|

You can listen to this episode on YouTube.

Retirement is a dream shared by many of us, but achieving it requires careful planning and early action. In this article, we’ll delve into the world of retirement savings and reveal exactly how much you need to save each month to retire comfortably. So, if you're aiming for financial independence but are possibly thinking it’s a pipe dream, buckle up and discover the key to retiring early!

Understanding the two pension types – DC and DB pensions Before we jump into the numbers, let's familiarize ourselves with the two primary types of pensions: Nowadays, most people have "defined contribution" (or DC) pensions, where the amount you and your employer contribute determines your retirement income. The risk lies with you, because your return, i.e. the pot of cash you’ll have at retirement, depends on the performance of the stock market. Previously, "defined benefit" (or DB) pensions were more common, guaranteeing a pension until death based on your final or average salary and the years of service. However, DB schemes have mostly been phased out and won’t be covered in this article. If you have a DC pension, if the stock market performs poorly you’ll either have to work longer or plan for a leaner retirement. Defined contribution schemes are sometimes called ‘money purchase’ schemes or self-invested personal pensions (SIPPs). They are similar to what Americans call 401K plans. How do you calculate your retirement "pot"? To estimate the size of the retirement fund you'll need, we can employ a simple rule of thumb. Multiply your desired annual retirement income by 25, and voila! You have worked out roughly how much you should aim to accumulate. But why 25? This is based on the ‘4% rule’ – a widely accepted guideline that suggests that withdrawing 4% of your invested pot annually, ensures your money lasts. Research has shown that even after three decades, your investments tend to grow due to average growth rates of a diversified investment fund surpassing the 4% withdrawal rate. {If the nerd in you wants to get into the maths: 4% = 4/100 and 100/4 = 25; … you don’t need to understand the maths, though, just use the rule} Estimating your retirement expenses – how much will you need to spend in retirement? Now, let's discuss the various lifestyle options and corresponding expenses you might encounter during retirement: according to research conducted by Loughborough University and the Pensions and Lifetime Savings Association, we can categorise retirement lifestyles into three levels: minimum living standard, moderate lifestyle, and comfortable lifestyle. To account for inflation experienced since these studies were done, I’ve increased the figures by 20%. To maintain a minimum living standard, a single retiree requires an annual income of £12,240, while a couple would need £18,840. For a moderate lifestyle, the figures rise to £24,240 for a single person and £34,920 for a couple. Lastly, to enjoy a comfortable retirement, aim for an income of £39,600 if you're single or £57,000 for a couple.

(source: moneyfacts.co.uk; and increased by 20%)

What are these different lifestyles assuming? A minimum living standard assumes a single retiree spends £46 per week on a food shop, has a one-week holiday and a long weekend in the UK each year, does not own a car and spends £555 a year on clothing and footwear. With a moderate lifestyle, our single retiree spends £55 on food each week, enjoys two weeks in Europe and a long weekend in the UK each year, and spends £900 on clothing and footwear each year. With a comfortable lifestyle, the single retiree spends £67 per week on their food shop, enjoys three weeks in Europe every year and spends £1,200-£1,800 on clothing and footwear each year. Calculating your investment targets Using the 4% rule and these lifestyle figures, we can estimate the amount you need to save for retirement. Here's a breakdown based on your desired lifestyle and whether you're single or part of a couple:

I know that these numbers look huge. But keep listening, I’ll show you that you can achieve them much more easily than you think.

Getting started: how much to save each month Now, let's explore the exciting part—how much you need to save each month to reach your retirement goals. Assuming you're a basic rate taxpayer, investing in a global passive fund with an average annual growth rate of 7% (we’ll discuss whether this is a reasonable assumption in a future post), aiming for the ‘comfortable’ lifestyle (i.e. £990k if single; £1.425m for couples) and ignoring the state pension (I’ll explain why in the next article) and employer contributions these are the monthly amounts you need to put into a pension account based on your starting age (rounded to the nearest 5): Each month until you’re 68 you need to save:

What the table shows is that the younger you start saving and the longer you save for, the less you need to set aside each month.

Factors that can offset the numbers Don't worry if these saving targets seem daunting because there are several factors that can actually work in your favour, offsetting even the larger amounts you need to save if you start late. Let's take a look at these positive factors:

In conclusion, securing a comfortable retirement requires forward thinking. If you didn't have this information when you started working, don't worry—now you do! There's no time like the present to start saving for your future. And here's a bonus: you can share this valuable knowledge with your children, ensuring they don't make the same mistake that many others do—starting too late. With the right strategies and a proactive approach, you can pave the way for a financially secure and fulfilling retirement. Your future is in your hands. References What Is the 4% Rule for Withdrawals in Retirement and How Much Can You Spend? Q&A: How much do I need to save for a comfortable retirement? Pensioners need a £33,000 a year income to enjoy a comfortable retirement Fidelity Retirement calculator How to get the £260,000 pension pot needed for a comfortable retirement - and why it might not be as hard as it sounds Dave Ramsey investment calculator (ignore the $sign) Fidelity.co.uk retirement calculator

0 Comments

Hi Heather,

My name’s Wendie. I am a support worker and earn about £1,600. I struggle to make savings due to all my commitments but I desire to start no matter how small. Please advise.

Thanks for this question Wendie…rather than talking about all the different ways you can save, I thought I would tackle your question by talking about 9 of the top mistakes that people make with money. Also, you haven’t given me any extra detail about your life like your marital status, age and whether or not you have kids so some of these things may not apply to you.

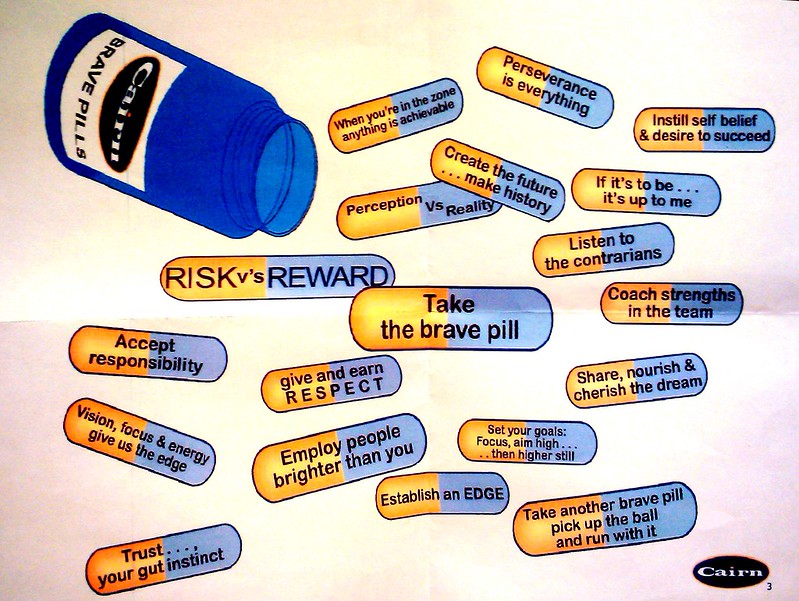

So, what are 9 of the most common mistakes people make with money? 1. Not believing you can achieve financial independence If you don’t believe, you don’t bother. If you don’t bother you’re less likely to achieve. Wealth is very rarely ever an accident and when it is an accident, like when you win the lottery without having pre-planned how that money will be spent, you usually lose it. According to cnbc.com, “Lottery winners are more likely to declare bankruptcy within three to five years than the average American.” This result is not going to be very different for the average Briton. Easy come, easy go, as they say. 2. Not thinking about money You don’t want to overdo thinking about money but it is important to think about it at least a few times a year to make sure you don’t get to retirement age and realise you’re done working or worse, that your body’s done working but you don’t have the resources to stop working. 3. Not talking about money or at least reading about money A LOT of the things I have learnt about money come from people I just chat with and even more from reading random books on money. I have had tips shared with me on what to invest in, what to read, how to save money and so on. And, if you want something to read that will inspire you I’d recommend to classics: The Richest Man in Babylon by George Clason and The Millionaire Next Door by Thomas Stanley and William Danko – I read both of those within a couple of years of graduating from university (15 years ago this year) and I still inspired by those books today. 4. Not getting a will If you have anyone that depends on you to survive, you need a will, period. This is especially important if you have children under 18 and amplified if you’re not married but in a relationship, possibly to a man that isn’t the father of your children. 5. Not getting life insurance Again, if you have anyone that depends on you to survive, you need life insurance, period. I went onto moneysupermarket.com to work out the cost of £250,000 of level term insurance for 25 years for a 40 year old healthy but overweight support worker. The cost was only £19 from a reputable insurer like AIG. 6. Not getting critical illness cover on your main home The most shocking thing about getting seriously ill is that absolutely no one ever expects it to be them, no one. That’s why it’s a good idea to have it. Most people get enough to cover the cost of paying their home off if they get critically ill and to keep the price low they get decreasing term cover. With this type of cover the amount of insurance money you get falls over time just as your mortgage would. It makes the cover more affordable. 7. Not tackling debt Debt increases your risk of ruin. Risk of ruin is a concept from the fields of gambling, insurance, and finance and it relates to the likelihood that someone will lose all of their investment capital. For general life, I use risk of ruin to mean that you end up in extreme financial problems. A few financial setbacks can lead to you not having the money to pay of bills, credit cards and loans and the more debts you have, the higher the chance that even small setbacks will send your financial life tumbling. If you have debts, it’s a good idea to get rid of them and never get back into debt again. If you can avoid credit cards, your chances of accumulating debt will fall. Although credit cards can build up points, travel miles, the fact is, the biggest thing that they build up is long-term, excruciatingly expensive debt. They’re debt traps. They can catch out even the smartest of people and they often do. 8. Not buying a home I think this is the biggest mistake you can make. Rent or mortgage payments are typically people’s largest expense. If you can wipe this cost away then you need so much less money to live in old age or whenever you’ve wiped the mortgage off. 9. Not investing in your self Investing in your self is about getting the qualifications and the type of experience that will lead to higher paid opportunities. If you think you don’t have the money to pay for education looks into grants. I decided to check out the cost of taking a degree course at the Open University and it looks like a degree taken part-time over 6 years would cost about £6,000 in total over those 6 years (that’s about 1,000 a year) which is 5 times cheaper than the £28,000 that students now pay for a three-year degree from a regular university. If your personal income is £25,000 or less, or you’re on certain benefits, you could qualify for the Part-Time Fee Grant and funding to cover 100% of your course fees. Definitely look into how you can improve your CV to move up the food chain in the job market. Last but not least, I decided to look into what Support Workers earn to see what a career path in Support Work could look like. In one google search I found the following Support worker salary statistics on adzuna.co.uk. These were the live stats on 1 February 2020 from Adzuna’s database of over 1 million job ads.

The salary varied a lot from area to area: The average in Newbury was £28,500 based on 67 jobs and the average in Caerphilly County was £54,000 based on 51 jobs – have you thought about moving areas? This is a huge difference in earnings, it’s the difference between struggling to pay off debt and saving well. Go to adzuna’s salary stats centre and study your profession. [link in blog] 1. Not believing you can achieve financial independence 2. Not thinking about money 3. Not talking about money or at least reading about money 4. Not getting a will 5. Not getting life insurance 6. Not getting critical illness cover on your main home 7. Not tackling debt 8. Not buying a home 9. Not investing in your self Hope this helps, Wendie. Good luck hitting your saving goals Have a money question for me?

If you have any personal finance questions send them to [ME] – I will answer whatever piques my fancy via a blog post.

Hi Heather,

I’m Melissa. As a full-time entrepreneur myself, I often find a difficulty in deciding how much monthly income to re-invest into my business and not OVERDO IT. This reminds me of why I often lose at the board game "Monopoly", ha! Because I'll spend every last dollar on buying up houses and hotels and when I fall on someone else's property, I don't have the money to pay them. And it's a downward spiral from there, haha. Anyway... I'm sure you know just as well as I do that our businesses are our babies and sometimes we think we aren't feeding them enough to grow as fast as they can. But at times, over-investing can cause immediate problems. What should I do to find a balance between re-investing as a business owner and putting money aside?

Hi Melissa,

The trick to answering this question is uncovering what your goals are for the business and what your goals are for your private life. This will both allow you to decide how much to take out of the business and also when to exit the business, if ever. I ran my own business from 2012 to 2017 and I had to answer this question myself. In the first year of the business I earned very little but I had saved over GBP60,000 because I knew I wouldn't make money from the get go. This is the reality for most businesses but from your question it sounds like you are past this stage and have some cash coming in, well done! You've gone past the first hurdle. So, what kind of business are you running?

I’ll define the three categories: The Lifestyle Business A lifestyle business to me is one where you want to earn enough to support all your needs and a good portion of your wants. You don't hire too many permanent staff - perhaps you have a couple of virtual assistants - for your social media and bookkeeping and use freelancers for everything else. The 'grow and sell' business With a ‘grow and sell business’ you’re a little more focused on the business than on yourself so you’re a little more willing to “suffer” for a period of time by cutting off all wants and just extracting enough for your needs because the business comes first. You want to get a consistent level of year-on-year growth and you want to track several observable metrics that will make it easier to sell your business in a time frame which you set. Sales numbers are the best metric to track but even social media statistics can be something worth measuring: healthy email lists, social media accounts with real followers, that kind of thing. The legacy business A legacy business is one that has to satisfy your income requirements for a prolonged period of time with a view to passing the business on to your children or selling far in the future if your children are not interested in running a business. Once you’ve decided the type of business you’re running, then you need to go through the following process: 1. Figure out how much cash your business needs every month? This is your, “monthly cost of operations” Some people think running an online business is virtually cost free but you and I both know it isn't so. Sit down and calculate the minimum amount of cash the business needs to have just to keep chugging along. This should include the cost of all your tools: email marketing software, social media software, graphics tools, website hosts, budget for freelancers and other staff costs, advertising! Back in 2012 when I started my business you could get a decent level of exposure for free, Facebook posts on pages were actually shown to people that had liked the page and you could monetise that exposure. Nowadays you have to spend money to get even low levels of exposure. You probably also need a budget for taking courses that will help you grow your business. The marketing techniques that work are constantly changing and you will need to keep on top of marketing intelligence to grow your business. So, it really is worth sitting down to figure these costs out. Once you have the number, you’ll know the minimum level of money you need to leave in your business bank account every month. Divide annual costs by 12 so that you have a reliable monthly cost of operations figure. 2. Figure out how much you need to live. This is your “monthly cost of living” If you are fortunate enough to have your living costs mostly met by your parents or your partner then this won't be a large number. My husband supported us for a good portion of my self-employment but I paid myself enough to cover my lifestyle costs: beauty products, going to cafes with friends, clothes, that type of thing and when we had our son, I made sure that the business covered his nursery costs too because the only reason he was going to nursery was because I needed to work. Ultimately, this meant I took out about £600/month to cover four half-days of nursery each week and £670/month for myself. The amount I paid myself wasn’t random: my accountant set my wage level just low enough not to have to pay national insurance tax. You will have to consider the tax impacts for yourself. That threshold moves every year. You could pay yourself more through dividends but speak to an accountant to get the balance right because if you pay dividends too often the taxman could say it looks like a salary and should therefore be taxed at the higher earned income tax rates. If you can live on less than the sort of figure I am suggesting, even better. If you're not living in a supported situation and have to pay all your own bills then this number could be much larger. So, having done steps 1 and 2 you will know the minimum amount you need to keep the business going and plus the minimum amount the business needs to make to keep you going too. Is your business producing at least this much? I hope so. 3. How much do you want to save? The next step is one I regret not having given enough focus when I was self-employed. I didn't save much at all for the household in that entire time. In fact, the only person that built up any savings is our son who had about £12,000 by the time I ditched the business and went back to work. In fairness, the business was not making enough for me to save but if I think back I could probably have managed to put away £300-500/month for the family if I really wanted to. I didn't suddenly start earning more when my son was born so the fact that we managed to find over £300/month to grow his savings shows the money was there. To decide on the ideal amount of money to save every month, project how much money you want to have at the age when you want to retire then using an online retirement calculator to figure out how much you ought to be saving every month. I found a good UK pension calculator on PensionBee.com and a good US retirement calculator on vanguard.com.

If you are running a lifestyle or legacy business and the business is generating not only enough to support operations but enough to save and live. Fab!

So, how's this different for a 'grow and flip' business? If you are building a 'grow and flip' business then I wouldn't worry too much about the savings elements. If you can sustain operations and yourself then you can continue running the business and ploughing all excess money back into it in the hope that you will sell the business for a good lump-sum in say, 5 to 7 years. Because this is a higher risk strategy you need to decide when you will quit the business. You can't continue running a business that doesn't allow you to put money into savings and investments indefinitely. You need to decide for yourself the point at which you will decide it isn't work. In summary: What you take out of the business depends on: 1. What the business needs to keep going. 2. What you need to live. 3. What you need and want to save. To attach some numbers to this discussion: Example 1 If your business is generating at least £1,500 every month (for example purposes) and it needs £800 to just keep moving then there's £700 left for you to either take for yourself or re-invest in the business. If £700/month isn't enough to meet your living costs then you need to figure out how long your savings can support you while you give the business a chance to grow. Example 2 If your business is generating at least £5,000 or more every month and it needs £1,000 per month to sustain operations and you need another £2,000 for yourself then there's still £2,000 to play with. In this scenario, even if I was running a 'grow and flip' business I would save to hedge myself against the risk that my business isn't sellable. A final thought. Ultimately, I left my business because it produced lower profits than I could earn in "regular job" and fortunately for me, I discovered that I actually love the routine of going to work and communing with my colleagues. If over a two to three year period the business is generating you, say, £30,000/year and you know you could earn £50,000, £60,000 or even £100,000/year working, have a deep think through whether the long hours of building the business are worth it. Many glamorise entrepreneurship but we both know the hours can be long and hard and the returns inconsistent from month to month and year to year. For knowledge workers (Economists, lawyers, researchers etc. – desk-type jobs), the in-work flexibility is unreal nowadays and you could pretty much set up your life to be more flexible than an entrepreneurial life, with much more free time and real holidays where you actually leave your laptop at home! Sorry if any of this last bit sound discouraging but I promised myself that when I blog about business I will always give people a real sense of what it's like. There are enough blogs out there pretending every 'trep is a millionaire when the reality is that the average self-employed person in both the UK and the US earns less than the average worker – shocking, right? Hope this helps, Melissa. Have a money question for me?

If you have any personal finance questions send them to [ME] – I will answer whatever piques my fancy via a blog post.

What's the point of saving? What's the point of saving?

Hi Heather,

Based on the things you told us about investing, my husband and I started putting £125 per month each into our SIPP pension. I hope this isn’t a silly question but what are these savings for? When can we expect to start spending that money and should we try to spend it in specific ways or on specific things? Both my husband and I are 30, we don’t plan on having children and our jobs have fixed pension benefits. Thanks Flora Hey Flora, That’s a great question. While everyone has a different value system, there are two main reasons that I strongly recommend that people put money into a self-invested pension plan or SIPP a) flexibility and b) security including funds to help pay a mortgage off early. A SIPP can be better than a stocks and shares ISA, in some cases, because you effectively pay less tax and because you can’t use the money until you are about 58 so it forces you to save. Let’s talk about each reason in turn: The first reason: is flexibility over when to retire In the past, a lot of work-based pensions (aka defined benefit pension plans) used to allow early retirement from between the ages of 55 and 60, most of these type of scheme are being completely phased out and are instead being linked to the state retirement age which for you is currently expected to be 68. There is talk of moving this to age 70, so this is a future possibility. Whatever happens, the funds that you build up in your SIPP can be taken from 10 years before the state retirement age. This means if the state retirement age moves to 70 you will still be able to use money that’s sitting in your SIPP from the age of 60. If you and your husband are putting £125 each into a SIPP then when you are 55 years old, you and your husband’s combined pot of savings would be worth £135,000 if the pot of money only grows fast enough to keep up with inflation of about 3%; if you get growth equivalent to the average stock market return of 7% then you would have £250,000 at the age of 55 and if you get an average stock market return of 10% you would have £410,000 saved up. At age 60 the figures would be £180,000 @ 3%, £375,000 @ 7% and £700,000 @ 10%. These sort of returns aren’t cuckoo. According thebalance.com, “the S&P 500 Index, delivered its worst twenty-year return of 6.4% a year over the twenty years ending in May 1979. The best twenty-year return of 18% a year occurred over the twenty years ending in March 2000.” Various sources suggest the S&P 500 has returned 10% before inflation if you buy and hold the money you invest into it. But of course, it’s useful to remember that this past success doesn’t guarantee that future returns will be as good. Right now you would struggle to find a bank account that gives you an interest rate of 1.5%. Back to flexibility on when you retire, however, unless you believe the US has no room for growth, then this total of £250/month you are saving could amount to a lot of money over a 25 to 30 year period and this would allow you to retire with a decent income well before the state retirement age. If your mortgage is fully paid off by the time you retire then your cost of living could be low enough that even a modest growth in the SIPP would provide a comfortable income before your state pensions and work-place pensions kick in. The second reason: to save the money is the added security from having extra retirement income Having money in a SIPP means you can top up your retirement income. Having the SIPP would mean you have 5 sources of income:

If the pension income from your jobs is lower than your final salary having access to extra funds will mean you can more or less maintain your lifestyle. This will be especially important if one person lives a lot longer than the other. There is one special feature that the SIPP has but all the other 4 pensions do not: and that’s the fact that if you or your husband dies the state pension stops coming through and the work-place pension either stops completely or is massively reduced. However, whatever money is outstanding in the SIPP would fully transfer to the spouse without penalty. Just to be clear, I will make that point twice: a work-place pension either dies with the person and at that point the spouse receives nothing or, from that point, the spouse gets a heavily reduced benefit – usually 50% or one-third of the amount that was being received before their spouse died. A LOT OF PEOPLE forget this about SIPPs and other defined contribution pensions. I won’t go into the differences between defined benefit and defined contribution pension plans here but if someone is interested go to themoneyspot.co.uk and leave me a voicemail with your request. Finally, when can you expect to start spending that money and should you try to spend it in specific ways or on specific things? Technically, the plan is that you will never have to spend the capital but can just spend the growth. If the fund is worth £250,000 when you start drawing from it and you are earning a 10% return per year at that point, then you could just withdraw the 10% (i.e. £25,000) or less and spend that. If your withdrawal rate is lower than the growth rate of the fund then your retirement would continue to grow even as you take money out. Note that some research suggests that the ideal withdrawal rate to maximise the likelihood that the money will never run out is 4%. But given you have pension income from your jobs in addition to the state retirement and you’re not worried about passing wealth on to children you could be more aggressive than this. As for how you spend that money, well that is up to you and is a great problem to have. Having more money doesn’t only mean more holidays, it also means you can buy private health insurance which might be a necessity to avoid NHS waiting lists at a time when health problems are more likely. This would give you a lot of peace of mind. Ability to pay mortgage off early One thing worth adding, is a note that once you can withdraw money from your SIPP you are allowed to take 25% out as a tax-free lump sum. If your household had £250,000 saved up, you could take £62,500 out in one go which could be used to clear all or most of your mortgage. You would then be allowed to take the rest out as an income or you could buy an annuity – with an annuity you essentially buy a fixed income which keeps being paid to you for the rest of your life. I wouldn’t recommend an annuity for you given you have two fixed pensions coming in already, you don’t need the extra security and annuities don’t tend to be worth the money now that interest rates are so low. What you could do instead of buying an annuity is withdraw what you need from the SIPP every year. You would pay taxes based only on what you take out and could manage the withdrawals to minimise the tax bill. I hope this helps. Heather Have a money question?

Hi Heather

I just had my first baby. I'm 31 and married. Do you have any tips for how I can think about saving and investing for my baby? Thanks, Diana Hey Diana, This is an awesome time to be asking me this question. I also started planning for my first baby as soon as he was born. You will be at an advantage if you start saving and investing for your children as soon as they are born. You will need to balance what you can afford with what you want to achieve for them. Firstly, what’s the goal? What are you saving for?

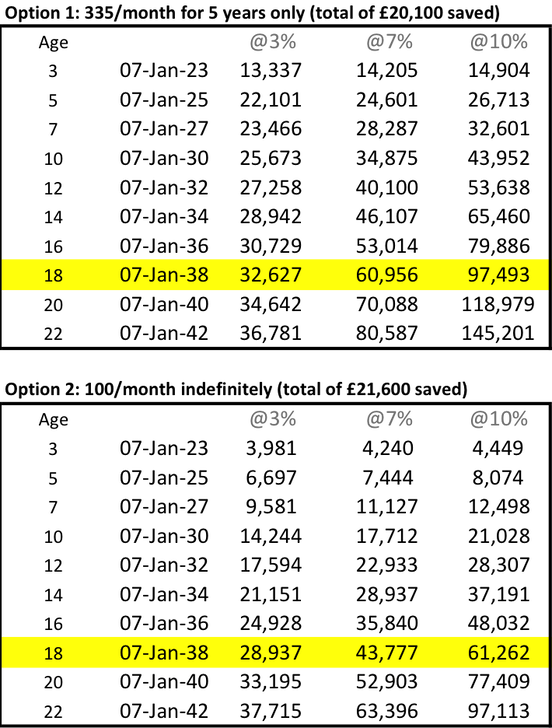

1. UNIVERSITY University costs c.£60,000 in tuition and living costs for a 3 year course at the moment - £10,000 for tuition and books, £10,000 for living – living costs can be higher or lower depending on whether you live at home, etc.. £60,000 is a huge amount of money and this cost is likely to rise in the future but it makes the maths too complicated to think about possible cost increases. Option 1 for university savings If you can save £20,000 in a tax-free account like a stocks and shares ISA by the time your child is 5 years old, then you can stop putting money aside and this money will have a reasonable chance of growing to £60,000 by the time your child is 18 years old. How could you save this £4,000 per year? Perhaps you could target saving a round amount like £250 per month (equivalent to just over £30/week each for a two-income family) and because this sums to £3,000 a year, at the end of the financial year you’d hustle to throw that extra £1,000 into the ISA before the financial year closes on 5 April. Or, if you can afford it, you could just save £335/month and you would save just over £4,000/year. Option 2 for university savings £4,000 is likely more than most can afford. The alternative is to save £100/month until age 18 which most people can afford even on the median household disposable income of £29,400 (2019). It’s equivalent to about £12.50/week each for a two-income family). Which option is better? I would say option 1 trumps option 2 because you give the money the best chance of growing. Equity markets are volatile in the short-run so by saving the money early you give the money a better chance of reaching your goal. That said, something is a lot better than nothing: small savings add up to large amounts over time. Your savings may be lower than you would like to target but you will still help your children avoid the full scourge of student debt. These are the results under each option:

Caveats on saving through a Junior ISA:

When you save the money through a Junior ISA, that money will be theirs when they hit 18 and you might not be able to control how they spend it. However, putting it into the Junior ISA means you won’t be tempted to spend it yourself because once the money goes in, it can’t be withdrawn until your child is 18. How can you avoid the Junior ISA so you have more control over the money?

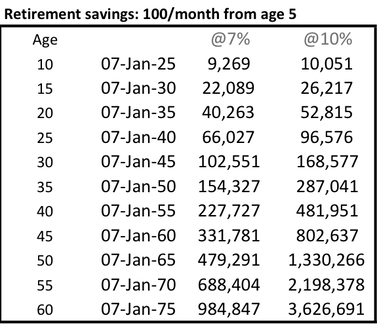

Plan b. is a good option because you could end up not having to pay tax anyway: The capital gains tax allowance in 2019-20 is £12,000. That is, you have to make a capital gain (the profit on your investment) bigger than this to pay the tax. If you save the £4,000 across two investment accounts - £2,000 in an investment account with your name and £2,000 in an investment account with your spouse’s name then when your child is 18 you can sell enough stock each year to keep the capital gain below the capital gains tax allowance. The risk however is that this threshold could fall or be completely removed in which case you would end up paying more capital gains tax on the sale. It’s still a sensible option, despite this risk. 2. RETIREMENT If you followed option 1 for university savings, at age 5 you’ll have stopped doing that and might find that you have some spare money to open a retirement account. Your children will not have access to this money until they are 57 to 60 but if life hasn’t worked this will be a great cushion for them. The beauty of investing in a retirement account is that for every £1 you put in the government puts in an extra 100/80. That is, if you want to save £100/month you only need to put £80 into the account. If you do invest £100 it will be £125/month with the government top up. For kids you can put a maximum of £2,880/year (£240/month) which equals £3,600/year. This is the result if you choose to save £100/month indefinitely into your child’s Self-Invested Pension Plan or SIPP starting from when they are 5-years old:

You notice that the extra £25 from the government makes a real difference. By saving through the pension, based on a 7% return, on 7-Jan-2025 the investments are worth £9,269 rather than only £7,444 without the government top-up.

Don’t save into a child’s retirement account unless you have the cash flow and are meeting your own goals, e.g. paying enough into your own retirement, paying off your mortgage early and ideally, are debt free yourself (apart from the mortgage). Some will be able to afford the full £240/month from birth, the rest of us have to work out what is realistic, that is why I personally opted for the £100/month from age 5. This decision will change with a change in your fortunes. 3. HELPING YOUR KIDS BUY A HOME This is where the decisions get a little tricky. Some people will be able to afford funding university, helping their children get ahead with retirement savings and help with a deposit on a home without compromising their lifestyle at all but the rest of us need to make choices. Private school vs. saving for a home What will make the biggest difference to your children: a private education or getting onto the property ladder? If you can afford one or the other but not both, then you might follow the route of private primary school followed by state secondary school (grammar/comprehensive). In this case you’d direct all the money you would have spent on a private secondary school education on saving for a home. In some cases this might mean your child starts life with a mortgage free home. If you save £15,000/year (£1,250/month) from age 11 until age 21 (10 years of saving) and it grows at an average rate of 7%, how much money would your child have at 21? About £220,00 – increasing to £260,000 if the average return over that period is 10%. This is not small money to most of us. You could use every last cent on a private education when at the end of the day the thing that helps your child follow a life of fulfilment is being relatively debt free. If you decide to go for a state education throughout and save £1,000/month (£12,000/year) from age 5 (when you are done with university saving) until age 21 (16 years of saving) and it grows at an average rate of 7%, how much money would your child have at 21? About £355,000 – increasing to £475,000 if the average return over that period is 10%, wow. Forget the children, you could be doing this for yourself! If you have already made the decision to send your children to a private primary school and they are thriving, you are unlikely to reverse that decision. If I you are seeing these numbers before making a decision, you might well make a very different decision… Not thinking about private education, anyway? If private school is not a consideration for you, then the best choice might be to save as much as you can towards your own ISA allowance of £20,000/year (£40,000/year in a two parent home), in addition to whatever you save towards your pension (I recommend 10-15%) and when the time comes you can decide whether you can contribute towards university or a first home or both. The best gift you can give your kids is possibly to be independent in old age so they don’t have to worry about taking care of you. You can boot strap them onto the property ladder by letting them live at home rent free – so that they can save more for their deposit. Even without cash gifts, you will be giving your children a competitive advantage by teaching them how to handle money at an early age. Starting to invest Next, you need to consider what platform to use for investing and what to investing in? If you have any personal finance questions send them to [ME] – I will answer whatever piques my fancy via a blog post.

Hi Heather, This is a simple question, how do you make money when you have no money? Belinda Jo W. I LOVE this question Belinda. It’s an awesome question because so many people are probably wondering the same darn thing. Okay, your question isn’t specifically asking about starting a business so I’ll tackle it from both a business and a career perspective too. I’ll be as broad as possible. BUSINESS  The Bank A lot of people need money to start a business or some other passion project. Back in the 80s my dad had very little cash, basically all he had was a credible enough business plan to make an appointment with a bank manager. The main basis for which he got that loan was the bank manager saying, “I can see a future in your eyes so I’ll approve this loan”. Sh!t like that doesn’t happen today. Banks can’t lend on the basis of just believing you have great potential so they don’t lend to start-ups. Typically, they’ll only lend to a business that has three years of trading history and appears to have a reasonably stable income. The Manufacturer Have you heard of Sara Blakely? If not, then you’ll definitely have heard of the brand Spanx. She started that brand with $1,000 which for all intents and purposes is almost nothing. She used that money to get a prototype made by a local US manufacturer. She then wanted a manufacturer to partner with her: she wanted them to produce her product in the hopes of sharing in the profits. Obviously, most suppliers gave her an outright no. Manufacturers don’t like taking entrepreneurial risks of that nature. Their business is just making stuff and they get paid upfront or based on a 30-day line of credit. The manufacturer that ultimately said yes had a daughter that convinced him it would work. That is still possible today especially if the product to be made seems quite innovative and if a small sample run can be made without a huge financial outlay. Her next problem was finding a big buyer. She trawled from supermarket to supermarket trying to get someone to see her. In the end, she got her first yes by asking the buyer to come to the bathroom with her to see how Spanx worked. She put them on and the buyer was like, “I get it”. The rest as they say is history, she now stands as one of very few self-made female BILLIONAIRES. Her story has so many elements that just seem “lucky”, for instance, if the buyer had been male she couldn’t have just been like, “Come to the bathroom with me and I’ll show you” – can you imagine what he’d be thinking? Lol That said, you only get lucky when you put yourself out there. Most people just let their ideas die in their head so they don’t get lucky. Luck comes from repeated effort. MAKING MONEY IN A JOB  Now, if you just want some money and have none, there are some key avenues you can take. EARN MORE – GET A GOOD JOB

EARN MORE – SELF IMPROVEMENT Here are a few ways you can improve your prospects. Education The better educated you are, the more money you tend to make. Even in poorly paid jobs you can navigate yourself into higher paid posts like a management position, over time. Every industry will have positions that make bank and roles that keep your bank account overdrawn. If you get educated, you’ll be able to take advantage to move up. In my case I have a BA in Economics from the University of Cambridge. I could have stopped there – most do, but I decided to become a Chartered Financial Analyst, CFA. I’m currently self-employed but, for no particular reason, I’m doing the Certificate in Mortgage Advice & Practice (CeMAP) AND I’ve signed up for ACCA exams…what can I say, I like writing exams. Like I said, I don’t have any specific plans for these qualifications, you could say I like collecting qualifications in the same way people like collecting, say stamps, but with all this on my CV it means I can pounce on opportunities faster than a cheetah in the Serengeti pounces on an unsuspecting wildebeest. Accents Don’t ask me why I think of this today; perhaps because the topic cropped up over the last few days. Some people associate certain accents with being dumb and having such an accent can therefore reduce one’s employability. Here in the UK, the Birmingham or Brummie accent is seen as dumb – I personally love it (see references below). In the US the Southern Accent is seen by some as dumb too and indeed some people find certain African accents dumb – sigh. I personally like lots of accents that people hate but I’m not trying to employ you. My personal pet peeve is poor grammar. Mix poor grammar with an accent that employers tend to be biased against and forget passing interview round one! I have a Chinese friend who went to the extent of getting elocution lessons to neutralize her accent. I haven’t seen her in a long while so I can’t tell you if it worked. Overall, if you think your accent could possibly be holding you back you should work on it. This could be as simple as polishing up your grammar and pronouncing words more clearly, you don’t necessarily need expensive elocution lessons. I won’t lie to you though, I’ve considered elocution lessons myself in the past. If we look at the c-suite of any firm we’d probably all be surprised who’s had some voice/accent coaching. Some people just want to change their tone to sound more authoritative others want to wipe out a whole accent. Your Overall Look Honey, I so wish it weren’t true but people do judge a book by its cover. Having polycystic ovarian syndrome (PCOS) means I gain weight if I so much as look at cake the wrong way and it is incredibly hard to shake off. I am not hugely overweight at all but people have no idea how hard it is for me to just stay this slightly overweight size even when my calorie intake is quite low. This is why I wish fattism did not exist, but it does. Employers have been empirically shown to discriminate against overweight people because they view them as lazy! Reference below. If you feel your weight could be holding you back, get your jog on. I’ve been jogging almost daily for three months right now and I haven’t lost ANY weight. However, I feel excellent and I’m buzzing with energy. If you, like me, struggle with weight focus on just doing regular exercise. It will make you feel more confident about your body and that confidence will shine through to other people. Coach or Mentor Ultimately, this is what I did to get my first well-paid job at Goldman Sachs. I was coached. My CV was reviewed, I had practice interviews, I got feedback on what I planned to wear to my interviews and I got the job. That job allowed me to save more and ultimately go on to buy my first property. SAVE MORE This is one thing people simply fail to do. I’ve coached people who think they couldn’t possibly save anything and when I delve into their finances there are literally savings that can be made everywhere. I have so many tips on saving that I wrote a book about it a few years ago, Build Super Savings. If you get the PDF book, I suggest you print it off and work through it diligently, from start to finish. Promise? INVEST IN PROPERTY (aka REAL ESTATE) FIRST I see property as a safe bet. If you buy a property you can afford the worst case scenario is that you’ll end up with negative equity for a while; however, provided you keep up with payments you will eventually own the home outright and always have somewhere to live. After you have one property why not get more properties to fund your retirement? Rent from tenants pays the mortgage off for you. If you buy in a good area you will at a minimum store the value of your home because over long periods of time property keeps up with inflation. In the best case scenario you’ll see you property price rise faster than inflation. Your equity capital will grow. I am a huge fan of property. It’s not a get rich quick strategy. You’ll only enjoy the maximum benefits of it in 20 to 30 years time when your mortgages are fully paid off but even before that property can bring in some extra spending cash. If property prices rise fast you can enjoy incredible benefits much sooner but I’d invest based on at least a 10-year plan. I started my working life off with no money. I saved enough to invest in one property and it is that property that I bought almost 10 years ago that I re-mortgaged to fund my Queen of Kinks product line. I can talk for days when it comes to property so I created an information-packed course on how to build a property portfolio from scratch. Anyhow... Can you think of other ways to make money? Make a comment below. Have a business or life question you want me to answer? Please email it to me with the subject “Question”. Note that all such questions will be answered as a blog post and will be sent to my full email list.

Want to start a business? Check out The Money Spot Program. References  Your spending will always expand to match your income unless you specifically plan to live beneath your means. You can do this as a lifestyle choice or for short periods of time to save for something you really want. Shop around to save money on the things that you buy regularly – buy in bulk, get products where they are cheapest instead of just going to your favourite shop, use coupons and take advantage of discount days at local stores. However, there are some things that you can live without completely;that is the topic this blog. We get so used to buying what we always buy that we don’t usually stop to contemplate what’s necessary and what isn’t. To help you think through your own shopping list I’ll go through some things my friends and I cut back on to save: Rent You could live in a cheaper area and save thousands immediately. I did this when I first started work. I was spending almost half what my peers were on rent just by living a little further out of the city. Of course, many of us are unwilling to compromise here so we have to look at the small stuff. Juice! For what you get, it’s not cheap at all. I was having a chat with one of my best friends about cutting back and she said, “Can you believe it, we’ve even had to stop buying juice!” I was like, “You were still buying juice? I stopped buying juice ages ago because it contains way too many calories. I’ll only buy it if I have guests coming.” I also find juice to be poor value for money besides being completely unnecessary for the weight conscious. Juice packs in a lot more calories than one might suspect. Restaurants We spend A LOT of money on eating out every month. I personally find it very hard to cut back because I think of it as a “treat” after a week of hard work. However, right now my husband and I have just spent a small fortune renovating a flat that we just bought so we’ll use that thought to spur us on during our financial fast in September. To stick to our resolve we add“treat foods” to our shopping list to encourage us to eat at home. For example, buying a frozen pizza that you just stick in the oven when you feel lazy is a lot cheaper than going out for pizza. We wouldn’t normally buy this type of food because it’s not healthy but it does the job of keeping us at home when we want to eat out. Meat News flash: you don’t have to eat meat every day. Some people would think this is unthinkable and perhaps an utterly ridiculous suggestion but it’s true. If your partner is against this suggestion remind them that desperate times call for desperate measures. You can also cut back by eating less meat rather than cutting it out completely. For instance, unless it’s a very small chicken I only ever eat one chicken piece, I find two to be excessive. If everyone in your home has two pieces your chicken will immediately last twice as long by enforcing a one-piece rule. The same goes for sausages and other meats. I normally cook minced meat with beans to bulk it up. Less meat means a heavier wallet and a more attractive waist line! You could go for offal aswell. Liver, oxtail and tongue are delicious. Body Products & Makeup There are so many options here. If you use a range of upmarket brands explore supermarket “equivalents” to see if they work just as well. You could save a tidy fortune here. Take a close look at what you tend to spend money and see what else you could do without. Magazines? New shoes or clothes? And so on. “Cut back on your rent or cut back on what you spend on food but never worry about investing money in a good book.” Robin S. Sharma  Want to Build a 6-Figure Beauty Business from the comfort of your sofa? Then my course is designed for YOU! "Beauty" includes a WIDE range of products from the not so obvious non-perishable foods and crafts to the more obvious hair, makeup, fashion, health & fitness.  One of my friends posted a very interesting status update on Facebook: "Why is it that some people in Malawi feel like it’s a crime to have a good life or have good things? If one wants to spend their money buying expensive shoes, so be it [it’s their money], [if they want to own a] Range Rover although they stay in a rented house [it’s their business], and if one wants to build a mansion so be it, if it makes you happy! Don’t plan other people’s lives for them! I just saw a certain post and it made me sad! Priorities differ good people!" [Text in square brackets has been translated to English (from Chichewa) for accessibility] Although I agree with the general sentiment that people should spend in any way they want to, I personally think some spending decisions are foolish and very myopic. Less than 60 seconds later, I happened upon this post: Lack of Saving Culture – Biggest Challenge Facing Malawian Entrepreneurs: (says Hitesh Anadkat of First Merchant Bank, Malawi) “In my view the biggest challenge Entrepreneurship faces in Malawi is our savings culture. Actually it is the ‘lack of savings’ culture. I would argue that if we look at the whole world, in 95% of the cases, the capital to start entrepreneurial businesses came from individual or family savings. If you have zero money, it is unlikely a bank will lend you 100% of your requirements. In almost every case you need to show seed capital. This saving culture has to apply to families who want to establish themselves. In my culture [ethnic Indian], most of us do not spend anywhere near what we earn. After basic needs are provided for, the rest goes to saving or businesses for future generations.  When families are starting out they are very careful with their money. Typically, you will have cases where parents and three or four brothers are living under one roof to save money. This is certainly how my father grew up in India. Even though you have money, you do not spend it on new cars, or eating out, or expensive holidays. The family has to realize that if they want the family to become long term players in the business world, or want to educate their children, or feel secure in life, they have to save. They have to sacrifice short term pleasure for greater long term gains. It is because I, my father and his father before me saved, that we had the money to start FMB (First Merchant Bank) and other businesses. We only pay a small percent of our income as dividends and the rest is saved in the company. But even out of the dividends, we save and invest most of this money. My father bought his first Mercedes when he was 56 years old. This was second hand. At this time, he could have afforded 10 new ones. He bought his house when he was 60. He could have afforded this a long time ago, but he decided he needed money for working capital, as he did not want to spend money on interest from bank borrowings.” Comment from the person that shared the post: I read this priceless advice over and over again. It is the kind of truth most Malawians are not ready to embrace, and that is why many Malawian families don’t have a foot in the business arena. We would rather build a mansion with five bedrooms and six toilets… and a Range Rover, a Merc and a Twincab parked outside. We lack the basic ingredient to business success – delayed gratification.  I personally was in total agreement with Hitesh because all around me I see people making what I would call shortermistic decisions. I have one Zimbabwean friend who managed to get into investment banking and with his first bonus bought a brand spanking new Mercedes Benz (while he lived in a rented flat). Six months later he was like, “Sha, Heather, I totally regret getting that car. If I had invested that money on the Zim stock exchange I would have ten times more money right now!” As they say, hindsight is 20/20. In his case, at least he even had the wealth to buy the car with his own money. I know many others that lease expensive cars when they don’t own the place where the sleep. Now, I would definitely say posturing and looking good is a culture amongst Africans. We not only want to keep up with the Joneses we want to one-up them every chance we get. Black people in general are heavily influence by hip-hop music, videos and culture where wealth and living it up is glamorized in a way that it is not in other types of music. Shows like “Cribs” and “Pimp My Ride” flaunt the good life and encourage us to spend. I’m not even sure if I can exclude myself from the myopic crowd. I too bought a brand new Merc at 27. Yes, I did have a portfolio of 4 houses and some land but I could still have invested that money. I justified the purchase to myself: I thought I deserved a treat because I had spent five years being so abstemious and a recent personal event made me realize just how short life is but is there really any justification for such indulgence at 27. If something were to happen to me my savings would have blessed my mum and siblings – I wasn’t married at the time. Anyhow, whilst I thought these things I also realized that on the flip side, Africans are hands-down the most laissez-faire, happy-go-lucky people I know. Given that, is it better that we accept lower levels of wealth as a group for more happiness? Can we have both? I don’t like to make sweeping statements about a population but having grown up in Malawi and lived my adult life in the West I can agree with Hitesh the Chairman of First Merchant Bank that there is a greater lack of savings culture in Malawi and Africa in general compared to the West and especially compared to Asia – notably Japan. Of course, I acknowledge that swathes of people in the West also live in debt; nonetheless there is a very strong culture around saving to buy a home and frequent media discussions around pensions and saving for old age – Africans especially in a rural setting talk about having children to look after them in old age... What do you think? Will the lack of a savings culture keep African lagging behind the world?  Want to Build a 6-Figure Beauty Business from the comfort of your sofa? Then my course is designed for YOU! "Beauty" includes a WIDE range of products from the not so obvious non-perishable foods and crafts to the more obvious hair, makeup, fashion, health & fitness. |

Heather on WealthI enjoy helping people think through their personal finances and blog about that here. Join my personal finance community at The Money Spot™. Categories

All

Archives

September 2023

|

Heather Katsonga-Woodward, a massive personal finance fanatic.

** All views expressed are my own and not those of any employer, past or present. ** Please get professional advice before re-arranging your personal finances.

RSS Feed

RSS Feed