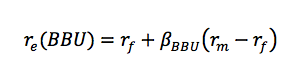

by Girl Banker Listen to the iTunes podcast instead. You cannot go to a corporate finance or asset management interview without knowing the CAPM. The CAPM model shows that the return to equity is a positive function of risk: BBU (Blissful Books United) is the fictional book store created in my book To Become an Investment Banker.

o US Government bond yields are relatively easy to get a hold of online. Some portals will even allow you to download historical data into Excel. o The downgrading of the US Government rating from AAA to AA+ by Standard & Poor's rating agency makes the usual text book assumption that the US Government is risk free debatable.

o If BBU is less volatile than the market, on average, β(BBU) will be less than 1. o If BBU is more volatile than the market, on average, β(BBU) will be more than 1.

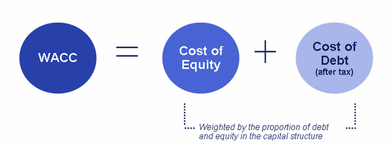

You might also like: What is WACC, the Weight Average Cost of Capital? Where can you get the cost debt used to calculate WACC?

0 Comments

by Girl Banker Listen to the iTunes podcast instead. The very word "derivative" makes some people start running for the hills. It sounds scary, complicated, brain numbing. However, if you take the time to read a little about them, the majority of derivatives are easy to understand, particularly derivatives that are designed to hedge specific financial risks. Speculative derivatives can get a lot more complicated. A derivative is a financial product whose value depends on the change in the value of some other underlying product. Derivatives are primarily used for:

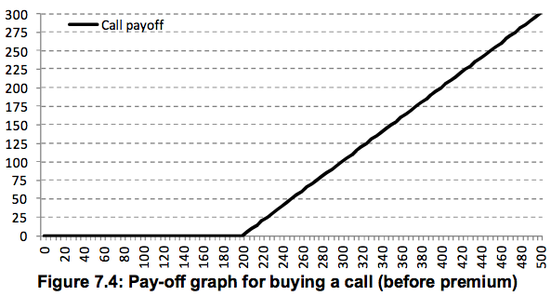

In the equity capital markets, the simplest derivative is an equity call option and in the debt capital markets the simplest derivative is an interest rate swap. So read: What is LIBOR? (it's an important variable in derivatives pricing) What is an interest rate swap (or IRS)? What is a call option or an equity call option?  by Girl Banker Listen to the iTunes podcast instead. An equity call option gives the buyer the right to buy a given number of shares in a given company at a given price on a given date (European-style option) or at any point with a given period of time (American-style option). Only the option buyer can exercise the option. To buy a call option is called going long a call and selling a call option is going short a call. Example Whilst Apple shares are trading at about $80 a share in late 2006 you decide to buy a call option that gives you the right to buy 1,000 shares in Apple Inc. at $200 anytime between 1 Jan 2010 and 31 Dec 2010. Buying out-of-the-money call options is much cheaper than actually paying the money to buy the shares outright. The call options are referred to as being out-of-the-money because the strike price, $200, is higher than the current share price of $80. If you buy this contract, you would be expressing the view that you believe in the company so much that you expect the share price to more than double over a four year period. This view would be the basis for buying the right to buy the shares at $200 in four years time, though the current value is only $80. If at any point in 2010 Apple shares exceeded the option strike price of $200, you could exercise your right to buy the shares at $200 and immediately sell them to lock in a profit. Let’s say each option cost you $1, this means you would pay a premium of $1,000 for this option contract. In Dec 2010, the Apple share price went over $320.

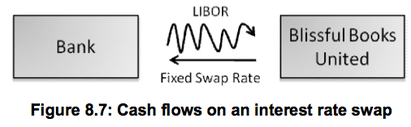

by Girl Banker Listen to the iTunes podcast instead. The interest rate on money borrowed at a variable rate of interest, e.g. LIBOR, rises as the rate rises and falls as the rate falls. If interest rates are expected to rise, it is possible to hedge against the rise by entering into an interest rate swap (IRS) so that the floating rate is converted to a fixed rate. An interest rate swap (IRS) is an agreement between two parties to exchange interest flows. One party pays a variable rate (normally LIBOR, but it can be another rate, e.g. a government base rate) whilst the other party pays a fixed rate as set on the date that the IRS is executed (i.e. when it is entered into). The LIBOR payments are referred to as the ‘floating leg’; the fixed rate interest payments are referred to as the ‘fixed leg’. The diagram below shows an interest swap between a book seller, Blissful Books United (BBU) and a bank. BBU pays a fixed rate to the bank and receives LIBOR. The maturity of interest rate swaps varies widely, they can be very short-dated e.g. 3 or 6 months or very long dated e.g. 30 or even 60 years. Very short-dated IRS and very long-dated ones are not very common. Maturities of 3-, 5- and 7 years are common amongst corporate entities.

The amount on which interest is calculated is called the ‘notional’ amount because this value isn’t paid upfront by either party involved in the swap. What would be the point of exchanging the same amount of the same currency? Payment dates occur periodically, typically every 3 or 6 months. On each payment the amount of interest due to be paid by each party is calculated and only the net amount is paid. For example, assume the fixed rate that Blissful Books United pays on the IRS is 1.50% and that Libor turns out to be 1.725% for a given period, who pays and how much do they pay? Assume a notional amount of $10m:

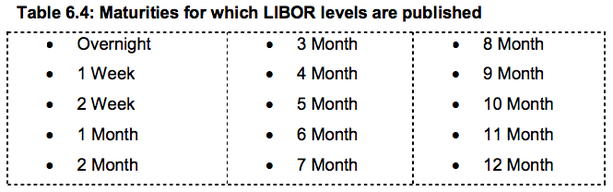

Normally, no upfront payment is required from either the bank or the non-bank counterparty to enter into an interest rate swap. Any costs and profits to the bank are incorporated into the periodic payments. To Become an Investment Banker goes into a little more detail on how the rates are arrived at, terminology and what an IRS term sheet looks like. If you want one-on-one coaching on interest rate swaps, please book a coaching package. In the week of June 25th 2012, the UK's financial services regulator the FSA claimed that some banks had mis-sold interest rate swaps to small businesses. Apparently, some small business claimed that they did not understand the risks that IRSs poised.  by Girl Banker Listen to the iTunes podcast instead. Libor is a very important concept if you want to work in the capital markets. You could easily be asked to define LIBOR in an interview. What is LIBOR or Libor? LIBOR is the London Inter-Bank Offered Rate. It is the rate of interest that banks charge to lend money to each other, i.e. it is an interbank interest rate.

If a LIBOR rate is needed for an intermediate point, simple linear interpolation is normally used.

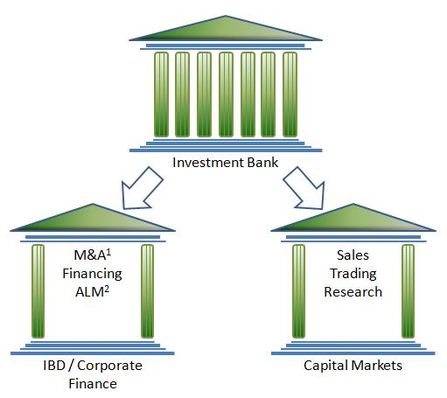

If LIBOR rates are plotted on a graph with time on the x-axis, the result is a LIBOR curve. The LIBOR curve is a type of yield curve, that is, a curve showing interest rates against time. Historical LIBOR levels are freely available from the BBA website. In the week of Jun 24th 2012 news broke that some banks had been manipulating LIBOR rates in order to look more secure during the financial crisis (dates range from as early as 2005 to 2009). Barclays was notably fined £290m ($450m) for its involvement in rate fixing. by Girl Banker Listen to the iTunes podcast instead. This is a possible investment banking interview question. Many investment banks are composed of two key divisions: 1. Corporate Finance. Frequently referred to as the (Classic) Investment Banking Division or simply (Classic) IBD in many banks. 2. Debt and Equity Capital Markets. This frequently includes Sales, Trading and Research functions. Many investment banks now also have large asset management divisions including private wealth management; however, this book focuses only on corporate finance and capital markets. The term ‘investment banking’ is sometimes used as a catch-all phrase for both corporate finance and the capital markets (sales and trading jobs) i.e. in referring to the industry as a whole or it could refer to the corporate finance division within an investment bank.

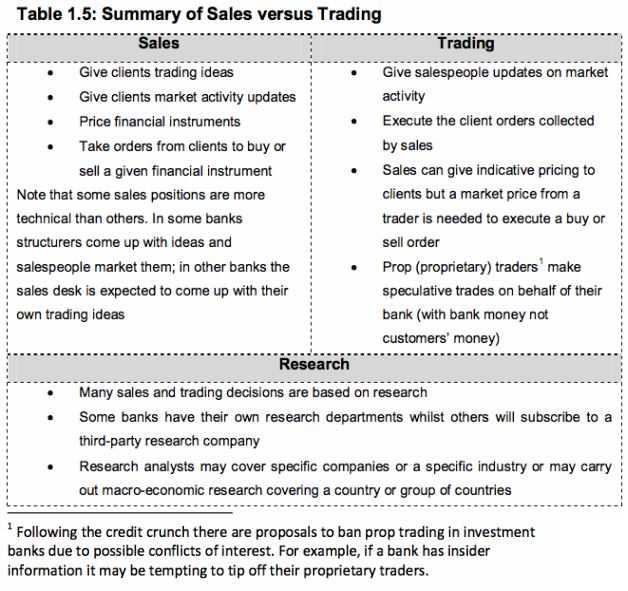

This is the quick answer. You can expand upon it by adding: Investment Banking 101 What is corporate finance or the investment banking division (IBD)? What are the capital markets/what is sales and trading? What is the difference between an investment bank and a commercial bank?  by Girl Banker Listen to the iTunes podcast instead. This is a very likely interview question. The purpose of a capital markets division is to provide a range of financial products to investors and companies. The sales force specializes by product and will be the first point of contact for clients. Any buy or sell orders are passed on from sales to a trader, who executes and manages the risk associated with such a purchase or sale. Many traditionally advice-only investment banks have incorporated capital markets activities to their offering because they wanted to offer a fuller suite of products to their clients. Excerpt from To Become an Investment Banker by Heather Katsonga-Woodward. The capital markets tend to be less hierarchical than corporate finance. Why?

Some view capital markets as more meritocratic than corporate finance. Why?

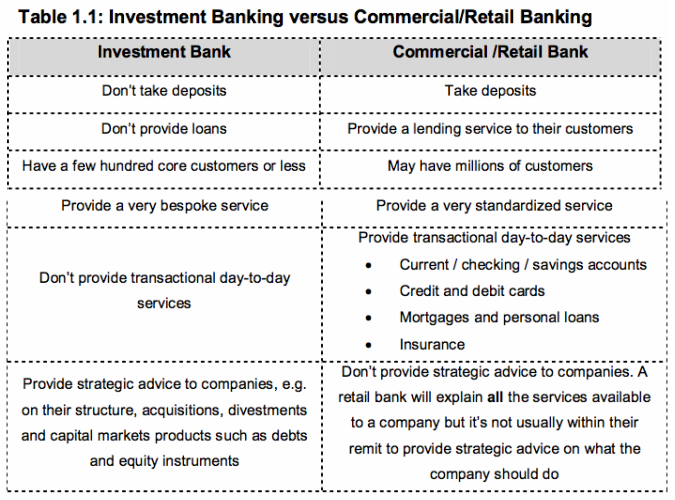

Please see these related interview questions: What is corporate finance or the investment banking division (IBD)? What is the difference between an investment bank and a commercial bank? by Girl Banker Listen to the iTunes podcast instead. This could easily be asked as an interview question. To help you understand investment banking, it’s best to differentiate it from the type of banking that you have experience with: commercial or retail banking – the banks that you see on the street. The bank where you maintain your current (UK), checking (USA) or savings account is a commercial or retail bank. Some investment banks have a commercial banking unit, others do not. Example

A Loan Structuring team in an investment bank can give a company advice on how to structure a loan; however, even if the investment bank has a commercial banking unit, it does not necessarily follow that they will provide that loan. When the loan is fully structured (i.e. the most achievable terms are determined) the borrowing company can show it to a variety of banks and select the bank that commits to the best terms. This may not be the structuring bank. The structuring bank gets a fee for their advice and the loan provider receives whatever fees they are due for actually providing the loan. Of course, the lending arm of the structuring bank is likely to provide the best lending terms in many cases as they can account for the fees received by their structuring team. That is, a bank providing several products to a client can afford to charge a little less for each product than would be the case if they were selling just one. by Girl Banker® Listen to the iTunes podcast instead. Having worked in both corporate finance and in the capital markets, I think the skill set needed is slightly different in each. That said, there are some universal requirements: 1. Learn quickly - no one is going to tolerate persistent mistakes; 2. Be personable - so that people enjoy working with you; 3. Have charisma - so that clients prefer you over your competitors. Let's look at the two divisions in turn:  CAPITAL MARKETS 1. Analytical + super assimilator of information Whether you're a trader or a salesperson, you need to take in a lot of information and process it to either relay to clients or to make a trade. A customer can call at anytime to ask random questions like, "What's 6-month LIBOR been doing in the last two weeks and where do you expect it to go now? Is 3-month LIBOR doing the same? Is that your bank's take or your personal opinion?" Trust me, there will be days when you get asked a question so random that you have to blag your way off the phone to find the answer!! 2. Multi-tasker If you like to work on something and finish it off completely before moving onto something else, you'll hate the capital markets. You are always working on several jobs at the same time and just as you start getting into the project at hand, you'll need to move onto a more urgent task. 3. Thick-skinned It's a stressful environment. People will swear and shout at you - so what? - dust yourself off and forget about it. If you're very emotional you'll struggle. Don't take things personally. It's entirely normal to have a shouting match one minute and be laughing with that same person five minutes later.  CORPORATE FINANCE 1. Analytical + highly structured Model building requires you to be decent with numbers and to think in a highly structured way. More often than not you will not be building a model from scratch but the better your understanding of financial statements, accounting rules and how the different line items relate to each other, the quicker you'll be able to sort out any modelling problems. 2. Diplomatic All corporate finance deals are based on a team unlike in the markets (sales & trading) where once you have learnt enough you often work on your own. You will, of course, want your contribution to be valued but if you are aggressive about it you will turn your peers off. With tact and diplomacy your individual contribution will shine through without putting others off. 3. Low sleep requirements The long hours you hear about in banking are not just rumours. You will work very long hours and what's more, you will not only get used to it but you'll start to think of it as "normal". A year into my role as an analyst at Goldman Sachs I got home around at 5:00 p.m. one day and I actually felt strange. I had become so accustomed to my long day that I thought, "What do people do with all this time?" I kid you not. Fun fact: did you know that the longest recorded period without sleep is a gobsmacking 33 years, endured by Thai Ngoc, a 64-year old Vietnamese man. Apparently, after an illness in the 1970s he lost his need for sleep!?! Jealous? Yes I am. I need 8 hours of shuteye to feel normal. I can get by on 7 but less than that on a regular basis and you don't want to be near me! Jokes aside, the hours are long and the less sleep you need, the easier life will be for you.

by Girl Banker®

Investment bankers don’t invest although the name may suggest it. If your day job involves advising people what to invest their funds in: equities versus debt versus real estate and so on, you are an “asset manager”. Asset management is not investment banking.

Investment bankers also don’t give out loans or handle money of any form. Whilst investment bankers might structure loans, they don’t give them out themselves. Handing out loans is the function of a commercial or retail banker. Some investment banks have their own commercial banking units, others do not. Investment bankers fall into two categories: corporate finance bankers (also referred to as classic investment banking) and capital markets bankers (product salespeople and traders). I will describe each category in turn.

CORPORATE FINANCE

Corporate finance is concerned with giving advice on strategy, valuation and financing. I myself spent two years in Corporate Finance at Goldman Sachs in London. Strategy If a company wants to merge with or takeover another company, so called, Mergers and Acquisitions, or if they want to divest a division or find a seller for the entire company as a going concern they would seek the advice of an investment bank. M&A bankers have specialized knowledge of a specific sector and are in a position to relay the best way of going about any corporate strategic initiative. Valuation As part of its strategic considerations, a company will contemplate its own value, the value of a target or the market value of its competitors. Investment bankers are trained in all current, relevant valuation methodologies and would be able to provide this information. Key valuation metrics include discounted cash flow analysis which shows the value of a company on a stand-alone basis and a variety of ratios that show a company’s value in comparison to other similar companies. Relative valuation metrics look at the company’s value relative to sales, or the share price relative to earnings or the amount of debt the company has compared to its cash flow and earnings. Relative valuation tends to focus on companies that are listed or have recently been involved in an acquisition because data is more readily available. However, using less specific assumptions the same analysis can be carried out for a privately held entity. Financing Particularly in the developed world, financing is not as simple as going to a bank to get a loan. There are a plethora of instruments that can be used to fund a business. Loans themselves can be structured in a variety of different ways each of which will have different tax, legal and rating agency consequences. Rather than attempt to secure bank lending, a company can alternatively issue a bond to investors. Bond structures themselves are limited only by imagination. They are bespoke instruments that can be exactly structured to satisfy the goals of a firm, it’s expected growth profile and its expectations of future changes in market variables particularly interest rates and foreign exchange, FX. This brings us neatly to the second category of bankers.

CAPITAL MARKETS

Compared to Classic IB, capital markets banking is relatively new. It took off in the early 80s and has grown massively particularly as internet technology and the ease of communication has improved. Capital markets bankers are financial product engineers. Product specialism is split into Equity Capital Markets, ECM, which includes cash equities and equity derivatives and Debt Capital Markets, DCM, sometimes referred to as Fixed Income, Currency and Commodities, FICC. I have spent the best part of 5 years working in debt capital markets as a derivatives structurer at HSBC. You will notice one difference between corporate finance and capital markets immediately. Whilst there may be many different sectors and country teams in corporate finance, the analytical tools they use are the same. Valuation fundamentals do not change. However, the various teams in the capital markets each deal with a different product so the tools and knowledge change completely from one team to the next. Within capital markets salespeople market and often also price/structure products whilst traders execute any sales and manage the risk/exposure thereof. Some traders trade based on perceived market opportunities rather than off of the back of client orders. These are proprietary traders. Their aim is to generate a return for their bank based on market expectations (speculation) or perceived mispricing (arbitrage). I will very briefly describe a few teams. Cash equities Have a firm understanding of the equity research within a specific sector. Based on their understanding and interpretation of equity research they can give advice regarding which shares are a good buy, which are not and which ones are better than others. Equity derivatives You don’t have to buy shares to gain exposure to a company. Equity derivatives allow you to express your view of a company, good or bad, without buying them and if that view is realized you make a profit. Buying and selling equity options is cheaper than transacting in the shares themselves. Loan or bond origination and structuring Originators have a relationship with investors that are interested in buy bonds (or loans). They use their contacts and their knowledge of current bond (or loan) markets to structure a bond prospectus (a detailed term sheet) that will get a company the most traction with investors. Rates Most companies have some debt on their balance sheet. Rates specialists help companies to protect themselves against adverse movements in rates and to make optimal funding decisions based on interest rates in different countries and the expected evolution of rates over time. FX Many companies, even small ones, have multinational exposure. They might sell goods across several countries, buy supplies or even raise funds from abroad. FX specialists help companies to protect themselves against adverse movements in FX and to manage funds across borders. This can be a very important requirement for a company especially if they have exposure to a country with many rules and exchange controls. China is one such country, in the last few years as they have been loosening their currency controls regulation has been changing rapidly. Commodities Commodity specialists help companies to protect themselves against adverse movements in a given commodity. They also facilitate investors’ desire to speculate on commodity prices. Commonly traded commodities include oil, precious metals and agricultural produce such as wheat. Credit Credit specialists allow investors to buy ‘insurance’ against a company’s failure using ‘credit default swaps’. A huge amount can be written about each function within an investment bank and I provide a more in-depth overview in To Become an Investment Banker. Nonetheless, the brief descriptions above should give you a flavor for how front-line investment banking is structured. If you have any questions please contact me. |

Girl Banker®I created my investment banking blog in 2012 as soon as I resigned from i-banking & published my book, To Become An Investment Banker.

Initially published at girlbanker.com, all posts were later subsumed into my personal website under katsonga.com/GirlBanker. With 7 years of front office i-banking experience from Goldman Sachs and HSBC, in both classic IBD (corporate finance) and Derivatives (DCM / FICC), the aim of GirlBanker.com was to make it as straight-forward as possible to get into a top tier investment bank. I'm also a CFA survivor having passed all three levels on the first attempt within 18 months - the shortest time possible. Categories

All

Archives

August 2017

|

Heather Katsonga-Woodward, a massive personal finance fanatic.

** All views expressed are my own and not those of any employer, past or present. ** Please get professional advice before re-arranging your personal finances.

RSS Feed

RSS Feed