|

Hi Heather,

Thank you so much for launching your podcast. I am really enjoying all your advice. My name’s Vivienne. I’m single and in my late 60s. I receive the state pension and find that I struggle to make ends meet – my saving grace is that I own my home outright but I don’t have any other investments outside of that. Although I would like to work because I get lonely sometimes, I lack the energy I used to have in my younger days and certainly I find a full day’s work very exhausting nowadays. Is there anything you can think of that can help me boost my income? Thanks

Thanks for this question Vivienne.

Given you are not working, I won’t give you advice about saving and investing at this stage as I normally would. I’m sorry you get lonely – loneliness is a rising issue in Britain and not only amongst older people – in 2016/17 Younger adults aged 16 to 24 years reported feeling lonely more often than those in older age groups according to the Office of National Statistics. I have two income boosting suggestions for you that could help boost your income and reduce your loneliness too. In the past, I have also given people advice about boosting their income by monetising any skills they might have on freelance sites like fiverr.com or upwork.com or by tutoring via websites like tutorful. However, I am going to suggest something totally different to you, perhaps even radical: have you considered taking in a lodger or renting out any spare rooms you might have on airbnb.com? You could do this even if you didn’t own your home as long as you get permission from your landlord to sublet. There are pros and cons with each option. Option 1: LODGER If you take in a lodger, you will have someone living in your home on a full time basis and you will probably have to give up some of your space in places like the kitchen to them. You will also need to be comfortable with that person using your appliances and white goods. Are you happy for someone to share your hob, your fridge space, your washing machine and your living space that closely. Taking a lodger in could flip you from being lonely to being frustrated very quickly if that person has very different habits and a very different lifestyle to you. Instead of a full-time professional lodger perhaps you could take in a more transient lodger like a student. Some students, especially international students don’t see university as one long party and may well be studious, well-behaved and easy to live with. If the person comes from Europe, they are also likely to go back home regularly leaving you to enjoy your living space on your own terms during such periods. The government allows you to earn up to £7,500 a year tax free by letting a room in your home. This amounts to £625/month, all tax free. Given that the state pension currently sits at c.£8,800 a year, you would almost be doubling your income if achieved this amount. If you have a generous spare room with an ensuite you might well be able to charge this kind of rent. Or if you have two spare rooms you can get a couple of lodgers. You could also exclusively look for someone that is retired with the objective of keeping each other company in retirement. The type of person you decide to let a room to is entirely up to you. One downside is that you might find a lodger who keeps too much to themselves and isn’t interested in bonding with you which might make you feel even more lonely. This brings me to option 2. Option 2: AirBnB Have you considered renting any spare rooms out on AirBnB? If you have the energy to change sheets and provide a breakfast this can be a fantastic little earner especially if you live in a popular city. However, even if you are in a quieter city it is certainly something that is well worth trying. A major advantage of letting rooms out on AirBnB is that you will retain full control over your home and kitchen space. When you are not home, for instance, if you are on holiday or visiting friends and family you won’t be leaving the house to a lodger which may offer you some peace of mind. Just as importantly, during times when you expect visitors such as at Christmas you can have the house free of AirBnB guests. A key advantage of AirBnb over a lodger is that you will get exposure to many different types of people with many curious about you and your city – based on them having to rent an AirBnB you can assume that most won’t be as familiar with your local area as you are and you can enjoy telling them about it and where to visit. Personally, if I were in your shoes, I think I would go for the AirBnB option but you should decide based on your own personality and preferences. For instance, you might find the perfect lodger for you – someone who is perhaps older and not transient and even wants to spend time with you. When I was single, once I bought a house, I always had a lodger for two reasons: firstly, I didn’t like the person I was becoming when I lived alone – I was becoming very rigid and set in my ways; secondly, I needed the extra money because my first mortgage was expensive and the monthly income boost made a big difference to me. I was also very likely to always find lodgers that I had things in common with so we could do some things together. Just as with getting a lodger, you can rent rooms out on AirBnB and not have to pay tax until you are earning over £7,500. I hope this is helpful. Outside of this there are the more obvious things like getting a part-time job or baby sitting when you have the energy and inclination to do that kind of thing. I hope this helps you thinks more broadly about how you can boost your income and get some companionship at the same time. If you are enjoying listening to my podcast, please give me a 5* rating wherever you listen to podcasts. If I don’t yet deserve your 5*, please let me know how I can earn it. I hope this helps! Heather Have a money question for me?

If you have any personal finance questions send them to [ME] – I will answer whatever piques my fancy via a blog post.

0 Comments

Hi Heather,

My name’s Reena, I’d really like to know what my spending looks like relative to the average person, can you do a blog post or podcast episode on that? Thanks.

Great question Reena. At some point, everyone wonders: how do other people spend their money? Do I spend much more money on food or eating out or rent than other people?

Well, we keep pretty good records of this in the UK so this is what I found out from the office of national statistics website, hereafter, I’ll just call them the ONS: The numbers on spending can change a fair amount from one year to the next. The ONS releases a report of the UK’s household spending each year. For 2015/16 the average household spent c.£530/week, in 2016/17 it moved to about £537/week and in 2017/18 despite all the Brexit drama it shot up to £573/week. That it’s the highest it’s been since 2005. £573/week translates to £2,483/month per household. Basically, if your household spends more than £2,500/month before accounting for the portion of your mortgage that pays off the mortgage debt, then you spend more than the average household. This rate of spending translates to just under £29,800/year but median household income was about £29,000 in FYE 2018 so spending slightly outstripped earning – no mega news there. Average household size in the UK has remained at 2.4 people for over the decade – so it’s pretty stable. An interesting factor about spending is that it can frequently bear little relation to earnings so some people spending this amount will be relatively well off and could spend more but they choose to live beneath their means and some people spending at this level will be persistently spending more than they earn by taking on debts, e.g. by renting cars via leases or buying them via hire purchase agreements and so on. Threes notes for you:

Sidebar: the UK financial year starts on 1 April and ends on 31 March and the tax year starts on 6 April every year and ends on 5 April… In the FYE 2018:

TRANSPORT In 2017/18 households spent £81 a week on average on transport – that’s about £350 per month. HOUSING The average UK household spent £217/month on housing and if you deduct housing benefit and related allowances this was only £156/month. Utility costs per month were: Electricity, gas and other fuels: £98 Water £40 Maintenance and household repairs £36 Total to housing is therefore: £330/month (156+ 98+ 40 +36) FOOD

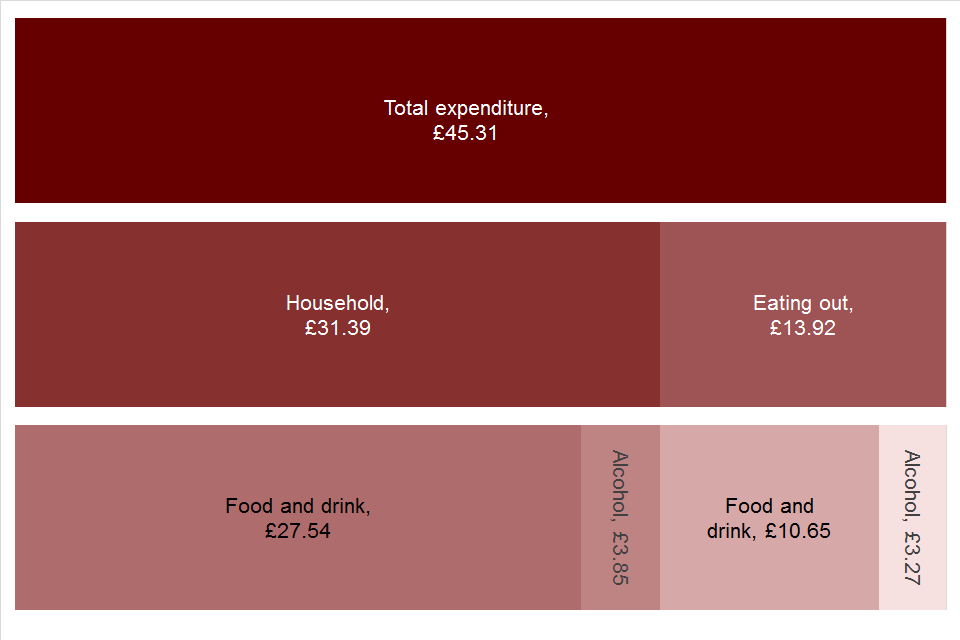

What this says to me is that if you are a teetotal household of 2 grown children aged 18+ and 2 parents you can expect to spend £153/week {(27.54+10.65)*4} on food and drink at home and in restaurants, i.e. about £660/month. Alcohol consumption increase that to £785/month – so alcohol adds about £125/month to our 4 person household of 2 grown children and 2 parents.

Really interesting, these stats suggests that our family should be spending £660/month but we frequently spend about half of this. The only month when we spent close to this is December when we spend £661 which is scarily bang on average. Outside of this mega month we’ve spent £190/month in our cheapest month and £330/month in the highest month outside of December and our food spend includes basic personal care stuff like roll-on and body wash which the ONS food spend number does not include.

Moving on… If you’re a teetotal average couple (i.e. no kids) you’re spending about £76/week on food at home and eating out, i.e. about £330/month increasing to close to £400/month if you buy alcohol. If you have two young children I’d count them as one and you should expect to spend £115/week on food and drink at home and in restaurants or about £500/month – this increases to about £590 per month if you spend money on alcohol. RECREATION AND CULTURE You know you are living in a privileged country when recreation and culture can fall into the top 4 spending categories. In fact, recreation and culture was the highest spending category for households in the North East and Scotland where it made up 16% and 14% of their spending, respectively. This was apparently driven by a few different factors, such as lower spending on transport and housing. Now, rather than give a narrative on each category, I will recommend you look at the table that I have compiled for you using the pretty awesome ONS website and see how the UK is spending. I’ll reel off the top numbers for you which I have split into weekly, monthly and annual spending so you can look at the metric that’s more relatable to you – some people work by the week, I prefer seeing things by month and year.

Weekly Monthly Yearly

Mortgage (for owners) 157 678 8,138 Rent (for renters) 108 467 5,606 Transport Personal transport 33 144 1,726 Purchase of vehicles 28 121 1,451 Public transport 20 85 1,024 Housing (net), fuel and power Rentals net of benefits 36 156 1,877 Maintenance and repair 8 36 426 Gas bill 10 42 510 Electricity bill 11 49 593 Other fuel 1 6 68 Water bill and misc. 9 40 484 Other expenditures Council tax, mortgage interest 47 202 2,423 Charity, cash gifts 14 59 712 Holiday spending 12 54 645 Licences, road tax, fine 4 16 192 Food and drink Food + alcohol-free drinks 61 263 3,151 Restaurants / catering 39 168 2,018 Hotels 11 47 567 Alcoholic drinks 9 38 452 Tobacco and narcotics 4 16 198 Recreation and culture Package holidays 27 117 1,399 TV+ video subscriptions 7 30 364 Newspapers, books, etc 5 23 276 Cinema, theatre, museums 3 13 161 Other recreation, e.g. photos 32 140 1,680 Households goods and services Furniture, carpets, floor 23 98 1,175 Routine household maintenance 7 29 348 Household appliances 4 19 224 Tools/equipment 3 13 151 Household textiles 2 10 114 Crockery and cutlery 2 8 99 Miscellaneous goods and services Insurances 18 76 915 Personal care 13 54 650 Bank fees, moving house, other 5 22 265 Personal effects 4 17 208 Childcare related 4 19 229 Clothing and footwear 24 105 1,264 Internet bill / spend 4 16 198 Telephone, fax, post office 14 61 733 Hospital / medical 7 30 359 Education Education fees 8 36 426 Secondary education 0 1 10 Nursery and primary education 0 1 10 TOTAL £572.6 £2,481 £29,775

I spent some dedicated time on the top things people spend money on to figure out how much is being spent according to a variety of sources; one of the sources I stumbled upon was the results of a survey carried out by powershop.co.uk on 2,000 people:

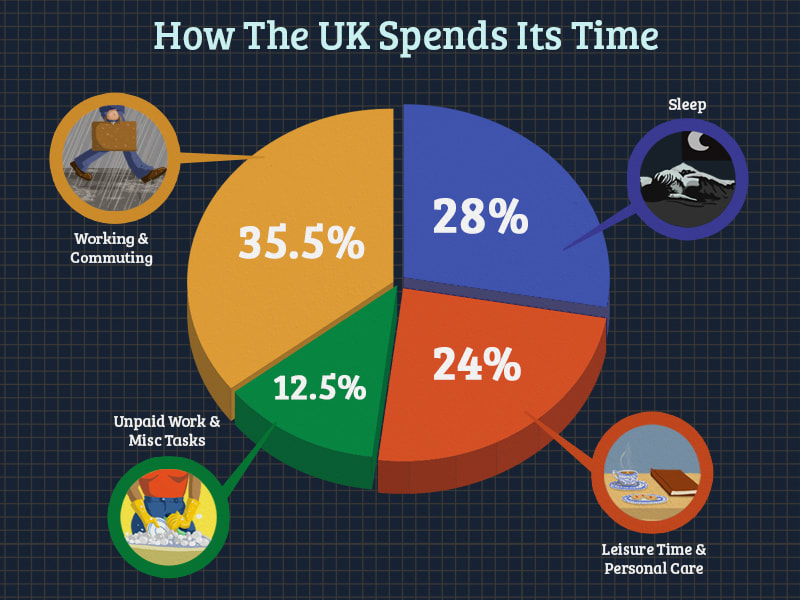

Interesting findings from the powershop survey include that 23% of households have a running direct debit for something they don’t use or need. This could be anything from a gym membership to a subscription to a streaming service such as Netflix. They also found that 20% of households delay switching energy suppliers even though it could save them up to £300 each year. How people spend their free time I also found it interesting to look up statistics to find out how the average person spends their time. This is very closely related to the question on how people spend their money. I found it extra interesting because I always wonder how everyone watches so much more TV than I do. For the UK:

So, 5.8 hours a day is spent on leisure and personal care. However, this masks a gender discrepancy as the average man has half an hour more free time than the average woman – 6.1 hours vs. 5.5 hours. The average American has about as one hour less leisure time than the average Briton at about 5 hours. Again American men spend more time engaged in leisure activities (5.8 hours) than did women (5.1 hours).

And the top 5 leisure activities are:

Key takeaways:

I hope this helps! Heather

Hi Heather,

My name’s Nicola. I’m fortunate enough to still have a job right now, most of my friends have lost their jobs and it’s made me realise that if I had lost my job I wouldn’t be able to survive at all. I have no savings, a few debts and spend all my earnings every month. What do I need to start doing, right now, to ensure that by the time the next crisis hits the economy, I would be able to survive regardless of my employment situation? Thanks for all the financial knowledge you share.

Dave Ramsey is having a field day with this COVID-19 pandemic and associated financial crisis! His very conservative school of advice is exactly the type of financial planning that you need to survive an economic crisis and it works especially well if you are in the type of job that is insecure and disappears in a market downturn. Go to his channel and he is all about the, “I told you so.”

Quite soon after the global COVID-19 pandemic hit in 2020, stock markets plunged to 2017 levels. Lots of investors got scared and decided to hold their money as cash, however, those of us that follow the Warren Buffet school of investing were not selling our shares, we continued buying as usual but at the now lower prices to reduce the average price at which we bought our shares. It turns out to have been a good idea because portfolios have bounced back very rapidly BUT it wouldn't have mattered either way, those of us with 15 plus horizon have plenty of time to recover and make fresh gains. Investing consistently over time and especially when stock prices are falling helps to reduce the average price at which you buy your shares, this is called “Dollar Cost Averaging”. Getting your financial house in order takes time; it is not an overnight thing. If you have a low income or significant debts it can take very many years indeed but these are the fundamentals you will not have regretted following in a world where the next crisis is always just around the corner. I don’t claim to have created a new financial world order; the principles I like and follow have been collected from many financial authors over the last fifteen years: 1. CREATE AN EMERGENCY FUND (and AD HOC FUND) Have an emergency fund of £1,000. This will cover most emergencies. If you’re a student, a £500 emergency fund should be sufficient. I used 60% of our £1,000 emergency fund to buy a freezer just before the UK went into COVID-19 lockdown. We only had a 70/30 fridge/freezer which means the freezer portion is tiny. I’ve personally always preferred fresh fruit, veg and milk to frozen or canned stuff so it was never a problem before but having such a low stock of food made me properly anxious and I am not even the anxious type. I won’t tell you the drama I went through to get what was probably Britain’s last freezer from a back alley warehouse shop but I do know I am not the only one that had some kind of emergency when COVID-19 hit. If you did use your emergency fund then please share how you used yours in the comments. If you didn’t have to use your emergency fund, that is awesome but I know you will have had a certain level of peace of mind by having had the £1,000 emergency fund set aside. An emergency fund is there to be used for any expenditure that you feel has to be made but had not been budgeted for: a car breakdown, an unexpected medical expense etc. How should you set up your emergency fund? Many UK savings accounts and current accounts are completely free so I would just add a savings account at your existing bank and build your emergency fund there. We also use the emergency fund for ‘ad hoc’ expenses so it gets topped up monthly to accommodate what we call ad hoc expenses. These are expected annual expenses that we prefer to pay for annually rather than by monthly direct debit. Ad hoc expenses include:

For example, if you figure out that these will total £1,800 per year, then you need to add an extra £150 every month to your Emergency Fund. Sometimes it will dip below £1,000 but because it’s topped up religiously every month it will get topped up again and if these annual expenses are bunched up around the same time of the year sometimes your emergency fund will be well above £1,000 but that is okay because you know that the money is there for a specific purpose. Paying for lumpy expenses annually rather than monthly gives you the same peace of mind as buying things for cash. You’ve paid for it, it’s done and frequently paying for it once a year is cheaper than setting up payments. Of course, if it costs exactly the same to pay monthly then that might be the better option to even out your cash flow. Alternative option: You could split bank accounts up further by having a separate "Emergency Fund" bank account and Ad Hoc Fund or Annual Expenses account; that way, the Emergency Fund remains sacred for a true emergency. 2. GET TO DEBT FREEDOM You will not ever regret having paid your debts off completely. Those that had zero debt when COVID-19 hit will have been best placed to weather the storm because they have no debt payments to be making in addition to their costs of living. If you want to tackle your debts systematically, get my “notes to debt freedom”. If you do have outstanding debt then create a plan such that in under 3 years, and ideally within 12 to 18 months you will be completely debt free. My notes to debt freedom will guide you through that process. 3. SET UP A CRISIS FUND The crisis fund is completely different to the emergency fund. A crisis fund is there to protect you against times of unemployment. The usual advice is to maintain 3 to 6 months of expenses to protect yourself against periods of unemployment. If you have a budget then you can easily calculate which expenses would continue whether you were unemployed or not. For guidance on creating your budget plus a downloadable spreadsheet to create a budget see my article, “Q&A: I hate budgeting – am I doomed to be broke?” Three months of living expenses is considered enough if you have a safe recession-proof job that’s likely to be easy to find again should you be unemployed for a period, think nurse, doctor, accountant, delivery person, bin man etc. If there is one thing that is being amply revealed by COVID-19, it’s the types of jobs that are safe and essential to our day-to-day life. A recession is not the only reason you might need to take time off work so that's why you need a crisis fund even if your job is recession proof. If you disliked your work environment because it was toxic, for instance, you might prefer to leave even if you haven't secured another job to move on to. If you send your children to private school, add at least a term of school fees to the crisis fund. If you have a property portfolio then add another three months of related expenses. You can make a reasonable judgment on this. If you have a large portfolio then this may not be necessary as you can make the judgment that some properties will always be occupied to support those properties that are not occupied. If you have lots of buy-to-let mortgages then do make a reasonable provision to accommodate continued payment of mortgages even if you lost a significant portion of rental income. If, when the COVID-19 pandemic hit you had:

If you have a mortgage-free portfolio of buy-to-let properties then you are feeling even more secure. With the stock market crash, it’s best to ride it out and not sell any of your shares. Selling would just convert paper losses to real losses. With a fully-outright-owned property portfolio you can enjoy some income stability in addition to having a healthy balance sheet as outlined above. To clarify, my household is not in the perfect situation either but we have been working towards it and will continue to do so. Our plan to get to the above situation is a 10-year plan and we are only at about year 2 right now. Thankfully we both still have our jobs so we can continue focusing on that plan. 4. GET/HAVE AN AFFORDABLE MORTGAGE The more affordable your mortgage is, the less financial pressure it adds to your life. If you are in a relationship, an ideal goal would be to have a life that is affordable on the lowest of your two salaries. So, whatever your mortgage is, that mortgage and all your other costs of living would be affordable on the lowest of your two salaries. Not entirely possible for all people. However, one way to work this is to have a very long-dated mortgage, e.g. a 30-year mortgage instead of a 15-year one, and in good times, make overpayments as though it were a shorter mortgage. However, in a crisis you would reduce payments on the mortgage to conserve cash. I reduced payments on one of my buy-to-let mortgages as soon as the covid-19 lockdown was put in place in the UK. The monthly re-payments for the last year were £2,500/month, which was £900 above the mortgage deal and in fact less than £500 of each payment was interest. This week I called the bank and reduced mortgage payments by £900 to conserve cash in case I lose a tenant, etc. This can work in exactly the same way for your personal mortgage. If I lose the tenant, I will call the bank and ask to pay interest only until the lockdown is over. My bank would probably be completely fine with that given my level of over-payments far exceed what they expected on the mortgage deal. In the past I have used this same type of cash flow management by getting an interest-only mortgage deal on our home and making excess payments with the intention of cutting back to interest only should times get tough such that we need to live on one salary. However, interest-only deals with a good interest rate are much harder to secure nowadays than they were in 2010 when I last got a residential interest-only mortgage. If your mortgage becomes unaffordable for any reason, call your bank and get a mortgage holiday. The media has made it sound as though mortgage holidays are something banks are doing as a one-off exceptional thing for COVID-19 but the truth is banks are always willing to give people payment holidays if they can prove that they are needed. Your bank would prefer not to have the hassle of repossessing a home. That wraps up the key 'big picture' things you can do to crisis proof your finances. >>>HABITS OF A LIFETIME THAT WILL HELP YOU SURVIVE THE CRISIS No matter what your personal finances look like, the one thing you can do right now is look at your monthly and annual budget with a fine tooth comb and figure out how to cut your cost of living – if you have a very expensive lifestyle, this is the time to think through your habits. If you want me to help you rework your finances, schedule a call using the “request a call button” on my coach page. Sometimes you just need an independent party to point out where you could possibly cut back, you know, the non-essentials you’ve began to see as essentials. Being confined to your home is not easy especially if you enjoy being out and about. The plethora of memes that have hit our whatsapp screens show just how much people are struggling to keep themselves entertained during the period of lockdown and social isolation. If your job, like mine, can continue as normal even from home then you have less time to get bored, however, this is the time when you can work on things that you wanted to do before because you don’t have a commute:

These are just a few ideas and I am sure you have more. Once the initial overwhelm and disruption to normal life created by COVID-19 subsides you will have the mental bandwidth to figure out how you can make the best use of this time. Oh and by the way, watching endless YouTube videos of all the skills you would love to develop, doesn’t count. Start working on something that you would never have otherwise had the opportunity to explore. In summary, to get your financial house in order:

Hope this helped. My prayers are with those that have lost a loved one or suffered a job loss at this already difficult time. Lots of love and adoration, Heather Have a money question for me?

If you have any personal finance questions send them to [ME] – I will answer whatever piques my fancy via a blog post.

|

Heather on WealthI enjoy helping people think through their personal finances and blog about that here. Join my personal finance community at The Money Spot™. Categories

All

Archives

September 2023

|

Heather Katsonga-Woodward, a massive personal finance fanatic.

** All views expressed are my own and not those of any employer, past or present. ** Please get professional advice before re-arranging your personal finances.

RSS Feed

RSS Feed