by Daily Forex The right forex broker can make a difference between profit and loss in forex trading. To choose the right forex broker, research the various options available to you so that you can pick the right one for you. Many articles will list the factors that need to be looked into when choosing a forex broker. Among them the most important ones are association with a regulatory body, reliability, initial deposit amount, leverage provided, spreads available, minimum lot size, forex training, customer service, currency pairs offered and many more. But the characteristics of the forex trader are not the only ones that you need to look into when you are picking one for forex trading. In fact, the first thing that you need to think about is your own forex trading objectives, goals and style. Choosing the Right Forex Broker for Yourself Choosing the right forex broker requires you need to be aware of your specific needs as a forex trader. These depend on the various aspects that concern you. Therefore before you even start researching the internet for forex brokerage firms or start asking around about the forex brokerage firms with a good reputation, take a look at what your needs are and then make a choice.

To pick the right forex broker, look at your requirements and circumstances and then decide the kind of forex broker that you want to use.

0 Comments

by Girl Banker® When you see an exchange rate on a trading screen there will be two prices: one for buying a currency and one for selling it.  Example exchange rates: GBPUSD: 1.6000 / 1.7000 (the mid-point = 1.6500) EURUSD: 1.2900 / 1.3000 (the mid-point = 1.2950) EURGBP: 0.8000 / 0.8100 (the mid-point = 0.8050) First, understand what the ‘base' is: For simplicity, I will use the mid-point of the above exchange rates to explain the base. When you see GBPUSD = 1.6500, it means £1 buys or sells $1.6500. GBP is the base. The currency that you are buying or selling “1” of is the base. If EURUSD = 1.2950, it means that €1 buys or sells $1.2950; EUR is the base. If EURGBP = 0.8050, it means that €1 buys or sells £0.8050; EUR is the base. What’s up with this notation?

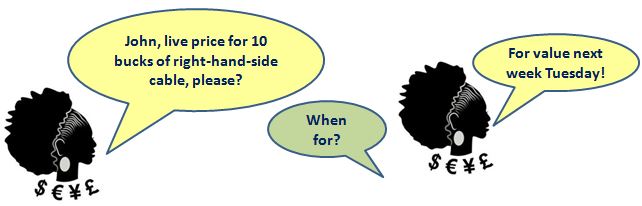

In text books you will normally see USD per GBP or USD/GBP and written like this it is easy to see that GBP is the base. However, all trading screens will show this relationship as GBPUSD. You might be thinking, I could never get used to this, but trust me, you will get used to the notation in no time at all. Once you understand the base you will know whether you are on the right or the left hand side of an FX transaction: If you - as the client - are buying the base, you are on the right hand side (RHS). So, for GBPUSD: 1.6000 / 1.7000 If you - as the client - want to buy GBP and sell USD you are on the RHS so you get the price that you see on the right (the higher price), 1.7000. If you want to buy GBP100,000, you would need to pay USD170,000. If you - as the client - are selling the base, you are on the left hand side (LHS). So, for GBPUSD: 1.6000 / 1.7000 If you want to sell GBP and buy USD you are on the LHS so you get the price that you see on the left (the lower price), 1.6000. If you want to sell GBP100,000, you would receive USD160,000. So, you receive USD10,000 less when you sell GBP than when you buy GBP. The difference in price between buying and selling exists because the trader needs to make money to cover the risk involved in trading as well as to make a profit. What does the request in the picture at the top mean? “Cable” is FX markets lingo for the exchange rate between GBP and USD, GBPUSD. “10 bucks” is markets lingo for USD10 million. So, if you hear, “John, live price for 10 bucks of right-hand-side cable value next Tuesday please?” John (the trader) is being asked to provide a price to a client that is selling USD10 million and buying GBP next week Tuesday. A live price is one that the client might accept and transact on. The opposite would be an “indicative”. If a client just wants an indication, it doesn’t have to be as accurate. We’ll chat more about live prices and indications in a later blog. To become an investment banker, you will need to know a little about FX. |

Girl Banker®I created my investment banking blog in 2012 as soon as I resigned from i-banking & published my book, To Become An Investment Banker.

Initially published at girlbanker.com, all posts were later subsumed into my personal website under katsonga.com/GirlBanker. With 7 years of front office i-banking experience from Goldman Sachs and HSBC, in both classic IBD (corporate finance) and Derivatives (DCM / FICC), the aim of GirlBanker.com was to make it as straight-forward as possible to get into a top tier investment bank. I'm also a CFA survivor having passed all three levels on the first attempt within 18 months - the shortest time possible. Categories

All

Archives

August 2017

|

Heather Katsonga-Woodward, a massive personal finance fanatic.

** All views expressed are my own and not those of any employer, past or present. ** Please get professional advice before re-arranging your personal finances.

RSS Feed

RSS Feed