|

Hey heather, thanks for your podcast, I find it incredibly useful because it's UK specific and everything else I find seems to be geared towards the US.

Anyhow, my name's Dee, I'm in my 50s and have been a military stay-at-home mum all my adult life although I went to university. Being a military wife has exposed me to so many countries and cultures which I love but you do sometimes encounter traumatic things so it's nice to settle in the UK. My family currently rents and all our adult children live at home including one that is dependent. We'd like to get on the property ladder but have been struggling with when and whether to do it. In the past I've left all the money stuff to my husband but now that the children are older I'd also like to start earning an income and I've been considering investment property. I want to gain some financial independence and I'd love to be able to help the children out financially. I am so ready to make up for the time I spent raising children. I don't know if it was stupid not to use my degree sooner but I guess better late than never. Keep helping with your posts! Thanks.

Hi D,

Thank you for this question that covers a very wide range of things. I am also very sorry that you have experienced something traumatic. Your life choices are not stupid, many women find themselves in circumstances that mean they have to stay at home with the kids for whatever reason so your question may well resonate with lots of other mums. Being in my mid to late 30s, you will forgive me for providing what might sound like a slightly optimistic review of your situation. Your question as it is framed requires me to speak to: 1.Providing for your children particularly the dependent child with medical needs; 2.Buying property as a home; 3.Buying property as an investment; 4.Earning an income for yourself; PROVIDING FOR YOUR CHILDREN By letting your adult children to stay at home rent free you are doing plenty. That alone should allow them to save for their own property deposits and is a financial boost many people including myself did not have. If I could have lived at home rent, free, that would have had me on the property ladder a lot sooner. The other thing you could do is direct them to read the type of personal finance books that will give them ideas for how they can be financially responsible so that you don’t need to worry about them. I recommend The Richest Man in Babylon and The Millionaire Next Door as good starting points. Does your child with medical needs financial support from you as well as general support for all their living? I won’t touch too much upon this except to say that make sure that you are accessing all the state benefits you can for the child’s support including the carer’s allowance if it is applicable. BUYING A HOME Firstly, as far as the UK is concerned I always advise that, if you get nothing else right, at least buy your own home. From your message, it’s not clear whether or not you and your husband discuss finances but I am guessing that this may not be the case. Firstly, I would try to get the two of you on the same page. Working as a team when it comes to building wealth can really supercharge your financial health. The UK property market is completely different to the US property market in so many ways so I’d be a little careful before taking advice on property from US authors and podcasters (lots of property advice on the internet tends to be US-focused that’s why I bring this up). To begin with the population density of the UK is 281 per Km2 (727 people per mi2); population density in the United States is 36 per Km2 (94 people per mi2). What does this mean? It means that UK property in many areas doesn’t see price crashes (too many people, too little land) and there is a propensity for house prices to be sticky upwards. In addition, because US mortgages are fixed for the full term of 25 years whereas UK fixed terms are only for 3, 5, 7 or 10 years, interest rates are much lower in the UK compared to the US (almost half). The result of this is that very often the interest you pay on your mortgage is much much lower than rent. As an example, I live on a street where the rents range from £1,200 to £1,500, however, the interest we pay on our mortgage is just £350 (it was a 25% deposit mortgage). The full monthly mortgage payment is almost £1,000 but everything above the interest of £350 is money that will come back to us if we sell our home. So, provided you can get a good deposit together, you will save a lot of money by buying a home rather than renting. In the long run owning where you live will give you a lot of security including the psychological comfort it provides. At 50-something, you are not too old to get a mortgage and may even be able to get a mortgage of 20+ years, however, if you owned property abroad and sold it when you left then it’s worth buying the home outright. State pension Another thing to consider with regard to your financial security is that even the full UK state pension only pays £175/week per person (about £759/month) this would be double for a couple. If you live in a home that’s been completely paid off, no mortgage, then you can survive on the state pension relatively comfortably. However, as you have lived abroad for many years you need to contact HMRC to see how many qualifying years you have. Your UK State Pension will be based on your UK National Insurance record. You need 10 years of UK National Insurance contributions to be eligible for any amount of the new State Pension and for people my age 35 years of credit are needed to get the full entitlement, you may be in the generation that only needs 30 years of credit. You may be able to use time spent abroad to make up the 10 qualifying years. This is most likely if you’ve lived or worked in:

I would contact HMRC as soon as possible (link above) and ask what you need to do or pay to increase your entitlement to the UK state pension. You may get National Insurance credits if you cannot work - for example because of illness or disability, or if you’re a carer or you’re unemployed. You might also be able to pay voluntary National Insurance contributions if you’re not in one of these groups but want to increase your State Pension amount. BUYING AN INVESTMENT PROPERTY I recently read David Tarn’s “The Complete No-Nonsense Guide to Becoming a UK Property Investor: The 1-2-3 on Property Investing” and found it useful on the topic. The author is based in the North of England where property is much cheaper. He is into buying property and letting out the whole house to a single group like a family – so, standard single let properties. In addition, I would recommend The Inside Property Investing podcast. There are over 300 episodes, if you binge listen to the episodes that appear interesting, you will move up the knowledge curve rapidly. The ‘Inside Property Investing’ podcasters are themselves heavily into High Multiple Occupancy properties (this is when you let a single property out to 3 or more unrelated people like students or professionals). However, the beauty of the podcast is that they regularly interview people on the show that follow a variety of different property investment strategies. Don’t pay for any overly expensive property course before you’ve gained all the knowledge that is available for free or almost free – a friend of mine recently paid £24,000 for a property course, she went 50-50 with her daughter and even had to put some of the cost on a credit card! You’ve been warned. For the basics on property investing I have a course up on Udemy for under £50. This will give you all the basic knowledge you need about the property buying process in the UK. EARNING There are many jobs out there. If you just want to boost your confidence and get some money rolling in there are plenty of jobs out there provided you are not too picky about the pay as long as you get your foot in the door. If you want to build a work life for yourself have a look on jobs boards at what’s going and start applying. If you want to build a career within a specific field related to your field of study consider taking a course to freshen up your skills. I have no idea what your salary expectations are but median UK income for 2020 is 30,800 according to the ONS. After tax that would bring home just over £2,000/month; if due to covid etc you secured a job with a salary of £24,000/year, that’s still £1,600/month which definitely isn’t shabby especially if your husband earns too. A GQ article gives an interesting breakdown on age, occupation and the covid-19 pandemic’s impact on earnings. I hope this helps. Far from thinking you are too old. I am feeling soooo excited for you. This is a fresh start and even over a 15 year period you can build an amazing life and financial cushion. Good luck.

0 Comments

Hi Heather,

I want to earn extra income, however I work as a nurse in the NHS which takes up my time, do you have any suggestions on any investment that can make money. I am also interested in the stock market but don’t know where to start. I am interested in both generating extra monthly cash flow now and increasing the amount of money I have in retirement. Denise. Hi Denise, Thanks for this question. I love it because I have two nurses in my immediate family, my mother-in-law was a nurse for a long time and my cousin is still one now. Boosting current income

The, “how can I make a little extra cash now” question is one I asked myself quite recently because I wanted to put extra cash into our household ISAs. There are a few things you can do to boost your cash now:

1. Working extra shifts / locum shifts My mother-in-law says this is not a great idea because being a nurse is hard enough work, as it is. I agree that it is very demanding work but one of the great features of working at the front line of medical services is that you can actually make more money by working more hours, even temporarily. Some jobs don’t offer opportunities to earn more by working more, you’re paid a fixed annual salary and that’s it - no overtime. Overtime either goes uncompensated or is compensated as time back in lieu. You can sign up to a locum agency and do the same type of work for higher pay on your free days. If you want to really juice up your income you can even look at things like working a 4-day week in your regular NHS job (your NHS pension would therefore be lower) and work for a locum agency on the 5th day. The advantage with this strategy is that you will boost your income without working more hours because the hourly rate is higher as a locum nurse. If the extra income is invested wisely it could more than make up for the lower NHS pension. Also, keep your eyes open for higher paying promotions. 2. Do some extra work in another field. If you have another skill that you can monetise you can look into doing extra work in that field. So ask yourself, "what other skills do I have?" I'll give you an example from my own life: In my early 20s when I worked in banking the bonuses were not good one year and to make some extra money I slipped flyers into doors offering massages (for women only) at my house for £25/half-hour. I had someone sign up that very day. I had done a course in therapeutic massage at London College of Massage for fun and when I needed it, that skill helped me boost my income. I didn’t do it for long but it showed me that if I wanted to earn more money I could monetise other skills in my free time. There are some things you can do that don’t even need a new skill such as babysitting. You could sign up at childcare.co.uk or sitters.co.uk and your credentials as a nurse would be very attractive to people that needed a babysitter for nights out or weekends. You haven’t said whether or not you have childcare responsibilities of your own so I don’t know if this is possible for you. If you have skills that you can monetise online then list yourself on freelance websites like upwork or fiverr. There is a wide range of professions people hire for on these sites. I have used these sites myself to buy all manner of things including artwork, copy, copy editing and even voiceovers! Imagine that, all you’d need as a voice over artist is a microphone that records your voice clearly. Some people make serious money side-gigging on these sites. These first two options are not completely aligned with your question as you asked for “investments that you can make” but I decided to add them to give a fuller answer. 3. Invest in or produce products that make cash. Investing in something necessarily involves parting with money in the hope that you’ll earn even more money. You haven’t said how much money you have to invest so here are a few options. Can you make something that people would be interested in buying that you can sell on etsy, eBay, amazon or Facebook marketplace? Make a few samples of what you want to sell and list them on all these sites. I ran a product business myself for almost 6 years mostly using Amazon so I would recommend that you:

I would never discourage anyone from starting a business but having experienced it, I would tell you that it is very hard work. It involves a lot of long hours and is nothing like as glamorous as our culture makes being an “entrepreneur” sound. A business could consume absolutely every free moment you have – evenings and weekends. And all that time might not even produce a profit. Investing in a business comes with a lot of risk – stats vary depending on source, however, 80% to 90% of businesses fail in under 3 years. 4. Teach Could you make money teaching something online? You could create a course and list it on Udemy, Teachable or another similar site. This would take some time to produce well, in the first instance, then you would need to spend some money on marketing your course but you could keep the costs very low. Alternatively if you want to teach a GCSE or A-Level subject (High school level) or even a university course level, you can sign up to places like tutorful (previously, tutora). 5. Invest in property. If you have enough for at least a 25% deposit then it may be worth looking into property investment. Because interest costs on buy-to-let property are no longer fully tax deductible, (that means, you can’t subtract the interest payment from the rent you receive before calculating your tax bill), property is not as attractive an investment as it used to be. That said, if you can buy a place with cash, or if the property produces a high enough profit to clear the mortgage within a reasonable amount of time (I personally target 10 to 15 years) then it could be worth doing. Overall, the option you go for will depend on your risk tolerance and the amount of cash you have to invest. If you are relatively risk averse and don’t have cash to invest then working more to earn more will be more attractive. If you can tolerate some risk and do have some spare cash saved up, then investing in property will provide you with medium risk while investing in a business will be the higher risk option. Boosting retirement/future income

If you’re looking to boost future income then you have two main options:

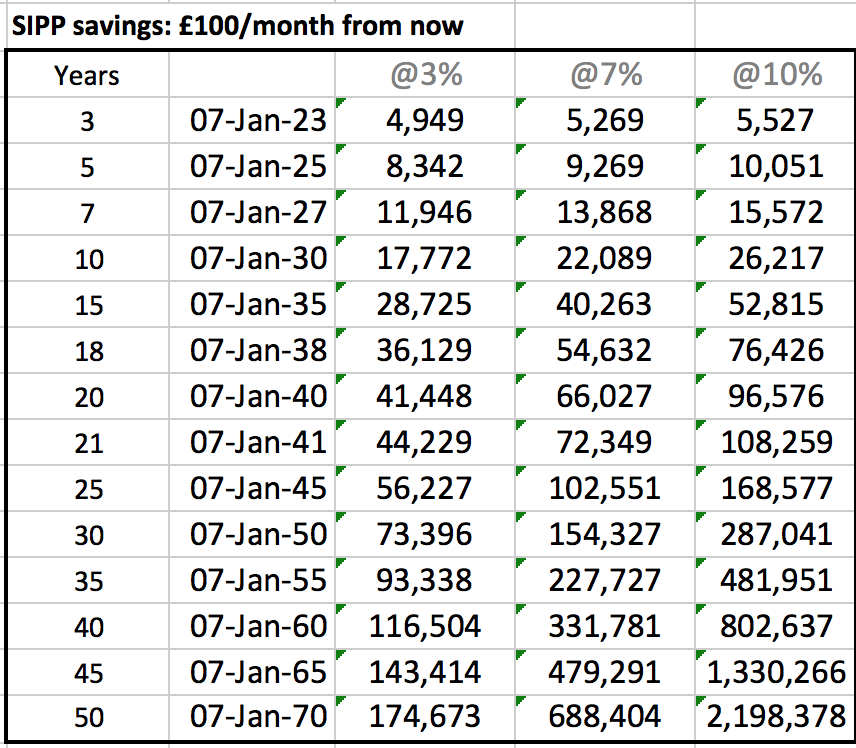

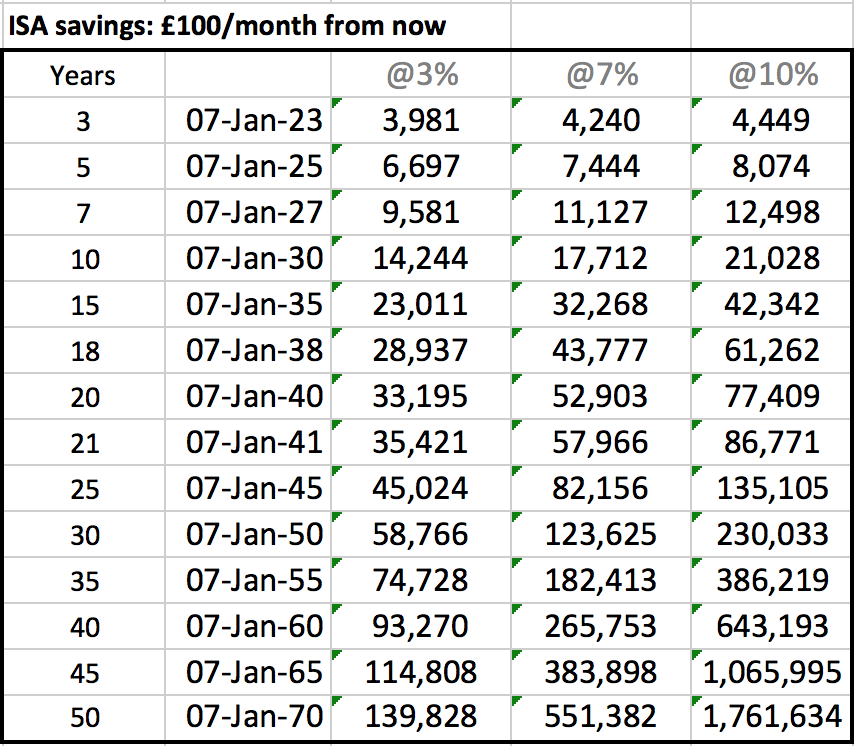

Property investing we've already talked about. The stock market provides a good return over long periods of time; most investment advisors would suggest an investment horizon of 5 years or more. Putting money into the stock market in the hopes of a good return in a year or less is gambling rather than investing, that's why I didn't offer it as an option when we were thinking through how to "boost income now". The most tax efficient options for investing the stock market are investing via an ISA or a SIPP. ISA are individual savings accounts and SIPPs are self-invest pension plans, they are a type of personal pension. If you invest the money via a SIPP then you won’t have access to that money until you are between 55 and 58 years old. The exact age will depend on your age and has been set at the state retirement age minus 10 years. The SIPP is a good option because for every £100 you put in, HMRC pay back £25 of tax and this saving is automatic. It is claimed by the SIPP provider and is shown on your investment account. The maximum you can put into a pension a year is £40,000 or your salary whichever is lower. So, if you earn £30,000/year you can put up to £30,000 into your pension without getting a tax charge. If you earn more than £40,000/year and haven’t reached the lifetime allowance of £1.055m, you can put up to £40,000 into your pension without getting a tax charge/penalty.

I will be writing several blogs on investing over the next few months that should hopefully build your confidence to make the move. In the meanwhile, you might find this useful: What platform should you use for investing and what should you invest in.

I hope this is helpful. Have a question? If you have any personal finance questions send them to [ME] – I will answer whatever piques my fancy via a blog post.

When people can't get a job they blame it on all manner of things: they're racist, they're fattist, it's because of my hair or my hijab or because immigrants are taking up all the jobs - I've never heard this one though and it's more likely now than ever before that your own crazy opinions are keeping you from the job you want. I love social networking as much as the next person, however, I am all too aware that what you write can make or break your chances of getting jobs. Nowadays your résumé/CV is not your potential employer's only source of information about you; they tend to google you as well. Would you be happy for your employer to see everything that comes up about you? Using social networks consciously and responsibly has never been more important. What you write, share and 'like' matters; it gives insight to your personality and temperament; it could be standing between you and that highflying job. Here are my tips: THE HEADLINE TEST Before you post anything think: “Would I be proud to see this shared on the front cover of The Wall Street Journal or The Financial Times?” I learnt this tip on my first job at Goldman Sachs. ANGER BACKTRACK If you’re angry, annoyed or irritated do not tweet, blog or post anything. Feel free to rant and rave about it in your personal word processor but leave it be until you are not angry or at least less angry and you’ll find that it was going to be one of those posts you later regretted. DE-CONNECT If you tweet a lot of random stuff, don't connect your twitter to your LinkedIn. You know employers and headhunters officially trawl LinkedIn profiles to find out stuff, right? CLOSE UP So you’re mr or ms popular: you’re the entertainment organiser at your school or university. Good for you, but that doesn’t mean you need to have a completely open Facebook profile. If people are interested in what you have to say they can follow you on Facebook in which case they only see your “public” posts not those to “friends” only. Go through your personal info and carefully select what is viewable by the public and what is not. It should only be stuff that adds positive value to your employability. CHOOSE YOUR FRIENDS CAREFULLY Facebook didn’t always have the subscription/follow button so people used to accept friends willy nilly. Personally, I don’t friend anyone that I don’t actually know. Decide what criteria people need to satisfy to be your “friend” on Facebook and only friend those. Everyone else can subscribe to your public posts. THE FUNNY TEST Funny or hateful? The biggest temptation is to share stuff that makes us laugh. Once you’ve had a good laugh you always want to share. Making people laugh makes them like us and everyone loves to be liked. Unfortunately, a lot of funny stuff is funny because it’s taking a stab at a certain segment of society. Before you share funny stuff, think about whether it makes you look like a misogynist, a racist, a homophobe, a pervert or whether it is persecuting a given religious group. I know a guy who had a nice job that he could have stayed in for years but ended up having to resign because he was sharing inappropriate material on an internal group chat. PSEUDONYM You don’t have to use your real name. Even if you use a real photo of yourself if you create a pseudonym you’re going to be hard to find with google searches. If you’re working under an alias you have a lot more leeway in terms of what you tweet and share, however, keep in mind that someone in the ‘inner circle’ could betray your confidence. Have a business or life question you want me to answer? Please email it to me with the subject “Question”. Note that all such questions will be answered as a blog post and will be sent to my full email list.

Want to start a business? Check out The Money Spot Program. Hi Heather, This is a simple question, how do you make money when you have no money? Belinda Jo W. I LOVE this question Belinda. It’s an awesome question because so many people are probably wondering the same darn thing. Okay, your question isn’t specifically asking about starting a business so I’ll tackle it from both a business and a career perspective too. I’ll be as broad as possible. BUSINESS  The Bank A lot of people need money to start a business or some other passion project. Back in the 80s my dad had very little cash, basically all he had was a credible enough business plan to make an appointment with a bank manager. The main basis for which he got that loan was the bank manager saying, “I can see a future in your eyes so I’ll approve this loan”. Sh!t like that doesn’t happen today. Banks can’t lend on the basis of just believing you have great potential so they don’t lend to start-ups. Typically, they’ll only lend to a business that has three years of trading history and appears to have a reasonably stable income. The Manufacturer Have you heard of Sara Blakely? If not, then you’ll definitely have heard of the brand Spanx. She started that brand with $1,000 which for all intents and purposes is almost nothing. She used that money to get a prototype made by a local US manufacturer. She then wanted a manufacturer to partner with her: she wanted them to produce her product in the hopes of sharing in the profits. Obviously, most suppliers gave her an outright no. Manufacturers don’t like taking entrepreneurial risks of that nature. Their business is just making stuff and they get paid upfront or based on a 30-day line of credit. The manufacturer that ultimately said yes had a daughter that convinced him it would work. That is still possible today especially if the product to be made seems quite innovative and if a small sample run can be made without a huge financial outlay. Her next problem was finding a big buyer. She trawled from supermarket to supermarket trying to get someone to see her. In the end, she got her first yes by asking the buyer to come to the bathroom with her to see how Spanx worked. She put them on and the buyer was like, “I get it”. The rest as they say is history, she now stands as one of very few self-made female BILLIONAIRES. Her story has so many elements that just seem “lucky”, for instance, if the buyer had been male she couldn’t have just been like, “Come to the bathroom with me and I’ll show you” – can you imagine what he’d be thinking? Lol That said, you only get lucky when you put yourself out there. Most people just let their ideas die in their head so they don’t get lucky. Luck comes from repeated effort. MAKING MONEY IN A JOB  Now, if you just want some money and have none, there are some key avenues you can take. EARN MORE – GET A GOOD JOB

EARN MORE – SELF IMPROVEMENT Here are a few ways you can improve your prospects. Education The better educated you are, the more money you tend to make. Even in poorly paid jobs you can navigate yourself into higher paid posts like a management position, over time. Every industry will have positions that make bank and roles that keep your bank account overdrawn. If you get educated, you’ll be able to take advantage to move up. In my case I have a BA in Economics from the University of Cambridge. I could have stopped there – most do, but I decided to become a Chartered Financial Analyst, CFA. I’m currently self-employed but, for no particular reason, I’m doing the Certificate in Mortgage Advice & Practice (CeMAP) AND I’ve signed up for ACCA exams…what can I say, I like writing exams. Like I said, I don’t have any specific plans for these qualifications, you could say I like collecting qualifications in the same way people like collecting, say stamps, but with all this on my CV it means I can pounce on opportunities faster than a cheetah in the Serengeti pounces on an unsuspecting wildebeest. Accents Don’t ask me why I think of this today; perhaps because the topic cropped up over the last few days. Some people associate certain accents with being dumb and having such an accent can therefore reduce one’s employability. Here in the UK, the Birmingham or Brummie accent is seen as dumb – I personally love it (see references below). In the US the Southern Accent is seen by some as dumb too and indeed some people find certain African accents dumb – sigh. I personally like lots of accents that people hate but I’m not trying to employ you. My personal pet peeve is poor grammar. Mix poor grammar with an accent that employers tend to be biased against and forget passing interview round one! I have a Chinese friend who went to the extent of getting elocution lessons to neutralize her accent. I haven’t seen her in a long while so I can’t tell you if it worked. Overall, if you think your accent could possibly be holding you back you should work on it. This could be as simple as polishing up your grammar and pronouncing words more clearly, you don’t necessarily need expensive elocution lessons. I won’t lie to you though, I’ve considered elocution lessons myself in the past. If we look at the c-suite of any firm we’d probably all be surprised who’s had some voice/accent coaching. Some people just want to change their tone to sound more authoritative others want to wipe out a whole accent. Your Overall Look Honey, I so wish it weren’t true but people do judge a book by its cover. Having polycystic ovarian syndrome (PCOS) means I gain weight if I so much as look at cake the wrong way and it is incredibly hard to shake off. I am not hugely overweight at all but people have no idea how hard it is for me to just stay this slightly overweight size even when my calorie intake is quite low. This is why I wish fattism did not exist, but it does. Employers have been empirically shown to discriminate against overweight people because they view them as lazy! Reference below. If you feel your weight could be holding you back, get your jog on. I’ve been jogging almost daily for three months right now and I haven’t lost ANY weight. However, I feel excellent and I’m buzzing with energy. If you, like me, struggle with weight focus on just doing regular exercise. It will make you feel more confident about your body and that confidence will shine through to other people. Coach or Mentor Ultimately, this is what I did to get my first well-paid job at Goldman Sachs. I was coached. My CV was reviewed, I had practice interviews, I got feedback on what I planned to wear to my interviews and I got the job. That job allowed me to save more and ultimately go on to buy my first property. SAVE MORE This is one thing people simply fail to do. I’ve coached people who think they couldn’t possibly save anything and when I delve into their finances there are literally savings that can be made everywhere. I have so many tips on saving that I wrote a book about it a few years ago, Build Super Savings. If you get the PDF book, I suggest you print it off and work through it diligently, from start to finish. Promise? INVEST IN PROPERTY (aka REAL ESTATE) FIRST I see property as a safe bet. If you buy a property you can afford the worst case scenario is that you’ll end up with negative equity for a while; however, provided you keep up with payments you will eventually own the home outright and always have somewhere to live. After you have one property why not get more properties to fund your retirement? Rent from tenants pays the mortgage off for you. If you buy in a good area you will at a minimum store the value of your home because over long periods of time property keeps up with inflation. In the best case scenario you’ll see you property price rise faster than inflation. Your equity capital will grow. I am a huge fan of property. It’s not a get rich quick strategy. You’ll only enjoy the maximum benefits of it in 20 to 30 years time when your mortgages are fully paid off but even before that property can bring in some extra spending cash. If property prices rise fast you can enjoy incredible benefits much sooner but I’d invest based on at least a 10-year plan. I started my working life off with no money. I saved enough to invest in one property and it is that property that I bought almost 10 years ago that I re-mortgaged to fund my Queen of Kinks product line. I can talk for days when it comes to property so I created an information-packed course on how to build a property portfolio from scratch. Anyhow... Can you think of other ways to make money? Make a comment below. Have a business or life question you want me to answer? Please email it to me with the subject “Question”. Note that all such questions will be answered as a blog post and will be sent to my full email list.

Want to start a business? Check out The Money Spot Program. References |

Heather on WealthI enjoy helping people think through their personal finances and blog about that here. Join my personal finance community at The Money Spot™. Categories

All

Archives

September 2023

|

Heather Katsonga-Woodward, a massive personal finance fanatic.

** All views expressed are my own and not those of any employer, past or present. ** Please get professional advice before re-arranging your personal finances.

RSS Feed

RSS Feed