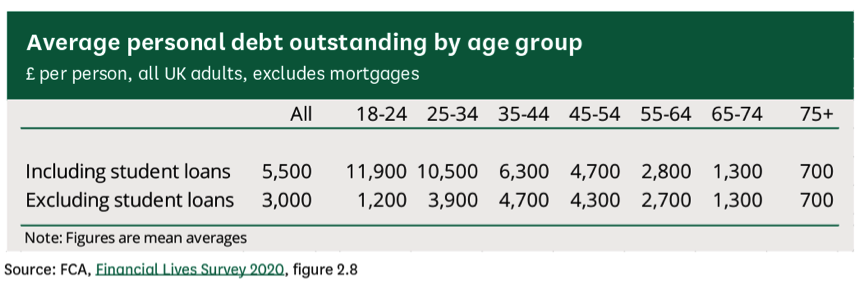

Taking control of debts: a step-by-step guide to debt freedom and improved financial resilience20/7/2023 Feeling overwhelmed by debt is a common experience that can affect anyone, regardless of age or income. In fact, 57% of UK adults carry some form of non-mortgage debt, with younger age groups being more susceptible – 80% of 25-34 year olds hold consumer credit but only 18% of people aged 75 and over. Despite quite significant numbers being affected by debt, oftentimes, someone struggling with debt can feel very alone and isolated, ‘it’s just me’, and worse feelings, of shame can stop you from speaking up and confiding in someone that can help or provide moral support. This article offers a practical and empowering guide to help you confront financial stress and take control of debts while prioritising your mental wellbeing. Who is most affected by debt in the UK? The Financial Conduct Authority (one of the UK’s financial regulators) defines "low financial resilience" as having limited capacity to cope with financial shocks. For example, if they had a financial incident such as a car breaking down or the loss of income for a week, they would not be able to cope without going deeper into debt. Certain groups, such as the unemployed, gig economy workers, renters, individuals with a household income below £15,000, and black or multi-ethnic adults are more likely to experience over-indebtedness. Recognising these patterns can help you understand that your struggles with debt are not unique and that external factors can contribute to this situation. A significant portion of debt for young adults is student loan debt. How to confront the financial stress of debt and reclaim your mental health

If you find yourself struggling with debts, take the below steps to regain control of the situation: 1. Figure out how much you owe You would be forgiven for thinking paying the debt down is the most difficult step. It isn’t, frequently opening your bills or credit card statements is the hardest step by a long shot. The very thought of having to do it will bring out a stress response – increased heart rate, difficulty breathing, headaches – I have seen a range of response. And, when you finally do manage to open the bills or credit card statements it’s not uncommon to get the runs or even throw up – this is all normal. Once you’ve been through this, you’ve probably ploughed through the worst emotions. But how do you get to the point of even being able to open the statements and figure out the damage? My advice: ask a trusted friend or relative to sit with you while you do it. If you don’t have one of those, perhaps contact a debt charity to help or call your employer’s ‘employee assistance programme’ to see if they can offer the moral support needed to get the task done. At this point all you want is a list of who you owe money and how much you owe them. List it all up and add it up. Great – you now know the extent of what you owe. 2. Get your Experian credit score and read through your credit record Next, get your credit score from “Experian”. This is free. If you have never used Experian before you can also review you credit record for free for a limited period. Go through your record carefully and if there is anything you disagree with, contact them or the relevant creditor to correct the errors. Check that your list of debt from ‘1’ matches what is on your credit record 3. Create a “debts sheet” in a spread sheet List all your debts in a spreadsheet. For each debt you want the amount owed and the minimum monthly payment. I recommend paying the debts off using what is known as “the debt snowball” this means you pay the smallest debt off first then move on to the next debt. Economically, speaking it makes most logical sense to start by paying off the most expensive debt and pay off the cheapest last, however, many people find that they get a psychological boost by seeing a debt fully cleared. I agree with this logic that is why I recommend the debt snowball. However, when I’m helping people figure out how to payoff their debts I sometimes take a hybrid approach, where it makes sense. Before we start tackling each debt though, there’s one more step. 4. Analyse your income and expenses then figure out where you can cut back and how you might increase your income This is a very important step: Prepare a detailed list of your expenses and compare them to your income. Identify areas where you can cut back: for each expense item, write what you spend now and what you plan to spend going forward. Be realistic. The aim is to reduce your expenses as much as is possible so that you can create as big a gap as possible between your income and expense. Average income in the UK is about £32,000/year or £2,000/month after tax and a 5% contribution to your pension. If you’ve typically spent all your earnings each month, then cutting expenses down to £1,700 would mean you have £300 to put towards paying off debts each month. If you have a skill you can monetise during evenings and weekends then you can make some extra money as well and put all of it towards paying off your debts. You can make money online or offline. Put flyers through doors and you might be surprised at the response. I was surprised at the success I had with putting flyers through doors when I wanted to earn some extra dosh in my mid 20s. 5. Go back to “debt sheet” and figure each month out Now that you know your capacity to repay debts, pay the minimum required on each debt and direct all extra cash to smallest debt until it is paid off. Ideally, create a timeline showing how much debt will be paid off, each month until you’re fully debt free. So that paying off your debts doesn’t feel like a punishment, throwing in the odd treat will help you stick to your debt-free plan. 6. Close debt accounts As you pay off each debt, consider closing the corresponding accounts to avoid the temptation of further credit. My personal approach is to not to keep any credit cards. However, if you find having one helpful and feel you can’t live without it, then maintain just one and think carefully about how best to use it. Conclusion Taking control of debts and building financial resilience is a journey that requires determination and support. Remember, you are not alone in this struggle. By facing your debts, understanding your financial situation, and devising a practical repayment plan, you can regain control of your finances and achieve a debt-free future. Stay focused, stay resilient, and embrace the small victories along the way. You've got this! To debt freedom. References: UK Parliament, Household debt: statistics and impact on economy, Dec-2022

0 Comments

Leave a Reply. |

Heather on WealthI enjoy helping people think through their personal finances and blog about that here. Join my personal finance community at The Money Spot™. Categories

All

Archives

September 2023

|

Heather Katsonga-Woodward, a massive personal finance fanatic.

** All views expressed are my own and not those of any employer, past or present. ** Please get professional advice before re-arranging your personal finances.

RSS Feed

RSS Feed