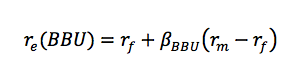

by Girl Banker Listen to the iTunes podcast instead. You cannot go to a corporate finance or asset management interview without knowing the CAPM. The CAPM model shows that the return to equity is a positive function of risk: BBU (Blissful Books United) is the fictional book store created in my book To Become an Investment Banker.

o US Government bond yields are relatively easy to get a hold of online. Some portals will even allow you to download historical data into Excel. o The downgrading of the US Government rating from AAA to AA+ by Standard & Poor's rating agency makes the usual text book assumption that the US Government is risk free debatable.

o If BBU is less volatile than the market, on average, β(BBU) will be less than 1. o If BBU is more volatile than the market, on average, β(BBU) will be more than 1.

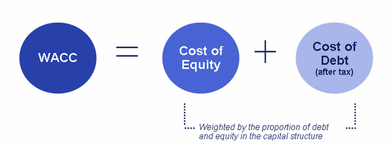

You might also like: What is WACC, the Weight Average Cost of Capital? Where can you get the cost debt used to calculate WACC?

0 Comments

Leave a Reply. |

Girl Banker®I created my investment banking blog in 2012 as soon as I resigned from i-banking & published my book, To Become An Investment Banker.

Initially published at girlbanker.com, all posts were later subsumed into my personal website under katsonga.com/GirlBanker. With 7 years of front office i-banking experience from Goldman Sachs and HSBC, in both classic IBD (corporate finance) and Derivatives (DCM / FICC), the aim of GirlBanker.com was to make it as straight-forward as possible to get into a top tier investment bank. I'm also a CFA survivor having passed all three levels on the first attempt within 18 months - the shortest time possible. Categories

All

Archives

August 2017

|

Heather Katsonga-Woodward, a massive personal finance fanatic.

** All views expressed are my own and not those of any employer, past or present. ** Please get professional advice before re-arranging your personal finances.

RSS Feed

RSS Feed