|

Hi Heather, my name's Kimberley. My husband and I have worked hard to build a financial safety net for our family.

We both come from modest backgrounds and weren’t taught much about money so we’ve had to figure everything out on our own and made quite a few mistakes along the way. Do you have any tips we can use to teach our children about managing money so that they make far fewer mistakes than we did? Thank you!

Thanks Kimberley, this is a brilliant question. As a mum myself, setting my children up for a healthy financial future is something I think about periodically. While every child is unique, from my personal experience and my experience of observing others these are the 9 things that I think help children grow up into good money managers.

1. Explain where money comes from early By the time a child is two, or even earlier, they have created an image in their own minds of what money is and where t comes from. Your child might think it comes from your wallet or from a wall in the machine or perhaps even that the plastic thing in your wallet has unlimited purchasing power. What you want your children to believe and know from an early age is that money comes from work. Whether you are employed, self-employed or an entrepreneur in order to earn money some kind of effort has to take place and that effort, be it pleasant or unpleasant, is called work. When I was growing up, my father was a business person and my mother was employed and they showed me two different types of work. Although they both went to work physically every day – one, my mum, was generally free to enjoy weekends although many nights were occupied by trauling through her in-tray which she brought home from work; the other, my dad, generally enjoyed free evenings but spent weekends overseeing his business ventures. These were my examples and your children will observe the type of work their immediate family engages in. 2. Explain that you have had to save for things that you buy When you bring a new expensive purchase home like a TV or a sofa your child might, in their own mind think that these purchases just happen, that they don’t involve much effort on your part. To take away any such thinking, I always tell my son that mummy and daddy had to save for the thing and I explain how long we had to save for it. In reality, sometimes I stretch the truth for example, if we are working ahead of our saving plan I might just save less in a given month and get what I was planning to get later. For example, two months into covid-19 lockdown our 13-inch TV broke so we replaced it with a 65-inch TV – very extravagant, I know – and I told my son that mummy and daddy had to save for a whole year to get the TV. He may not understand fully what the whole saving process entails but that information is sitting in his head and is setting an expectation for himself; that expectation being, when he wants something he needs to save for it appropriately. 3. Make your children practice delayed gratification Delayed gratification is difficult even for adults but I believe that the more it is practiced the less painful it gets. Because things were very expensive in Malawi when I was growing up, my parents only bought us things, including some basic necessities, when they went abroad which was not very often, perhaps every 4 to 6 months, sometimes longer so I often had to wait many, many months to get what I want. Living in England, everything is so much more accessible but I tell my children that they can get what they want on their birthday or Christmas, whatever comes first. This means whenever they want something in shops I can just say, “add it to your birthday list” or “Christmas list” – it helps. As I am writing this article my 5 year old son is watching a YouTube video that’s marketing Paw Patrol toys to him. He has asked for a dozen or so things and because of my usual “add it to your Christmas list” he is writing a very long list for Santa and getting some much needed writing and spelling practice in the process – win-win. 4. Don’t give your children more money than they need I remember when I was in boarding school my father made me write a list of all the things I needed for the coming term, then I’d get money to go and buy those things – snacks, feminine hygiene products, stationery, that sort of thing. On top of this, he gave me a very basic allowance for buying the odd donut from the tuck shop. This taught me two things: how to plan for my needs in three-month chunks at a time and how to resist the temptation to buy too many things from the tuck shop too early in the term for fear my money would run out. I hate to say it but I also became an expert at getting people to “treat me” at the tuck shop and when I say people I mean the guys. Fortunately, they were genuine friends and nothing other than my friendship was expected in return. My negotiation skills probably got a lot of flex in the process – how does one ask without sounding like you are begging…? I could do a course on that. There were peers in high school receiving five times the pocket money I did and I will admit, I was jealous at the time but with hindsight I can see my father’s wisdom in giving us no more pocket money than we needed, he didn’t want to set unrealistic expectations for me and my sisters. 5. Don’t give your children an expectation that you will bail them out If you rescue a child financially that robs of them of a lesson and also robs of them of any incentive to behave responsibly next time. If your child finds themselves in debt, by all means help them write a plan to get themselves out of debt but avoid paying the debt off for them because that will definitely not be the last time you do it. I watched a friend of mine work diligently over 18 months to pay off debts that her mother could have cleared for her at the click of a button. The person that emerged at the end of those 18 months was miraculously different: not only was she debt free but she cut up her credit cards because her experience of paying them off taught her that the pleasure of the purchase was not worth the pain of paying the loan off. She now only buys what she has saved for nowadays. 6. Don’t lend your children money interest-free for anything …maybe only for the deposit on a house (but even that is debatable) Each time I have asked my dad to lend me money he has agreed to lend it to me but at a commercial Malawi rate of interest. Interest rates in Malawi have tended to be between 25% and 35% - so I haven’t taken him up on his offer and have instead borrowed money commercially from banks. Although I am annoyed at the time, I am, again in hindsight, grateful for this approach because it’s let me own my property projects and made my successes feel like my own. It’s forced me to plan and to be prudent about how I spend money. I plan to take the same approach with my children, I will make them take full responsibility for their plans and projects and if I do invest with them, it will be on a commercial basis. They should own their successes. 7. Don’t create an expectation that there will be a large inheritance The need to make a living gets many people out of bed every morning. Those that know they don’t need to work to earn frequently don’t bother. Why would you go through that pain of forcing yourself up if you don’t have to? I heard an interesting stat from The Money Guy on YouTube: apparently, 68% of Americans expect to receive an inheritance BUT only 40% of parents expect to leave one. And I bet, some of those 40% of parents that will leave an inheritance are leaving it to the 32% of children that aren’t expecting it. Who do you thinking is working hard to set themselves up for a good life and retirement, the 68% that expect an inheritance or the 32% that don’t? My children are too young to talk inheritance but when they are they are going to know full well that I plan on spending my money liberally before my final call! 8. Be a good example – this is probably the most important tip The way you handle money will inform your children’s behaviour around money massively. Your actions normalise money behaviours for children. Do you buy on impulse or plan your purchase, are you frugal or a spendthrift, are you anxious about money or just sensible without making it a thing? If you never talk about money then don’t be surprised if your kids turn out to be the type of adults that don’t deal with their money issues at all, they might just pretend the issues don’t exist. Whatever it is you do, your children are watching and they are learning. Teach them to acknowledge how much they have relative to many others. A healthy sense of gratitude may help with any sense of discontentment, you know, because Peter has more toys, more shoes or a better phone than I do… …I know we adults (myself included) struggle with comparison to the Joneses constantly ourselves. 9. Teach your children the basic concepts of money I see the basics of money as come in four categories:

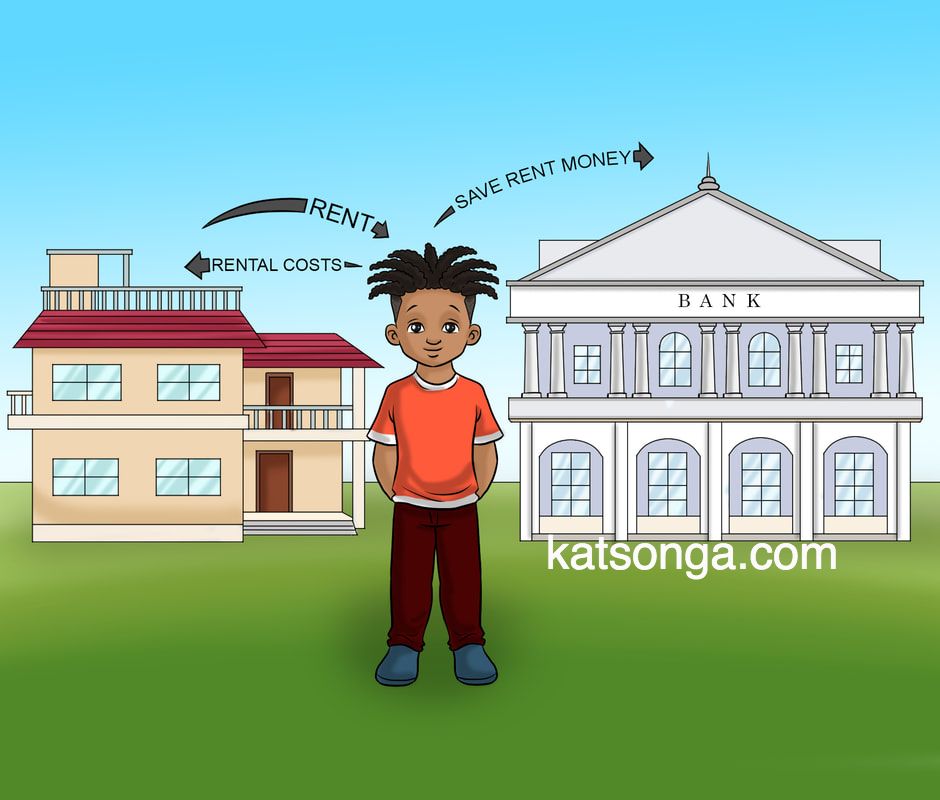

If your child leaves home knowing just these things, they are well ahead of their peers and are more than likely to win with money, here is an example of what I mean, If you like what you’re about to hear get workbook – B. School: for money-wise wealth-bound kids. It’s available in 9 languages! Heather x

0 Comments

Leave a Reply. |

Heather on WealthI enjoy helping people think through their personal finances and blog about that here. Join my personal finance community at The Money Spot™. Categories

All

Archives

September 2023

|

Heather Katsonga-Woodward, a massive personal finance fanatic.

** All views expressed are my own and not those of any employer, past or present. ** Please get professional advice before re-arranging your personal finances.

RSS Feed

RSS Feed