|

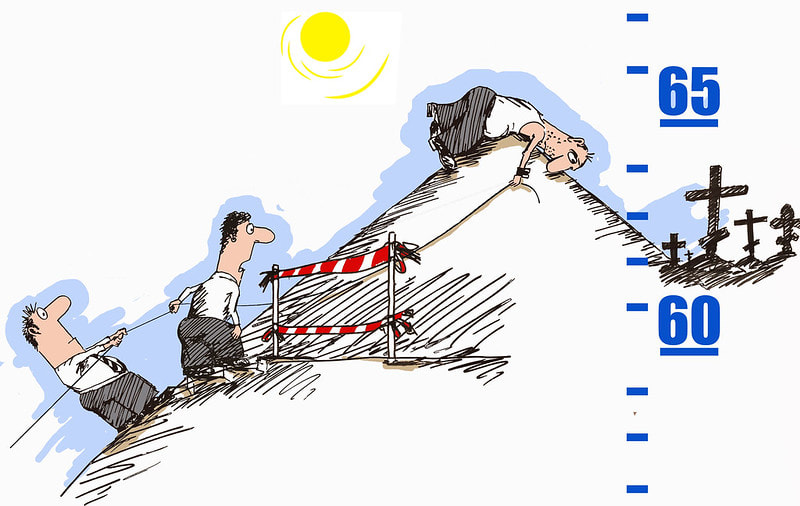

To include the State Pension or to ignore the State Pension, that is the question…when you’re retirement planning.

If you’re a millennial (born between 1981 and 1996) or later, I’ve come to a bold conclusion: it’s best to assume you won’t receive a State Pension, when you’re planning how much to save for retirement. Let me explain why… While it's likely that some form of State Pension will persist, I believe there’s a good chance that it will become much less generous or that the state retirement age will increase even further. It is also possible that it will become means-tested so only the least well-off will receive it. Because the UK population is ageing and, as a result, the cost of the State Pension is increasing, one or all of these possibilities is almost inevitable. With an ageing population, a conundrum arises: an increasing number of people require care in their later years, while the workforce available to support them through tax contributions continues to dwindle. And, as State Pensions rely on current tax collections – that is, taxes collected from today’s workers are used to pay today’s pensioners, fewer workers will shoulder the burden of supporting a larger and growing retired population. So pensions will be less generous unless something changes. How has retirement and the State Pension evolved over time? Retirement is still a rather new concept. In the past the average person worked until they physically couldn't anymore; if they were lucky, their family looked after them in old age otherwise they faced serious financial struggles (this is how it still works for many in developing economies). In the UK, the introduction of the means-tested 'Old Age Pension' in 1909 marked a big turning point, providing a modest income to people aged 70+ with an income below £21 a year. The pension payable to a single person of 25p a month is roughly equivalent to about £157/month today (if we account for inflation and the increase in average earnings over time) – very much in line with the current Basic State Pension of £156.20. But...average life expectancy in the UK was about 50 in 1909 so, most people did not reach the state retirement age. This initial State Pension didn’t require any contributions to be made in order to be entitled to it; a contributory State Pension scheme only came about in 1925 for manual workers and others earning £250 a year or less (equivalent to £12,500 in 2023 prices). It wasn’t until after the Second World War, in 1946, when the ‘Welfare State’ was created, that a contributory State Pension applied for all people. From 1946 until 1980 people with higher average earnings enjoyed a higher State Pension, however, linking State Pensions to earnings was abolished in 1980. Personally, I think the new flat rate for all is much fairer. The State Pension has become less generous over time and may need to become less generous still In terms of what the money you receive can purchase, the State Pension seems to have not changed too much since 1909 - it’s just as generous or not so generous, depending on your view, as it ever was. What has changed since the introduction of the Welfare State is the bar you need to meet in order to get a State Pension. Whereas women used to start receiving their State Pension at 60 and men at 65, now, both men and women get it at 65 for the older generation and that’s rising to 68 for my generation. In addition, while someone used to need just 30 qualifying years of National Insurance contributions or credits to get the full basic State Pension, a total of 35 years is now needed and, to get anything at all, at least 10 years of National Insurance contributions or credits is required. These changes reflect the challenges governments face in balancing the needs of retirees with the available resources. To maintain the purchasing power of pensioners, the Government has maintained a 'triple lock' since 2010; under this mechanism the basic State Pension is increased each year by either average wage increases, average price increases (i.e. inflation) or 2.5%, whichever is higher. Despite all this, to continue to be able to take care of those that need it most, more may need to be done. There is only so much that can be done to raise the qualifying age or the number of years of contributions; at some point, it may become necessary to start cutting out those that don’t really need the State Pension given their other sources of income. And if I’m honest, I wouldn’t be upset if this is where we end up because if the government can balance its books it can stop progressively increasing taxes (including through fiscal drag). What does the State Pension currently cost? Consider this: in the 2023-24 fiscal year, an estimated £124.3 billion (10.5% of public spending) is projected to be spent on State Pensions. This figure, equivalent to approximately £4,400 per household, highlights the scale of financial commitment required, particularly when you realise that UK median household disposable income (that’s income after tax) is only about £32,300. Just to give you an idea of how mind-blowing this statistic is, in my native Malawi, the government's budget for the whole year for absolutely everything is £450 per household (UK: £42,000). And, the average Malawian household is 4.3 people compared to just 2.4 people in the UK. And what’s going on with population projections? Without an increase in immigration, the UK’s natural population is projected to start declining by 2025 … that’s in two years; a lot sooner than was expected based on estimates made in 2018; at that point we didn’t expect the natural population to start declining until 2043. So, what’s the long and short of it? There’s no two ways about it, to sustain the current generosity of State Pension in the context of an ageing population, some difficult decisions will have to be made. Sustaining the system will require adjustments such as raising the retirement age further (it’s difficult to imagine, I know) or reassessing eligibility criteria. In the short-term increased immigration may help to boost tax receipts but it’s unlikely to be a long-term solution. Some thorny questions will need to be addressed on how to balance fairness and affordability when it comes to State Pensions. Having enjoyed a sneak peak into the state of our public finances, it seems sensible that if you’re planning how much to save for retirement, as we did last week, especially if you’d like to retire early, then the best approach is to view the State Pension as a bonus. It will be awesome to get it but if you find that you’re not entitled to it, then by saving as though it won’t be there, the retirement you would like to have won’t be scuppered. References How much would the original old age pension be worth today? Basic state pension rates, Royal London Why should I pay national insurance once I've paid enough for a state pension? Steve Webb (former pensions minister) A brief guide to the public finances, OBR Average household income, UK: financial year ending 2022, ONS UK natural population set to start to decline by 2025, FT Government expenditure on state pension in the United Kingdom from 1948/49+, Statista

0 Comments

I receive a lot of questions about “how to start investing” and this month alone I’ve fielded more questions than ever before, so, as a belated birthday present to myself I decided to get this all out into a simple blog.

A couple of housekeeping points first: Any tax rates and thresholds mentioned in this post will be correct as at the time of writing but tax is something that gets tinkered with all the time so this could get dated pretty quickly but using figures will help you to understand how it all currently works, in principle. Everything I share here is information not advice. Once you decide to actually start investing you would be well advised to: a) do some further research yourself; and b) speak to a fee-only all-of-market independent financial advisor. Fee only means they don’t charge you a percentage of what you have to invest (that is, they charge a fixed fee) and all-of-market means they can offer products from a range of institutions.. Ideally, you should only invest money that you will not need for at least 5 years. This is because share market prices move up and down a lot and if you need that money before five years is up, there is more chance that you might have to sell at a loss. Investing is a long-term game, the longer the time you can wait, the higher the probability of being up. Over a 20 year period, the S&P500 (which is the 500 largest listed companies in the USA) has returned a positive return 100% of the time. While the future may turn out to be different, you are generally well advised to leave money invested for as long as possible. While my aim is to make this discussion as simple and as unintimidating as possible, at times it will feel really complex not because investing is hard but because we invest within the context of a very complicated and convoluted tax system. But you have to get to grips with our tax system to get ahead with investing…anyhow,…I’ll divide this into four parts to keep it clear:

PART 1 – What sort of investment account should you put your money in

You can think of your 'investment account' or ‘investment vehicle’ as the “house” where your money is kept. There are three different types of vehicles:

1. A pension be it a workplace place pension or personal pension (aka a Self Invested Personal Pension) allows you to invest money before it is taxed; 2. A “stocks and shares” individual savings account or ISA allows you to invest money after it’s been taxed but all dividends and capitals gains are tax free; 3. A taxable brokerage account – means you invest money after it’s been taxed and any capital gains and dividends are also taxable. Any business that offers the services to buy or sell shares and investment funds will typically offer all three vehicles, i.e. they will usually offer pension accounts, ISA accounts, and taxable trading accounts. There are different pros and cons of investing in each of these three. I will highlight the main pros and cons. PENSIONS I am only going to cover defined contribution pension schemes in this post, which is what most people have nowadays. I won’t cover defined benefit pension schemes in which the employer commits to pay you a specific amount from a pre-defined retirement date until death. The rules are much the same between the two but if you’re responsible for your own retirement income as is the case if you have a DC scheme you’re likely to be more aggressive with building that pension pot. I’ll cover the difference between DC and DB pensions in a future post. Pros of investing through a pension

Cons of investing through a pension

Rules on how much you can invest in a pension… There are limits on how much you can invest via pension each year and over your whole lifetime. Firstly, the annual allowance is the maximum you can put into your pension each year and still get a tax benefit. This is currently £40,000 gross (i.e. before tax) or your full annual income, whichever is lower. So, if you earn £30,000 a year the maximum you can put into a pension is £30,000. I am sorry that this is getting complicated already but the UK tax system is mad – so a little detail is essential. A key thing to note is that not all income qualifies towards this pension contribution limit. Earnings from property aren’t allowed. So if all your earnings are from a buy-to-let property portfolio that is in your name, the maximum you can put into a pension is £2,880 and with the government tax benefit this is grossed up to £3,600. So, you’d only invest £2,880 into the pension and it would be grossed up to £3,600. If your BTL properties are in a company, then you could pay yourself a salary (and you’d need to follow rules on national insurance contributions too) and whatever your salary is – up to the £40k annual allowance limit – would be the maximum you could pay into a pension and still get a tax benefit. The second limit is the pension lifetime allowance which is just over £1m at the moment. This may sound like a high limit but it includes capital gains not just contributions so you can easily breach the limit. For instance, if you had £250k in your pension at the age of 35, a 7% growth rate in your portfolio would mean the money doubles every 10 years, so even if you didn’t invest anything else, that £250k would grow to £1m by the age of 55. Ideally, the lifetime pension allowance should grow with inflation but it’s frequently frozen and was even slashed from £1.8m in 2012 to £1m in 2017. This post is not about pensions but they are one of the primary vehicles you can invest through so hopefully what I’ve said so far will help you understand whether is this is the best vehicle for you. Depending on how much money you have to invest, I would look at putting some money in both a pension and an ISA and if you have more besides then you can put some into a taxable investment account. ISAs I love ISAs because once the money goes in, you don’t have to think about making tax declarations any more – it’s all tax free from that point. Pros of investing through a stocks and shares ISA I won’t cover cash ISAs here as this post is specifically on getting started with investing in stocks and shares.

Cons of investing in an ISA

Whether you plan to invest in a SIPP or ISA depends on your financial position and future plans, e.g. retirement goals, goals for your children if you have any etc. As tax advisor to my friends and family I recommend different things depending on what I know about the person including their propensity to choose spending over saving or investing, there is no blanket rule. Taxable brokerage account If you have maxed out your £20,000 ISA allowance and your spouse’s £20,000 ISA allowance and your £40,000 pension allowance then the next place you would look to invest is via a taxable brokerage account. If you are saving that much though, you may want to just spend more…better holidays, more life experiences etc. PART 2 – Who i.e. which institution should you invest your money through

So, you’ve figured out whether to put your money in a pension, an ISA or even taxable account, you now need to decide where to open your pension, ISA or taxable account. The way to think about this is, if you had money to save, one of the questions you would want to answer is ‘which bank should I keep my money with’, that’s the decision we are trying to make in part 2.

If you have a workplace defined contribution pension, that decision is usually made for you although in some cases you’re offered limited options. You are allowed to have a personal pension outside your workplace in addition to the work one but I personally I’m happy with the options provided by the provider of my DC pension at work so I don’t contribute more to another SIPP. There are three options open to you when it comes to type of institution:

The key driver of which platform to use is:

Fees – annual management charge Of the platforms I would guide you to research, these are the annual platform fees you can expect to pay as a beginner. In many cases the fee falls as your portfolio grows:

In addition to platform fees, whatever you invest in will have an ongoing annual fee. Ongoing fees usually range from as little as 0.05% to over 1.00% and in some cases as much as 3%. Watch out for the ongoing fees of what you buy as this is what can really harm the growth of your portfolio. There may also be fees for leaving or joining the platform. Look at all chargeable fees before committing to an account – you can always change institutions if you change your mind but it’s better to do your research before you even start. Any institution regulated by the Financial Conduct Authority, FCA, will be transparent about all the fees charged. Don’t invest through any unregulated institutions. As I researched this article I discovered that Junior ISAs at Fidelity are not charged an annual management charge and I immediately transferred all my children’s ISA investments to them from Hargreaves Lansdown. That was £55k in total – their investments of £20k each, have grown well over time so despite the poor stock market returns of 2022, they remain up. If you’re interested in how I invested for my kids see my post, Q&A: How can I save and invest for my children? I won’t spend a lot of time on fees but will link to several articles that discuss fees across a range of platform: PART 3: HOW MUCH TO INVEST

sIf you have a lump sum to kick start your investing, that’s great. You can invest it all in one go, however, some people prefer to spread a large investment into smaller chunks spread over 2 or 3 months. There is no real benefit in this if you are investing for the long-term – in fact, data suggests that lump-sum investing beats drip feeding your investment into the stock market 75% of the time. But if it makes a psychological difference to you, you can split a large lump sum over a few months.

What’s large? That’s for you to define because if I had a large sum to invest, I would invest however much I plan on investing all in one go. Generally, most people don’t have a large sum and the decision is about how much to invest each month. Investing monthly, over a long period of time, is called ‘dollar cost averaging’ into the market as your shares are cheaper in a bear market and more expensive in a bull market so over time you are paying the average price of the market. If I was working with a specific person, I would want to know how much they want to have at the age of 50 or 55, either as an annual income or in total and I would back calculate the amount they need to invest monthly, today, to achieve that goal. You can do this for yourself using an online calculator - I like the investment calculator on Dave Ramsey's website, you can ignore the fact that it has a $ sign and put in your GBP investments - the sign doesn't matter - I assume a gross return of 7% (that's the return before inflation is taken into account - with average inflation of 3% this is a net return of 4%). You can also ignore links to other resources as they are US-centric. PART 4: WHAT TO INVEST IN

Equities / shares

Investing in the shares of companies is called investing in equities. Equities pay dividends if they have money left over after paying all costs including interest on their debt. Some companies, especially fast growing companies, choose not to pay dividends and instead re-invest the money. If you buy the shares in a company, you’re known as a shareholder and you also make a return or loss from any increase or fall in the price of shares. So, if you buy shares for 10 and they grow to 12, that’s a 20% return; if their price falls to 8, that’s a 20% loss (the profit or loss is only realised if you sell, i.e. a loss is only a loss on paper - not a real loss - unless you sell, so, if share prices fall they can be left invested so that they recover in price). Debt / bonds Investing in the debt that companies issue is called investing in bonds. Bonds earn a fixed and known return. There are a few options you can choose from, here I’ll suggest 3 for you to look into: Option 1: 100% stocks in a diversified fund If you’re starting out in investing, you should be satisfied to earn the average stock market return by investing in a low cost diversified index fund. It requires a lot of time to identify specific companies that are undervalued or those with great growth potential and you don't need to do this to do well with investing - in fact, the evidence suggests just putting money in one or two diversified passive funds gives better returns than stock picking yourself and trying to beat the market. I personally prefer stock indices that track the S&P500 (these are the 500 largest companies in the US) – these funds usually cost 0.10% or less. Large US companies usually have global sales and source materials internationally so I feel it is adequate diversification that implicitly includes Europe and exposure to many emerging markets without having to worry about corporate governance issues. The historical average yearly return of the S&P 500 is 9.645% over the last 20 years, as of the end of November 2022. This assumes dividends are reinvested. Adjusted for inflation, the 20-year average return (including dividends) is 6.932%. (source: tradethatswing.com) If you prefer to invest in the UK stock market, you can choose fund that tracks the FTSE-100 in the UK. In the 20 years leading up to 31 December 2019, the FTSE 100 had an average annual return of 0.4% if dividends were not re-invested but this rose to a not insubstantial return of 4% a year if dividends were reinvested. Option 2: Target date funds Target date funds are funds that invest based on the assumption that you will retire in a given year. These funds have a higher proportion of riskier equity investments and a lower proportion of bonds which give a fixed and known return. As the retirement date approaches, more and more money is invested in bonds and less and less is invested in equities. Some in the investment community consider that target date funds get too conservative too quickly because no one retires and needs all their invested money straight away. So, if you want to have some money in equities and a portion in bonds, you could start with a target date fund with the retirement date set further in the future than you plan to retire - perhaps set it 20 years further than you plan to retire especially if you're partly saving to pass on an inheritance rather than just for your retirement needs. Option 3: Ready-made funds Many institutions offer ‘ready-made funds’ to get you started with investing and if you choose to go with that, as I did when I first started investing, take that as a learning opportunity. Seek to understand what is in those funds, what the fee structure is and if you don’t like the underlying investments or see that the relative fees are high, either don’t buy them in the first place or seek to move away to other investments. I do not recommend investing in single stocks, e.g. buying specific companies as this exposes one to a lot more risk than tracking a whole market so I won’t cover single stock investing here. I used to trade in single stocks myself but I no longer do. A simple example - investing in action

I know all this information might seem confusing so I thought I’d give you an example of all this in action.

So, as an example, about 3 years ago, unprompted, I told a 30-year old couple I know and like that if they wanted to have £300,000 or so when they are 55, in addition to their work place pensions, they should put £100 into a SIPP every month. With a lump sum like that they would have the option to retire early and as DINKies (double income no kids) I knew they wouldn’t feel that kind of investment even if it fell to zero – and with the government match they would be 25% up from the outset due to the tax saving. As I knew they were first time investors and quite risk-averse I got them to put almost all of the invested money in S&P 500 trackers with about 10% in an actively invested fund. They use Hargreaves Lansdown – I chose this for them because their customer service is great and you can easily get a person on the phone – but as their funds grow I might get them to move to a cheaper provider. I’ll review this when they have £50,000 or so. Three years later, they have about £20k between them (they invest a little more than I suggested). As I wasn’t happy with the performance of the actively managed fund, I got them to sell all of that and stick to low cost diversified funds. They’re happy with this set and forget strategy and aren’t much interested in overthinking it and unlike most of their friends have savings. In about four years, they will also be mortgage free to boot – based on a repayment plan I’ve advised them to stick to. Financially they’re on a great track and are also enjoying life… So, investing doesn't need to be complicated or big. You can start small and increase your investment as you learn more, develop confidence, and start to understand how different investments work...OVER TO YOU! Get help investing:

If you want help with setting up your investment account and selecting funds, click the PayPal link below to book me and fill the form in to tell me a little about your situation. Your booking gets you two one-hour phone calls during which we will chat through what you want to achieve with investing then I'll help you set your investment account up in your own name and automate everything for you.

3-Month Coaching Program

£1,000.00

This 3-month coaching program will be custom built to suit your needs.

I used to coach people on business issues only but I quickly discovered most struggles were the result of factors that hadn't even been considered. My coaching programs last 3, 6 or 12 months. During that period you have full access to me by phone, email, text, skype and if you live locally, even for coffees. So that we can just crack on with making you awesome I take payment upfront. Psychologically this makes you commit fully and wholly to the program too. My coaching covers:

Before a coaching relationship starts I recommend you book a one-off call to discuss your self-development needs . If you go on to book a coaching package this "analysis call" will be refunded. You're awesome. Let's make sure everyone who so much as walks past you sees that too! Bonus: you will get the Build A Booming Business Planner & the iPlan To Succeed Life Planner free with this coaching package. Check your email as soon as you've checked out of the shopping cart. 6-Month Coaching Program

£1,875.00

This 6-month coaching program will be custom built to suit your needs.

I used to coach people on business issues only but I quickly discovered most struggles were the result of factors that hadn't even been considered. My coaching programs last 3, 6 or 12 months. During that period you have full access to me by phone, email, text, skype and if you live locally, even for coffees. So that we can just crack on with making you awesome I take payment upfront. Psychologically this makes you commit fully and wholly to the program too. My coaching covers:

Before a coaching relationship starts I recommend you book a one-off call to discuss your self-development needs . If you go on to book a coaching package this "analysis call" will be refunded. You're awesome. Let's make sure everyone who so much as walks past you sees that too! Bonus: you will get the Build A Booming Business Planner & the iPlan To Succeed Life Planner free with this coaching package. Check your email as soon as you've checked out of the shopping cart. 12-Month Coaching Program

£3,600.00

This 12-month coaching program will be custom built to suit your needs.

I used to coach people on business issues only but I quickly discovered most struggles were the result of factors that hadn't even been considered. My coaching programs last 3, 6 or 12 months. During that period you have full access to me by phone, email, text, skype and if you live locally, even for coffees. So that we can just crack on with making you awesome I take payment upfront. Psychologically this makes you commit fully and wholly to the program too. My coaching covers:

Before a coaching relationship starts I recommend you book a one-off call to discuss your self-development needs . If you go on to book a coaching package this "analysis call" will be refunded. You're awesome. Let's make sure everyone who so much as walks past you sees that too! Bonus: you will get the Build A Booming Business Planner & the iPlan To Succeed Life Planner free with this coaching package. Check your email as soon as you've checked out of the shopping cart.

.I always say that if you get nothing else right in your financial life, at least own where you live outright by the time you hit retirement and ideally much earlier. Well that’s not quite right, the other thing you need to make sure of, is that you qualify for the full UK state pension.

Currently, when I am 68, for so long as I have 35 qualifying years, I will get £185/week in state pension until my dying day. That’s about £800/month or £9,620/year. This is not an insignificant amount and if you live with someone, i.e. your partner, a sibling or friend, it’s double that as you would each qualify separately. My calculations suggest that if you’re living on your own, that amount of state pension would at least cover all basic utilities (water, energy, council tax) and food. You can check how many qualifying years you have and whether you can boost them at gov.uk/check-state-pension. If you’re self-employed, to qualify for the full state pension later on, make sure you’re signed up to pay Class 2 national insurance and if there are any gaps in your national insurance record, pay for them asap as you can only fill gaps going back 6 years: gov.uk/national-insurance/national-insurance-classes As the state pension is unlikely to be enough, it’s helpful to contribute towards a personal pension (aka a self-invested personal pension or SIPP) as pension contributions get tax relief such taht every £240/month contribution equates to £300/month into your pension pot. Based on a 7% gross growth rate of your pension pot (and keeping in mind the historic average return of the S&P 500 is 10%)

If you want to play around with how much you should expect to spend in retirement, here are a few other helpful blogs:

Building on the last post on 7 things that hold black children back from succeeding. This is the current Economic status of black people in the UK relative to other groups:

ASSETS

On home ownership According to .gov.uk:

On pensions assets: According to a January 2020 report by the People Pension, compared to White ethnic groups,

The average gap between a female pensioner from an ethnic minority group and male pensioner from white ethnic groups is 51% (half). This figure is 27% for an ethnic minority male pensioner. The average ethnic minority pensioner has £3,350 less in annual pension income. Ethnic minorities are also less likely to qualify for auto-enrolment into a work place pension because they are more likely to earn less than the auto-enrolment threshold of £10,000. INCOME According to gov.uk: In the year ending March 2019, the median annual household income in each quintile before housing costs were paid was:

If we look at the bottom two income quintiles, that is the lowest 40% of income earners,

These figures are before housing costs. The picture changes a little bit after housing costs but I chose to present the ‘before housing costs’ picture because there is a degree of discretion with regards to how much a household decides to spend on housing. While there are income disparities that will feed the gap between the assets of the rich and the assets of the poor, I feel as though the reasoning behind the asset differential is very basic and needs further exploration. On job security: Do ethnic minorities just work less and as a result earn less? No! According to gov.uk:

Based on these stats, the employment rate for black people is 8 points lower than the average for the population and 15 points lower than for Whites. In addition, it’s worth noting that Black people and other minorities are more likely to be self-employed, be on zero hours contracts and are generally more likely to be employed in less secure lower income jobs including as part of the gig economy. Two things stand out as definitely missing:

The UK doesn’t have an identical history to the US and certainly I don’t think UK mortgage lenders discriminate according to race directly or indirectly but if someone thinks they do, I’d love to hear their story. Remittances are a key component of economic growth in Africa. According to Pew Research, "money sent by the African diaspora to their home countries in sub-Saharan Africa reached a record $41 billion in 2017...a 10% jump in remittances from the previous year", another source suggests $46 billion was remitted in 2018, that would be the official figures but billions more are remitted via unrecorded channels. Official development aid to Africa was just shy of $52.8 billion in 2017 (OECD 2019 statistic). Provided this money isn't all being used for consumption, wealth accumulation by Africans is underestimated if we look purely at wealth held by the diaspora within the countries they live. In addition, after discussing the issue of low rates of home ownership with my African peers other factors to consider include:

Social mobility According to research from the University of Manchester,

FACTORS THAT COULD HOLD BLACK PEOPLE BACK When it comes to discrimination in the labour market, some of the same things that lead to targeting or discrimination in the formative years (as described in my previous post) can also adversely affect the likelihood of black people getting well paid jobs:

So there you have it. This is a summary of the current wealth and income stats for black people in Britain. I think it raises a lot of questions. I would love for people to contact me and leave a voice message or a note at katsonga.com/coach or as a comment on this post explaining what they think has helped them succeed or what they believe is holding them back from progressing to higher levels in their career and in building wealth. Heather p.s. subscribe to my podcast and ask me any money question, HERE - do it now!

Hi Heather

I’m really enjoying your podcasts and have already given a 5 star rating. I am 57 and plan to retire at 60 so love your retirement items. When talking about 4% draw down for retirement income, it’s never clear if the figures are before or after tax. For example 4% of £1m is £40k, but after tax this could be nearer £30k. If you then get a state pension of say £9k, the figure before tax is £49k, but after tax it is nearer £35k. So when you talk about money needed in retirement, do you mean before or after tax? Thanks, David

David, thanks so much for the review! I definitely appreciate it.

First things first, David I am sorry that it’s taken me ages to get a blog post done on this, however, I did respond to your question directly within 24 hours of you asking it so I hope that will make up for the late blog post response to your question which you asked me roughly 3 months ago and 4 months ago by the time this airs on The Money Spot podcast. Turning to the 4% rule… For those that have not ever heard of it, the 4% rule states that if you don’t want your pot of invested retirement funds to run out before you die, the maximum you can take from that pot each year is 4%. This means that if you want an annual income of 40,000 from your retirement pot, you need to save one million (GBP, USD, EUR) – I believe the study was done using American stock market performance but if you invest in a global portfolio it will be heavily weighted towards the US so you can use the 4% rule as the best proxy we have on what a reasonable withdrawal rate is. To answer, David’s question, the 4% drawdown is gross and you would have to pay tax after that. So, if you have £1,000,000 (for simplicity) in your pension pot in a given year, you would draw £40,000 and pay the tax on that. If you are based in the UK, you cannot throw the gross amount drawn from your SIPP or other taxable investment account into listentotaxman.com to get a calculation of your after-tax income because your drawings from your investments are chargeable to capital gains tax so you don’t pay income tax on them but capital gains tax. Capital gains tax rates are different. In 2020, assuming 50% of the £40,000 you draw is capital gains, then your net income after tax would be calculated as follows: Not taxable: £20,000 (this is the portion you actually saved) Taxable: £20,000 (the capital gain) Deduct capital gains tax allowance: (12,300) Taxable: £7,700 This taxable amount all falls into the basic rate band for 2020/21 so you’d pay tax of 10% on it, i.e. £770. If you had a portion in the higher rate tax band even that is only taxable at a rate of 20%. So, out of the £40,000 the net amount received would be £39,230. This is a huge different to what you would have paid if this was income of £40,000 as the net income would have amounted to £30,841. That’s a difference of £8,389 – wow! People on work place pension will be taxed in that way because the DB pension counts as income, you can’t separate it into capital and capital gain. If you are UK based and have reached your state retirement age then you would have an annual state pension. This is taxable to income tax and you can throw the total annual state pension amount that you receive into listentotaxman.com to figure out how much you will receive after tax. State pension is taxable if all your sources of income sum exceed the threshold needed to pay tax. That annual state pension is just over £9,000 so if that’s your only source of retirement income you wouldn’t pay any tax because it’s below the personal allowance of £12,500 – however, if this is you, you probably wouldn’t be the type of person that listens to personal finance podcasts - #JustSaying. A few BIG things to remember though: ISAs If your retirement income is all in your ISA then it is all tax free; not tax needs to be paid. Capital gains tax allowance Current tax rules allow you to have a tax free allowance on capital gains in addition to the tax-free personal allowance SO your tax bill may be much less than you think because your state pension and any other pension income may fall into the regular income bucket and this enjoy a separate tax free allowance. For 2020 the Capital Gains tax-free allowance is £12,300. I don’t know if this will be available when I retire, there’s talk of eradicating it to raise more tax… Early retirement Those that retire very early, and I’d classify anything before 55 as early may be overdrawing if they draw 4% because the study of the 4% rule was based on a 30-year retirement. David, you’re probably okay given you’re 57. Sequence of returns risk Sequence of returns risk analyses the order in which your investment returns occur. If a high proportion of negative returns occur in the beginning years of your retirement, these negative returns will have a lasting negative effect on the balance of your investment portfolio and the amount of income you can withdraw over your lifetime is reduced. This is sequence of returns risk. However, if you have a few years of good returns when you retire and negative returns only occur later, say in the middle of retirement, then there’s a lasting positive impact. If this happened to me, I would probably stop drawing income from my retirement pot for 2 or 3 years and live off non-stock market income, e.g. if you have cash pot set aside, I’d deplete that first; or I’d consider getting a part-time job; or for those fortunate enough to have rental income, you can live on that and give your investment portfolio time to recover. I think that’s all the main stuff. To summarise:

I hope this answers all your questions and I additionally hope that I threw in a few thoughts that you hadn’t considered. Heather p.s. subscribe to my podcast and ask me any money question, HERE - do it now!

Hi Heather

When is a good time to draw equity from your house: when I retire which is in about 5 years or before? Mary

Hi Mary

Thanks for this question because it really got me scratching my head. I was initially quite flummoxed when I received the question because as a proponent of the FIRE movement (Financial Independence Retire Early) the whole premise of my money management toolkit is to get out of debt including mortgage debt completely and NEVER go back. However, I am going to park this way of thinking and answer your question in the most unbiased fashion that I can and I will also ask you a few probing questions so you can figure out whether this is what you want to do. FIRSTLY, what do you plan to do with the money? Do you want to use the money for general living or to make a significant purchase or investment? Generally, I think in most cases it is not a good idea to get into debt during retirement as it may cause undue stress if you run into any unexpected financial problems. OPTION 1: Take equity out and pay off the debt or interest during retirement I don’t know the value of your home or any other numbers, however, if you take equity out of your house that money will be charged interest and if you enter into a standard mortgage contract, you will have to pay the interest and possibly repayments from the month after you take that equity out. From my follow up email to you I gathered you have a pension that will come in when you retire. I am assuming this is a “defined benefit” pension so it’ll be paid to you from retirement until you die. By taking on debt you will have a reduced income. So, if your pension is income amount to 2,500 per month and if you take out equity requiring 500 in monthly payments you will lose 20% of your pension straight off the bat to debt payments. How will this affect your standard of living? OPTION 2: Take equity out and pay all the interest off when you die If you are over 55, which I assume you are, you can also get a mortgage that doesn’t require interest payments to be made until you died.

Depending on the terms you may be allowed to repay some or all of the amount borrowed. Otherwise, with a lifetime mortgage all the interest would be accumulated and paid on your death.

So if your home is worth 100,000 you might sell a 40% stake to the bank for a 20,000 lump sum. When you die, the bank gets 40% of whatever the house is worth at the point. So if you die 20 years later and your home is worth 300,000 the bank get 40% of 300,000 which is 120,000 for the 20,000 that they lent to you. If you died the very next year and your house has stayed the same in value then the bank gets 40,000 for the 20,000 that they lent to you. Even if your house falls in value the bank is still likely to come out ahead because they take a huge hair cut off the value of the house. The reason these mortgages are only offered to people over a given age is to minimise the chance of the bank losing its money, for example, because accumulated interest exceeds the value of the house on a lifetime mortgage. To safeguard the bank further, they keep the amount of equity that can be released quite low; the younger you are, the lower the allowed equity release. So, a 55 year old might be restricted to releasing no more than 20% but a 75 year old might be allowed to release 30-40%. I am making numbers up here because the reality is that more conservative banks will have lower limits and banks that are more risk tolerant allow a bigger release of equity. It all sounds great on first inspection but banks have received a lot of bad press regarding equity release schemes because in the fine print they have stuff like, you don’t need to repay the interest PROVIDED you live in the house so if you need to move home, even into a care home or to a more accessible home because you develop mobility issues, all that money comes due and you would be forced to sell your house and pay the bank. There are likely to be other catches too because banks are in this to make money so if you go for an equity release scheme of any nature you should have a lawyer or financial advisor look at the terms and conditions diligently for you so you know exactly what you are getting yourself into. The bank might get a guarantee that you will never owe more than the value of your home but this means that you could owe the full value of your home to the bank. If you release equity at age 55 and live until 95 there is every chance that interest can accumulate to the point of exceeding the home value. It’s nice to get a tax free lump sum via an equity release but in doing so you may reduce your entitlement to means-tested state benefits, now or in the future so you need to think about this angle too. I don’t know how well I am doing with the unbiased view thing here as you can probably tell that I think releasing equity is a high risk game and it frankly, freaks me out. If you don’t have any kids or charities/causes that you’d like to leave an inheritance to and you’re certain you will be physically fit enough to live in your home until the day you die then perhaps the risk of releasing equity could be worth it. Another form of equity release is to downsize your home, i.e. you sell an expensive home and buy a cheaper home and live off the difference, this way you release equity but don’t incur any debt in the process. COST OF EQUITY RELEASE According to moneysaving expert.com, a lifetime mortgage equity release typically has an interest rate of c.5%, but some rates are under 3%. This is a lot higher than rates on regular mortgages. E.g. With a 40% deposit you can now get a 5 year fixed rate mortgage of just under 1.4%, just to give you an idea. If you release equity at a rate of 5% then the amount you owe would double every 14 years (see my article on the rule of 72); so if, say, you borrow 20,000 on a 120,000 home, if you live until 74 you’d owe around £40,000, live until 88 and you’d owe £80,000 and live until 102 and you’d owe 160,000. As well as the cost of the interest, don’t forget that you'll have to pay arrangement fees when you take out the mortgage and in the UK these range from £1,500-£3,000 depending on the mortgage deal and including things like solicitors and surveys. ALTERNATIVE As you have 5 years until retirement, you could try to boost your savings over the five years so that rather than borrow money you’ve saved for it. If you don’t feel you earn enough to save the amount you want you can look at things like renting rooms in your home via AirBnB or by getting a more full time lodger. I would personally find it very scary to go into retirement with debt because the need to keep with payments or even the knowledge that I don’t actually own my home but if you are more comfortable with the idea then this won’t be a consideration for you. My biggest advice would be get professional advice before you take this massive step and do whatever you can to avoid having to do it. A debt-free retirement is a peaceful retirement. Much love and thanks for being a long-time follower. See the linked article on equity release on the moneysavingexpert.com website. Heather x p.s. subscribe to my podcast and ask me any money question, HERE - do it now!

Hi Heather, just discovered your podcast and blog. Really inspiring. Could I ask a question?

I have about £10k to invest and I’m considering three options. I’d really appreciate your help in deciding what to do.

Any advice would be hugely appreciated. Many thanks Nik M

Hi Nik

I apologise for the delayed response as I realise your question was time-sensitive but I was in project execution mode over the last two weeks. I think this is an awesome question and I’ll tell you how I would go about thinking about this. Firstly, did you know that I too am a civil servant with access to the Alpha pension scheme? Let me know via the comments box if you did know. I have never mentioned it in any blog or podcast before but it is on my LinkedIn. Given what you have said about when you could access your SIPP, I am guessing you are about 43 years old, i.e. you have 12 years to reach age 55 when you can access the SIPP and if your retirement age is 67 then you have 24 years until you can access your Alpha pension savings. There are 4 keys things you might want to consider:

PORTFOLIO EFFECT By portfolio effect I mean you should consider how the lump-sum is invested in the context of other sources of income you expect to have in retirement. Firstly, I opted out of the Alpha pension scheme because my husband works for the NHS and has access to their defined benefit scheme and because we manage our household finances as a single unit, I felt we could take more risk. His NHS pension gives us a safety cushion and I went for the civil service partnership pension which works exactly like a SIPP in that what I get at retirement depends on the return. An added benefit is that I can access the money at age 55 rather than 67 if I want to although I doubt I would do that as I’d rather use up my ISA savings first. THE RETURNS Average stock market returns have historically been about 10%. This could be the same in the future or it could be different. There are no guarantees. I am not sure what your passive investment portfolio is specifically invested in but I will assume it is a passive global fund and as you haven’t said it is in an ISA, I will assume it’s in a taxable investment account. The last time I looked for a reasonable return to use to model my future returns I found an article that suggested 9% gross and 6% net of inflation was reasonable. I prefer to use 7% gross and 4% net of inflation. If we go for the 7% return in taxable brokerage account – i.e. ignore the SIPP option to begin with:

If you drew the money down according to the 4% rule which says that you should draw no more than 4% of an invested portfolio so that it doesn’t run out, then if you start to draw on this money from age 67 (same as when you would have access to your Alpha pension money) you would draw £2,028 in the first year of retirement (50,700 x 4%). The following year when you are 68, you would draw £2,083 i.e. (50,700-2,028) x 1.07 x 4% - you draw slightly more because although the money has been drawn it is still invested and continues to grow at the average rate of 7%. These are gross numbers – what about after inflation? If you wanted to look at what you would be drawing after inflation, then in the equivalent of today’s money you would draw £1,024 (25,600 x 4%) and you would draw slightly more in real terms the following year. You need to compare what this looks like against Alpha. I know Alpha is inflation protected but I am not clear whether the £1k increase in Alpha payments that you mention is from today or whether it’s £1k from the age of 67 and growing from inflation at that point. If it’s £1k and growing with inflation from today then at the age of 67 you would be getting £2,030 in real terms (1,000 x 1.03^24) whereas with the stock market investment you were getting only £1,024 in real terms – from this perspective Alpha is a no-brainer as it’s a guaranteed £2k per year until death rather than a probabilistic gross drawdown of £2k per annum. I see the stock market as broadly providing some inflation protection given all companies increase the prices of their products over time. If it’s the case that the increase in the Alpha pension is £1k at age 67 then growing by inflation from that point then the additional gross £1k in real terms after 24 years is only £490 (1,000) / (1.03^24) – in this case the stock market investment looks much more attractive. If you go for Alpha with self and dependents then multiply the Alpha benefit by 90% to evaluate the impact. If we go for the 7% in a SIPP account – then you get an immediate uplift because there is an immediate tax saving. As a higher rate tax payer note that the SIPP provider would only claim tax relief at the basic rate of tax and you would need to claim additional tax relief via your self-assessment tax return or if you don’t do a tax return you would need to call HMRC to see if you could just do it by changing your tax code. With the full tax relief £10k translates to £16,667 in your SIPP.

If you drew the money down according to the 4% rule, then if you start to draw on this money from age 67, you would draw £3,380 gross (84,530 x 4%) or about £1,700 in inflation adjusted terms and steadily growing. From a returns perspective putting the money into a SIPP begins to look very attractive indeed. This brings us to the next consideration, horizon/flexibility.

HORIZON / FLEXIBILITY

With a SIPP you have access to the money from age 55. Unless you are 100% sure you don’t want to retire before age 67 or even to part-retire then you don’t need earlier access to the money. With the money in a taxable brokerage account you can draw the full gross amount invested in one go, if you like. There would be tax to be paid but you would still have the full amount if you wanted it. You can reduce the tax amount due from a full drawdown if you put half i.e. £5k into your own investment account and half into a spouse’s investment account. You can avoid tax completely by putting the full £10k into an ISA (the annual limit is £20k so you would be within that). INHERITANCE If you have all your assets in a defined benefit pension plan then your dependents don’t have access to those assets except to the extent defined by the plan. For Alpha, if you die before your spouse then I believe your spouse continues to get 37.5% of what you would have got and children only get a benefit if they are under 18 or under 23 and in full time education. With a SIPP your family gets everything invested and under current tax law money sitting in a pension is protected from inheritance tax if you die before the age of 75 (this could change given the tax rules are constantly changing). So, as basic example, if you died at the age of 67– in 24 years just before you could claim any pension, if your 10k had been invested in:

I apologise that this response is so full of numbers but this is essentially all the things you need to think about and the numbers are pretty important when we are thinking about pension and retirement options. IN SUMMARY If having access to a few pots of money before the age of 67 is important to you or if passing on some cash to dependents matters, then Alpha is not attractive. If you are risk averse and want to ensure you have a comfortable, guaranteed inflation-linked pension pot then plough the £10k into the Alpha pension plan as this would suit your risk tolerance better. I hope this helps! Heather Have a money question for me?

If you have any personal finance questions send them to [ME] – I respond to all emails but there can be a lag of a few weeks between me getting a question and responding to it as I try to give very comprehensive responses.

Hi Heather!

I'm 22 years old and I've been trying to get a good control of my finances. I'm still a student so I don't have a regular income. I've set up a LISA account to save for a house but I'd also like to begin saving for retirement. I've looked everywhere online but nothing seems to explain what different kinds of pensions there are, how to open them and how they work. Please help! Alex

Alex, this is an amazing question to be coming from a 22 year old! Well done for setting up a Lifetime ISA, that's a good move especially as they are considering phasing that scheme out.

I have been meaning to write a post on personal pensions this since Christmas because another person asked a few specific questions so I’ll tick their questions off in this post too as they could apply to you as well at some point in the future. PENSIONS! Pensions are one of my favourite topics. If you were in a job you would have access to either:

What you need to open is a self-invested pension plan or SIPP. When you do have a work place pension, you can also have a SIPP in addition to it; there are no penalties for doing so unless you’ve reached the annual limit for investing in a pension but this isn’t something most people need to worry about. Once you open a pension account, you need to decide how you want your money to be invested. This is your decision unless you hire a financial adviser. However, even if you do get financial advice I always strongly advise getting some financial knowledge so that you can judge whether you agree with the advice you are getting or not. Every financial adviser has her own beliefs and biases about investing, that's human, the question is whether you agree with her. Most people don’t know a lot about investing (including me when I started working) so some investment sites might ask you to answer a few questions on how you feel about risk-taking and then they suggest “ready made portfolios” to you to invest in which would be aligned with what you say your risk tolerance is, your “stated” tolerance for risk. On some sites you might have access to “target retirement funds” this means you state when you want to retire and they adjust the risk of your investments based on that. For example, if you want to retire at the age of 62 which is 40 years from now, in your case, you would select a 2060 target retirement portfolio. The fund manager would then manage the risk by investing in more risky stuff now when you are far away from retirement and as you approach retirement the balance of investments would be adjusted away from higher risk, higher return investments towards lower risk, lower return investments. The risk-return relationship is very important here. If you say you have a lower tolerance for risk then the options you will be given will have a lower associated risk but also a lower return on your money. If you have a long time until retirement, and being 22 Alex, you have a very very long time until you need to retire then you can afford to take more risk. Personally, 100% of my stock investments are in equities (that is, they’re invested in company shares) because I get a fixed bond-like return from property investing so that balances it out. By comparison, the average investor will usually have a portion invested in bonds and a portion in equities. By buying bonds you lend money to companies or a government and they pay you a fixed amount for that loan. As a lender, you are not a part-owner of the company and as such you don’t get a share of the company’s profits as you would if you invested in the shares. By the way: shares, stocks, equities are usually used interchangeably – they mean the same thing in most cases. Equities vs. bonds I won’t go into too much detail on equities vs. bonds but here are some important differences:

Why am I telling you all this? Because you need this sort of high level knowledge to decide how your money will be invested. What portion of your investments will you put into equities and what portion into bonds?

If you’re investing in ready-made portfolios and they give you an indication of risk, the higher risk portfolios have more equities and the lower risk portfolios have less equity investments. Single stocks or index funds You can manage your risk by only investing in funds or portfolios that invest in a wide variety of companies. Some people find it more exciting to buy a single company's shares (single stocks) but that is much more risky than investing in funds because a fund is a diverse portfolio of lots of companies. As Index funds include a large number of companies, the complete failure of any one of those companies would have a much more limited impact on your return. I have dabbled in buying single stocks myself and I can tell you that it’s very difficult to choose winning stocks – to maximise your chance of winning “buy a whole stock market”, either by buying index funds that track a whole country or by buying index funds that track a whole industry. If you do want to dabble in single stock investing, don’t put any more than 10% of your portfolio into them and as your portfolio gets larger I would reduce that to 5%. So, for every £1,000 invested don’t put more than £100 into single companies and as you move towards a portfolio worth £100,000 I would personally reduce single stocks to no more than 5% of my investments. These are arbitrary percentages and as you gain experience you will decide what feels more appropriate for you. Actively managed vs. passively managed funds There are two main types of fund to choose between, actively managed funds and passively managed funds. Passively managed funds track a whole market such as the S&P500 which tracks the 500 largest, listed companies in the US or the FTSE100 which tracks the 100 largest listed companies in the UK - I emphasise listed because there may be companies that are just as large as those listed on the stock market but because they are privately owned you wouldn’t have access to buy their shares. Alternatively, instead of tracking the whole market in a given country you can choose to invest in a specific sector such as utilities or technology or consumer goods. Actively managed funds have an actual person choosing which shares are likely to outperform the market and investing in such undervalued shares or choosing companies that are likely to grow rapidly and enjoy a rapid increase in value. The objective of an active manager is to beat the market index, while the objective of a passive fund is to match the return on an index. Now, you would think active funds, managed by "clever" fund managers are likely to beat the average market return from passive funds, right? Unfortunately, history has taught us that this very simply isn’t so: over 95% of the time fund managers do not beat index trackers. Not only that, the fees on actively managed funds are higher so even if you observe that an actively managed fund has achieved the same gross return as a market tracker you would be earning less from the active fund after fees have been deducted. Where to start? Where to start? I realise that this is all very technical stuff especially if you are beginner so here are links to a few indices to get you researching and investing. These are all funds I am invested in but I am not recommending you invest in them, only that you look at them to see what is included in each fund, what countries are represented, which companies are invested in, what the fees are and what returns have looked like over the last 5 years. I have put the fees each fund charges in brackets as the fees charged is one of the primary reasons I choose whether or not to invest in a fund. Fees can dramatically erode your return so you should always consider what the fees are before you invest in anything:

Even from the above you can see the large difference in fees between my actively managed fund and the passively managed ones. However, I am personally convinced by the management of Fundsmith. Their investment philosophies are aligned with mine and I think they have the potential to beat the market over time but I don’t put all my eggs into the Fundsmith basket despite my confidence in them. In summary, if you invest in a self-invested pension plan there is no commitment to a fixed pension income at the point of retirement. You therefore need to carefully decide how the money is invested. In doing this you need to consider:

Where can you open a SIPP? The biggest difference between the various platforms where you can open a SIPP is the user interface, customer service and the FEES. In a nutshell you might be charged any and all of the following fees:

Here are a few places you can open a SIPP account including the fees. The money to the masses website has a table showing what the fees look like depending on the amount invested. I recommend you have a look at that but below I share four that I consider to be popular and cost effective. Halifax share dealing

Hargreaves Lansdown

iWeb

Vanguard

Having only Vanguard’s funds is not necessarily a bad thing, they are cost effective and if you have an ISA elsewhere in addition to the SIPP at Vanguard, you can use that to invest in funds run by other institutions, e.g. Legal and General and Fidelity to name a few. Vanguard are very well rated in terms of performance and customer service in addition to having good fees. That said, you could save money on the account fee by investing in Vanguard funds via Halifax share dealing or iWeb and those two platforms would give you access to a wider variety of funds as well. Also, Vanguard’s minimum investment is £100/month or £500 lump sum. If you want to start out with £25/month which at your age is absolutely fine, then you need a platform that will allow lower monthly contributions. Where do I invest? I have a SIPP for my son at Hargreaves Lansdowne and I have a SIPP for myself at iWeb. The fees at iWeb were the cheapest for my ISA and I decided to have my SIPP there too as the fees were reasonable although not the cheapest at the time I opened it. It didn’t make sense to have a SIPP elsewhere to save not very much money. iWeb don’t offer junior ISAs and I wanted to keep my son’s SIPP with his ISA as well so I added it to his Hargreaves Lansdowne account. Based on the small amounts being added to his SIPP (£100 per month) the SIPP fees were actually cheaper at HL but they would have been more expensive for me because my SIPP account has much more invested than my son’s. To cut a long story short, where you choose to open a SIPP can also be influenced by where you have an ISA and whether you want these to be kept together. It’s not necessary to have your investments all in one place, I certainly have several investment accounts for various reasons. Before you decide speak to a few people including family members so you have a flavour for where your social circle seem to be investing, if at all. How much can you put into the SIPP each year? You can have a SIPP if you're resident in the UK whether or not you pay tax but your earnings impact the maximum amount you can put in each year. If you are not employed via the PAYE system, the maximum is £2,880 if you are not employed which becomes £3,600 including the government top-up which is equal to what you putting times 100/80. When you are employed you can put the equivalent of your full salary into your pension up to a maximum of £40,000 per year. I won’t go into lifetime limits for you as you are so young and will discuss those in my general post on pensions. Can you have a SIPP if you are a British citizen living abroad? You cannot make contributions to a SIPP if you are not a UK resident even if you have a British passport. You have to be a UK resident. If you have spent some of the year abroad and some of the year working in the UK, HMRC counts the number of days spent in the UK to confirm if you are UK resident. I won’t go into detail here because the actual number you need to qualify as a UK resident depends on whether you were a UK resident in the previous few years. You can, however, set up a SIPP if you're resident overseas and want to transfer a UK pension from a previous job to the SIPP (but you cannot make further contributions to it). So, for example, if you have a pension with a UK employer and want to transfer that to a SIPP while you are abroad, you can do that. If you’re resident abroad but paid in the UK and pay tax here you can also have a SIPP. So, for example, some British expats work abroad but are paid in the UK and pay a portion of their tax in the UK and are likely to qualify, however, speak to an accountant or financial planner to make sure you don’t fall foul of any rules if you’re ever in this complex domicile situation. What happens if the company you have your SIPP with goes bust? If your SIPP provider becomes bankrupt, your money should remain unaffected. Your money is not invested in the SIPP provider themselves; they either simply manage your investment or act as a platform for you to manage your own investments. I hope this helps! Heather References: What happens if my SIPP provider goes bust? Build a low-cost DIY pension Have a money question for me?

If you have any personal finance questions send them to [ME] – I will answer whatever piques my fancy via a blog post.

Hi Heather,

My name’s Linda. I would like to have a comfortable retirement but I am not sure how much money I need to have saved up in order to achieve this goal. I am not particularly extravagant but I do want to be able to afford at least two holidays a year. I additionally don’t have access to a fixed workplace pension so I need to live within the means of my own investments and the state pension. How should I go about working this out? Thanks

Thanks for this question Linda.

There are a few ways to think about this. Firstly, when do you want to retire? The reason that this matters is that your state pension will only kick in at the state retirement age so if you retire earlier than this you will need to make up the difference from your own investments. You also need to consider your living situation during retirement. If you are likely to be married or in a relationship then you would have two state pensions coming into the household but not double the costs – for instance, utility bills don’t double with double the number of occupants in a home. You would also need to factor in that, even if you are in a relationship, one person will probably outlive the other and at that point one source of pension income may be lost. TWO WAYS TO GET AN INCOME IN RETIREMENT FROM A SAVED LUMP SUM There are two ways that your savings and investments can be used to secure your income in retirement: The first way is to buy what is called an annuity. The second way is to just draw down your income slowly over time. ANNUITY An annuity is a financial product that provides a guaranteed income for life. Essentially, you take a lump sum of money, give it to a financial provider and they tell you how much they can pay you for life depending on the features you want. For example they can give you a fixed amount every month for life, or they can increase that amount every year by inflation, if you want an annuity that grows with inflation the starting amount will be smaller than if you go for the fixed amount. You can also buy an annuity that covers one person’s life or two people’s lives, that is, once the first person dies the annuity continues to pay out until the second person named on the annuity also dies. Annuities used to be popular in the past but because interest rates have fallen drastically since the 2008 financial crisis they have not been so attractive. How much would you need if you were planning on retiring today, were getting a state pension and were planning on buying an annuity? According to this is money who in turn source a report by Royal London, you would need £260,000. “Royal London’s sums were based on the amount needed to bridge the gap between an £8,500 state pension and two-thirds of the £26,700 average salary.” Two-thirds of £26,700 is £17,800. This means Royal London are assuming that you would live on £17,800 every year: £8,500 of this would be coming from the state pension and £9,300 would be coming from the purchase of the annuity. These figures suggest the annuity is giving a return of just 3.6%. In my opinion, that’s a very poor return and not even worth getting the annuity. This is money also confirm in their article that if you plan to retire in 30 years’ time rather than today, this £260,000 becomes £400,000 and this further assumes that annuity rates improve by then. If interest rates are just as low in 30 years’ time as they are now and if we assume average inflation of 3% per year (which is what it has been historically), then instead of £260,000 you would need £630,000. Personally, I do not recommend the annuity route AT ALL. If you are happy to take a little risk then you would be FAR better off just drawing on the invested money. DRAWDOWN The most popularized rule for drawing down on your invested pot is the 4% rule. The 4% rule essentially says that if you drawdown 4% of an invested pot every year, you are unlikely to run out of money over a 30 year period. While the study that came up with the 4% rule used 30 years as the period during which a person would be retired, the general conclusion is that even at the end of that 30 years the money invested will have grown because the average drawdown rate of 4% is lower than the average growth rate of your investments. So, for example, if your investments grew by 7% in the last year then taking 4% means you are still ahead. The beauty of drawing down rather than buying an annuity is that whatever is left when you die can be passed on to children, charities or whatever you choose. With an annuity, the payments die with you. For example, if you bought the annuity of £9,300/year today and died next month, tata £260,000 – that’s it. The full benefit of your early demise goes to the financial institution that sold you the annuity in the first place. Rubbish, right, well that’s what you get for playing it too safe! If we take the £260,000 lump sum we have been using and continue with it for example purposes, then a 4% drawdown would produce £10,400/year in the first year which is better than the £9,300 you were getting from the annuity that ‘this is money’ talked about. Not only that, in the following year it could be that you will base the drawdown on a bigger number than £260,000 because the investments will have grown in value. The average growth rate of the stock market over the last few decades has been 10% before accounting for inflation. Of course, this says nothing about the future as stock market returns in the future could be better than or worse than this. Rather than working backward from what income a given lump sum will give you? Let’s figure out how much you will probably need to spend in retirement, that is, let’s work out your desired retirement income. Once we have your desired income we will subtract income from your state pension and any other pensions. We will then divide the gap by 4% and this will give you the value of investment assets that you need. SPENDING I’ll share two sources that I have found for trying to work out how much money you will need each year in retirement. SOURCE 1 – on how much money you need for retirement “According to research carried out by Loughborough University and the Pensions and Lifetime Savings Association (PLSA), workers who only manage to save enough for a retirement income that provides them with £10,200 a year (£15,700 for couples) will achieve a minimum living standard, those who managed to save enough for £20,200 a year (£29,100 for couples) will be able to live a moderate lifestyle during retirement and those who are able to save enough for £33,000 a year (£47,500 for couples) will be able to enjoy a comfortable retirement.” (source: moneyfacts.co.uk) This £33,000 a year (£47,500 for couples) includes holidays abroad, a generous clothing allowance and a car. These are the lifestyles that the Loughborough University and PLSA study creates:

I don’t know about you but I would like to target the comfortable lifestyle or better! Using the 4% rule, if you are targeting a comfortable lifestyle then:

Before you give up before you’ve even started because these numbers sound too hard to achieve, keep listening, I’ll give you an example at the end of how much you need to save now and it will sound much more achievable. If you are targeting a moderate or minimum living standard, you can calculate the equivalent numbers by following this formula:

As a reminder, the full state pension is currently £8,767.20 per year but I used £8,500 in my examples for simplicity. If you plan to retire based on the minimum standard of living at say 60, then when you start getting the state pension as well if you are a single person, you would be boosted to close the moderate living standard; and if you are in a couple, you would be boosted just beyond the moderate living standard by receiving two state pensions – assuming both people are entitled to the full state pension or close. SOURCE 2 – on how much money you need for retirement Using a report from the Joseph Rowntree Foundation, a respected charity, Fidelity.co.uk allows you to start of with a basic standard of living which costs £16,300 and allows you to add annual costs to this depending on the lifestyle you want. This £16,300 accommodates basic rental accommodation, basic costs for food, alcohol, clothing, water, gas, electricity, council tax, household insurances and other housing costs, public transport costs and an occasional visit to the cinema. The basic £16,300 cost of living assumes a single person not a couple. Within this figure you don’t run a car, you don’t eat out much at all, you don’t smoke and you don’t have internet access or paid-for film channels (I guess you would watch only free channels and have to go to the local library for the internet). Note that this £16,300 is higher than the £10,200 suggested by the Loughborough University study for a basic standard of living but lower than the £20,200 suggested for a moderate standard of living so we can call it basic Plus. I would guess the Loughborough study assumes you have paid your home off in their basic living assumption which could explain the difference. So, how do we boost the £16,300 basic income to improve our life style?

If you added on every single one of these extras, you’ll be at a very comfortable £37,500/year which is not too far off the £33,000 suggested by the Loughborough University study for a comfortable retirement. This would be equivalent to £54,000 for couple if we increase in direct proportion to the Loughborough study (37,500 * (47.5/33)). What level of investment assets do you need to achieve this? You need c.£940k if you are a single person or £1.35m if you are a couple before the benefit of a state pension. This £1.35m is very aligned with the £1.2m we got using the Loughborough University study. State pension income reduces your need to save and invest by about £200,000. If you keep a budget it might be easy to calculate what your monthly spending in retirement will be; just remove all the things you spend on now that you won’t need to spend on in retirement, like travel to work or rent or a mortgage payment if you plan to own your home outright at the point of retiring. There are a lot of numbers here but it’s more or less pretty straight forward once you have worked through it systematically. How much do you need to save now to live your ideal lifestyle and to hit your goal by retirement? You’ll need to take the next step and figure that out. If you want me to help you do this, request a call. As an example, if you are a 22-year old couple now and plan to retire at 67, you only need to be saving £285/month in total into pensions (that’s only £140/each). This has to be into pensions and not into an ISA as I am assuming you get the tax benefit of saving into a pension. My calculation assumes you get an average market return over those 45 years of 7%. If returns average 10% as they have in the last 45 years, you would completely overshoot and end up with a retirement pot of £3.7m – how’s that for compound interest?! If you are enjoying listening to my podcast, please give me a 5* rating wherever you listen to podcasts. If I don’t yet deserve your 5*, please let me know how I can earn it. I hope this helps! Heather Have a money question for me?

If you have any personal finance questions send them to [ME] – I will answer whatever piques my fancy via a blog post.

What's the point of saving? What's the point of saving?

Hi Heather,