|

I receive a lot of questions about “how to start investing” and this month alone I’ve fielded more questions than ever before, so, as a belated birthday present to myself I decided to get this all out into a simple blog.

A couple of housekeeping points first: Any tax rates and thresholds mentioned in this post will be correct as at the time of writing but tax is something that gets tinkered with all the time so this could get dated pretty quickly but using figures will help you to understand how it all currently works, in principle. Everything I share here is information not advice. Once you decide to actually start investing you would be well advised to: a) do some further research yourself; and b) speak to a fee-only all-of-market independent financial advisor. Fee only means they don’t charge you a percentage of what you have to invest (that is, they charge a fixed fee) and all-of-market means they can offer products from a range of institutions.. Ideally, you should only invest money that you will not need for at least 5 years. This is because share market prices move up and down a lot and if you need that money before five years is up, there is more chance that you might have to sell at a loss. Investing is a long-term game, the longer the time you can wait, the higher the probability of being up. Over a 20 year period, the S&P500 (which is the 500 largest listed companies in the USA) has returned a positive return 100% of the time. While the future may turn out to be different, you are generally well advised to leave money invested for as long as possible. While my aim is to make this discussion as simple and as unintimidating as possible, at times it will feel really complex not because investing is hard but because we invest within the context of a very complicated and convoluted tax system. But you have to get to grips with our tax system to get ahead with investing…anyhow,…I’ll divide this into four parts to keep it clear:

PART 1 – What sort of investment account should you put your money in

You can think of your 'investment account' or ‘investment vehicle’ as the “house” where your money is kept. There are three different types of vehicles:

1. A pension be it a workplace place pension or personal pension (aka a Self Invested Personal Pension) allows you to invest money before it is taxed; 2. A “stocks and shares” individual savings account or ISA allows you to invest money after it’s been taxed but all dividends and capitals gains are tax free; 3. A taxable brokerage account – means you invest money after it’s been taxed and any capital gains and dividends are also taxable. Any business that offers the services to buy or sell shares and investment funds will typically offer all three vehicles, i.e. they will usually offer pension accounts, ISA accounts, and taxable trading accounts. There are different pros and cons of investing in each of these three. I will highlight the main pros and cons. PENSIONS I am only going to cover defined contribution pension schemes in this post, which is what most people have nowadays. I won’t cover defined benefit pension schemes in which the employer commits to pay you a specific amount from a pre-defined retirement date until death. The rules are much the same between the two but if you’re responsible for your own retirement income as is the case if you have a DC scheme you’re likely to be more aggressive with building that pension pot. I’ll cover the difference between DC and DB pensions in a future post. Pros of investing through a pension

Cons of investing through a pension

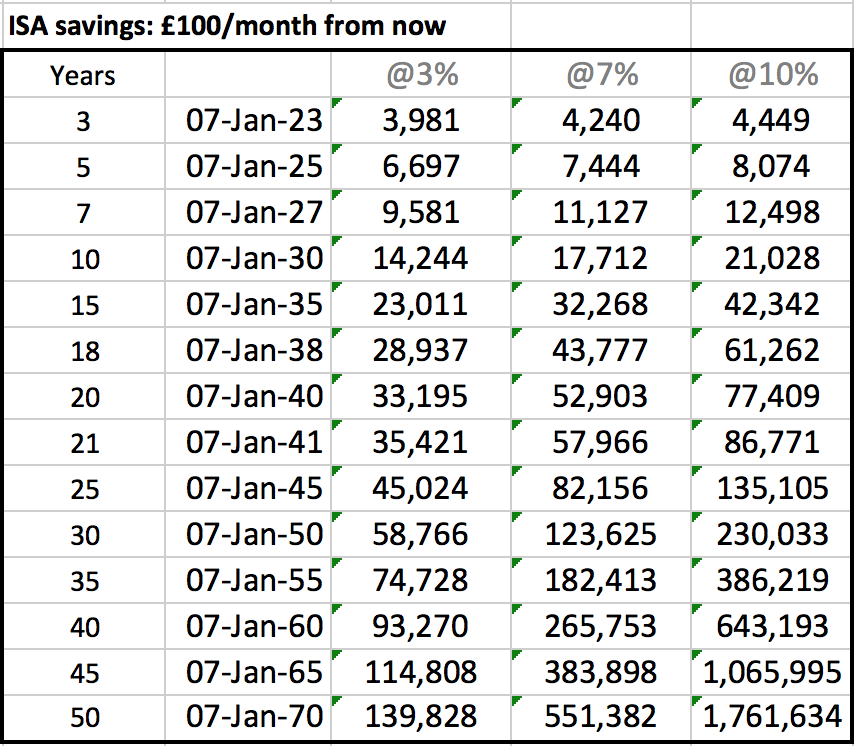

Rules on how much you can invest in a pension… There are limits on how much you can invest via pension each year and over your whole lifetime. Firstly, the annual allowance is the maximum you can put into your pension each year and still get a tax benefit. This is currently £40,000 gross (i.e. before tax) or your full annual income, whichever is lower. So, if you earn £30,000 a year the maximum you can put into a pension is £30,000. I am sorry that this is getting complicated already but the UK tax system is mad – so a little detail is essential. A key thing to note is that not all income qualifies towards this pension contribution limit. Earnings from property aren’t allowed. So if all your earnings are from a buy-to-let property portfolio that is in your name, the maximum you can put into a pension is £2,880 and with the government tax benefit this is grossed up to £3,600. So, you’d only invest £2,880 into the pension and it would be grossed up to £3,600. If your BTL properties are in a company, then you could pay yourself a salary (and you’d need to follow rules on national insurance contributions too) and whatever your salary is – up to the £40k annual allowance limit – would be the maximum you could pay into a pension and still get a tax benefit. The second limit is the pension lifetime allowance which is just over £1m at the moment. This may sound like a high limit but it includes capital gains not just contributions so you can easily breach the limit. For instance, if you had £250k in your pension at the age of 35, a 7% growth rate in your portfolio would mean the money doubles every 10 years, so even if you didn’t invest anything else, that £250k would grow to £1m by the age of 55. Ideally, the lifetime pension allowance should grow with inflation but it’s frequently frozen and was even slashed from £1.8m in 2012 to £1m in 2017. This post is not about pensions but they are one of the primary vehicles you can invest through so hopefully what I’ve said so far will help you understand whether is this is the best vehicle for you. Depending on how much money you have to invest, I would look at putting some money in both a pension and an ISA and if you have more besides then you can put some into a taxable investment account. ISAs I love ISAs because once the money goes in, you don’t have to think about making tax declarations any more – it’s all tax free from that point. Pros of investing through a stocks and shares ISA I won’t cover cash ISAs here as this post is specifically on getting started with investing in stocks and shares.

Cons of investing in an ISA

Whether you plan to invest in a SIPP or ISA depends on your financial position and future plans, e.g. retirement goals, goals for your children if you have any etc. As tax advisor to my friends and family I recommend different things depending on what I know about the person including their propensity to choose spending over saving or investing, there is no blanket rule. Taxable brokerage account If you have maxed out your £20,000 ISA allowance and your spouse’s £20,000 ISA allowance and your £40,000 pension allowance then the next place you would look to invest is via a taxable brokerage account. If you are saving that much though, you may want to just spend more…better holidays, more life experiences etc. PART 2 – Who i.e. which institution should you invest your money through

So, you’ve figured out whether to put your money in a pension, an ISA or even taxable account, you now need to decide where to open your pension, ISA or taxable account. The way to think about this is, if you had money to save, one of the questions you would want to answer is ‘which bank should I keep my money with’, that’s the decision we are trying to make in part 2.

If you have a workplace defined contribution pension, that decision is usually made for you although in some cases you’re offered limited options. You are allowed to have a personal pension outside your workplace in addition to the work one but I personally I’m happy with the options provided by the provider of my DC pension at work so I don’t contribute more to another SIPP. There are three options open to you when it comes to type of institution:

The key driver of which platform to use is:

Fees – annual management charge Of the platforms I would guide you to research, these are the annual platform fees you can expect to pay as a beginner. In many cases the fee falls as your portfolio grows:

In addition to platform fees, whatever you invest in will have an ongoing annual fee. Ongoing fees usually range from as little as 0.05% to over 1.00% and in some cases as much as 3%. Watch out for the ongoing fees of what you buy as this is what can really harm the growth of your portfolio. There may also be fees for leaving or joining the platform. Look at all chargeable fees before committing to an account – you can always change institutions if you change your mind but it’s better to do your research before you even start. Any institution regulated by the Financial Conduct Authority, FCA, will be transparent about all the fees charged. Don’t invest through any unregulated institutions. As I researched this article I discovered that Junior ISAs at Fidelity are not charged an annual management charge and I immediately transferred all my children’s ISA investments to them from Hargreaves Lansdown. That was £55k in total – their investments of £20k each, have grown well over time so despite the poor stock market returns of 2022, they remain up. If you’re interested in how I invested for my kids see my post, Q&A: How can I save and invest for my children? I won’t spend a lot of time on fees but will link to several articles that discuss fees across a range of platform: PART 3: HOW MUCH TO INVEST

sIf you have a lump sum to kick start your investing, that’s great. You can invest it all in one go, however, some people prefer to spread a large investment into smaller chunks spread over 2 or 3 months. There is no real benefit in this if you are investing for the long-term – in fact, data suggests that lump-sum investing beats drip feeding your investment into the stock market 75% of the time. But if it makes a psychological difference to you, you can split a large lump sum over a few months.

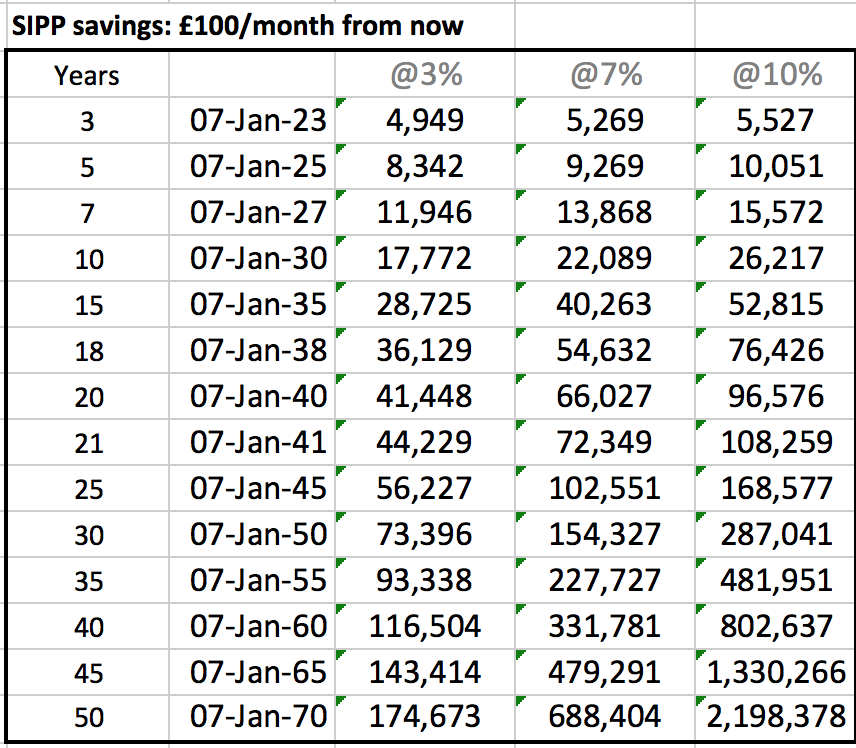

What’s large? That’s for you to define because if I had a large sum to invest, I would invest however much I plan on investing all in one go. Generally, most people don’t have a large sum and the decision is about how much to invest each month. Investing monthly, over a long period of time, is called ‘dollar cost averaging’ into the market as your shares are cheaper in a bear market and more expensive in a bull market so over time you are paying the average price of the market. If I was working with a specific person, I would want to know how much they want to have at the age of 50 or 55, either as an annual income or in total and I would back calculate the amount they need to invest monthly, today, to achieve that goal. You can do this for yourself using an online calculator - I like the investment calculator on Dave Ramsey's website, you can ignore the fact that it has a $ sign and put in your GBP investments - the sign doesn't matter - I assume a gross return of 7% (that's the return before inflation is taken into account - with average inflation of 3% this is a net return of 4%). You can also ignore links to other resources as they are US-centric. PART 4: WHAT TO INVEST IN

Equities / shares

Investing in the shares of companies is called investing in equities. Equities pay dividends if they have money left over after paying all costs including interest on their debt. Some companies, especially fast growing companies, choose not to pay dividends and instead re-invest the money. If you buy the shares in a company, you’re known as a shareholder and you also make a return or loss from any increase or fall in the price of shares. So, if you buy shares for 10 and they grow to 12, that’s a 20% return; if their price falls to 8, that’s a 20% loss (the profit or loss is only realised if you sell, i.e. a loss is only a loss on paper - not a real loss - unless you sell, so, if share prices fall they can be left invested so that they recover in price). Debt / bonds Investing in the debt that companies issue is called investing in bonds. Bonds earn a fixed and known return. There are a few options you can choose from, here I’ll suggest 3 for you to look into: Option 1: 100% stocks in a diversified fund If you’re starting out in investing, you should be satisfied to earn the average stock market return by investing in a low cost diversified index fund. It requires a lot of time to identify specific companies that are undervalued or those with great growth potential and you don't need to do this to do well with investing - in fact, the evidence suggests just putting money in one or two diversified passive funds gives better returns than stock picking yourself and trying to beat the market. I personally prefer stock indices that track the S&P500 (these are the 500 largest companies in the US) – these funds usually cost 0.10% or less. Large US companies usually have global sales and source materials internationally so I feel it is adequate diversification that implicitly includes Europe and exposure to many emerging markets without having to worry about corporate governance issues. The historical average yearly return of the S&P 500 is 9.645% over the last 20 years, as of the end of November 2022. This assumes dividends are reinvested. Adjusted for inflation, the 20-year average return (including dividends) is 6.932%. (source: tradethatswing.com) If you prefer to invest in the UK stock market, you can choose fund that tracks the FTSE-100 in the UK. In the 20 years leading up to 31 December 2019, the FTSE 100 had an average annual return of 0.4% if dividends were not re-invested but this rose to a not insubstantial return of 4% a year if dividends were reinvested. Option 2: Target date funds Target date funds are funds that invest based on the assumption that you will retire in a given year. These funds have a higher proportion of riskier equity investments and a lower proportion of bonds which give a fixed and known return. As the retirement date approaches, more and more money is invested in bonds and less and less is invested in equities. Some in the investment community consider that target date funds get too conservative too quickly because no one retires and needs all their invested money straight away. So, if you want to have some money in equities and a portion in bonds, you could start with a target date fund with the retirement date set further in the future than you plan to retire - perhaps set it 20 years further than you plan to retire especially if you're partly saving to pass on an inheritance rather than just for your retirement needs. Option 3: Ready-made funds Many institutions offer ‘ready-made funds’ to get you started with investing and if you choose to go with that, as I did when I first started investing, take that as a learning opportunity. Seek to understand what is in those funds, what the fee structure is and if you don’t like the underlying investments or see that the relative fees are high, either don’t buy them in the first place or seek to move away to other investments. I do not recommend investing in single stocks, e.g. buying specific companies as this exposes one to a lot more risk than tracking a whole market so I won’t cover single stock investing here. I used to trade in single stocks myself but I no longer do. A simple example - investing in action

I know all this information might seem confusing so I thought I’d give you an example of all this in action.

So, as an example, about 3 years ago, unprompted, I told a 30-year old couple I know and like that if they wanted to have £300,000 or so when they are 55, in addition to their work place pensions, they should put £100 into a SIPP every month. With a lump sum like that they would have the option to retire early and as DINKies (double income no kids) I knew they wouldn’t feel that kind of investment even if it fell to zero – and with the government match they would be 25% up from the outset due to the tax saving. As I knew they were first time investors and quite risk-averse I got them to put almost all of the invested money in S&P 500 trackers with about 10% in an actively invested fund. They use Hargreaves Lansdown – I chose this for them because their customer service is great and you can easily get a person on the phone – but as their funds grow I might get them to move to a cheaper provider. I’ll review this when they have £50,000 or so. Three years later, they have about £20k between them (they invest a little more than I suggested). As I wasn’t happy with the performance of the actively managed fund, I got them to sell all of that and stick to low cost diversified funds. They’re happy with this set and forget strategy and aren’t much interested in overthinking it and unlike most of their friends have savings. In about four years, they will also be mortgage free to boot – based on a repayment plan I’ve advised them to stick to. Financially they’re on a great track and are also enjoying life… So, investing doesn't need to be complicated or big. You can start small and increase your investment as you learn more, develop confidence, and start to understand how different investments work...OVER TO YOU! Get help investing:

If you want help with setting up your investment account and selecting funds, click the PayPal link below to book me and fill the form in to tell me a little about your situation. Your booking gets you two one-hour phone calls during which we will chat through what you want to achieve with investing then I'll help you set your investment account up in your own name and automate everything for you.

3-Month Coaching Program

£1,000.00

This 3-month coaching program will be custom built to suit your needs.

I used to coach people on business issues only but I quickly discovered most struggles were the result of factors that hadn't even been considered. My coaching programs last 3, 6 or 12 months. During that period you have full access to me by phone, email, text, skype and if you live locally, even for coffees. So that we can just crack on with making you awesome I take payment upfront. Psychologically this makes you commit fully and wholly to the program too. My coaching covers:

Before a coaching relationship starts I recommend you book a one-off call to discuss your self-development needs . If you go on to book a coaching package this "analysis call" will be refunded. You're awesome. Let's make sure everyone who so much as walks past you sees that too! Bonus: you will get the Build A Booming Business Planner & the iPlan To Succeed Life Planner free with this coaching package. Check your email as soon as you've checked out of the shopping cart. 6-Month Coaching Program

£1,875.00

This 6-month coaching program will be custom built to suit your needs.

I used to coach people on business issues only but I quickly discovered most struggles were the result of factors that hadn't even been considered. My coaching programs last 3, 6 or 12 months. During that period you have full access to me by phone, email, text, skype and if you live locally, even for coffees. So that we can just crack on with making you awesome I take payment upfront. Psychologically this makes you commit fully and wholly to the program too. My coaching covers:

Before a coaching relationship starts I recommend you book a one-off call to discuss your self-development needs . If you go on to book a coaching package this "analysis call" will be refunded. You're awesome. Let's make sure everyone who so much as walks past you sees that too! Bonus: you will get the Build A Booming Business Planner & the iPlan To Succeed Life Planner free with this coaching package. Check your email as soon as you've checked out of the shopping cart. 12-Month Coaching Program

£3,600.00

This 12-month coaching program will be custom built to suit your needs.

I used to coach people on business issues only but I quickly discovered most struggles were the result of factors that hadn't even been considered. My coaching programs last 3, 6 or 12 months. During that period you have full access to me by phone, email, text, skype and if you live locally, even for coffees. So that we can just crack on with making you awesome I take payment upfront. Psychologically this makes you commit fully and wholly to the program too. My coaching covers:

Before a coaching relationship starts I recommend you book a one-off call to discuss your self-development needs . If you go on to book a coaching package this "analysis call" will be refunded. You're awesome. Let's make sure everyone who so much as walks past you sees that too! Bonus: you will get the Build A Booming Business Planner & the iPlan To Succeed Life Planner free with this coaching package. Check your email as soon as you've checked out of the shopping cart.

0 Comments

Hi Heather, just discovered your podcast and blog. Really inspiring. Could I ask a question?

I have about £10k to invest and I’m considering three options. I’d really appreciate your help in deciding what to do.

Any advice would be hugely appreciated. Many thanks Nik M

Hi Nik

I apologise for the delayed response as I realise your question was time-sensitive but I was in project execution mode over the last two weeks. I think this is an awesome question and I’ll tell you how I would go about thinking about this. Firstly, did you know that I too am a civil servant with access to the Alpha pension scheme? Let me know via the comments box if you did know. I have never mentioned it in any blog or podcast before but it is on my LinkedIn. Given what you have said about when you could access your SIPP, I am guessing you are about 43 years old, i.e. you have 12 years to reach age 55 when you can access the SIPP and if your retirement age is 67 then you have 24 years until you can access your Alpha pension savings. There are 4 keys things you might want to consider:

PORTFOLIO EFFECT By portfolio effect I mean you should consider how the lump-sum is invested in the context of other sources of income you expect to have in retirement. Firstly, I opted out of the Alpha pension scheme because my husband works for the NHS and has access to their defined benefit scheme and because we manage our household finances as a single unit, I felt we could take more risk. His NHS pension gives us a safety cushion and I went for the civil service partnership pension which works exactly like a SIPP in that what I get at retirement depends on the return. An added benefit is that I can access the money at age 55 rather than 67 if I want to although I doubt I would do that as I’d rather use up my ISA savings first. THE RETURNS Average stock market returns have historically been about 10%. This could be the same in the future or it could be different. There are no guarantees. I am not sure what your passive investment portfolio is specifically invested in but I will assume it is a passive global fund and as you haven’t said it is in an ISA, I will assume it’s in a taxable investment account. The last time I looked for a reasonable return to use to model my future returns I found an article that suggested 9% gross and 6% net of inflation was reasonable. I prefer to use 7% gross and 4% net of inflation. If we go for the 7% return in taxable brokerage account – i.e. ignore the SIPP option to begin with:

If you drew the money down according to the 4% rule which says that you should draw no more than 4% of an invested portfolio so that it doesn’t run out, then if you start to draw on this money from age 67 (same as when you would have access to your Alpha pension money) you would draw £2,028 in the first year of retirement (50,700 x 4%). The following year when you are 68, you would draw £2,083 i.e. (50,700-2,028) x 1.07 x 4% - you draw slightly more because although the money has been drawn it is still invested and continues to grow at the average rate of 7%. These are gross numbers – what about after inflation? If you wanted to look at what you would be drawing after inflation, then in the equivalent of today’s money you would draw £1,024 (25,600 x 4%) and you would draw slightly more in real terms the following year. You need to compare what this looks like against Alpha. I know Alpha is inflation protected but I am not clear whether the £1k increase in Alpha payments that you mention is from today or whether it’s £1k from the age of 67 and growing from inflation at that point. If it’s £1k and growing with inflation from today then at the age of 67 you would be getting £2,030 in real terms (1,000 x 1.03^24) whereas with the stock market investment you were getting only £1,024 in real terms – from this perspective Alpha is a no-brainer as it’s a guaranteed £2k per year until death rather than a probabilistic gross drawdown of £2k per annum. I see the stock market as broadly providing some inflation protection given all companies increase the prices of their products over time. If it’s the case that the increase in the Alpha pension is £1k at age 67 then growing by inflation from that point then the additional gross £1k in real terms after 24 years is only £490 (1,000) / (1.03^24) – in this case the stock market investment looks much more attractive. If you go for Alpha with self and dependents then multiply the Alpha benefit by 90% to evaluate the impact. If we go for the 7% in a SIPP account – then you get an immediate uplift because there is an immediate tax saving. As a higher rate tax payer note that the SIPP provider would only claim tax relief at the basic rate of tax and you would need to claim additional tax relief via your self-assessment tax return or if you don’t do a tax return you would need to call HMRC to see if you could just do it by changing your tax code. With the full tax relief £10k translates to £16,667 in your SIPP.

If you drew the money down according to the 4% rule, then if you start to draw on this money from age 67, you would draw £3,380 gross (84,530 x 4%) or about £1,700 in inflation adjusted terms and steadily growing. From a returns perspective putting the money into a SIPP begins to look very attractive indeed. This brings us to the next consideration, horizon/flexibility.

HORIZON / FLEXIBILITY

With a SIPP you have access to the money from age 55. Unless you are 100% sure you don’t want to retire before age 67 or even to part-retire then you don’t need earlier access to the money. With the money in a taxable brokerage account you can draw the full gross amount invested in one go, if you like. There would be tax to be paid but you would still have the full amount if you wanted it. You can reduce the tax amount due from a full drawdown if you put half i.e. £5k into your own investment account and half into a spouse’s investment account. You can avoid tax completely by putting the full £10k into an ISA (the annual limit is £20k so you would be within that). INHERITANCE If you have all your assets in a defined benefit pension plan then your dependents don’t have access to those assets except to the extent defined by the plan. For Alpha, if you die before your spouse then I believe your spouse continues to get 37.5% of what you would have got and children only get a benefit if they are under 18 or under 23 and in full time education. With a SIPP your family gets everything invested and under current tax law money sitting in a pension is protected from inheritance tax if you die before the age of 75 (this could change given the tax rules are constantly changing). So, as basic example, if you died at the age of 67– in 24 years just before you could claim any pension, if your 10k had been invested in:

I apologise that this response is so full of numbers but this is essentially all the things you need to think about and the numbers are pretty important when we are thinking about pension and retirement options. IN SUMMARY If having access to a few pots of money before the age of 67 is important to you or if passing on some cash to dependents matters, then Alpha is not attractive. If you are risk averse and want to ensure you have a comfortable, guaranteed inflation-linked pension pot then plough the £10k into the Alpha pension plan as this would suit your risk tolerance better. I hope this helps! Heather Have a money question for me?

If you have any personal finance questions send them to [ME] – I respond to all emails but there can be a lag of a few weeks between me getting a question and responding to it as I try to give very comprehensive responses.

Hi Heather,

Happy new year! I’m a big fan of yours and have been following you for a while. I bought all your three books. I would like to open a stocks and shares ISA for myself and two children aged 16 & 14 but I don’t know where to start due to fear of risk. I want to invest 15% of my income in stocks and also considering real estate. I have seen some recommendations like Vanguard or Hargreaves Lansdowne but I’m clueless on what to go for. I am a nurse and the only debt I have is a repayment mortgage. I just finished paying off credit card debt. I saw your post on Malawi Queens. Please help. Thank you My name’s Angela by the way.

Angela – congratulations on getting rid of all your credit card debt, you must be super proud of yourself.

And a massive thank you for supporting me by buying my books. Book sales are helping to pay for the production of “The Money Spot” podcast so I don’t take your purchase for granted – it’s really appreciated. Stocks and shares ISA When it comes to investing in stocks and shares ISAs, target a minimum investment period of 5 years and ideally your should invest for much longer than that. Is the money that you want to save for your children for university or for something else? I will assume it’s to contribute towards the cost of university. One important thing that you need to keep in mind is that although tuition fees are given to students as long as they apply for them, the maintenance loan is assessed according to household wealth; basically, children that come from wealthier households are eligible for a smaller maintenance allowance. Only children from households with a total income of less than £25,000 qualify for the full maintenance loan. In addition, students that live at home get a smaller maintenance allowance and those that attend universities outside of London qualify for a lower maintenance loan. In my opinion, the less debt children can get themselves into by the time they graduate, the more disposable income they’ll have when they land their first jobs and the faster they can save for a deposit on a mortgage. If you want to read a little more about what you might need to contribute towards university costs, have a look at the moneysavingexpert.com website. The site has a ready-made calculator that will tell you exactly how much you need to save for each child to contribute towards university. Or, for parents that don’t want to contribute then it’s how much their children will need to earn from a uni job to fill the gap. The calculator will also tell you exactly how much you need to save every month from now to make sure you have enough by the time your child starts university. Child aged 16 For your 16 year old, saving into a stocks and shares ISA is too risky because university is just around the corner – the stock market generally doesn’t offer good returns for periods of less than 5 years. The safest option for the 16 year old is probably to save into a high interest account, this might not be a cash ISA so shop around. The best rate you will find at the moment is between 1.45% to 1.65%. Child aged 14 As you could put money away for five years for your 14 year old, a stocks and shares ISA makes sense here. Again, use the calculator on money saving expert for an idea of how much you will need to contribute each month if you don’t want your children to have to work through university. Your ISA For your own ISA, you have a limit of £20,000 per year. If you prefer, you can save all the money into your own ISA rather than into junior ISAs so that you have more control over it. Money saved into a Junior ISA is legally belongs to the child named on the account when they turn 18 and you would have no control over how they choose to spend it. Risk Before I tackle where you should save I will say that you have every right to fear taking risk with your money, you’ve worked hard to earn it so you should rightfully want to preserve what you have earned. The safest path if you are investing in shares is to avoid single stocks and to invest in diversified index funds. There are two main types of fund to choose between, actively managed funds and passively managed funds. Passively managed funds track a whole market such as the S&P500 for the USA or the FTSE100 for the UK; alternatively, instead of tracking the whole market in a given country you can choose to invest in a specific sector such as utilities or technology or retail. Actively managed funds have a an actual person choosing what shares will outperform the market and investing exclusively in those. The objective of an active manager is to beat the index, while the objective of a passive fund is to match the return on an index. Now, you would think the funds managed by clever fund managers are the ones to go for, right? Wrong! History suggests that over 95% of the time fund managers do not beat the index. Not only that, fees on actively managed funds are higher. The cheapest are about 0.5% nowadays and the most expensive charge in the region of 2%. Many passive funds now charge less 0.2% or what industry professionals call 20 basis points or bps. How can you improve your risk appetite? Improve your understanding of how stock markets work. I would recommend two investment books, if you can, get the audio versions: Charlie Munger: The Complete Investor by Tren Griffin and Common Sense Investing By John Bogle (the inventor of passive investing) Which platform should you use for investing? I personally use iWeb for share dealing because they are the cheapest but I wouldn’t recommend iWeb for most people because you can’t automate your investing. That said, iWeb have good fund centre that helps you sort through the different indices and allows you to order them in different ways, for example, you can sort funds or shares from those with the lowest fees or starting from those that are enjoying the highest return down, you can also exclusively analyse the different sectors that you might want to invest in – technology is enjoying pretty good returns at the moment but I don’t put too much into tech because it’s volatile it goes up fast and can also come down fast. Even if you ultimately choose to invest using a different platform you might want to use iWeb for stock selection if their analysis tools are better than where you end up. iWeb’s fund centre is actually easier for discovery than HL – HL seem to have a vested interest in people selecting actively managed funds so those show up more prominently on their site. They don’t seem, for example, to have a tool that allows you to just look at absolutely every fund they offer ordered by fees. If I just haven’t found this function, someone please help a sister out and send me the link. So, what platform should you use? The two options you have suggested (HL and vanguard) are very different. The likes of Vanguard only offer their own funds. This isn’t a bad thing necessarily but it would mean you need to be sure you won’t want to invest any other fund manager’s products and that is a hard position for a beginner to take. The likes of Hargreaves Lansdown offer you access to a large universe of fund managers. HL don’t create funds, they are essentially a supermarket for other fund managers. It’s the difference between shopping at Aldi and Sainsbury’s. If you want choice, you go to Sainsbury’s; if you’re not too bothered about choice and want to save money, you go to Aldi, but you’re mostly only going to find Aldi’s own-brand products at Aldi – this is not a perfect analogy but it’s not a bad one. Vanguard’s passively managed index funds are known for being very cost effective but they’re platform charges are not the cheapest. At least not in the UK. The likes of Fidelity have a hybrid model: they offer their own funds and other fund managers’ products BUT if you use their tools for selecting funds, which I did to write this piece, the resulting suggestion is one of their own funds. The biggest driver for where you invest should be fees, customer service and ease of use of the platform. Fees Platform fees are the fees you get charged for using a given platform. Vanguard 0.15% HL 0.45% (if less than £250k and 0 if > £2m) iWeb 0 Halifax £12.50 Fidelity 0.35% Either way, if you have less than £50,000 invested the differences in fees aren’t that dramatic but as you start approaching £250,000 in investments you will feel the difference. Once you have £250k invested, and trust me you will get there, on iWeb you would be paying £60/year (if you trade once a month) and on HL you would be paying £1,125 for the same assets invested. Little tip, because I invest for both my husband and I, instead of splitting monthly investments in half, so half goes to his account and half to me, each month I do one trade for either me or for him so that the net result is that we do 6 trades each. This saves £60 in dealing costs every year. Obviously I could save even more by doing one trade a year but as our incomes are paid monthly it’s better to invest monthly rather than just keep the money in a savings account for one trade at the end of the year. I’d lose all the gains I make within the year. Transaction fees are the fees you pay for buying an investment product – these can be a fixed sum or a percentage. Some platforms will have one charge for buying and selling shares and another for funds. Vanguard depends on the product – 0.02% to close to 2% HL 0 for funds, £12/share falling to £6 a share for 20 trades + iWeb £5 Halifax £12.50/share or £2/month for scheduled investment Fidelity £10/share or £1.50/month for scheduled investment Because Fidelity’s platform fees are cheaper than HL, I am tempted to recommend them but I think you should make the decision. Why don’t you spend an hour a day on each of the following three site: HL, Fidelity and Halifax. Download their apps and see what you think of them. If by the end of that analysis you’re not sure then I will suggest you use HL as a beginner and as you figure out how things work move platforms, it’s very easy to do that. Also, it’s worth mentioning that I pulled a couple of funds that I invest in on Fidelity and you pay more for them via Fidelity because HL negotiates discounts with actively managed funds due to the volume of business they direct their way. NOW – I have spoken a lot about investing as I felt that that’s what you wanted me to focus on but I think this discussion would not be complete without me saying that, ultimately, if the stock market scares you, then you can go the property route. Property There are many strategies you can follow with property. You can rent to families, or students or even another subset of people. One of my friends specialises in letting property to truck drivers. Letting to students or a migrant group like truck drivers has high turnover which means you need a lot of time to manage the property. And if you went down the AirBnB route that’s like managing a hotel because you have to think about changing sheets and cleaning literally week-on-week – as involving as it sounds, I have a friend who has a full time job as a professor and has also grown a good property portfolio on the side with a mix of AirBnB and family lets. The key is to start with your first property. Have you heard of the 3 for 1 property strategy? With this strategy you set a goal of investing in 3 buy to let properties and you work to have all mortgages paid off by the time you retire. This would mean that you live in one fully paid off house and you would live off the rent of the three properties – this reduces the risk somewhat. For each buy-to-let property you would target a given amount of rental earnings that you can choose yourself . For example if each property earned £800 per month, then you would retire on £2,400 / month. This would be linked to inflation because as prices rise, rents also tend to rise and sometimes rental increases rise far faster [example]. If this feels safer for you and you have at least 20 years until retirement then think about either just going for the 3 for 1 property strategy with a good lump-sum saved in a savings account for emergencies might feel less risky OR follow a combination of investing small amount in the stock market with property as your security blanket. Massively enjoyed answering this question, Angela, especially from a fellow Malawian. It’s nice to know other people are investing and getting wealth focused. Let’s summarise what you need to do:

I hope this helps! Heather Have a money question for me?

If you have any personal finance questions send them to [ME] – I will answer whatever piques my fancy via a blog post.

Hi Heather,

I want to earn extra income, however I work as a nurse in the NHS which takes up my time, do you have any suggestions on any investment that can make money. I am also interested in the stock market but don’t know where to start. I am interested in both generating extra monthly cash flow now and increasing the amount of money I have in retirement. Denise. Hi Denise, Thanks for this question. I love it because I have two nurses in my immediate family, my mother-in-law was a nurse for a long time and my cousin is still one now. Boosting current income

The, “how can I make a little extra cash now” question is one I asked myself quite recently because I wanted to put extra cash into our household ISAs. There are a few things you can do to boost your cash now:

1. Working extra shifts / locum shifts My mother-in-law says this is not a great idea because being a nurse is hard enough work, as it is. I agree that it is very demanding work but one of the great features of working at the front line of medical services is that you can actually make more money by working more hours, even temporarily. Some jobs don’t offer opportunities to earn more by working more, you’re paid a fixed annual salary and that’s it - no overtime. Overtime either goes uncompensated or is compensated as time back in lieu. You can sign up to a locum agency and do the same type of work for higher pay on your free days. If you want to really juice up your income you can even look at things like working a 4-day week in your regular NHS job (your NHS pension would therefore be lower) and work for a locum agency on the 5th day. The advantage with this strategy is that you will boost your income without working more hours because the hourly rate is higher as a locum nurse. If the extra income is invested wisely it could more than make up for the lower NHS pension. Also, keep your eyes open for higher paying promotions. 2. Do some extra work in another field. If you have another skill that you can monetise you can look into doing extra work in that field. So ask yourself, "what other skills do I have?" I'll give you an example from my own life: In my early 20s when I worked in banking the bonuses were not good one year and to make some extra money I slipped flyers into doors offering massages (for women only) at my house for £25/half-hour. I had someone sign up that very day. I had done a course in therapeutic massage at London College of Massage for fun and when I needed it, that skill helped me boost my income. I didn’t do it for long but it showed me that if I wanted to earn more money I could monetise other skills in my free time. There are some things you can do that don’t even need a new skill such as babysitting. You could sign up at childcare.co.uk or sitters.co.uk and your credentials as a nurse would be very attractive to people that needed a babysitter for nights out or weekends. You haven’t said whether or not you have childcare responsibilities of your own so I don’t know if this is possible for you. If you have skills that you can monetise online then list yourself on freelance websites like upwork or fiverr. There is a wide range of professions people hire for on these sites. I have used these sites myself to buy all manner of things including artwork, copy, copy editing and even voiceovers! Imagine that, all you’d need as a voice over artist is a microphone that records your voice clearly. Some people make serious money side-gigging on these sites. These first two options are not completely aligned with your question as you asked for “investments that you can make” but I decided to add them to give a fuller answer. 3. Invest in or produce products that make cash. Investing in something necessarily involves parting with money in the hope that you’ll earn even more money. You haven’t said how much money you have to invest so here are a few options. Can you make something that people would be interested in buying that you can sell on etsy, eBay, amazon or Facebook marketplace? Make a few samples of what you want to sell and list them on all these sites. I ran a product business myself for almost 6 years mostly using Amazon so I would recommend that you:

I would never discourage anyone from starting a business but having experienced it, I would tell you that it is very hard work. It involves a lot of long hours and is nothing like as glamorous as our culture makes being an “entrepreneur” sound. A business could consume absolutely every free moment you have – evenings and weekends. And all that time might not even produce a profit. Investing in a business comes with a lot of risk – stats vary depending on source, however, 80% to 90% of businesses fail in under 3 years. 4. Teach Could you make money teaching something online? You could create a course and list it on Udemy, Teachable or another similar site. This would take some time to produce well, in the first instance, then you would need to spend some money on marketing your course but you could keep the costs very low. Alternatively if you want to teach a GCSE or A-Level subject (High school level) or even a university course level, you can sign up to places like tutorful (previously, tutora). 5. Invest in property. If you have enough for at least a 25% deposit then it may be worth looking into property investment. Because interest costs on buy-to-let property are no longer fully tax deductible, (that means, you can’t subtract the interest payment from the rent you receive before calculating your tax bill), property is not as attractive an investment as it used to be. That said, if you can buy a place with cash, or if the property produces a high enough profit to clear the mortgage within a reasonable amount of time (I personally target 10 to 15 years) then it could be worth doing. Overall, the option you go for will depend on your risk tolerance and the amount of cash you have to invest. If you are relatively risk averse and don’t have cash to invest then working more to earn more will be more attractive. If you can tolerate some risk and do have some spare cash saved up, then investing in property will provide you with medium risk while investing in a business will be the higher risk option. Boosting retirement/future income

If you’re looking to boost future income then you have two main options:

Property investing we've already talked about. The stock market provides a good return over long periods of time; most investment advisors would suggest an investment horizon of 5 years or more. Putting money into the stock market in the hopes of a good return in a year or less is gambling rather than investing, that's why I didn't offer it as an option when we were thinking through how to "boost income now". The most tax efficient options for investing the stock market are investing via an ISA or a SIPP. ISA are individual savings accounts and SIPPs are self-invest pension plans, they are a type of personal pension. If you invest the money via a SIPP then you won’t have access to that money until you are between 55 and 58 years old. The exact age will depend on your age and has been set at the state retirement age minus 10 years. The SIPP is a good option because for every £100 you put in, HMRC pay back £25 of tax and this saving is automatic. It is claimed by the SIPP provider and is shown on your investment account. The maximum you can put into a pension a year is £40,000 or your salary whichever is lower. So, if you earn £30,000/year you can put up to £30,000 into your pension without getting a tax charge. If you earn more than £40,000/year and haven’t reached the lifetime allowance of £1.055m, you can put up to £40,000 into your pension without getting a tax charge/penalty.

I will be writing several blogs on investing over the next few months that should hopefully build your confidence to make the move. In the meanwhile, you might find this useful: What platform should you use for investing and what should you invest in.

I hope this is helpful. Have a question? If you have any personal finance questions send them to [ME] – I will answer whatever piques my fancy via a blog post.

|

Heather on WealthI enjoy helping people think through their personal finances and blog about that here. Join my personal finance community at The Money Spot™. Categories

All

Archives

September 2023

|

Heather Katsonga-Woodward, a massive personal finance fanatic.

** All views expressed are my own and not those of any employer, past or present. ** Please get professional advice before re-arranging your personal finances.

RSS Feed

RSS Feed