|

Fifi asks about how best to manage her money when her income from month to month fluctuates a lot with some months bringing in just enough for her to get by. She also wonders how best to manage her credit score and to boost her monthly income.

I give a broad answer covering:

Heather p.s. subscribe to my podcast and ask me any money question, HERE - do it now!

0 Comments

Hi Heather,

Thank you so much for launching your podcast. I am really enjoying all your advice. My name’s Vivienne. I’m single and in my late 60s. I receive the state pension and find that I struggle to make ends meet – my saving grace is that I own my home outright but I don’t have any other investments outside of that. Although I would like to work because I get lonely sometimes, I lack the energy I used to have in my younger days and certainly I find a full day’s work very exhausting nowadays. Is there anything you can think of that can help me boost my income? Thanks

Thanks for this question Vivienne.

Given you are not working, I won’t give you advice about saving and investing at this stage as I normally would. I’m sorry you get lonely – loneliness is a rising issue in Britain and not only amongst older people – in 2016/17 Younger adults aged 16 to 24 years reported feeling lonely more often than those in older age groups according to the Office of National Statistics. I have two income boosting suggestions for you that could help boost your income and reduce your loneliness too. In the past, I have also given people advice about boosting their income by monetising any skills they might have on freelance sites like fiverr.com or upwork.com or by tutoring via websites like tutorful. However, I am going to suggest something totally different to you, perhaps even radical: have you considered taking in a lodger or renting out any spare rooms you might have on airbnb.com? You could do this even if you didn’t own your home as long as you get permission from your landlord to sublet. There are pros and cons with each option. Option 1: LODGER If you take in a lodger, you will have someone living in your home on a full time basis and you will probably have to give up some of your space in places like the kitchen to them. You will also need to be comfortable with that person using your appliances and white goods. Are you happy for someone to share your hob, your fridge space, your washing machine and your living space that closely. Taking a lodger in could flip you from being lonely to being frustrated very quickly if that person has very different habits and a very different lifestyle to you. Instead of a full-time professional lodger perhaps you could take in a more transient lodger like a student. Some students, especially international students don’t see university as one long party and may well be studious, well-behaved and easy to live with. If the person comes from Europe, they are also likely to go back home regularly leaving you to enjoy your living space on your own terms during such periods. The government allows you to earn up to £7,500 a year tax free by letting a room in your home. This amounts to £625/month, all tax free. Given that the state pension currently sits at c.£8,800 a year, you would almost be doubling your income if achieved this amount. If you have a generous spare room with an ensuite you might well be able to charge this kind of rent. Or if you have two spare rooms you can get a couple of lodgers. You could also exclusively look for someone that is retired with the objective of keeping each other company in retirement. The type of person you decide to let a room to is entirely up to you. One downside is that you might find a lodger who keeps too much to themselves and isn’t interested in bonding with you which might make you feel even more lonely. This brings me to option 2. Option 2: AirBnB Have you considered renting any spare rooms out on AirBnB? If you have the energy to change sheets and provide a breakfast this can be a fantastic little earner especially if you live in a popular city. However, even if you are in a quieter city it is certainly something that is well worth trying. A major advantage of letting rooms out on AirBnB is that you will retain full control over your home and kitchen space. When you are not home, for instance, if you are on holiday or visiting friends and family you won’t be leaving the house to a lodger which may offer you some peace of mind. Just as importantly, during times when you expect visitors such as at Christmas you can have the house free of AirBnB guests. A key advantage of AirBnb over a lodger is that you will get exposure to many different types of people with many curious about you and your city – based on them having to rent an AirBnB you can assume that most won’t be as familiar with your local area as you are and you can enjoy telling them about it and where to visit. Personally, if I were in your shoes, I think I would go for the AirBnB option but you should decide based on your own personality and preferences. For instance, you might find the perfect lodger for you – someone who is perhaps older and not transient and even wants to spend time with you. When I was single, once I bought a house, I always had a lodger for two reasons: firstly, I didn’t like the person I was becoming when I lived alone – I was becoming very rigid and set in my ways; secondly, I needed the extra money because my first mortgage was expensive and the monthly income boost made a big difference to me. I was also very likely to always find lodgers that I had things in common with so we could do some things together. Just as with getting a lodger, you can rent rooms out on AirBnB and not have to pay tax until you are earning over £7,500. I hope this is helpful. Outside of this there are the more obvious things like getting a part-time job or baby sitting when you have the energy and inclination to do that kind of thing. I hope this helps you thinks more broadly about how you can boost your income and get some companionship at the same time. If you are enjoying listening to my podcast, please give me a 5* rating wherever you listen to podcasts. If I don’t yet deserve your 5*, please let me know how I can earn it. I hope this helps! Heather Have a money question for me?

If you have any personal finance questions send them to [ME] – I will answer whatever piques my fancy via a blog post.

Hi Heather,

My name’s Nicola. I’m fortunate enough to still have a job right now, most of my friends have lost their jobs and it’s made me realise that if I had lost my job I wouldn’t be able to survive at all. I have no savings, a few debts and spend all my earnings every month. What do I need to start doing, right now, to ensure that by the time the next crisis hits the economy, I would be able to survive regardless of my employment situation? Thanks for all the financial knowledge you share.

Dave Ramsey is having a field day with this COVID-19 pandemic and associated financial crisis! His very conservative school of advice is exactly the type of financial planning that you need to survive an economic crisis and it works especially well if you are in the type of job that is insecure and disappears in a market downturn. Go to his channel and he is all about the, “I told you so.”

Quite soon after the global COVID-19 pandemic hit in 2020, stock markets plunged to 2017 levels. Lots of investors got scared and decided to hold their money as cash, however, those of us that follow the Warren Buffet school of investing were not selling our shares, we continued buying as usual but at the now lower prices to reduce the average price at which we bought our shares. It turns out to have been a good idea because portfolios have bounced back very rapidly BUT it wouldn't have mattered either way, those of us with 15 plus horizon have plenty of time to recover and make fresh gains. Investing consistently over time and especially when stock prices are falling helps to reduce the average price at which you buy your shares, this is called “Dollar Cost Averaging”. Getting your financial house in order takes time; it is not an overnight thing. If you have a low income or significant debts it can take very many years indeed but these are the fundamentals you will not have regretted following in a world where the next crisis is always just around the corner. I don’t claim to have created a new financial world order; the principles I like and follow have been collected from many financial authors over the last fifteen years: 1. CREATE AN EMERGENCY FUND (and AD HOC FUND) Have an emergency fund of £1,000. This will cover most emergencies. If you’re a student, a £500 emergency fund should be sufficient. I used 60% of our £1,000 emergency fund to buy a freezer just before the UK went into COVID-19 lockdown. We only had a 70/30 fridge/freezer which means the freezer portion is tiny. I’ve personally always preferred fresh fruit, veg and milk to frozen or canned stuff so it was never a problem before but having such a low stock of food made me properly anxious and I am not even the anxious type. I won’t tell you the drama I went through to get what was probably Britain’s last freezer from a back alley warehouse shop but I do know I am not the only one that had some kind of emergency when COVID-19 hit. If you did use your emergency fund then please share how you used yours in the comments. If you didn’t have to use your emergency fund, that is awesome but I know you will have had a certain level of peace of mind by having had the £1,000 emergency fund set aside. An emergency fund is there to be used for any expenditure that you feel has to be made but had not been budgeted for: a car breakdown, an unexpected medical expense etc. How should you set up your emergency fund? Many UK savings accounts and current accounts are completely free so I would just add a savings account at your existing bank and build your emergency fund there. We also use the emergency fund for ‘ad hoc’ expenses so it gets topped up monthly to accommodate what we call ad hoc expenses. These are expected annual expenses that we prefer to pay for annually rather than by monthly direct debit. Ad hoc expenses include:

For example, if you figure out that these will total £1,800 per year, then you need to add an extra £150 every month to your Emergency Fund. Sometimes it will dip below £1,000 but because it’s topped up religiously every month it will get topped up again and if these annual expenses are bunched up around the same time of the year sometimes your emergency fund will be well above £1,000 but that is okay because you know that the money is there for a specific purpose. Paying for lumpy expenses annually rather than monthly gives you the same peace of mind as buying things for cash. You’ve paid for it, it’s done and frequently paying for it once a year is cheaper than setting up payments. Of course, if it costs exactly the same to pay monthly then that might be the better option to even out your cash flow. Alternative option: You could split bank accounts up further by having a separate "Emergency Fund" bank account and Ad Hoc Fund or Annual Expenses account; that way, the Emergency Fund remains sacred for a true emergency. 2. GET TO DEBT FREEDOM You will not ever regret having paid your debts off completely. Those that had zero debt when COVID-19 hit will have been best placed to weather the storm because they have no debt payments to be making in addition to their costs of living. If you want to tackle your debts systematically, get my “notes to debt freedom”. If you do have outstanding debt then create a plan such that in under 3 years, and ideally within 12 to 18 months you will be completely debt free. My notes to debt freedom will guide you through that process. 3. SET UP A CRISIS FUND The crisis fund is completely different to the emergency fund. A crisis fund is there to protect you against times of unemployment. The usual advice is to maintain 3 to 6 months of expenses to protect yourself against periods of unemployment. If you have a budget then you can easily calculate which expenses would continue whether you were unemployed or not. For guidance on creating your budget plus a downloadable spreadsheet to create a budget see my article, “Q&A: I hate budgeting – am I doomed to be broke?” Three months of living expenses is considered enough if you have a safe recession-proof job that’s likely to be easy to find again should you be unemployed for a period, think nurse, doctor, accountant, delivery person, bin man etc. If there is one thing that is being amply revealed by COVID-19, it’s the types of jobs that are safe and essential to our day-to-day life. A recession is not the only reason you might need to take time off work so that's why you need a crisis fund even if your job is recession proof. If you disliked your work environment because it was toxic, for instance, you might prefer to leave even if you haven't secured another job to move on to. If you send your children to private school, add at least a term of school fees to the crisis fund. If you have a property portfolio then add another three months of related expenses. You can make a reasonable judgment on this. If you have a large portfolio then this may not be necessary as you can make the judgment that some properties will always be occupied to support those properties that are not occupied. If you have lots of buy-to-let mortgages then do make a reasonable provision to accommodate continued payment of mortgages even if you lost a significant portion of rental income. If, when the COVID-19 pandemic hit you had:

If you have a mortgage-free portfolio of buy-to-let properties then you are feeling even more secure. With the stock market crash, it’s best to ride it out and not sell any of your shares. Selling would just convert paper losses to real losses. With a fully-outright-owned property portfolio you can enjoy some income stability in addition to having a healthy balance sheet as outlined above. To clarify, my household is not in the perfect situation either but we have been working towards it and will continue to do so. Our plan to get to the above situation is a 10-year plan and we are only at about year 2 right now. Thankfully we both still have our jobs so we can continue focusing on that plan. 4. GET/HAVE AN AFFORDABLE MORTGAGE The more affordable your mortgage is, the less financial pressure it adds to your life. If you are in a relationship, an ideal goal would be to have a life that is affordable on the lowest of your two salaries. So, whatever your mortgage is, that mortgage and all your other costs of living would be affordable on the lowest of your two salaries. Not entirely possible for all people. However, one way to work this is to have a very long-dated mortgage, e.g. a 30-year mortgage instead of a 15-year one, and in good times, make overpayments as though it were a shorter mortgage. However, in a crisis you would reduce payments on the mortgage to conserve cash. I reduced payments on one of my buy-to-let mortgages as soon as the covid-19 lockdown was put in place in the UK. The monthly re-payments for the last year were £2,500/month, which was £900 above the mortgage deal and in fact less than £500 of each payment was interest. This week I called the bank and reduced mortgage payments by £900 to conserve cash in case I lose a tenant, etc. This can work in exactly the same way for your personal mortgage. If I lose the tenant, I will call the bank and ask to pay interest only until the lockdown is over. My bank would probably be completely fine with that given my level of over-payments far exceed what they expected on the mortgage deal. In the past I have used this same type of cash flow management by getting an interest-only mortgage deal on our home and making excess payments with the intention of cutting back to interest only should times get tough such that we need to live on one salary. However, interest-only deals with a good interest rate are much harder to secure nowadays than they were in 2010 when I last got a residential interest-only mortgage. If your mortgage becomes unaffordable for any reason, call your bank and get a mortgage holiday. The media has made it sound as though mortgage holidays are something banks are doing as a one-off exceptional thing for COVID-19 but the truth is banks are always willing to give people payment holidays if they can prove that they are needed. Your bank would prefer not to have the hassle of repossessing a home. That wraps up the key 'big picture' things you can do to crisis proof your finances. >>>HABITS OF A LIFETIME THAT WILL HELP YOU SURVIVE THE CRISIS No matter what your personal finances look like, the one thing you can do right now is look at your monthly and annual budget with a fine tooth comb and figure out how to cut your cost of living – if you have a very expensive lifestyle, this is the time to think through your habits. If you want me to help you rework your finances, schedule a call using the “request a call button” on my coach page. Sometimes you just need an independent party to point out where you could possibly cut back, you know, the non-essentials you’ve began to see as essentials. Being confined to your home is not easy especially if you enjoy being out and about. The plethora of memes that have hit our whatsapp screens show just how much people are struggling to keep themselves entertained during the period of lockdown and social isolation. If your job, like mine, can continue as normal even from home then you have less time to get bored, however, this is the time when you can work on things that you wanted to do before because you don’t have a commute:

These are just a few ideas and I am sure you have more. Once the initial overwhelm and disruption to normal life created by COVID-19 subsides you will have the mental bandwidth to figure out how you can make the best use of this time. Oh and by the way, watching endless YouTube videos of all the skills you would love to develop, doesn’t count. Start working on something that you would never have otherwise had the opportunity to explore. In summary, to get your financial house in order:

Hope this helped. My prayers are with those that have lost a loved one or suffered a job loss at this already difficult time. Lots of love and adoration, Heather Have a money question for me?

If you have any personal finance questions send them to [ME] – I will answer whatever piques my fancy via a blog post.

Hi Heather,

I’m Melissa. As a full-time entrepreneur myself, I often find a difficulty in deciding how much monthly income to re-invest into my business and not OVERDO IT. This reminds me of why I often lose at the board game "Monopoly", ha! Because I'll spend every last dollar on buying up houses and hotels and when I fall on someone else's property, I don't have the money to pay them. And it's a downward spiral from there, haha. Anyway... I'm sure you know just as well as I do that our businesses are our babies and sometimes we think we aren't feeding them enough to grow as fast as they can. But at times, over-investing can cause immediate problems. What should I do to find a balance between re-investing as a business owner and putting money aside?

Hi Melissa,

The trick to answering this question is uncovering what your goals are for the business and what your goals are for your private life. This will both allow you to decide how much to take out of the business and also when to exit the business, if ever. I ran my own business from 2012 to 2017 and I had to answer this question myself. In the first year of the business I earned very little but I had saved over GBP60,000 because I knew I wouldn't make money from the get go. This is the reality for most businesses but from your question it sounds like you are past this stage and have some cash coming in, well done! You've gone past the first hurdle. So, what kind of business are you running?

I’ll define the three categories: The Lifestyle Business A lifestyle business to me is one where you want to earn enough to support all your needs and a good portion of your wants. You don't hire too many permanent staff - perhaps you have a couple of virtual assistants - for your social media and bookkeeping and use freelancers for everything else. The 'grow and sell' business With a ‘grow and sell business’ you’re a little more focused on the business than on yourself so you’re a little more willing to “suffer” for a period of time by cutting off all wants and just extracting enough for your needs because the business comes first. You want to get a consistent level of year-on-year growth and you want to track several observable metrics that will make it easier to sell your business in a time frame which you set. Sales numbers are the best metric to track but even social media statistics can be something worth measuring: healthy email lists, social media accounts with real followers, that kind of thing. The legacy business A legacy business is one that has to satisfy your income requirements for a prolonged period of time with a view to passing the business on to your children or selling far in the future if your children are not interested in running a business. Once you’ve decided the type of business you’re running, then you need to go through the following process: 1. Figure out how much cash your business needs every month? This is your, “monthly cost of operations” Some people think running an online business is virtually cost free but you and I both know it isn't so. Sit down and calculate the minimum amount of cash the business needs to have just to keep chugging along. This should include the cost of all your tools: email marketing software, social media software, graphics tools, website hosts, budget for freelancers and other staff costs, advertising! Back in 2012 when I started my business you could get a decent level of exposure for free, Facebook posts on pages were actually shown to people that had liked the page and you could monetise that exposure. Nowadays you have to spend money to get even low levels of exposure. You probably also need a budget for taking courses that will help you grow your business. The marketing techniques that work are constantly changing and you will need to keep on top of marketing intelligence to grow your business. So, it really is worth sitting down to figure these costs out. Once you have the number, you’ll know the minimum level of money you need to leave in your business bank account every month. Divide annual costs by 12 so that you have a reliable monthly cost of operations figure. 2. Figure out how much you need to live. This is your “monthly cost of living” If you are fortunate enough to have your living costs mostly met by your parents or your partner then this won't be a large number. My husband supported us for a good portion of my self-employment but I paid myself enough to cover my lifestyle costs: beauty products, going to cafes with friends, clothes, that type of thing and when we had our son, I made sure that the business covered his nursery costs too because the only reason he was going to nursery was because I needed to work. Ultimately, this meant I took out about £600/month to cover four half-days of nursery each week and £670/month for myself. The amount I paid myself wasn’t random: my accountant set my wage level just low enough not to have to pay national insurance tax. You will have to consider the tax impacts for yourself. That threshold moves every year. You could pay yourself more through dividends but speak to an accountant to get the balance right because if you pay dividends too often the taxman could say it looks like a salary and should therefore be taxed at the higher earned income tax rates. If you can live on less than the sort of figure I am suggesting, even better. If you're not living in a supported situation and have to pay all your own bills then this number could be much larger. So, having done steps 1 and 2 you will know the minimum amount you need to keep the business going and plus the minimum amount the business needs to make to keep you going too. Is your business producing at least this much? I hope so. 3. How much do you want to save? The next step is one I regret not having given enough focus when I was self-employed. I didn't save much at all for the household in that entire time. In fact, the only person that built up any savings is our son who had about £12,000 by the time I ditched the business and went back to work. In fairness, the business was not making enough for me to save but if I think back I could probably have managed to put away £300-500/month for the family if I really wanted to. I didn't suddenly start earning more when my son was born so the fact that we managed to find over £300/month to grow his savings shows the money was there. To decide on the ideal amount of money to save every month, project how much money you want to have at the age when you want to retire then using an online retirement calculator to figure out how much you ought to be saving every month. I found a good UK pension calculator on PensionBee.com and a good US retirement calculator on vanguard.com.

If you are running a lifestyle or legacy business and the business is generating not only enough to support operations but enough to save and live. Fab!

So, how's this different for a 'grow and flip' business? If you are building a 'grow and flip' business then I wouldn't worry too much about the savings elements. If you can sustain operations and yourself then you can continue running the business and ploughing all excess money back into it in the hope that you will sell the business for a good lump-sum in say, 5 to 7 years. Because this is a higher risk strategy you need to decide when you will quit the business. You can't continue running a business that doesn't allow you to put money into savings and investments indefinitely. You need to decide for yourself the point at which you will decide it isn't work. In summary: What you take out of the business depends on: 1. What the business needs to keep going. 2. What you need to live. 3. What you need and want to save. To attach some numbers to this discussion: Example 1 If your business is generating at least £1,500 every month (for example purposes) and it needs £800 to just keep moving then there's £700 left for you to either take for yourself or re-invest in the business. If £700/month isn't enough to meet your living costs then you need to figure out how long your savings can support you while you give the business a chance to grow. Example 2 If your business is generating at least £5,000 or more every month and it needs £1,000 per month to sustain operations and you need another £2,000 for yourself then there's still £2,000 to play with. In this scenario, even if I was running a 'grow and flip' business I would save to hedge myself against the risk that my business isn't sellable. A final thought. Ultimately, I left my business because it produced lower profits than I could earn in "regular job" and fortunately for me, I discovered that I actually love the routine of going to work and communing with my colleagues. If over a two to three year period the business is generating you, say, £30,000/year and you know you could earn £50,000, £60,000 or even £100,000/year working, have a deep think through whether the long hours of building the business are worth it. Many glamorise entrepreneurship but we both know the hours can be long and hard and the returns inconsistent from month to month and year to year. For knowledge workers (Economists, lawyers, researchers etc. – desk-type jobs), the in-work flexibility is unreal nowadays and you could pretty much set up your life to be more flexible than an entrepreneurial life, with much more free time and real holidays where you actually leave your laptop at home! Sorry if any of this last bit sound discouraging but I promised myself that when I blog about business I will always give people a real sense of what it's like. There are enough blogs out there pretending every 'trep is a millionaire when the reality is that the average self-employed person in both the UK and the US earns less than the average worker – shocking, right? Hope this helps, Melissa. Have a money question for me?

If you have any personal finance questions send them to [ME] – I will answer whatever piques my fancy via a blog post.

Hi Heather,

My husband and I want to buy a house, how can we go about improving our credit score? Chrissy Hi Chrissy, This is an awesome question. I think lots of people come up against this issue at one point or another. Before I get into the detail, straight off the bat I’ll tell you what you don’t need to do, you don’t need to get a credit card. You can build excellent credit without a credit card despite what people say about needing a credit card to build a credit record and strong credit score. Now that I’ve got that off my chest let’s start from the beginning? Firstly, what is a credit score and what’s it trying to achieve? A credit score is a number that’s designed to be an indicator of your creditworthiness. This means that the credit score gives lenders an indication of how good you are at paying your debts and how likely you are to default and not pay them. Lenders only want to lend to people that are likely to repay that money and the credit score is an indicator of your likelihood to repay. Your credit score is built up using all the information a credit reference agency has collected about you over time especially over the last 6 years; information older than 6 years usually doesn’t weigh into your score. The credit reference agencies that you might have heard about are:

You can also go directly to Transunion or Crediva to get a credit report from but they don’t give you a score directly – they only do so via CreditKarma and checkmyfile, respectively. If you want to improve your credit score you need to know what your current score is so you can track it. You can’t improve something if you haven’t measured. Credit scores work in the following way:

How come ClearScore and CreditKarma are free?

Both make money by selling products to their customers. But, in my opinion, the way ClearScore goes about it could land you in unnecessary debt so I wouldn’t recommend them. Under the credit information, there’s a section on ClearScore that asks you “How can I improve my credit score” and one of their pointers if you don’t have a credit card, is that you get one. CreditKarma aren’t so brazen. I feel as though ClearScore keep my score artificially and strategically low to nudge me towards that credit card. So, if you do use ClearScore, know that even if you pay your debts on time, are current on all your bills and are essentially doing everything you should to be classified as financially responsible, you won’t get the top credit score if you don’t have a credit card. I am very anti-credit cards so I would never get one and this one aspect of ClearScore annoys me and stops me from using them. With all this knowledge about the agencies, this is what I recommend you do to improve your credit score: Firstly, get a CheckMyFile credit report and credit score. As I mentioned, CheckMyFile’s score is out of 1,000 and based on information from 4 agencies; you will be able to view a lot of the information that all 4 agencies hold on you. Second, I suggest you check your credit score only (not the credit report) at Experian. Experian have a service where you can view your score anytime for free but you won’t be able to see the full credit report under that service. Because you are getting an Experian report via CheckMyFile there is no need to get it directly from Experian too, at least not in the same month. The reason I am suggesting you get your Experian score (which is out off 999) is that I find their score very responsive to changes in your financial footprint. If you pay off debts and so on, the Experian credit score improves within a month or two and it’s actually possible to get a perfect Experian score of 999, I have had that several times. In my experience, Experian’s credit scoring system is the most legitimate and reliable. Make sure you unsubscribe from CheckMyFile before a month is up because they will start charging you £15 per month after that. This will mean you lose access to credit reports and the checkmyfile score but that’s okay because you will have the Experian score and to check your credit report on a regular basis, just use CreditKarma. The level of detail Credit Karma has is actually very impressive. They actually have financial details on my profile that Experian seem to have missed and yet, outside of the little bits of missing data, Experian is generally the most comprehensive. FYI, Experian is not paying me to say any of this. Okay, so what can you do to improve your credit score?

These are the things that will have a huge negative impact on your credit score:

In summary, what should you do to improve your credit score:

Hope this helps, Chrissy. Have a money question for me?

If you have any personal finance questions send them to [ME] – I will answer whatever piques my fancy via a blog post.

What's the point of saving? What's the point of saving?

Hi Heather,

Based on the things you told us about investing, my husband and I started putting £125 per month each into our SIPP pension. I hope this isn’t a silly question but what are these savings for? When can we expect to start spending that money and should we try to spend it in specific ways or on specific things? Both my husband and I are 30, we don’t plan on having children and our jobs have fixed pension benefits. Thanks Flora Hey Flora, That’s a great question. While everyone has a different value system, there are two main reasons that I strongly recommend that people put money into a self-invested pension plan or SIPP a) flexibility and b) security including funds to help pay a mortgage off early. A SIPP can be better than a stocks and shares ISA, in some cases, because you effectively pay less tax and because you can’t use the money until you are about 58 so it forces you to save. Let’s talk about each reason in turn: The first reason: is flexibility over when to retire In the past, a lot of work-based pensions (aka defined benefit pension plans) used to allow early retirement from between the ages of 55 and 60, most of these type of scheme are being completely phased out and are instead being linked to the state retirement age which for you is currently expected to be 68. There is talk of moving this to age 70, so this is a future possibility. Whatever happens, the funds that you build up in your SIPP can be taken from 10 years before the state retirement age. This means if the state retirement age moves to 70 you will still be able to use money that’s sitting in your SIPP from the age of 60. If you and your husband are putting £125 each into a SIPP then when you are 55 years old, you and your husband’s combined pot of savings would be worth £135,000 if the pot of money only grows fast enough to keep up with inflation of about 3%; if you get growth equivalent to the average stock market return of 7% then you would have £250,000 at the age of 55 and if you get an average stock market return of 10% you would have £410,000 saved up. At age 60 the figures would be £180,000 @ 3%, £375,000 @ 7% and £700,000 @ 10%. These sort of returns aren’t cuckoo. According thebalance.com, “the S&P 500 Index, delivered its worst twenty-year return of 6.4% a year over the twenty years ending in May 1979. The best twenty-year return of 18% a year occurred over the twenty years ending in March 2000.” Various sources suggest the S&P 500 has returned 10% before inflation if you buy and hold the money you invest into it. But of course, it’s useful to remember that this past success doesn’t guarantee that future returns will be as good. Right now you would struggle to find a bank account that gives you an interest rate of 1.5%. Back to flexibility on when you retire, however, unless you believe the US has no room for growth, then this total of £250/month you are saving could amount to a lot of money over a 25 to 30 year period and this would allow you to retire with a decent income well before the state retirement age. If your mortgage is fully paid off by the time you retire then your cost of living could be low enough that even a modest growth in the SIPP would provide a comfortable income before your state pensions and work-place pensions kick in. The second reason: to save the money is the added security from having extra retirement income Having money in a SIPP means you can top up your retirement income. Having the SIPP would mean you have 5 sources of income:

If the pension income from your jobs is lower than your final salary having access to extra funds will mean you can more or less maintain your lifestyle. This will be especially important if one person lives a lot longer than the other. There is one special feature that the SIPP has but all the other 4 pensions do not: and that’s the fact that if you or your husband dies the state pension stops coming through and the work-place pension either stops completely or is massively reduced. However, whatever money is outstanding in the SIPP would fully transfer to the spouse without penalty. Just to be clear, I will make that point twice: a work-place pension either dies with the person and at that point the spouse receives nothing or, from that point, the spouse gets a heavily reduced benefit – usually 50% or one-third of the amount that was being received before their spouse died. A LOT OF PEOPLE forget this about SIPPs and other defined contribution pensions. I won’t go into the differences between defined benefit and defined contribution pension plans here but if someone is interested go to themoneyspot.co.uk and leave me a voicemail with your request. Finally, when can you expect to start spending that money and should you try to spend it in specific ways or on specific things? Technically, the plan is that you will never have to spend the capital but can just spend the growth. If the fund is worth £250,000 when you start drawing from it and you are earning a 10% return per year at that point, then you could just withdraw the 10% (i.e. £25,000) or less and spend that. If your withdrawal rate is lower than the growth rate of the fund then your retirement would continue to grow even as you take money out. Note that some research suggests that the ideal withdrawal rate to maximise the likelihood that the money will never run out is 4%. But given you have pension income from your jobs in addition to the state retirement and you’re not worried about passing wealth on to children you could be more aggressive than this. As for how you spend that money, well that is up to you and is a great problem to have. Having more money doesn’t only mean more holidays, it also means you can buy private health insurance which might be a necessity to avoid NHS waiting lists at a time when health problems are more likely. This would give you a lot of peace of mind. Ability to pay mortgage off early One thing worth adding, is a note that once you can withdraw money from your SIPP you are allowed to take 25% out as a tax-free lump sum. If your household had £250,000 saved up, you could take £62,500 out in one go which could be used to clear all or most of your mortgage. You would then be allowed to take the rest out as an income or you could buy an annuity – with an annuity you essentially buy a fixed income which keeps being paid to you for the rest of your life. I wouldn’t recommend an annuity for you given you have two fixed pensions coming in already, you don’t need the extra security and annuities don’t tend to be worth the money now that interest rates are so low. What you could do instead of buying an annuity is withdraw what you need from the SIPP every year. You would pay taxes based only on what you take out and could manage the withdrawals to minimise the tax bill. I hope this helps. Heather Have a money question?

Hi Heather,

I want to earn extra income, however I work as a nurse in the NHS which takes up my time, do you have any suggestions on any investment that can make money. I am also interested in the stock market but don’t know where to start. I am interested in both generating extra monthly cash flow now and increasing the amount of money I have in retirement. Denise. Hi Denise, Thanks for this question. I love it because I have two nurses in my immediate family, my mother-in-law was a nurse for a long time and my cousin is still one now. Boosting current income

The, “how can I make a little extra cash now” question is one I asked myself quite recently because I wanted to put extra cash into our household ISAs. There are a few things you can do to boost your cash now:

1. Working extra shifts / locum shifts My mother-in-law says this is not a great idea because being a nurse is hard enough work, as it is. I agree that it is very demanding work but one of the great features of working at the front line of medical services is that you can actually make more money by working more hours, even temporarily. Some jobs don’t offer opportunities to earn more by working more, you’re paid a fixed annual salary and that’s it - no overtime. Overtime either goes uncompensated or is compensated as time back in lieu. You can sign up to a locum agency and do the same type of work for higher pay on your free days. If you want to really juice up your income you can even look at things like working a 4-day week in your regular NHS job (your NHS pension would therefore be lower) and work for a locum agency on the 5th day. The advantage with this strategy is that you will boost your income without working more hours because the hourly rate is higher as a locum nurse. If the extra income is invested wisely it could more than make up for the lower NHS pension. Also, keep your eyes open for higher paying promotions. 2. Do some extra work in another field. If you have another skill that you can monetise you can look into doing extra work in that field. So ask yourself, "what other skills do I have?" I'll give you an example from my own life: In my early 20s when I worked in banking the bonuses were not good one year and to make some extra money I slipped flyers into doors offering massages (for women only) at my house for £25/half-hour. I had someone sign up that very day. I had done a course in therapeutic massage at London College of Massage for fun and when I needed it, that skill helped me boost my income. I didn’t do it for long but it showed me that if I wanted to earn more money I could monetise other skills in my free time. There are some things you can do that don’t even need a new skill such as babysitting. You could sign up at childcare.co.uk or sitters.co.uk and your credentials as a nurse would be very attractive to people that needed a babysitter for nights out or weekends. You haven’t said whether or not you have childcare responsibilities of your own so I don’t know if this is possible for you. If you have skills that you can monetise online then list yourself on freelance websites like upwork or fiverr. There is a wide range of professions people hire for on these sites. I have used these sites myself to buy all manner of things including artwork, copy, copy editing and even voiceovers! Imagine that, all you’d need as a voice over artist is a microphone that records your voice clearly. Some people make serious money side-gigging on these sites. These first two options are not completely aligned with your question as you asked for “investments that you can make” but I decided to add them to give a fuller answer. 3. Invest in or produce products that make cash. Investing in something necessarily involves parting with money in the hope that you’ll earn even more money. You haven’t said how much money you have to invest so here are a few options. Can you make something that people would be interested in buying that you can sell on etsy, eBay, amazon or Facebook marketplace? Make a few samples of what you want to sell and list them on all these sites. I ran a product business myself for almost 6 years mostly using Amazon so I would recommend that you:

I would never discourage anyone from starting a business but having experienced it, I would tell you that it is very hard work. It involves a lot of long hours and is nothing like as glamorous as our culture makes being an “entrepreneur” sound. A business could consume absolutely every free moment you have – evenings and weekends. And all that time might not even produce a profit. Investing in a business comes with a lot of risk – stats vary depending on source, however, 80% to 90% of businesses fail in under 3 years. 4. Teach Could you make money teaching something online? You could create a course and list it on Udemy, Teachable or another similar site. This would take some time to produce well, in the first instance, then you would need to spend some money on marketing your course but you could keep the costs very low. Alternatively if you want to teach a GCSE or A-Level subject (High school level) or even a university course level, you can sign up to places like tutorful (previously, tutora). 5. Invest in property. If you have enough for at least a 25% deposit then it may be worth looking into property investment. Because interest costs on buy-to-let property are no longer fully tax deductible, (that means, you can’t subtract the interest payment from the rent you receive before calculating your tax bill), property is not as attractive an investment as it used to be. That said, if you can buy a place with cash, or if the property produces a high enough profit to clear the mortgage within a reasonable amount of time (I personally target 10 to 15 years) then it could be worth doing. Overall, the option you go for will depend on your risk tolerance and the amount of cash you have to invest. If you are relatively risk averse and don’t have cash to invest then working more to earn more will be more attractive. If you can tolerate some risk and do have some spare cash saved up, then investing in property will provide you with medium risk while investing in a business will be the higher risk option. Boosting retirement/future income

If you’re looking to boost future income then you have two main options:

Property investing we've already talked about. The stock market provides a good return over long periods of time; most investment advisors would suggest an investment horizon of 5 years or more. Putting money into the stock market in the hopes of a good return in a year or less is gambling rather than investing, that's why I didn't offer it as an option when we were thinking through how to "boost income now". The most tax efficient options for investing the stock market are investing via an ISA or a SIPP. ISA are individual savings accounts and SIPPs are self-invest pension plans, they are a type of personal pension. If you invest the money via a SIPP then you won’t have access to that money until you are between 55 and 58 years old. The exact age will depend on your age and has been set at the state retirement age minus 10 years. The SIPP is a good option because for every £100 you put in, HMRC pay back £25 of tax and this saving is automatic. It is claimed by the SIPP provider and is shown on your investment account. The maximum you can put into a pension a year is £40,000 or your salary whichever is lower. So, if you earn £30,000/year you can put up to £30,000 into your pension without getting a tax charge. If you earn more than £40,000/year and haven’t reached the lifetime allowance of £1.055m, you can put up to £40,000 into your pension without getting a tax charge/penalty.

I will be writing several blogs on investing over the next few months that should hopefully build your confidence to make the move. In the meanwhile, you might find this useful: What platform should you use for investing and what should you invest in.

I hope this is helpful. Have a question? If you have any personal finance questions send them to [ME] – I will answer whatever piques my fancy via a blog post.

Hi Heather

I just had my first baby. I'm 31 and married. Do you have any tips for how I can think about saving and investing for my baby? Thanks, Diana Hey Diana, This is an awesome time to be asking me this question. I also started planning for my first baby as soon as he was born. You will be at an advantage if you start saving and investing for your children as soon as they are born. You will need to balance what you can afford with what you want to achieve for them. Firstly, what’s the goal? What are you saving for?

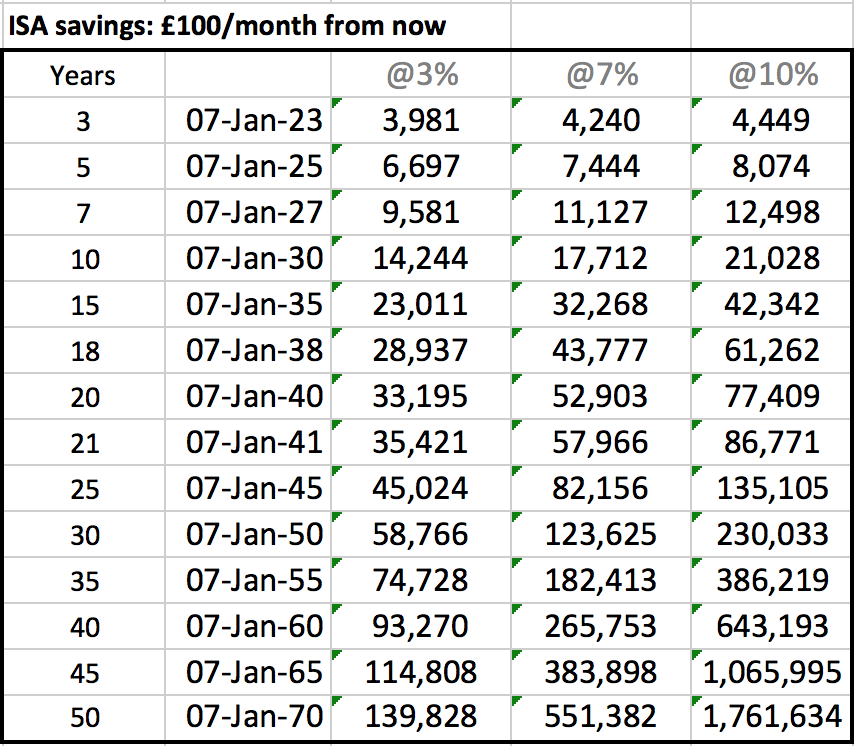

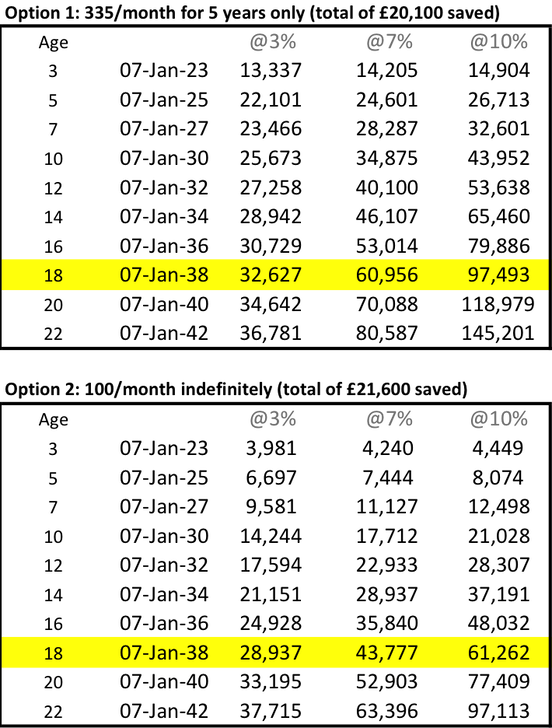

1. UNIVERSITY University costs c.£60,000 in tuition and living costs for a 3 year course at the moment - £10,000 for tuition and books, £10,000 for living – living costs can be higher or lower depending on whether you live at home, etc.. £60,000 is a huge amount of money and this cost is likely to rise in the future but it makes the maths too complicated to think about possible cost increases. Option 1 for university savings If you can save £20,000 in a tax-free account like a stocks and shares ISA by the time your child is 5 years old, then you can stop putting money aside and this money will have a reasonable chance of growing to £60,000 by the time your child is 18 years old. How could you save this £4,000 per year? Perhaps you could target saving a round amount like £250 per month (equivalent to just over £30/week each for a two-income family) and because this sums to £3,000 a year, at the end of the financial year you’d hustle to throw that extra £1,000 into the ISA before the financial year closes on 5 April. Or, if you can afford it, you could just save £335/month and you would save just over £4,000/year. Option 2 for university savings £4,000 is likely more than most can afford. The alternative is to save £100/month until age 18 which most people can afford even on the median household disposable income of £29,400 (2019). It’s equivalent to about £12.50/week each for a two-income family). Which option is better? I would say option 1 trumps option 2 because you give the money the best chance of growing. Equity markets are volatile in the short-run so by saving the money early you give the money a better chance of reaching your goal. That said, something is a lot better than nothing: small savings add up to large amounts over time. Your savings may be lower than you would like to target but you will still help your children avoid the full scourge of student debt. These are the results under each option:

Caveats on saving through a Junior ISA:

When you save the money through a Junior ISA, that money will be theirs when they hit 18 and you might not be able to control how they spend it. However, putting it into the Junior ISA means you won’t be tempted to spend it yourself because once the money goes in, it can’t be withdrawn until your child is 18. How can you avoid the Junior ISA so you have more control over the money?

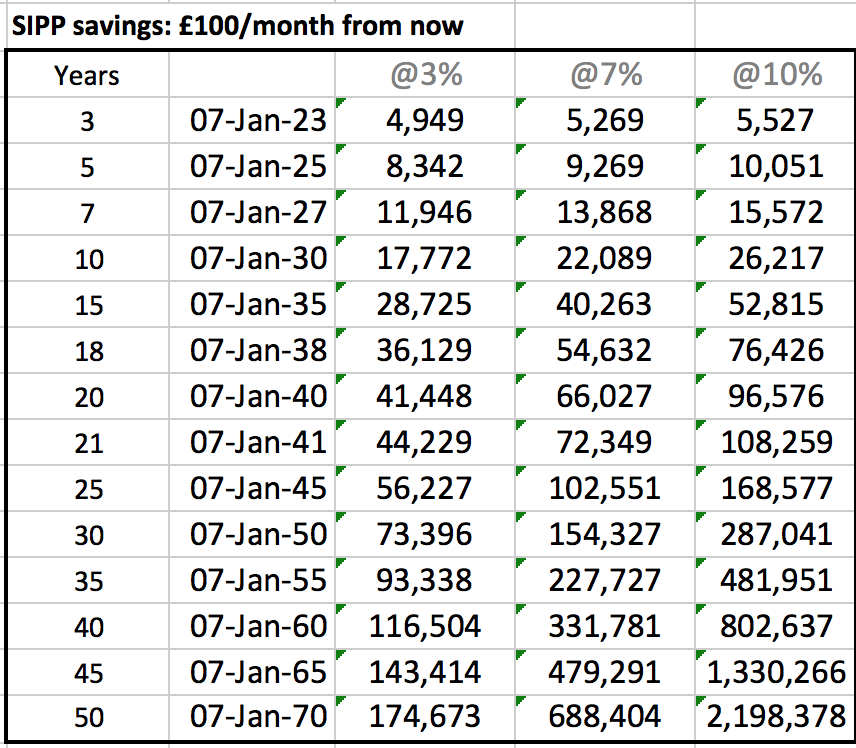

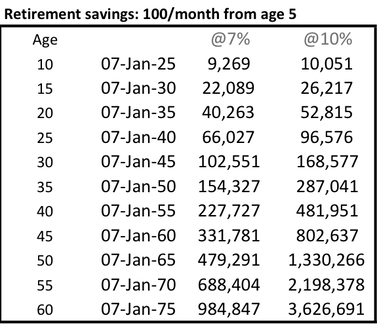

Plan b. is a good option because you could end up not having to pay tax anyway: The capital gains tax allowance in 2019-20 is £12,000. That is, you have to make a capital gain (the profit on your investment) bigger than this to pay the tax. If you save the £4,000 across two investment accounts - £2,000 in an investment account with your name and £2,000 in an investment account with your spouse’s name then when your child is 18 you can sell enough stock each year to keep the capital gain below the capital gains tax allowance. The risk however is that this threshold could fall or be completely removed in which case you would end up paying more capital gains tax on the sale. It’s still a sensible option, despite this risk. 2. RETIREMENT If you followed option 1 for university savings, at age 5 you’ll have stopped doing that and might find that you have some spare money to open a retirement account. Your children will not have access to this money until they are 57 to 60 but if life hasn’t worked this will be a great cushion for them. The beauty of investing in a retirement account is that for every £1 you put in the government puts in an extra 100/80. That is, if you want to save £100/month you only need to put £80 into the account. If you do invest £100 it will be £125/month with the government top up. For kids you can put a maximum of £2,880/year (£240/month) which equals £3,600/year. This is the result if you choose to save £100/month indefinitely into your child’s Self-Invested Pension Plan or SIPP starting from when they are 5-years old:

You notice that the extra £25 from the government makes a real difference. By saving through the pension, based on a 7% return, on 7-Jan-2025 the investments are worth £9,269 rather than only £7,444 without the government top-up.

Don’t save into a child’s retirement account unless you have the cash flow and are meeting your own goals, e.g. paying enough into your own retirement, paying off your mortgage early and ideally, are debt free yourself (apart from the mortgage). Some will be able to afford the full £240/month from birth, the rest of us have to work out what is realistic, that is why I personally opted for the £100/month from age 5. This decision will change with a change in your fortunes. 3. HELPING YOUR KIDS BUY A HOME This is where the decisions get a little tricky. Some people will be able to afford funding university, helping their children get ahead with retirement savings and help with a deposit on a home without compromising their lifestyle at all but the rest of us need to make choices. Private school vs. saving for a home What will make the biggest difference to your children: a private education or getting onto the property ladder? If you can afford one or the other but not both, then you might follow the route of private primary school followed by state secondary school (grammar/comprehensive). In this case you’d direct all the money you would have spent on a private secondary school education on saving for a home. In some cases this might mean your child starts life with a mortgage free home. If you save £15,000/year (£1,250/month) from age 11 until age 21 (10 years of saving) and it grows at an average rate of 7%, how much money would your child have at 21? About £220,00 – increasing to £260,000 if the average return over that period is 10%. This is not small money to most of us. You could use every last cent on a private education when at the end of the day the thing that helps your child follow a life of fulfilment is being relatively debt free. If you decide to go for a state education throughout and save £1,000/month (£12,000/year) from age 5 (when you are done with university saving) until age 21 (16 years of saving) and it grows at an average rate of 7%, how much money would your child have at 21? About £355,000 – increasing to £475,000 if the average return over that period is 10%, wow. Forget the children, you could be doing this for yourself! If you have already made the decision to send your children to a private primary school and they are thriving, you are unlikely to reverse that decision. If I you are seeing these numbers before making a decision, you might well make a very different decision… Not thinking about private education, anyway? If private school is not a consideration for you, then the best choice might be to save as much as you can towards your own ISA allowance of £20,000/year (£40,000/year in a two parent home), in addition to whatever you save towards your pension (I recommend 10-15%) and when the time comes you can decide whether you can contribute towards university or a first home or both. The best gift you can give your kids is possibly to be independent in old age so they don’t have to worry about taking care of you. You can boot strap them onto the property ladder by letting them live at home rent free – so that they can save more for their deposit. Even without cash gifts, you will be giving your children a competitive advantage by teaching them how to handle money at an early age. Starting to invest Next, you need to consider what platform to use for investing and what to investing in? If you have any personal finance questions send them to [ME] – I will answer whatever piques my fancy via a blog post.

Q&A: If You Want To Diversify From Real Estate, Property & Land, What Should You Invest In?17/8/2016

Dear Heather,

Greetings from Chengdu, China; I love your vlogs and I enjoyed watching your birthing story and recent vlog on how to make money. You are so inspiring and motivating. You inspire me. On the recent vlog you discouraged investing on the stock market. Why was that? My husband and I have invested in properties in America and are looking at buying one in China since we will be here for the next four years. We have also been eyeing property in England. My question for you is since we want to diversify our portfolio from real estate and land what do you recommend? You have the cutest family and gorgeous son. My son is [] months and has been keeping me very busy. Looking forward to hearing from you when you have some free time. Best Regards, Faith

Dearest Faith

Thank you so much for your lovely email. I really appreciate everything you say, it keeps me motivated and keeps me wanting to work. Children do keep you busy but they're so enriching :). The first thing I thought when I received your email last week was, what on earth are you doing in Chengdu, China? (email me for privacy) I am always super intrigued re. what black people do when they’re in Asia but not studying…I’d love to learn more about that. Anyhow, back to property. Firstly, I hope you have made the very low investment in my property course, the price will go up soon so get in while it’s cheap! This is how I think about investing in general. Firstly, I am working towards a given gross rental income per month of £10,000 from a UK/Europe and US portfolio. We don’t currently have anything in Europe or the US but I’m eyeing both up. After mortgages are paid off 90-95% of this will be pure profit. I could easily reach this in the next three years if I include income from rents in Malawi but I discount that income because the country has a lot of political and economic instability and it’s possible that something could happen that completely erodes the rental income. Based on this methodology, we’re roughly half way. If you invest in China you might want to apply a discount too given they’re legal framework may not be as solid as that in the US or UK. That said, they are definitely much more stable than Malawi so invest away. Keep in mind that investing in real estate in different areas and countries is also diversification. There are four main reasons I find property so attractive:

1. Leverage magnifies returns

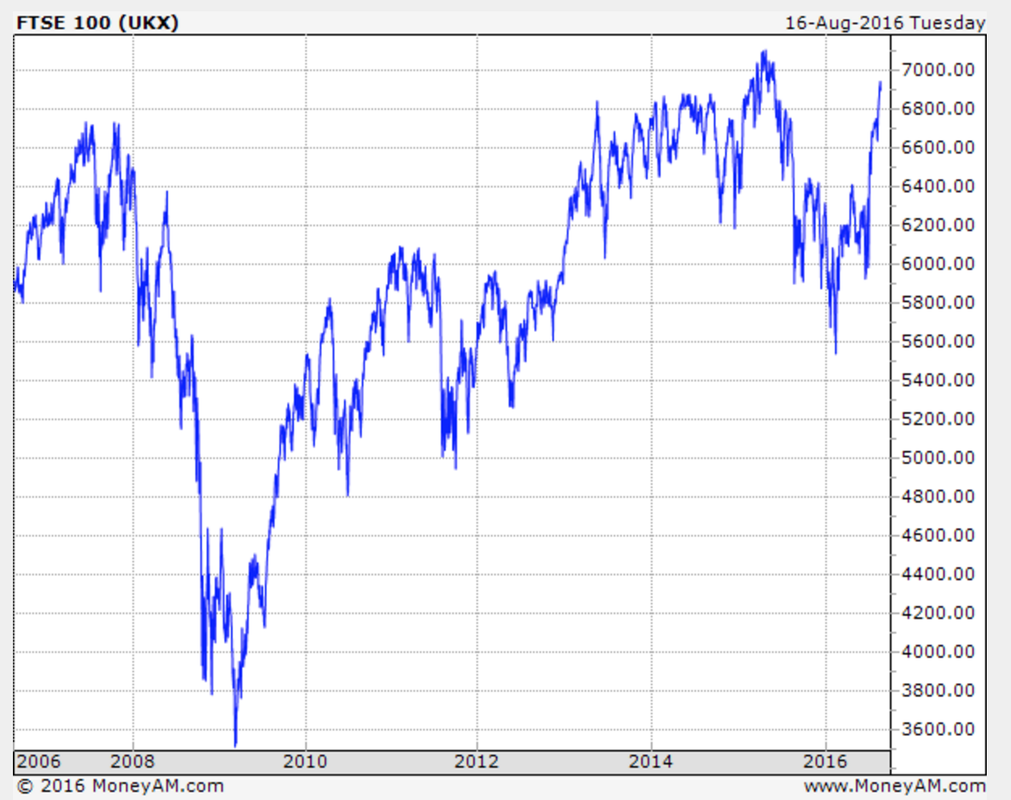

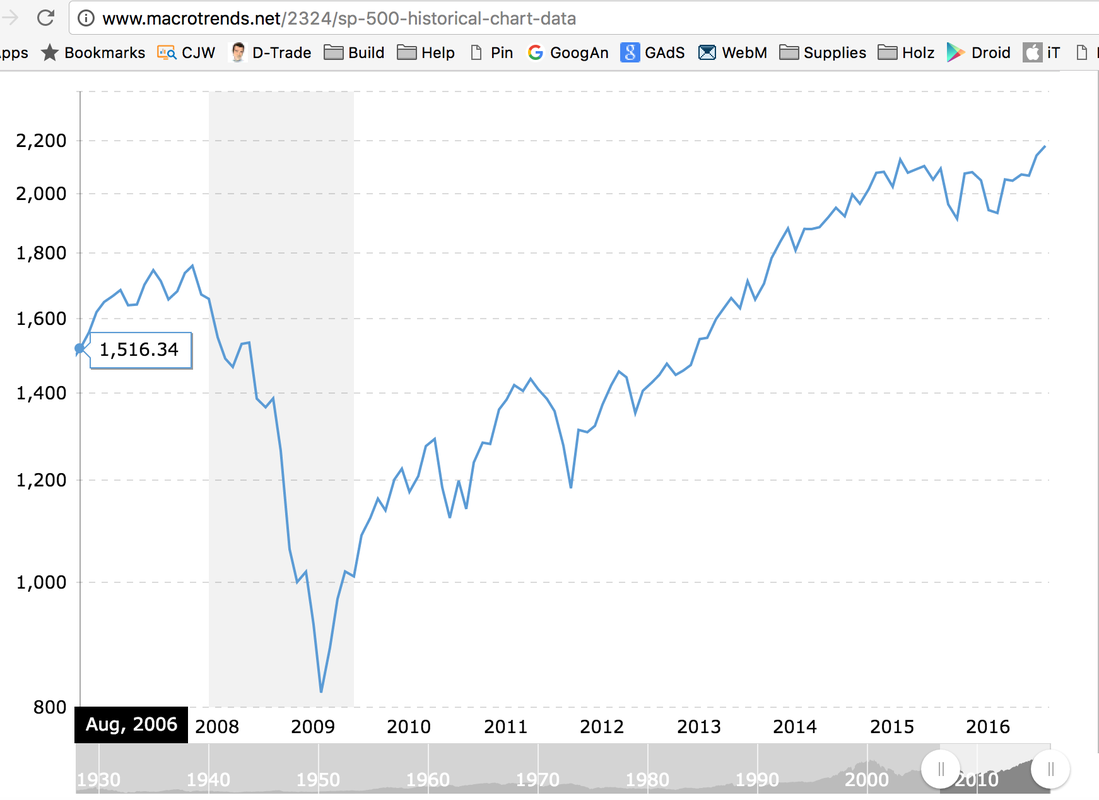

Just to give you an idea of what I mean. The first property I bought cost me £16,500 including a 5% deposit of £12,500. Stamp duty of £2,500 (this is a UK property purchase tax) and about £1,500 in other costs. That was 2006. Fast forward 10 years and the current value of £550,000 meaning a £300,000 capital gain and a gross equity value of £400,000 including what’s been chipped off the mortgage. No other £16,500 investment could have produced that kind of return for me. Firstly, no one would have given me cheap leverage to invest in the stock market and secondly, the returns would have been rubbish – to use a technical term. An investment tracking the FTSE100 would have me worse off; I’d have roughly the same £16,500 today eroded by 10 years of inflation. An investment tracking the S&P500 would have given me £23,700 today, 16,500 x (2178/1516), this is good but certainly far from £400,000. FTSE 100 from 2006 to 2016S&P 500 from 2006 to 2016

2. Reduced saving burden

We don’t spend rental income. This means after interest has been paid off, every month, my tenants are effectively saving for my retirement on my behalf. Currently, that’s about £2,000 worth of savings before tax. Very few investments can do that for you. 3. Easy release of value without impacting the investment I remortgaged this property and took out £80,000 to invest in a business. This doesn’t affect the property’s value in any way and isn’t taxable because it’s a loan not a sale of equity. If you sold some stock to get some money for another investment, firstly, you would have fewer shares so the overall value remaining would be lower and whatever you sold would potentially be subject to capital gains tax. 4. Stability Even accounting for short-term falls in value, property is very stable. Even if you don’t see an increase the value of your real estate investment you would still have the rental incomes. Provided you invest were there is demand for rental properties by tourists, students or families, you have secured an income for yourself in 25-years’ time if not immediately. Now, once I reach my target rental income of £10,000 what will I invest in? STOCK MARKET & ANGEL INVESTING

While I used to invest in single stocks in the past, I no longer do so as I think that long-term investing into diversified index funds is much, much wiser and definitely safer. This view has been informed by tonnes of reading and more experience in investing.

The next few paragraphs written in 2016 illustrate how I used to invest in 2006/7 when I was a newbie with zero experience - I no longer invest in this way but I share this anyway: When I used to invest in the stock market at the beginning of my working like (2005 to 2010), I had no education in investing and my methods were quite time consuming but the time spent made it feel less like gambling and more like investing: I’d download data on the main stock indices from Bloomberg (FTSE, S&P, Hang Seng, etc.) For each share I'd have the following data: 52-week high, 52-week low, P/E ratio, current price and other vital stats to try and identify a company that was undervalued. I’d also think of industries that I thought were growth industries and look at new companies in the sector. For instance, I once invested in a solar company and an Asian company because Asia and renewable energy were/are both growth areas. I sold my investment in the solar company (a German company called Phoenix Solar) when I tripled my money to £3,000. If I still had those shares they would be worth like £300 – the company is down badly. I sold my shares in Citic Pacific (the Asian company) in 2011 just about recovering my money and if I’d held on for 10 years, my £1,000 investment would be worth £750 – 25% down. Single stock investing is very risky especially if investing is not your full time job so you don't have time to go into great deal - reading annual reports and other regulatory filings. Citic Pacific from 2000 to 2016

I made a great investment in Apple in 2006. I sold when I had tripled my money. If I’d held on to my Apple shares until it hit its peak my £1,000 would have reached a £15,000 in value – kaching! That said, if I still had the shares they would be worth about £10,000 today because Apple is down from its peak.

I actually didn’t lose much money investing in the stock market. Citic Pacific and Yahoo were sold roughly were I bought them and Phoenix Solar and Apple were sold after tripling my money. The only complete loss was a bank called Northern Rock. I bought £1,000 when the share price was crashing in the belief that the UK Government wouldn’t let it fail. I was right, the UK Government didn’t let them fail but all shareholders lost all their money. Stock markets go up and down in an unpredictable fashion. This is why I prefer to have a base of rental income from property before dabbling in the stock market. However, if you are investing in the stock market for the very long term 10+ years, and also in well-diversified funds, I think it is a sensible place to keep money safe and earn a decent above-inflation return. BUSINESS

Finally, I invest time and money in creating businesses. Whilst business is also speculative there are many low risk businesses that can bring a stable income.

For example, creating courses online doesn’t cost too much money and once you recover the investment it’s fairly easy to maintain a steady income from the investment. With physical products you might invest more but if the investment fails you normally gain knowledge that will help a future business grow. Business is by nature speculative but the upside is fairly unlimited and you have more control over that upside than you would with an investment in shares. CONCLUSION

My personal strategy is to have enough retirement income coming from property to cover all my needs and some of my luxuries and the rest coming from my stock portfolio. So I focused my early investing on property and started diverting more savings into stock market indices when I was comfortable with the rental income we were generating.

In addition, I love writing, sharing knowledge and business in general so I pump lots of energy into these activities because I believe they produce a good return in the long run and even if they don’t, I thoroughly enjoy engaging in these activities.

Have a business or life question you want me to answer? send me a message.

Me, after a MAC makeup session. Me, after a MAC makeup session. Hi Heather, Thank you for you inspiring words. I started a handmade skin care business but it failed miserably. I gave it my best shot and wasted a lot of money. My question is do you think the beauty market is saturated and what tips would you give to start a successful business. Regards Denise R. This is a great question, Denise, you’re not the first person to ask me this. The truth is there are A LOT of skin (and hair) care products out there and a good majority of them have exactly the same ingredients so consumers find it difficult to distinguish good brands from rubbish brands. The result is that a buyer may continue to buy a product for many, many years although that product that doesn’t work particularly well for them. The vast majority of supermarket skincare products are in fact owned by just two companies, Proctor & Gamble and Unliever; moreover, a good proportion of more upmarket skin and beauty brands are owned by L’Oreal and Estee Lauder. This has certain repercussions for people who want to start a new brand: Disadvantages

Advantages Despite this there are some advantages for you:

Is the market saturated? It is definitely saturated for “me too” products but it’s not saturated for products that come out with a great story and attempt to do something different. To succeed today you need to find a very narrow niche, don’t try to be all things to all people and you need to do things a little differently to turn heads and make people consider switching products. You cannot succeed with a product that’s dull and appears to be no different to existing brands. So, how do you succeed?  Mum looks A-MA-ZING at 57. Mum looks A-MA-ZING at 57. A. Have a great story. Do you know Levi Roots? He created a cooking sauce when there were thousands of sauces on supermarket aisles. He went on to Dragon’s Den (the equivalent of Shark Tank in the US) and nailed it with his pitch. He wasn’t same-old, same-old. He came on with his guitar, he was authentic – he didn’t attempt to change his Jamaican Patois and he charmed us all with his reggae-reggae sauce jingle. After that interview you just thought, I want that guy’s product, that guy deserves to be rich…and rich he became. B. Have fantastic branding. People have more money nowadays so they’re willing to spend a bit more for something that looks amazing. Middle class consumers care now, probably more than ever, about how they are perceived and they want to buy things that make them look wealthy and successful. Poorly branded products have no chance. C. Build your own audience, grass roots style. Have you heard of Michelle Phan? She is a beauty vlogger on YouTube that’s spent hundred of hours producing beauty videos. She grew such a large audience that L’Oreal paid her several million dollars to have her own brand of makeup products, Em. Ultimately that product line didn’t make the type of money L’Oreal hoped for, the suspicion is that the products were overpriced for the type of fans Michelle has (young and just starting out in life), but the brand is still around; it’s now owned by Michelle’s own company, Ipsy. Building a big following means you can sell directly to a certain audience and although most beauty bloggers won’t get bought by the L’Oreals of this world, they have an opportunity to create their own brands, they have influence and can disrupt people (and industries) from their usual way of doing business. What do you need to build a significant audience? Time, lots of time to produce vlogs, blogs and incredible images for your social media pages. I hope this answered your question, Denise. Have a business or life question you want me to answer? Please email it to me with the subject “Question”. Note that all such questions will be answered as a blog post and will be sent to my full email list. Want to start a business? Check out The Money Spot Program. Related stories: Are P&G And Unilever Headed In Opposite Directions? Who Owns What In The Beauty Industry? Levi Roots on Dragon’s Den |

Heather on WealthI enjoy helping people think through their personal finances and blog about that here. Join my personal finance community at The Money Spot™. Categories

All

Archives

September 2023

|

Heather Katsonga-Woodward, a massive personal finance fanatic.

** All views expressed are my own and not those of any employer, past or present. ** Please get professional advice before re-arranging your personal finances.

RSS Feed

RSS Feed