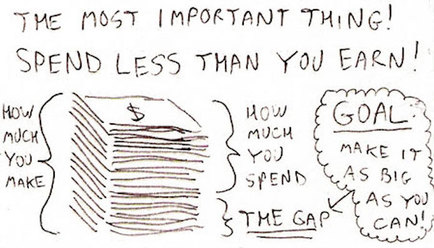

Your spending will always expand to match your income unless you specifically plan to live beneath your means. You can do this as a lifestyle choice or for short periods of time to save for something you really want. Shop around to save money on the things that you buy regularly – buy in bulk, get products where they are cheapest instead of just going to your favourite shop, use coupons and take advantage of discount days at local stores. However, there are some things that you can live without completely;that is the topic this blog. We get so used to buying what we always buy that we don’t usually stop to contemplate what’s necessary and what isn’t. To help you think through your own shopping list I’ll go through some things my friends and I cut back on to save: Rent You could live in a cheaper area and save thousands immediately. I did this when I first started work. I was spending almost half what my peers were on rent just by living a little further out of the city. Of course, many of us are unwilling to compromise here so we have to look at the small stuff. Juice! For what you get, it’s not cheap at all. I was having a chat with one of my best friends about cutting back and she said, “Can you believe it, we’ve even had to stop buying juice!” I was like, “You were still buying juice? I stopped buying juice ages ago because it contains way too many calories. I’ll only buy it if I have guests coming.” I also find juice to be poor value for money besides being completely unnecessary for the weight conscious. Juice packs in a lot more calories than one might suspect. Restaurants We spend A LOT of money on eating out every month. I personally find it very hard to cut back because I think of it as a “treat” after a week of hard work. However, right now my husband and I have just spent a small fortune renovating a flat that we just bought so we’ll use that thought to spur us on during our financial fast in September. To stick to our resolve we add“treat foods” to our shopping list to encourage us to eat at home. For example, buying a frozen pizza that you just stick in the oven when you feel lazy is a lot cheaper than going out for pizza. We wouldn’t normally buy this type of food because it’s not healthy but it does the job of keeping us at home when we want to eat out. Meat News flash: you don’t have to eat meat every day. Some people would think this is unthinkable and perhaps an utterly ridiculous suggestion but it’s true. If your partner is against this suggestion remind them that desperate times call for desperate measures. You can also cut back by eating less meat rather than cutting it out completely. For instance, unless it’s a very small chicken I only ever eat one chicken piece, I find two to be excessive. If everyone in your home has two pieces your chicken will immediately last twice as long by enforcing a one-piece rule. The same goes for sausages and other meats. I normally cook minced meat with beans to bulk it up. Less meat means a heavier wallet and a more attractive waist line! You could go for offal aswell. Liver, oxtail and tongue are delicious. Body Products & Makeup There are so many options here. If you use a range of upmarket brands explore supermarket “equivalents” to see if they work just as well. You could save a tidy fortune here. Take a close look at what you tend to spend money and see what else you could do without. Magazines? New shoes or clothes? And so on. “Cut back on your rent or cut back on what you spend on food but never worry about investing money in a good book.” Robin S. Sharma  Want to Build a 6-Figure Beauty Business from the comfort of your sofa? Then my course is designed for YOU! "Beauty" includes a WIDE range of products from the not so obvious non-perishable foods and crafts to the more obvious hair, makeup, fashion, health & fitness.

3 Comments

How often do you think about how you're going to live life in your 60s? Here are alternative outcomes. Living Off The Kiddies Some will reach the age of 60 without a single saving. You will depend on your kids for money, for food and perhaps even need them to house you somehow – if they are willing. For many this will not happen because life has been unkind to you, it will be the result of a series of bad choices such as having more children than you can afford to support and not saving enough. Be in no doubt that if you find yourself in this situation you will be a burden to your children. In the ideal world children don’t want to have to look after their parents financially and if they just earn enough to support their family will resent having to look after you because you didn’t plan for old age. Could this be you? POSSIBLE SCENARIOS Oh, This Isn't My House? Some will reach retirement age and realise that the bank or the company they work for owns “their” house and “their” car. It’s easy to forget such things when you are enjoying life but at this point you will be forced to either live off your children or invest your savings in a business. If you’re lucky you’ll find jobs in retirement or positions on boards of directors that provide an income whilst you make up for lost time on the investment front. Living Off The Rentals Some will reach the age of 60 with a tidy property portfolio. You will own the house you live in outright and you will have at least two rental properties. Your rental properties will produce enough money to cover all necessities, bills and wants such as holidays. When your children come to visit you, they will come with pride. Pride that they have forward-thinking parents that had the wisdom to cover their own retirement. You will have no unnecessary worries and will be safe in the knowledge that you never have to go to bed hungry or cold.  The Art of Visualisation Visualising is like fantasising. You visualise a specific event in the future in very specific and detailed terms and think about how much you will enjoy it. Scientists have confirmed that visualising can lead to the achievement of real results. In a well-known study on creative visualisation in sports, Russian scientists compared three groups of Olympic athletes:

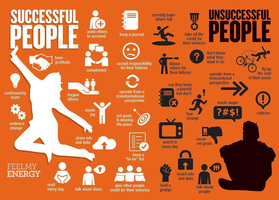

Group 3 had the best performance results. This indicates that some types of mental training, such as consciously invoking specific subjective states, can have significant measurable effects on biological performance. Further to this, some celebrities have argued that they have achieved certain results in their life by visualising them first. These include Oprah, Will Smith and Jim Carrey. Visualising helps you to focus on a goal. If you can find just ten minutes a day to meditate and visualise the things you want to achieve you will increase your chances of achieving them. Most people don't think too far beyond the next couple of years, if that. Those that do are at an advantage. Of course you shouldn't live so far in the future that you cannotenjoy the present. That said, thinking about and planning for the future is enjoyable in itself –just do it! "Ordinary people believe only in the possible. Extraordinary people visualize not what is possible or probable, but rather what is impossible. And by visualizing the impossible, they begin to see it as possible." Cherie Carter-Scott  Want to Build a 6-Figure Beauty Business from the comfort of your sofa? Then my course is designed for YOU! "Beauty" includes a WIDE range of products from the not so obvious non-perishable foods and crafts to the more obvious hair, makeup, fashion, health & fitness.  A series of good habits is pretty much all it takes to foster a culture of success in all areas of your life. To form a set of good habits all you need to do is adopt a couple of good habits at a time through repeated action. Don’t commit to adopting too many habits all in one go.That is more than the average person’s will power can handle. However, once a good habit is formed it gets easier and easier to build on that base to form more good habits. Now, a lot of literature out there talks about how will power is limited, however, what you don’t often hear being discussed is that “the will power muscle” can be grown. The more you exercise your will power the more will power you gain. In this article I aim to help you understand will power a little better so that you can use it to your advantage.My writing on will power is informed by several books that I have read including The One Thing by Gary Keller and Jay Papasan as well as The Power of Habit by Charles Duhigg. Will Power Is Limited – What Does That Mean? When you wake up in the morning you have a full tank of will power. Over the course of the day, every time you encounter a situationthat requires you to exercise control, that will power is used up. This means every time you encounter a situation you have less and less will power to deal with that situation. Once you form certain habits or standard responses, those challenging circumstances cease to tax your will power. I’ll give you some examples that are very common in every day life.  Examples of Instances Where Exercise Will Power Is Used Up Food You wake up in the morning and face the first challenge:Crunchy Nut Cornflakes or Oats If you don’t particularly like oats but choose to eat them anyway because they are good for you then that decision uses up a bit of your limited will power for that day. If you set a given standard that you’ll eat oats for breakfast everyday except Saturday you cease to use up any will power at breakfast because the decision of what to eat has been decided beforehand;you’ll eat oats at breakfast out of habit and you might even start to like them. Challenge 2: Around 10 a.m. you feel hungry. If someone offers you a biscuit or slice of cake you will take it. If you’ve developed the habit of always carrying fruit with you to snack on when mid-morning hunger hits then you’re equipped not to give in to sugary treats. Carrying fruit around with you is a good standard habit. Temper Every time you get annoyed or upset but manage to handle a situation without letting emotions get the better of you, you use up some will power. In The Power of Habit by Charles Duhigg he recounts a very interesting experiment. Two groups were invited to take part in a study:

After that, each group was asked to do a boring task. A series of numbers popped up on a computer and every time a 6 was followed by a 4 the participants were told to press a certain button. Interestingly, group 1 did well and managed to continue doing this rather mundane task for the entire 12 minutes whilst group 2 kept making errors and for the most part couldn’t do the experiment for the full 12 minutes. The conclusion was group 2 had used up their will power in the first part of the experiment. However, because group 1 were made to feel like they were helping and were an integral part of the initial phase of the experiment their will power wasn’t used up by the time they were set in front of the computer. To the extent that we feel in control of a situation(as group 1 were made to feel) we don’t use up will power. Money Most people purchase whatever they want to buy if they have the money (or credit) and every time they stop themself from purchasing something their heart desiresthey use up some will power. If you adopt the standardthat you only go shopping for, say makeup and clothes, on a Sunday then every other time you see something nice in a street window you don’t purchase it on impulse because it’s not Sunday. By the time Sunday arrives you might decide you don’t want whatever it is that looked amazing in the week. In conclusion, any situation that requires you to exercise self-control uses up your limited will power. If you set up some rules for dealing with these situations then you don’t have to think up a reaction every time; this will result in less usage of your will power. The better you get at managing your will power using a bank of good habits and pre-set standard responses, the less of it you will use up unnecessarily To your success.  Want to Build a 6-Figure Beauty Business from the comfort of your sofa? Then my course is designed for YOU! "Beauty" includes a WIDE range of products from the not so obvious non-perishable foods and crafts to the more obvious hair, makeup, fashion, health & fitness.  When I got downstairs this morning I opened the cereal drawer and remembered it was my first day off healthy eating and tracking every morsel I eat on the myfitnesspal app to congratulate myself for losing 5 kg in a month. I did the funky chicken, I high-fived my husband but then after those first few happy moments I couldn’t do it. Yes, I was going to eat more liberally than usual but I couldn’t not track my food and I decided I still wasn’t going to eat cake or any dessert because I want to lose more weight before I do that. I have formed the habit of eating smaller portions and even when I have a scheduled day allowing crazy eating, I don’t want to do it. This reminded me how so many good things are accountable to good habits. Habits, both good and bad, are very easy to form. According to The One Thing - The Surprisingly Simple Truth Behind Extraordinary Results By Gary Keller And Jay Papasan, habits have been empirically shown to take an average of 66 days to form but can take as little as 18 days and as many as 200 days depending on the complexity of the habit one is trying to form. This sentiment is reinforced in the book I am currently reading The Power of Habit by Charles Duhigg. He reminds us that “habits are not born, but created. Every bad, good or insignificant habit starts with a psychological pattern called a “habit loop.” Okay, so, what sort of habits build wealth? I’ll give you a few that you can easily implement. Some good habits I’ve had since before I was a teenager like the habit of enjoying work; however, I continually work on adopting more and more new good habits.  Eating healthily is a habit I struggle with and I always seem to slip back after a life change like getting pregnant or moving house; I revert to eating huge portions and too much unhealthy food then I decide enough is enough so I start working on reforming good eating habits again. I call these lifestyle changes. Since 2005 I have had 3 or 4 lifestyle changes. On the plus side, each time I slip back I don’t lose every good habit, just a few of my old habits creep into my life again. Anyhow, what can you start working on today?

Finally, note that everyone has a limited amount of will power. If you stop yourself from doing something that you want to do, you use up a bit of that limited will power such that by then of each day your stock of will power is almost depleted. Consequently, don’t try to implement too many things at once. Work on one or two habits at a time. Once you form the required habit introduce a new one.If you take this approach it will feel less taxing because once a habit is formed it’s automatic, you don’t have to think about it Forming good habits is one of the elements we focus on in the Success portion of The Money Spot Program on how to build a 6-figure product business. If you would like to build a product business and if you want to maximize the chance of building it into a 6-figure annual income then you should do The Money Spot Program. Live the life you want. This year the workshop is at New Hall Spa Hotel in Birmingham, UK on 17 & 18 October. A night’s accommodation is included. Join us. If you’re based in London the train out there is less than 1.5 hours and if you’re in Europe you can fly into Birmingham International Airport. If you can’t make the workshop then the online-only course is waiting for you.  Want to Build a 6-Figure Beauty Business from the comfort of your sofa? Then my course is designed for YOU! "Beauty" includes a WIDE range of products from the not so obvious non-perishable foods and crafts to the more obvious hair, makeup, fashion, health & fitness. |

Heather on WealthI enjoy helping people think through their personal finances and blog about that here. Join my personal finance community at The Money Spot™. Categories

All

Archives

September 2023

|

Heather Katsonga-Woodward, a massive personal finance fanatic.

** All views expressed are my own and not those of any employer, past or present. ** Please get professional advice before re-arranging your personal finances.

RSS Feed

RSS Feed