|

Hi Heather

When is a good time to draw equity from your house: when I retire which is in about 5 years or before? Mary

Hi Mary

Thanks for this question because it really got me scratching my head. I was initially quite flummoxed when I received the question because as a proponent of the FIRE movement (Financial Independence Retire Early) the whole premise of my money management toolkit is to get out of debt including mortgage debt completely and NEVER go back. However, I am going to park this way of thinking and answer your question in the most unbiased fashion that I can and I will also ask you a few probing questions so you can figure out whether this is what you want to do. FIRSTLY, what do you plan to do with the money? Do you want to use the money for general living or to make a significant purchase or investment? Generally, I think in most cases it is not a good idea to get into debt during retirement as it may cause undue stress if you run into any unexpected financial problems. OPTION 1: Take equity out and pay off the debt or interest during retirement I don’t know the value of your home or any other numbers, however, if you take equity out of your house that money will be charged interest and if you enter into a standard mortgage contract, you will have to pay the interest and possibly repayments from the month after you take that equity out. From my follow up email to you I gathered you have a pension that will come in when you retire. I am assuming this is a “defined benefit” pension so it’ll be paid to you from retirement until you die. By taking on debt you will have a reduced income. So, if your pension is income amount to 2,500 per month and if you take out equity requiring 500 in monthly payments you will lose 20% of your pension straight off the bat to debt payments. How will this affect your standard of living? OPTION 2: Take equity out and pay all the interest off when you die If you are over 55, which I assume you are, you can also get a mortgage that doesn’t require interest payments to be made until you died.

Depending on the terms you may be allowed to repay some or all of the amount borrowed. Otherwise, with a lifetime mortgage all the interest would be accumulated and paid on your death.

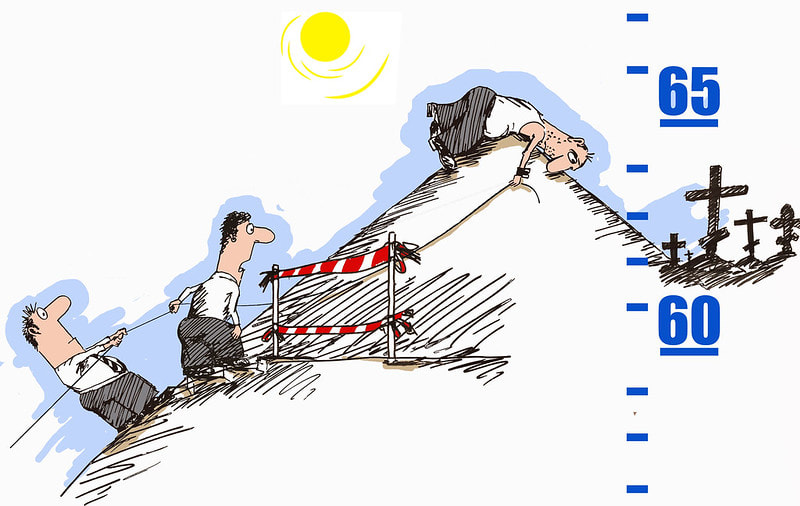

So if your home is worth 100,000 you might sell a 40% stake to the bank for a 20,000 lump sum. When you die, the bank gets 40% of whatever the house is worth at the point. So if you die 20 years later and your home is worth 300,000 the bank get 40% of 300,000 which is 120,000 for the 20,000 that they lent to you. If you died the very next year and your house has stayed the same in value then the bank gets 40,000 for the 20,000 that they lent to you. Even if your house falls in value the bank is still likely to come out ahead because they take a huge hair cut off the value of the house. The reason these mortgages are only offered to people over a given age is to minimise the chance of the bank losing its money, for example, because accumulated interest exceeds the value of the house on a lifetime mortgage. To safeguard the bank further, they keep the amount of equity that can be released quite low; the younger you are, the lower the allowed equity release. So, a 55 year old might be restricted to releasing no more than 20% but a 75 year old might be allowed to release 30-40%. I am making numbers up here because the reality is that more conservative banks will have lower limits and banks that are more risk tolerant allow a bigger release of equity. It all sounds great on first inspection but banks have received a lot of bad press regarding equity release schemes because in the fine print they have stuff like, you don’t need to repay the interest PROVIDED you live in the house so if you need to move home, even into a care home or to a more accessible home because you develop mobility issues, all that money comes due and you would be forced to sell your house and pay the bank. There are likely to be other catches too because banks are in this to make money so if you go for an equity release scheme of any nature you should have a lawyer or financial advisor look at the terms and conditions diligently for you so you know exactly what you are getting yourself into. The bank might get a guarantee that you will never owe more than the value of your home but this means that you could owe the full value of your home to the bank. If you release equity at age 55 and live until 95 there is every chance that interest can accumulate to the point of exceeding the home value. It’s nice to get a tax free lump sum via an equity release but in doing so you may reduce your entitlement to means-tested state benefits, now or in the future so you need to think about this angle too. I don’t know how well I am doing with the unbiased view thing here as you can probably tell that I think releasing equity is a high risk game and it frankly, freaks me out. If you don’t have any kids or charities/causes that you’d like to leave an inheritance to and you’re certain you will be physically fit enough to live in your home until the day you die then perhaps the risk of releasing equity could be worth it. Another form of equity release is to downsize your home, i.e. you sell an expensive home and buy a cheaper home and live off the difference, this way you release equity but don’t incur any debt in the process. COST OF EQUITY RELEASE According to moneysaving expert.com, a lifetime mortgage equity release typically has an interest rate of c.5%, but some rates are under 3%. This is a lot higher than rates on regular mortgages. E.g. With a 40% deposit you can now get a 5 year fixed rate mortgage of just under 1.4%, just to give you an idea. If you release equity at a rate of 5% then the amount you owe would double every 14 years (see my article on the rule of 72); so if, say, you borrow 20,000 on a 120,000 home, if you live until 74 you’d owe around £40,000, live until 88 and you’d owe £80,000 and live until 102 and you’d owe 160,000. As well as the cost of the interest, don’t forget that you'll have to pay arrangement fees when you take out the mortgage and in the UK these range from £1,500-£3,000 depending on the mortgage deal and including things like solicitors and surveys. ALTERNATIVE As you have 5 years until retirement, you could try to boost your savings over the five years so that rather than borrow money you’ve saved for it. If you don’t feel you earn enough to save the amount you want you can look at things like renting rooms in your home via AirBnB or by getting a more full time lodger. I would personally find it very scary to go into retirement with debt because the need to keep with payments or even the knowledge that I don’t actually own my home but if you are more comfortable with the idea then this won’t be a consideration for you. My biggest advice would be get professional advice before you take this massive step and do whatever you can to avoid having to do it. A debt-free retirement is a peaceful retirement. Much love and thanks for being a long-time follower. See the linked article on equity release on the moneysavingexpert.com website. Heather x p.s. subscribe to my podcast and ask me any money question, HERE - do it now!

0 Comments

Leave a Reply. |

Heather on WealthI enjoy helping people think through their personal finances and blog about that here. Join my personal finance community at The Money Spot™. Categories

All

Archives

September 2023

|

Heather Katsonga-Woodward, a massive personal finance fanatic.

** All views expressed are my own and not those of any employer, past or present. ** Please get professional advice before re-arranging your personal finances.

RSS Feed

RSS Feed