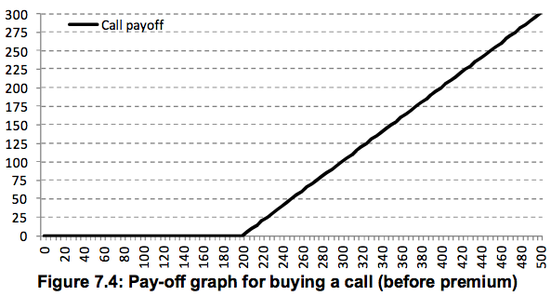

by Girl Banker Listen to the iTunes podcast instead. An equity call option gives the buyer the right to buy a given number of shares in a given company at a given price on a given date (European-style option) or at any point with a given period of time (American-style option). Only the option buyer can exercise the option. To buy a call option is called going long a call and selling a call option is going short a call. Example Whilst Apple shares are trading at about $80 a share in late 2006 you decide to buy a call option that gives you the right to buy 1,000 shares in Apple Inc. at $200 anytime between 1 Jan 2010 and 31 Dec 2010. Buying out-of-the-money call options is much cheaper than actually paying the money to buy the shares outright. The call options are referred to as being out-of-the-money because the strike price, $200, is higher than the current share price of $80. If you buy this contract, you would be expressing the view that you believe in the company so much that you expect the share price to more than double over a four year period. This view would be the basis for buying the right to buy the shares at $200 in four years time, though the current value is only $80. If at any point in 2010 Apple shares exceeded the option strike price of $200, you could exercise your right to buy the shares at $200 and immediately sell them to lock in a profit. Let’s say each option cost you $1, this means you would pay a premium of $1,000 for this option contract. In Dec 2010, the Apple share price went over $320.

2 Comments

Equity Tips

11/8/2016 08:26:39 am

Great work! This is the type of info that should be shared around the web. Shame on the search engines for not positioning this post higher! Come on over and visit my web site . Thanks =)

Reply

Heather as "Girl Banker"

11/8/2016 08:27:13 am

Where was it positioned in your search? The website is only 3 months old at the moment. Hopefully with more content we will rank higher.

Reply

Leave a Reply. |

Girl Banker®I created my investment banking blog in 2012 as soon as I resigned from i-banking & published my book, To Become An Investment Banker.

Initially published at girlbanker.com, all posts were later subsumed into my personal website under katsonga.com/GirlBanker. With 7 years of front office i-banking experience from Goldman Sachs and HSBC, in both classic IBD (corporate finance) and Derivatives (DCM / FICC), the aim of GirlBanker.com was to make it as straight-forward as possible to get into a top tier investment bank. I'm also a CFA survivor having passed all three levels on the first attempt within 18 months - the shortest time possible. Categories

All

Archives

August 2017

|

Heather Katsonga-Woodward, a massive personal finance fanatic.

** All views expressed are my own and not those of any employer, past or present. ** Please get professional advice before re-arranging your personal finances.

RSS Feed

RSS Feed