|

Hi Heather,

My name’s Grace. I recently started investing in stocks and shares and want to know the type of returns I should realistically expect? I’m especially interested in how long it will take for my money to double in value. Thanks

Great question Grace, thank you for asking it.

I will start by telling you a little story. When I first started working, I didn’t believe in long-term investing on the stock market. My philosophy was that you buy shares at a good price and when the price has gone up high enough, you sell, take the profits and move on. You know, the buy low, sell high philosophy. My philosophy has since changed. I believe you should buy shares and ideally never sell them except to manufacture a dividend while you are in retirement and I’ll give you two experiences that turned my thinking on this so radically. In about 2006, I bought about $2,000 worth of Apple shares. The price at the time was $70-something. I sold a couple of years later when the price had trebled feeling like a complete winner. If I had held onto those shares they would now be worth about $30,000 (maybe more, it hurts too much to sit down and calculate the exact amount) AND I would have additionally enjoyed about 14 years of dividends from Apple which I would have reinvested back into the stock as I always do. Note that the price you see now shouldn’t be compared to the price I paid directly because Apple had a 7 for 1 stock split in 2014. The way that works is that for every share you own, they split it into 7 shares and the price for each becomes one-seventh of what it was. The lower price is designed to make buying shares more palatable to smaller investors. Anyhow, had I held the shares to retirement, I could have either benefitted from the dividends to support my living or sold them slowly for income to support my lifestyle in retirement (this is called manufacturing your own dividend). FYI, I’m only 36 so retirement is still a while away for me as I enjoy working and don’t plan to stop working for a while yet. The second story is what happened to my pension savings from a job I had that had a defined contribution plan – this is a retirement plan that depends on how the stock market. Unlike the traditional workplace pensions the income in retirement is not based on a fixed formula. Anyhow, I didn’t know much about pensions at the time but a colleague called Karen Matthey told me that even if I didn’t believe in pensions I should pay in up until the match “because it was free money” – I think the company matched contributions into the pension scheme up to a maximum of 3%. I didn’t even know what “up until the match meant” – I was 24 and clueless but I listened to her and did just that. By the time I left that job in 2012 I had just shy of £30,000 in my pension account and within 5 years that had grown to £60,000, that is, it had doubled. I didn’t expect this performance at all and it’s at this point that I started taking the whole investing long-term thing seriously. Now, this made me curious to find how long it takes for an invested amount to double, which is exactly what you’re asking, Grace, and it’s at this point that I discovered what they call the rule of 72. With the rule of 72, you take the investment return you expect, divide it into 72 and that’s how long it will take for you money to double. So, if you expect a 10% return, then your money will double in about 7 years. (72/10); if you expect a 7% return then you money will double in 10 years, it ‘s a very easy calculation. Because my money doubled in 5 years, it’s also quick to calculate that I earned an average return of 14.4% (72/x = 5). And keep in mind that I wasn’t invested in anything fancy: all my money in this pension was in a passive global equity tracker, it still is – and my old employer pays all the fees so I just let that pension pot sit there, I can’t touch it until I am at least 55. If that money earns at least an average return of 10% (this is the actual historical stock market return), then over 21 years the money will double three times: 60k will double to 120k in 7 years (that’s by 2024, and it’s actually growing faster than this right now) which will double to 240k 7 years after that which will double to 480k 7 years after that (that’s by 2038 when I’ll be hitting 55). That’s insane, all from an initial 30k investment! After I figured this out I was annoyed at myself for not taking the stock market and pension investing more seriously and I’ve been making up aggressively for the last 3 years. At the end of the day though, it’s not about crazy returns for me, it’s about making a commitment to investing healthy amounts monthly. It’s very hard for most people, my younger self included, to believe that even £100/month invested over 30 or 40 years will amount to much but it is really surprising how these small amounts add up. What stock market return should you expect? There are no guarantees in the market, but the 10% average has been remarkably steady for a long time. That said, from year to year returns are very volatile. You will only get the average market return if you buy and hold, do not try to time the market. Personally, I model my investments in excel based on a 7% gross return (gross return meaning the return before adjusting for inflation) this would be about 4% after inflation of 3%. My general reading suggests that expecting a return after inflation of 6% is realistic: my 4% net return is therefore not over optimistic. If the experts are telling you to expect a real return of 6% that would make it a gross return of 9% because inflation tends to average 3%, using the rule of 72 you would expect your money to double every 8 years. Simples. To ensure you end up with enough money in retirement, perhaps base your returns on a lower number so that either you end up with more money than you need or so that you can retire early because you reach your goal much sooner. Key takeaways?

If you are enjoying listening to my podcast, please give me a 5* rating wherever you listen to podcasts. If I don’t yet deserve your 5*, please let me know how I can earn it. I hope this helps! Heather Have a money question for me?

If you have any personal finance questions send them to [ME] – I will answer whatever piques my fancy via a blog post.

0 Comments

Q&A: If You Want To Diversify From Real Estate, Property & Land, What Should You Invest In?17/8/2016

Dear Heather,

Greetings from Chengdu, China; I love your vlogs and I enjoyed watching your birthing story and recent vlog on how to make money. You are so inspiring and motivating. You inspire me. On the recent vlog you discouraged investing on the stock market. Why was that? My husband and I have invested in properties in America and are looking at buying one in China since we will be here for the next four years. We have also been eyeing property in England. My question for you is since we want to diversify our portfolio from real estate and land what do you recommend? You have the cutest family and gorgeous son. My son is [] months and has been keeping me very busy. Looking forward to hearing from you when you have some free time. Best Regards, Faith

Dearest Faith

Thank you so much for your lovely email. I really appreciate everything you say, it keeps me motivated and keeps me wanting to work. Children do keep you busy but they're so enriching :). The first thing I thought when I received your email last week was, what on earth are you doing in Chengdu, China? (email me for privacy) I am always super intrigued re. what black people do when they’re in Asia but not studying…I’d love to learn more about that. Anyhow, back to property. Firstly, I hope you have made the very low investment in my property course, the price will go up soon so get in while it’s cheap! This is how I think about investing in general. Firstly, I am working towards a given gross rental income per month of £10,000 from a UK/Europe and US portfolio. We don’t currently have anything in Europe or the US but I’m eyeing both up. After mortgages are paid off 90-95% of this will be pure profit. I could easily reach this in the next three years if I include income from rents in Malawi but I discount that income because the country has a lot of political and economic instability and it’s possible that something could happen that completely erodes the rental income. Based on this methodology, we’re roughly half way. If you invest in China you might want to apply a discount too given they’re legal framework may not be as solid as that in the US or UK. That said, they are definitely much more stable than Malawi so invest away. Keep in mind that investing in real estate in different areas and countries is also diversification. There are four main reasons I find property so attractive:

1. Leverage magnifies returns

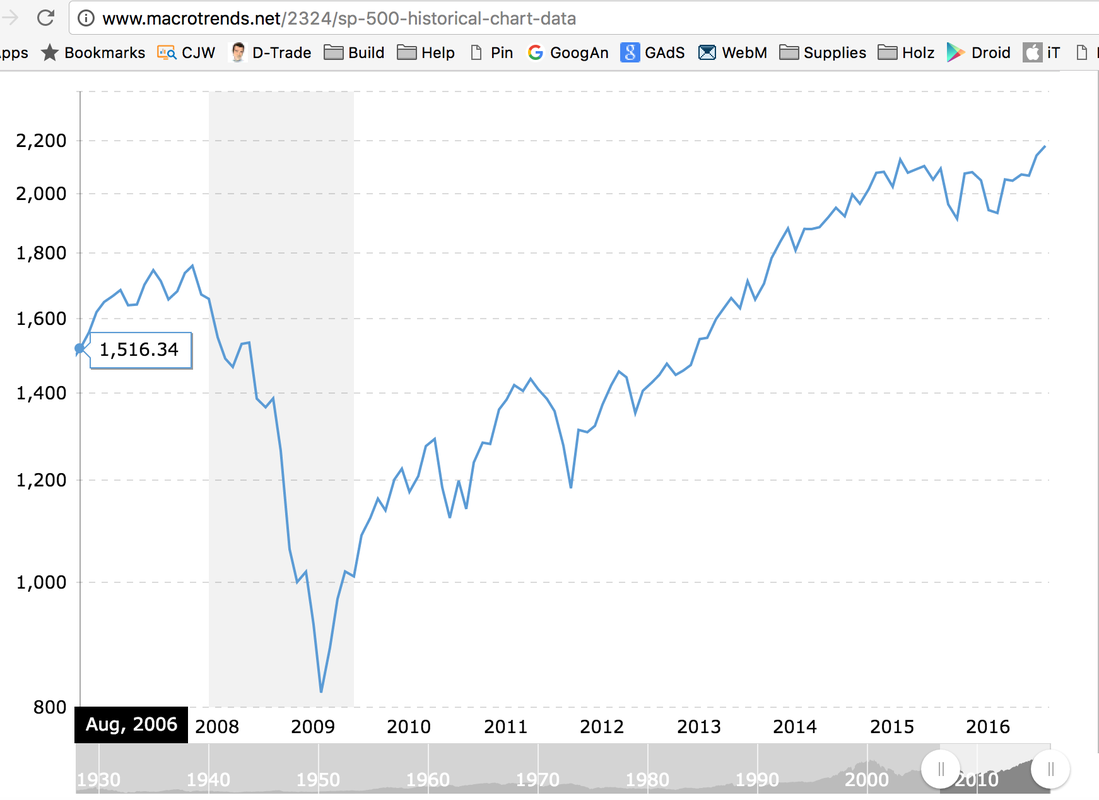

Just to give you an idea of what I mean. The first property I bought cost me £16,500 including a 5% deposit of £12,500. Stamp duty of £2,500 (this is a UK property purchase tax) and about £1,500 in other costs. That was 2006. Fast forward 10 years and the current value of £550,000 meaning a £300,000 capital gain and a gross equity value of £400,000 including what’s been chipped off the mortgage. No other £16,500 investment could have produced that kind of return for me. Firstly, no one would have given me cheap leverage to invest in the stock market and secondly, the returns would have been rubbish – to use a technical term. An investment tracking the FTSE100 would have me worse off; I’d have roughly the same £16,500 today eroded by 10 years of inflation. An investment tracking the S&P500 would have given me £23,700 today, 16,500 x (2178/1516), this is good but certainly far from £400,000. FTSE 100 from 2006 to 2016S&P 500 from 2006 to 2016

2. Reduced saving burden

We don’t spend rental income. This means after interest has been paid off, every month, my tenants are effectively saving for my retirement on my behalf. Currently, that’s about £2,000 worth of savings before tax. Very few investments can do that for you. 3. Easy release of value without impacting the investment I remortgaged this property and took out £80,000 to invest in a business. This doesn’t affect the property’s value in any way and isn’t taxable because it’s a loan not a sale of equity. If you sold some stock to get some money for another investment, firstly, you would have fewer shares so the overall value remaining would be lower and whatever you sold would potentially be subject to capital gains tax. 4. Stability Even accounting for short-term falls in value, property is very stable. Even if you don’t see an increase the value of your real estate investment you would still have the rental incomes. Provided you invest were there is demand for rental properties by tourists, students or families, you have secured an income for yourself in 25-years’ time if not immediately. Now, once I reach my target rental income of £10,000 what will I invest in? STOCK MARKET & ANGEL INVESTING

While I used to invest in single stocks in the past, I no longer do so as I think that long-term investing into diversified index funds is much, much wiser and definitely safer. This view has been informed by tonnes of reading and more experience in investing.

The next few paragraphs written in 2016 illustrate how I used to invest in 2006/7 when I was a newbie with zero experience - I no longer invest in this way but I share this anyway: When I used to invest in the stock market at the beginning of my working like (2005 to 2010), I had no education in investing and my methods were quite time consuming but the time spent made it feel less like gambling and more like investing: I’d download data on the main stock indices from Bloomberg (FTSE, S&P, Hang Seng, etc.) For each share I'd have the following data: 52-week high, 52-week low, P/E ratio, current price and other vital stats to try and identify a company that was undervalued. I’d also think of industries that I thought were growth industries and look at new companies in the sector. For instance, I once invested in a solar company and an Asian company because Asia and renewable energy were/are both growth areas. I sold my investment in the solar company (a German company called Phoenix Solar) when I tripled my money to £3,000. If I still had those shares they would be worth like £300 – the company is down badly. I sold my shares in Citic Pacific (the Asian company) in 2011 just about recovering my money and if I’d held on for 10 years, my £1,000 investment would be worth £750 – 25% down. Single stock investing is very risky especially if investing is not your full time job so you don't have time to go into great deal - reading annual reports and other regulatory filings. Citic Pacific from 2000 to 2016

I made a great investment in Apple in 2006. I sold when I had tripled my money. If I’d held on to my Apple shares until it hit its peak my £1,000 would have reached a £15,000 in value – kaching! That said, if I still had the shares they would be worth about £10,000 today because Apple is down from its peak.

I actually didn’t lose much money investing in the stock market. Citic Pacific and Yahoo were sold roughly were I bought them and Phoenix Solar and Apple were sold after tripling my money. The only complete loss was a bank called Northern Rock. I bought £1,000 when the share price was crashing in the belief that the UK Government wouldn’t let it fail. I was right, the UK Government didn’t let them fail but all shareholders lost all their money. Stock markets go up and down in an unpredictable fashion. This is why I prefer to have a base of rental income from property before dabbling in the stock market. However, if you are investing in the stock market for the very long term 10+ years, and also in well-diversified funds, I think it is a sensible place to keep money safe and earn a decent above-inflation return. BUSINESS

Finally, I invest time and money in creating businesses. Whilst business is also speculative there are many low risk businesses that can bring a stable income.

For example, creating courses online doesn’t cost too much money and once you recover the investment it’s fairly easy to maintain a steady income from the investment. With physical products you might invest more but if the investment fails you normally gain knowledge that will help a future business grow. Business is by nature speculative but the upside is fairly unlimited and you have more control over that upside than you would with an investment in shares. CONCLUSION

My personal strategy is to have enough retirement income coming from property to cover all my needs and some of my luxuries and the rest coming from my stock portfolio. So I focused my early investing on property and started diverting more savings into stock market indices when I was comfortable with the rental income we were generating.

In addition, I love writing, sharing knowledge and business in general so I pump lots of energy into these activities because I believe they produce a good return in the long run and even if they don’t, I thoroughly enjoy engaging in these activities.

Have a business or life question you want me to answer? send me a message.

|

Heather on WealthI enjoy helping people think through their personal finances and blog about that here. Join my personal finance community at The Money Spot™. Categories

All

Archives

September 2023

|

Heather Katsonga-Woodward, a massive personal finance fanatic.

** All views expressed are my own and not those of any employer, past or present. ** Please get professional advice before re-arranging your personal finances.

RSS Feed

RSS Feed