|

Hey Girl!

I’ve been trying to get my cancelled flight to Zimbabwe refunded for a month but haven’t made any progress, do you have any suggestions? Tsungi

Hi Tsungi

This is a great question and highly topical now that flights and holidays are being cancelled left, right and centre. The tips below resulted in Tsungi getting a refund of about £1,500 within a week when she had been struggling for a month to get her money back. I hope you have the same luck…ultimately… There are three paths you need to follow for a refund and you need to follow them in the following order: 1. Ask the seller for a refund first. So, if you booked via a third-party site, eg. Booking.com, trivago, etc call that third-party company and ask for a refund. If you booked directly, e.g. with easyjet, Kenya Airways or Ryanair ask them for a refund. Some sellers are very good at giving refunds and can turn something around within a matter of days that’s why I would choose this route first. It can be pretty low hassle. If you have nothing back within a week go to step 2. 2. If you booked your holiday or whatever product it is using a credit card, the credit card provider is legally obliged to refund you if you make a request, under section 75 of the consumer credit act in the UK. If you booked via a debit card banks refund you via a voluntary scheme called a chargeback scheme and sometimes this can result in a faster refund than with the legally required credit card refund, although chargebacks are not enshrined in law. According to moneysavingexpert.com, You can use chargebacks under any of the following circumstances:

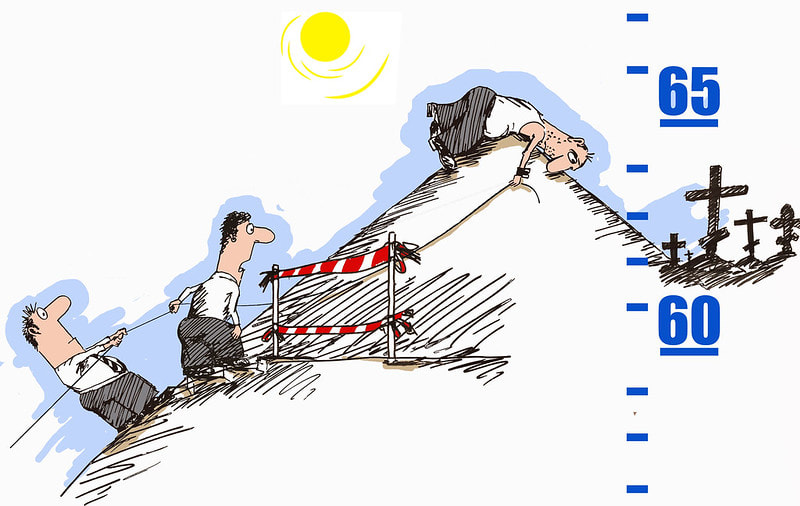

I used the chargeback scheme when Monarch airlines went into administration and natwest refunded me within less than one week and before they themselves got the money back from Monarch’s administrators. So, it’s an awesome scheme. As anyone who follows me know, I don’t own a credit card so I have never had the experience of needing to claim something back under section 75 but as it is a legal requirement you would definitely get the money back PROVIDED you spent over £100, i.e. you need to spend at least £100.01 for a single item for you to be able to make a claim under section 75 of the consumer credit act. This is different to the chargeback scheme available for debit cards as you are covered for anything over £10. There is also a difference in timing: Credit cards allow you upto 6 years to make a claim while chargebacks can be requested up to 120 days from when the service should have been provided. After 120 days you can’t make a chargeback. If you paid via PayPal you have upto 180 days to claim a refund. Although I had a great experience with my chargeback for flights with Monarch Airlines, I have been waiting over 60 days for HSBC to get a chargeback for me from flights booked with Dream World Travel and they are blaming covid for the delay. 3. Finally, if the two routes above fail, claim on your travel insurance. Travel insurance won’t pay out until the two routes above have been exhausted. If you don’t think you have travel insurance check you don’t have via your bank account, e.g. my family gets free travel insurance under my HSBC Premier bank account. In summary, to get money back request a refund:

Heather x p.s. subscribe to my podcast and ask me any money question, HERE - do it now!

0 Comments

Hi Heather

When is a good time to draw equity from your house: when I retire which is in about 5 years or before? Mary

Hi Mary

Thanks for this question because it really got me scratching my head. I was initially quite flummoxed when I received the question because as a proponent of the FIRE movement (Financial Independence Retire Early) the whole premise of my money management toolkit is to get out of debt including mortgage debt completely and NEVER go back. However, I am going to park this way of thinking and answer your question in the most unbiased fashion that I can and I will also ask you a few probing questions so you can figure out whether this is what you want to do. FIRSTLY, what do you plan to do with the money? Do you want to use the money for general living or to make a significant purchase or investment? Generally, I think in most cases it is not a good idea to get into debt during retirement as it may cause undue stress if you run into any unexpected financial problems. OPTION 1: Take equity out and pay off the debt or interest during retirement I don’t know the value of your home or any other numbers, however, if you take equity out of your house that money will be charged interest and if you enter into a standard mortgage contract, you will have to pay the interest and possibly repayments from the month after you take that equity out. From my follow up email to you I gathered you have a pension that will come in when you retire. I am assuming this is a “defined benefit” pension so it’ll be paid to you from retirement until you die. By taking on debt you will have a reduced income. So, if your pension is income amount to 2,500 per month and if you take out equity requiring 500 in monthly payments you will lose 20% of your pension straight off the bat to debt payments. How will this affect your standard of living? OPTION 2: Take equity out and pay all the interest off when you die If you are over 55, which I assume you are, you can also get a mortgage that doesn’t require interest payments to be made until you died.

Depending on the terms you may be allowed to repay some or all of the amount borrowed. Otherwise, with a lifetime mortgage all the interest would be accumulated and paid on your death.

So if your home is worth 100,000 you might sell a 40% stake to the bank for a 20,000 lump sum. When you die, the bank gets 40% of whatever the house is worth at the point. So if you die 20 years later and your home is worth 300,000 the bank get 40% of 300,000 which is 120,000 for the 20,000 that they lent to you. If you died the very next year and your house has stayed the same in value then the bank gets 40,000 for the 20,000 that they lent to you. Even if your house falls in value the bank is still likely to come out ahead because they take a huge hair cut off the value of the house. The reason these mortgages are only offered to people over a given age is to minimise the chance of the bank losing its money, for example, because accumulated interest exceeds the value of the house on a lifetime mortgage. To safeguard the bank further, they keep the amount of equity that can be released quite low; the younger you are, the lower the allowed equity release. So, a 55 year old might be restricted to releasing no more than 20% but a 75 year old might be allowed to release 30-40%. I am making numbers up here because the reality is that more conservative banks will have lower limits and banks that are more risk tolerant allow a bigger release of equity. It all sounds great on first inspection but banks have received a lot of bad press regarding equity release schemes because in the fine print they have stuff like, you don’t need to repay the interest PROVIDED you live in the house so if you need to move home, even into a care home or to a more accessible home because you develop mobility issues, all that money comes due and you would be forced to sell your house and pay the bank. There are likely to be other catches too because banks are in this to make money so if you go for an equity release scheme of any nature you should have a lawyer or financial advisor look at the terms and conditions diligently for you so you know exactly what you are getting yourself into. The bank might get a guarantee that you will never owe more than the value of your home but this means that you could owe the full value of your home to the bank. If you release equity at age 55 and live until 95 there is every chance that interest can accumulate to the point of exceeding the home value. It’s nice to get a tax free lump sum via an equity release but in doing so you may reduce your entitlement to means-tested state benefits, now or in the future so you need to think about this angle too. I don’t know how well I am doing with the unbiased view thing here as you can probably tell that I think releasing equity is a high risk game and it frankly, freaks me out. If you don’t have any kids or charities/causes that you’d like to leave an inheritance to and you’re certain you will be physically fit enough to live in your home until the day you die then perhaps the risk of releasing equity could be worth it. Another form of equity release is to downsize your home, i.e. you sell an expensive home and buy a cheaper home and live off the difference, this way you release equity but don’t incur any debt in the process. COST OF EQUITY RELEASE According to moneysaving expert.com, a lifetime mortgage equity release typically has an interest rate of c.5%, but some rates are under 3%. This is a lot higher than rates on regular mortgages. E.g. With a 40% deposit you can now get a 5 year fixed rate mortgage of just under 1.4%, just to give you an idea. If you release equity at a rate of 5% then the amount you owe would double every 14 years (see my article on the rule of 72); so if, say, you borrow 20,000 on a 120,000 home, if you live until 74 you’d owe around £40,000, live until 88 and you’d owe £80,000 and live until 102 and you’d owe 160,000. As well as the cost of the interest, don’t forget that you'll have to pay arrangement fees when you take out the mortgage and in the UK these range from £1,500-£3,000 depending on the mortgage deal and including things like solicitors and surveys. ALTERNATIVE As you have 5 years until retirement, you could try to boost your savings over the five years so that rather than borrow money you’ve saved for it. If you don’t feel you earn enough to save the amount you want you can look at things like renting rooms in your home via AirBnB or by getting a more full time lodger. I would personally find it very scary to go into retirement with debt because the need to keep with payments or even the knowledge that I don’t actually own my home but if you are more comfortable with the idea then this won’t be a consideration for you. My biggest advice would be get professional advice before you take this massive step and do whatever you can to avoid having to do it. A debt-free retirement is a peaceful retirement. Much love and thanks for being a long-time follower. See the linked article on equity release on the moneysavingexpert.com website. Heather x p.s. subscribe to my podcast and ask me any money question, HERE - do it now! Third world poor to dollar millionaire - the story of business man Mark Katsonga Phiri - my dad3/7/2020

[To *listen* to this story, search "The Money Spot" in your podcast app; available everywhere including Apple podcasts, Stitcher, PocketCasts, Spotify, TuneIn radio, SoundCloud, CastBox, Overcast and many more.]

Heather – What motivates you? From…lots of people I wrote a post a while ago sharing a four-hour conversation that I had with my dad. My initial sharing of the conversation was just as a story but I listened to the conversation again with a view to pulling out what I learned about life that has served me well in my journey towards financial freedom.

My dad is one of my best friends and inspiration.

A lot of my values, I got from him. For instance, he always taught me that his dad taught him that holidays weren’t an opportunity to do nothing, they were an opportunity to explore other activities and interests including ones that look a lot like work. Of course, you can relax too but the premise of this idea was that even some types of work can count as relaxation and you shouldn’t feel that you need to put a full stop to all productivity. Another thing he always emphasized was to chase work not money, "Heather, don't ever chase money," he often tells me, "Chase work; if you chase work, money will start chasing you". I have always loved that one. Anyhow, over 5 episodes I will give you access to recordings made in July 2010 - exactly 10 years ago - on his life and business journey. The setting was a drive to Neno Village where my father grew up. My dad was sat in the back seat with me and Harry, my then boyfriend now husband, was sat in the front passenger seat next to the driver. It was one of the most enjoyable times I have ever spent with my dad. If you haven't already maybe this will inspire to capture your own parents' life story in this way. My dad went from a relatively poor village boy to creating not one, not two but three businesses in Malawi all of which were multimillion dollar businesses and his success obviously meant I have never had to deal with many of the character building challenges that my dad encountered. He was very careful not to spoil his kids though and while I always had everything I needed, I knew that in order to get the comforts I really want, I had to work for them because they most certainly would not be handed to me, of that my dad was very clear. My dad is very meticulous in setting expectations – he would only pay for a first degree, he would never buy anyone a car, he wouldn’t buy imported treats if he didn’t have to, “support local industry” was an important maxim in our house. My dad has lead such a productive life, I don’t think there is anything I can do to surpass his success or make him think wow, all I can do is record his journey and continue to be inspired by it. Episode 1

In the first recording of five my dad takes me through some of his earliest years in the village. Sorry if you think I keep butting in too much but this was the very first time I had had a conversation like this with my dad and I didn’t want to miss details like the context or how he felt emotionally about situations. It’s very African to gloss over things like feelings but being a father-daughter conversation this was of the utmost importance to me.

Without further adoo… enjoy this journey through the life of a serial entrepreneur before that was even a thing. What did we learn? In this episode I picked up:

Before he's sixteen my dad has already experienced 3 businesses:

You’ll note I asked whether he had black teachers. I asked this because I myself was sent to a private primary school in Malawi that only had white teachers. I grew up in a 1980s Malawi where "good teacher" meant "white teacher". I don’t know why the “Life President” of Malawi who was in rule when I was growing up decided to make this a thing but it was; colonial mentality, I suppose. My best teacher in high school was a black Malawian so things did begin to change but colonial mentality was a big thing when I was growing up and it still hurts us today. I note that he says he wasn’t bright but when it comes to business and street smarts and general with-it-ness, I know no one smarter than my dad. Episode 2

His years in the police, at Southern Bottlers (SoBo) and his decision to go Zimbabwe for further education. Dad's brief stint as a houseboy (about 2/3 months).

In episode 1 we found out that, my dad was walking about town with a friend and his friend saw a job ad for police recruits. He asked my dad to accompany him to inquire about the job. When they entered the police station the officer on duty laughed at the guy and said he was too short but that his friend (my dad) looked about the right height. My dad had no ambitions to be in the police but when he told his family about the opportunity they essentially forced him to do it because he needed a job. He decided he would do it for 6 months before moving on but on his first day he discovered that as soon as he was sworn in he was committed for four years. After lunch he pretended to be sick to buy himself time - that cracked me up. It bought him a month of time because the ceremony was only held once a month on the 5th of the month. His uncle gave him a right bollocking for messing about so he went to the village to tell his mum so she could back his decision not to join. Unfortunately, he told her the story in front of another villager who said - "Ntchito imeneyo ndi yabwino, posachedwa pano akhala kopulo" (That's a great job, very soon he'll be a corporal). His mother was sold. My dad cried tears as he felt sorry for himself! Saving In this episode he also reveals what an astute saver he was. He received 18 kwacha per month in the police: Mwk5 was spent on foods that have a long shelf-life (sugar etc.), Mwk5 was sent to his mum in the village to help her with household items, Mwk5 was banked to fund the education of his siblings and Mwk3 was his pocket money. Over the four years in the police his salary grew to Mwk24. He says some of his fellow police officers would borrow so much money through salary advances that at the end of some months their salary was negative but he stayed disciplined. He did not go to the staff tuck shop even once in four years. Business He still had the business bug and was operating a fruit business as a sideline whilst he was a policeman although that was not allowed. He got caught a mere 6 months before 4 years was up and was punished by being made to become a uniformed police officer after being in his civilian clothing for a long time. It didn't sit well with him and added to his reasons not to renew his contract with the police a few months later. I say it was fate. Houseboy For about a period of 3 months my dad worked as houseboy for a white man for a salary of Gbp3 - about Mwk6. Salesman Dad became a salesman for SoBo after leaving the police. From a salary of Mwk24 he started earning Mwk56 then Mwk65 once he was confirmed plus sales commission. He would earn over Mwk200 in some months because he was so good at selling. At around the time he had about Mwk2,000 in savings an incident occurred where he was being forced to go to work in Chikwawa but he didn't want to go there because he had contracted Malaria on a recent stint there to the point of being hospitalized. He quit the job. What did we learn? In this episode I picked up on the importance of :

Episode 3

Living in Zimbabwe including visa issues faced in Zimbabwe and working for Unilever.

In episode two of this series, the last episode, my dad had just arrived in Zimbabwe on a flight from Malawi and in this episode he picks up from there. He left our home country (Malawi) without any knowledge of exactly what would happen when he got to Zimbabwe. As it happens, he met a kind man on the flight who let him stay at his house for the night. I'll give a summary at the end for those that miss some things because they were in the Chichewa language. Two tips on language:

The objective of dad's journey to Zimbabwe in 1975 was to realize his life-long ambition of furthering his education. He bought a one-way ticket to Zimbabwe for Mwk39. On arrival, a kind Malawian stranger that he had met on the flight allowed him to stay over at his house for the night. When he got to his college he was shocked by the living conditions. Four men shared a room and slept on mats (mphasa) with limited amenities. Now that he had worked for a while and had lived better than this throughout his time in the police and as a salesman it just felt horrid but it was all he could afford. As fate had it he had the address of an uncle in Zimbabwe - the man had married his mother's youngest sister but they had never met before. He visited him very early one morning (before 7 a.m.) to introduce himself. After he told his uncle where he was staying, his uncle told him it wasn't a good place; he instructed him to collect his luggage and come to live with him rent free. His uncle wasn't rich either; in fact he had to share his room with my dad to accommodate him. His wife was stuck in Malawi at this time so he was essentially just living with his daughter. Living with his uncle allowed my dad to take even more courses at his college because he saved money by not having to pay his uncle rent. Race Relations From my dad's story, race relations between white people and black people in Zimbabwe were not as friendly as they were in Malawi. My dad went to Zimbabwe on a tourist visa and after 3 months had a lot of trouble with the Zimbabwean authorities. Ultimately, they gave him a "stupor" which basically required him NOT to live in any Zimbabwean town; he was relegated to the village. I found this insight into colonial life mind blowing because I can't imagine being allowed to only live in certain areas and having access only to the blue colour jobs - how ironic that my dad worked a job in a poultry farm, couldn't hack it and about 25 years later ended up owning a poultry farm perhaps that job was his inspiration! I haven't asked yet but I will. Anyhow what did I learn in this episode?

Episode 4

From unilever to a trade contact business and a tailoring business which he sold for a surprisingly healthy profit while he worked at Old Mutual to his candle business (Candlex) that led to his name becoming a household name.

This fourth installment of the series on the life of Mark Katsonga Phiri is possibly the most exciting if you're into business because dad goes from pure struggling with the tailoring business and massive debts that he had no idea how he would clear to being so cash rich that even he couldn't understand what was going on. Just to recap, in episode 3, dad returned from Zimbabwe in the late 1970s with his diplomas and secured a job at Lever Brothers, now called Unilever. Whilst he was at Unilever, after work he started running a business called "International Trade Contact" in which he got the contact details of various suppliers and enabled people to fulfill purchase orders. After that in 1981 he started a tailoring business. He invested Mwk1,500 in the business and hired a tailor to sew and someone he knew to run the operations and sales. He later discovered that the competition was extremely stiff so 1981 and 1982 were very tough for the business; he says he really struggled. He'd left his job at Unliever to do business full time but things got so rough he had to take on a job at Old Mutual selling insurance so again, business became the side hustle. By 1982 the business had assets of Mwk5,000 and creditors amounting to Mwk12,000 - that's negative equity of Mwk7,000. He decided to sell the business so he could clear the debts. After putting an ad in the paper he was surprised to get 12 offers, he hadn't expected to get any. Incidentally, because the Government had reserved tailoring businesses for Malawians there was huge demand from Indians for tailoring businesses that had licenses. My father didn't have one and the process for getting one was long and painful. Ultimately, though he sold the business for Mwk25,786 plus Mwk4,000 for the working capital or work in progress. That bid of Mwk25,786 had been on the table for 2 months before he finally got the license and the Indian buyer was losing patience - there were quite a few sleepless nights for dad. The day they drove to get the business license from Lilongwe my dad said he felt like that licence was pure gold. It was approved by Mr Malange, now my cousin's Grandpa but this was well before that happened. After his auditors had paid all creditors (and themselves) he had Mwk18,000. He used Usd4,500 to buy a candle machine from Japan. This was a time when Malawi kwacha was still pegged to the British pound and was much more valuable than Usd. Usd4,500 was about Mwk3,000. What happened next was pure magic. Within 6 months of launching the candle business he had Mwk150,000 - we're not talking turnover here, we're saying saved up! Quite shocking when you consider that each candle was selling for just 10 tambala each and cost 4 tambala to produce. Keep in mind this is still 1983 - basically, when little Heather was born in November of that year business was booming, the sleepless nights were a thing of the past. What did we learn in this episode? You may well have learned different things to me but I learnt that:

Episode 5

In episode 5 we are taken through the early years of Candlex the booming business that was introduced in episode 4. It was his 7th business and still his most memorable as it made him. Although I never really understood this until I got to secondary school age and would often be introduced as the daughter of the owner of Candlex.

In this episode I ask my dad how he came up with the name Candlex and I also want to know why he didn't buy a Mercedes Benz the moment he was cash rich. This is the modus operandi of the majority of guys I know who sniff the littlest bit of "big" cash. By the end of 1983 he had the funds to afford a Mercedes but he kept his little Datsun and didn't get a "flashy" car until 8 years of good business later in 1990. Summary

Some people will immediately say, he was just lucky. To a certain degree, yes, he was and he says so himself by saying "I have always said my businesses are God-given because I don't know how the ideas come into my head" he also said, "I have made some very big errors by not doing proper research but a natural solution always came up". One thing that can't be missed though is that luck was generated by his own constant actions and hustle which meant that when the opportunity hit, dude was prepared to take advantage of it.

In the first episode you may remember that my dad's friends were mostly playing when he was 11 but he was helping with his mum's business. Throughout his life story I can tell you that two things were almost completely absent: drinking and football. There was a brief period of less than a year when my dad took up wine drinking but in the end he decided it wasn't for him. He would have a glass at home and always allowed me and my sisters to have some too. In addition, my dad has never been a watcher of sport or films; he had a handful of VHS films. As he said in his story after work he was always researching the next thing or working on a business. It took 20 years of practice before he got his lucky break but he wasn't working towards a lucky break. His ambition was to have a wife children a good second hand car and to own a home that was it, he didn't imagine that he was capable of much else... |

Heather on WealthI enjoy helping people think through their personal finances and blog about that here. Join my personal finance community at The Money Spot™. Categories

All

Archives

September 2023

|

Heather Katsonga-Woodward, a massive personal finance fanatic.

** All views expressed are my own and not those of any employer, past or present. ** Please get professional advice before re-arranging your personal finances.

RSS Feed

RSS Feed