyspot.co.uk and leave me a voicemail with your request. Finally, when can you expect to start spending that money and should you try to spend it in specific ways or on specific things? Technically, the plan is that you will never have to spend the capital but can just spend the growth. If the fund is worth £250,000 when you start drawing from it and you are earning a 10% return per year at that point, then you could just withdraw the 10% (i.e. £25,000) or less and spend that. If your withdrawal rate is lower than the growth rate of the fund then your retirement would continue to grow even as you take money out. Note that some research suggests that the ideal withdrawal rate to maximise the likelihood that the money will never run out is 4%. But given you have pension income from your jobs in addition to the state retirement and you’re not worried about passing wealth on to children you could be more aggressive than this. As for how you spend that money, well that is up to you and is a great problem to have. Having more money doesn’t only mean more holidays, it also means you can buy private health insurance which might be a necessity to avoid NHS waiting lists at a time when health problems are more likely. This would give you a lot of peace of mind. Ability to pay mortgage off early One thing worth adding, is a note that once you can withdraw money from your SIPP you are allowed to take 25% out as a tax-free lump sum. If your household had £250,000 saved up, you could take £62,500 out in one go which could be used to clear all or most of your mortgage. You would then be allowed to take the rest out as an income or you could buy an annuity – with an annuity you essentially buy a fixed income which keeps being paid to you for the rest of your life. I wouldn’t recommend an annuity for you given you have two fixed pensions coming in already, you don’t need the extra security and annuities don’t tend to be worth the money now that interest rates are so low. What you could do instead of buying an annuity is withdraw what you need from the SIPP every year. You would pay taxes based only on what you take out and could manage the withdrawals to minimise the tax bill. I hope this helps. Heather Have a money question?

Hi Heather,

I want to earn extra income, however I work as a nurse in the NHS which takes up my time, do you have any suggestions on any investment that can make money. I am also interested in the stock market but don’t know where to start. I am interested in both generating extra monthly cash flow now and increasing the amount of money I have in retirement. Denise. Hi Denise, Thanks for this question. I love it because I have two nurses in my immediate family, my mother-in-law was a nurse for a long time and my cousin is still one now. Boosting current income

The, “how can I make a little extra cash now” question is one I asked myself quite recently because I wanted to put extra cash into our household ISAs. There are a few things you can do to boost your cash now:

1. Working extra shifts / locum shifts My mother-in-law says this is not a great idea because being a nurse is hard enough work, as it is. I agree that it is very demanding work but one of the great features of working at the front line of medical services is that you can actually make more money by working more hours, even temporarily. Some jobs don’t offer opportunities to earn more by working more, you’re paid a fixed annual salary and that’s it - no overtime. Overtime either goes uncompensated or is compensated as time back in lieu. You can sign up to a locum agency and do the same type of work for higher pay on your free days. If you want to really juice up your income you can even look at things like working a 4-day week in your regular NHS job (your NHS pension would therefore be lower) and work for a locum agency on the 5th day. The advantage with this strategy is that you will boost your income without working more hours because the hourly rate is higher as a locum nurse. If the extra income is invested wisely it could more than make up for the lower NHS pension. Also, keep your eyes open for higher paying promotions. 2. Do some extra work in another field. If you have another skill that you can monetise you can look into doing extra work in that field. So ask yourself, "what other skills do I have?" I'll give you an example from my own life: In my early 20s when I worked in banking the bonuses were not good one year and to make some extra money I slipped flyers into doors offering massages (for women only) at my house for £25/half-hour. I had someone sign up that very day. I had done a course in therapeutic massage at London College of Massage for fun and when I needed it, that skill helped me boost my income. I didn’t do it for long but it showed me that if I wanted to earn more money I could monetise other skills in my free time. There are some things you can do that don’t even need a new skill such as babysitting. You could sign up at childcare.co.uk or sitters.co.uk and your credentials as a nurse would be very attractive to people that needed a babysitter for nights out or weekends. You haven’t said whether or not you have childcare responsibilities of your own so I don’t know if this is possible for you. If you have skills that you can monetise online then list yourself on freelance websites like upwork or fiverr. There is a wide range of professions people hire for on these sites. I have used these sites myself to buy all manner of things including artwork, copy, copy editing and even voiceovers! Imagine that, all you’d need as a voice over artist is a microphone that records your voice clearly. Some people make serious money side-gigging on these sites. These first two options are not completely aligned with your question as you asked for “investments that you can make” but I decided to add them to give a fuller answer. 3. Invest in or produce products that make cash. Investing in something necessarily involves parting with money in the hope that you’ll earn even more money. You haven’t said how much money you have to invest so here are a few options. Can you make something that people would be interested in buying that you can sell on etsy, eBay, amazon or Facebook marketplace? Make a few samples of what you want to sell and list them on all these sites. I ran a product business myself for almost 6 years mostly using Amazon so I would recommend that you:

I would never discourage anyone from starting a business but having experienced it, I would tell you that it is very hard work. It involves a lot of long hours and is nothing like as glamorous as our culture makes being an “entrepreneur” sound. A business could consume absolutely every free moment you have – evenings and weekends. And all that time might not even produce a profit. Investing in a business comes with a lot of risk – stats vary depending on source, however, 80% to 90% of businesses fail in under 3 years. 4. Teach Could you make money teaching something online? You could create a course and list it on Udemy, Teachable or another similar site. This would take some time to produce well, in the first instance, then you would need to spend some money on marketing your course but you could keep the costs very low. Alternatively if you want to teach a GCSE or A-Level subject (High school level) or even a university course level, you can sign up to places like tutorful (previously, tutora). 5. Invest in property. If you have enough for at least a 25% deposit then it may be worth looking into property investment. Because interest costs on buy-to-let property are no longer fully tax deductible, (that means, you can’t subtract the interest payment from the rent you receive before calculating your tax bill), property is not as attractive an investment as it used to be. That said, if you can buy a place with cash, or if the property produces a high enough profit to clear the mortgage within a reasonable amount of time (I personally target 10 to 15 years) then it could be worth doing. Overall, the option you go for will depend on your risk tolerance and the amount of cash you have to invest. If you are relatively risk averse and don’t have cash to invest then working more to earn more will be more attractive. If you can tolerate some risk and do have some spare cash saved up, then investing in property will provide you with medium risk while investing in a business will be the higher risk option. Boosting retirement/future income

If you’re looking to boost future income then you have two main options:

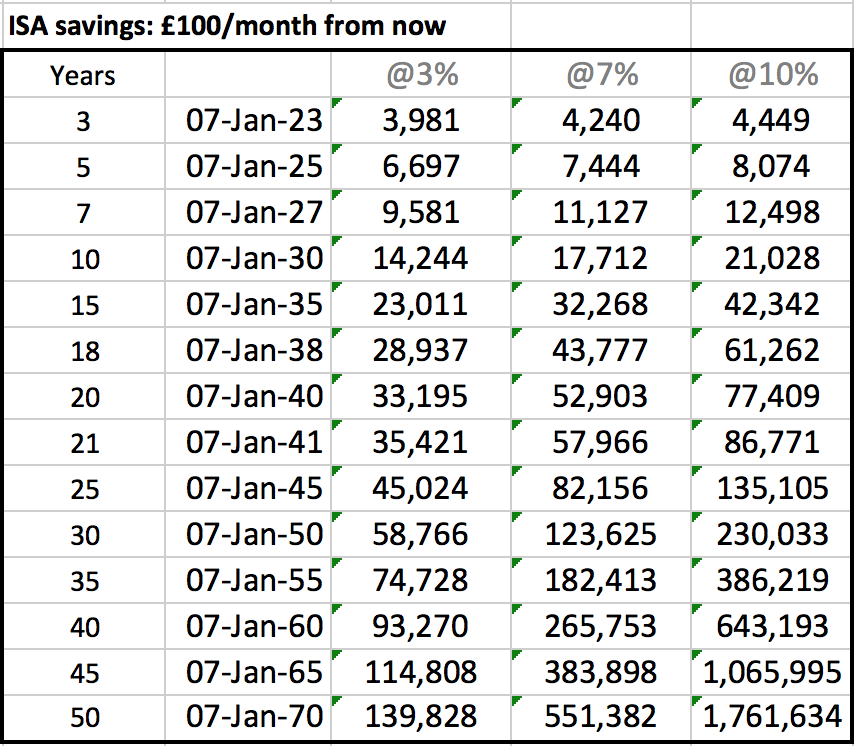

Property investing we've already talked about. The stock market provides a good return over long periods of time; most investment advisors would suggest an investment horizon of 5 years or more. Putting money into the stock market in the hopes of a good return in a year or less is gambling rather than investing, that's why I didn't offer it as an option when we were thinking through how to "boost income now". The most tax efficient options for investing the stock market are investing via an ISA or a SIPP. ISA are individual savings accounts and SIPPs are self-invest pension plans, they are a type of personal pension. If you invest the money via a SIPP then you won’t have access to that money until you are between 55 and 58 years old. The exact age will depend on your age and has been set at the state retirement age minus 10 years. The SIPP is a good option because for every £100 you put in, HMRC pay back £25 of tax and this saving is automatic. It is claimed by the SIPP provider and is shown on your investment account. The maximum you can put into a pension a year is £40,000 or your salary whichever is lower. So, if you earn £30,000/year you can put up to £30,000 into your pension without getting a tax charge. If you earn more than £40,000/year and haven’t reached the lifetime allowance of £1.055m, you can put up to £40,000 into your pension without getting a tax charge/penalty.

I will be writing several blogs on investing over the next few months that should hopefully build your confidence to make the move. In the meanwhile, you might find this useful: What platform should you use for investing and what should you invest in.

I hope this is helpful. Have a question? If you have any personal finance questions send them to [ME] – I will answer whatever piques my fancy via a blog post.

|

Heather on WealthI enjoy helping people think through their personal finances and blog about that here. Join my personal finance community at The Money Spot™. Categories

All

Archives

September 2023

|

||||||||||

Heather Katsonga-Woodward, a massive personal finance fanatic.

** All views expressed are my own and not those of any employer, past or present. ** Please get professional advice before re-arranging your personal finances.

RSS Feed

RSS Feed