We all know someone with more energy than us. For some unknown reason even if you can produce just as much work as they can in any given amount of time, they seem to be able to just go on for hours and hours. They seem to need less sleep than you do and even after a game of squash or whatever it is they’ll shower and just rabbit on where as you need a break. I’ll call these type of people Energizer Bunnies. Energizer Bunnies are exhausting to watch…so how can you work on their level? Pretty much, something’s gotta give. You just have to focus on fewer tasks than they do and make more sacrifices. If you try to do everything that they do you will just burn out. For the most part, I need 8 hours of sleep a night and this is how I achieve the same or better academic and financial goals as Energizer Bunnies. Firstly, I remember one little piece of advice my daddy gave me when I was a teenager, he said “Heather, there is a time for everything.” By this, he meant that sometimes you have to give up all or most of the fun stuff for a while in order to enjoy yourself properly in the future. If you try to have all your fun now as well as get your academic or financial success it just ends up with you having to work harder for longer. I thought he had a point so I took what he said on-board. With this in mind:

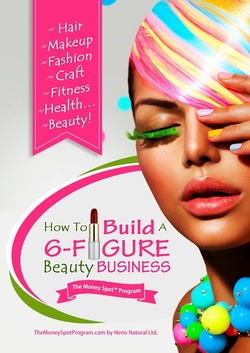

In summary, I don’t try to live the life of the Energizer Bunny. Ultimately, my idea of fun involves having more free time to hang out with my husband and kids, reading books in cafes whenever I want, eating out wherever I want and whenever I feel like it, sending my kids to good private schools and getting my cleaner to come more often. Even if the Energizer Bunny posts numerous social posts of them moving from one party to the next, flying to various exotic locations and playing lots of sport I know those are not my goals so comparing myself to them is fruitless. The problem some find is that they do want to live the same life as their Energizer Bunny friend. If that is the case you just have to accept that in the short term you’ll need to have less fun and work harder so that in future your hard work pays you enough income to buy more leisure time. There’s a time for everything.  Want to Build a 6-Figure Beauty Business from the comfort of your sofa? Then my course is designed for YOU! "Beauty" includes a WIDE range of products from the not so obvious non-perishable foods and crafts to the more obvious hair, makeup, fashion, health & fitness.

0 Comments

Leave a Reply. |

Heather on WealthI enjoy helping people think through their personal finances and blog about that here. Join my personal finance community at The Money Spot™. Categories

All

Archives

September 2023

|

Heather Katsonga-Woodward, a massive personal finance fanatic.

** All views expressed are my own and not those of any employer, past or present. ** Please get professional advice before re-arranging your personal finances.

RSS Feed

RSS Feed