A month after two hours of free coaching from me a client messaged me to say she’d saved MWK200,000 (£200/$260) - having previously struggled to reach the end of the month cash positive - and she’d completed a long list of things I'd suggested she do to push her business forward; fabulous news given only a month had passed since we sat down. This is what happened: On 24 July 2016 I was invited to speak at Blantyre’s Pitch Night in Malawi. It was a fun filled event. There were three speakers including my sister, Yolanda who pitched her Montessori nursery. I pitched wealth building using 10 principles we should all ideally follow to ultimately enable retirement – a much more pertinent issue in Malawi where there are no state pension plans. At the end of my talk I offered a maximum of three people two hours of one-on-one coaching with me for MWK250,000 (£250/$350) and being the charitable person I am, I offered the same session for free to one lucky winner. To win all you had to do is email me 250 words explaining why you deserved a free session. After that talk I was engulfed by people asking questions; I had one university kid practically attached to my butt for 10 minutes asking me tonnes of questions regarding what he needed to write to get the free session. He said he’d be sure to get his piece in as soon as possible. No one took up my paid offer although one lady intimated she might. I wasn’t in the least bit surprised – self-development is not a huge thing in Malawi - If you don’t get a degree or a certificate at the end of it, most people tend not to be interested. Two days later, I checked my email and only two pitches for a free session had arrived – nothing from the enthusiastic university kid, go figure. Both were good but one was definitely better. I didn’t know much about the person I chose but I had a good feeling – okay, I’ll admit…I’d slapped her ass at pitch night thinking she was one of my friends from high school only to find she wasn’t. That incident, in the end, worked to her advantage because I felt a little bit guilty. Anyway, long story short: I went through her personal and financial life. Two hours together passed in a flash. I discovered she was naturally very ambitious and motivated, in fact, her parents were well-to-do but she was keen to make her own mark on the world. She was open and receptive to the things I shared. She was humble and extremely likeable; we got on well, I was super impressed with the things she was already achieving in her life at such a young age. She took my free advice and ran with it leading to the above results. Now, this is a simple example, I have a more extreme one: In 2011/12 one of my friends paid £10,000 ($16,000 at the time) for a property investment course. In the 3 years after that he accumulated £3million in property including a portfolio of 10 houses in multiple occupation (HMOs) and four buy-to-lets. Interestingly he spent most of his savings to do the course but he was convinced he’d get the money back. He went to one of those 2-day marketing events where they share just enough knowledge to make you want to do the full course. To grow his portfolio he used other people’s money: He’d team up with someone that had lots of money but very little time, do all the work and they’d share 50-50 in the equity. Now, I’m not saying go out and spend £10,000 on a property course. In fact, I am personally not interested in HMO investing but I love the way this guy looked at the cost as an investment and focused on the return. Not all expenditure is an investment. Thoroughly research your idea before spending that kind of money – if there is a money back guarantee take note of when it expires and how it works. If opportunities to invest in something come your way, don’t just buy the product then forget about it, so many people do this. You need to take action. The key is to give the investment 100% - learn everything you can, take the suggested action and you’ll should hopefully get your investment back. Unfortunately, the exact people who need this advice are precisely the ones that don’t use it. Those already on a positive trajectory are the ones following this advice. If you've had a horrible or a fantastic investment experience, please share it with a comment. Have a business or life question you want me to answer? Please email it to me with the subject “Question”. Note that all such questions will be answered as a blog post and will be sent to my full email list.

Want to start a business? Check out The Money Spot Program.

0 Comments

When people can't get a job they blame it on all manner of things: they're racist, they're fattist, it's because of my hair or my hijab or because immigrants are taking up all the jobs - I've never heard this one though and it's more likely now than ever before that your own crazy opinions are keeping you from the job you want. I love social networking as much as the next person, however, I am all too aware that what you write can make or break your chances of getting jobs. Nowadays your résumé/CV is not your potential employer's only source of information about you; they tend to google you as well. Would you be happy for your employer to see everything that comes up about you? Using social networks consciously and responsibly has never been more important. What you write, share and 'like' matters; it gives insight to your personality and temperament; it could be standing between you and that highflying job. Here are my tips: THE HEADLINE TEST Before you post anything think: “Would I be proud to see this shared on the front cover of The Wall Street Journal or The Financial Times?” I learnt this tip on my first job at Goldman Sachs. ANGER BACKTRACK If you’re angry, annoyed or irritated do not tweet, blog or post anything. Feel free to rant and rave about it in your personal word processor but leave it be until you are not angry or at least less angry and you’ll find that it was going to be one of those posts you later regretted. DE-CONNECT If you tweet a lot of random stuff, don't connect your twitter to your LinkedIn. You know employers and headhunters officially trawl LinkedIn profiles to find out stuff, right? CLOSE UP So you’re mr or ms popular: you’re the entertainment organiser at your school or university. Good for you, but that doesn’t mean you need to have a completely open Facebook profile. If people are interested in what you have to say they can follow you on Facebook in which case they only see your “public” posts not those to “friends” only. Go through your personal info and carefully select what is viewable by the public and what is not. It should only be stuff that adds positive value to your employability. CHOOSE YOUR FRIENDS CAREFULLY Facebook didn’t always have the subscription/follow button so people used to accept friends willy nilly. Personally, I don’t friend anyone that I don’t actually know. Decide what criteria people need to satisfy to be your “friend” on Facebook and only friend those. Everyone else can subscribe to your public posts. THE FUNNY TEST Funny or hateful? The biggest temptation is to share stuff that makes us laugh. Once you’ve had a good laugh you always want to share. Making people laugh makes them like us and everyone loves to be liked. Unfortunately, a lot of funny stuff is funny because it’s taking a stab at a certain segment of society. Before you share funny stuff, think about whether it makes you look like a misogynist, a racist, a homophobe, a pervert or whether it is persecuting a given religious group. I know a guy who had a nice job that he could have stayed in for years but ended up having to resign because he was sharing inappropriate material on an internal group chat. PSEUDONYM You don’t have to use your real name. Even if you use a real photo of yourself if you create a pseudonym you’re going to be hard to find with google searches. If you’re working under an alias you have a lot more leeway in terms of what you tweet and share, however, keep in mind that someone in the ‘inner circle’ could betray your confidence. Have a business or life question you want me to answer? Please email it to me with the subject “Question”. Note that all such questions will be answered as a blog post and will be sent to my full email list.

Want to start a business? Check out The Money Spot Program. The Top Investment You Need To Make If You Have Kids – Life Insurance and Mortgage Insurance24/8/2016  If your partner died today would you struggle financially? Would you be able to make mortgage payments, pay the bills and school fees easily? I would and it’s not because I’ve got a huge stash of cash in the bank. If you are a parent and you haven’t done this, I suggest you stop doing whatever you’re doing right now and sort it out! I come from a country where most people don’t plan for their death at all. When a Malawian dies their family often expects everyone to pitch in for the funeral. There is often no financial plan for the children left behind and some well-wishing relative will normally take the children in. The death rate of young, working people in Malawi is high so this is a frequent occurrence. Now, because the cost of insurance is high and unaffordable for most, this is acceptable. I love coming from a society that supports its own. If you live in a developed country, however, I think it’s completely unacceptable. Whether you own something or nothing, are an immigrant or a native you should get life insurance especially if you have kids. WHAT IS LIFE INSURANCE? In exchange for monthly payments called insurance premiums a life insurance contract pays out a lump sum if the holder of the insurance dies. This is called pure life insurance. If you want to be covered if you get critically ill as well, you can get life insurance with critical illness cover. The specific illnesses that are covered are listed in the insurance contract. Paying premiums can feel like a waste of money but if you think about it as a payment for peace of mind, it makes paying feel like less of a burden. The insurance can be under a single name or joint names. If it is in joint names the cover pays out when either one of the named parties dies or falls critically ill (if critical illness is included). WHAT IS MORTGAGE INSURANCE? In exchange for monthly payments (mortgage insurance premiums) a mortgage insurance contract pays out a lump sum if the holder of the insurance dies. The sum paid out is designed to track the amount outstanding on your mortgage. This means the amount you would get on a payout falls from month to month as the mortgage outstanding falls. You can also add critical illness cover to a mortgage insurance contract. WHY WOULD YOU GET INSURANCE? WHY DOES IT MATTER? You buy insurance to make sure your loved ones don’t struggle financially if the worst should happen – that is, if you died. It’s a back up plan. Plan B. So, if for example your partner dies, you would contact the insurance company, present the death certificate and they would pay you whatever the insurance contracts states they should pay. Although a mortgage insurance contract is designed to track your mortgage, when the money is paid out you are free to use it for whatever you want. You don’t have to pay off the mortgage. If you made overpayments on your mortgage or if the interest rate on the mortgage insurance contract is higher than the interest rate you were actually paying (this is usually the case) you will have some money left over after paying off the mortgage. Claiming for a death can be easier than claiming for an illness because it’s simpler to prove. Sometimes when a claim is put in for a critical illness insurance companies go all out trying to prove you hid something when you signed the contract. The good news is that it’s a lot harder for companies in Europe to do that nowadays. The courts look more favourably upon the contract holder especially if any omission the insurance company claims was made is completely unrelated to the illness at hand. WHAT IF YOU DON’T OWN PROPERTY OR ANYTHING ELSE? Get life insurance anyway to cover funeral expenses and to give the surviving partner time to grieve without worrying about money. MY LOVER IS GOING TO KILL ME TO GET THE INSURANCE PAYOUT! I’ve heard some people argue that getting life insurance isn’t a good decision because it would incentivise their partner to kill them. Firstly, if you think this, get a new partner. That said, to avoid any sort of incentive get a level of cover that’s worth less than your partner’s lifetime earnings. If your partner’s earnings over the life you’ll have together will exceed the insurance contract’s payout then this won’t be a risk. Don’t forget that there’s a financial burden when a death occurs even if the partner that dies wasn’t earning money but worked in the home. In the case where the homemaker dies the earner has to now invest in costly childcare and home cleaning services. WHAT DOES INSURANCE COST AND WHERE CAN YOU GET IT? I don’t recommend getting life insurance through price comparison websites. Ideally, get the advice of an independent financial adviser so that they can guide you towards a provider that will suit your needs best. Try to get life insurance from a well-known company or bank. If you have never heard of the company check that they are regulated by the Financial Conduct Authority in the UK or whoever your local regulator is you are else where. If you’re 20 years old, £200,000 of pure life cover for 25 years costs as little as £8/month. This increases to about £10 per month if you’re 30. Our key interest was covering our children’s private education. The expected cost is £24,000 a year and we estimated to have such costs for the next 21 years so we got a level £504,000 of insurance cover for 21 years with critical illness included for about £87.10/month. This sounds like a lot but without the critical illness cover it was under £40/month. Mortgage insurance cover costs us £37.10/month. It doesn’t include critical illness. Oh, yeah, and while you’re at it please get a will in place too. What are your thoughts on life insurance? A great way to get peace of mind or a waste of good earned cash? Have a business or life question you want me to answer? Please email it to me with the subject “Question”. Note that all such questions will be answered as a blog post and will be sent to my full email list.

Want to start a business? Check out The Money Spot Program. Q&A: If You Want To Diversify From Real Estate, Property & Land, What Should You Invest In?17/8/2016

Dear Heather,

Greetings from Chengdu, China; I love your vlogs and I enjoyed watching your birthing story and recent vlog on how to make money. You are so inspiring and motivating. You inspire me. On the recent vlog you discouraged investing on the stock market. Why was that? My husband and I have invested in properties in America and are looking at buying one in China since we will be here for the next four years. We have also been eyeing property in England. My question for you is since we want to diversify our portfolio from real estate and land what do you recommend? You have the cutest family and gorgeous son. My son is [] months and has been keeping me very busy. Looking forward to hearing from you when you have some free time. Best Regards, Faith

Dearest Faith

Thank you so much for your lovely email. I really appreciate everything you say, it keeps me motivated and keeps me wanting to work. Children do keep you busy but they're so enriching :). The first thing I thought when I received your email last week was, what on earth are you doing in Chengdu, China? (email me for privacy) I am always super intrigued re. what black people do when they’re in Asia but not studying…I’d love to learn more about that. Anyhow, back to property. Firstly, I hope you have made the very low investment in my property course, the price will go up soon so get in while it’s cheap! This is how I think about investing in general. Firstly, I am working towards a given gross rental income per month of £10,000 from a UK/Europe and US portfolio. We don’t currently have anything in Europe or the US but I’m eyeing both up. After mortgages are paid off 90-95% of this will be pure profit. I could easily reach this in the next three years if I include income from rents in Malawi but I discount that income because the country has a lot of political and economic instability and it’s possible that something could happen that completely erodes the rental income. Based on this methodology, we’re roughly half way. If you invest in China you might want to apply a discount too given they’re legal framework may not be as solid as that in the US or UK. That said, they are definitely much more stable than Malawi so invest away. Keep in mind that investing in real estate in different areas and countries is also diversification. There are four main reasons I find property so attractive:

1. Leverage magnifies returns

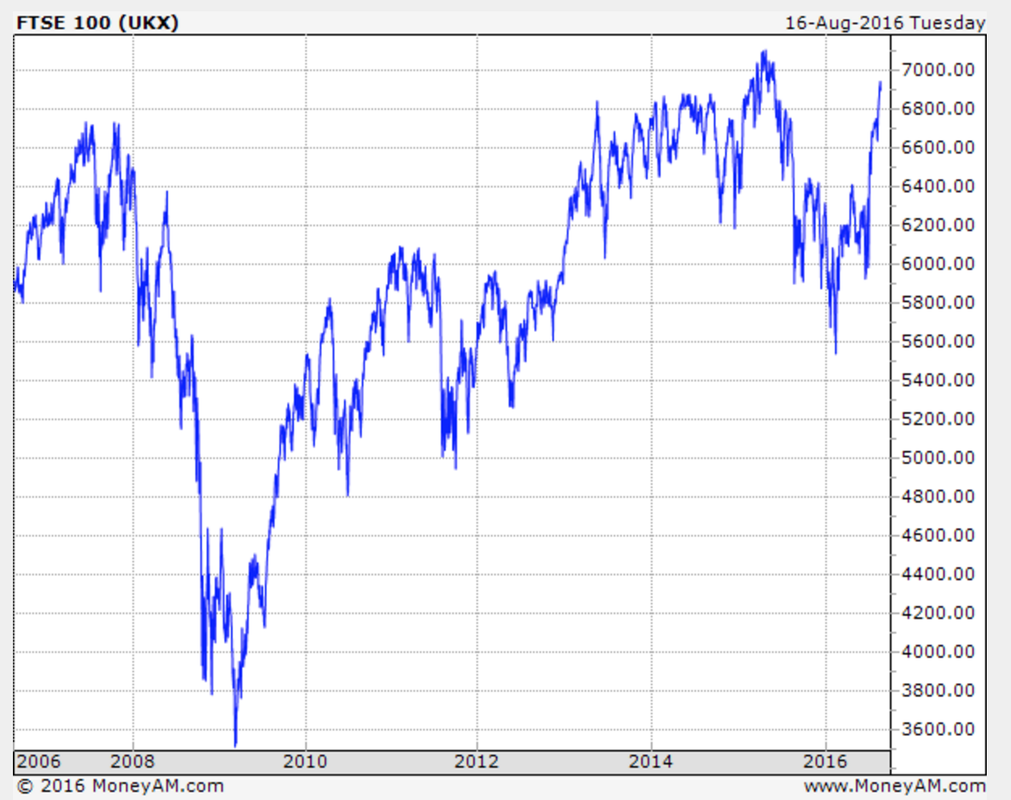

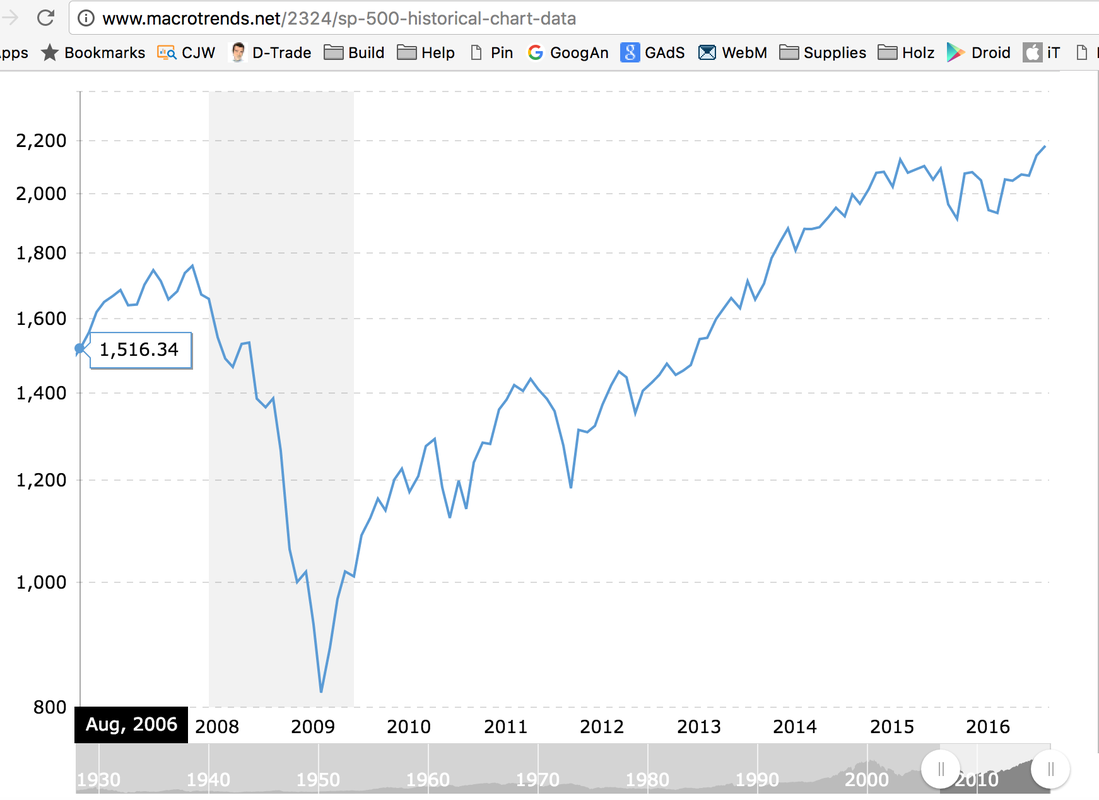

Just to give you an idea of what I mean. The first property I bought cost me £16,500 including a 5% deposit of £12,500. Stamp duty of £2,500 (this is a UK property purchase tax) and about £1,500 in other costs. That was 2006. Fast forward 10 years and the current value of £550,000 meaning a £300,000 capital gain and a gross equity value of £400,000 including what’s been chipped off the mortgage. No other £16,500 investment could have produced that kind of return for me. Firstly, no one would have given me cheap leverage to invest in the stock market and secondly, the returns would have been rubbish – to use a technical term. An investment tracking the FTSE100 would have me worse off; I’d have roughly the same £16,500 today eroded by 10 years of inflation. An investment tracking the S&P500 would have given me £23,700 today, 16,500 x (2178/1516), this is good but certainly far from £400,000. FTSE 100 from 2006 to 2016S&P 500 from 2006 to 2016

2. Reduced saving burden

We don’t spend rental income. This means after interest has been paid off, every month, my tenants are effectively saving for my retirement on my behalf. Currently, that’s about £2,000 worth of savings before tax. Very few investments can do that for you. 3. Easy release of value without impacting the investment I remortgaged this property and took out £80,000 to invest in a business. This doesn’t affect the property’s value in any way and isn’t taxable because it’s a loan not a sale of equity. If you sold some stock to get some money for another investment, firstly, you would have fewer shares so the overall value remaining would be lower and whatever you sold would potentially be subject to capital gains tax. 4. Stability Even accounting for short-term falls in value, property is very stable. Even if you don’t see an increase the value of your real estate investment you would still have the rental incomes. Provided you invest were there is demand for rental properties by tourists, students or families, you have secured an income for yourself in 25-years’ time if not immediately. Now, once I reach my target rental income of £10,000 what will I invest in? STOCK MARKET & ANGEL INVESTING

While I used to invest in single stocks in the past, I no longer do so as I think that long-term investing into diversified index funds is much, much wiser and definitely safer. This view has been informed by tonnes of reading and more experience in investing.

The next few paragraphs written in 2016 illustrate how I used to invest in 2006/7 when I was a newbie with zero experience - I no longer invest in this way but I share this anyway: When I used to invest in the stock market at the beginning of my working like (2005 to 2010), I had no education in investing and my methods were quite time consuming but the time spent made it feel less like gambling and more like investing: I’d download data on the main stock indices from Bloomberg (FTSE, S&P, Hang Seng, etc.) For each share I'd have the following data: 52-week high, 52-week low, P/E ratio, current price and other vital stats to try and identify a company that was undervalued. I’d also think of industries that I thought were growth industries and look at new companies in the sector. For instance, I once invested in a solar company and an Asian company because Asia and renewable energy were/are both growth areas. I sold my investment in the solar company (a German company called Phoenix Solar) when I tripled my money to £3,000. If I still had those shares they would be worth like £300 – the company is down badly. I sold my shares in Citic Pacific (the Asian company) in 2011 just about recovering my money and if I’d held on for 10 years, my £1,000 investment would be worth £750 – 25% down. Single stock investing is very risky especially if investing is not your full time job so you don't have time to go into great deal - reading annual reports and other regulatory filings. Citic Pacific from 2000 to 2016

I made a great investment in Apple in 2006. I sold when I had tripled my money. If I’d held on to my Apple shares until it hit its peak my £1,000 would have reached a £15,000 in value – kaching! That said, if I still had the shares they would be worth about £10,000 today because Apple is down from its peak.

I actually didn’t lose much money investing in the stock market. Citic Pacific and Yahoo were sold roughly were I bought them and Phoenix Solar and Apple were sold after tripling my money. The only complete loss was a bank called Northern Rock. I bought £1,000 when the share price was crashing in the belief that the UK Government wouldn’t let it fail. I was right, the UK Government didn’t let them fail but all shareholders lost all their money. Stock markets go up and down in an unpredictable fashion. This is why I prefer to have a base of rental income from property before dabbling in the stock market. However, if you are investing in the stock market for the very long term 10+ years, and also in well-diversified funds, I think it is a sensible place to keep money safe and earn a decent above-inflation return. BUSINESS

Finally, I invest time and money in creating businesses. Whilst business is also speculative there are many low risk businesses that can bring a stable income.

For example, creating courses online doesn’t cost too much money and once you recover the investment it’s fairly easy to maintain a steady income from the investment. With physical products you might invest more but if the investment fails you normally gain knowledge that will help a future business grow. Business is by nature speculative but the upside is fairly unlimited and you have more control over that upside than you would with an investment in shares. CONCLUSION

My personal strategy is to have enough retirement income coming from property to cover all my needs and some of my luxuries and the rest coming from my stock portfolio. So I focused my early investing on property and started diverting more savings into stock market indices when I was comfortable with the rental income we were generating.

In addition, I love writing, sharing knowledge and business in general so I pump lots of energy into these activities because I believe they produce a good return in the long run and even if they don’t, I thoroughly enjoy engaging in these activities.

Have a business or life question you want me to answer? send me a message.

SoundCloud Is The Best Place To Upload Your Podcasts On The Internet. Why I Left AudioAcrobat.9/8/2016 I’ve been uploading podcasts online via AudioAcrobat since 2012 – that is a very, very, long time. I started using the site because an internet marketer I followed at the time recommended it and because I couldn’t find another more suitable platform, I went for it. I didn’t like AudioAcrobat from the start, if I’m honest; the site is slow and not user friendly. Audio Acrobat is also quite pricey. Their plans are:

I chose the Basic Plan, so, considering I joined in about June 2012 I’ve paid $1,050 (that’s £700-750) over those 4 years. One-freaking-thousand dollars. That is messed up, man. Anyhow, by comparison SoundCloud are charging me £75 a year paid upfront. I will have to be on SoundCloud for almost 10 years to pay them the same amount as I did to AudioAcrobat. The most annoying thing about AudioAcrobat’s basic plan is they add $1 to your bill whenever your views exceed your allowed bandwidth by 1GB but they have absolutely zero stats on what listenership looks like. I found that positively ridiculous. To make matters worse they don’t send monthly bills by email; they say their technology doesn’t allow for it, however, I suspect they want you to forget what a bucket load AudioAcrobat costs so they can keep on enjoying your hard-earned money. Call me cynical… Anyhow, last week my friend Fifi from California emails me to say she’s started a podcast – I checked it out and asked which host she was using: SoundCloud, she said. I check out the podcast on iTunes, then swoon over to SoundCloud and I’m like, this is such a fun site to use – where has it been all my life?! Actually, I’ve know about SoundCloud since June-2014 when I was interviewed on The Entrepreneur Dad Podcast but I didn’t spend much time looking at it. Don’t ask me why. To cut a long boring-ass story short, a week ago I started migrating my GirlBanker podcasts to SoundCloud and by this week I was pretty sure I’m not interested in AudioAcrobat anymore so I kicked their ass to the curb. I currently have five, yes you heard right, FIVE podcasts on iTunes. I’m stream-lining my content so I will be completely deleting two accounts and combining the info from three podcasts into one. Oh, and you know that thing about not getting AudioAcrobat bills by email? Well, I would have had absolutely no record of the invoices for tax purposes because as soon as I deactivated my account they locked me out despite the fact that I am a paid up user for two more weeks. Fortunately, because I know how rubbish they are I had saved all my invoices just prior to deactivating the account. IN CONCLUSION... If you want to get your stuff out there through podcasts, sign up to SoundClound. Unlike AudioAcrobat they also have a free plan. The only facility that AudioAcrobat has that SoundCloud does not appear to have is the ability to schedule podcasts to publish later. That was a good feature because it allows you to plan a whole month’s podcasts, say, then forget about it for a while. It’s a minor thing, however, as I’ve found the upload process to be fast and efficient. I won't take too much more of your time, though, there is a follow button below, hit it if you use SoundCloud then head to iTunes and subscribe. Have a business or life question you want me to answer? send me a message.

Hi Heather, This is a simple question, how do you make money when you have no money? Belinda Jo W. I LOVE this question Belinda. It’s an awesome question because so many people are probably wondering the same darn thing. Okay, your question isn’t specifically asking about starting a business so I’ll tackle it from both a business and a career perspective too. I’ll be as broad as possible. BUSINESS  The Bank A lot of people need money to start a business or some other passion project. Back in the 80s my dad had very little cash, basically all he had was a credible enough business plan to make an appointment with a bank manager. The main basis for which he got that loan was the bank manager saying, “I can see a future in your eyes so I’ll approve this loan”. Sh!t like that doesn’t happen today. Banks can’t lend on the basis of just believing you have great potential so they don’t lend to start-ups. Typically, they’ll only lend to a business that has three years of trading history and appears to have a reasonably stable income. The Manufacturer Have you heard of Sara Blakely? If not, then you’ll definitely have heard of the brand Spanx. She started that brand with $1,000 which for all intents and purposes is almost nothing. She used that money to get a prototype made by a local US manufacturer. She then wanted a manufacturer to partner with her: she wanted them to produce her product in the hopes of sharing in the profits. Obviously, most suppliers gave her an outright no. Manufacturers don’t like taking entrepreneurial risks of that nature. Their business is just making stuff and they get paid upfront or based on a 30-day line of credit. The manufacturer that ultimately said yes had a daughter that convinced him it would work. That is still possible today especially if the product to be made seems quite innovative and if a small sample run can be made without a huge financial outlay. Her next problem was finding a big buyer. She trawled from supermarket to supermarket trying to get someone to see her. In the end, she got her first yes by asking the buyer to come to the bathroom with her to see how Spanx worked. She put them on and the buyer was like, “I get it”. The rest as they say is history, she now stands as one of very few self-made female BILLIONAIRES. Her story has so many elements that just seem “lucky”, for instance, if the buyer had been male she couldn’t have just been like, “Come to the bathroom with me and I’ll show you” – can you imagine what he’d be thinking? Lol That said, you only get lucky when you put yourself out there. Most people just let their ideas die in their head so they don’t get lucky. Luck comes from repeated effort. MAKING MONEY IN A JOB  Now, if you just want some money and have none, there are some key avenues you can take. EARN MORE – GET A GOOD JOB

EARN MORE – SELF IMPROVEMENT Here are a few ways you can improve your prospects. Education The better educated you are, the more money you tend to make. Even in poorly paid jobs you can navigate yourself into higher paid posts like a management position, over time. Every industry will have positions that make bank and roles that keep your bank account overdrawn. If you get educated, you’ll be able to take advantage to move up. In my case I have a BA in Economics from the University of Cambridge. I could have stopped there – most do, but I decided to become a Chartered Financial Analyst, CFA. I’m currently self-employed but, for no particular reason, I’m doing the Certificate in Mortgage Advice & Practice (CeMAP) AND I’ve signed up for ACCA exams…what can I say, I like writing exams. Like I said, I don’t have any specific plans for these qualifications, you could say I like collecting qualifications in the same way people like collecting, say stamps, but with all this on my CV it means I can pounce on opportunities faster than a cheetah in the Serengeti pounces on an unsuspecting wildebeest. Accents Don’t ask me why I think of this today; perhaps because the topic cropped up over the last few days. Some people associate certain accents with being dumb and having such an accent can therefore reduce one’s employability. Here in the UK, the Birmingham or Brummie accent is seen as dumb – I personally love it (see references below). In the US the Southern Accent is seen by some as dumb too and indeed some people find certain African accents dumb – sigh. I personally like lots of accents that people hate but I’m not trying to employ you. My personal pet peeve is poor grammar. Mix poor grammar with an accent that employers tend to be biased against and forget passing interview round one! I have a Chinese friend who went to the extent of getting elocution lessons to neutralize her accent. I haven’t seen her in a long while so I can’t tell you if it worked. Overall, if you think your accent could possibly be holding you back you should work on it. This could be as simple as polishing up your grammar and pronouncing words more clearly, you don’t necessarily need expensive elocution lessons. I won’t lie to you though, I’ve considered elocution lessons myself in the past. If we look at the c-suite of any firm we’d probably all be surprised who’s had some voice/accent coaching. Some people just want to change their tone to sound more authoritative others want to wipe out a whole accent. Your Overall Look Honey, I so wish it weren’t true but people do judge a book by its cover. Having polycystic ovarian syndrome (PCOS) means I gain weight if I so much as look at cake the wrong way and it is incredibly hard to shake off. I am not hugely overweight at all but people have no idea how hard it is for me to just stay this slightly overweight size even when my calorie intake is quite low. This is why I wish fattism did not exist, but it does. Employers have been empirically shown to discriminate against overweight people because they view them as lazy! Reference below. If you feel your weight could be holding you back, get your jog on. I’ve been jogging almost daily for three months right now and I haven’t lost ANY weight. However, I feel excellent and I’m buzzing with energy. If you, like me, struggle with weight focus on just doing regular exercise. It will make you feel more confident about your body and that confidence will shine through to other people. Coach or Mentor Ultimately, this is what I did to get my first well-paid job at Goldman Sachs. I was coached. My CV was reviewed, I had practice interviews, I got feedback on what I planned to wear to my interviews and I got the job. That job allowed me to save more and ultimately go on to buy my first property. SAVE MORE This is one thing people simply fail to do. I’ve coached people who think they couldn’t possibly save anything and when I delve into their finances there are literally savings that can be made everywhere. I have so many tips on saving that I wrote a book about it a few years ago, Build Super Savings. If you get the PDF book, I suggest you print it off and work through it diligently, from start to finish. Promise? INVEST IN PROPERTY (aka REAL ESTATE) FIRST I see property as a safe bet. If you buy a property you can afford the worst case scenario is that you’ll end up with negative equity for a while; however, provided you keep up with payments you will eventually own the home outright and always have somewhere to live. After you have one property why not get more properties to fund your retirement? Rent from tenants pays the mortgage off for you. If you buy in a good area you will at a minimum store the value of your home because over long periods of time property keeps up with inflation. In the best case scenario you’ll see you property price rise faster than inflation. Your equity capital will grow. I am a huge fan of property. It’s not a get rich quick strategy. You’ll only enjoy the maximum benefits of it in 20 to 30 years time when your mortgages are fully paid off but even before that property can bring in some extra spending cash. If property prices rise fast you can enjoy incredible benefits much sooner but I’d invest based on at least a 10-year plan. I started my working life off with no money. I saved enough to invest in one property and it is that property that I bought almost 10 years ago that I re-mortgaged to fund my Queen of Kinks product line. I can talk for days when it comes to property so I created an information-packed course on how to build a property portfolio from scratch. Anyhow... Can you think of other ways to make money? Make a comment below. Have a business or life question you want me to answer? Please email it to me with the subject “Question”. Note that all such questions will be answered as a blog post and will be sent to my full email list.

Want to start a business? Check out The Money Spot Program. References How To Test Your Package Designer Before You Hire Them & Avoid Losing Lots of Time and Money3/8/2016 So, now that I’ve suggested that you Get A Professional Label Designer you’re hopefully more likely to. However, I have an additional tip for you: test drive the designer first! Back in 2014 when we were formulating the Queen of Kinks product line my formulator said they had a designer on their books who would be “right up my street” – she was supposedly A-MA-ZING and indeed, when I looked at her portfolio she was creative and had done some awesome designs for other people. Now, the one thing I look for in a designer is “the surprise element” – if I commission a job and the designer produces something I really didn’t imagine they would, they’re the one. It is extremely difficult to find this calibre of designer. More often than not I find that designers give me exactly what I ask for and they don’t do anything extra. I am not too often wowed. I was even more cautious in this case because the said designer was English and as you know the cost of living here in England is high so I knew I’d be paying top dollar. I needed to test drive the designer on a small job before committing to a big job... Before hiring the designer for my packaging I asked them to make a simple change to my logo. I wanted my logo to be developed into a personality. The results were simply not to my taste, I felt like she hadn’t tried very hard at all. Based on my feedback we continued working until the project was done but that experience was enough to let me know she would not be designing my packaging. This is the work she produced: DRAFT 1DRAFT 2DRAFT 3 / FINAL: I went with a variation on 3A belowI know some people might look at the above and think it’s not too bad, however DRAFT 1 for me was particularly poor; it wasn’t what I imagined when I commissioned the work and it didn’t meet (or exceed) my expectations. I thought, "I've waited 3 weeks for, this?!" By the time I worked with the above designer I had worked with several designers in the past on a variety of non-packaging related projects from book covers to labels and I’d been wowed a few times. This time I was looking for an experienced package designer. In the end, there were a few other issues that put me off: Firstly, it took about 2 to 3 weeks to get each draft, secondly, she didn’t work weekends and public holidays and I will admit, I’m used to designers that just get the job done come weekend or public holiday. I frequently hire designers via 99designs and they get the job done in under a week from draft to the finished article and the standard is very high, that’s what I’m used to. In the end, you know what you have in your head and you need to feel as though your designer not only listens to you but understands what you are trying to achieve and converts your vision into an Oscar winning design piece. If you’re struggling with ideas on how to develop a quality brand and how to commission decent designers go through the branding section of The Money Spot Program. Details of the package designer that I commissioned for Queen of Kinks are in the details section of module 3, just scroll down.  Lots of scary statistics get thrown around regarding the negative retirement prospects for current 30-somethings (and even worse for those younger than us), so this week I’ve decided to dig deep. I’ll write a series of 3 articles on retirement: what do that the stats look like in the UK and the US and ultimately, what will it cost you to retire? I will not do an article on retirement stats in Africa because for the most part those statistics are VERY hard to come by. However, I found a fantastical article by the OECD that looks at Pensions In Africa. This is what I assume we all want to know:

When Do You Get A UK State Pension?The retirement age used to be 60 for men and 65 for women. It’s now been equalized to 65 for both. It’s moving up to 66 by 2020, 67 by 2028 and 68 by 2046. I’ll qualify to get a UK state pension at the age 68 in 2051 provided I’ve paid national insurance (NI) taxes or have NI Credits. You can calculate your own pension age here. What does this mean? Those of us that reach retirement age after 6 April 2010 need to have 30 “qualifying years” to get the maximum state pension and at least 10 qualifying years to get anything at all. If you don’t have a National Insurance record before 6 April 2016 you’ll need 35 qualifying years. Qualifying years are years in which:

For instance, if you work abroad or aren’t working for any reason you can pay voluntary contributions to ensure you qualify for a full state pension. I see this as a sort of backup insurance policy and I would definitely do it if I was working abroad. “If you reached the pension age before April 2010, then a woman normally needed 39 qualifying years, and a man needed 44 qualifying years during a regular working life to get the full state pension.” BBC What’s The Amount of The UK State Pension?If you are retiring on or after 6 April 2016 the full state pension you can get is £155.65/week, this is £8,094/year or £675/month. This amount is guaranteed by the government to rise by the higher of:

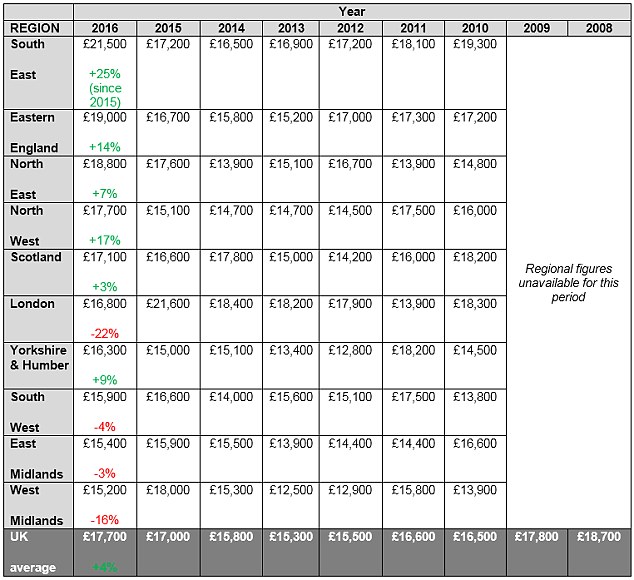

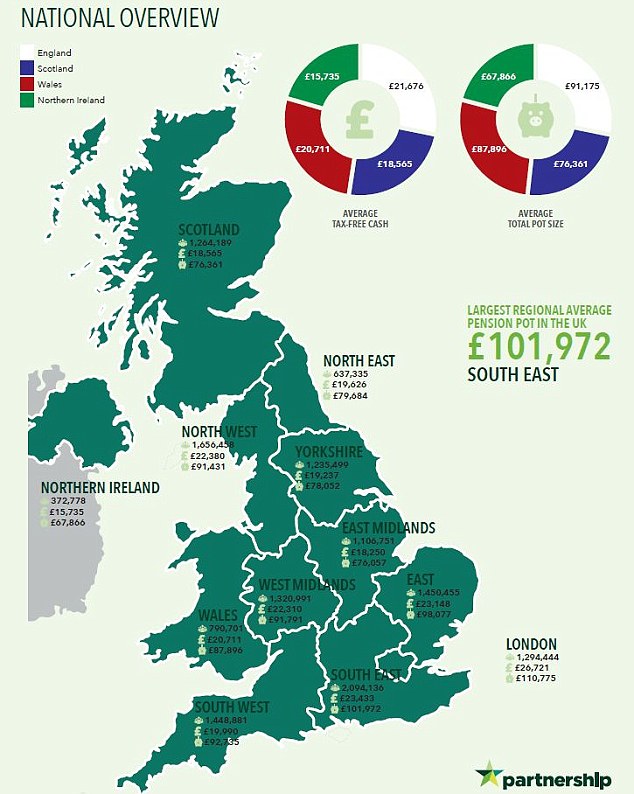

But, of course, government plans do change and this guarantee could fall away if the UK hits problems. There is a lot of press surrounding this possibility right now. How Much Does The Average Pensioner Actually Have In The UK?People retiring in 2016 expected income of £17,700 per annum according to a Prudential survey. They carry out this survey annually and the table below shows the results. This number is actually £1,000 lower than in 2008 but it’s been making a steady recovery: What Do The Pension Savings of Workers In The UK Look Like?According to Partnership the average UK pension pot stood at £87,724 in 2015. There is a lot of variance within the UK, with Essex having the highest pension pots, £125,478, and Shropshire the lowest, £44,336. Check out where your region stands using the image below. With compulsory workplace pensions now in effect pension savings should hopefully rise for a good majority of people. What Proportion Of Pensioners Own Their Home Outright? Property ownership is one of the key determinants of financial independence in old age. Here are stats from the 2011 census carried out by the Office of National Statistics:

The obvious advantage of outright home ownership when you are retired is that you save yourself what is usually a household’s biggest expense. Home ownership is almost necessary to guarantee a comfortable retirement because state pensions rules are changing all the time. Personally, I hope for the best when it comes to state pensions but I certainly won’t depend on the government to look after me in old age. Have a business or life question you want me to answer? Please email it to me with the subject “Question”. Note that all such questions will be answered as a blog post and will be sent to my full email list.

Want to start a business? Check out The Money Spot Program. References Basic State Pension Overview (gov.uk) State Pension Eligibility (gov.uk) State pension: The overhaul and you The pension pot map of the UK revealed Retirees in 2016 expect income of nearly £18k a year Home ownership and renting in England and Wales Number of UK working-age households drops for first time Pensions In Africa  Me, after a MAC makeup session. Me, after a MAC makeup session. Hi Heather, Thank you for you inspiring words. I started a handmade skin care business but it failed miserably. I gave it my best shot and wasted a lot of money. My question is do you think the beauty market is saturated and what tips would you give to start a successful business. Regards Denise R. This is a great question, Denise, you’re not the first person to ask me this. The truth is there are A LOT of skin (and hair) care products out there and a good majority of them have exactly the same ingredients so consumers find it difficult to distinguish good brands from rubbish brands. The result is that a buyer may continue to buy a product for many, many years although that product that doesn’t work particularly well for them. The vast majority of supermarket skincare products are in fact owned by just two companies, Proctor & Gamble and Unliever; moreover, a good proportion of more upmarket skin and beauty brands are owned by L’Oreal and Estee Lauder. This has certain repercussions for people who want to start a new brand: Disadvantages

Advantages Despite this there are some advantages for you:

Is the market saturated? It is definitely saturated for “me too” products but it’s not saturated for products that come out with a great story and attempt to do something different. To succeed today you need to find a very narrow niche, don’t try to be all things to all people and you need to do things a little differently to turn heads and make people consider switching products. You cannot succeed with a product that’s dull and appears to be no different to existing brands. So, how do you succeed?  Mum looks A-MA-ZING at 57. Mum looks A-MA-ZING at 57. A. Have a great story. Do you know Levi Roots? He created a cooking sauce when there were thousands of sauces on supermarket aisles. He went on to Dragon’s Den (the equivalent of Shark Tank in the US) and nailed it with his pitch. He wasn’t same-old, same-old. He came on with his guitar, he was authentic – he didn’t attempt to change his Jamaican Patois and he charmed us all with his reggae-reggae sauce jingle. After that interview you just thought, I want that guy’s product, that guy deserves to be rich…and rich he became. B. Have fantastic branding. People have more money nowadays so they’re willing to spend a bit more for something that looks amazing. Middle class consumers care now, probably more than ever, about how they are perceived and they want to buy things that make them look wealthy and successful. Poorly branded products have no chance. C. Build your own audience, grass roots style. Have you heard of Michelle Phan? She is a beauty vlogger on YouTube that’s spent hundred of hours producing beauty videos. She grew such a large audience that L’Oreal paid her several million dollars to have her own brand of makeup products, Em. Ultimately that product line didn’t make the type of money L’Oreal hoped for, the suspicion is that the products were overpriced for the type of fans Michelle has (young and just starting out in life), but the brand is still around; it’s now owned by Michelle’s own company, Ipsy. Building a big following means you can sell directly to a certain audience and although most beauty bloggers won’t get bought by the L’Oreals of this world, they have an opportunity to create their own brands, they have influence and can disrupt people (and industries) from their usual way of doing business. What do you need to build a significant audience? Time, lots of time to produce vlogs, blogs and incredible images for your social media pages. I hope this answered your question, Denise. Have a business or life question you want me to answer? Please email it to me with the subject “Question”. Note that all such questions will be answered as a blog post and will be sent to my full email list. Want to start a business? Check out The Money Spot Program. Related stories: Are P&G And Unilever Headed In Opposite Directions? Who Owns What In The Beauty Industry? Levi Roots on Dragon’s Den |

Heather on WealthI enjoy helping people think through their personal finances and blog about that here. Join my personal finance community at The Money Spot™. Categories

All

Archives

September 2023

|

Heather Katsonga-Woodward, a massive personal finance fanatic.

** All views expressed are my own and not those of any employer, past or present. ** Please get professional advice before re-arranging your personal finances.

RSS Feed

RSS Feed