Q&A: If You Want To Diversify From Real Estate, Property & Land, What Should You Invest In?17/8/2016

Dear Heather,

Greetings from Chengdu, China; I love your vlogs and I enjoyed watching your birthing story and recent vlog on how to make money. You are so inspiring and motivating. You inspire me. On the recent vlog you discouraged investing on the stock market. Why was that? My husband and I have invested in properties in America and are looking at buying one in China since we will be here for the next four years. We have also been eyeing property in England. My question for you is since we want to diversify our portfolio from real estate and land what do you recommend? You have the cutest family and gorgeous son. My son is [] months and has been keeping me very busy. Looking forward to hearing from you when you have some free time. Best Regards, Faith

Dearest Faith

Thank you so much for your lovely email. I really appreciate everything you say, it keeps me motivated and keeps me wanting to work. Children do keep you busy but they're so enriching :). The first thing I thought when I received your email last week was, what on earth are you doing in Chengdu, China? (email me for privacy) I am always super intrigued re. what black people do when they’re in Asia but not studying…I’d love to learn more about that. Anyhow, back to property. Firstly, I hope you have made the very low investment in my property course, the price will go up soon so get in while it’s cheap! This is how I think about investing in general. Firstly, I am working towards a given gross rental income per month of £10,000 from a UK/Europe and US portfolio. We don’t currently have anything in Europe or the US but I’m eyeing both up. After mortgages are paid off 90-95% of this will be pure profit. I could easily reach this in the next three years if I include income from rents in Malawi but I discount that income because the country has a lot of political and economic instability and it’s possible that something could happen that completely erodes the rental income. Based on this methodology, we’re roughly half way. If you invest in China you might want to apply a discount too given they’re legal framework may not be as solid as that in the US or UK. That said, they are definitely much more stable than Malawi so invest away. Keep in mind that investing in real estate in different areas and countries is also diversification. There are four main reasons I find property so attractive:

1. Leverage magnifies returns

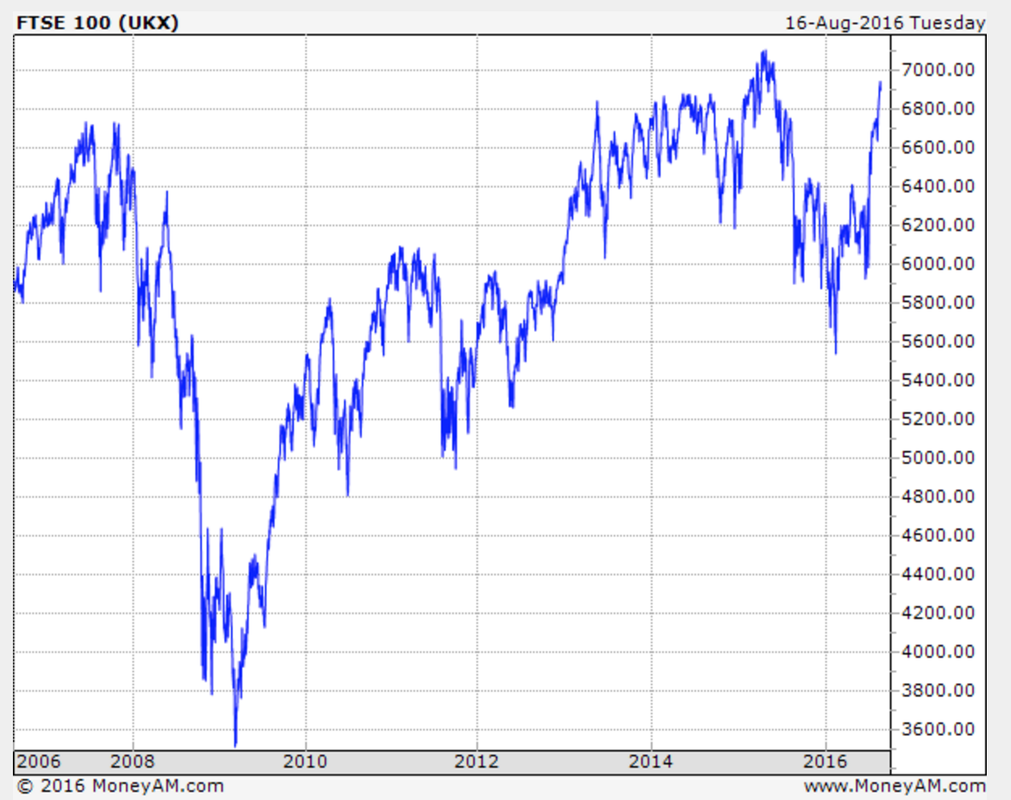

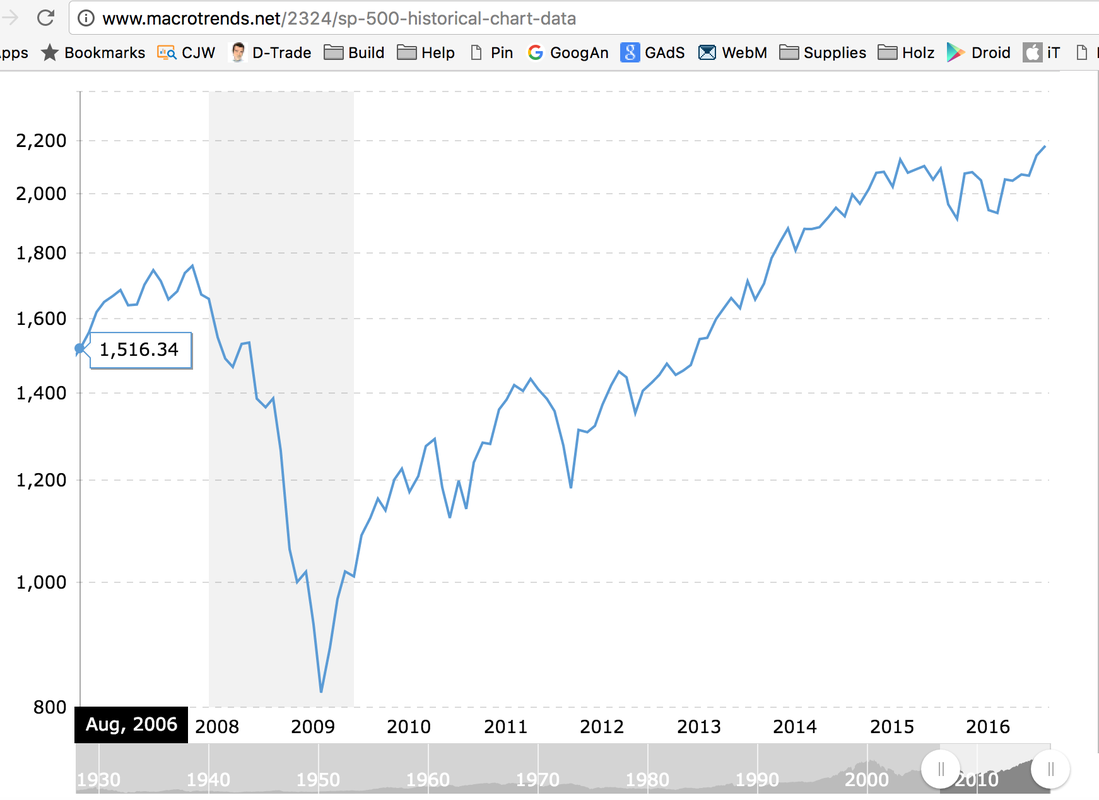

Just to give you an idea of what I mean. The first property I bought cost me £16,500 including a 5% deposit of £12,500. Stamp duty of £2,500 (this is a UK property purchase tax) and about £1,500 in other costs. That was 2006. Fast forward 10 years and the current value of £550,000 meaning a £300,000 capital gain and a gross equity value of £400,000 including what’s been chipped off the mortgage. No other £16,500 investment could have produced that kind of return for me. Firstly, no one would have given me cheap leverage to invest in the stock market and secondly, the returns would have been rubbish – to use a technical term. An investment tracking the FTSE100 would have me worse off; I’d have roughly the same £16,500 today eroded by 10 years of inflation. An investment tracking the S&P500 would have given me £23,700 today, 16,500 x (2178/1516), this is good but certainly far from £400,000. FTSE 100 from 2006 to 2016S&P 500 from 2006 to 2016

2. Reduced saving burden

We don’t spend rental income. This means after interest has been paid off, every month, my tenants are effectively saving for my retirement on my behalf. Currently, that’s about £2,000 worth of savings before tax. Very few investments can do that for you. 3. Easy release of value without impacting the investment I remortgaged this property and took out £80,000 to invest in a business. This doesn’t affect the property’s value in any way and isn’t taxable because it’s a loan not a sale of equity. If you sold some stock to get some money for another investment, firstly, you would have fewer shares so the overall value remaining would be lower and whatever you sold would potentially be subject to capital gains tax. 4. Stability Even accounting for short-term falls in value, property is very stable. Even if you don’t see an increase the value of your real estate investment you would still have the rental incomes. Provided you invest were there is demand for rental properties by tourists, students or families, you have secured an income for yourself in 25-years’ time if not immediately. Now, once I reach my target rental income of £10,000 what will I invest in? STOCK MARKET & ANGEL INVESTING

While I used to invest in single stocks in the past, I no longer do so as I think that long-term investing into diversified index funds is much, much wiser and definitely safer. This view has been informed by tonnes of reading and more experience in investing.

The next few paragraphs written in 2016 illustrate how I used to invest in 2006/7 when I was a newbie with zero experience - I no longer invest in this way but I share this anyway: When I used to invest in the stock market at the beginning of my working like (2005 to 2010), I had no education in investing and my methods were quite time consuming but the time spent made it feel less like gambling and more like investing: I’d download data on the main stock indices from Bloomberg (FTSE, S&P, Hang Seng, etc.) For each share I'd have the following data: 52-week high, 52-week low, P/E ratio, current price and other vital stats to try and identify a company that was undervalued. I’d also think of industries that I thought were growth industries and look at new companies in the sector. For instance, I once invested in a solar company and an Asian company because Asia and renewable energy were/are both growth areas. I sold my investment in the solar company (a German company called Phoenix Solar) when I tripled my money to £3,000. If I still had those shares they would be worth like £300 – the company is down badly. I sold my shares in Citic Pacific (the Asian company) in 2011 just about recovering my money and if I’d held on for 10 years, my £1,000 investment would be worth £750 – 25% down. Single stock investing is very risky especially if investing is not your full time job so you don't have time to go into great deal - reading annual reports and other regulatory filings. Citic Pacific from 2000 to 2016

I made a great investment in Apple in 2006. I sold when I had tripled my money. If I’d held on to my Apple shares until it hit its peak my £1,000 would have reached a £15,000 in value – kaching! That said, if I still had the shares they would be worth about £10,000 today because Apple is down from its peak.

I actually didn’t lose much money investing in the stock market. Citic Pacific and Yahoo were sold roughly were I bought them and Phoenix Solar and Apple were sold after tripling my money. The only complete loss was a bank called Northern Rock. I bought £1,000 when the share price was crashing in the belief that the UK Government wouldn’t let it fail. I was right, the UK Government didn’t let them fail but all shareholders lost all their money. Stock markets go up and down in an unpredictable fashion. This is why I prefer to have a base of rental income from property before dabbling in the stock market. However, if you are investing in the stock market for the very long term 10+ years, and also in well-diversified funds, I think it is a sensible place to keep money safe and earn a decent above-inflation return. BUSINESS

Finally, I invest time and money in creating businesses. Whilst business is also speculative there are many low risk businesses that can bring a stable income.

For example, creating courses online doesn’t cost too much money and once you recover the investment it’s fairly easy to maintain a steady income from the investment. With physical products you might invest more but if the investment fails you normally gain knowledge that will help a future business grow. Business is by nature speculative but the upside is fairly unlimited and you have more control over that upside than you would with an investment in shares. CONCLUSION

My personal strategy is to have enough retirement income coming from property to cover all my needs and some of my luxuries and the rest coming from my stock portfolio. So I focused my early investing on property and started diverting more savings into stock market indices when I was comfortable with the rental income we were generating.

In addition, I love writing, sharing knowledge and business in general so I pump lots of energy into these activities because I believe they produce a good return in the long run and even if they don’t, I thoroughly enjoy engaging in these activities.

Have a business or life question you want me to answer? send me a message.

1 Comment

Imnet

6/9/2016 09:48:50 am

Dear Heather,

Reply

Leave a Reply. |

Heather on WealthI enjoy helping people think through their personal finances and blog about that here. Join my personal finance community at The Money Spot™. Categories

All

Archives

September 2023

|

Heather Katsonga-Woodward, a massive personal finance fanatic.

** All views expressed are my own and not those of any employer, past or present. ** Please get professional advice before re-arranging your personal finances.

RSS Feed

RSS Feed