|

In this inspiring episode of The Money Spot™ podcast, we explore the remarkable story of Jon, a true financial maestro who has maintained an annual budget of under £7,000 since 2009.

What makes his journey truly extraordinary is not just his modest income, but his ability to achieve financial independence. If Jon were to cease working today, his sustainable living wouldn't falter. So, how does he work this financial wizardry? Jon's secret lies in his meticulous tracking of expenses, not income. He openly admits to occasional years where his spending exceeded his earnings. However, his steadfast indifference to material desires, such as fashionable attire and dining out, allows him to keep his spending at a minimum. His rent, a mere £280 monthly, and a thrifty weekly food budget of around £20, all while maintaining a health-conscious, predominantly plant-based diet, highlight his financial prowess. In this episode, we explore the many reasons to admire Jon's simple yet financially savvy lifestyle. Join me as we uncover the inspiring lessons from his journey to achieving financial independence before the age of 40, all by reigning in his expenditure...

2 Comments

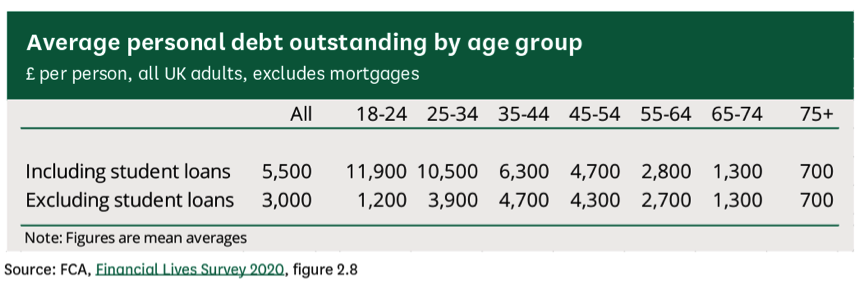

Taking control of debts: a step-by-step guide to debt freedom and improved financial resilience20/7/2023 Feeling overwhelmed by debt is a common experience that can affect anyone, regardless of age or income. In fact, 57% of UK adults carry some form of non-mortgage debt, with younger age groups being more susceptible – 80% of 25-34 year olds hold consumer credit but only 18% of people aged 75 and over. Despite quite significant numbers being affected by debt, oftentimes, someone struggling with debt can feel very alone and isolated, ‘it’s just me’, and worse feelings, of shame can stop you from speaking up and confiding in someone that can help or provide moral support. This article offers a practical and empowering guide to help you confront financial stress and take control of debts while prioritising your mental wellbeing. Who is most affected by debt in the UK? The Financial Conduct Authority (one of the UK’s financial regulators) defines "low financial resilience" as having limited capacity to cope with financial shocks. For example, if they had a financial incident such as a car breaking down or the loss of income for a week, they would not be able to cope without going deeper into debt. Certain groups, such as the unemployed, gig economy workers, renters, individuals with a household income below £15,000, and black or multi-ethnic adults are more likely to experience over-indebtedness. Recognising these patterns can help you understand that your struggles with debt are not unique and that external factors can contribute to this situation. A significant portion of debt for young adults is student loan debt. How to confront the financial stress of debt and reclaim your mental health

If you find yourself struggling with debts, take the below steps to regain control of the situation: 1. Figure out how much you owe You would be forgiven for thinking paying the debt down is the most difficult step. It isn’t, frequently opening your bills or credit card statements is the hardest step by a long shot. The very thought of having to do it will bring out a stress response – increased heart rate, difficulty breathing, headaches – I have seen a range of response. And, when you finally do manage to open the bills or credit card statements it’s not uncommon to get the runs or even throw up – this is all normal. Once you’ve been through this, you’ve probably ploughed through the worst emotions. But how do you get to the point of even being able to open the statements and figure out the damage? My advice: ask a trusted friend or relative to sit with you while you do it. If you don’t have one of those, perhaps contact a debt charity to help or call your employer’s ‘employee assistance programme’ to see if they can offer the moral support needed to get the task done. At this point all you want is a list of who you owe money and how much you owe them. List it all up and add it up. Great – you now know the extent of what you owe. 2. Get your Experian credit score and read through your credit record Next, get your credit score from “Experian”. This is free. If you have never used Experian before you can also review you credit record for free for a limited period. Go through your record carefully and if there is anything you disagree with, contact them or the relevant creditor to correct the errors. Check that your list of debt from ‘1’ matches what is on your credit record 3. Create a “debts sheet” in a spread sheet List all your debts in a spreadsheet. For each debt you want the amount owed and the minimum monthly payment. I recommend paying the debts off using what is known as “the debt snowball” this means you pay the smallest debt off first then move on to the next debt. Economically, speaking it makes most logical sense to start by paying off the most expensive debt and pay off the cheapest last, however, many people find that they get a psychological boost by seeing a debt fully cleared. I agree with this logic that is why I recommend the debt snowball. However, when I’m helping people figure out how to payoff their debts I sometimes take a hybrid approach, where it makes sense. Before we start tackling each debt though, there’s one more step. 4. Analyse your income and expenses then figure out where you can cut back and how you might increase your income This is a very important step: Prepare a detailed list of your expenses and compare them to your income. Identify areas where you can cut back: for each expense item, write what you spend now and what you plan to spend going forward. Be realistic. The aim is to reduce your expenses as much as is possible so that you can create as big a gap as possible between your income and expense. Average income in the UK is about £32,000/year or £2,000/month after tax and a 5% contribution to your pension. If you’ve typically spent all your earnings each month, then cutting expenses down to £1,700 would mean you have £300 to put towards paying off debts each month. If you have a skill you can monetise during evenings and weekends then you can make some extra money as well and put all of it towards paying off your debts. You can make money online or offline. Put flyers through doors and you might be surprised at the response. I was surprised at the success I had with putting flyers through doors when I wanted to earn some extra dosh in my mid 20s. 5. Go back to “debt sheet” and figure each month out Now that you know your capacity to repay debts, pay the minimum required on each debt and direct all extra cash to smallest debt until it is paid off. Ideally, create a timeline showing how much debt will be paid off, each month until you’re fully debt free. So that paying off your debts doesn’t feel like a punishment, throwing in the odd treat will help you stick to your debt-free plan. 6. Close debt accounts As you pay off each debt, consider closing the corresponding accounts to avoid the temptation of further credit. My personal approach is to not to keep any credit cards. However, if you find having one helpful and feel you can’t live without it, then maintain just one and think carefully about how best to use it. Conclusion Taking control of debts and building financial resilience is a journey that requires determination and support. Remember, you are not alone in this struggle. By facing your debts, understanding your financial situation, and devising a practical repayment plan, you can regain control of your finances and achieve a debt-free future. Stay focused, stay resilient, and embrace the small victories along the way. You've got this! To debt freedom. References: UK Parliament, Household debt: statistics and impact on economy, Dec-2022

To include the State Pension or to ignore the State Pension, that is the question…when you’re retirement planning.

If you’re a millennial (born between 1981 and 1996) or later, I’ve come to a bold conclusion: it’s best to assume you won’t receive a State Pension, when you’re planning how much to save for retirement. Let me explain why… While it's likely that some form of State Pension will persist, I believe there’s a good chance that it will become much less generous or that the state retirement age will increase even further. It is also possible that it will become means-tested so only the least well-off will receive it. Because the UK population is ageing and, as a result, the cost of the State Pension is increasing, one or all of these possibilities is almost inevitable. With an ageing population, a conundrum arises: an increasing number of people require care in their later years, while the workforce available to support them through tax contributions continues to dwindle. And, as State Pensions rely on current tax collections – that is, taxes collected from today’s workers are used to pay today’s pensioners, fewer workers will shoulder the burden of supporting a larger and growing retired population. So pensions will be less generous unless something changes. How has retirement and the State Pension evolved over time? Retirement is still a rather new concept. In the past the average person worked until they physically couldn't anymore; if they were lucky, their family looked after them in old age otherwise they faced serious financial struggles (this is how it still works for many in developing economies). In the UK, the introduction of the means-tested 'Old Age Pension' in 1909 marked a big turning point, providing a modest income to people aged 70+ with an income below £21 a year. The pension payable to a single person of 25p a month is roughly equivalent to about £157/month today (if we account for inflation and the increase in average earnings over time) – very much in line with the current Basic State Pension of £156.20. But...average life expectancy in the UK was about 50 in 1909 so, most people did not reach the state retirement age. This initial State Pension didn’t require any contributions to be made in order to be entitled to it; a contributory State Pension scheme only came about in 1925 for manual workers and others earning £250 a year or less (equivalent to £12,500 in 2023 prices). It wasn’t until after the Second World War, in 1946, when the ‘Welfare State’ was created, that a contributory State Pension applied for all people. From 1946 until 1980 people with higher average earnings enjoyed a higher State Pension, however, linking State Pensions to earnings was abolished in 1980. Personally, I think the new flat rate for all is much fairer. The State Pension has become less generous over time and may need to become less generous still In terms of what the money you receive can purchase, the State Pension seems to have not changed too much since 1909 - it’s just as generous or not so generous, depending on your view, as it ever was. What has changed since the introduction of the Welfare State is the bar you need to meet in order to get a State Pension. Whereas women used to start receiving their State Pension at 60 and men at 65, now, both men and women get it at 65 for the older generation and that’s rising to 68 for my generation. In addition, while someone used to need just 30 qualifying years of National Insurance contributions or credits to get the full basic State Pension, a total of 35 years is now needed and, to get anything at all, at least 10 years of National Insurance contributions or credits is required. These changes reflect the challenges governments face in balancing the needs of retirees with the available resources. To maintain the purchasing power of pensioners, the Government has maintained a 'triple lock' since 2010; under this mechanism the basic State Pension is increased each year by either average wage increases, average price increases (i.e. inflation) or 2.5%, whichever is higher. Despite all this, to continue to be able to take care of those that need it most, more may need to be done. There is only so much that can be done to raise the qualifying age or the number of years of contributions; at some point, it may become necessary to start cutting out those that don’t really need the State Pension given their other sources of income. And if I’m honest, I wouldn’t be upset if this is where we end up because if the government can balance its books it can stop progressively increasing taxes (including through fiscal drag). What does the State Pension currently cost? Consider this: in the 2023-24 fiscal year, an estimated £124.3 billion (10.5% of public spending) is projected to be spent on State Pensions. This figure, equivalent to approximately £4,400 per household, highlights the scale of financial commitment required, particularly when you realise that UK median household disposable income (that’s income after tax) is only about £32,300. Just to give you an idea of how mind-blowing this statistic is, in my native Malawi, the government's budget for the whole year for absolutely everything is £450 per household (UK: £42,000). And, the average Malawian household is 4.3 people compared to just 2.4 people in the UK. And what’s going on with population projections? Without an increase in immigration, the UK’s natural population is projected to start declining by 2025 … that’s in two years; a lot sooner than was expected based on estimates made in 2018; at that point we didn’t expect the natural population to start declining until 2043. So, what’s the long and short of it? There’s no two ways about it, to sustain the current generosity of State Pension in the context of an ageing population, some difficult decisions will have to be made. Sustaining the system will require adjustments such as raising the retirement age further (it’s difficult to imagine, I know) or reassessing eligibility criteria. In the short-term increased immigration may help to boost tax receipts but it’s unlikely to be a long-term solution. Some thorny questions will need to be addressed on how to balance fairness and affordability when it comes to State Pensions. Having enjoyed a sneak peak into the state of our public finances, it seems sensible that if you’re planning how much to save for retirement, as we did last week, especially if you’d like to retire early, then the best approach is to view the State Pension as a bonus. It will be awesome to get it but if you find that you’re not entitled to it, then by saving as though it won’t be there, the retirement you would like to have won’t be scuppered. References How much would the original old age pension be worth today? Basic state pension rates, Royal London Why should I pay national insurance once I've paid enough for a state pension? Steve Webb (former pensions minister) A brief guide to the public finances, OBR Average household income, UK: financial year ending 2022, ONS UK natural population set to start to decline by 2025, FT Government expenditure on state pension in the United Kingdom from 1948/49+, Statista

You can listen to this episode on YouTube.

Retirement is a dream shared by many of us, but achieving it requires careful planning and early action. In this article, we’ll delve into the world of retirement savings and reveal exactly how much you need to save each month to retire comfortably. So, if you're aiming for financial independence but are possibly thinking it’s a pipe dream, buckle up and discover the key to retiring early!

Understanding the two pension types – DC and DB pensions Before we jump into the numbers, let's familiarize ourselves with the two primary types of pensions: Nowadays, most people have "defined contribution" (or DC) pensions, where the amount you and your employer contribute determines your retirement income. The risk lies with you, because your return, i.e. the pot of cash you’ll have at retirement, depends on the performance of the stock market. Previously, "defined benefit" (or DB) pensions were more common, guaranteeing a pension until death based on your final or average salary and the years of service. However, DB schemes have mostly been phased out and won’t be covered in this article. If you have a DC pension, if the stock market performs poorly you’ll either have to work longer or plan for a leaner retirement. Defined contribution schemes are sometimes called ‘money purchase’ schemes or self-invested personal pensions (SIPPs). They are similar to what Americans call 401K plans. How do you calculate your retirement "pot"? To estimate the size of the retirement fund you'll need, we can employ a simple rule of thumb. Multiply your desired annual retirement income by 25, and voila! You have worked out roughly how much you should aim to accumulate. But why 25? This is based on the ‘4% rule’ – a widely accepted guideline that suggests that withdrawing 4% of your invested pot annually, ensures your money lasts. Research has shown that even after three decades, your investments tend to grow due to average growth rates of a diversified investment fund surpassing the 4% withdrawal rate. {If the nerd in you wants to get into the maths: 4% = 4/100 and 100/4 = 25; … you don’t need to understand the maths, though, just use the rule} Estimating your retirement expenses – how much will you need to spend in retirement? Now, let's discuss the various lifestyle options and corresponding expenses you might encounter during retirement: according to research conducted by Loughborough University and the Pensions and Lifetime Savings Association, we can categorise retirement lifestyles into three levels: minimum living standard, moderate lifestyle, and comfortable lifestyle. To account for inflation experienced since these studies were done, I’ve increased the figures by 20%. To maintain a minimum living standard, a single retiree requires an annual income of £12,240, while a couple would need £18,840. For a moderate lifestyle, the figures rise to £24,240 for a single person and £34,920 for a couple. Lastly, to enjoy a comfortable retirement, aim for an income of £39,600 if you're single or £57,000 for a couple.

(source: moneyfacts.co.uk; and increased by 20%)

What are these different lifestyles assuming? A minimum living standard assumes a single retiree spends £46 per week on a food shop, has a one-week holiday and a long weekend in the UK each year, does not own a car and spends £555 a year on clothing and footwear. With a moderate lifestyle, our single retiree spends £55 on food each week, enjoys two weeks in Europe and a long weekend in the UK each year, and spends £900 on clothing and footwear each year. With a comfortable lifestyle, the single retiree spends £67 per week on their food shop, enjoys three weeks in Europe every year and spends £1,200-£1,800 on clothing and footwear each year. Calculating your investment targets Using the 4% rule and these lifestyle figures, we can estimate the amount you need to save for retirement. Here's a breakdown based on your desired lifestyle and whether you're single or part of a couple:

I know that these numbers look huge. But keep listening, I’ll show you that you can achieve them much more easily than you think.

Getting started: how much to save each month Now, let's explore the exciting part—how much you need to save each month to reach your retirement goals. Assuming you're a basic rate taxpayer, investing in a global passive fund with an average annual growth rate of 7% (we’ll discuss whether this is a reasonable assumption in a future post), aiming for the ‘comfortable’ lifestyle (i.e. £990k if single; £1.425m for couples) and ignoring the state pension (I’ll explain why in the next article) and employer contributions these are the monthly amounts you need to put into a pension account based on your starting age (rounded to the nearest 5): Each month until you’re 68 you need to save:

What the table shows is that the younger you start saving and the longer you save for, the less you need to set aside each month.

Factors that can offset the numbers Don't worry if these saving targets seem daunting because there are several factors that can actually work in your favour, offsetting even the larger amounts you need to save if you start late. Let's take a look at these positive factors:

In conclusion, securing a comfortable retirement requires forward thinking. If you didn't have this information when you started working, don't worry—now you do! There's no time like the present to start saving for your future. And here's a bonus: you can share this valuable knowledge with your children, ensuring they don't make the same mistake that many others do—starting too late. With the right strategies and a proactive approach, you can pave the way for a financially secure and fulfilling retirement. Your future is in your hands. References What Is the 4% Rule for Withdrawals in Retirement and How Much Can You Spend? Q&A: How much do I need to save for a comfortable retirement? Pensioners need a £33,000 a year income to enjoy a comfortable retirement Fidelity Retirement calculator How to get the £260,000 pension pot needed for a comfortable retirement - and why it might not be as hard as it sounds Dave Ramsey investment calculator (ignore the $sign) Fidelity.co.uk retirement calculator

Have you heard about the FIRE movement? It's an acronym for Financial Independence Retire Early. While many people interpret it literally, there's more to this movement than meets the eye. In this post, we'll delve into what FIRE truly means, dispel some common misconceptions, and explore the different aspects of achieving financial independence (or FI) and retiring early. So, let's get started!

Understanding what FIRE is and what it is not Contrary to popular belief, the FIRE movement is not a cult or a race to become a millionaire overnight. FIRE is also not about living close to the poverty line so that you can save every penny possible – in the process depriving your family of positive life experiences such as holidays. This latter interpretation is from a podcast run by one of the mainstream broadsheet newspapers! FIRE is about gaining control over your financial life and having the freedom to choose how you spend your time without worrying about money. Many attribute the beginnings of the FIRE movement to Vicki Robin and Joe Dominguez’s 1992 book, ‘Your Money or Your Life’. Let's break down FIRE into its key components: financial independence, retiring ‘early’, and what retirement means in this context. FINANCIAL INDEPENDENCE (FI) - what is FI? Financial independence is the foundation of the FIRE movement. Inevitably, you have to gain some FI before you can enjoy any of the benefits of ‘retiring early’. At its core, FI means having enough passive income from investments to cover your living expenses. However, it's important to note that there are different levels of financial independence. Regular FI – what does ‘regular’ financial independence look like? Regular financial independence ensures that your passive income can sustain your pre-retirement standard of living. This includes basic necessities such as utilities, transportation, food, clothing, and some travel. While many people in the UK aim to pay off their mortgages before retiring early, it's not a strict requirement. Lean FI – what does ‘lean’ financial independence look like? Lean financial independence focuses on covering only the essential expenses like utilities, food, transportation, and basic rental accommodation – perhaps, in a housing association or choosing to purchase the most affordable property available in an out-of-town area where property prices are much lower. Those targeting lean FI may choose not to have children or plan to retire to low cost-of-living countries in Asia or Eastern Europe (popular destinations include Thailand, Malaysia and Turkey). A just-getting-by type of FI, like this, is not most people’s idea of financial independence but it suits some minimalists. For instance, Jacob Lund Fisker, author of ‘Early Retirement Extreme’ needed only $7,000 a year to live and that meant he was FI at 30 and retired at 33! And if you think that wouldn't be possible in the UK, a very close friend of mine has lived on a similar amount for the 18 years since we graduated from uni...we'll cover their story in a future post. If Lean FI is the goal then you may plan to earn some money from temporary or part-time jobs when you retire to cover luxuries such as a special holiday; this version of Lean FI is called ‘Barista FIRE’. Fat FI – what does ‘fat’ financial independence look like? On the other end of the spectrum is fat financial independence. It represents a comfortable retirement with all necessities and desired luxuries covered. Fat FI allows for frequent holidays, dining out, a nice house, and a generous budget for food and clothing. Downsizing is probably not on the cards for FAT FI-ers. EARLY – what does retiring early mean? The "Early" in FIRE refers to retiring earlier than traditional retirement ages. The timeframe for early retirement varies depending on personal goals and circumstances. As soon as possible For some, ‘early’ means ‘as soon as possible’. Some people join the workforce with the clear objective of achieving financial independence as quickly as possible, ideally within 10 to 15 years. To achieve this, they actively pursue high-paying careers and dedicate themselves to saving and investing. Timing with family goals Others discover the FIRE movement later in life or choose to align their retirement plans with family goals. For example, they might aim to retire when their last child enters university. This could be around the age of 50 or 55. In the context of a UK state retirement age currently set at 68 for millennials – and which could rise to 70 or older by the time we actually get there – 50 is ‘well’ early. Retirement can end up being a mini-retirement While the extremely early retirees in their 30s and 40s grab most of the headlines, some may retire in their 30s or 40s but go back to ‘traditional work’ after a few years in which case the first retirement ends up only being a mini-retirement – a fantastic opportunity to do something different for a few years. How soon you want to retire informs the type of financial independence you go for. The ‘leaner’ your lifestyle, the quicker you can achieve FI. It also informs the type of career you go for: you might choose a career in finance or high tech over public service, for example, to maximise your saving potential. RETIRE – what does 'retire' mean to those on FIRE? Retiring early doesn't necessarily mean quitting work entirely. Some individuals choose to work part-time in the same career or switch to more fulfilling, passion-driven careers that may not pay as well. Others pursue non-earning hobbies, engage in charitable work, or spend quality time with their children while they're young. And others identify with the FIRE movement and want FI for the peace of mind and flexibility it offers, but haven’t decided what ‘ ‘retire early’ means for them yet. In conclusion, the FIRE movement has revolutionized the way we perceive financial independence and early retirement. It's about breaking free from the constraints of a traditional career and embracing a life filled with possibilities. Whether you aim for regular, lean, or fat financial independence, the goal remains the same—to achieve a level of passive income that affords you the freedom to live life on your terms. In my next post, we'll delve into the exciting topic of how much you need to save to embark on your ‘retirement’ journey. So, stay tuned as we uncover the secrets to financial freedom and pave the way to a future filled with endless opportunities. References:

I receive a lot of questions about “how to start investing” and this month alone I’ve fielded more questions than ever before, so, as a belated birthday present to myself I decided to get this all out into a simple blog.

A couple of housekeeping points first: Any tax rates and thresholds mentioned in this post will be correct as at the time of writing but tax is something that gets tinkered with all the time so this could get dated pretty quickly but using figures will help you to understand how it all currently works, in principle. Everything I share here is information not advice. Once you decide to actually start investing you would be well advised to: a) do some further research yourself; and b) speak to a fee-only all-of-market independent financial advisor. Fee only means they don’t charge you a percentage of what you have to invest (that is, they charge a fixed fee) and all-of-market means they can offer products from a range of institutions.. Ideally, you should only invest money that you will not need for at least 5 years. This is because share market prices move up and down a lot and if you need that money before five years is up, there is more chance that you might have to sell at a loss. Investing is a long-term game, the longer the time you can wait, the higher the probability of being up. Over a 20 year period, the S&P500 (which is the 500 largest listed companies in the USA) has returned a positive return 100% of the time. While the future may turn out to be different, you are generally well advised to leave money invested for as long as possible. While my aim is to make this discussion as simple and as unintimidating as possible, at times it will feel really complex not because investing is hard but because we invest within the context of a very complicated and convoluted tax system. But you have to get to grips with our tax system to get ahead with investing…anyhow,…I’ll divide this into four parts to keep it clear:

PART 1 – What sort of investment account should you put your money in

You can think of your 'investment account' or ‘investment vehicle’ as the “house” where your money is kept. There are three different types of vehicles:

1. A pension be it a workplace place pension or personal pension (aka a Self Invested Personal Pension) allows you to invest money before it is taxed; 2. A “stocks and shares” individual savings account or ISA allows you to invest money after it’s been taxed but all dividends and capitals gains are tax free; 3. A taxable brokerage account – means you invest money after it’s been taxed and any capital gains and dividends are also taxable. Any business that offers the services to buy or sell shares and investment funds will typically offer all three vehicles, i.e. they will usually offer pension accounts, ISA accounts, and taxable trading accounts. There are different pros and cons of investing in each of these three. I will highlight the main pros and cons. PENSIONS I am only going to cover defined contribution pension schemes in this post, which is what most people have nowadays. I won’t cover defined benefit pension schemes in which the employer commits to pay you a specific amount from a pre-defined retirement date until death. The rules are much the same between the two but if you’re responsible for your own retirement income as is the case if you have a DC scheme you’re likely to be more aggressive with building that pension pot. I’ll cover the difference between DC and DB pensions in a future post. Pros of investing through a pension

Cons of investing through a pension

Rules on how much you can invest in a pension… There are limits on how much you can invest via pension each year and over your whole lifetime. Firstly, the annual allowance is the maximum you can put into your pension each year and still get a tax benefit. This is currently £40,000 gross (i.e. before tax) or your full annual income, whichever is lower. So, if you earn £30,000 a year the maximum you can put into a pension is £30,000. I am sorry that this is getting complicated already but the UK tax system is mad – so a little detail is essential. A key thing to note is that not all income qualifies towards this pension contribution limit. Earnings from property aren’t allowed. So if all your earnings are from a buy-to-let property portfolio that is in your name, the maximum you can put into a pension is £2,880 and with the government tax benefit this is grossed up to £3,600. So, you’d only invest £2,880 into the pension and it would be grossed up to £3,600. If your BTL properties are in a company, then you could pay yourself a salary (and you’d need to follow rules on national insurance contributions too) and whatever your salary is – up to the £40k annual allowance limit – would be the maximum you could pay into a pension and still get a tax benefit. The second limit is the pension lifetime allowance which is just over £1m at the moment. This may sound like a high limit but it includes capital gains not just contributions so you can easily breach the limit. For instance, if you had £250k in your pension at the age of 35, a 7% growth rate in your portfolio would mean the money doubles every 10 years, so even if you didn’t invest anything else, that £250k would grow to £1m by the age of 55. Ideally, the lifetime pension allowance should grow with inflation but it’s frequently frozen and was even slashed from £1.8m in 2012 to £1m in 2017. This post is not about pensions but they are one of the primary vehicles you can invest through so hopefully what I’ve said so far will help you understand whether is this is the best vehicle for you. Depending on how much money you have to invest, I would look at putting some money in both a pension and an ISA and if you have more besides then you can put some into a taxable investment account. ISAs I love ISAs because once the money goes in, you don’t have to think about making tax declarations any more – it’s all tax free from that point. Pros of investing through a stocks and shares ISA I won’t cover cash ISAs here as this post is specifically on getting started with investing in stocks and shares.

Cons of investing in an ISA

Whether you plan to invest in a SIPP or ISA depends on your financial position and future plans, e.g. retirement goals, goals for your children if you have any etc. As tax advisor to my friends and family I recommend different things depending on what I know about the person including their propensity to choose spending over saving or investing, there is no blanket rule. Taxable brokerage account If you have maxed out your £20,000 ISA allowance and your spouse’s £20,000 ISA allowance and your £40,000 pension allowance then the next place you would look to invest is via a taxable brokerage account. If you are saving that much though, you may want to just spend more…better holidays, more life experiences etc. PART 2 – Who i.e. which institution should you invest your money through

So, you’ve figured out whether to put your money in a pension, an ISA or even taxable account, you now need to decide where to open your pension, ISA or taxable account. The way to think about this is, if you had money to save, one of the questions you would want to answer is ‘which bank should I keep my money with’, that’s the decision we are trying to make in part 2.

If you have a workplace defined contribution pension, that decision is usually made for you although in some cases you’re offered limited options. You are allowed to have a personal pension outside your workplace in addition to the work one but I personally I’m happy with the options provided by the provider of my DC pension at work so I don’t contribute more to another SIPP. There are three options open to you when it comes to type of institution:

The key driver of which platform to use is:

Fees – annual management charge Of the platforms I would guide you to research, these are the annual platform fees you can expect to pay as a beginner. In many cases the fee falls as your portfolio grows:

In addition to platform fees, whatever you invest in will have an ongoing annual fee. Ongoing fees usually range from as little as 0.05% to over 1.00% and in some cases as much as 3%. Watch out for the ongoing fees of what you buy as this is what can really harm the growth of your portfolio. There may also be fees for leaving or joining the platform. Look at all chargeable fees before committing to an account – you can always change institutions if you change your mind but it’s better to do your research before you even start. Any institution regulated by the Financial Conduct Authority, FCA, will be transparent about all the fees charged. Don’t invest through any unregulated institutions. As I researched this article I discovered that Junior ISAs at Fidelity are not charged an annual management charge and I immediately transferred all my children’s ISA investments to them from Hargreaves Lansdown. That was £55k in total – their investments of £20k each, have grown well over time so despite the poor stock market returns of 2022, they remain up. If you’re interested in how I invested for my kids see my post, Q&A: How can I save and invest for my children? I won’t spend a lot of time on fees but will link to several articles that discuss fees across a range of platform: PART 3: HOW MUCH TO INVEST

sIf you have a lump sum to kick start your investing, that’s great. You can invest it all in one go, however, some people prefer to spread a large investment into smaller chunks spread over 2 or 3 months. There is no real benefit in this if you are investing for the long-term – in fact, data suggests that lump-sum investing beats drip feeding your investment into the stock market 75% of the time. But if it makes a psychological difference to you, you can split a large lump sum over a few months.

What’s large? That’s for you to define because if I had a large sum to invest, I would invest however much I plan on investing all in one go. Generally, most people don’t have a large sum and the decision is about how much to invest each month. Investing monthly, over a long period of time, is called ‘dollar cost averaging’ into the market as your shares are cheaper in a bear market and more expensive in a bull market so over time you are paying the average price of the market. If I was working with a specific person, I would want to know how much they want to have at the age of 50 or 55, either as an annual income or in total and I would back calculate the amount they need to invest monthly, today, to achieve that goal. You can do this for yourself using an online calculator - I like the investment calculator on Dave Ramsey's website, you can ignore the fact that it has a $ sign and put in your GBP investments - the sign doesn't matter - I assume a gross return of 7% (that's the return before inflation is taken into account - with average inflation of 3% this is a net return of 4%). You can also ignore links to other resources as they are US-centric. PART 4: WHAT TO INVEST IN

Equities / shares

Investing in the shares of companies is called investing in equities. Equities pay dividends if they have money left over after paying all costs including interest on their debt. Some companies, especially fast growing companies, choose not to pay dividends and instead re-invest the money. If you buy the shares in a company, you’re known as a shareholder and you also make a return or loss from any increase or fall in the price of shares. So, if you buy shares for 10 and they grow to 12, that’s a 20% return; if their price falls to 8, that’s a 20% loss (the profit or loss is only realised if you sell, i.e. a loss is only a loss on paper - not a real loss - unless you sell, so, if share prices fall they can be left invested so that they recover in price). Debt / bonds Investing in the debt that companies issue is called investing in bonds. Bonds earn a fixed and known return. There are a few options you can choose from, here I’ll suggest 3 for you to look into: Option 1: 100% stocks in a diversified fund If you’re starting out in investing, you should be satisfied to earn the average stock market return by investing in a low cost diversified index fund. It requires a lot of time to identify specific companies that are undervalued or those with great growth potential and you don't need to do this to do well with investing - in fact, the evidence suggests just putting money in one or two diversified passive funds gives better returns than stock picking yourself and trying to beat the market. I personally prefer stock indices that track the S&P500 (these are the 500 largest companies in the US) – these funds usually cost 0.10% or less. Large US companies usually have global sales and source materials internationally so I feel it is adequate diversification that implicitly includes Europe and exposure to many emerging markets without having to worry about corporate governance issues. The historical average yearly return of the S&P 500 is 9.645% over the last 20 years, as of the end of November 2022. This assumes dividends are reinvested. Adjusted for inflation, the 20-year average return (including dividends) is 6.932%. (source: tradethatswing.com) If you prefer to invest in the UK stock market, you can choose fund that tracks the FTSE-100 in the UK. In the 20 years leading up to 31 December 2019, the FTSE 100 had an average annual return of 0.4% if dividends were not re-invested but this rose to a not insubstantial return of 4% a year if dividends were reinvested. Option 2: Target date funds Target date funds are funds that invest based on the assumption that you will retire in a given year. These funds have a higher proportion of riskier equity investments and a lower proportion of bonds which give a fixed and known return. As the retirement date approaches, more and more money is invested in bonds and less and less is invested in equities. Some in the investment community consider that target date funds get too conservative too quickly because no one retires and needs all their invested money straight away. So, if you want to have some money in equities and a portion in bonds, you could start with a target date fund with the retirement date set further in the future than you plan to retire - perhaps set it 20 years further than you plan to retire especially if you're partly saving to pass on an inheritance rather than just for your retirement needs. Option 3: Ready-made funds Many institutions offer ‘ready-made funds’ to get you started with investing and if you choose to go with that, as I did when I first started investing, take that as a learning opportunity. Seek to understand what is in those funds, what the fee structure is and if you don’t like the underlying investments or see that the relative fees are high, either don’t buy them in the first place or seek to move away to other investments. I do not recommend investing in single stocks, e.g. buying specific companies as this exposes one to a lot more risk than tracking a whole market so I won’t cover single stock investing here. I used to trade in single stocks myself but I no longer do. A simple example - investing in action

I know all this information might seem confusing so I thought I’d give you an example of all this in action.

So, as an example, about 3 years ago, unprompted, I told a 30-year old couple I know and like that if they wanted to have £300,000 or so when they are 55, in addition to their work place pensions, they should put £100 into a SIPP every month. With a lump sum like that they would have the option to retire early and as DINKies (double income no kids) I knew they wouldn’t feel that kind of investment even if it fell to zero – and with the government match they would be 25% up from the outset due to the tax saving. As I knew they were first time investors and quite risk-averse I got them to put almost all of the invested money in S&P 500 trackers with about 10% in an actively invested fund. They use Hargreaves Lansdown – I chose this for them because their customer service is great and you can easily get a person on the phone – but as their funds grow I might get them to move to a cheaper provider. I’ll review this when they have £50,000 or so. Three years later, they have about £20k between them (they invest a little more than I suggested). As I wasn’t happy with the performance of the actively managed fund, I got them to sell all of that and stick to low cost diversified funds. They’re happy with this set and forget strategy and aren’t much interested in overthinking it and unlike most of their friends have savings. In about four years, they will also be mortgage free to boot – based on a repayment plan I’ve advised them to stick to. Financially they’re on a great track and are also enjoying life… So, investing doesn't need to be complicated or big. You can start small and increase your investment as you learn more, develop confidence, and start to understand how different investments work...OVER TO YOU! Get help investing:

If you want help with setting up your investment account and selecting funds, click the PayPal link below to book me and fill the form in to tell me a little about your situation. Your booking gets you two one-hour phone calls during which we will chat through what you want to achieve with investing then I'll help you set your investment account up in your own name and automate everything for you.

3-Month Coaching Program

£1,000.00

This 3-month coaching program will be custom built to suit your needs.

I used to coach people on business issues only but I quickly discovered most struggles were the result of factors that hadn't even been considered. My coaching programs last 3, 6 or 12 months. During that period you have full access to me by phone, email, text, skype and if you live locally, even for coffees. So that we can just crack on with making you awesome I take payment upfront. Psychologically this makes you commit fully and wholly to the program too. My coaching covers:

Before a coaching relationship starts I recommend you book a one-off call to discuss your self-development needs . If you go on to book a coaching package this "analysis call" will be refunded. You're awesome. Let's make sure everyone who so much as walks past you sees that too! Bonus: you will get the Build A Booming Business Planner & the iPlan To Succeed Life Planner free with this coaching package. Check your email as soon as you've checked out of the shopping cart. 6-Month Coaching Program

£1,875.00

This 6-month coaching program will be custom built to suit your needs.

I used to coach people on business issues only but I quickly discovered most struggles were the result of factors that hadn't even been considered. My coaching programs last 3, 6 or 12 months. During that period you have full access to me by phone, email, text, skype and if you live locally, even for coffees. So that we can just crack on with making you awesome I take payment upfront. Psychologically this makes you commit fully and wholly to the program too. My coaching covers:

Before a coaching relationship starts I recommend you book a one-off call to discuss your self-development needs . If you go on to book a coaching package this "analysis call" will be refunded. You're awesome. Let's make sure everyone who so much as walks past you sees that too! Bonus: you will get the Build A Booming Business Planner & the iPlan To Succeed Life Planner free with this coaching package. Check your email as soon as you've checked out of the shopping cart. 12-Month Coaching Program

£3,600.00

This 12-month coaching program will be custom built to suit your needs.

I used to coach people on business issues only but I quickly discovered most struggles were the result of factors that hadn't even been considered. My coaching programs last 3, 6 or 12 months. During that period you have full access to me by phone, email, text, skype and if you live locally, even for coffees. So that we can just crack on with making you awesome I take payment upfront. Psychologically this makes you commit fully and wholly to the program too. My coaching covers:

Before a coaching relationship starts I recommend you book a one-off call to discuss your self-development needs . If you go on to book a coaching package this "analysis call" will be refunded. You're awesome. Let's make sure everyone who so much as walks past you sees that too! Bonus: you will get the Build A Booming Business Planner & the iPlan To Succeed Life Planner free with this coaching package. Check your email as soon as you've checked out of the shopping cart.

Hi Heather,

Here’s my questions. I'm a single first time buyer, I have just under £10k deposit and i can borrow up to £200K based on some mortgage brokers.. is there any way I can borrow more money to buy a bigger house? What are your thoughts on the "helping hand mortgage" by Nationwide. Are there any other schemes for first time buyers? Second question, my plan is to use the house hacking method to save up faster in order to invest in more BTL properties. What’s your advice on house hacking and is it legal, do i need to inform the lender and would that make them more inclined to raise my interest rate? Third question, do I generally need both council and lender permission to change the structure to the house? Such as extension or loft conversion..etc? And how do I go about it.. where do I start? And are there any zone-ing regulations here in the UK as there is in the US? Finally, I am a foreign national here in the UK on a skilled worker visa, I've lived here for just over 5 years including a year in university, my credit score is very low due to the fact that I am not eligible to register for voting! I spoke to the council and they said they can't do anything. Is there anything I can do..? That's the only reason why my credit score is low. Thanks, Ahmed AND Hi Heather, I want to get into property investment but have very little capital. Is there any advice other than save to help buy properties with little to no capital? Your help is much appreciated. Shahid

Amrita owns a buy to let property and is a renter herself. She has been renting for over a year and wants to buy a home to live in. She wonders if she will have to be pay the extra 3 per cent stamp duty tax on the purchase of her new home. In addition, if she is subject to the extra 3% tax, she asks if she can she avoid it by buying her home through a limited company?

That’s what we answer in this short podcast. If you need advice for your own situation, please contact a mortgage broker or personal financial advisor.

.I always say that if you get nothing else right in your financial life, at least own where you live outright by the time you hit retirement and ideally much earlier. Well that’s not quite right, the other thing you need to make sure of, is that you qualify for the full UK state pension.

Currently, when I am 68, for so long as I have 35 qualifying years, I will get £185/week in state pension until my dying day. That’s about £800/month or £9,620/year. This is not an insignificant amount and if you live with someone, i.e. your partner, a sibling or friend, it’s double that as you would each qualify separately. My calculations suggest that if you’re living on your own, that amount of state pension would at least cover all basic utilities (water, energy, council tax) and food. You can check how many qualifying years you have and whether you can boost them at gov.uk/check-state-pension. If you’re self-employed, to qualify for the full state pension later on, make sure you’re signed up to pay Class 2 national insurance and if there are any gaps in your national insurance record, pay for them asap as you can only fill gaps going back 6 years: gov.uk/national-insurance/national-insurance-classes As the state pension is unlikely to be enough, it’s helpful to contribute towards a personal pension (aka a self-invested personal pension or SIPP) as pension contributions get tax relief such taht every £240/month contribution equates to £300/month into your pension pot. Based on a 7% gross growth rate of your pension pot (and keeping in mind the historic average return of the S&P 500 is 10%)

If you want to play around with how much you should expect to spend in retirement, here are a few other helpful blogs:

When you’re at one point in your life it’s often nearly impossible to imagine having much more than what you’ve got – or maybe that’s just my lack of imagination – anyhow, in this podcast I recount the steps we went through to move from our £385,000 beautiful terraced home to a £1.1m detached bungalow in the same neighbourhood.

We did all this in 2020 but, even as recently as in 2017, when I walked past the homes on the street where we now live, I thought actually living in one of them was pure fantasy for us and at that point, it was. It took getting a proper second income, a stamp-duty holiday and an all-time low 5-year fixed interest rate of 1% to achieve this, oh, and a few consumer loans for a short period. Was it worth it, 100%. One thing I forget to mention in the episode is that one of the key drivers was I saw already expensive properties getting more expensive and mid-priced (like our terrace) to low-priced properties appreciating very little in value or even falling in price – how does that work? I am not sure but I figured there was some kind of bifurcation in the property market with average incomes driving prices on the lower end and something bigger at play with bigger, more expensive properties – they tended to be owned by business people not restricted by average incomes, some people with inheritances and hence large sums to play with and people with much larger incomes…whatever it was, I wanted in. The funny thing is, if we sold our new house right now, we would be in a position to buy our old house mortgage-free AND still have £200,000 to £300,000 in change ALTHOUGH our old house has gone up by about £30-40k! Listen to the episode and let me know if you have questions. Here’s my property course on Udemy. |

Heather on WealthI enjoy helping people think through their personal finances and blog about that here. Join my personal finance community at The Money Spot™. Categories

All

Archives

September 2023

|

Heather Katsonga-Woodward, a massive personal finance fanatic.

** All views expressed are my own and not those of any employer, past or present. ** Please get professional advice before re-arranging your personal finances.

RSS Feed

RSS Feed