What's the point of saving? What's the point of saving?

Hi Heather,

Based on the things you told us about investing, my husband and I started putting £125 per month each into our SIPP pension. I hope this isn’t a silly question but what are these savings for? When can we expect to start spending that money and should we try to spend it in specific ways or on specific things? Both my husband and I are 30, we don’t plan on having children and our jobs have fixed pension benefits. Thanks Flora Hey Flora, That’s a great question. While everyone has a different value system, there are two main reasons that I strongly recommend that people put money into a self-invested pension plan or SIPP a) flexibility and b) security including funds to help pay a mortgage off early. A SIPP can be better than a stocks and shares ISA, in some cases, because you effectively pay less tax and because you can’t use the money until you are about 58 so it forces you to save. Let’s talk about each reason in turn: The first reason: is flexibility over when to retire In the past, a lot of work-based pensions (aka defined benefit pension plans) used to allow early retirement from between the ages of 55 and 60, most of these type of scheme are being completely phased out and are instead being linked to the state retirement age which for you is currently expected to be 68. There is talk of moving this to age 70, so this is a future possibility. Whatever happens, the funds that you build up in your SIPP can be taken from 10 years before the state retirement age. This means if the state retirement age moves to 70 you will still be able to use money that’s sitting in your SIPP from the age of 60. If you and your husband are putting £125 each into a SIPP then when you are 55 years old, you and your husband’s combined pot of savings would be worth £135,000 if the pot of money only grows fast enough to keep up with inflation of about 3%; if you get growth equivalent to the average stock market return of 7% then you would have £250,000 at the age of 55 and if you get an average stock market return of 10% you would have £410,000 saved up. At age 60 the figures would be £180,000 @ 3%, £375,000 @ 7% and £700,000 @ 10%. These sort of returns aren’t cuckoo. According thebalance.com, “the S&P 500 Index, delivered its worst twenty-year return of 6.4% a year over the twenty years ending in May 1979. The best twenty-year return of 18% a year occurred over the twenty years ending in March 2000.” Various sources suggest the S&P 500 has returned 10% before inflation if you buy and hold the money you invest into it. But of course, it’s useful to remember that this past success doesn’t guarantee that future returns will be as good. Right now you would struggle to find a bank account that gives you an interest rate of 1.5%. Back to flexibility on when you retire, however, unless you believe the US has no room for growth, then this total of £250/month you are saving could amount to a lot of money over a 25 to 30 year period and this would allow you to retire with a decent income well before the state retirement age. If your mortgage is fully paid off by the time you retire then your cost of living could be low enough that even a modest growth in the SIPP would provide a comfortable income before your state pensions and work-place pensions kick in. The second reason: to save the money is the added security from having extra retirement income Having money in a SIPP means you can top up your retirement income. Having the SIPP would mean you have 5 sources of income:

If the pension income from your jobs is lower than your final salary having access to extra funds will mean you can more or less maintain your lifestyle. This will be especially important if one person lives a lot longer than the other. There is one special feature that the SIPP has but all the other 4 pensions do not: and that’s the fact that if you or your husband dies the state pension stops coming through and the work-place pension either stops completely or is massively reduced. However, whatever money is outstanding in the SIPP would fully transfer to the spouse without penalty. Just to be clear, I will make that point twice: a work-place pension either dies with the person and at that point the spouse receives nothing or, from that point, the spouse gets a heavily reduced benefit – usually 50% or one-third of the amount that was being received before their spouse died. A LOT OF PEOPLE forget this about SIPPs and other defined contribution pensions. I won’t go into the differences between defined benefit and defined contribution pension plans here but if someone is interested go to themoneyspot.co.uk and leave me a voicemail with your request. Finally, when can you expect to start spending that money and should you try to spend it in specific ways or on specific things? Technically, the plan is that you will never have to spend the capital but can just spend the growth. If the fund is worth £250,000 when you start drawing from it and you are earning a 10% return per year at that point, then you could just withdraw the 10% (i.e. £25,000) or less and spend that. If your withdrawal rate is lower than the growth rate of the fund then your retirement would continue to grow even as you take money out. Note that some research suggests that the ideal withdrawal rate to maximise the likelihood that the money will never run out is 4%. But given you have pension income from your jobs in addition to the state retirement and you’re not worried about passing wealth on to children you could be more aggressive than this. As for how you spend that money, well that is up to you and is a great problem to have. Having more money doesn’t only mean more holidays, it also means you can buy private health insurance which might be a necessity to avoid NHS waiting lists at a time when health problems are more likely. This would give you a lot of peace of mind. Ability to pay mortgage off early One thing worth adding, is a note that once you can withdraw money from your SIPP you are allowed to take 25% out as a tax-free lump sum. If your household had £250,000 saved up, you could take £62,500 out in one go which could be used to clear all or most of your mortgage. You would then be allowed to take the rest out as an income or you could buy an annuity – with an annuity you essentially buy a fixed income which keeps being paid to you for the rest of your life. I wouldn’t recommend an annuity for you given you have two fixed pensions coming in already, you don’t need the extra security and annuities don’t tend to be worth the money now that interest rates are so low. What you could do instead of buying an annuity is withdraw what you need from the SIPP every year. You would pay taxes based only on what you take out and could manage the withdrawals to minimise the tax bill. I hope this helps. Heather Have a money question?

0 Comments

Once you have decided on an investment strategy for yourself or for your children you need to decide where to invest and what to invest in. WHICH PLATFORM TO USE FOR INVESTING Choose a platform that has the lowest fees for the highest convenience. Fees change over time but when I was deciding on a platform I found these articles:

In the end, I chose iWeb for myself and Hargreaves Lansdown for the children’s investments. Why iWeb? I chose iWeb because annual fees are zero (after a £25 account opening fee) and you only pay £5 per transaction. As I only transact once a month (on pay day), our annual household fees are £60 and if you consider that I only transact on either my account or my husband’s account in any given month, then we are only paying £30/year per account. More than fair. The main problem with iWeb is that they don’t do junior ISA and you can’t automate investing. I don’t mind manually investing for my and my husband’s ISAs because we invest different amounts in different funds each month. Why Hargreaves Lansdown? They do junior ISAs, they have a good app and you can fully automate all your investing – their customer service is also pretty good; if you call you will get through to a human pretty quickly. Ultimately, I don’t expect the children’s ISAs or pensions to have a value greater than £100,000 before they’re adults so a platform with a percentage fee will tend to be cheaper than one with a fixed fee. When they’re older I’ll advise them to move to a cheaper platform. Which platform will work best for you? Unless you’re an investment buff that actually enjoys making monthly investment decisions, I recommend you choose a platform that allows automation, possibly Halifax share dealing or Cavendish; one of my friends recommends Fidelity. For children, transact within a junior ISA. For yourself or partner, an adult ISA. If you can invest more than the annual limit then use the ISAs first before transacting via a taxable account. WHAT SHOULD YOU INVEST IN? Unless you have a lot of time to research different companies, I would only invest in low-cost (passive), well-diversified mutual funds such as an S&P500 tracker or a FTSE100 tracker. Passive means the fund is not actively managed, it just follows the stock market so your return is essentially the average market return. Research suggests that actively managed funds (ones where a ‘clever’ manager stock picks) generally underperform the market in the long-run. My long-run strategy is to have 70-80% of my money in (safe) passive funds and 20-30% in actively managed funds. ETFs? I don’t do ETFs – I think funds make more sense. Over to you. Have a question? If you have any personal finance questions send them to [ME] – I will answer whatever piques my fancy via a blog post.

Hi Heather

I just had my first baby. I'm 31 and married. Do you have any tips for how I can think about saving and investing for my baby? Thanks, Diana Hey Diana, This is an awesome time to be asking me this question. I also started planning for my first baby as soon as he was born. You will be at an advantage if you start saving and investing for your children as soon as they are born. You will need to balance what you can afford with what you want to achieve for them. Firstly, what’s the goal? What are you saving for?

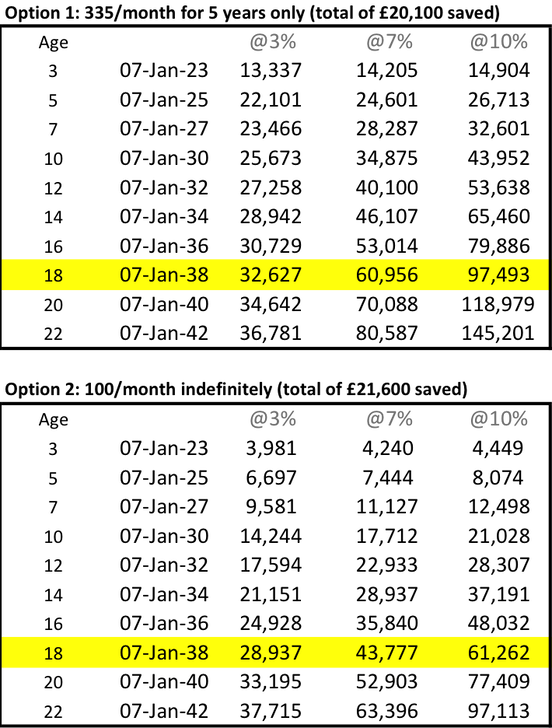

1. UNIVERSITY University costs c.£60,000 in tuition and living costs for a 3 year course at the moment - £10,000 for tuition and books, £10,000 for living – living costs can be higher or lower depending on whether you live at home, etc.. £60,000 is a huge amount of money and this cost is likely to rise in the future but it makes the maths too complicated to think about possible cost increases. Option 1 for university savings If you can save £20,000 in a tax-free account like a stocks and shares ISA by the time your child is 5 years old, then you can stop putting money aside and this money will have a reasonable chance of growing to £60,000 by the time your child is 18 years old. How could you save this £4,000 per year? Perhaps you could target saving a round amount like £250 per month (equivalent to just over £30/week each for a two-income family) and because this sums to £3,000 a year, at the end of the financial year you’d hustle to throw that extra £1,000 into the ISA before the financial year closes on 5 April. Or, if you can afford it, you could just save £335/month and you would save just over £4,000/year. Option 2 for university savings £4,000 is likely more than most can afford. The alternative is to save £100/month until age 18 which most people can afford even on the median household disposable income of £29,400 (2019). It’s equivalent to about £12.50/week each for a two-income family). Which option is better? I would say option 1 trumps option 2 because you give the money the best chance of growing. Equity markets are volatile in the short-run so by saving the money early you give the money a better chance of reaching your goal. That said, something is a lot better than nothing: small savings add up to large amounts over time. Your savings may be lower than you would like to target but you will still help your children avoid the full scourge of student debt. These are the results under each option:

Caveats on saving through a Junior ISA:

When you save the money through a Junior ISA, that money will be theirs when they hit 18 and you might not be able to control how they spend it. However, putting it into the Junior ISA means you won’t be tempted to spend it yourself because once the money goes in, it can’t be withdrawn until your child is 18. How can you avoid the Junior ISA so you have more control over the money?

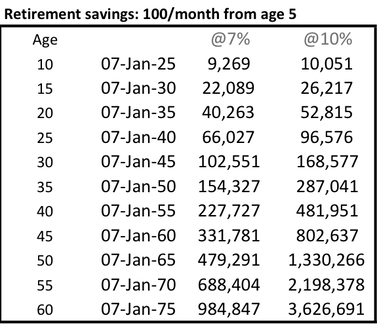

Plan b. is a good option because you could end up not having to pay tax anyway: The capital gains tax allowance in 2019-20 is £12,000. That is, you have to make a capital gain (the profit on your investment) bigger than this to pay the tax. If you save the £4,000 across two investment accounts - £2,000 in an investment account with your name and £2,000 in an investment account with your spouse’s name then when your child is 18 you can sell enough stock each year to keep the capital gain below the capital gains tax allowance. The risk however is that this threshold could fall or be completely removed in which case you would end up paying more capital gains tax on the sale. It’s still a sensible option, despite this risk. 2. RETIREMENT If you followed option 1 for university savings, at age 5 you’ll have stopped doing that and might find that you have some spare money to open a retirement account. Your children will not have access to this money until they are 57 to 60 but if life hasn’t worked this will be a great cushion for them. The beauty of investing in a retirement account is that for every £1 you put in the government puts in an extra 100/80. That is, if you want to save £100/month you only need to put £80 into the account. If you do invest £100 it will be £125/month with the government top up. For kids you can put a maximum of £2,880/year (£240/month) which equals £3,600/year. This is the result if you choose to save £100/month indefinitely into your child’s Self-Invested Pension Plan or SIPP starting from when they are 5-years old:

You notice that the extra £25 from the government makes a real difference. By saving through the pension, based on a 7% return, on 7-Jan-2025 the investments are worth £9,269 rather than only £7,444 without the government top-up.

Don’t save into a child’s retirement account unless you have the cash flow and are meeting your own goals, e.g. paying enough into your own retirement, paying off your mortgage early and ideally, are debt free yourself (apart from the mortgage). Some will be able to afford the full £240/month from birth, the rest of us have to work out what is realistic, that is why I personally opted for the £100/month from age 5. This decision will change with a change in your fortunes. 3. HELPING YOUR KIDS BUY A HOME This is where the decisions get a little tricky. Some people will be able to afford funding university, helping their children get ahead with retirement savings and help with a deposit on a home without compromising their lifestyle at all but the rest of us need to make choices. Private school vs. saving for a home What will make the biggest difference to your children: a private education or getting onto the property ladder? If you can afford one or the other but not both, then you might follow the route of private primary school followed by state secondary school (grammar/comprehensive). In this case you’d direct all the money you would have spent on a private secondary school education on saving for a home. In some cases this might mean your child starts life with a mortgage free home. If you save £15,000/year (£1,250/month) from age 11 until age 21 (10 years of saving) and it grows at an average rate of 7%, how much money would your child have at 21? About £220,00 – increasing to £260,000 if the average return over that period is 10%. This is not small money to most of us. You could use every last cent on a private education when at the end of the day the thing that helps your child follow a life of fulfilment is being relatively debt free. If you decide to go for a state education throughout and save £1,000/month (£12,000/year) from age 5 (when you are done with university saving) until age 21 (16 years of saving) and it grows at an average rate of 7%, how much money would your child have at 21? About £355,000 – increasing to £475,000 if the average return over that period is 10%, wow. Forget the children, you could be doing this for yourself! If you have already made the decision to send your children to a private primary school and they are thriving, you are unlikely to reverse that decision. If I you are seeing these numbers before making a decision, you might well make a very different decision… Not thinking about private education, anyway? If private school is not a consideration for you, then the best choice might be to save as much as you can towards your own ISA allowance of £20,000/year (£40,000/year in a two parent home), in addition to whatever you save towards your pension (I recommend 10-15%) and when the time comes you can decide whether you can contribute towards university or a first home or both. The best gift you can give your kids is possibly to be independent in old age so they don’t have to worry about taking care of you. You can boot strap them onto the property ladder by letting them live at home rent free – so that they can save more for their deposit. Even without cash gifts, you will be giving your children a competitive advantage by teaching them how to handle money at an early age. Starting to invest Next, you need to consider what platform to use for investing and what to investing in? If you have any personal finance questions send them to [ME] – I will answer whatever piques my fancy via a blog post.

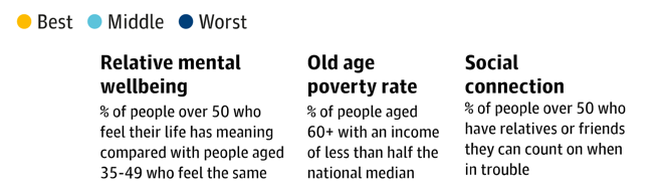

This article looks into what retirement & pensions look like for the USA and for black people in particular. Skip half way down if you just want the race-based statistics but not the overall picture. Jim Crow laws and US-style racial segregation mean black people in America as a whole are still catching up with wealth accumulation. This article brings together data and charts from various sources; references to all sources are listed at the bottom. Overall, retirement statistics show a dim picture for everyone except the very affluent in America and the situation is worse for black and hispanic populations. One factor that fascinates me is that the US doesn't have a national state pension system. This means old people have to claim social security benefits to get by. This is important because in the UK and other developed economies you get the state pension based on your tax contribution history, it's essentially a prize for working hard during your life and whether you've got millions in the bank or not, you're entitled. You can even claim your state pension if you are still working when you reach retirement age. In the US, you have to claim social security in old age in the same way you would if you were unemployed. There is no State reward for having been a long-standing tax payer when you reach retirement age in the US. RETIREMENT STATISTICS FOR THE US OVERALLWhilst the graphic below shows that the US is one of the best places for social connections and mental well being in old age, it is the third worst country in the list for old age poverty. Only Australia and Japan are worse, even India a country far behind the US in development has better relative poverty in old age.

What proportion of an old person's income does this form?

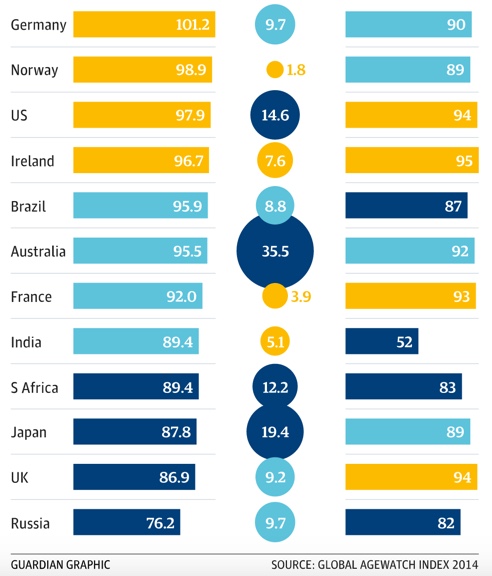

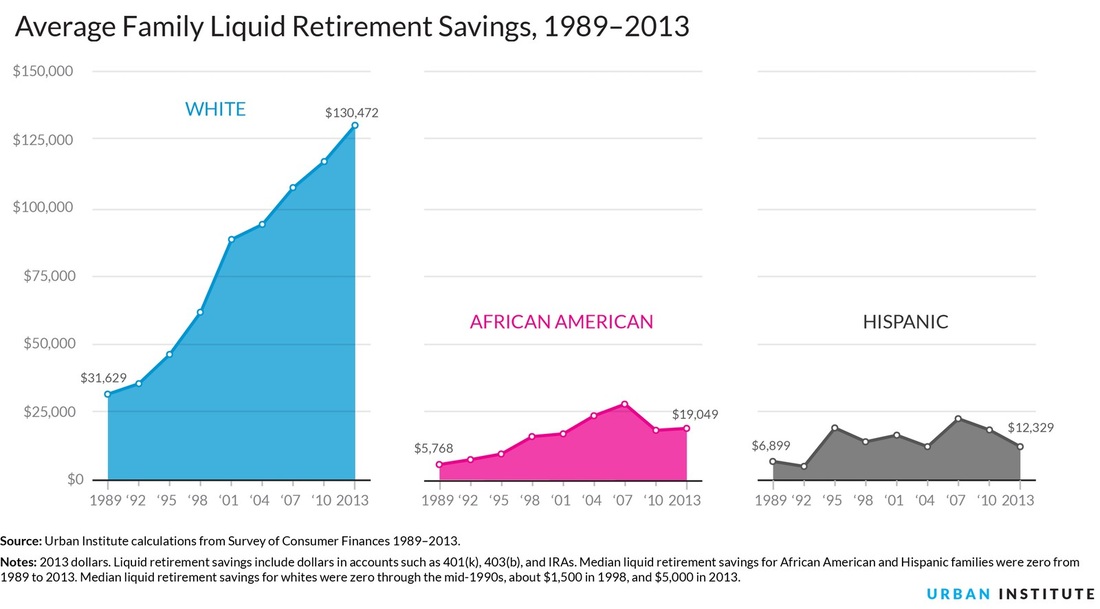

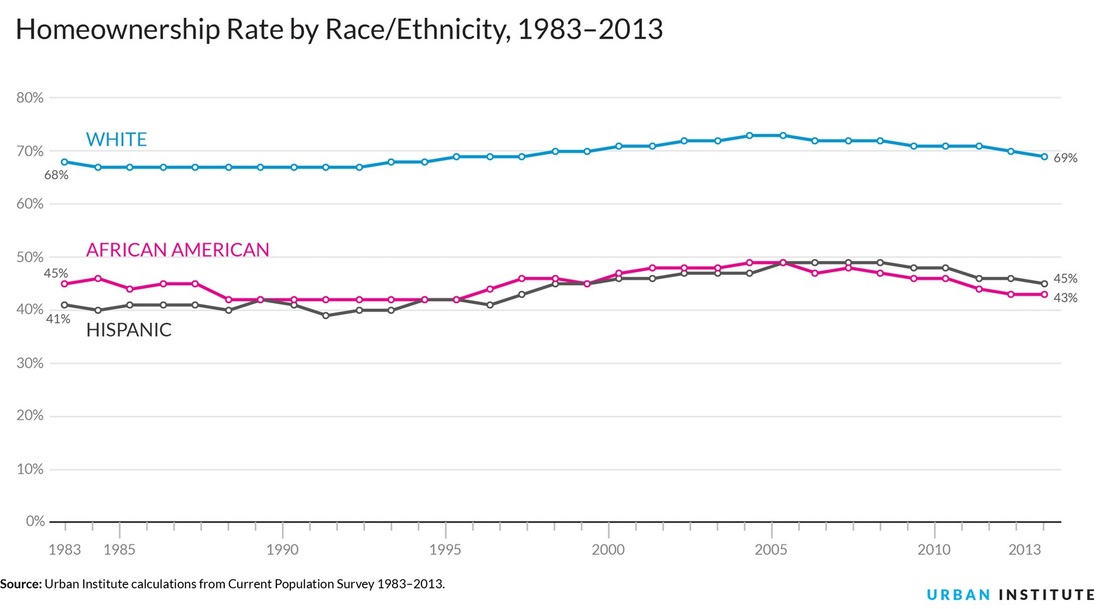

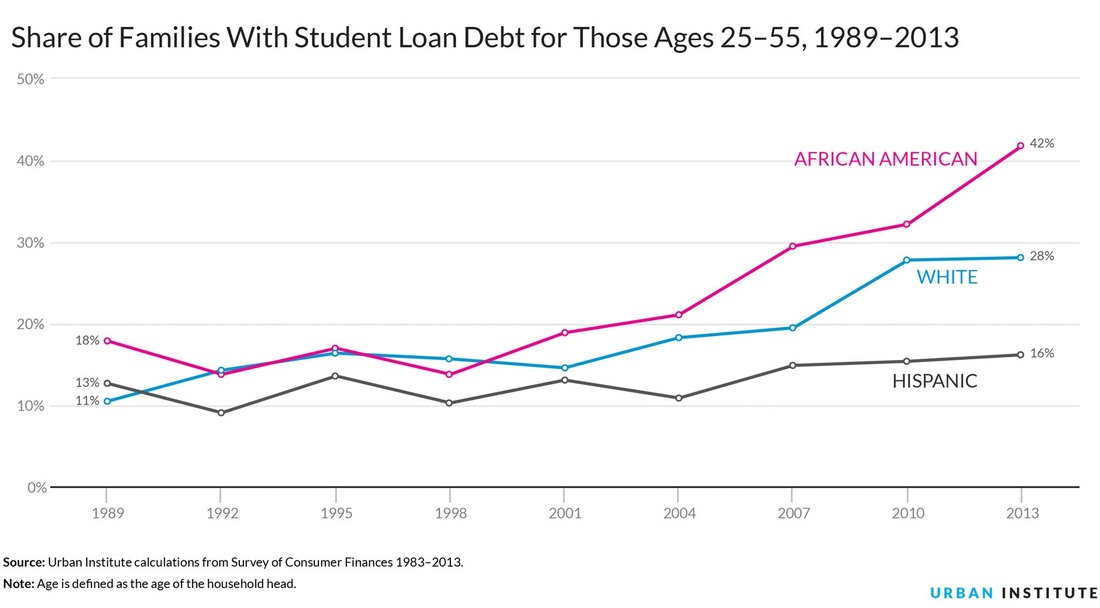

RETIREMENT AND WEALTH FOR AFRICAN AMERICANS"In 1983, the median white family had more than $100,000 in wealth, compared to less than $13,000 for African-American families—an eight-fold difference." (newrepublic.com) By 2013, 30 years later whites were 34% wealthier with $134k whilst black people were poorer with only $11k in wealth. Hispanics were in exactly the same situation as the graph on the right shows. Wealth by RaceWhite Americans earn a lot more, on average, than black Americans such that by age 61 the average white person had earned $2 million over their life and the average black person $1.5 million, Hispanics were worse off with $1 million in earnings by age 61. Obviously, the more you earn the more you can save, earn interest and invest. Liquid Retirement SavingsLiquid retirement savings are cash saved for retirement e.g. as a 401k. In 2013, the average white family had $130k in liquid retirement savings, for blacks this was $19k and only $13k for hispanics. BUT - the situation is actually worse than that, a few very rich people skew up the average number especially for whites. If you use the median, i.e. the middle person, whites only have $5k in retirement savings, blacks and Hispanics have zero. HomeownershipHomeownership is one of the key ways people around the world build wealth. The homeownership rate amongst black Americans (43%) is 60% lower than amongst whites (69%). For a very long time black Americans were locked out of property ownership because of discriminatory laws and even now, property prices are lower in black areas than in white areas and price growth is slower (Forbes). Student DebtDebts reduce people's ability to save. Black Americans have higher levels of student debt, 42%, compared to 28% for whites and 16% for Hispanics. Ultimately this would be a good thing if it was leading to higher future incomes but black people also have lower graduation rates. This means some people get saddled with debt and don't get a degree at the end of it to boost future income. The lower student debt amongst whites could be because more of them have parental support in paying for tuition and living costs. Keep in mind as you read the above that not all minorities are reflected in the statistics. The Jewish community and Asians tend to have better rates of saving, wealth accumulation and lower overall poverty than whites, blacks and Hispanics. Closing the gap in property ownership will definitely be one of the key ways black people in America will boost the retirement asset base and wealth in general. Please take a look at my property toolkit for information on how to grow a portfolio. You might also like:

Old Age Life, Pensions And Poverty In The UK References Which are the best countries in the world to grow old in? (The Guardian) How Home Ownership Keeps Blacks Poorer Than Whites (Forbes) The Alarming Retirement Crisis Facing Minorities in America (newrepublic.com) Why you may retire in poverty (reuters) Lots of scary statistics get thrown around regarding the negative retirement prospects for current 30-somethings (and even worse for those younger than us), so this week I’ve decided to dig deep. I’ll write a series of 3 articles on retirement: what do that the stats look like in the UK and the US and ultimately, what will it cost you to retire? I will not do an article on retirement stats in Africa because for the most part those statistics are VERY hard to come by. However, I found a fantastical article by the OECD that looks at Pensions In Africa. This is what I assume we all want to know:

When Do You Get A UK State Pension?The retirement age used to be 60 for men and 65 for women. It’s now been equalized to 65 for both. It’s moving up to 66 by 2020, 67 by 2028 and 68 by 2046. I’ll qualify to get a UK state pension at the age 68 in 2051 provided I’ve paid national insurance (NI) taxes or have NI Credits. You can calculate your own pension age here. What does this mean? Those of us that reach retirement age after 6 April 2010 need to have 30 “qualifying years” to get the maximum state pension and at least 10 qualifying years to get anything at all. If you don’t have a National Insurance record before 6 April 2016 you’ll need 35 qualifying years. Qualifying years are years in which:

For instance, if you work abroad or aren’t working for any reason you can pay voluntary contributions to ensure you qualify for a full state pension. I see this as a sort of backup insurance policy and I would definitely do it if I was working abroad. “If you reached the pension age before April 2010, then a woman normally needed 39 qualifying years, and a man needed 44 qualifying years during a regular working life to get the full state pension.” BBC What’s The Amount of The UK State Pension?If you are retiring on or after 6 April 2016 the full state pension you can get is £155.65/week, this is £8,094/year or £675/month. This amount is guaranteed by the government to rise by the higher of:

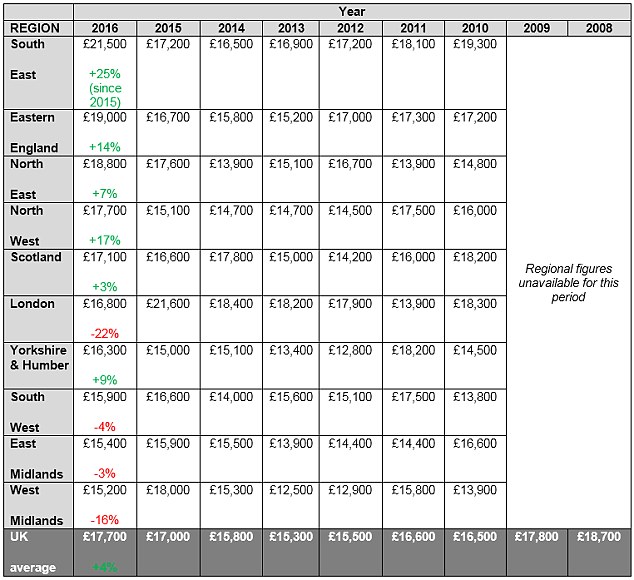

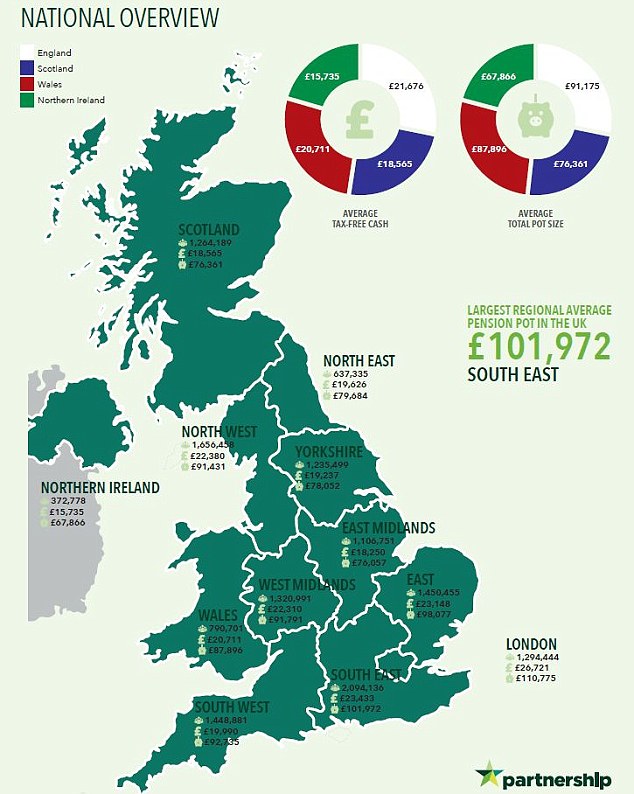

But, of course, government plans do change and this guarantee could fall away if the UK hits problems. There is a lot of press surrounding this possibility right now. How Much Does The Average Pensioner Actually Have In The UK?People retiring in 2016 expected income of £17,700 per annum according to a Prudential survey. They carry out this survey annually and the table below shows the results. This number is actually £1,000 lower than in 2008 but it’s been making a steady recovery: What Do The Pension Savings of Workers In The UK Look Like?According to Partnership the average UK pension pot stood at £87,724 in 2015. There is a lot of variance within the UK, with Essex having the highest pension pots, £125,478, and Shropshire the lowest, £44,336. Check out where your region stands using the image below. With compulsory workplace pensions now in effect pension savings should hopefully rise for a good majority of people. What Proportion Of Pensioners Own Their Home Outright? Property ownership is one of the key determinants of financial independence in old age. Here are stats from the 2011 census carried out by the Office of National Statistics:

The obvious advantage of outright home ownership when you are retired is that you save yourself what is usually a household’s biggest expense. Home ownership is almost necessary to guarantee a comfortable retirement because state pensions rules are changing all the time. Personally, I hope for the best when it comes to state pensions but I certainly won’t depend on the government to look after me in old age. Have a business or life question you want me to answer? Please email it to me with the subject “Question”. Note that all such questions will be answered as a blog post and will be sent to my full email list.

Want to start a business? Check out The Money Spot Program. References Basic State Pension Overview (gov.uk) State Pension Eligibility (gov.uk) State pension: The overhaul and you The pension pot map of the UK revealed Retirees in 2016 expect income of nearly £18k a year Home ownership and renting in England and Wales Number of UK working-age households drops for first time Pensions In Africa  Have you ever felt tired? Like really, really tired? Like so tired you just want to shut the world out and chill out on your own? Yes? I’m pretty sure it happens to most people at some point in their life and that’s how I found myself feeling late in 2015. Chester, my little boy, was not even one yet and I was trying to do so much – be a great mum and run a business. I kept myself so busy that I was working again pretty much two days after giving birth. I didn’t feel I deserved a total break so I worked whenever Chester was sleeping and I also got a nanny to come round for 10 hours a week from when he was about 8 weeks old. Anyway, I won’t bore you with the ins and outs of my childcare routine all I’ll say is you can only do so much before your body says stop, NOW! In addition to my Virtual Assistant (VA) who works 20 hours a week, I tried to hire a couple of people but it didn’t work out so at the end of January I thought, you know what, I’m going to retire. I’ll let my VA do what she normally does and I’ll do almost no work until I start to feel like it again and so that’s what I did.  My YouTube followers will attest to the fact that I’ve only uploaded one video in three months when I used to have 3 or 4 videos up every single week. I’m only 32 so you might wonder why I’d want to retire and why I’m even calling it retirement instead of say, unemployment or perhaps housewife or my favourite term for it, homemaker – you’ve got to love the Americans…well… I’m still employed as the business pays my salary every month and my Amazon sales are still rolling in day-in-day-out so I’m not unemployed. Chester still goes to nursery part-time so I’m not a full-time mum either. Finally, we have a weekly cleaner so I don’t spend much time making the home either. What inspired me to retire? Besides feeling constantly exhausted, I’ve always loved Tim Ferriss’s notion of interspersing retirement throughout life rather than working towards one huge break at the end. There are after all no guarantees regarding when that end might come nor even whether you’ll be in good enough health to enjoy it. Given my business runs using Amazon fulfilment which means my sales are immediately dispatched by Amazon without my input and my virtual assistant does a lot for me it is possible to reduce my work hours to almost nothing so I thought, let’s do it; now would be a great time for a mini-retirment. So, what does a retired 32 year old do with their time?  I came to this dilemma the moment I decided to retire and the first answer was I’m going to watch TV in the evenings, lots and lots of it. So I swapped editing videos every evening for watching TV plus 30 minutes to an hour of reading. I’m currently working my way through a novel by Val McDermid. I’ve missed reading fiction. I’ve always loved crime fiction and it’s taken a back seat since I started running the business back in 2012. I then decided to sign up to a mortgage course because our property portfolio is growing and there’s nothing like knowledge to get you ahead in that game. I’m still building the property portfolio and the legal and tax framework surrounding mortgages is getting ever more complex so this will surely help. Mind you, even fully-fledged accountants sometimes feel as though they’re guessing. I’ve additionally taken up an upholstery course because I’ve always been interested in upholstery. Incidentally, at about the time I officially retired (end of January 2016), Harry and I put in an offer for a house and I worked on the purchase and refurbishment of the house. It took all of April and £32,000 ($50,000) to get the house up to my standard, video coming up, and having loved that experience I’m definitely looking to do more of it. This purchase brings the portfolio up to 6 houses. I've recently started jogging again too and within less than two weeks my BP was back down to all-time lows. It had been elevated for almost 2 years How long do I plan to stay retired for? All of 2016 and probably most of 2017. Ultimately, I’ve said I’ll literally only do things that a) I really, really want to share and b) that take no more than 10 to 15 hours of effort per week on my part. No work will happen in the evenings and nothing at weekends. I’ve had a few people email me to ask for one-on-one coaching and I’m considering taking on a handful of people or so because I do enjoy getting into a person’s financial situation and sorting it out. For me, work is a habit and I do find myself forcing my body not to work at times so I’m sure I’ll do some odd filing and edit the odd video at night. That said, taking a rest like this is AWE-SOME. It works because of the type of business I run but with technology this is the type of thing many people in the future will be able to do. To be honest, I don’t know why it isn’t the done thing. Everyone should take a year or at least 6 months out every decade just to enjoy life a little more. You deserve it. The only downside is that with so little input my business is unlikely to earn 6-figures as it has for the last two years but it's earning enough to keep the bills paid and I'm fine with that. Ultimately, for me, retirement has been about doing more hobby-like activities and being less obsessed with productivity. Oh yeah, and doing more exercise. Does your business (idea) have potential for 6-figure revenues and beyond? Take the test! |

Heather on WealthI enjoy helping people think through their personal finances and blog about that here. Join my personal finance community at The Money Spot™. Categories

All

Archives

September 2023

|

Heather Katsonga-Woodward, a massive personal finance fanatic.

** All views expressed are my own and not those of any employer, past or present. ** Please get professional advice before re-arranging your personal finances.

RSS Feed

RSS Feed