by Girl Banker Getting an internship is hard, getting one when you don't fit into the standard criteria is even harder. I recently held a talk at Birmingham Business School on strategies for finding a job or internship when the standard programmes won't accept you. I thought I would share a few of the points here with you. 1. Networking Networking is very important but it becomes critical when you can't get an internship. Recruiters host most of their events at universities so look for events at your university as well as other nearby institutions. Do some serious reading on how to network effectively. How to Network Yourself into an Investment Bank (part 1) 2. Leverage your friends This doesn't necessarily fall under networking because when you "network" you try to forge new connections, however, have you looked at your friend lists (and friends of friends) closely? If you haven't been in touch with certain friends for a while look them up on LinkedIn to see what experiences they have recently had that you may not necessarily know about. If your friends haven't started working then speak to them about contacts that they may have through family as well as via their own networking efforts. Don't feel embarrassed to ask for help! Even if you are shooting for banks that you believe won't give you a second look chat to friends about your plans. They may surprise you with the feedback that they give you. 3. Focus on Them Not You Be guided by the principle that people love themselves. If you haven't already read, How To Make Friends & Influence People by Dale Carnegie who explains this concept eloquently. If you can make a potential employer look good, they will love you immediately. If you can solve a problem that they have they will want you to come in.  4. Keep In Touch With Your Careers Office Your careers office is there to help you even after you graduate; connect with them.

5. Speak To Headhunters If you have previous RELEVANT experience, they can help. If you don’t, this avenue is not open to you. Here are some headhunters you can start off with: GirlBanker.com/Headhunters 6. Look At Associate-level Internships The requirements to get onto internships for Associates can be more flexible than analyst-level programmes, however, you need to have relevant work experience. 7. Look For Off-cycle Internships These are harder to find but they will be more accessible to people that don’t fit into standard internships. E.g. the Goldman's returnship. Go to banks’ websites to find them. 8. Go For Smaller Firms Look at boutiques and small firms, e.g. firms listed number 11 and lower in my book: Pages 42-44 in To Become An Investment Banker, Tables 2.2, 2.3, 2.4. 9. Chase Bankers That Are Similar To You Fact: People like people that are like themselves so seek out:

10. Don't Forget The Other Stuff

Hope this helps! Heather -> BOOK COACHING

0 Comments

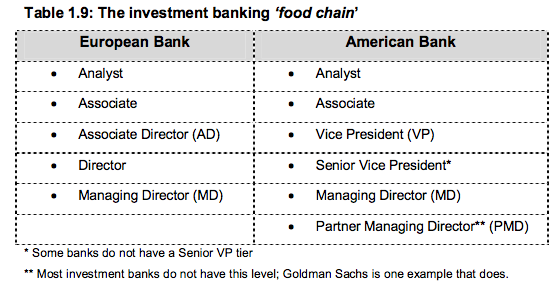

by Girl Banker® Listen to the iTunes podcast instead. I'll give you the standard textbook answer and then I'll tell you a little about the variations that I have seen. All newbie front-office investment bankers in both corporate finance and the capital markets start life off as analysts. The table below sets out the different career stages in an investment bank; the terminology used in European banks is slightly different to that used in American banks. You may find further differentiation in specific banks, e.g. splitting the VP category into junior VP and senior VP, but broadly speaking the below applies. 'Analyst' is usually a three year stage, 'Associate' is normally a three to four year stage depending on progress and internal politics. 'Associate Director' in a European bank is normally two to three years. 'VP'/'Director' can be as short as two years, or indefinite! Some people never make it to MD. Your emotional quotient (people skills) and your ability to master corporate politics can be critical in making that jump from VP to MD. Does anyone move up the chain faster than this? Of course. If you are a star performer you can zoom right up to the top in no time. I know a really smart guy who joined the trading floor as a Ph.D. from the University of Chicago (you know, the same place where Milton Friedman went); he jumped from Associate to VP to MD to Partner in roughly two year stints. He was super, super bright. He paid me the biggest compliment I have ever been given: he said, 'I think you're special,' and coming from such a bright spark, I still feel good when I think about it today :) Can one get demoted?Unfortunately, yes! I have seen two types of demotion:

1. An actual demotion. I know a PMD at Goldman who wasn't making enough money to warrant the coveted title so he was recrowned just an MD. 2. Role change. If someone isn't producing the results that the firm wants, they just make them join another team. Especially in the UK, firing people is expensive and management would rather just send them hints so that they quit themselves. |

Girl Banker®I created my investment banking blog in 2012 as soon as I resigned from i-banking & published my book, To Become An Investment Banker.

Initially published at girlbanker.com, all posts were later subsumed into my personal website under katsonga.com/GirlBanker. With 7 years of front office i-banking experience from Goldman Sachs and HSBC, in both classic IBD (corporate finance) and Derivatives (DCM / FICC), the aim of GirlBanker.com was to make it as straight-forward as possible to get into a top tier investment bank. I'm also a CFA survivor having passed all three levels on the first attempt within 18 months - the shortest time possible. Categories

All

Archives

August 2017

|

Heather Katsonga-Woodward, a massive personal finance fanatic.

** All views expressed are my own and not those of any employer, past or present. ** Please get professional advice before re-arranging your personal finances.

RSS Feed

RSS Feed