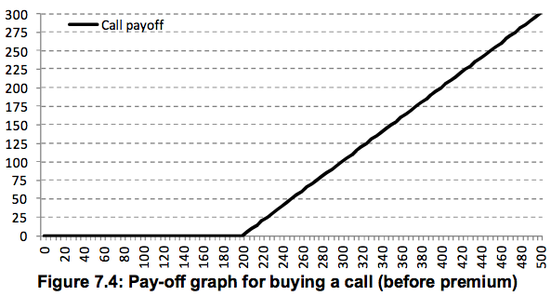

by Girl Banker Listen to the iTunes podcast instead. An equity call option gives the buyer the right to buy a given number of shares in a given company at a given price on a given date (European-style option) or at any point with a given period of time (American-style option). Only the option buyer can exercise the option. To buy a call option is called going long a call and selling a call option is going short a call. Example Whilst Apple shares are trading at about $80 a share in late 2006 you decide to buy a call option that gives you the right to buy 1,000 shares in Apple Inc. at $200 anytime between 1 Jan 2010 and 31 Dec 2010. Buying out-of-the-money call options is much cheaper than actually paying the money to buy the shares outright. The call options are referred to as being out-of-the-money because the strike price, $200, is higher than the current share price of $80. If you buy this contract, you would be expressing the view that you believe in the company so much that you expect the share price to more than double over a four year period. This view would be the basis for buying the right to buy the shares at $200 in four years time, though the current value is only $80. If at any point in 2010 Apple shares exceeded the option strike price of $200, you could exercise your right to buy the shares at $200 and immediately sell them to lock in a profit. Let’s say each option cost you $1, this means you would pay a premium of $1,000 for this option contract. In Dec 2010, the Apple share price went over $320.

2 Comments

|

Girl Banker®I created my investment banking blog in 2012 as soon as I resigned from i-banking & published my book, To Become An Investment Banker.

Initially published at girlbanker.com, all posts were later subsumed into my personal website under katsonga.com/GirlBanker. With 7 years of front office i-banking experience from Goldman Sachs and HSBC, in both classic IBD (corporate finance) and Derivatives (DCM / FICC), the aim of GirlBanker.com was to make it as straight-forward as possible to get into a top tier investment bank. I'm also a CFA survivor having passed all three levels on the first attempt within 18 months - the shortest time possible. Categories

All

Archives

August 2017

|

Heather Katsonga-Woodward, a massive personal finance fanatic.

** All views expressed are my own and not those of any employer, past or present. ** Please get professional advice before re-arranging your personal finances.

RSS Feed

RSS Feed