|

Have you heard about the FIRE movement? It's an acronym for Financial Independence Retire Early. While many people interpret it literally, there's more to this movement than meets the eye. In this post, we'll delve into what FIRE truly means, dispel some common misconceptions, and explore the different aspects of achieving financial independence (or FI) and retiring early. So, let's get started!

Understanding what FIRE is and what it is not Contrary to popular belief, the FIRE movement is not a cult or a race to become a millionaire overnight. FIRE is also not about living close to the poverty line so that you can save every penny possible – in the process depriving your family of positive life experiences such as holidays. This latter interpretation is from a podcast run by one of the mainstream broadsheet newspapers! FIRE is about gaining control over your financial life and having the freedom to choose how you spend your time without worrying about money. Many attribute the beginnings of the FIRE movement to Vicki Robin and Joe Dominguez’s 1992 book, ‘Your Money or Your Life’. Let's break down FIRE into its key components: financial independence, retiring ‘early’, and what retirement means in this context. FINANCIAL INDEPENDENCE (FI) - what is FI? Financial independence is the foundation of the FIRE movement. Inevitably, you have to gain some FI before you can enjoy any of the benefits of ‘retiring early’. At its core, FI means having enough passive income from investments to cover your living expenses. However, it's important to note that there are different levels of financial independence. Regular FI – what does ‘regular’ financial independence look like? Regular financial independence ensures that your passive income can sustain your pre-retirement standard of living. This includes basic necessities such as utilities, transportation, food, clothing, and some travel. While many people in the UK aim to pay off their mortgages before retiring early, it's not a strict requirement. Lean FI – what does ‘lean’ financial independence look like? Lean financial independence focuses on covering only the essential expenses like utilities, food, transportation, and basic rental accommodation – perhaps, in a housing association or choosing to purchase the most affordable property available in an out-of-town area where property prices are much lower. Those targeting lean FI may choose not to have children or plan to retire to low cost-of-living countries in Asia or Eastern Europe (popular destinations include Thailand, Malaysia and Turkey). A just-getting-by type of FI, like this, is not most people’s idea of financial independence but it suits some minimalists. For instance, Jacob Lund Fisker, author of ‘Early Retirement Extreme’ needed only $7,000 a year to live and that meant he was FI at 30 and retired at 33! And if you think that wouldn't be possible in the UK, a very close friend of mine has lived on a similar amount for the 18 years since we graduated from uni...we'll cover their story in a future post. If Lean FI is the goal then you may plan to earn some money from temporary or part-time jobs when you retire to cover luxuries such as a special holiday; this version of Lean FI is called ‘Barista FIRE’. Fat FI – what does ‘fat’ financial independence look like? On the other end of the spectrum is fat financial independence. It represents a comfortable retirement with all necessities and desired luxuries covered. Fat FI allows for frequent holidays, dining out, a nice house, and a generous budget for food and clothing. Downsizing is probably not on the cards for FAT FI-ers. EARLY – what does retiring early mean? The "Early" in FIRE refers to retiring earlier than traditional retirement ages. The timeframe for early retirement varies depending on personal goals and circumstances. As soon as possible For some, ‘early’ means ‘as soon as possible’. Some people join the workforce with the clear objective of achieving financial independence as quickly as possible, ideally within 10 to 15 years. To achieve this, they actively pursue high-paying careers and dedicate themselves to saving and investing. Timing with family goals Others discover the FIRE movement later in life or choose to align their retirement plans with family goals. For example, they might aim to retire when their last child enters university. This could be around the age of 50 or 55. In the context of a UK state retirement age currently set at 68 for millennials – and which could rise to 70 or older by the time we actually get there – 50 is ‘well’ early. Retirement can end up being a mini-retirement While the extremely early retirees in their 30s and 40s grab most of the headlines, some may retire in their 30s or 40s but go back to ‘traditional work’ after a few years in which case the first retirement ends up only being a mini-retirement – a fantastic opportunity to do something different for a few years. How soon you want to retire informs the type of financial independence you go for. The ‘leaner’ your lifestyle, the quicker you can achieve FI. It also informs the type of career you go for: you might choose a career in finance or high tech over public service, for example, to maximise your saving potential. RETIRE – what does 'retire' mean to those on FIRE? Retiring early doesn't necessarily mean quitting work entirely. Some individuals choose to work part-time in the same career or switch to more fulfilling, passion-driven careers that may not pay as well. Others pursue non-earning hobbies, engage in charitable work, or spend quality time with their children while they're young. And others identify with the FIRE movement and want FI for the peace of mind and flexibility it offers, but haven’t decided what ‘ ‘retire early’ means for them yet. In conclusion, the FIRE movement has revolutionized the way we perceive financial independence and early retirement. It's about breaking free from the constraints of a traditional career and embracing a life filled with possibilities. Whether you aim for regular, lean, or fat financial independence, the goal remains the same—to achieve a level of passive income that affords you the freedom to live life on your terms. In my next post, we'll delve into the exciting topic of how much you need to save to embark on your ‘retirement’ journey. So, stay tuned as we uncover the secrets to financial freedom and pave the way to a future filled with endless opportunities. References:

0 Comments

Hi Heather,

My name’s Linda. I would like to have a comfortable retirement but I am not sure how much money I need to have saved up in order to achieve this goal. I am not particularly extravagant but I do want to be able to afford at least two holidays a year. I additionally don’t have access to a fixed workplace pension so I need to live within the means of my own investments and the state pension. How should I go about working this out? Thanks

Thanks for this question Linda.

There are a few ways to think about this. Firstly, when do you want to retire? The reason that this matters is that your state pension will only kick in at the state retirement age so if you retire earlier than this you will need to make up the difference from your own investments. You also need to consider your living situation during retirement. If you are likely to be married or in a relationship then you would have two state pensions coming into the household but not double the costs – for instance, utility bills don’t double with double the number of occupants in a home. You would also need to factor in that, even if you are in a relationship, one person will probably outlive the other and at that point one source of pension income may be lost. TWO WAYS TO GET AN INCOME IN RETIREMENT FROM A SAVED LUMP SUM There are two ways that your savings and investments can be used to secure your income in retirement: The first way is to buy what is called an annuity. The second way is to just draw down your income slowly over time. ANNUITY An annuity is a financial product that provides a guaranteed income for life. Essentially, you take a lump sum of money, give it to a financial provider and they tell you how much they can pay you for life depending on the features you want. For example they can give you a fixed amount every month for life, or they can increase that amount every year by inflation, if you want an annuity that grows with inflation the starting amount will be smaller than if you go for the fixed amount. You can also buy an annuity that covers one person’s life or two people’s lives, that is, once the first person dies the annuity continues to pay out until the second person named on the annuity also dies. Annuities used to be popular in the past but because interest rates have fallen drastically since the 2008 financial crisis they have not been so attractive. How much would you need if you were planning on retiring today, were getting a state pension and were planning on buying an annuity? According to this is money who in turn source a report by Royal London, you would need £260,000. “Royal London’s sums were based on the amount needed to bridge the gap between an £8,500 state pension and two-thirds of the £26,700 average salary.” Two-thirds of £26,700 is £17,800. This means Royal London are assuming that you would live on £17,800 every year: £8,500 of this would be coming from the state pension and £9,300 would be coming from the purchase of the annuity. These figures suggest the annuity is giving a return of just 3.6%. In my opinion, that’s a very poor return and not even worth getting the annuity. This is money also confirm in their article that if you plan to retire in 30 years’ time rather than today, this £260,000 becomes £400,000 and this further assumes that annuity rates improve by then. If interest rates are just as low in 30 years’ time as they are now and if we assume average inflation of 3% per year (which is what it has been historically), then instead of £260,000 you would need £630,000. Personally, I do not recommend the annuity route AT ALL. If you are happy to take a little risk then you would be FAR better off just drawing on the invested money. DRAWDOWN The most popularized rule for drawing down on your invested pot is the 4% rule. The 4% rule essentially says that if you drawdown 4% of an invested pot every year, you are unlikely to run out of money over a 30 year period. While the study that came up with the 4% rule used 30 years as the period during which a person would be retired, the general conclusion is that even at the end of that 30 years the money invested will have grown because the average drawdown rate of 4% is lower than the average growth rate of your investments. So, for example, if your investments grew by 7% in the last year then taking 4% means you are still ahead. The beauty of drawing down rather than buying an annuity is that whatever is left when you die can be passed on to children, charities or whatever you choose. With an annuity, the payments die with you. For example, if you bought the annuity of £9,300/year today and died next month, tata £260,000 – that’s it. The full benefit of your early demise goes to the financial institution that sold you the annuity in the first place. Rubbish, right, well that’s what you get for playing it too safe! If we take the £260,000 lump sum we have been using and continue with it for example purposes, then a 4% drawdown would produce £10,400/year in the first year which is better than the £9,300 you were getting from the annuity that ‘this is money’ talked about. Not only that, in the following year it could be that you will base the drawdown on a bigger number than £260,000 because the investments will have grown in value. The average growth rate of the stock market over the last few decades has been 10% before accounting for inflation. Of course, this says nothing about the future as stock market returns in the future could be better than or worse than this. Rather than working backward from what income a given lump sum will give you? Let’s figure out how much you will probably need to spend in retirement, that is, let’s work out your desired retirement income. Once we have your desired income we will subtract income from your state pension and any other pensions. We will then divide the gap by 4% and this will give you the value of investment assets that you need. SPENDING I’ll share two sources that I have found for trying to work out how much money you will need each year in retirement. SOURCE 1 – on how much money you need for retirement “According to research carried out by Loughborough University and the Pensions and Lifetime Savings Association (PLSA), workers who only manage to save enough for a retirement income that provides them with £10,200 a year (£15,700 for couples) will achieve a minimum living standard, those who managed to save enough for £20,200 a year (£29,100 for couples) will be able to live a moderate lifestyle during retirement and those who are able to save enough for £33,000 a year (£47,500 for couples) will be able to enjoy a comfortable retirement.” (source: moneyfacts.co.uk) This £33,000 a year (£47,500 for couples) includes holidays abroad, a generous clothing allowance and a car. These are the lifestyles that the Loughborough University and PLSA study creates:

I don’t know about you but I would like to target the comfortable lifestyle or better! Using the 4% rule, if you are targeting a comfortable lifestyle then:

Before you give up before you’ve even started because these numbers sound too hard to achieve, keep listening, I’ll give you an example at the end of how much you need to save now and it will sound much more achievable. If you are targeting a moderate or minimum living standard, you can calculate the equivalent numbers by following this formula:

As a reminder, the full state pension is currently £8,767.20 per year but I used £8,500 in my examples for simplicity. If you plan to retire based on the minimum standard of living at say 60, then when you start getting the state pension as well if you are a single person, you would be boosted to close the moderate living standard; and if you are in a couple, you would be boosted just beyond the moderate living standard by receiving two state pensions – assuming both people are entitled to the full state pension or close. SOURCE 2 – on how much money you need for retirement Using a report from the Joseph Rowntree Foundation, a respected charity, Fidelity.co.uk allows you to start of with a basic standard of living which costs £16,300 and allows you to add annual costs to this depending on the lifestyle you want. This £16,300 accommodates basic rental accommodation, basic costs for food, alcohol, clothing, water, gas, electricity, council tax, household insurances and other housing costs, public transport costs and an occasional visit to the cinema. The basic £16,300 cost of living assumes a single person not a couple. Within this figure you don’t run a car, you don’t eat out much at all, you don’t smoke and you don’t have internet access or paid-for film channels (I guess you would watch only free channels and have to go to the local library for the internet). Note that this £16,300 is higher than the £10,200 suggested by the Loughborough University study for a basic standard of living but lower than the £20,200 suggested for a moderate standard of living so we can call it basic Plus. I would guess the Loughborough study assumes you have paid your home off in their basic living assumption which could explain the difference. So, how do we boost the £16,300 basic income to improve our life style?

If you added on every single one of these extras, you’ll be at a very comfortable £37,500/year which is not too far off the £33,000 suggested by the Loughborough University study for a comfortable retirement. This would be equivalent to £54,000 for couple if we increase in direct proportion to the Loughborough study (37,500 * (47.5/33)). What level of investment assets do you need to achieve this? You need c.£940k if you are a single person or £1.35m if you are a couple before the benefit of a state pension. This £1.35m is very aligned with the £1.2m we got using the Loughborough University study. State pension income reduces your need to save and invest by about £200,000. If you keep a budget it might be easy to calculate what your monthly spending in retirement will be; just remove all the things you spend on now that you won’t need to spend on in retirement, like travel to work or rent or a mortgage payment if you plan to own your home outright at the point of retiring. There are a lot of numbers here but it’s more or less pretty straight forward once you have worked through it systematically. How much do you need to save now to live your ideal lifestyle and to hit your goal by retirement? You’ll need to take the next step and figure that out. If you want me to help you do this, request a call. As an example, if you are a 22-year old couple now and plan to retire at 67, you only need to be saving £285/month in total into pensions (that’s only £140/each). This has to be into pensions and not into an ISA as I am assuming you get the tax benefit of saving into a pension. My calculation assumes you get an average market return over those 45 years of 7%. If returns average 10% as they have in the last 45 years, you would completely overshoot and end up with a retirement pot of £3.7m – how’s that for compound interest?! If you are enjoying listening to my podcast, please give me a 5* rating wherever you listen to podcasts. If I don’t yet deserve your 5*, please let me know how I can earn it. I hope this helps! Heather Have a money question for me?

If you have any personal finance questions send them to [ME] – I will answer whatever piques my fancy via a blog post.

Hi Heather,

My name’s Sam. Can you talk about financial independence and the steps one has to move through to get there? Thanks

Thanks for this question, Sam.

In the past, I used to think about financial independence in a one-dimensional way: you were financially independent if your income from passive investments exceeded what you need to maintain the lifestyle you want indefinitely. It wasn’t until I heard JD Roth the founder of Get Rich Slowly on Paula Pant’s Afford Anything podcast that I started thinking about financial independence as something that can be broken down into stages. I like his idea so rather than re-invent the wheel, I’ll share his wisdom with you and you can decide where you are on this continuum: Stage 0 – Dependence In the dependence stage, your lifestyle depends on other people for financial support. Absolutely everyone starts here, we are born fully dependent on our parents and people break out of parental dependence at different stage. I dare say you can break out of being dependent from parents and fall back into dependence in your 40s and 50s because of a life incident or poor planning. However, if even if you don’t live at home with family you would still be in the dependence stage if your spending exceeds your income. Following the dependence stage, stage 0, there are six stages to full financial independence in JD Roth’s model. The first three stages of the journey are the “surviving” stages. Stage 1 – Solvency You’re solvent if you can meet your financial commitments, that is, you have enough earnings to pay your bills. You will have reached this stage when you no longer rely on anyone else or on credit for financial support. You are a solvent person if your income exceeds expenses, and you are no longer accumulating debt. I reached this stage when I was 18 thanks to an academic scholarship. My scholarship paid for all fees and gave me a lump sum to cover accommodation, food and a plane ticket home every year. In December 2002 when my dad sent me a gift of money with my mother who was visiting me at school, I told her that from here on out I don’t need money from you and dad; I will survive within the means of my scholarship – I asked that they saved the money for my sisters’ education and I haven’t looked back since. My dad took that thanks and ran! While some people will reach this stage in their teens, as I did, most people reach this stage when they start the first job that allows them to leave home. Some never reach it and are dependent on others for survival from cradle to grave. Stage 2 – Stability You have achieved financial stability once you've repaid all your consumer debt and have some money set aside for emergencies, and continue to earn enough to save – you can think of your savings as your profits. You may still possess some “good debt” — student loans, a mortgage — but you've eliminated other obligations and built a buffer of savings to protect you from unfortunate events. Dave Ramsey suggests a buffer of £1,000 and I would agree with that as being adequate to cover most emergencies. I would recommend buying insurance cover for things that could cost more than this, e.g. buildings and contents insurance to cover damage to your home and your personal possessions. As I have never been in debt, again thanks to my scholarship, I could say I reached this stage at 18 as well. As a Malawian student living in Britain I had no credit history so no bank would give me access to a credit card or even an overdraft facility and no store would allow me store credit. You know how you get to stores and they ask you if you want to get 10% off by signing up to a store card? Well, I said yes and I got rejected with the net result that I always said no after that because I felt so ashamed when she walked back to the counter to tell me I didn’t qualify in front of other customers. Thank God for small mercies. I was an unsuspecting teenager in a foreign country and I don’t know what debt I could have landed myself in had that request for store credit gone through. Stage 3 – Agency The final “surviving” stage in JD Roth’s model is free agency. He describes this as the ability to work and live how and where you want. In the free agency stage, you've cleared all debt (including student loans and your home mortgage) and you have enough banked that you could quit your job at a moment's notice without hesitation. Apparently, some call this “screw-you money”. I was about to disagree with the free agency stage until I saw JD’s note that: “he knows first-hand there are times when you might prefer to carry a mortgage even if you don't have to. So, for the purposes of this stage, if you have enough saved and invested to pay off your mortgage, it's the same thing as not having one. Technically, I would say I initially reached this stage when I was about 30 because I had enough equity in a home I bought when I was 23 to pay off our home mortgage free and clear and I had enough passive income from a small business I set up at when I was 26 (but spent only 10 minutes a month on) to meet the other financial needs that I had at the time. I say technically because in practice, I would never have done that as even then, I knew I would probably want kids and I would need more money to give them the life I wanted them to have, essentially, even if you are in the agency stage but you know your future financial needs will be greater, you’re probably not fully there yet. In JD’s six-stage model to financial independence, you move from surviving to thriving in stages 4 to 6. As you work your way through these stages, money is no longer a safety net, but a tool to help you build the life you imagined for yourself and for your family. Each of the next series of stages assumes no debt or enough cash on hand to instantly repay all debts. Stage 4 – Security You have achieved financial security when your investment income can cover your basic needs. Investment income is money that you don’t need to actively work for; it arrives like clock work without any further input from you. So, in the security stage, based on how much you have saved and invested, you could live a meagre existence for the rest of your life. Even if you never worked another day in your life, you have enough to afford simple housing, basic food, essential clothing, and insurance. I would say we are currently working towards stage 4. If we both quit our jobs and took our children out of a fee-paying school, rental income would cover our cost of living and we have some decent savings to cover tenancy gaps BUT our whole life would come tumbling down if interest rates rose because of the buy-to-let mortgages and our mortgage so we are not here yet. In the security stage you should be able to cover all basics regardless what interests and other economic indicators are doing. Stage 5 – Independence Financial independence is the ultimate goal for most people. At this stage, your investment income is enough to fund your current standard of living for the rest of your life. You cannot only afford the basics, but you can afford some comforts such as holidays abroad too. You have “Enough” with a capital E. Stage 6 – Abundance In JD Roth’s sixth and final stage of financial freedom, you have “enough — and then some”. At the abundance stage your passive income from all sources not only funds your lifestyle indefinitely, but it grants you the freedom to do whatever you want. Besides sharing your wealth with others – which you should be doing whatever your stage of wealth but can really ramp up once you’re in the abundance stage – you can indulge in luxuries, explore the world. When you see me wearing a Patek Philippe, we have arrived here. Both children will be in university at this stage (think early 50s) and I will spend a full year of school fees on one watch! Okay, so in a world with starving children, even writing that doesn’t feel quite right – I’ll downgrade that aspiration to a Rolex which I could buy now but that will be my gift to myself for getting to Abundance! Jokes aside, the more money you can save either by clearing mortgages on your home or rental properties or by investing in stocks and shares and shares, the more your financial independence increases. As you become more financially independent your happiness levels are likely to increase because you can make decisions based on life fulfilment rather than what makes financial sense. Being financially independent doesn’t mean you will quit working, it just means that you can if you wanted to! Now, I can’t talk about financial independence without talking about the FIRE movement. FIRE stands for Financial Independence, Retire Early. The movement is a lifestyle movement whose goal is financial independence and retiring early. Most people agree on the financial independence bit of the equation but RE means different things to different people. To some, retire early actually means quitting work and living a hobby life of travel and blogging, to others it’s simply a reference to reaching the ‘Abundance’ stage of financial freedom. I am totally into the FIRE movement because I love how they’ve changed the meaning of what it means to live rich, many in the community live humble lifestyles in the secure knowledge that they are building real wealth. FIRE is not about conspicuous consumption it’s about real wealth and achieving meaning in your day to day life. Let’s wrap up with some key takeaways on what you can do to move towards financial independence?

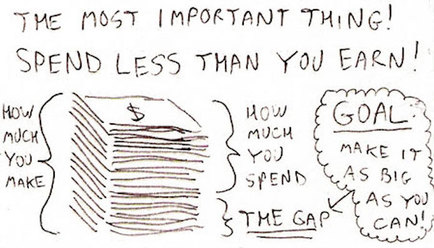

The philosophy is simple and as you put ‘spend less’ principles into practice, it gets easier and easier not to spend over time. I hope this helps! Heather Have a money question for me?

If you have any personal finance questions send them to [ME] – I will answer whatever piques my fancy via a blog post.

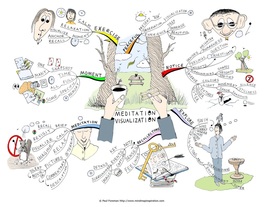

Have you ever felt tired? Like really, really tired? Like so tired you just want to shut the world out and chill out on your own? Yes? I’m pretty sure it happens to most people at some point in their life and that’s how I found myself feeling late in 2015. Chester, my little boy, was not even one yet and I was trying to do so much – be a great mum and run a business. I kept myself so busy that I was working again pretty much two days after giving birth. I didn’t feel I deserved a total break so I worked whenever Chester was sleeping and I also got a nanny to come round for 10 hours a week from when he was about 8 weeks old. Anyway, I won’t bore you with the ins and outs of my childcare routine all I’ll say is you can only do so much before your body says stop, NOW! In addition to my Virtual Assistant (VA) who works 20 hours a week, I tried to hire a couple of people but it didn’t work out so at the end of January I thought, you know what, I’m going to retire. I’ll let my VA do what she normally does and I’ll do almost no work until I start to feel like it again and so that’s what I did.  My YouTube followers will attest to the fact that I’ve only uploaded one video in three months when I used to have 3 or 4 videos up every single week. I’m only 32 so you might wonder why I’d want to retire and why I’m even calling it retirement instead of say, unemployment or perhaps housewife or my favourite term for it, homemaker – you’ve got to love the Americans…well… I’m still employed as the business pays my salary every month and my Amazon sales are still rolling in day-in-day-out so I’m not unemployed. Chester still goes to nursery part-time so I’m not a full-time mum either. Finally, we have a weekly cleaner so I don’t spend much time making the home either. What inspired me to retire? Besides feeling constantly exhausted, I’ve always loved Tim Ferriss’s notion of interspersing retirement throughout life rather than working towards one huge break at the end. There are after all no guarantees regarding when that end might come nor even whether you’ll be in good enough health to enjoy it. Given my business runs using Amazon fulfilment which means my sales are immediately dispatched by Amazon without my input and my virtual assistant does a lot for me it is possible to reduce my work hours to almost nothing so I thought, let’s do it; now would be a great time for a mini-retirment. So, what does a retired 32 year old do with their time?  I came to this dilemma the moment I decided to retire and the first answer was I’m going to watch TV in the evenings, lots and lots of it. So I swapped editing videos every evening for watching TV plus 30 minutes to an hour of reading. I’m currently working my way through a novel by Val McDermid. I’ve missed reading fiction. I’ve always loved crime fiction and it’s taken a back seat since I started running the business back in 2012. I then decided to sign up to a mortgage course because our property portfolio is growing and there’s nothing like knowledge to get you ahead in that game. I’m still building the property portfolio and the legal and tax framework surrounding mortgages is getting ever more complex so this will surely help. Mind you, even fully-fledged accountants sometimes feel as though they’re guessing. I’ve additionally taken up an upholstery course because I’ve always been interested in upholstery. Incidentally, at about the time I officially retired (end of January 2016), Harry and I put in an offer for a house and I worked on the purchase and refurbishment of the house. It took all of April and £32,000 ($50,000) to get the house up to my standard, video coming up, and having loved that experience I’m definitely looking to do more of it. This purchase brings the portfolio up to 6 houses. I've recently started jogging again too and within less than two weeks my BP was back down to all-time lows. It had been elevated for almost 2 years How long do I plan to stay retired for? All of 2016 and probably most of 2017. Ultimately, I’ve said I’ll literally only do things that a) I really, really want to share and b) that take no more than 10 to 15 hours of effort per week on my part. No work will happen in the evenings and nothing at weekends. I’ve had a few people email me to ask for one-on-one coaching and I’m considering taking on a handful of people or so because I do enjoy getting into a person’s financial situation and sorting it out. For me, work is a habit and I do find myself forcing my body not to work at times so I’m sure I’ll do some odd filing and edit the odd video at night. That said, taking a rest like this is AWE-SOME. It works because of the type of business I run but with technology this is the type of thing many people in the future will be able to do. To be honest, I don’t know why it isn’t the done thing. Everyone should take a year or at least 6 months out every decade just to enjoy life a little more. You deserve it. The only downside is that with so little input my business is unlikely to earn 6-figures as it has for the last two years but it's earning enough to keep the bills paid and I'm fine with that. Ultimately, for me, retirement has been about doing more hobby-like activities and being less obsessed with productivity. Oh yeah, and doing more exercise. Does your business (idea) have potential for 6-figure revenues and beyond? Take the test!  Fact: you are capable of a lot more than you think you are capable of. I was driving around with my husband one weekend looking at plots of land and various properties.In addition, we drove to a few car dealerships and asked for quotes on cars. Whenever I liked something I said, I want that orI’m going to get that. Finally, after two days of hearing me say this so many times, my husband asks: with what money! I smiled and said, “You don’t ever need to worry about that. First, you decide what you want and then the money somehow finds you!” It sounds crazy, I know, but if I limited my heart’s desires based on the funds currently available I’d probably be nowhere right now. I’m sure I’ve written about this before but the first time I ever wanted something crazy, I wanted to go to The University of Cambridge. I told my friends what I wanted and only after I got in and got a scholarship to attend did some admit that they thought I was insane for wanting to go to this Cambridge place that many thought was unreachable.  When I had this desire I didn’t know where the money would come from, all I knew is that I had certain things in my control: hard work, achieving the best grades I could, getting the teachers to like me and back my application and if it came to it, begging whoever would listen for help and advice. I almost never thought of the money issue because that would have discouraged me and it was 100% out of my control. I focused exclusively on what was right in front me – the next A grade. In the end, I went to Cambridge. Since then there have been many triumphs and of course, a few failures or life lessons, as I like to call them. My latest fantasy moment occurred after I quit my job and realized I didn’t want a service business coaching people on how to get into investment banking after all;what I wanted was a product business. Problem: I needed £80k to £100k($130k to 160k) to get it off the ground. Eek! Now, I could have written a business plan and tried to get investors to be honest, very few people (even friends and family) are willing to fund a business in a genre that they think is overcrowded like the hair industry – and pretty much every industry outside of technology. I had two solutions: Solution 1:start off small, sell things that will keep me earning and enjoying a lifestyle based on working from home. I did that and incurred some mocking but I didn’t care because my small business was earning enough to keep the bills paid. Okay, if we are being fully honest, I did get a little upset at some of the mockery. I’ll still never forget someone “laughing at me” me for selling wide-tooth combs on instagram – they made some comment about how desperate it was to be selling combs to earn a buck…whatevs, don’t worry hun bun, haters are always going to hate, just focus on your goals and yourdreams.  Solution 2:just focus ononestep at a time and hope that I’ll save enough by the time I was ready to hire a manufacturer. So…I hired a formulating company. Do you know how silly I felt walking into a meeting I’d arranged at an established factory as the 30-year-old CEO of Neno Natural to an audience of 3 people ALL over the age of 50 with a long career in formulating and producing beauty products? Very! To boost my confidence I was dressed well and I looked good in my makeup. I came out shining. They thought I was smart and they said the business I was proposing excited them above and beyond many other clients they were doing things for. Over the course of 12 months I paid for the formulation and as we approached the 15th month enough money appeared to enable an order. Some of my earlier investments paid off and I was able to pursue the dream. That’s life. If you set your mind on something, you will get it, I promise you. That stuff they tell you about self-belief making things happen? It isn’t just “stuff”, it’s for real! Anyhow, I’d love to carry on this discussion with you and help you realise your dreams, if you want to start a product business sign up to The Money Spot program. You can join for as little as £49.99/month or come to my upcoming workshop on How To Build A 6-Figure Product Business.  Want to Build a 6-Figure Beauty Business from the comfort of your sofa? Then my course is designed for YOU! "Beauty" includes a WIDE range of products from the not so obvious non-perishable foods and crafts to the more obvious hair, makeup, fashion, health & fitness.  Too many people try to solve every problem they encounter by themselves. This is not only a waste of time but it’s completely unnecessary. I came up with this insight as I watched my 8-month old son trying to solve his problems. I noticed that every time he wanted to get to something, if there was an obstacle in his way he continually tried to climb over the obstacle or push through it when he could simply walk around the obstacle and avoid it entirely. One time, there was a ball behind me and he kept trying to squeeze through my legs when there was ample space to crawl on one side of me. Another time there were some cushions in his way, and yet, another time his little girlfriend Maya was in his way; she really didn’t appreciate having a 9 kg boy trying to climb over her. His problem solving skills are still in development, of course, but some people do exactly what he was doing throughout their lives.  Today’s tip is simple: Think about how you can avoid your problems. Instead of climbing over them, can you work around them? I’m not suggesting you take short cuts, no, I’m just saying the solution is sometimes a lot simpler than you think. If I’m struggling with an issue I refer it to my mastermind group. I have weekly mastermind calls with my entrepreneur friends and often, we problem solve together. There’s nothing like a fresh pair of eyes. Note that I don’t go to non-business friends to solve business problems; I only go to those of my friends that are in business because they are better equipped to give good business advice. I started my business in 2012 and it took about two years to build a good quality, credible network of friends. If you wanting to accelerate the growth of your product business with my coaching program, you can either join the online solution or come to my upcoming live workshop. Alternatively, call to discuss the best solution for you.  Want to Build a 6-Figure Beauty Business from the comfort of your sofa? Then my course is designed for YOU! "Beauty" includes a WIDE range of products from the not so obvious non-perishable foods and crafts to the more obvious hair, makeup, fashion, health & fitness.  Your spending will always expand to match your income unless you specifically plan to live beneath your means. You can do this as a lifestyle choice or for short periods of time to save for something you really want. Shop around to save money on the things that you buy regularly – buy in bulk, get products where they are cheapest instead of just going to your favourite shop, use coupons and take advantage of discount days at local stores. However, there are some things that you can live without completely;that is the topic this blog. We get so used to buying what we always buy that we don’t usually stop to contemplate what’s necessary and what isn’t. To help you think through your own shopping list I’ll go through some things my friends and I cut back on to save: Rent You could live in a cheaper area and save thousands immediately. I did this when I first started work. I was spending almost half what my peers were on rent just by living a little further out of the city. Of course, many of us are unwilling to compromise here so we have to look at the small stuff. Juice! For what you get, it’s not cheap at all. I was having a chat with one of my best friends about cutting back and she said, “Can you believe it, we’ve even had to stop buying juice!” I was like, “You were still buying juice? I stopped buying juice ages ago because it contains way too many calories. I’ll only buy it if I have guests coming.” I also find juice to be poor value for money besides being completely unnecessary for the weight conscious. Juice packs in a lot more calories than one might suspect. Restaurants We spend A LOT of money on eating out every month. I personally find it very hard to cut back because I think of it as a “treat” after a week of hard work. However, right now my husband and I have just spent a small fortune renovating a flat that we just bought so we’ll use that thought to spur us on during our financial fast in September. To stick to our resolve we add“treat foods” to our shopping list to encourage us to eat at home. For example, buying a frozen pizza that you just stick in the oven when you feel lazy is a lot cheaper than going out for pizza. We wouldn’t normally buy this type of food because it’s not healthy but it does the job of keeping us at home when we want to eat out. Meat News flash: you don’t have to eat meat every day. Some people would think this is unthinkable and perhaps an utterly ridiculous suggestion but it’s true. If your partner is against this suggestion remind them that desperate times call for desperate measures. You can also cut back by eating less meat rather than cutting it out completely. For instance, unless it’s a very small chicken I only ever eat one chicken piece, I find two to be excessive. If everyone in your home has two pieces your chicken will immediately last twice as long by enforcing a one-piece rule. The same goes for sausages and other meats. I normally cook minced meat with beans to bulk it up. Less meat means a heavier wallet and a more attractive waist line! You could go for offal aswell. Liver, oxtail and tongue are delicious. Body Products & Makeup There are so many options here. If you use a range of upmarket brands explore supermarket “equivalents” to see if they work just as well. You could save a tidy fortune here. Take a close look at what you tend to spend money and see what else you could do without. Magazines? New shoes or clothes? And so on. “Cut back on your rent or cut back on what you spend on food but never worry about investing money in a good book.” Robin S. Sharma  Want to Build a 6-Figure Beauty Business from the comfort of your sofa? Then my course is designed for YOU! "Beauty" includes a WIDE range of products from the not so obvious non-perishable foods and crafts to the more obvious hair, makeup, fashion, health & fitness.  How often do you think about how you're going to live life in your 60s? Here are alternative outcomes. Living Off The Kiddies Some will reach the age of 60 without a single saving. You will depend on your kids for money, for food and perhaps even need them to house you somehow – if they are willing. For many this will not happen because life has been unkind to you, it will be the result of a series of bad choices such as having more children than you can afford to support and not saving enough. Be in no doubt that if you find yourself in this situation you will be a burden to your children. In the ideal world children don’t want to have to look after their parents financially and if they just earn enough to support their family will resent having to look after you because you didn’t plan for old age. Could this be you? POSSIBLE SCENARIOS Oh, This Isn't My House? Some will reach retirement age and realise that the bank or the company they work for owns “their” house and “their” car. It’s easy to forget such things when you are enjoying life but at this point you will be forced to either live off your children or invest your savings in a business. If you’re lucky you’ll find jobs in retirement or positions on boards of directors that provide an income whilst you make up for lost time on the investment front. Living Off The Rentals Some will reach the age of 60 with a tidy property portfolio. You will own the house you live in outright and you will have at least two rental properties. Your rental properties will produce enough money to cover all necessities, bills and wants such as holidays. When your children come to visit you, they will come with pride. Pride that they have forward-thinking parents that had the wisdom to cover their own retirement. You will have no unnecessary worries and will be safe in the knowledge that you never have to go to bed hungry or cold.  The Art of Visualisation Visualising is like fantasising. You visualise a specific event in the future in very specific and detailed terms and think about how much you will enjoy it. Scientists have confirmed that visualising can lead to the achievement of real results. In a well-known study on creative visualisation in sports, Russian scientists compared three groups of Olympic athletes:

Group 3 had the best performance results. This indicates that some types of mental training, such as consciously invoking specific subjective states, can have significant measurable effects on biological performance. Further to this, some celebrities have argued that they have achieved certain results in their life by visualising them first. These include Oprah, Will Smith and Jim Carrey. Visualising helps you to focus on a goal. If you can find just ten minutes a day to meditate and visualise the things you want to achieve you will increase your chances of achieving them. Most people don't think too far beyond the next couple of years, if that. Those that do are at an advantage. Of course you shouldn't live so far in the future that you cannotenjoy the present. That said, thinking about and planning for the future is enjoyable in itself –just do it! "Ordinary people believe only in the possible. Extraordinary people visualize not what is possible or probable, but rather what is impossible. And by visualizing the impossible, they begin to see it as possible." Cherie Carter-Scott  Want to Build a 6-Figure Beauty Business from the comfort of your sofa? Then my course is designed for YOU! "Beauty" includes a WIDE range of products from the not so obvious non-perishable foods and crafts to the more obvious hair, makeup, fashion, health & fitness.  Human beings are hard-wired to conform. Back in the hunter-gatherer days you had to conform because if you didn’t you’d become a social outcast and that basically meant you spent a lot of time alone. No one would make friends with the guy or gal that had been relegated as unfit for the community for fear that they too would be tarnished with the same brush. Even now, the more homogenous a society is, the more you feel the pressure to conform. I grew up within a homogenous culture back in Malawi. Everyone pretty much had the same core beliefs so if you thought differently you just kept it to yourself. You wouldn’t admit you were an atheist or gay for instance, you would just keep it to yourself. Even then, some of my closest friends were gay but it was a secret that you kept sealed tight. As for not believing in a God, I had such strong views on the matter (I didn’t understand why you wouldn’t believe in God) that it took me about 7 years of living in Britain – a very Cosmopolitan country – to get my head around it being acceptable to be agnostic or simply not to believe. Anyway, I digress. WHY DO WE CONFORM? We conform because we want to be liked. That is the key reason. We want to be part of a community. We want social approval. Our own self-worth and value tends to be so wrapped up in what people think of us.  WHY COULD IT BE BAD TO CONFORM? Unfortunately, conforming is what keeps many people in wage slavery or stops them pursuing their dreams – we’re afraid to take massive action or even to take small risks because of what people might say. Quitting a job to start a business is a massive risk and a couple of negative comments are enough to discourage most people from taking the chance to create something special. WHAT YOU CAN DO TO GET RID OF THE FEAR OF DOING SOMETHING DIFFERENT Stop caring what everyone thinks. When someone gives you an opinion, you have no idea why they are offering that particular perspective.

Everyone sees life from a different point of view and everyone has different goals. Compromising your dreams based on other people’s opinions isn’t a good strategy for personal growth. Frequently, the people that will stop us are our very own parents; parents tend to be massively afraid of children breaking from societal norms. Good examples of people who believed enough in their dreams to stop conforming.  Sara Blakely: She is the founder of Spanx. In a Bloomberg Game Changers documentary I watched about her she revealed that she was so afraid of people thinking her idea was stupid that she told no one about it until it was already rolling. Now, she is the youngest ever female entrepreneur to build a billion-dollar company. She succeeded with real products when everyone else was going into tech. You have got to admire that. Arunachalam Muruganantham: He is a school dropout from a poor family in southern India and he completely revolutionised menstrual health for rural women in developing countries by inventing a simple machine for making cheap sanitary pads. It took him years to get to the perfect design. People laughed at him and called him weird as he carried out research on menstrual periods and it all culminated in his wife leaving him because he had become a social pariah. The irony was he started on this entrepreneurial path to help his wife. I have massive admiration for this guy. I’m giving you just two examples here but I could give you many more. I could even talk about my own life and the mocking that I went through in high school but I chose to use third-party examples. I hope these people inspire you to take some risk, to stop conforming and to ultimately take the massive actions that will buy your financial freedom. References: The Indian sanitary pad revolutionary, BBC How to fail your way to your first $1 billion, Entrepreneurs Institute  Want to Build a 6-Figure Beauty Business from the comfort of your sofa? Then my course is designed for YOU! "Beauty" includes a WIDE range of products from the not so obvious non-perishable foods and crafts to the more obvious hair, makeup, fashion, health & fitness. |

Heather on WealthI enjoy helping people think through their personal finances and blog about that here. Join my personal finance community at The Money Spot™. Categories

All

Archives

September 2023

|

Heather Katsonga-Woodward, a massive personal finance fanatic.

** All views expressed are my own and not those of any employer, past or present. ** Please get professional advice before re-arranging your personal finances.

RSS Feed

RSS Feed