Spending normally involves small amounts at any one time but an investment normally involves a chunky cash out flow all in one go. Investing is scary, it’s more risky and as such it’s easier to just not do it. I was thinking these things when one of my friends was telling me about how she wanted to invest in a personal development program but thought it was too expensive. It was going to cost her about £2,000 ($3,200) which is a lot of money to spend in one go but if that £2,000 helps to build a business that produces £2,000 worth of profit every month faster then it’s not a big deal. In fact, it’s a fabulous investment. Now, I started thinking about spending vs. investing because I know my friend’s spending habits quite well. On average:

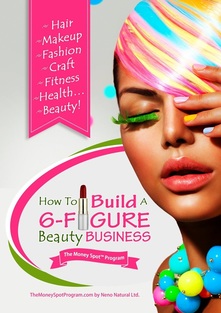

These are not necessities, they are her life’s pleasures. I’m not even counting dinners because let’s face it, a bit of socializing is necessary, it’s just a matter of picking places that don’t break the bank.  Anyway I would conservatively estimate that £40-60 is spent weekly that wouldn’t hurt her to completely eliminate – if you annualize this – I’m a big fan of annualizing –that’s over £2,000 to £3,000 a year. However, it never feels like that when you’re spending it in £3 to £10 increments. That said, you need to spend money wisely: there are a lot of great courses out there but you need to do the one that is relevant to you at that time before moving on to the next. I make it a point to do at least one course every year. When I worked in investment banking I did courses for fun (for example, I did a course in Black History, another in Aromatherapy and Massage, an art class etc.) and ever since I quit the rat race in early 2012 I have focused on courses that help the business. Anyhow, the main point I want to relay here is that you should analyze the return you get when spending money instead of the absolute amount. A suit can be an investment if it helps you get that high-powered job but most of the time, expenditure on clothes is not an investment. Do courses for fun to see how they help to develop your creative side. Indeed, spending less time doing what most people do, like spending lots of money on complete rubbish, can only be good for you. Invest instead.  Want to Build a 6-Figure Beauty Business from the comfort of your sofa? Then my course is designed for YOU! "Beauty" includes a WIDE range of products from the not so obvious non-perishable foods and crafts to the more obvious hair, makeup, fashion, health & fitness.

0 Comments

Leave a Reply. |

Heather on WealthI enjoy helping people think through their personal finances and blog about that here. Join my personal finance community at The Money Spot™. Categories

All

Archives

September 2023

|

Heather Katsonga-Woodward, a massive personal finance fanatic.

** All views expressed are my own and not those of any employer, past or present. ** Please get professional advice before re-arranging your personal finances.

RSS Feed

RSS Feed