|

I’m on a crusade: five years from now I want to be able to say none of my close friends own a credit card – yes, you heard right, if you consider yourself to be a close friend of mine I want your credit card balance, by the time I hit 40, to be zero and for you to have closed those credit card accounts. Moreover, if you consider yourself a close friend of mine, I want you to promise never to own a credit card again your life. And another thing, if you are a close friend of mine, I want you to avoid consumer debt like the plague for non-essentials like laptops, clothes and electronic items. Debt should, by and large, only be taken for investment purposes, like investing in buy-to-let properties. If you can’t pay cash, you don’t really need to be getting a new kitchen or bathroom for your house! However, if you did that, I could forgive you. I’m a horrible person to have as a close friend, aren’t I? My credit card situation I don't own a credit card. I haven't used one for over 10 years because when I owned one, I realised I always spent more than I normally would, not more than I earned, but more than I normally would.  My issues with credit cards I hate credit cards. If there is one vehicle out there that keeps people enslaved to lenders, it's the credit card. £5,000 can turn into over £10,000 in three short years if you’re only paying the minimum monthly payment. And that debt increases at an increasing rate – heard of the “miracle of compound interest”? Well if a consistent 7% rate of return can increase your wealth in untold ways, over many years, imagine what a credit card rate of 25-30% can do to your levels of debt? Many, many years ago it wasn't possible to book a holiday on a debit card on some websites (that is how I ended up getting one) but now you can use debit cards for absolutely any type of purchase...I think. Have I mentioned that I hate credit cards? The usual excuse for credit cards – it offers me better protection on purchases Not necessarily so. Debit cards offer many of the protections too via a voluntary scheme called chargeback. When Monarch Airlines went bankrupt in 2018, I had a holiday booked through my Natwest debit card and I received all my money back from Natwest via chargeback. There were no hassles in doing so either. Within less than a day of Monarch's bankruptcy, Natwest had a link on it’s home page telling people what to do if they were affected. It took under 5 minutes for me to fill a form in and with a couple of weeks I had received a letter notifying me that the money had been refunded to my bank account. Credit cards do offer more protections but ONLY for items costing £100 or more. According to the Money Advice Service, "the £100 minimum amount applies to each item or set of items you buy, as opposed to the total bill. For example, if you bought a dress and jacket that weren’t part of a suit, with each one costing less than £100, you wouldn’t qualify for the consumer protection under section 75." Huh?... I don't know about you but except for hotel bills, when I am on holiday I don't buy any items that cost £100+ which means all those items would not be more protected. And if you're scared from fraud and other card scams, use cash only. Another excuse for credit cards – I do it for the points or miles So, if you spend £10,000 you get £500 worth of benefits? For most people it’s a false economy. You end up spending more over time than the points or miles are worth – trust me on this. There are very few people frugal enough to win one over the credit card company. Most of us will never win. The best thing you can do for yourself is to shun credit cards. I consider myself highly intelligent and relatively frugal but I will be the first to concede that I will never even attempt to think I’m smarter than a credit card’s psychology department. They win. Give them back their credit card! Important note: if you've found yourself with overwhelming levels of debt. Do not feel ashamed or embarrassed - hundreds of thousands of people are in exactly the same situation. Get support to work your way out of the situation. ***** If you consider yourself a close friend of mine, WhatsApp me for help with writing a plan to erase credit cards from your life.

4 Comments

RS

8/9/2019 08:12:43 am

Hello Heather.

Reply

Heather

22/9/2019 02:32:29 pm

No, it isn't true. Things like your phone bills, your utility bills etc. all count towards building up your credit. When I bought my first property back in 2006, I didn't own a credit card and I still got approved for a mortgage. Banks are dying to lend to you. The biggest determinant of whether or not you get a mortgage will be your earnings. In the meanwhile, get a mobile phone contract and have your name added to the electoral register and have your name on some domestic bills (water, electric, broadband, etc.) - you will be fine without a credit card.

Reply

Ruwa

5/11/2019 01:41:17 pm

This is an interesting perspective. I have 5 credit cards all for different uses depending on what points/rewards I'm collecting. I use my main card for collecting travel points and find that if I charge my everyday transactions on it, I end up with about $500 a year in points that I can use towards flights and hotels. That said, I never carry a balance on any of my cards and pay them off every two weeks when I get paid. It takes a lot of discipline to use a credit card effectively and not get charged interest but I find it more convenient than my debit card.

Reply

Heather Katsonga-Woodward

23/5/2020 10:19:00 am

It looks like you've found a way to make it work, that's awesome and keep it that way.

Reply

Leave a Reply. |

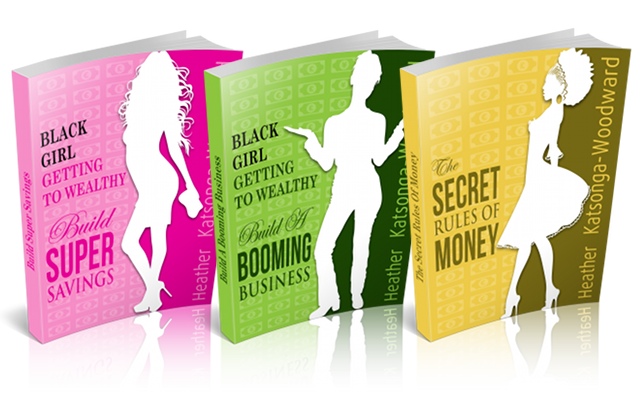

Heather on WealthI enjoy helping people think through their personal finances and blog about that here. Join my personal finance community at The Money Spot™. Categories

All

Archives

September 2023

|

Heather Katsonga-Woodward, a massive personal finance fanatic.

** All views expressed are my own and not those of any employer, past or present. ** Please get professional advice before re-arranging your personal finances.

RSS Feed

RSS Feed