Don't Go Henry, Go Cash, First - rushing kids onto bank cards could ruin their financial future5/5/2022

,There are a lot of apps out there right now purporting they’re the divine intervention you’ve been waiting for to turn your kids into personal finance ninjas…news flash: you can’t delegate teaching your kids about money to an app.

The app may be able to relay some basic knowledge but ultimately the best builders of wealth need to only master one thing: their emotions. And, like as not, all the behaviours around money in your house – and yes, not talking about money at all counts as ‘a behaviour’ are all adding up towards what your children will ultimately believe about money and how it ought to function in their lives. This is what financial psychologist, Brad Klontz, calls money scripts. In addition, we humans are hard wired with certain biases: loss aversion, optimism or confidence bias, the pull of instant gratification, action bias and a bias towards earning rather than saving, to name a few. The money scripts you pass on to your children interact with these biases to determine their future responses, fears, anxities and attitude to their financial affairs. So, now that I have scared the bejesus out of you, what can you do to pass on a more rational approach to money. Well, before you expose them to cash cards or debit cards give them cash – I’m a supporter of making them earn it – then see what they instinctively want to do with it and capitalise on the teaching moments that will bring, and there will be many. My son’s basic knowledge of money acquired through our going through stage 1 of B.School for Money-wise, Wealth-bound kids means we are now having really good discussions about money and his reactions to it. And having heard Brad Klontz on Paula Pant’s Afford Anything and now on Hidden Brain I have bought Money Mammoth (Amazon USA, Amazon UK) and if I enjoy that I will read more of his books. Are you consciously thinking about how your household’s behaviours around money are impacting your impressionable little ones?

0 Comments

I thought it would be fitting to end the 2020 series of The Money Spot podcast with a series on the Economics of being black. The issue I would like to explore first is a list of things that could hold a child back before they are even 18.

Where possible, I will depend on UK studies and statistics but if that’s not possible reference will be made to US studies where much more research on race tends to be available.

1. Name

Having a name that is perceived as “different” may be a factor that exacerbates a black child’s feeling of otherness, of being different to the mainstream. In the worst case, it may lead to teasing or just feeling discomfort and insecurity with what might seem like innocent questions from teachers, like “how do you say your name?” I’ll talk more about names in my piece about what holds black adults back. Personally, our desire for our children not to be discriminated against in mainstream British society was a key consideration in name selection. We want them to blend to the extent possible and didn’t feel that name was an issue they should need to deal with in addition to everything else. 2. Hair Is there an issue more contentious? My son noticed the difference in his hair before he mentioned that his colour was different to that of everyone else in his class. There are many anecdotal examples of black children being treated in an unfair way at school on account of their hair, for example:

But, while a name and hair, in addition to skin colour may add to a feeling of being different, there are real and recent statistics from the Social Market Foundation and other research organisations to show that black children are discriminated against at higher rates: 3. The perception of being threatening There is a perception and stereotype of being threatening which especially haunts black boys. In studies, black boys as young as 5 years old have been perceived as more threatening compared to similar aged white boys which is a scary fact. This has been elicited with tests of association of faces and objects like guns or puppies rather than by asking directly. And where as being “tall and dark” would give a white boy advantages with perceptions of stature, strength and athleticism – for a black boy the exact same tallness and darkness may only serve to make them appear more threatening and with that all the disadvantages: more regular police stop-and-searches and fewer opportunities. This sentiment is my own, rather than from elsewhere but it is something that recently occurred to me as a risk. 4. At-school and In-class discrimination The Social Market Foundation reports that “discrimination in education frequently takes place outside of the syllabus. There are a range of institutional practices that underpin Black students’ exclusion and, ultimately, their educational attainment.” For example:

So, unfortunate as it is, black children especially black boys face discrimination at much higher rates at school. I haven’t found any research to back it up but a friend who works in the field told me that some recent studies suggest that black boys are ahead of all other ethnic groups on entering school but within a year they are behind others because of the poor engagement they receive. 5. Low expectations Akala in his autobiographical, “Natives: Race and Class in the Ruins of Empire” recounts how he was a gifted child, highly intelligent with a GCSE reading age by the time he was 7 and yet, he was placed in a class with children with learning difficulties. It took his (white) mother advocating for him and speaking up for this to change. And in her time on Desert Island discs Sonita Alleyne, the first black Master of a Cambridge college admits that exactly the same thing happened to her when she arrived from Barbados as a young child. Placed in the special needs class, her mum walked into school and explained that her daughter’s accent wasn’t a sign or symptom of being stupid. The most frustrating thing about these examples is that similar things are happening to many black children today and they don’t have an advocate. What of those children that reveal they want to be a doctor, lawyer or astronaut that are told to be realistic and guided towards nursing, hair dressing, plumbing and other manual jobs. Or towards sports and more artistic jobs like music – yes, there are more examples of black people succeeding in these fields but this is simply because you can’t pretend the boy or girl who came first in the 200m sprint actually didn’t. If nurtured correctly there’s nothing to stop black children excelling in any and every field. Further, many black children up and down Britain simply assume it’s “stupid” or “unrealistic” for them to aim for Oxford and Cambridge and there is no one there telling them otherwise. Conversely, the majority of those in private schools assume it’s a given that they are expected to apply to the top universities. Not long ago women had many of the same challenges – in her time on Desert Island discs retired surgeon Averil Mansfield (born in 1937) says her mum told her to lie she wanted to be a nurse rather than admit she wanted to be a doctor to avoid the mockery. Any girl can say they want to be a doctor now and no one would bat an eyelid and that is the position I would love all disadvantaged children and black children specifically to get to. 6. Poverty People can live in a vicious cycle of poverty from which they struggle to escape. What proportion of black children live in poverty? The Social Metrics Commission found that almost half of people living in a family in the UK where the head of the household is black are in poverty. This compares with 19% or about a fifth for white people. This means black-headed households in the UK are 2.5 times more likely to live in poverty than their white counterparts. Poverty comes with many disadvantages that you can probably list yourself, a few that are commonly discussed in the press include:

These are example economic factors but poverty, of course, also has negative social consequences, living in an economically deprived area may mean increased exposure to crime etc. According to research by the University of Manchester, “a fifth of its Black African, Black Caribbean, and Arab populations live in the country’s most deprived neighbourhoods compared to 8% of the white British population.” I will tackle “social mobility” in my next instalment, for now it is enough to know that many more black children than white children are living in poverty and therefore do not have access to opportunities taken for granted by middle class and more well off children. 7. Single parent home This data is a little old (from 2007) but is unlikely to have changed much so I will use it. According to a Metro article, “48% (almost half) of black Caribbean families have one parent, as do 36% (a third) of black African households.” This figure is 10% for Indians (and marginally higher for those of other South Asian background), 15% for the Chinese and 22% (a fifth) for whites. 90% of single-parent families are headed by mothers. Children who grow up without their biological father are more likely to be

I don’t want to stereotype the single parent with lots of dreary stats but suffice it to say having to manage as a single parent according to the data tends to exacerbate poverty – which stands to reason because one person equals fewer resources including services like washing, cooking etc rather than financial resources. It may also mean the child has less access to parental support for homework and possibly other emotional needs. In summary, before a black child is even a teenager they may face major challenges with their development because they are:

If ALL school teachers could treated ALL children like they are special and going places regardless of race so much progress could be made in erasing educational inequalities between the races. And over the long run, erasing wealth inequality. Heather p.s. subscribe to my podcast and ask me any money question, HERE - do it now!

Hi Heather

My name’s Grace. I’m looking into saving money for my little one so that it can be invested in the same way as government-backed child trust funds. My older one has a child trust fund but I don’t know how to go about opening something similar for my younger child. As I understand it, banks don't offer government-backed child trust funds anymore.

Hi Grace,

Thank you for this message. In podcast episode number two, I talked about how you can save and invest for children in today’s world. All that information is still relevant so please have look at that post for ideas on the best saving strategy. A Child Trust Fund (CTF) is a long-term tax-free savings account for children. You cannot apply for a new Child Trust Fund because the scheme is now closed. The alternative available for today’s parents is the Junior Individual Savings Account or junior ISA. What is a junior ISA? A junior ISA like its adult equivalent is a tax-advantaged account that can be used for saving or for investing in the stock market. Once you place money into a junior ISA it cannot be withdrawn until your child is 18 and it legally belongs to your child so you would not have control over how that money is used. This is not necessarily a bad thing but it’s something you will need to consider when you’re making a decision. I know a few people that don’t want to use junior ISAs because they don’t want their children having cash that they as parents can’t fully control. Personally, I think that I would still be able to guide my children about the wise thing to do with the money and if they didn’t want my advice that would still be useful information for me to know. My approach is that because you won’t have full control over the money you might want to limit how much you put into the junior ISA so that your child doesn’t have too much money available at the age of 18. The junior cash ISA Saving into a junior cash ISA is like saving into any bank account, it earns a very poor interest rate and is therefore not a great idea at a time when interest rates are so low. A junior stocks and shares ISA The alternative option is a junior stocks and shares ISA. The value of the stock market falls and rises but when money is invested over a long period of time it tends to rise. For example if you are investing for a 10-year period or more you can have a reasonable degree of confidence that your investment pot will produce a good return – certainly a better rate than current savings rates. In podcast episode 2 you will see that my strategy is to invest £4k/year from birth to age 5 and then stop once I have put £20,000 into each child’s ISA. Once I reach that I stop and just watch the money rise and fall. My son’s £20k investment now has a value of £26,000 and he isn’t 6 years old yet. If the stock market enjoys a 10% return on average over the next 14 years he will have just over £100,000 in his stock account from that £20,000 that I invested – that is the miracle of compounding, something Einstein called the 6th wonder of the world. Even if the pot only grows at half that rate, that is at 5%, he’ll still have £50,000 – that’s a princely pot of cash that could be used for university or a deposit on his first home. How to set a Junior ISA up If you want to open a junior stocks and shares ISA there are many brokers you can use. To start off with, I would suggest you look into I have provided you with links to pages that will give you more information on the junior ISA. Personally I use Hargreaves Lansdown for my children. The fee for using the platform is 0.45% per year versus 0.35% at Fidelity. HL have a user-friendly app and have made setting up direct debits so that investing for my kids is easy. The key difference between HL and Fidelity besides the platform fee is that Fidelity also create investment products and may therefore have an incentive to push some of their own products to you. HL aren’t completely innocent though, they earn more if you invest in actively managed funds so they have an incentive to recommend actively managed funds to you. The best strategy is to know what you want to invest in. As a new investor you might want to keep things simple and put the money in low-cost diversified index funds. These are funds that are invested in many companies so you won’t be putting all your eggs in one basket. Here are example of funds that my children are invested in:

I have given you a link to each fund’s page so that you can read more about what the funds are invested in and what the fees look like. I hope this helps you kick start investing for your children. Junior ISAs do not have the government boost that the Child Trust Fund did but they are a very similar product and have much more flexibility attached to them because you can invest in a wide range of products. Even if you start of with a small amount, it will give you some confidence and you will begin to learn how the stock market works. Investing for our children is the path that got us investing for ourselves too. Good luck and keep in touch. Heather p.s. subscribe to my podcast and ask me any money question, HERE - do it now!

Hi Heather,

My name’s Harriet. Thanks for the UK-focused personal finance podcast. I feel slightly worried that I don’t have a will because of the covid-19 pandemic. I have children and some assets and I want to go about getting a will in place in the right way, please tell me what I need to think about so I get my will done correctly from the get-go. Thanks a mil.

When covid-19 hit, I started getting quite a few questions on wills and as luck would have it, I got a brochure through my door from Julia Fleetwood of the Will Writing Partnership so I invited her to the podcast. In our discussion, we covered the following questions:

My key takeaway from the discussion were:

If you would like to get in touch with Julia to learn more about wills, estate planning and getting your affairs in order, these are her details: Julia Fleetwood [email protected] Phone: 0121 472 0644 m.me/Juliathewillwriter (Facebook messenger) www.twp.co.uk I learnt a lot from Julia, I hope you did too. Heather p.s. subscribe to my podcast and ask me any money question, HERE - do it now!

Hi Heather,

Happy new year! I’m a big fan of yours and have been following you for a while. I bought all your three books. I would like to open a stocks and shares ISA for myself and two children aged 16 & 14 but I don’t know where to start due to fear of risk. I want to invest 15% of my income in stocks and also considering real estate. I have seen some recommendations like Vanguard or Hargreaves Lansdowne but I’m clueless on what to go for. I am a nurse and the only debt I have is a repayment mortgage. I just finished paying off credit card debt. I saw your post on Malawi Queens. Please help. Thank you My name’s Angela by the way.

Angela – congratulations on getting rid of all your credit card debt, you must be super proud of yourself.

And a massive thank you for supporting me by buying my books. Book sales are helping to pay for the production of “The Money Spot” podcast so I don’t take your purchase for granted – it’s really appreciated. Stocks and shares ISA When it comes to investing in stocks and shares ISAs, target a minimum investment period of 5 years and ideally your should invest for much longer than that. Is the money that you want to save for your children for university or for something else? I will assume it’s to contribute towards the cost of university. One important thing that you need to keep in mind is that although tuition fees are given to students as long as they apply for them, the maintenance loan is assessed according to household wealth; basically, children that come from wealthier households are eligible for a smaller maintenance allowance. Only children from households with a total income of less than £25,000 qualify for the full maintenance loan. In addition, students that live at home get a smaller maintenance allowance and those that attend universities outside of London qualify for a lower maintenance loan. In my opinion, the less debt children can get themselves into by the time they graduate, the more disposable income they’ll have when they land their first jobs and the faster they can save for a deposit on a mortgage. If you want to read a little more about what you might need to contribute towards university costs, have a look at the moneysavingexpert.com website. The site has a ready-made calculator that will tell you exactly how much you need to save for each child to contribute towards university. Or, for parents that don’t want to contribute then it’s how much their children will need to earn from a uni job to fill the gap. The calculator will also tell you exactly how much you need to save every month from now to make sure you have enough by the time your child starts university. Child aged 16 For your 16 year old, saving into a stocks and shares ISA is too risky because university is just around the corner – the stock market generally doesn’t offer good returns for periods of less than 5 years. The safest option for the 16 year old is probably to save into a high interest account, this might not be a cash ISA so shop around. The best rate you will find at the moment is between 1.45% to 1.65%. Child aged 14 As you could put money away for five years for your 14 year old, a stocks and shares ISA makes sense here. Again, use the calculator on money saving expert for an idea of how much you will need to contribute each month if you don’t want your children to have to work through university. Your ISA For your own ISA, you have a limit of £20,000 per year. If you prefer, you can save all the money into your own ISA rather than into junior ISAs so that you have more control over it. Money saved into a Junior ISA is legally belongs to the child named on the account when they turn 18 and you would have no control over how they choose to spend it. Risk Before I tackle where you should save I will say that you have every right to fear taking risk with your money, you’ve worked hard to earn it so you should rightfully want to preserve what you have earned. The safest path if you are investing in shares is to avoid single stocks and to invest in diversified index funds. There are two main types of fund to choose between, actively managed funds and passively managed funds. Passively managed funds track a whole market such as the S&P500 for the USA or the FTSE100 for the UK; alternatively, instead of tracking the whole market in a given country you can choose to invest in a specific sector such as utilities or technology or retail. Actively managed funds have a an actual person choosing what shares will outperform the market and investing exclusively in those. The objective of an active manager is to beat the index, while the objective of a passive fund is to match the return on an index. Now, you would think the funds managed by clever fund managers are the ones to go for, right? Wrong! History suggests that over 95% of the time fund managers do not beat the index. Not only that, fees on actively managed funds are higher. The cheapest are about 0.5% nowadays and the most expensive charge in the region of 2%. Many passive funds now charge less 0.2% or what industry professionals call 20 basis points or bps. How can you improve your risk appetite? Improve your understanding of how stock markets work. I would recommend two investment books, if you can, get the audio versions: Charlie Munger: The Complete Investor by Tren Griffin and Common Sense Investing By John Bogle (the inventor of passive investing) Which platform should you use for investing? I personally use iWeb for share dealing because they are the cheapest but I wouldn’t recommend iWeb for most people because you can’t automate your investing. That said, iWeb have good fund centre that helps you sort through the different indices and allows you to order them in different ways, for example, you can sort funds or shares from those with the lowest fees or starting from those that are enjoying the highest return down, you can also exclusively analyse the different sectors that you might want to invest in – technology is enjoying pretty good returns at the moment but I don’t put too much into tech because it’s volatile it goes up fast and can also come down fast. Even if you ultimately choose to invest using a different platform you might want to use iWeb for stock selection if their analysis tools are better than where you end up. iWeb’s fund centre is actually easier for discovery than HL – HL seem to have a vested interest in people selecting actively managed funds so those show up more prominently on their site. They don’t seem, for example, to have a tool that allows you to just look at absolutely every fund they offer ordered by fees. If I just haven’t found this function, someone please help a sister out and send me the link. So, what platform should you use? The two options you have suggested (HL and vanguard) are very different. The likes of Vanguard only offer their own funds. This isn’t a bad thing necessarily but it would mean you need to be sure you won’t want to invest any other fund manager’s products and that is a hard position for a beginner to take. The likes of Hargreaves Lansdown offer you access to a large universe of fund managers. HL don’t create funds, they are essentially a supermarket for other fund managers. It’s the difference between shopping at Aldi and Sainsbury’s. If you want choice, you go to Sainsbury’s; if you’re not too bothered about choice and want to save money, you go to Aldi, but you’re mostly only going to find Aldi’s own-brand products at Aldi – this is not a perfect analogy but it’s not a bad one. Vanguard’s passively managed index funds are known for being very cost effective but they’re platform charges are not the cheapest. At least not in the UK. The likes of Fidelity have a hybrid model: they offer their own funds and other fund managers’ products BUT if you use their tools for selecting funds, which I did to write this piece, the resulting suggestion is one of their own funds. The biggest driver for where you invest should be fees, customer service and ease of use of the platform. Fees Platform fees are the fees you get charged for using a given platform. Vanguard 0.15% HL 0.45% (if less than £250k and 0 if > £2m) iWeb 0 Halifax £12.50 Fidelity 0.35% Either way, if you have less than £50,000 invested the differences in fees aren’t that dramatic but as you start approaching £250,000 in investments you will feel the difference. Once you have £250k invested, and trust me you will get there, on iWeb you would be paying £60/year (if you trade once a month) and on HL you would be paying £1,125 for the same assets invested. Little tip, because I invest for both my husband and I, instead of splitting monthly investments in half, so half goes to his account and half to me, each month I do one trade for either me or for him so that the net result is that we do 6 trades each. This saves £60 in dealing costs every year. Obviously I could save even more by doing one trade a year but as our incomes are paid monthly it’s better to invest monthly rather than just keep the money in a savings account for one trade at the end of the year. I’d lose all the gains I make within the year. Transaction fees are the fees you pay for buying an investment product – these can be a fixed sum or a percentage. Some platforms will have one charge for buying and selling shares and another for funds. Vanguard depends on the product – 0.02% to close to 2% HL 0 for funds, £12/share falling to £6 a share for 20 trades + iWeb £5 Halifax £12.50/share or £2/month for scheduled investment Fidelity £10/share or £1.50/month for scheduled investment Because Fidelity’s platform fees are cheaper than HL, I am tempted to recommend them but I think you should make the decision. Why don’t you spend an hour a day on each of the following three site: HL, Fidelity and Halifax. Download their apps and see what you think of them. If by the end of that analysis you’re not sure then I will suggest you use HL as a beginner and as you figure out how things work move platforms, it’s very easy to do that. Also, it’s worth mentioning that I pulled a couple of funds that I invest in on Fidelity and you pay more for them via Fidelity because HL negotiates discounts with actively managed funds due to the volume of business they direct their way. NOW – I have spoken a lot about investing as I felt that that’s what you wanted me to focus on but I think this discussion would not be complete without me saying that, ultimately, if the stock market scares you, then you can go the property route. Property There are many strategies you can follow with property. You can rent to families, or students or even another subset of people. One of my friends specialises in letting property to truck drivers. Letting to students or a migrant group like truck drivers has high turnover which means you need a lot of time to manage the property. And if you went down the AirBnB route that’s like managing a hotel because you have to think about changing sheets and cleaning literally week-on-week – as involving as it sounds, I have a friend who has a full time job as a professor and has also grown a good property portfolio on the side with a mix of AirBnB and family lets. The key is to start with your first property. Have you heard of the 3 for 1 property strategy? With this strategy you set a goal of investing in 3 buy to let properties and you work to have all mortgages paid off by the time you retire. This would mean that you live in one fully paid off house and you would live off the rent of the three properties – this reduces the risk somewhat. For each buy-to-let property you would target a given amount of rental earnings that you can choose yourself . For example if each property earned £800 per month, then you would retire on £2,400 / month. This would be linked to inflation because as prices rise, rents also tend to rise and sometimes rental increases rise far faster [example]. If this feels safer for you and you have at least 20 years until retirement then think about either just going for the 3 for 1 property strategy with a good lump-sum saved in a savings account for emergencies might feel less risky OR follow a combination of investing small amount in the stock market with property as your security blanket. Massively enjoyed answering this question, Angela, especially from a fellow Malawian. It’s nice to know other people are investing and getting wealth focused. Let’s summarise what you need to do:

I hope this helps! Heather Have a money question for me?

If you have any personal finance questions send them to [ME] – I will answer whatever piques my fancy via a blog post.

Once you have decided on an investment strategy for yourself or for your children you need to decide where to invest and what to invest in. WHICH PLATFORM TO USE FOR INVESTING Choose a platform that has the lowest fees for the highest convenience. Fees change over time but when I was deciding on a platform I found these articles:

In the end, I chose iWeb for myself and Hargreaves Lansdown for the children’s investments. Why iWeb? I chose iWeb because annual fees are zero (after a £25 account opening fee) and you only pay £5 per transaction. As I only transact once a month (on pay day), our annual household fees are £60 and if you consider that I only transact on either my account or my husband’s account in any given month, then we are only paying £30/year per account. More than fair. The main problem with iWeb is that they don’t do junior ISA and you can’t automate investing. I don’t mind manually investing for my and my husband’s ISAs because we invest different amounts in different funds each month. Why Hargreaves Lansdown? They do junior ISAs, they have a good app and you can fully automate all your investing – their customer service is also pretty good; if you call you will get through to a human pretty quickly. Ultimately, I don’t expect the children’s ISAs or pensions to have a value greater than £100,000 before they’re adults so a platform with a percentage fee will tend to be cheaper than one with a fixed fee. When they’re older I’ll advise them to move to a cheaper platform. Which platform will work best for you? Unless you’re an investment buff that actually enjoys making monthly investment decisions, I recommend you choose a platform that allows automation, possibly Halifax share dealing or Cavendish; one of my friends recommends Fidelity. For children, transact within a junior ISA. For yourself or partner, an adult ISA. If you can invest more than the annual limit then use the ISAs first before transacting via a taxable account. WHAT SHOULD YOU INVEST IN? Unless you have a lot of time to research different companies, I would only invest in low-cost (passive), well-diversified mutual funds such as an S&P500 tracker or a FTSE100 tracker. Passive means the fund is not actively managed, it just follows the stock market so your return is essentially the average market return. Research suggests that actively managed funds (ones where a ‘clever’ manager stock picks) generally underperform the market in the long-run. My long-run strategy is to have 70-80% of my money in (safe) passive funds and 20-30% in actively managed funds. ETFs? I don’t do ETFs – I think funds make more sense. Over to you. Have a question? If you have any personal finance questions send them to [ME] – I will answer whatever piques my fancy via a blog post.

Hi Heather

I just had my first baby. I'm 31 and married. Do you have any tips for how I can think about saving and investing for my baby? Thanks, Diana Hey Diana, This is an awesome time to be asking me this question. I also started planning for my first baby as soon as he was born. You will be at an advantage if you start saving and investing for your children as soon as they are born. You will need to balance what you can afford with what you want to achieve for them. Firstly, what’s the goal? What are you saving for?

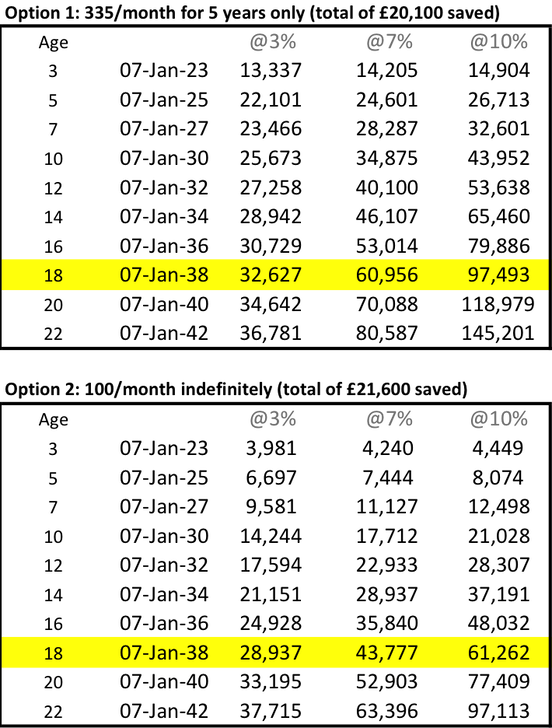

1. UNIVERSITY University costs c.£60,000 in tuition and living costs for a 3 year course at the moment - £10,000 for tuition and books, £10,000 for living – living costs can be higher or lower depending on whether you live at home, etc.. £60,000 is a huge amount of money and this cost is likely to rise in the future but it makes the maths too complicated to think about possible cost increases. Option 1 for university savings If you can save £20,000 in a tax-free account like a stocks and shares ISA by the time your child is 5 years old, then you can stop putting money aside and this money will have a reasonable chance of growing to £60,000 by the time your child is 18 years old. How could you save this £4,000 per year? Perhaps you could target saving a round amount like £250 per month (equivalent to just over £30/week each for a two-income family) and because this sums to £3,000 a year, at the end of the financial year you’d hustle to throw that extra £1,000 into the ISA before the financial year closes on 5 April. Or, if you can afford it, you could just save £335/month and you would save just over £4,000/year. Option 2 for university savings £4,000 is likely more than most can afford. The alternative is to save £100/month until age 18 which most people can afford even on the median household disposable income of £29,400 (2019). It’s equivalent to about £12.50/week each for a two-income family). Which option is better? I would say option 1 trumps option 2 because you give the money the best chance of growing. Equity markets are volatile in the short-run so by saving the money early you give the money a better chance of reaching your goal. That said, something is a lot better than nothing: small savings add up to large amounts over time. Your savings may be lower than you would like to target but you will still help your children avoid the full scourge of student debt. These are the results under each option:

Caveats on saving through a Junior ISA:

When you save the money through a Junior ISA, that money will be theirs when they hit 18 and you might not be able to control how they spend it. However, putting it into the Junior ISA means you won’t be tempted to spend it yourself because once the money goes in, it can’t be withdrawn until your child is 18. How can you avoid the Junior ISA so you have more control over the money?

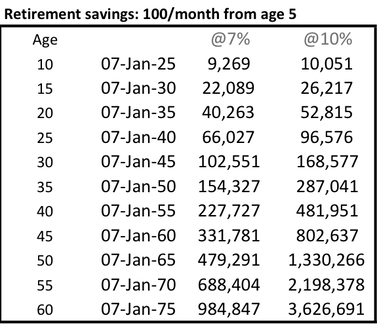

Plan b. is a good option because you could end up not having to pay tax anyway: The capital gains tax allowance in 2019-20 is £12,000. That is, you have to make a capital gain (the profit on your investment) bigger than this to pay the tax. If you save the £4,000 across two investment accounts - £2,000 in an investment account with your name and £2,000 in an investment account with your spouse’s name then when your child is 18 you can sell enough stock each year to keep the capital gain below the capital gains tax allowance. The risk however is that this threshold could fall or be completely removed in which case you would end up paying more capital gains tax on the sale. It’s still a sensible option, despite this risk. 2. RETIREMENT If you followed option 1 for university savings, at age 5 you’ll have stopped doing that and might find that you have some spare money to open a retirement account. Your children will not have access to this money until they are 57 to 60 but if life hasn’t worked this will be a great cushion for them. The beauty of investing in a retirement account is that for every £1 you put in the government puts in an extra 100/80. That is, if you want to save £100/month you only need to put £80 into the account. If you do invest £100 it will be £125/month with the government top up. For kids you can put a maximum of £2,880/year (£240/month) which equals £3,600/year. This is the result if you choose to save £100/month indefinitely into your child’s Self-Invested Pension Plan or SIPP starting from when they are 5-years old:

You notice that the extra £25 from the government makes a real difference. By saving through the pension, based on a 7% return, on 7-Jan-2025 the investments are worth £9,269 rather than only £7,444 without the government top-up.

Don’t save into a child’s retirement account unless you have the cash flow and are meeting your own goals, e.g. paying enough into your own retirement, paying off your mortgage early and ideally, are debt free yourself (apart from the mortgage). Some will be able to afford the full £240/month from birth, the rest of us have to work out what is realistic, that is why I personally opted for the £100/month from age 5. This decision will change with a change in your fortunes. 3. HELPING YOUR KIDS BUY A HOME This is where the decisions get a little tricky. Some people will be able to afford funding university, helping their children get ahead with retirement savings and help with a deposit on a home without compromising their lifestyle at all but the rest of us need to make choices. Private school vs. saving for a home What will make the biggest difference to your children: a private education or getting onto the property ladder? If you can afford one or the other but not both, then you might follow the route of private primary school followed by state secondary school (grammar/comprehensive). In this case you’d direct all the money you would have spent on a private secondary school education on saving for a home. In some cases this might mean your child starts life with a mortgage free home. If you save £15,000/year (£1,250/month) from age 11 until age 21 (10 years of saving) and it grows at an average rate of 7%, how much money would your child have at 21? About £220,00 – increasing to £260,000 if the average return over that period is 10%. This is not small money to most of us. You could use every last cent on a private education when at the end of the day the thing that helps your child follow a life of fulfilment is being relatively debt free. If you decide to go for a state education throughout and save £1,000/month (£12,000/year) from age 5 (when you are done with university saving) until age 21 (16 years of saving) and it grows at an average rate of 7%, how much money would your child have at 21? About £355,000 – increasing to £475,000 if the average return over that period is 10%, wow. Forget the children, you could be doing this for yourself! If you have already made the decision to send your children to a private primary school and they are thriving, you are unlikely to reverse that decision. If I you are seeing these numbers before making a decision, you might well make a very different decision… Not thinking about private education, anyway? If private school is not a consideration for you, then the best choice might be to save as much as you can towards your own ISA allowance of £20,000/year (£40,000/year in a two parent home), in addition to whatever you save towards your pension (I recommend 10-15%) and when the time comes you can decide whether you can contribute towards university or a first home or both. The best gift you can give your kids is possibly to be independent in old age so they don’t have to worry about taking care of you. You can boot strap them onto the property ladder by letting them live at home rent free – so that they can save more for their deposit. Even without cash gifts, you will be giving your children a competitive advantage by teaching them how to handle money at an early age. Starting to invest Next, you need to consider what platform to use for investing and what to investing in? If you have any personal finance questions send them to [ME] – I will answer whatever piques my fancy via a blog post.

|

Heather on WealthI enjoy helping people think through their personal finances and blog about that here. Join my personal finance community at The Money Spot™. Categories

All

Archives

September 2023

|

Heather Katsonga-Woodward, a massive personal finance fanatic.

** All views expressed are my own and not those of any employer, past or present. ** Please get professional advice before re-arranging your personal finances.

RSS Feed

RSS Feed