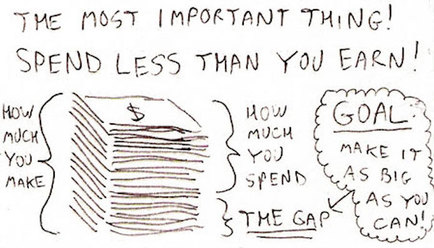

Your spending will always expand to match your income unless you specifically plan to live beneath your means. You can do this as a lifestyle choice or for short periods of time to save for something you really want. Shop around to save money on the things that you buy regularly – buy in bulk, get products where they are cheapest instead of just going to your favourite shop, use coupons and take advantage of discount days at local stores. However, there are some things that you can live without completely;that is the topic this blog. We get so used to buying what we always buy that we don’t usually stop to contemplate what’s necessary and what isn’t. To help you think through your own shopping list I’ll go through some things my friends and I cut back on to save: Rent You could live in a cheaper area and save thousands immediately. I did this when I first started work. I was spending almost half what my peers were on rent just by living a little further out of the city. Of course, many of us are unwilling to compromise here so we have to look at the small stuff. Juice! For what you get, it’s not cheap at all. I was having a chat with one of my best friends about cutting back and she said, “Can you believe it, we’ve even had to stop buying juice!” I was like, “You were still buying juice? I stopped buying juice ages ago because it contains way too many calories. I’ll only buy it if I have guests coming.” I also find juice to be poor value for money besides being completely unnecessary for the weight conscious. Juice packs in a lot more calories than one might suspect. Restaurants We spend A LOT of money on eating out every month. I personally find it very hard to cut back because I think of it as a “treat” after a week of hard work. However, right now my husband and I have just spent a small fortune renovating a flat that we just bought so we’ll use that thought to spur us on during our financial fast in September. To stick to our resolve we add“treat foods” to our shopping list to encourage us to eat at home. For example, buying a frozen pizza that you just stick in the oven when you feel lazy is a lot cheaper than going out for pizza. We wouldn’t normally buy this type of food because it’s not healthy but it does the job of keeping us at home when we want to eat out. Meat News flash: you don’t have to eat meat every day. Some people would think this is unthinkable and perhaps an utterly ridiculous suggestion but it’s true. If your partner is against this suggestion remind them that desperate times call for desperate measures. You can also cut back by eating less meat rather than cutting it out completely. For instance, unless it’s a very small chicken I only ever eat one chicken piece, I find two to be excessive. If everyone in your home has two pieces your chicken will immediately last twice as long by enforcing a one-piece rule. The same goes for sausages and other meats. I normally cook minced meat with beans to bulk it up. Less meat means a heavier wallet and a more attractive waist line! You could go for offal aswell. Liver, oxtail and tongue are delicious. Body Products & Makeup There are so many options here. If you use a range of upmarket brands explore supermarket “equivalents” to see if they work just as well. You could save a tidy fortune here. Take a close look at what you tend to spend money and see what else you could do without. Magazines? New shoes or clothes? And so on. “Cut back on your rent or cut back on what you spend on food but never worry about investing money in a good book.” Robin S. Sharma  Want to Build a 6-Figure Beauty Business from the comfort of your sofa? Then my course is designed for YOU! "Beauty" includes a WIDE range of products from the not so obvious non-perishable foods and crafts to the more obvious hair, makeup, fashion, health & fitness.

3 Comments

Okay, so I’m sat on a train trying to mind my own business. I’m sat with other people that all know each other: a mum, a daughter and what appears to be a family friend. Now, anyone who knows me knows that minding my own business is not exactly a forte, I love to take part in conversation but I was feeling a little tired. Well, that was until the daughter tells her mum that her sister and brother-in-law still do things like remind each other: oh, you still owe me for that burger two nights ago or that meal last weekend. I was aghast! “Are they married?” I suddenly butted in and the daughter laughed, “Yes, and they still operate all their finances completely independently”. The train was coming to a stop so I didn’t get to dig in deeper except for the fact that they didn’t even own a joint bank account for household expenses. As I walked off the train I started thinking about what my mum told me: avoid stingy men – they’re not only stingy with their money but they try to control how you spend yours or make such strong value judgments about the way you spend that it causes a lot of bickering. My mum is a smart gal. If you’re trying to start or grow a business having a stingy husband will hold you back for the following reasons:

Overall, a stingy man will just make running a business less enjoyable. The risks involved are already nerve wracking – anything worth doing will make you nervous – and having a constant force around you that is not supportive will make you feel like pursuing your dream of a business is not worth it. If you think you’ve got the entrepreneurial streak and identify that your man is stingy before you marry him, then this is one of those instances when I’d agree with my mum and say: run girl run. You deserve better! That man will kill your business before it even starts. Without the moral support of my husband I would be nowhere. Yes, you can build a booming business despite negativity around you but why should you have to?  Want to Build a 6-Figure Beauty Business from the comfort of your sofa? Then my course is designed for YOU! "Beauty" includes a WIDE range of products from the not so obvious non-perishable foods and crafts to the more obvious hair, makeup, fashion, health & fitness.  Everyone loves free stuff – it’s human nature; we all have limited resources so if you can obtain something without using your own resources, it pleases you. However, the ubiquitousness of free stuff nowadays has led to some people loving freebies to a fault…let me explain… Have you ever wondered why a good majority of the time when people get something easily they seem to lose it just as easily. For instance, people who’s source of income is crime never seem to get rich except for temporary periods of time. For those of us that abide by the law, when we download free ebooks or get books for free we don’t read the majority of them. I swear, I have loads of free books that I got off Amazon and 80% of them haven’t been read. Of the books that I have paid for, and I have many of those too only one hasn’t been read even after a year and I keep thinking I need to read it. Well, there is actually a scientific reason for this. People who study human behavior and how the brain functions call it negativity bias: people give a lot more weight to losses and negative events than they do to positive events. What does this mean for your life and business success? If you feel you have invested in something, especially learning something new, you’ll take it a lot more seriously. There are two ways you can invest in knowledge: either with money or with time. TIME If you decide to learn something using all the free internet resources available, even if it’s quite simple you will not find all the information in one place. You’ll likely have to use several sources to figure out whatever you need. You value your time and having done the hard work to understand something you’ll be sure to implement it into your life or business. MONEY I’ll give examples from my own life. In 2010 I paid about £300 ($500) for an online writing course. You were set 10 pieces of work but only received subsequent installments when you completed one set of work. Five years later I still haven’t done 80% of the course. Admittedly I was an employee when I signed up to the course and therefore was time poor and I was also on a huge, 6-figure salary so the investment of £300 wasn’t significant to me. Fast forward to 2013. I wanted to join an entrepreneur networking group and program but the fee was £7,000 ($12,000) and I didn’t have that money free. I saved for 6 months and joined the program and to-date I have never taken anything more seriously. I did all the work set to A* standard and I never missed a networking day. That was a lot of money to me and I wanted to get my money’s worth.  One of my favourite authors Grant Cordone expresses exactly the same thought in If You’re Not First, You’re Last. Whilst time and money are two key ways you can invest in something there are other factors that can drive you such as guilt or a coach that pushes you. GUILT As a teenager I always felt guilty that my parents were investing so much in my education so that pushed me and it does push many other people. The education was free to me but it was costing someone that I love (mummy and daddy) dearly and that was enough to push me towards success. GIVING KIDS TOO MUCH There is also a common trend in which one generation works hard to build wealth and subsequent generations lose it. The explanation is the same. The parents invest a lot of time and money building a business and personal asset base. They know the pain of their work and they don’t spend that hard earned cash without careful thought and planning. Their children enjoy the fruits of this labour but have no real connection to the pains their parents went through or the poverty their parents might have grown up with so that wealth is free to the children. You can’t really enjoy the sweetness of success without some concept of the pain of hard work. If someone does all the work for you, you don’t have any real goals to get you out of bed every morning. You don’t care about preserving the wealth that someone else created as much as you would if you made it yourself. In summary, if you want to achieve real success you probably have to roll up your sleeves and get your elbows dirty. Unfortunately that’s the only way success comes. Free stuff won’t take you very far. If you’re so into free stuff that you fail to see the value that exists in many paid resources then it could be the reason you’re stuck in a just-over-broke (j.o.b) cycle. Thomas Edison said it best when he said, “We often miss opportunity because it's dressed in overalls and looks like work.” I’ll change this a little to apply to this new world where many people want things for free by saying, we often miss opportunity because it requires us to invest time or money. As always, if you’re interested in building a 6-figure product business, check out TheMoneySpotProgram.com.  Want to Build a 6-Figure Beauty Business from the comfort of your sofa? Then my course is designed for YOU! "Beauty" includes a WIDE range of products from the not so obvious non-perishable foods and crafts to the more obvious hair, makeup, fashion, health & fitness.  Spending normally involves small amounts at any one time but an investment normally involves a chunky cash out flow all in one go. Investing is scary, it’s more risky and as such it’s easier to just not do it. I was thinking these things when one of my friends was telling me about how she wanted to invest in a personal development program but thought it was too expensive. It was going to cost her about £2,000 ($3,200) which is a lot of money to spend in one go but if that £2,000 helps to build a business that produces £2,000 worth of profit every month faster then it’s not a big deal. In fact, it’s a fabulous investment. Now, I started thinking about spending vs. investing because I know my friend’s spending habits quite well. On average:

These are not necessities, they are her life’s pleasures. I’m not even counting dinners because let’s face it, a bit of socializing is necessary, it’s just a matter of picking places that don’t break the bank.  Anyway I would conservatively estimate that £40-60 is spent weekly that wouldn’t hurt her to completely eliminate – if you annualize this – I’m a big fan of annualizing –that’s over £2,000 to £3,000 a year. However, it never feels like that when you’re spending it in £3 to £10 increments. That said, you need to spend money wisely: there are a lot of great courses out there but you need to do the one that is relevant to you at that time before moving on to the next. I make it a point to do at least one course every year. When I worked in investment banking I did courses for fun (for example, I did a course in Black History, another in Aromatherapy and Massage, an art class etc.) and ever since I quit the rat race in early 2012 I have focused on courses that help the business. Anyhow, the main point I want to relay here is that you should analyze the return you get when spending money instead of the absolute amount. A suit can be an investment if it helps you get that high-powered job but most of the time, expenditure on clothes is not an investment. Do courses for fun to see how they help to develop your creative side. Indeed, spending less time doing what most people do, like spending lots of money on complete rubbish, can only be good for you. Invest instead.  Want to Build a 6-Figure Beauty Business from the comfort of your sofa? Then my course is designed for YOU! "Beauty" includes a WIDE range of products from the not so obvious non-perishable foods and crafts to the more obvious hair, makeup, fashion, health & fitness. |

Heather on WealthI enjoy helping people think through their personal finances and blog about that here. Join my personal finance community at The Money Spot™. Categories

All

Archives

September 2023

|

Heather Katsonga-Woodward, a massive personal finance fanatic.

** All views expressed are my own and not those of any employer, past or present. ** Please get professional advice before re-arranging your personal finances.

RSS Feed

RSS Feed