Fact: you are capable of a lot more than you think you are capable of. I was driving around with my husband one weekend looking at plots of land and various properties.In addition, we drove to a few car dealerships and asked for quotes on cars. Whenever I liked something I said, I want that orI’m going to get that. Finally, after two days of hearing me say this so many times, my husband asks: with what money! I smiled and said, “You don’t ever need to worry about that. First, you decide what you want and then the money somehow finds you!” It sounds crazy, I know, but if I limited my heart’s desires based on the funds currently available I’d probably be nowhere right now. I’m sure I’ve written about this before but the first time I ever wanted something crazy, I wanted to go to The University of Cambridge. I told my friends what I wanted and only after I got in and got a scholarship to attend did some admit that they thought I was insane for wanting to go to this Cambridge place that many thought was unreachable.  When I had this desire I didn’t know where the money would come from, all I knew is that I had certain things in my control: hard work, achieving the best grades I could, getting the teachers to like me and back my application and if it came to it, begging whoever would listen for help and advice. I almost never thought of the money issue because that would have discouraged me and it was 100% out of my control. I focused exclusively on what was right in front me – the next A grade. In the end, I went to Cambridge. Since then there have been many triumphs and of course, a few failures or life lessons, as I like to call them. My latest fantasy moment occurred after I quit my job and realized I didn’t want a service business coaching people on how to get into investment banking after all;what I wanted was a product business. Problem: I needed £80k to £100k($130k to 160k) to get it off the ground. Eek! Now, I could have written a business plan and tried to get investors to be honest, very few people (even friends and family) are willing to fund a business in a genre that they think is overcrowded like the hair industry – and pretty much every industry outside of technology. I had two solutions: Solution 1:start off small, sell things that will keep me earning and enjoying a lifestyle based on working from home. I did that and incurred some mocking but I didn’t care because my small business was earning enough to keep the bills paid. Okay, if we are being fully honest, I did get a little upset at some of the mockery. I’ll still never forget someone “laughing at me” me for selling wide-tooth combs on instagram – they made some comment about how desperate it was to be selling combs to earn a buck…whatevs, don’t worry hun bun, haters are always going to hate, just focus on your goals and yourdreams.  Solution 2:just focus ononestep at a time and hope that I’ll save enough by the time I was ready to hire a manufacturer. So…I hired a formulating company. Do you know how silly I felt walking into a meeting I’d arranged at an established factory as the 30-year-old CEO of Neno Natural to an audience of 3 people ALL over the age of 50 with a long career in formulating and producing beauty products? Very! To boost my confidence I was dressed well and I looked good in my makeup. I came out shining. They thought I was smart and they said the business I was proposing excited them above and beyond many other clients they were doing things for. Over the course of 12 months I paid for the formulation and as we approached the 15th month enough money appeared to enable an order. Some of my earlier investments paid off and I was able to pursue the dream. That’s life. If you set your mind on something, you will get it, I promise you. That stuff they tell you about self-belief making things happen? It isn’t just “stuff”, it’s for real! Anyhow, I’d love to carry on this discussion with you and help you realise your dreams, if you want to start a product business sign up to The Money Spot program. You can join for as little as £49.99/month or come to my upcoming workshop on How To Build A 6-Figure Product Business.  Want to Build a 6-Figure Beauty Business from the comfort of your sofa? Then my course is designed for YOU! "Beauty" includes a WIDE range of products from the not so obvious non-perishable foods and crafts to the more obvious hair, makeup, fashion, health & fitness.

1 Comment

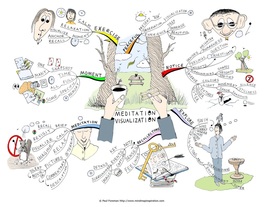

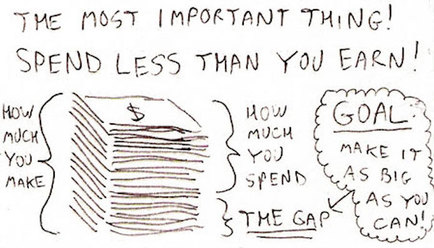

Too many people try to solve every problem they encounter by themselves. This is not only a waste of time but it’s completely unnecessary. I came up with this insight as I watched my 8-month old son trying to solve his problems. I noticed that every time he wanted to get to something, if there was an obstacle in his way he continually tried to climb over the obstacle or push through it when he could simply walk around the obstacle and avoid it entirely. One time, there was a ball behind me and he kept trying to squeeze through my legs when there was ample space to crawl on one side of me. Another time there were some cushions in his way, and yet, another time his little girlfriend Maya was in his way; she really didn’t appreciate having a 9 kg boy trying to climb over her. His problem solving skills are still in development, of course, but some people do exactly what he was doing throughout their lives.  Today’s tip is simple: Think about how you can avoid your problems. Instead of climbing over them, can you work around them? I’m not suggesting you take short cuts, no, I’m just saying the solution is sometimes a lot simpler than you think. If I’m struggling with an issue I refer it to my mastermind group. I have weekly mastermind calls with my entrepreneur friends and often, we problem solve together. There’s nothing like a fresh pair of eyes. Note that I don’t go to non-business friends to solve business problems; I only go to those of my friends that are in business because they are better equipped to give good business advice. I started my business in 2012 and it took about two years to build a good quality, credible network of friends. If you wanting to accelerate the growth of your product business with my coaching program, you can either join the online solution or come to my upcoming live workshop. Alternatively, call to discuss the best solution for you.  Want to Build a 6-Figure Beauty Business from the comfort of your sofa? Then my course is designed for YOU! "Beauty" includes a WIDE range of products from the not so obvious non-perishable foods and crafts to the more obvious hair, makeup, fashion, health & fitness.  Your spending will always expand to match your income unless you specifically plan to live beneath your means. You can do this as a lifestyle choice or for short periods of time to save for something you really want. Shop around to save money on the things that you buy regularly – buy in bulk, get products where they are cheapest instead of just going to your favourite shop, use coupons and take advantage of discount days at local stores. However, there are some things that you can live without completely;that is the topic this blog. We get so used to buying what we always buy that we don’t usually stop to contemplate what’s necessary and what isn’t. To help you think through your own shopping list I’ll go through some things my friends and I cut back on to save: Rent You could live in a cheaper area and save thousands immediately. I did this when I first started work. I was spending almost half what my peers were on rent just by living a little further out of the city. Of course, many of us are unwilling to compromise here so we have to look at the small stuff. Juice! For what you get, it’s not cheap at all. I was having a chat with one of my best friends about cutting back and she said, “Can you believe it, we’ve even had to stop buying juice!” I was like, “You were still buying juice? I stopped buying juice ages ago because it contains way too many calories. I’ll only buy it if I have guests coming.” I also find juice to be poor value for money besides being completely unnecessary for the weight conscious. Juice packs in a lot more calories than one might suspect. Restaurants We spend A LOT of money on eating out every month. I personally find it very hard to cut back because I think of it as a “treat” after a week of hard work. However, right now my husband and I have just spent a small fortune renovating a flat that we just bought so we’ll use that thought to spur us on during our financial fast in September. To stick to our resolve we add“treat foods” to our shopping list to encourage us to eat at home. For example, buying a frozen pizza that you just stick in the oven when you feel lazy is a lot cheaper than going out for pizza. We wouldn’t normally buy this type of food because it’s not healthy but it does the job of keeping us at home when we want to eat out. Meat News flash: you don’t have to eat meat every day. Some people would think this is unthinkable and perhaps an utterly ridiculous suggestion but it’s true. If your partner is against this suggestion remind them that desperate times call for desperate measures. You can also cut back by eating less meat rather than cutting it out completely. For instance, unless it’s a very small chicken I only ever eat one chicken piece, I find two to be excessive. If everyone in your home has two pieces your chicken will immediately last twice as long by enforcing a one-piece rule. The same goes for sausages and other meats. I normally cook minced meat with beans to bulk it up. Less meat means a heavier wallet and a more attractive waist line! You could go for offal aswell. Liver, oxtail and tongue are delicious. Body Products & Makeup There are so many options here. If you use a range of upmarket brands explore supermarket “equivalents” to see if they work just as well. You could save a tidy fortune here. Take a close look at what you tend to spend money and see what else you could do without. Magazines? New shoes or clothes? And so on. “Cut back on your rent or cut back on what you spend on food but never worry about investing money in a good book.” Robin S. Sharma  Want to Build a 6-Figure Beauty Business from the comfort of your sofa? Then my course is designed for YOU! "Beauty" includes a WIDE range of products from the not so obvious non-perishable foods and crafts to the more obvious hair, makeup, fashion, health & fitness.  How often do you think about how you're going to live life in your 60s? Here are alternative outcomes. Living Off The Kiddies Some will reach the age of 60 without a single saving. You will depend on your kids for money, for food and perhaps even need them to house you somehow – if they are willing. For many this will not happen because life has been unkind to you, it will be the result of a series of bad choices such as having more children than you can afford to support and not saving enough. Be in no doubt that if you find yourself in this situation you will be a burden to your children. In the ideal world children don’t want to have to look after their parents financially and if they just earn enough to support their family will resent having to look after you because you didn’t plan for old age. Could this be you? POSSIBLE SCENARIOS Oh, This Isn't My House? Some will reach retirement age and realise that the bank or the company they work for owns “their” house and “their” car. It’s easy to forget such things when you are enjoying life but at this point you will be forced to either live off your children or invest your savings in a business. If you’re lucky you’ll find jobs in retirement or positions on boards of directors that provide an income whilst you make up for lost time on the investment front. Living Off The Rentals Some will reach the age of 60 with a tidy property portfolio. You will own the house you live in outright and you will have at least two rental properties. Your rental properties will produce enough money to cover all necessities, bills and wants such as holidays. When your children come to visit you, they will come with pride. Pride that they have forward-thinking parents that had the wisdom to cover their own retirement. You will have no unnecessary worries and will be safe in the knowledge that you never have to go to bed hungry or cold.  The Art of Visualisation Visualising is like fantasising. You visualise a specific event in the future in very specific and detailed terms and think about how much you will enjoy it. Scientists have confirmed that visualising can lead to the achievement of real results. In a well-known study on creative visualisation in sports, Russian scientists compared three groups of Olympic athletes:

Group 3 had the best performance results. This indicates that some types of mental training, such as consciously invoking specific subjective states, can have significant measurable effects on biological performance. Further to this, some celebrities have argued that they have achieved certain results in their life by visualising them first. These include Oprah, Will Smith and Jim Carrey. Visualising helps you to focus on a goal. If you can find just ten minutes a day to meditate and visualise the things you want to achieve you will increase your chances of achieving them. Most people don't think too far beyond the next couple of years, if that. Those that do are at an advantage. Of course you shouldn't live so far in the future that you cannotenjoy the present. That said, thinking about and planning for the future is enjoyable in itself –just do it! "Ordinary people believe only in the possible. Extraordinary people visualize not what is possible or probable, but rather what is impossible. And by visualizing the impossible, they begin to see it as possible." Cherie Carter-Scott  Want to Build a 6-Figure Beauty Business from the comfort of your sofa? Then my course is designed for YOU! "Beauty" includes a WIDE range of products from the not so obvious non-perishable foods and crafts to the more obvious hair, makeup, fashion, health & fitness.  It’s a dream to have a job that works around your life. I have such a job and a few people I know aspire towards this lifestyle but their approach, I now realize, is completely wrong. Before I had a baby, I used to imagine that maternity leave allowed one to pursue personal interests other than those of rearing a child. When people told me they planned on starting something during maternity leave I agreed that this was indeed an appropriate time. When friends with babies said they weren’t being able to get anything done I thought they just weren’t balancing things correctly – I, in this case, was wrong. Unless you pay for childcare don’t expect to have any time to focus on a business when you are on maternity leave. In America where maternity leave is only two months it’s definitely not going to happen but in the UK and Europe where you are allowed up to a year off with your job still guaranteed at the end, an opportunity to plough more energy into a business exists. My baby is overall an easy one. He sleeps well at night but during the day he requires a fair amount of playing with and attention. I think that’s fair. I wouldn’t feel right to ignore him or place him in front of a TV if he’s awake. I have to deal with my business things on my own time, not his. As a consequence I have a nanny for 3 to 4 hours three afternoons a week and during this time I do my blog writing, video editing, business accounts and catch up with the people that do graphics and other work for my business.  I did start off trying to work while he slept but the problem with that is that it led to inconsistent output: Sometimes my boy would sleep for ages and other times he wouldn’t do more than a 30 minute nap here and there. There was simply no way I could do any solid work unless I had someone caring for him so, in the end, that’s what my husband and I decided to do. If you want to start a business and think that the best time to start is during maternity leave, I hate to tell you this but this is unlikely to happen unless you organise some support. Several of my friends have tried this and have all tragically failed; now that I too am a mum, I understand why. So, what are your options for child care? 1. Nanny or nanny share If you can afford it, pay for several fixed hours every week for childcare. A more affordable way to do this is to have a nanny share whereby one nanny looks after your child and someone else’s at the same time so that the cost is shared. I am lucky to have someone on my street to nanny share with so this reduces the cost. Mind you, the cost is not exactly slashed in half by having a nanny-share because the hourly cost of taking care of two babies is higher than the cost of one-on-one care (but it’s not double). I only need to work 20 hours a week (4 hours a day, Monday to Friday) but for now I only pay for 10 hours because I can make up for the rest during nights when my son (and husband are asleep).  2. Ask family for help If you are lucky enough to have family nearby they may be willing or even dying to spend time with your baby. Work out an arrangement that works for everyone so that your family get some valuable time with your baby and you get to do some work. 3. Speak to your partner Ask your partner how they can best pitch in to help you get work done. My husband adores our son and gets one-on-one time whilst I work. He loves doing bath time and does some play time. Luckily, I don’t need to take that much time away from family time. Once I’m done with my work I let it be and spend time with the family. 4. Save for childcare If you don’t have family nearby, a supportive partner or the funds for child care then it may be a good idea to save a lump sum for childcare before you have your baby. If you have more suggestions please make a comment. In summary, maternity leave may provide a chance to put more energy into a business but if you don’t plan for childcare, it won’t happen; so, plan for it! I hope you have all the knowledge you need to build your 6-figure product business so that you don’t waste time making it up as you go along when you should just be running your business. If you need a blueprint for building a product business join The Money Spot Program. You not only get access to knowledge but to a network of individuals who can share ideas with you via our closed, members-only Facebook page but you can obviously ask me questions whenever you need.  Want to Build a 6-Figure Beauty Business from the comfort of your sofa? Then my course is designed for YOU! "Beauty" includes a WIDE range of products from the not so obvious non-perishable foods and crafts to the more obvious hair, makeup, fashion, health & fitness.  I watched one of my entrepreneur friends go from making great money for a two year period to having to get a job after a very short period of declining revenues: I saw it coming but I failed to stop it. I strongly believed that they person needed to build a brand and to market themselves with that brand using the usual blogs and social media relationship building. Out of the three elements of my money spot program they only had one element on lock-down: distribution. My friend was selling very successfully via an online portal and to be honest as their revenues were better than mine I felt they wouldn’t listen to my advice. Why should they? Why did I think they were working on the wrong things? They got it right by starting with and focusing on one product. However, they spent all day, every day ordering and managing stock plus packing and shipping product to customers. This, in my book, is one of the worst things an entrepreneur can do.  These kind of tasks are some of the easiest to do and the most straight-forward to pass on to someone else. I did ask my friend to hire someone to do it but they ultimately said they enjoyed and preferred to do all these operations themselves. Fair enough. If these admin like tasks were only taking one maybe two hours per day, I would have been like fine, it’s not a big deal, however, this was not the case – they consumed most of the working day. Why did the strategy fail? By spending all time on admin, no time was spent on building a strong and attractive brand and no relationship was being built with potential new customers. This meant the person was just selling another commodity rather than a lasting brand identity.  If they had spent some time building a following then in hard times when sales were poor they would appeal to their fans with promotions etc. The only emails to-hand were those of existing customers and unfortunately most of those had already bought all the items they would have wanted from my friend’s store. Unconvinced by the potential for social media, the dream life that had been worked on so hard was neglected. How can you avoid the same trap? I have three simple tips. Don’t be satisfied with selling another commodity:

If you’ve been selling another commodity – sit down and strategize your way out of this sticky situation – selling a commodity will fail you in a recession.  Want to Build a 6-Figure Beauty Business from the comfort of your sofa? Then my course is designed for YOU! "Beauty" includes a WIDE range of products from the not so obvious non-perishable foods and crafts to the more obvious hair, makeup, fashion, health & fitness. |

Heather on WealthI enjoy helping people think through their personal finances and blog about that here. Join my personal finance community at The Money Spot™. Categories

All

Archives

September 2023

|

Heather Katsonga-Woodward, a massive personal finance fanatic.

** All views expressed are my own and not those of any employer, past or present. ** Please get professional advice before re-arranging your personal finances.

RSS Feed

RSS Feed