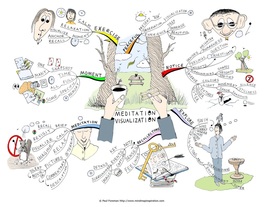

How often do you think about how you're going to live life in your 60s? Here are alternative outcomes. Living Off The Kiddies Some will reach the age of 60 without a single saving. You will depend on your kids for money, for food and perhaps even need them to house you somehow – if they are willing. For many this will not happen because life has been unkind to you, it will be the result of a series of bad choices such as having more children than you can afford to support and not saving enough. Be in no doubt that if you find yourself in this situation you will be a burden to your children. In the ideal world children don’t want to have to look after their parents financially and if they just earn enough to support their family will resent having to look after you because you didn’t plan for old age. Could this be you? POSSIBLE SCENARIOS Oh, This Isn't My House? Some will reach retirement age and realise that the bank or the company they work for owns “their” house and “their” car. It’s easy to forget such things when you are enjoying life but at this point you will be forced to either live off your children or invest your savings in a business. If you’re lucky you’ll find jobs in retirement or positions on boards of directors that provide an income whilst you make up for lost time on the investment front. Living Off The Rentals Some will reach the age of 60 with a tidy property portfolio. You will own the house you live in outright and you will have at least two rental properties. Your rental properties will produce enough money to cover all necessities, bills and wants such as holidays. When your children come to visit you, they will come with pride. Pride that they have forward-thinking parents that had the wisdom to cover their own retirement. You will have no unnecessary worries and will be safe in the knowledge that you never have to go to bed hungry or cold.  The Art of Visualisation Visualising is like fantasising. You visualise a specific event in the future in very specific and detailed terms and think about how much you will enjoy it. Scientists have confirmed that visualising can lead to the achievement of real results. In a well-known study on creative visualisation in sports, Russian scientists compared three groups of Olympic athletes:

Group 3 had the best performance results. This indicates that some types of mental training, such as consciously invoking specific subjective states, can have significant measurable effects on biological performance. Further to this, some celebrities have argued that they have achieved certain results in their life by visualising them first. These include Oprah, Will Smith and Jim Carrey. Visualising helps you to focus on a goal. If you can find just ten minutes a day to meditate and visualise the things you want to achieve you will increase your chances of achieving them. Most people don't think too far beyond the next couple of years, if that. Those that do are at an advantage. Of course you shouldn't live so far in the future that you cannotenjoy the present. That said, thinking about and planning for the future is enjoyable in itself –just do it! "Ordinary people believe only in the possible. Extraordinary people visualize not what is possible or probable, but rather what is impossible. And by visualizing the impossible, they begin to see it as possible." Cherie Carter-Scott  Want to Build a 6-Figure Beauty Business from the comfort of your sofa? Then my course is designed for YOU! "Beauty" includes a WIDE range of products from the not so obvious non-perishable foods and crafts to the more obvious hair, makeup, fashion, health & fitness.

6 Comments

Sharon Daniels

19/8/2015 03:22:26 pm

Ms. Katsonga,

Reply

Heather KW

19/8/2015 03:41:49 pm

I think you may have missed the point of this blog.

Reply

Sharon Daniels

19/8/2015 05:05:37 pm

Gratefulness should always be reciprocated.

Reply

Stephanie

23/8/2015 05:12:53 pm

Hi Heather - i have to say i absolutely love ur posts - i read all of them religiously. Thank you for putting out such informative posts and also for taking the time to answer my question about the PT.

Reply

Sindy

23/8/2015 07:36:50 pm

Thanks Heather for your thoughts that you share with us. They are very helpful and quite thought provoking in the right direction. I plan to do your online course one of these days

Reply

Roann

5/9/2015 12:08:57 am

I really love this post .Thanks so much for sharing more than.juat growing natural hair.This post have given me a whole new perception to my advantage

Reply

Leave a Reply. |

Heather on WealthI enjoy helping people think through their personal finances and blog about that here. Join my personal finance community at The Money Spot™. Categories

All

Archives

September 2023

|

Heather Katsonga-Woodward, a massive personal finance fanatic.

** All views expressed are my own and not those of any employer, past or present. ** Please get professional advice before re-arranging your personal finances.

RSS Feed

RSS Feed