|

You can listen to this episode on YouTube.

Retirement is a dream shared by many of us, but achieving it requires careful planning and early action. In this article, we’ll delve into the world of retirement savings and reveal exactly how much you need to save each month to retire comfortably. So, if you're aiming for financial independence but are possibly thinking it’s a pipe dream, buckle up and discover the key to retiring early!

Understanding the two pension types – DC and DB pensions Before we jump into the numbers, let's familiarize ourselves with the two primary types of pensions: Nowadays, most people have "defined contribution" (or DC) pensions, where the amount you and your employer contribute determines your retirement income. The risk lies with you, because your return, i.e. the pot of cash you’ll have at retirement, depends on the performance of the stock market. Previously, "defined benefit" (or DB) pensions were more common, guaranteeing a pension until death based on your final or average salary and the years of service. However, DB schemes have mostly been phased out and won’t be covered in this article. If you have a DC pension, if the stock market performs poorly you’ll either have to work longer or plan for a leaner retirement. Defined contribution schemes are sometimes called ‘money purchase’ schemes or self-invested personal pensions (SIPPs). They are similar to what Americans call 401K plans. How do you calculate your retirement "pot"? To estimate the size of the retirement fund you'll need, we can employ a simple rule of thumb. Multiply your desired annual retirement income by 25, and voila! You have worked out roughly how much you should aim to accumulate. But why 25? This is based on the ‘4% rule’ – a widely accepted guideline that suggests that withdrawing 4% of your invested pot annually, ensures your money lasts. Research has shown that even after three decades, your investments tend to grow due to average growth rates of a diversified investment fund surpassing the 4% withdrawal rate. {If the nerd in you wants to get into the maths: 4% = 4/100 and 100/4 = 25; … you don’t need to understand the maths, though, just use the rule} Estimating your retirement expenses – how much will you need to spend in retirement? Now, let's discuss the various lifestyle options and corresponding expenses you might encounter during retirement: according to research conducted by Loughborough University and the Pensions and Lifetime Savings Association, we can categorise retirement lifestyles into three levels: minimum living standard, moderate lifestyle, and comfortable lifestyle. To account for inflation experienced since these studies were done, I’ve increased the figures by 20%. To maintain a minimum living standard, a single retiree requires an annual income of £12,240, while a couple would need £18,840. For a moderate lifestyle, the figures rise to £24,240 for a single person and £34,920 for a couple. Lastly, to enjoy a comfortable retirement, aim for an income of £39,600 if you're single or £57,000 for a couple.

(source: moneyfacts.co.uk; and increased by 20%)

What are these different lifestyles assuming? A minimum living standard assumes a single retiree spends £46 per week on a food shop, has a one-week holiday and a long weekend in the UK each year, does not own a car and spends £555 a year on clothing and footwear. With a moderate lifestyle, our single retiree spends £55 on food each week, enjoys two weeks in Europe and a long weekend in the UK each year, and spends £900 on clothing and footwear each year. With a comfortable lifestyle, the single retiree spends £67 per week on their food shop, enjoys three weeks in Europe every year and spends £1,200-£1,800 on clothing and footwear each year. Calculating your investment targets Using the 4% rule and these lifestyle figures, we can estimate the amount you need to save for retirement. Here's a breakdown based on your desired lifestyle and whether you're single or part of a couple:

I know that these numbers look huge. But keep listening, I’ll show you that you can achieve them much more easily than you think.

Getting started: how much to save each month Now, let's explore the exciting part—how much you need to save each month to reach your retirement goals. Assuming you're a basic rate taxpayer, investing in a global passive fund with an average annual growth rate of 7% (we’ll discuss whether this is a reasonable assumption in a future post), aiming for the ‘comfortable’ lifestyle (i.e. £990k if single; £1.425m for couples) and ignoring the state pension (I’ll explain why in the next article) and employer contributions these are the monthly amounts you need to put into a pension account based on your starting age (rounded to the nearest 5): Each month until you’re 68 you need to save:

What the table shows is that the younger you start saving and the longer you save for, the less you need to set aside each month.

Factors that can offset the numbers Don't worry if these saving targets seem daunting because there are several factors that can actually work in your favour, offsetting even the larger amounts you need to save if you start late. Let's take a look at these positive factors:

In conclusion, securing a comfortable retirement requires forward thinking. If you didn't have this information when you started working, don't worry—now you do! There's no time like the present to start saving for your future. And here's a bonus: you can share this valuable knowledge with your children, ensuring they don't make the same mistake that many others do—starting too late. With the right strategies and a proactive approach, you can pave the way for a financially secure and fulfilling retirement. Your future is in your hands. References What Is the 4% Rule for Withdrawals in Retirement and How Much Can You Spend? Q&A: How much do I need to save for a comfortable retirement? Pensioners need a £33,000 a year income to enjoy a comfortable retirement Fidelity Retirement calculator How to get the £260,000 pension pot needed for a comfortable retirement - and why it might not be as hard as it sounds Dave Ramsey investment calculator (ignore the $sign) Fidelity.co.uk retirement calculator

0 Comments

Have you heard about the FIRE movement? It's an acronym for Financial Independence Retire Early. While many people interpret it literally, there's more to this movement than meets the eye. In this post, we'll delve into what FIRE truly means, dispel some common misconceptions, and explore the different aspects of achieving financial independence (or FI) and retiring early. So, let's get started!

Understanding what FIRE is and what it is not Contrary to popular belief, the FIRE movement is not a cult or a race to become a millionaire overnight. FIRE is also not about living close to the poverty line so that you can save every penny possible – in the process depriving your family of positive life experiences such as holidays. This latter interpretation is from a podcast run by one of the mainstream broadsheet newspapers! FIRE is about gaining control over your financial life and having the freedom to choose how you spend your time without worrying about money. Many attribute the beginnings of the FIRE movement to Vicki Robin and Joe Dominguez’s 1992 book, ‘Your Money or Your Life’. Let's break down FIRE into its key components: financial independence, retiring ‘early’, and what retirement means in this context. FINANCIAL INDEPENDENCE (FI) - what is FI? Financial independence is the foundation of the FIRE movement. Inevitably, you have to gain some FI before you can enjoy any of the benefits of ‘retiring early’. At its core, FI means having enough passive income from investments to cover your living expenses. However, it's important to note that there are different levels of financial independence. Regular FI – what does ‘regular’ financial independence look like? Regular financial independence ensures that your passive income can sustain your pre-retirement standard of living. This includes basic necessities such as utilities, transportation, food, clothing, and some travel. While many people in the UK aim to pay off their mortgages before retiring early, it's not a strict requirement. Lean FI – what does ‘lean’ financial independence look like? Lean financial independence focuses on covering only the essential expenses like utilities, food, transportation, and basic rental accommodation – perhaps, in a housing association or choosing to purchase the most affordable property available in an out-of-town area where property prices are much lower. Those targeting lean FI may choose not to have children or plan to retire to low cost-of-living countries in Asia or Eastern Europe (popular destinations include Thailand, Malaysia and Turkey). A just-getting-by type of FI, like this, is not most people’s idea of financial independence but it suits some minimalists. For instance, Jacob Lund Fisker, author of ‘Early Retirement Extreme’ needed only $7,000 a year to live and that meant he was FI at 30 and retired at 33! And if you think that wouldn't be possible in the UK, a very close friend of mine has lived on a similar amount for the 18 years since we graduated from uni...we'll cover their story in a future post. If Lean FI is the goal then you may plan to earn some money from temporary or part-time jobs when you retire to cover luxuries such as a special holiday; this version of Lean FI is called ‘Barista FIRE’. Fat FI – what does ‘fat’ financial independence look like? On the other end of the spectrum is fat financial independence. It represents a comfortable retirement with all necessities and desired luxuries covered. Fat FI allows for frequent holidays, dining out, a nice house, and a generous budget for food and clothing. Downsizing is probably not on the cards for FAT FI-ers. EARLY – what does retiring early mean? The "Early" in FIRE refers to retiring earlier than traditional retirement ages. The timeframe for early retirement varies depending on personal goals and circumstances. As soon as possible For some, ‘early’ means ‘as soon as possible’. Some people join the workforce with the clear objective of achieving financial independence as quickly as possible, ideally within 10 to 15 years. To achieve this, they actively pursue high-paying careers and dedicate themselves to saving and investing. Timing with family goals Others discover the FIRE movement later in life or choose to align their retirement plans with family goals. For example, they might aim to retire when their last child enters university. This could be around the age of 50 or 55. In the context of a UK state retirement age currently set at 68 for millennials – and which could rise to 70 or older by the time we actually get there – 50 is ‘well’ early. Retirement can end up being a mini-retirement While the extremely early retirees in their 30s and 40s grab most of the headlines, some may retire in their 30s or 40s but go back to ‘traditional work’ after a few years in which case the first retirement ends up only being a mini-retirement – a fantastic opportunity to do something different for a few years. How soon you want to retire informs the type of financial independence you go for. The ‘leaner’ your lifestyle, the quicker you can achieve FI. It also informs the type of career you go for: you might choose a career in finance or high tech over public service, for example, to maximise your saving potential. RETIRE – what does 'retire' mean to those on FIRE? Retiring early doesn't necessarily mean quitting work entirely. Some individuals choose to work part-time in the same career or switch to more fulfilling, passion-driven careers that may not pay as well. Others pursue non-earning hobbies, engage in charitable work, or spend quality time with their children while they're young. And others identify with the FIRE movement and want FI for the peace of mind and flexibility it offers, but haven’t decided what ‘ ‘retire early’ means for them yet. In conclusion, the FIRE movement has revolutionized the way we perceive financial independence and early retirement. It's about breaking free from the constraints of a traditional career and embracing a life filled with possibilities. Whether you aim for regular, lean, or fat financial independence, the goal remains the same—to achieve a level of passive income that affords you the freedom to live life on your terms. In my next post, we'll delve into the exciting topic of how much you need to save to embark on your ‘retirement’ journey. So, stay tuned as we uncover the secrets to financial freedom and pave the way to a future filled with endless opportunities. References:

I receive a lot of questions about “how to start investing” and this month alone I’ve fielded more questions than ever before, so, as a belated birthday present to myself I decided to get this all out into a simple blog.

A couple of housekeeping points first: Any tax rates and thresholds mentioned in this post will be correct as at the time of writing but tax is something that gets tinkered with all the time so this could get dated pretty quickly but using figures will help you to understand how it all currently works, in principle. Everything I share here is information not advice. Once you decide to actually start investing you would be well advised to: a) do some further research yourself; and b) speak to a fee-only all-of-market independent financial advisor. Fee only means they don’t charge you a percentage of what you have to invest (that is, they charge a fixed fee) and all-of-market means they can offer products from a range of institutions.. Ideally, you should only invest money that you will not need for at least 5 years. This is because share market prices move up and down a lot and if you need that money before five years is up, there is more chance that you might have to sell at a loss. Investing is a long-term game, the longer the time you can wait, the higher the probability of being up. Over a 20 year period, the S&P500 (which is the 500 largest listed companies in the USA) has returned a positive return 100% of the time. While the future may turn out to be different, you are generally well advised to leave money invested for as long as possible. While my aim is to make this discussion as simple and as unintimidating as possible, at times it will feel really complex not because investing is hard but because we invest within the context of a very complicated and convoluted tax system. But you have to get to grips with our tax system to get ahead with investing…anyhow,…I’ll divide this into four parts to keep it clear:

PART 1 – What sort of investment account should you put your money in

You can think of your 'investment account' or ‘investment vehicle’ as the “house” where your money is kept. There are three different types of vehicles:

1. A pension be it a workplace place pension or personal pension (aka a Self Invested Personal Pension) allows you to invest money before it is taxed; 2. A “stocks and shares” individual savings account or ISA allows you to invest money after it’s been taxed but all dividends and capitals gains are tax free; 3. A taxable brokerage account – means you invest money after it’s been taxed and any capital gains and dividends are also taxable. Any business that offers the services to buy or sell shares and investment funds will typically offer all three vehicles, i.e. they will usually offer pension accounts, ISA accounts, and taxable trading accounts. There are different pros and cons of investing in each of these three. I will highlight the main pros and cons. PENSIONS I am only going to cover defined contribution pension schemes in this post, which is what most people have nowadays. I won’t cover defined benefit pension schemes in which the employer commits to pay you a specific amount from a pre-defined retirement date until death. The rules are much the same between the two but if you’re responsible for your own retirement income as is the case if you have a DC scheme you’re likely to be more aggressive with building that pension pot. I’ll cover the difference between DC and DB pensions in a future post. Pros of investing through a pension

Cons of investing through a pension

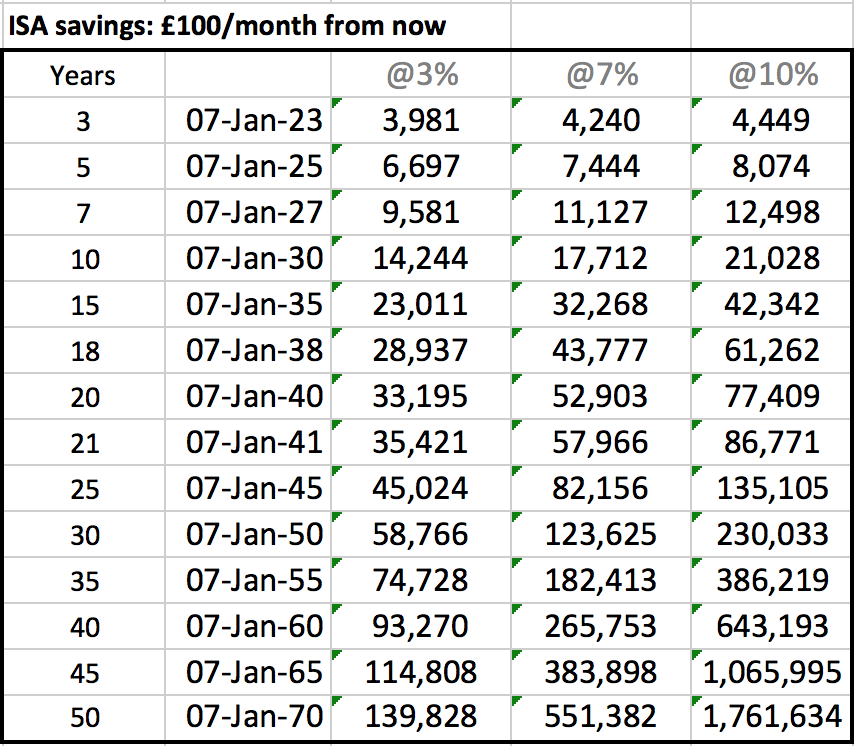

Rules on how much you can invest in a pension… There are limits on how much you can invest via pension each year and over your whole lifetime. Firstly, the annual allowance is the maximum you can put into your pension each year and still get a tax benefit. This is currently £40,000 gross (i.e. before tax) or your full annual income, whichever is lower. So, if you earn £30,000 a year the maximum you can put into a pension is £30,000. I am sorry that this is getting complicated already but the UK tax system is mad – so a little detail is essential. A key thing to note is that not all income qualifies towards this pension contribution limit. Earnings from property aren’t allowed. So if all your earnings are from a buy-to-let property portfolio that is in your name, the maximum you can put into a pension is £2,880 and with the government tax benefit this is grossed up to £3,600. So, you’d only invest £2,880 into the pension and it would be grossed up to £3,600. If your BTL properties are in a company, then you could pay yourself a salary (and you’d need to follow rules on national insurance contributions too) and whatever your salary is – up to the £40k annual allowance limit – would be the maximum you could pay into a pension and still get a tax benefit. The second limit is the pension lifetime allowance which is just over £1m at the moment. This may sound like a high limit but it includes capital gains not just contributions so you can easily breach the limit. For instance, if you had £250k in your pension at the age of 35, a 7% growth rate in your portfolio would mean the money doubles every 10 years, so even if you didn’t invest anything else, that £250k would grow to £1m by the age of 55. Ideally, the lifetime pension allowance should grow with inflation but it’s frequently frozen and was even slashed from £1.8m in 2012 to £1m in 2017. This post is not about pensions but they are one of the primary vehicles you can invest through so hopefully what I’ve said so far will help you understand whether is this is the best vehicle for you. Depending on how much money you have to invest, I would look at putting some money in both a pension and an ISA and if you have more besides then you can put some into a taxable investment account. ISAs I love ISAs because once the money goes in, you don’t have to think about making tax declarations any more – it’s all tax free from that point. Pros of investing through a stocks and shares ISA I won’t cover cash ISAs here as this post is specifically on getting started with investing in stocks and shares.

Cons of investing in an ISA

Whether you plan to invest in a SIPP or ISA depends on your financial position and future plans, e.g. retirement goals, goals for your children if you have any etc. As tax advisor to my friends and family I recommend different things depending on what I know about the person including their propensity to choose spending over saving or investing, there is no blanket rule. Taxable brokerage account If you have maxed out your £20,000 ISA allowance and your spouse’s £20,000 ISA allowance and your £40,000 pension allowance then the next place you would look to invest is via a taxable brokerage account. If you are saving that much though, you may want to just spend more…better holidays, more life experiences etc. PART 2 – Who i.e. which institution should you invest your money through

So, you’ve figured out whether to put your money in a pension, an ISA or even taxable account, you now need to decide where to open your pension, ISA or taxable account. The way to think about this is, if you had money to save, one of the questions you would want to answer is ‘which bank should I keep my money with’, that’s the decision we are trying to make in part 2.

If you have a workplace defined contribution pension, that decision is usually made for you although in some cases you’re offered limited options. You are allowed to have a personal pension outside your workplace in addition to the work one but I personally I’m happy with the options provided by the provider of my DC pension at work so I don’t contribute more to another SIPP. There are three options open to you when it comes to type of institution:

The key driver of which platform to use is:

Fees – annual management charge Of the platforms I would guide you to research, these are the annual platform fees you can expect to pay as a beginner. In many cases the fee falls as your portfolio grows:

In addition to platform fees, whatever you invest in will have an ongoing annual fee. Ongoing fees usually range from as little as 0.05% to over 1.00% and in some cases as much as 3%. Watch out for the ongoing fees of what you buy as this is what can really harm the growth of your portfolio. There may also be fees for leaving or joining the platform. Look at all chargeable fees before committing to an account – you can always change institutions if you change your mind but it’s better to do your research before you even start. Any institution regulated by the Financial Conduct Authority, FCA, will be transparent about all the fees charged. Don’t invest through any unregulated institutions. As I researched this article I discovered that Junior ISAs at Fidelity are not charged an annual management charge and I immediately transferred all my children’s ISA investments to them from Hargreaves Lansdown. That was £55k in total – their investments of £20k each, have grown well over time so despite the poor stock market returns of 2022, they remain up. If you’re interested in how I invested for my kids see my post, Q&A: How can I save and invest for my children? I won’t spend a lot of time on fees but will link to several articles that discuss fees across a range of platform: PART 3: HOW MUCH TO INVEST

sIf you have a lump sum to kick start your investing, that’s great. You can invest it all in one go, however, some people prefer to spread a large investment into smaller chunks spread over 2 or 3 months. There is no real benefit in this if you are investing for the long-term – in fact, data suggests that lump-sum investing beats drip feeding your investment into the stock market 75% of the time. But if it makes a psychological difference to you, you can split a large lump sum over a few months.

What’s large? That’s for you to define because if I had a large sum to invest, I would invest however much I plan on investing all in one go. Generally, most people don’t have a large sum and the decision is about how much to invest each month. Investing monthly, over a long period of time, is called ‘dollar cost averaging’ into the market as your shares are cheaper in a bear market and more expensive in a bull market so over time you are paying the average price of the market. If I was working with a specific person, I would want to know how much they want to have at the age of 50 or 55, either as an annual income or in total and I would back calculate the amount they need to invest monthly, today, to achieve that goal. You can do this for yourself using an online calculator - I like the investment calculator on Dave Ramsey's website, you can ignore the fact that it has a $ sign and put in your GBP investments - the sign doesn't matter - I assume a gross return of 7% (that's the return before inflation is taken into account - with average inflation of 3% this is a net return of 4%). You can also ignore links to other resources as they are US-centric. PART 4: WHAT TO INVEST IN

Equities / shares

Investing in the shares of companies is called investing in equities. Equities pay dividends if they have money left over after paying all costs including interest on their debt. Some companies, especially fast growing companies, choose not to pay dividends and instead re-invest the money. If you buy the shares in a company, you’re known as a shareholder and you also make a return or loss from any increase or fall in the price of shares. So, if you buy shares for 10 and they grow to 12, that’s a 20% return; if their price falls to 8, that’s a 20% loss (the profit or loss is only realised if you sell, i.e. a loss is only a loss on paper - not a real loss - unless you sell, so, if share prices fall they can be left invested so that they recover in price). Debt / bonds Investing in the debt that companies issue is called investing in bonds. Bonds earn a fixed and known return. There are a few options you can choose from, here I’ll suggest 3 for you to look into: Option 1: 100% stocks in a diversified fund If you’re starting out in investing, you should be satisfied to earn the average stock market return by investing in a low cost diversified index fund. It requires a lot of time to identify specific companies that are undervalued or those with great growth potential and you don't need to do this to do well with investing - in fact, the evidence suggests just putting money in one or two diversified passive funds gives better returns than stock picking yourself and trying to beat the market. I personally prefer stock indices that track the S&P500 (these are the 500 largest companies in the US) – these funds usually cost 0.10% or less. Large US companies usually have global sales and source materials internationally so I feel it is adequate diversification that implicitly includes Europe and exposure to many emerging markets without having to worry about corporate governance issues. The historical average yearly return of the S&P 500 is 9.645% over the last 20 years, as of the end of November 2022. This assumes dividends are reinvested. Adjusted for inflation, the 20-year average return (including dividends) is 6.932%. (source: tradethatswing.com) If you prefer to invest in the UK stock market, you can choose fund that tracks the FTSE-100 in the UK. In the 20 years leading up to 31 December 2019, the FTSE 100 had an average annual return of 0.4% if dividends were not re-invested but this rose to a not insubstantial return of 4% a year if dividends were reinvested. Option 2: Target date funds Target date funds are funds that invest based on the assumption that you will retire in a given year. These funds have a higher proportion of riskier equity investments and a lower proportion of bonds which give a fixed and known return. As the retirement date approaches, more and more money is invested in bonds and less and less is invested in equities. Some in the investment community consider that target date funds get too conservative too quickly because no one retires and needs all their invested money straight away. So, if you want to have some money in equities and a portion in bonds, you could start with a target date fund with the retirement date set further in the future than you plan to retire - perhaps set it 20 years further than you plan to retire especially if you're partly saving to pass on an inheritance rather than just for your retirement needs. Option 3: Ready-made funds Many institutions offer ‘ready-made funds’ to get you started with investing and if you choose to go with that, as I did when I first started investing, take that as a learning opportunity. Seek to understand what is in those funds, what the fee structure is and if you don’t like the underlying investments or see that the relative fees are high, either don’t buy them in the first place or seek to move away to other investments. I do not recommend investing in single stocks, e.g. buying specific companies as this exposes one to a lot more risk than tracking a whole market so I won’t cover single stock investing here. I used to trade in single stocks myself but I no longer do. A simple example - investing in action

I know all this information might seem confusing so I thought I’d give you an example of all this in action.

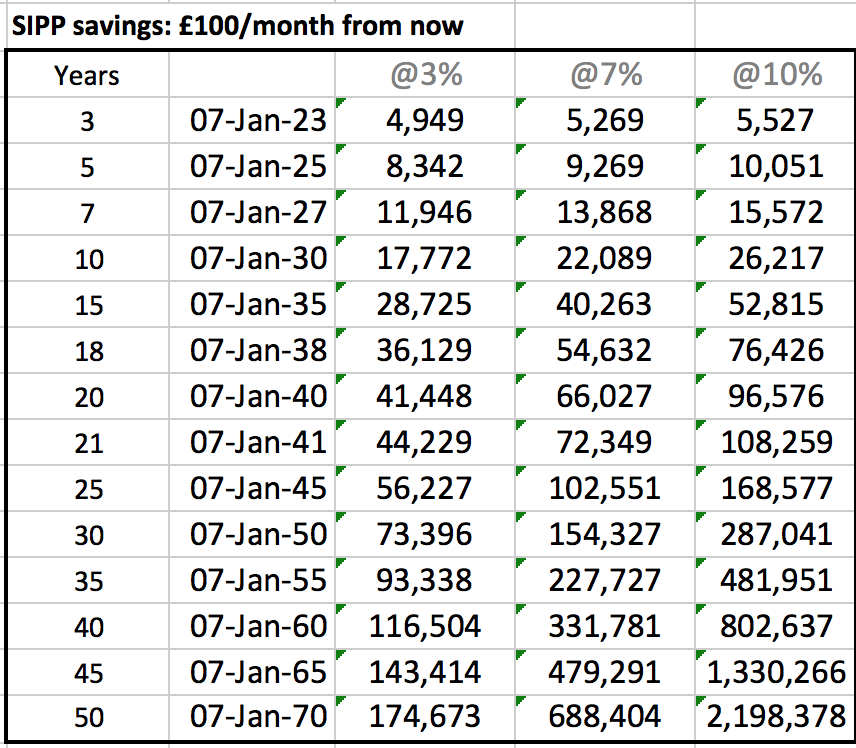

So, as an example, about 3 years ago, unprompted, I told a 30-year old couple I know and like that if they wanted to have £300,000 or so when they are 55, in addition to their work place pensions, they should put £100 into a SIPP every month. With a lump sum like that they would have the option to retire early and as DINKies (double income no kids) I knew they wouldn’t feel that kind of investment even if it fell to zero – and with the government match they would be 25% up from the outset due to the tax saving. As I knew they were first time investors and quite risk-averse I got them to put almost all of the invested money in S&P 500 trackers with about 10% in an actively invested fund. They use Hargreaves Lansdown – I chose this for them because their customer service is great and you can easily get a person on the phone – but as their funds grow I might get them to move to a cheaper provider. I’ll review this when they have £50,000 or so. Three years later, they have about £20k between them (they invest a little more than I suggested). As I wasn’t happy with the performance of the actively managed fund, I got them to sell all of that and stick to low cost diversified funds. They’re happy with this set and forget strategy and aren’t much interested in overthinking it and unlike most of their friends have savings. In about four years, they will also be mortgage free to boot – based on a repayment plan I’ve advised them to stick to. Financially they’re on a great track and are also enjoying life… So, investing doesn't need to be complicated or big. You can start small and increase your investment as you learn more, develop confidence, and start to understand how different investments work...OVER TO YOU! Get help investing:

If you want help with setting up your investment account and selecting funds, click the PayPal link below to book me and fill the form in to tell me a little about your situation. Your booking gets you two one-hour phone calls during which we will chat through what you want to achieve with investing then I'll help you set your investment account up in your own name and automate everything for you.

3-Month Coaching Program

£1,000.00

This 3-month coaching program will be custom built to suit your needs.

I used to coach people on business issues only but I quickly discovered most struggles were the result of factors that hadn't even been considered. My coaching programs last 3, 6 or 12 months. During that period you have full access to me by phone, email, text, skype and if you live locally, even for coffees. So that we can just crack on with making you awesome I take payment upfront. Psychologically this makes you commit fully and wholly to the program too. My coaching covers:

Before a coaching relationship starts I recommend you book a one-off call to discuss your self-development needs . If you go on to book a coaching package this "analysis call" will be refunded. You're awesome. Let's make sure everyone who so much as walks past you sees that too! Bonus: you will get the Build A Booming Business Planner & the iPlan To Succeed Life Planner free with this coaching package. Check your email as soon as you've checked out of the shopping cart. 6-Month Coaching Program

£1,875.00

This 6-month coaching program will be custom built to suit your needs.

I used to coach people on business issues only but I quickly discovered most struggles were the result of factors that hadn't even been considered. My coaching programs last 3, 6 or 12 months. During that period you have full access to me by phone, email, text, skype and if you live locally, even for coffees. So that we can just crack on with making you awesome I take payment upfront. Psychologically this makes you commit fully and wholly to the program too. My coaching covers:

Before a coaching relationship starts I recommend you book a one-off call to discuss your self-development needs . If you go on to book a coaching package this "analysis call" will be refunded. You're awesome. Let's make sure everyone who so much as walks past you sees that too! Bonus: you will get the Build A Booming Business Planner & the iPlan To Succeed Life Planner free with this coaching package. Check your email as soon as you've checked out of the shopping cart. 12-Month Coaching Program

£3,600.00

This 12-month coaching program will be custom built to suit your needs.

I used to coach people on business issues only but I quickly discovered most struggles were the result of factors that hadn't even been considered. My coaching programs last 3, 6 or 12 months. During that period you have full access to me by phone, email, text, skype and if you live locally, even for coffees. So that we can just crack on with making you awesome I take payment upfront. Psychologically this makes you commit fully and wholly to the program too. My coaching covers:

Before a coaching relationship starts I recommend you book a one-off call to discuss your self-development needs . If you go on to book a coaching package this "analysis call" will be refunded. You're awesome. Let's make sure everyone who so much as walks past you sees that too! Bonus: you will get the Build A Booming Business Planner & the iPlan To Succeed Life Planner free with this coaching package. Check your email as soon as you've checked out of the shopping cart.

When you’re at one point in your life it’s often nearly impossible to imagine having much more than what you’ve got – or maybe that’s just my lack of imagination – anyhow, in this podcast I recount the steps we went through to move from our £385,000 beautiful terraced home to a £1.1m detached bungalow in the same neighbourhood.

We did all this in 2020 but, even as recently as in 2017, when I walked past the homes on the street where we now live, I thought actually living in one of them was pure fantasy for us and at that point, it was. It took getting a proper second income, a stamp-duty holiday and an all-time low 5-year fixed interest rate of 1% to achieve this, oh, and a few consumer loans for a short period. Was it worth it, 100%. One thing I forget to mention in the episode is that one of the key drivers was I saw already expensive properties getting more expensive and mid-priced (like our terrace) to low-priced properties appreciating very little in value or even falling in price – how does that work? I am not sure but I figured there was some kind of bifurcation in the property market with average incomes driving prices on the lower end and something bigger at play with bigger, more expensive properties – they tended to be owned by business people not restricted by average incomes, some people with inheritances and hence large sums to play with and people with much larger incomes…whatever it was, I wanted in. The funny thing is, if we sold our new house right now, we would be in a position to buy our old house mortgage-free AND still have £200,000 to £300,000 in change ALTHOUGH our old house has gone up by about £30-40k! Listen to the episode and let me know if you have questions. Here’s my property course on Udemy.

Hi Heather

My name’s Grace. I’m looking into saving money for my little one so that it can be invested in the same way as government-backed child trust funds. My older one has a child trust fund but I don’t know how to go about opening something similar for my younger child. As I understand it, banks don't offer government-backed child trust funds anymore.

Hi Grace,

Thank you for this message. In podcast episode number two, I talked about how you can save and invest for children in today’s world. All that information is still relevant so please have look at that post for ideas on the best saving strategy. A Child Trust Fund (CTF) is a long-term tax-free savings account for children. You cannot apply for a new Child Trust Fund because the scheme is now closed. The alternative available for today’s parents is the Junior Individual Savings Account or junior ISA. What is a junior ISA? A junior ISA like its adult equivalent is a tax-advantaged account that can be used for saving or for investing in the stock market. Once you place money into a junior ISA it cannot be withdrawn until your child is 18 and it legally belongs to your child so you would not have control over how that money is used. This is not necessarily a bad thing but it’s something you will need to consider when you’re making a decision. I know a few people that don’t want to use junior ISAs because they don’t want their children having cash that they as parents can’t fully control. Personally, I think that I would still be able to guide my children about the wise thing to do with the money and if they didn’t want my advice that would still be useful information for me to know. My approach is that because you won’t have full control over the money you might want to limit how much you put into the junior ISA so that your child doesn’t have too much money available at the age of 18. The junior cash ISA Saving into a junior cash ISA is like saving into any bank account, it earns a very poor interest rate and is therefore not a great idea at a time when interest rates are so low. A junior stocks and shares ISA The alternative option is a junior stocks and shares ISA. The value of the stock market falls and rises but when money is invested over a long period of time it tends to rise. For example if you are investing for a 10-year period or more you can have a reasonable degree of confidence that your investment pot will produce a good return – certainly a better rate than current savings rates. In podcast episode 2 you will see that my strategy is to invest £4k/year from birth to age 5 and then stop once I have put £20,000 into each child’s ISA. Once I reach that I stop and just watch the money rise and fall. My son’s £20k investment now has a value of £26,000 and he isn’t 6 years old yet. If the stock market enjoys a 10% return on average over the next 14 years he will have just over £100,000 in his stock account from that £20,000 that I invested – that is the miracle of compounding, something Einstein called the 6th wonder of the world. Even if the pot only grows at half that rate, that is at 5%, he’ll still have £50,000 – that’s a princely pot of cash that could be used for university or a deposit on his first home. How to set a Junior ISA up If you want to open a junior stocks and shares ISA there are many brokers you can use. To start off with, I would suggest you look into I have provided you with links to pages that will give you more information on the junior ISA. Personally I use Hargreaves Lansdown for my children. The fee for using the platform is 0.45% per year versus 0.35% at Fidelity. HL have a user-friendly app and have made setting up direct debits so that investing for my kids is easy. The key difference between HL and Fidelity besides the platform fee is that Fidelity also create investment products and may therefore have an incentive to push some of their own products to you. HL aren’t completely innocent though, they earn more if you invest in actively managed funds so they have an incentive to recommend actively managed funds to you. The best strategy is to know what you want to invest in. As a new investor you might want to keep things simple and put the money in low-cost diversified index funds. These are funds that are invested in many companies so you won’t be putting all your eggs in one basket. Here are example of funds that my children are invested in:

I have given you a link to each fund’s page so that you can read more about what the funds are invested in and what the fees look like. I hope this helps you kick start investing for your children. Junior ISAs do not have the government boost that the Child Trust Fund did but they are a very similar product and have much more flexibility attached to them because you can invest in a wide range of products. Even if you start of with a small amount, it will give you some confidence and you will begin to learn how the stock market works. Investing for our children is the path that got us investing for ourselves too. Good luck and keep in touch. Heather p.s. subscribe to my podcast and ask me any money question, HERE - do it now!

Hi Heather!

I'm 22 years old and I've been trying to get a good control of my finances. I'm still a student so I don't have a regular income. I've set up a LISA account to save for a house but I'd also like to begin saving for retirement. I've looked everywhere online but nothing seems to explain what different kinds of pensions there are, how to open them and how they work. Please help! Alex

Alex, this is an amazing question to be coming from a 22 year old! Well done for setting up a Lifetime ISA, that's a good move especially as they are considering phasing that scheme out.

I have been meaning to write a post on personal pensions this since Christmas because another person asked a few specific questions so I’ll tick their questions off in this post too as they could apply to you as well at some point in the future. PENSIONS! Pensions are one of my favourite topics. If you were in a job you would have access to either:

What you need to open is a self-invested pension plan or SIPP. When you do have a work place pension, you can also have a SIPP in addition to it; there are no penalties for doing so unless you’ve reached the annual limit for investing in a pension but this isn’t something most people need to worry about. Once you open a pension account, you need to decide how you want your money to be invested. This is your decision unless you hire a financial adviser. However, even if you do get financial advice I always strongly advise getting some financial knowledge so that you can judge whether you agree with the advice you are getting or not. Every financial adviser has her own beliefs and biases about investing, that's human, the question is whether you agree with her. Most people don’t know a lot about investing (including me when I started working) so some investment sites might ask you to answer a few questions on how you feel about risk-taking and then they suggest “ready made portfolios” to you to invest in which would be aligned with what you say your risk tolerance is, your “stated” tolerance for risk. On some sites you might have access to “target retirement funds” this means you state when you want to retire and they adjust the risk of your investments based on that. For example, if you want to retire at the age of 62 which is 40 years from now, in your case, you would select a 2060 target retirement portfolio. The fund manager would then manage the risk by investing in more risky stuff now when you are far away from retirement and as you approach retirement the balance of investments would be adjusted away from higher risk, higher return investments towards lower risk, lower return investments. The risk-return relationship is very important here. If you say you have a lower tolerance for risk then the options you will be given will have a lower associated risk but also a lower return on your money. If you have a long time until retirement, and being 22 Alex, you have a very very long time until you need to retire then you can afford to take more risk. Personally, 100% of my stock investments are in equities (that is, they’re invested in company shares) because I get a fixed bond-like return from property investing so that balances it out. By comparison, the average investor will usually have a portion invested in bonds and a portion in equities. By buying bonds you lend money to companies or a government and they pay you a fixed amount for that loan. As a lender, you are not a part-owner of the company and as such you don’t get a share of the company’s profits as you would if you invested in the shares. By the way: shares, stocks, equities are usually used interchangeably – they mean the same thing in most cases. Equities vs. bonds I won’t go into too much detail on equities vs. bonds but here are some important differences:

Why am I telling you all this? Because you need this sort of high level knowledge to decide how your money will be invested. What portion of your investments will you put into equities and what portion into bonds?

If you’re investing in ready-made portfolios and they give you an indication of risk, the higher risk portfolios have more equities and the lower risk portfolios have less equity investments. Single stocks or index funds You can manage your risk by only investing in funds or portfolios that invest in a wide variety of companies. Some people find it more exciting to buy a single company's shares (single stocks) but that is much more risky than investing in funds because a fund is a diverse portfolio of lots of companies. As Index funds include a large number of companies, the complete failure of any one of those companies would have a much more limited impact on your return. I have dabbled in buying single stocks myself and I can tell you that it’s very difficult to choose winning stocks – to maximise your chance of winning “buy a whole stock market”, either by buying index funds that track a whole country or by buying index funds that track a whole industry. If you do want to dabble in single stock investing, don’t put any more than 10% of your portfolio into them and as your portfolio gets larger I would reduce that to 5%. So, for every £1,000 invested don’t put more than £100 into single companies and as you move towards a portfolio worth £100,000 I would personally reduce single stocks to no more than 5% of my investments. These are arbitrary percentages and as you gain experience you will decide what feels more appropriate for you. Actively managed vs. passively managed funds There are two main types of fund to choose between, actively managed funds and passively managed funds. Passively managed funds track a whole market such as the S&P500 which tracks the 500 largest, listed companies in the US or the FTSE100 which tracks the 100 largest listed companies in the UK - I emphasise listed because there may be companies that are just as large as those listed on the stock market but because they are privately owned you wouldn’t have access to buy their shares. Alternatively, instead of tracking the whole market in a given country you can choose to invest in a specific sector such as utilities or technology or consumer goods. Actively managed funds have an actual person choosing which shares are likely to outperform the market and investing in such undervalued shares or choosing companies that are likely to grow rapidly and enjoy a rapid increase in value. The objective of an active manager is to beat the market index, while the objective of a passive fund is to match the return on an index. Now, you would think active funds, managed by "clever" fund managers are likely to beat the average market return from passive funds, right? Unfortunately, history has taught us that this very simply isn’t so: over 95% of the time fund managers do not beat index trackers. Not only that, the fees on actively managed funds are higher so even if you observe that an actively managed fund has achieved the same gross return as a market tracker you would be earning less from the active fund after fees have been deducted. Where to start? Where to start? I realise that this is all very technical stuff especially if you are beginner so here are links to a few indices to get you researching and investing. These are all funds I am invested in but I am not recommending you invest in them, only that you look at them to see what is included in each fund, what countries are represented, which companies are invested in, what the fees are and what returns have looked like over the last 5 years. I have put the fees each fund charges in brackets as the fees charged is one of the primary reasons I choose whether or not to invest in a fund. Fees can dramatically erode your return so you should always consider what the fees are before you invest in anything:

Even from the above you can see the large difference in fees between my actively managed fund and the passively managed ones. However, I am personally convinced by the management of Fundsmith. Their investment philosophies are aligned with mine and I think they have the potential to beat the market over time but I don’t put all my eggs into the Fundsmith basket despite my confidence in them. In summary, if you invest in a self-invested pension plan there is no commitment to a fixed pension income at the point of retirement. You therefore need to carefully decide how the money is invested. In doing this you need to consider:

Where can you open a SIPP? The biggest difference between the various platforms where you can open a SIPP is the user interface, customer service and the FEES. In a nutshell you might be charged any and all of the following fees:

Here are a few places you can open a SIPP account including the fees. The money to the masses website has a table showing what the fees look like depending on the amount invested. I recommend you have a look at that but below I share four that I consider to be popular and cost effective. Halifax share dealing

Hargreaves Lansdown

iWeb

Vanguard

Having only Vanguard’s funds is not necessarily a bad thing, they are cost effective and if you have an ISA elsewhere in addition to the SIPP at Vanguard, you can use that to invest in funds run by other institutions, e.g. Legal and General and Fidelity to name a few. Vanguard are very well rated in terms of performance and customer service in addition to having good fees. That said, you could save money on the account fee by investing in Vanguard funds via Halifax share dealing or iWeb and those two platforms would give you access to a wider variety of funds as well. Also, Vanguard’s minimum investment is £100/month or £500 lump sum. If you want to start out with £25/month which at your age is absolutely fine, then you need a platform that will allow lower monthly contributions. Where do I invest? I have a SIPP for my son at Hargreaves Lansdowne and I have a SIPP for myself at iWeb. The fees at iWeb were the cheapest for my ISA and I decided to have my SIPP there too as the fees were reasonable although not the cheapest at the time I opened it. It didn’t make sense to have a SIPP elsewhere to save not very much money. iWeb don’t offer junior ISAs and I wanted to keep my son’s SIPP with his ISA as well so I added it to his Hargreaves Lansdowne account. Based on the small amounts being added to his SIPP (£100 per month) the SIPP fees were actually cheaper at HL but they would have been more expensive for me because my SIPP account has much more invested than my son’s. To cut a long story short, where you choose to open a SIPP can also be influenced by where you have an ISA and whether you want these to be kept together. It’s not necessary to have your investments all in one place, I certainly have several investment accounts for various reasons. Before you decide speak to a few people including family members so you have a flavour for where your social circle seem to be investing, if at all. How much can you put into the SIPP each year? You can have a SIPP if you're resident in the UK whether or not you pay tax but your earnings impact the maximum amount you can put in each year. If you are not employed via the PAYE system, the maximum is £2,880 if you are not employed which becomes £3,600 including the government top-up which is equal to what you putting times 100/80. When you are employed you can put the equivalent of your full salary into your pension up to a maximum of £40,000 per year. I won’t go into lifetime limits for you as you are so young and will discuss those in my general post on pensions. Can you have a SIPP if you are a British citizen living abroad? You cannot make contributions to a SIPP if you are not a UK resident even if you have a British passport. You have to be a UK resident. If you have spent some of the year abroad and some of the year working in the UK, HMRC counts the number of days spent in the UK to confirm if you are UK resident. I won’t go into detail here because the actual number you need to qualify as a UK resident depends on whether you were a UK resident in the previous few years. You can, however, set up a SIPP if you're resident overseas and want to transfer a UK pension from a previous job to the SIPP (but you cannot make further contributions to it). So, for example, if you have a pension with a UK employer and want to transfer that to a SIPP while you are abroad, you can do that. If you’re resident abroad but paid in the UK and pay tax here you can also have a SIPP. So, for example, some British expats work abroad but are paid in the UK and pay a portion of their tax in the UK and are likely to qualify, however, speak to an accountant or financial planner to make sure you don’t fall foul of any rules if you’re ever in this complex domicile situation. What happens if the company you have your SIPP with goes bust? If your SIPP provider becomes bankrupt, your money should remain unaffected. Your money is not invested in the SIPP provider themselves; they either simply manage your investment or act as a platform for you to manage your own investments. I hope this helps! Heather References: What happens if my SIPP provider goes bust? Build a low-cost DIY pension Have a money question for me?

If you have any personal finance questions send them to [ME] – I will answer whatever piques my fancy via a blog post.

Hi Heather,

My name’s Grace. I recently started investing in stocks and shares and want to know the type of returns I should realistically expect? I’m especially interested in how long it will take for my money to double in value. Thanks

Great question Grace, thank you for asking it.

I will start by telling you a little story. When I first started working, I didn’t believe in long-term investing on the stock market. My philosophy was that you buy shares at a good price and when the price has gone up high enough, you sell, take the profits and move on. You know, the buy low, sell high philosophy. My philosophy has since changed. I believe you should buy shares and ideally never sell them except to manufacture a dividend while you are in retirement and I’ll give you two experiences that turned my thinking on this so radically. In about 2006, I bought about $2,000 worth of Apple shares. The price at the time was $70-something. I sold a couple of years later when the price had trebled feeling like a complete winner. If I had held onto those shares they would now be worth about $30,000 (maybe more, it hurts too much to sit down and calculate the exact amount) AND I would have additionally enjoyed about 14 years of dividends from Apple which I would have reinvested back into the stock as I always do. Note that the price you see now shouldn’t be compared to the price I paid directly because Apple had a 7 for 1 stock split in 2014. The way that works is that for every share you own, they split it into 7 shares and the price for each becomes one-seventh of what it was. The lower price is designed to make buying shares more palatable to smaller investors. Anyhow, had I held the shares to retirement, I could have either benefitted from the dividends to support my living or sold them slowly for income to support my lifestyle in retirement (this is called manufacturing your own dividend). FYI, I’m only 36 so retirement is still a while away for me as I enjoy working and don’t plan to stop working for a while yet. The second story is what happened to my pension savings from a job I had that had a defined contribution plan – this is a retirement plan that depends on how the stock market. Unlike the traditional workplace pensions the income in retirement is not based on a fixed formula. Anyhow, I didn’t know much about pensions at the time but a colleague called Karen Matthey told me that even if I didn’t believe in pensions I should pay in up until the match “because it was free money” – I think the company matched contributions into the pension scheme up to a maximum of 3%. I didn’t even know what “up until the match meant” – I was 24 and clueless but I listened to her and did just that. By the time I left that job in 2012 I had just shy of £30,000 in my pension account and within 5 years that had grown to £60,000, that is, it had doubled. I didn’t expect this performance at all and it’s at this point that I started taking the whole investing long-term thing seriously. Now, this made me curious to find how long it takes for an invested amount to double, which is exactly what you’re asking, Grace, and it’s at this point that I discovered what they call the rule of 72. With the rule of 72, you take the investment return you expect, divide it into 72 and that’s how long it will take for you money to double. So, if you expect a 10% return, then your money will double in about 7 years. (72/10); if you expect a 7% return then you money will double in 10 years, it ‘s a very easy calculation. Because my money doubled in 5 years, it’s also quick to calculate that I earned an average return of 14.4% (72/x = 5). And keep in mind that I wasn’t invested in anything fancy: all my money in this pension was in a passive global equity tracker, it still is – and my old employer pays all the fees so I just let that pension pot sit there, I can’t touch it until I am at least 55. If that money earns at least an average return of 10% (this is the actual historical stock market return), then over 21 years the money will double three times: 60k will double to 120k in 7 years (that’s by 2024, and it’s actually growing faster than this right now) which will double to 240k 7 years after that which will double to 480k 7 years after that (that’s by 2038 when I’ll be hitting 55). That’s insane, all from an initial 30k investment! After I figured this out I was annoyed at myself for not taking the stock market and pension investing more seriously and I’ve been making up aggressively for the last 3 years. At the end of the day though, it’s not about crazy returns for me, it’s about making a commitment to investing healthy amounts monthly. It’s very hard for most people, my younger self included, to believe that even £100/month invested over 30 or 40 years will amount to much but it is really surprising how these small amounts add up. What stock market return should you expect? There are no guarantees in the market, but the 10% average has been remarkably steady for a long time. That said, from year to year returns are very volatile. You will only get the average market return if you buy and hold, do not try to time the market. Personally, I model my investments in excel based on a 7% gross return (gross return meaning the return before adjusting for inflation) this would be about 4% after inflation of 3%. My general reading suggests that expecting a return after inflation of 6% is realistic: my 4% net return is therefore not over optimistic. If the experts are telling you to expect a real return of 6% that would make it a gross return of 9% because inflation tends to average 3%, using the rule of 72 you would expect your money to double every 8 years. Simples. To ensure you end up with enough money in retirement, perhaps base your returns on a lower number so that either you end up with more money than you need or so that you can retire early because you reach your goal much sooner. Key takeaways?

If you are enjoying listening to my podcast, please give me a 5* rating wherever you listen to podcasts. If I don’t yet deserve your 5*, please let me know how I can earn it. I hope this helps! Heather Have a money question for me?

If you have any personal finance questions send them to [ME] – I will answer whatever piques my fancy via a blog post.

Hi Heather,

Happy new year! I’m a big fan of yours and have been following you for a while. I bought all your three books. I would like to open a stocks and shares ISA for myself and two children aged 16 & 14 but I don’t know where to start due to fear of risk. I want to invest 15% of my income in stocks and also considering real estate. I have seen some recommendations like Vanguard or Hargreaves Lansdowne but I’m clueless on what to go for. I am a nurse and the only debt I have is a repayment mortgage. I just finished paying off credit card debt. I saw your post on Malawi Queens. Please help. Thank you My name’s Angela by the way.

Angela – congratulations on getting rid of all your credit card debt, you must be super proud of yourself.

And a massive thank you for supporting me by buying my books. Book sales are helping to pay for the production of “The Money Spot” podcast so I don’t take your purchase for granted – it’s really appreciated. Stocks and shares ISA When it comes to investing in stocks and shares ISAs, target a minimum investment period of 5 years and ideally your should invest for much longer than that. Is the money that you want to save for your children for university or for something else? I will assume it’s to contribute towards the cost of university. One important thing that you need to keep in mind is that although tuition fees are given to students as long as they apply for them, the maintenance loan is assessed according to household wealth; basically, children that come from wealthier households are eligible for a smaller maintenance allowance. Only children from households with a total income of less than £25,000 qualify for the full maintenance loan. In addition, students that live at home get a smaller maintenance allowance and those that attend universities outside of London qualify for a lower maintenance loan. In my opinion, the less debt children can get themselves into by the time they graduate, the more disposable income they’ll have when they land their first jobs and the faster they can save for a deposit on a mortgage. If you want to read a little more about what you might need to contribute towards university costs, have a look at the moneysavingexpert.com website. The site has a ready-made calculator that will tell you exactly how much you need to save for each child to contribute towards university. Or, for parents that don’t want to contribute then it’s how much their children will need to earn from a uni job to fill the gap. The calculator will also tell you exactly how much you need to save every month from now to make sure you have enough by the time your child starts university. Child aged 16 For your 16 year old, saving into a stocks and shares ISA is too risky because university is just around the corner – the stock market generally doesn’t offer good returns for periods of less than 5 years. The safest option for the 16 year old is probably to save into a high interest account, this might not be a cash ISA so shop around. The best rate you will find at the moment is between 1.45% to 1.65%. Child aged 14 As you could put money away for five years for your 14 year old, a stocks and shares ISA makes sense here. Again, use the calculator on money saving expert for an idea of how much you will need to contribute each month if you don’t want your children to have to work through university. Your ISA For your own ISA, you have a limit of £20,000 per year. If you prefer, you can save all the money into your own ISA rather than into junior ISAs so that you have more control over it. Money saved into a Junior ISA is legally belongs to the child named on the account when they turn 18 and you would have no control over how they choose to spend it. Risk Before I tackle where you should save I will say that you have every right to fear taking risk with your money, you’ve worked hard to earn it so you should rightfully want to preserve what you have earned. The safest path if you are investing in shares is to avoid single stocks and to invest in diversified index funds. There are two main types of fund to choose between, actively managed funds and passively managed funds. Passively managed funds track a whole market such as the S&P500 for the USA or the FTSE100 for the UK; alternatively, instead of tracking the whole market in a given country you can choose to invest in a specific sector such as utilities or technology or retail. Actively managed funds have a an actual person choosing what shares will outperform the market and investing exclusively in those. The objective of an active manager is to beat the index, while the objective of a passive fund is to match the return on an index. Now, you would think the funds managed by clever fund managers are the ones to go for, right? Wrong! History suggests that over 95% of the time fund managers do not beat the index. Not only that, fees on actively managed funds are higher. The cheapest are about 0.5% nowadays and the most expensive charge in the region of 2%. Many passive funds now charge less 0.2% or what industry professionals call 20 basis points or bps. How can you improve your risk appetite? Improve your understanding of how stock markets work. I would recommend two investment books, if you can, get the audio versions: Charlie Munger: The Complete Investor by Tren Griffin and Common Sense Investing By John Bogle (the inventor of passive investing) Which platform should you use for investing? I personally use iWeb for share dealing because they are the cheapest but I wouldn’t recommend iWeb for most people because you can’t automate your investing. That said, iWeb have good fund centre that helps you sort through the different indices and allows you to order them in different ways, for example, you can sort funds or shares from those with the lowest fees or starting from those that are enjoying the highest return down, you can also exclusively analyse the different sectors that you might want to invest in – technology is enjoying pretty good returns at the moment but I don’t put too much into tech because it’s volatile it goes up fast and can also come down fast. Even if you ultimately choose to invest using a different platform you might want to use iWeb for stock selection if their analysis tools are better than where you end up. iWeb’s fund centre is actually easier for discovery than HL – HL seem to have a vested interest in people selecting actively managed funds so those show up more prominently on their site. They don’t seem, for example, to have a tool that allows you to just look at absolutely every fund they offer ordered by fees. If I just haven’t found this function, someone please help a sister out and send me the link. So, what platform should you use? The two options you have suggested (HL and vanguard) are very different. The likes of Vanguard only offer their own funds. This isn’t a bad thing necessarily but it would mean you need to be sure you won’t want to invest any other fund manager’s products and that is a hard position for a beginner to take. The likes of Hargreaves Lansdown offer you access to a large universe of fund managers. HL don’t create funds, they are essentially a supermarket for other fund managers. It’s the difference between shopping at Aldi and Sainsbury’s. If you want choice, you go to Sainsbury’s; if you’re not too bothered about choice and want to save money, you go to Aldi, but you’re mostly only going to find Aldi’s own-brand products at Aldi – this is not a perfect analogy but it’s not a bad one. Vanguard’s passively managed index funds are known for being very cost effective but they’re platform charges are not the cheapest. At least not in the UK. The likes of Fidelity have a hybrid model: they offer their own funds and other fund managers’ products BUT if you use their tools for selecting funds, which I did to write this piece, the resulting suggestion is one of their own funds. The biggest driver for where you invest should be fees, customer service and ease of use of the platform. Fees Platform fees are the fees you get charged for using a given platform. Vanguard 0.15% HL 0.45% (if less than £250k and 0 if > £2m) iWeb 0 Halifax £12.50 Fidelity 0.35% Either way, if you have less than £50,000 invested the differences in fees aren’t that dramatic but as you start approaching £250,000 in investments you will feel the difference. Once you have £250k invested, and trust me you will get there, on iWeb you would be paying £60/year (if you trade once a month) and on HL you would be paying £1,125 for the same assets invested. Little tip, because I invest for both my husband and I, instead of splitting monthly investments in half, so half goes to his account and half to me, each month I do one trade for either me or for him so that the net result is that we do 6 trades each. This saves £60 in dealing costs every year. Obviously I could save even more by doing one trade a year but as our incomes are paid monthly it’s better to invest monthly rather than just keep the money in a savings account for one trade at the end of the year. I’d lose all the gains I make within the year. Transaction fees are the fees you pay for buying an investment product – these can be a fixed sum or a percentage. Some platforms will have one charge for buying and selling shares and another for funds. Vanguard depends on the product – 0.02% to close to 2% HL 0 for funds, £12/share falling to £6 a share for 20 trades + iWeb £5 Halifax £12.50/share or £2/month for scheduled investment Fidelity £10/share or £1.50/month for scheduled investment Because Fidelity’s platform fees are cheaper than HL, I am tempted to recommend them but I think you should make the decision. Why don’t you spend an hour a day on each of the following three site: HL, Fidelity and Halifax. Download their apps and see what you think of them. If by the end of that analysis you’re not sure then I will suggest you use HL as a beginner and as you figure out how things work move platforms, it’s very easy to do that. Also, it’s worth mentioning that I pulled a couple of funds that I invest in on Fidelity and you pay more for them via Fidelity because HL negotiates discounts with actively managed funds due to the volume of business they direct their way. NOW – I have spoken a lot about investing as I felt that that’s what you wanted me to focus on but I think this discussion would not be complete without me saying that, ultimately, if the stock market scares you, then you can go the property route. Property There are many strategies you can follow with property. You can rent to families, or students or even another subset of people. One of my friends specialises in letting property to truck drivers. Letting to students or a migrant group like truck drivers has high turnover which means you need a lot of time to manage the property. And if you went down the AirBnB route that’s like managing a hotel because you have to think about changing sheets and cleaning literally week-on-week – as involving as it sounds, I have a friend who has a full time job as a professor and has also grown a good property portfolio on the side with a mix of AirBnB and family lets. The key is to start with your first property. Have you heard of the 3 for 1 property strategy? With this strategy you set a goal of investing in 3 buy to let properties and you work to have all mortgages paid off by the time you retire. This would mean that you live in one fully paid off house and you would live off the rent of the three properties – this reduces the risk somewhat. For each buy-to-let property you would target a given amount of rental earnings that you can choose yourself . For example if each property earned £800 per month, then you would retire on £2,400 / month. This would be linked to inflation because as prices rise, rents also tend to rise and sometimes rental increases rise far faster [example]. If this feels safer for you and you have at least 20 years until retirement then think about either just going for the 3 for 1 property strategy with a good lump-sum saved in a savings account for emergencies might feel less risky OR follow a combination of investing small amount in the stock market with property as your security blanket. Massively enjoyed answering this question, Angela, especially from a fellow Malawian. It’s nice to know other people are investing and getting wealth focused. Let’s summarise what you need to do:

I hope this helps! Heather Have a money question for me?

If you have any personal finance questions send them to [ME] – I will answer whatever piques my fancy via a blog post.

What's the point of saving? What's the point of saving?

Hi Heather,

Based on the things you told us about investing, my husband and I started putting £125 per month each into our SIPP pension. I hope this isn’t a silly question but what are these savings for? When can we expect to start spending that money and should we try to spend it in specific ways or on specific things? Both my husband and I are 30, we don’t plan on having children and our jobs have fixed pension benefits. Thanks Flora Hey Flora, That’s a great question. While everyone has a different value system, there are two main reasons that I strongly recommend that people put money into a self-invested pension plan or SIPP a) flexibility and b) security including funds to help pay a mortgage off early. A SIPP can be better than a stocks and shares ISA, in some cases, because you effectively pay less tax and because you can’t use the money until you are about 58 so it forces you to save. Let’s talk about each reason in turn: The first reason: is flexibility over when to retire In the past, a lot of work-based pensions (aka defined benefit pension plans) used to allow early retirement from between the ages of 55 and 60, most of these type of scheme are being completely phased out and are instead being linked to the state retirement age which for you is currently expected to be 68. There is talk of moving this to age 70, so this is a future possibility. Whatever happens, the funds that you build up in your SIPP can be taken from 10 years before the state retirement age. This means if the state retirement age moves to 70 you will still be able to use money that’s sitting in your SIPP from the age of 60. If you and your husband are putting £125 each into a SIPP then when you are 55 years old, you and your husband’s combined pot of savings would be worth £135,000 if the pot of money only grows fast enough to keep up with inflation of about 3%; if you get growth equivalent to the average stock market return of 7% then you would have £250,000 at the age of 55 and if you get an average stock market return of 10% you would have £410,000 saved up. At age 60 the figures would be £180,000 @ 3%, £375,000 @ 7% and £700,000 @ 10%. These sort of returns aren’t cuckoo. According thebalance.com, “the S&P 500 Index, delivered its worst twenty-year return of 6.4% a year over the twenty years ending in May 1979. The best twenty-year return of 18% a year occurred over the twenty years ending in March 2000.” Various sources suggest the S&P 500 has returned 10% before inflation if you buy and hold the money you invest into it. But of course, it’s useful to remember that this past success doesn’t guarantee that future returns will be as good. Right now you would struggle to find a bank account that gives you an interest rate of 1.5%. Back to flexibility on when you retire, however, unless you believe the US has no room for growth, then this total of £250/month you are saving could amount to a lot of money over a 25 to 30 year period and this would allow you to retire with a decent income well before the state retirement age. If your mortgage is fully paid off by the time you retire then your cost of living could be low enough that even a modest growth in the SIPP would provide a comfortable income before your state pensions and work-place pensions kick in. The second reason: to save the money is the added security from having extra retirement income Having money in a SIPP means you can top up your retirement income. Having the SIPP would mean you have 5 sources of income: