|

Once you have decided on an investment strategy for yourself or for your children you need to decide where to invest and what to invest in. WHICH PLATFORM TO USE FOR INVESTING Choose a platform that has the lowest fees for the highest convenience. Fees change over time but when I was deciding on a platform I found these articles:

In the end, I chose iWeb for myself and Hargreaves Lansdown for the children’s investments. Why iWeb? I chose iWeb because annual fees are zero (after a £25 account opening fee) and you only pay £5 per transaction. As I only transact once a month (on pay day), our annual household fees are £60 and if you consider that I only transact on either my account or my husband’s account in any given month, then we are only paying £30/year per account. More than fair. The main problem with iWeb is that they don’t do junior ISA and you can’t automate investing. I don’t mind manually investing for my and my husband’s ISAs because we invest different amounts in different funds each month. Why Hargreaves Lansdown? They do junior ISAs, they have a good app and you can fully automate all your investing – their customer service is also pretty good; if you call you will get through to a human pretty quickly. Ultimately, I don’t expect the children’s ISAs or pensions to have a value greater than £100,000 before they’re adults so a platform with a percentage fee will tend to be cheaper than one with a fixed fee. When they’re older I’ll advise them to move to a cheaper platform. Which platform will work best for you? Unless you’re an investment buff that actually enjoys making monthly investment decisions, I recommend you choose a platform that allows automation, possibly Halifax share dealing or Cavendish; one of my friends recommends Fidelity. For children, transact within a junior ISA. For yourself or partner, an adult ISA. If you can invest more than the annual limit then use the ISAs first before transacting via a taxable account. WHAT SHOULD YOU INVEST IN? Unless you have a lot of time to research different companies, I would only invest in low-cost (passive), well-diversified mutual funds such as an S&P500 tracker or a FTSE100 tracker. Passive means the fund is not actively managed, it just follows the stock market so your return is essentially the average market return. Research suggests that actively managed funds (ones where a ‘clever’ manager stock picks) generally underperform the market in the long-run. My long-run strategy is to have 70-80% of my money in (safe) passive funds and 20-30% in actively managed funds. ETFs? I don’t do ETFs – I think funds make more sense. Over to you. Have a question? If you have any personal finance questions send them to [ME] – I will answer whatever piques my fancy via a blog post.

0 Comments

Hi Heather

I just had my first baby. I'm 31 and married. Do you have any tips for how I can think about saving and investing for my baby? Thanks, Diana Hey Diana, This is an awesome time to be asking me this question. I also started planning for my first baby as soon as he was born. You will be at an advantage if you start saving and investing for your children as soon as they are born. You will need to balance what you can afford with what you want to achieve for them. Firstly, what’s the goal? What are you saving for?

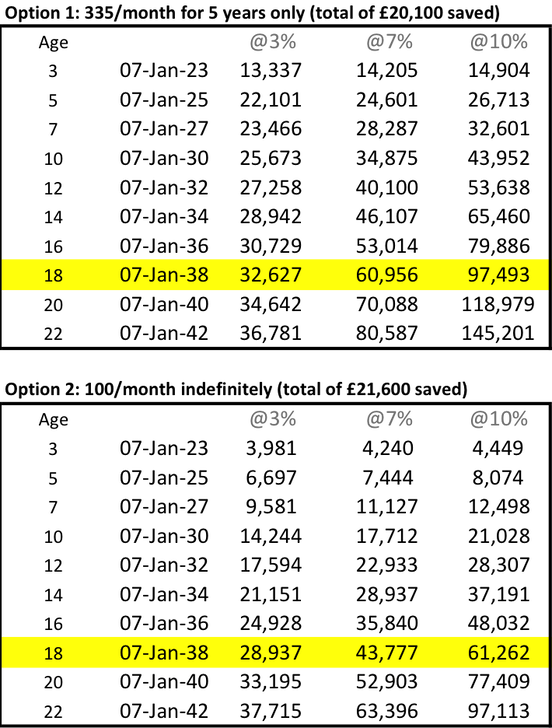

1. UNIVERSITY University costs c.£60,000 in tuition and living costs for a 3 year course at the moment - £10,000 for tuition and books, £10,000 for living – living costs can be higher or lower depending on whether you live at home, etc.. £60,000 is a huge amount of money and this cost is likely to rise in the future but it makes the maths too complicated to think about possible cost increases. Option 1 for university savings If you can save £20,000 in a tax-free account like a stocks and shares ISA by the time your child is 5 years old, then you can stop putting money aside and this money will have a reasonable chance of growing to £60,000 by the time your child is 18 years old. How could you save this £4,000 per year? Perhaps you could target saving a round amount like £250 per month (equivalent to just over £30/week each for a two-income family) and because this sums to £3,000 a year, at the end of the financial year you’d hustle to throw that extra £1,000 into the ISA before the financial year closes on 5 April. Or, if you can afford it, you could just save £335/month and you would save just over £4,000/year. Option 2 for university savings £4,000 is likely more than most can afford. The alternative is to save £100/month until age 18 which most people can afford even on the median household disposable income of £29,400 (2019). It’s equivalent to about £12.50/week each for a two-income family). Which option is better? I would say option 1 trumps option 2 because you give the money the best chance of growing. Equity markets are volatile in the short-run so by saving the money early you give the money a better chance of reaching your goal. That said, something is a lot better than nothing: small savings add up to large amounts over time. Your savings may be lower than you would like to target but you will still help your children avoid the full scourge of student debt. These are the results under each option:

Caveats on saving through a Junior ISA:

When you save the money through a Junior ISA, that money will be theirs when they hit 18 and you might not be able to control how they spend it. However, putting it into the Junior ISA means you won’t be tempted to spend it yourself because once the money goes in, it can’t be withdrawn until your child is 18. How can you avoid the Junior ISA so you have more control over the money?

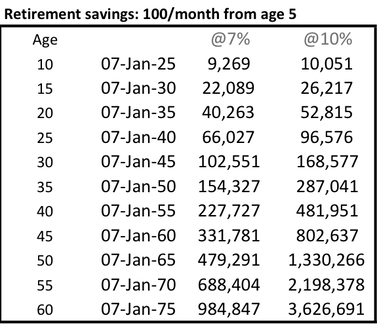

Plan b. is a good option because you could end up not having to pay tax anyway: The capital gains tax allowance in 2019-20 is £12,000. That is, you have to make a capital gain (the profit on your investment) bigger than this to pay the tax. If you save the £4,000 across two investment accounts - £2,000 in an investment account with your name and £2,000 in an investment account with your spouse’s name then when your child is 18 you can sell enough stock each year to keep the capital gain below the capital gains tax allowance. The risk however is that this threshold could fall or be completely removed in which case you would end up paying more capital gains tax on the sale. It’s still a sensible option, despite this risk. 2. RETIREMENT If you followed option 1 for university savings, at age 5 you’ll have stopped doing that and might find that you have some spare money to open a retirement account. Your children will not have access to this money until they are 57 to 60 but if life hasn’t worked this will be a great cushion for them. The beauty of investing in a retirement account is that for every £1 you put in the government puts in an extra 100/80. That is, if you want to save £100/month you only need to put £80 into the account. If you do invest £100 it will be £125/month with the government top up. For kids you can put a maximum of £2,880/year (£240/month) which equals £3,600/year. This is the result if you choose to save £100/month indefinitely into your child’s Self-Invested Pension Plan or SIPP starting from when they are 5-years old:

You notice that the extra £25 from the government makes a real difference. By saving through the pension, based on a 7% return, on 7-Jan-2025 the investments are worth £9,269 rather than only £7,444 without the government top-up.

Don’t save into a child’s retirement account unless you have the cash flow and are meeting your own goals, e.g. paying enough into your own retirement, paying off your mortgage early and ideally, are debt free yourself (apart from the mortgage). Some will be able to afford the full £240/month from birth, the rest of us have to work out what is realistic, that is why I personally opted for the £100/month from age 5. This decision will change with a change in your fortunes. 3. HELPING YOUR KIDS BUY A HOME This is where the decisions get a little tricky. Some people will be able to afford funding university, helping their children get ahead with retirement savings and help with a deposit on a home without compromising their lifestyle at all but the rest of us need to make choices. Private school vs. saving for a home What will make the biggest difference to your children: a private education or getting onto the property ladder? If you can afford one or the other but not both, then you might follow the route of private primary school followed by state secondary school (grammar/comprehensive). In this case you’d direct all the money you would have spent on a private secondary school education on saving for a home. In some cases this might mean your child starts life with a mortgage free home. If you save £15,000/year (£1,250/month) from age 11 until age 21 (10 years of saving) and it grows at an average rate of 7%, how much money would your child have at 21? About £220,00 – increasing to £260,000 if the average return over that period is 10%. This is not small money to most of us. You could use every last cent on a private education when at the end of the day the thing that helps your child follow a life of fulfilment is being relatively debt free. If you decide to go for a state education throughout and save £1,000/month (£12,000/year) from age 5 (when you are done with university saving) until age 21 (16 years of saving) and it grows at an average rate of 7%, how much money would your child have at 21? About £355,000 – increasing to £475,000 if the average return over that period is 10%, wow. Forget the children, you could be doing this for yourself! If you have already made the decision to send your children to a private primary school and they are thriving, you are unlikely to reverse that decision. If I you are seeing these numbers before making a decision, you might well make a very different decision… Not thinking about private education, anyway? If private school is not a consideration for you, then the best choice might be to save as much as you can towards your own ISA allowance of £20,000/year (£40,000/year in a two parent home), in addition to whatever you save towards your pension (I recommend 10-15%) and when the time comes you can decide whether you can contribute towards university or a first home or both. The best gift you can give your kids is possibly to be independent in old age so they don’t have to worry about taking care of you. You can boot strap them onto the property ladder by letting them live at home rent free – so that they can save more for their deposit. Even without cash gifts, you will be giving your children a competitive advantage by teaching them how to handle money at an early age. Starting to invest Next, you need to consider what platform to use for investing and what to investing in? If you have any personal finance questions send them to [ME] – I will answer whatever piques my fancy via a blog post.

|

Heather on WealthI enjoy helping people think through their personal finances and blog about that here. Join my personal finance community at The Money Spot™. Categories

All

Archives

September 2023

|

Heather Katsonga-Woodward, a massive personal finance fanatic.

** All views expressed are my own and not those of any employer, past or present. ** Please get professional advice before re-arranging your personal finances.

RSS Feed

RSS Feed