|

Hi Heather,

My name’s Reena, I’d really like to know what my spending looks like relative to the average person, can you do a blog post or podcast episode on that? Thanks.

Great question Reena. At some point, everyone wonders: how do other people spend their money? Do I spend much more money on food or eating out or rent than other people?

Well, we keep pretty good records of this in the UK so this is what I found out from the office of national statistics website, hereafter, I’ll just call them the ONS: The numbers on spending can change a fair amount from one year to the next. The ONS releases a report of the UK’s household spending each year. For 2015/16 the average household spent c.£530/week, in 2016/17 it moved to about £537/week and in 2017/18 despite all the Brexit drama it shot up to £573/week. That it’s the highest it’s been since 2005. £573/week translates to £2,483/month per household. Basically, if your household spends more than £2,500/month before accounting for the portion of your mortgage that pays off the mortgage debt, then you spend more than the average household. This rate of spending translates to just under £29,800/year but median household income was about £29,000 in FYE 2018 so spending slightly outstripped earning – no mega news there. Average household size in the UK has remained at 2.4 people for over the decade – so it’s pretty stable. An interesting factor about spending is that it can frequently bear little relation to earnings so some people spending this amount will be relatively well off and could spend more but they choose to live beneath their means and some people spending at this level will be persistently spending more than they earn by taking on debts, e.g. by renting cars via leases or buying them via hire purchase agreements and so on. Threes notes for you:

Sidebar: the UK financial year starts on 1 April and ends on 31 March and the tax year starts on 6 April every year and ends on 5 April… In the FYE 2018:

TRANSPORT In 2017/18 households spent £81 a week on average on transport – that’s about £350 per month. HOUSING The average UK household spent £217/month on housing and if you deduct housing benefit and related allowances this was only £156/month. Utility costs per month were: Electricity, gas and other fuels: £98 Water £40 Maintenance and household repairs £36 Total to housing is therefore: £330/month (156+ 98+ 40 +36) FOOD

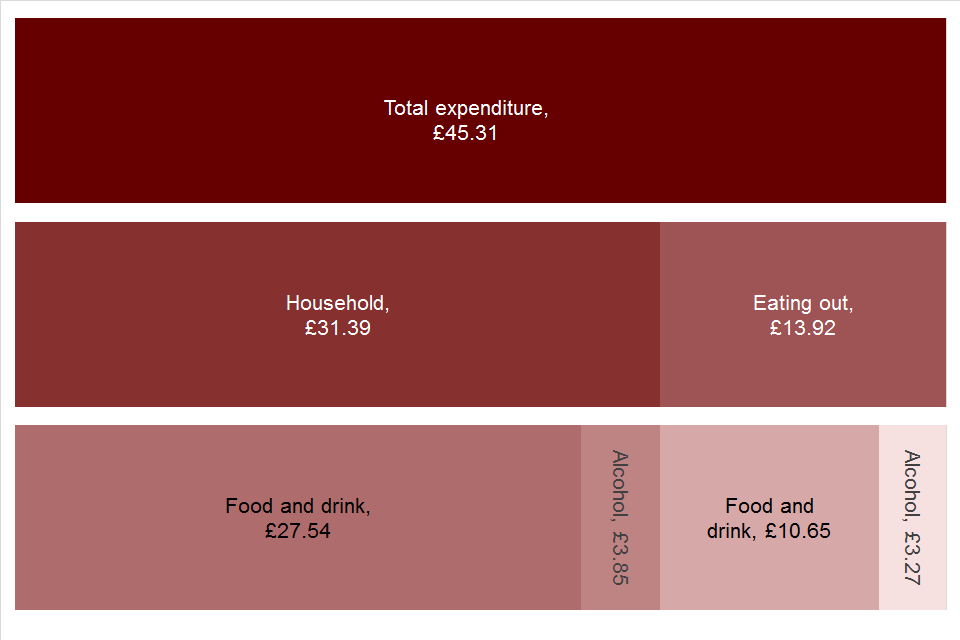

What this says to me is that if you are a teetotal household of 2 grown children aged 18+ and 2 parents you can expect to spend £153/week {(27.54+10.65)*4} on food and drink at home and in restaurants, i.e. about £660/month. Alcohol consumption increase that to £785/month – so alcohol adds about £125/month to our 4 person household of 2 grown children and 2 parents.

Really interesting, these stats suggests that our family should be spending £660/month but we frequently spend about half of this. The only month when we spent close to this is December when we spend £661 which is scarily bang on average. Outside of this mega month we’ve spent £190/month in our cheapest month and £330/month in the highest month outside of December and our food spend includes basic personal care stuff like roll-on and body wash which the ONS food spend number does not include.

Moving on… If you’re a teetotal average couple (i.e. no kids) you’re spending about £76/week on food at home and eating out, i.e. about £330/month increasing to close to £400/month if you buy alcohol. If you have two young children I’d count them as one and you should expect to spend £115/week on food and drink at home and in restaurants or about £500/month – this increases to about £590 per month if you spend money on alcohol. RECREATION AND CULTURE You know you are living in a privileged country when recreation and culture can fall into the top 4 spending categories. In fact, recreation and culture was the highest spending category for households in the North East and Scotland where it made up 16% and 14% of their spending, respectively. This was apparently driven by a few different factors, such as lower spending on transport and housing. Now, rather than give a narrative on each category, I will recommend you look at the table that I have compiled for you using the pretty awesome ONS website and see how the UK is spending. I’ll reel off the top numbers for you which I have split into weekly, monthly and annual spending so you can look at the metric that’s more relatable to you – some people work by the week, I prefer seeing things by month and year.

Weekly Monthly Yearly

Mortgage (for owners) 157 678 8,138 Rent (for renters) 108 467 5,606 Transport Personal transport 33 144 1,726 Purchase of vehicles 28 121 1,451 Public transport 20 85 1,024 Housing (net), fuel and power Rentals net of benefits 36 156 1,877 Maintenance and repair 8 36 426 Gas bill 10 42 510 Electricity bill 11 49 593 Other fuel 1 6 68 Water bill and misc. 9 40 484 Other expenditures Council tax, mortgage interest 47 202 2,423 Charity, cash gifts 14 59 712 Holiday spending 12 54 645 Licences, road tax, fine 4 16 192 Food and drink Food + alcohol-free drinks 61 263 3,151 Restaurants / catering 39 168 2,018 Hotels 11 47 567 Alcoholic drinks 9 38 452 Tobacco and narcotics 4 16 198 Recreation and culture Package holidays 27 117 1,399 TV+ video subscriptions 7 30 364 Newspapers, books, etc 5 23 276 Cinema, theatre, museums 3 13 161 Other recreation, e.g. photos 32 140 1,680 Households goods and services Furniture, carpets, floor 23 98 1,175 Routine household maintenance 7 29 348 Household appliances 4 19 224 Tools/equipment 3 13 151 Household textiles 2 10 114 Crockery and cutlery 2 8 99 Miscellaneous goods and services Insurances 18 76 915 Personal care 13 54 650 Bank fees, moving house, other 5 22 265 Personal effects 4 17 208 Childcare related 4 19 229 Clothing and footwear 24 105 1,264 Internet bill / spend 4 16 198 Telephone, fax, post office 14 61 733 Hospital / medical 7 30 359 Education Education fees 8 36 426 Secondary education 0 1 10 Nursery and primary education 0 1 10 TOTAL £572.6 £2,481 £29,775

I spent some dedicated time on the top things people spend money on to figure out how much is being spent according to a variety of sources; one of the sources I stumbled upon was the results of a survey carried out by powershop.co.uk on 2,000 people:

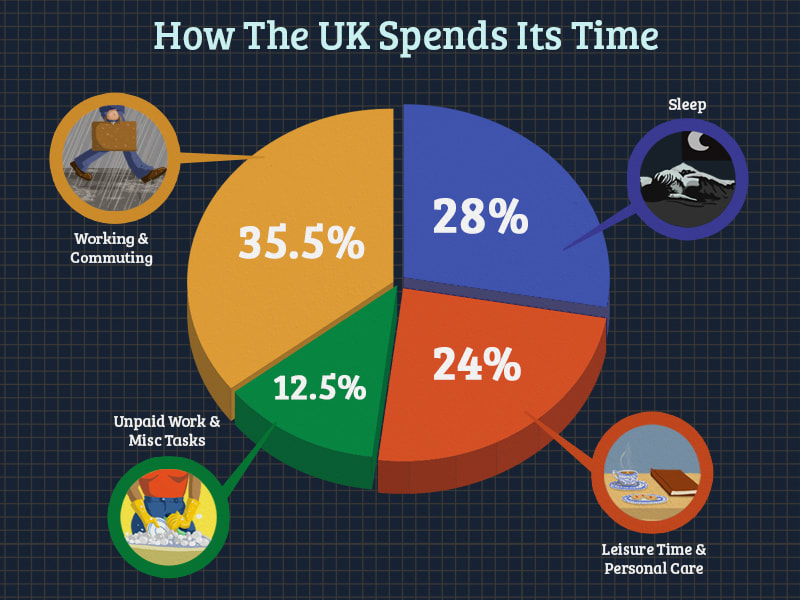

Interesting findings from the powershop survey include that 23% of households have a running direct debit for something they don’t use or need. This could be anything from a gym membership to a subscription to a streaming service such as Netflix. They also found that 20% of households delay switching energy suppliers even though it could save them up to £300 each year. How people spend their free time I also found it interesting to look up statistics to find out how the average person spends their time. This is very closely related to the question on how people spend their money. I found it extra interesting because I always wonder how everyone watches so much more TV than I do. For the UK:

So, 5.8 hours a day is spent on leisure and personal care. However, this masks a gender discrepancy as the average man has half an hour more free time than the average woman – 6.1 hours vs. 5.5 hours. The average American has about as one hour less leisure time than the average Briton at about 5 hours. Again American men spend more time engaged in leisure activities (5.8 hours) than did women (5.1 hours).

And the top 5 leisure activities are:

Key takeaways:

I hope this helps! Heather

0 Comments

|

Heather on WealthI enjoy helping people think through their personal finances and blog about that here. Join my personal finance community at The Money Spot™. Categories

All

Archives

September 2023

|

Heather Katsonga-Woodward, a massive personal finance fanatic.

** All views expressed are my own and not those of any employer, past or present. ** Please get professional advice before re-arranging your personal finances.

RSS Feed

RSS Feed