by Girl Banker Listen to the iTunes podcast instead. These are the eight things that will get you a job in investment banking. I believe having seven out of these eight helped me get into Goldman Sachs as a newbie analyst. 1. Gain knowledge Read the news! At first you might feel like it’s a waste of time especially if you’re not interviewing yet but as time passes you’ll realize that some knowledge just sticks. Without a shadow of doubt, if you spend 20-30 minutes per day on financial press, your overall knowledge and feel for the industry will start to become well-rounded. 2. Come top of the Class or Course If you came top in any class or course - highlight it, it means you’re smart; smart = hard working (normally). In my second year in university, I came 5th in the Econometrics paper – you best believe that I brought that up interviews. Econometrics is hard and to come 5th out of about 150 people in a University of Cambridge class is the sort stuff interviewers are going to remember afterwards. 3. Be an Achiever - prizes, awards and scholarships Even if you’re not top of a class, any major prizes, awards and scholarships must be revealed when the opportunity arises. This sort of stuff shows that you are an achiever, bankers love to work with and be associated with high performers. 4. Be a Team Captain If you are captain of any sporting teams - don't forget to bring it up; out of any other credentials you might have, this shows you are popular and hence personable the most. Especially at the secondary school level, to be awarded the role of captain you need to be liked by the teacher and the people you will be in charge of.  5. High/school or College Start-up If you have ever started a business, especially if it did well - mention it; starting a business or anything else shows that you have initiative and superior time-management skills. 6. Be the Linguist If you can speak several useful languages mention it; it’s impressive and it means you can be presented to a wide variety of clients. One time a VP of mine went to talk to someone and when he came back it wasn't the project we were working on at the forefront of his mind, he said, “Tiana is amazing, I was at her desk for 30 minutes and in that time four different people came to her desk with problems and she spoke to all of them in different languages”. She was fluent in Spanish, French, Portuguese and English. 7. Network and Get Contacts Look for events related to investment banking. If there aren’t any or enough at your own university make friends with people at nearby universities that can invite you to their banking events. 8. Get some work experience I have left this until last because many people applying to banking for the first time frequently do not have any work experience; sometimes they feel as though their work experience isn’t relevant. Mention whatever experience you have anyway even if it's a newspaper-round, there are likely some transferable skills e.g. a newspaper-round requires you to get up earlier and be more organised than your friends. The most crucial work experience is an internship the year before you graduate. Why then? Because if you impress the bank they will offer you a job that starts the moment you graduate. This means you can go back to your last year of university with peace of mind. You’ll be secure in the knowledge that there’s a job waiting for you at the end and you can just focus on your studies. Hope this helps! Peace and chicken grease, Heather

0 Comments

by Girl Banker Listen to the iTunes podcast instead. This post is related to, The most effective 10-step strategy for cold calling an investment banker. However, this post is concerned only with the actual phone call not the research and data gathering. 1. Sound upbeat A monotonous voice will bore the person you are calling and they'll want to get you off the phone as soon as possible. 2. Work on your high-pitched voice If you have a high-pitched voice practice talking at a lower tone. High-pitched voices are generally perceived to be irritating. 3. Before you hit the dial button, practice You can either do this yourself using the voice recorder on your phone or with a friend/family/professional coach. Video isn't necessary because only your voice matters in this case. 4. State your name. 5. State where you got the person's details if possible If you can say how you came to know of the person, that is very useful for building rapport. I found your details on LinkedIn is not a good line, you'll sound like a stalker. However, if you found details on the company's website, say so.  6. Mention a mutual contact, it will help to keep them on the phone longer Check your LinkedIn profile to see if you do have a mutual connection. If so, call the person you know and ask them for permission to mention your name in the phone call. 7. State what you need help with. If you have done decent research on the person you might have found out interesting things about them, think about how you can spin their experiences to make yourself sound like a knowledgeable person on their industry and their job function and why you would be a good addition to the team or bank. 8. Get a promise. Before you get off that phone try to get some kind of a promise e.g. permission to call again, a promise that they will forward your CV to someone and, highly unlikely - but an agreement to meet or be interviewed. If you're not getting anywhere say something like: you sound very busy, I am so sorry to have called you at an inconvenient time, can I call you back at a better time? If they say, yes, ask when. Get the person's email if you do not already have it! 9. Follow up. If you failed to get anywhere on the first call, see what a second call might unveil. A third call is also okay but if that doesn't prove successful, that's where you need to stop. People in banking know each other and if you're branded a stalker it's not going to bode well for your job hunt. Happy job hunting.  by Girl Banker Listen to the iTunes podcast instead. If you haven't reached the penultimate year of university, you don't really need the information below. Get a copy of To Become an Investment Banker and follow the path that has been outlined in there. If you have graduated, are near graduation or indeed, well into another career, you might need to search more aggressively to get your foot in the door. 1. Decide which investment banks to target If you don't know which banks you want to focus on, have a look at the top 50 banks. GirlBanker.com/Banks has a lot of links that take you directly to the recruitment pages of the top 50 investment banks. The biggest banks provide a lot of information so any basic queries you might have will be answered on their website. 2. LinkedIn Lots of people voluntarily put their resumes/CVs onto LinkedIn. Before LinkedIn was publicly listed in 2011, you could get all manner of information; but because they now need to make money for their shareholders, some information is withheld from basic account users. They only show enough to entice you to upgrade to fee-paying status. If you have some generic questions about jobs at the company search for: "Investment Bank" + "Human Resources" "Investment Bank" + "Human Capital Management" "Investment Bank" + "Recruitment" Terms like investment banking division (IBD), or capital markets will not get you very far. Any big bank will have a huge IBD or capital markets department so you need to be a lot more specific than this. You should have a pretty clear idea of what teams you are interested in. Examples of good searches for team members: "Investment Bank" + "FX Sales" "Investment Bank" + "Derivative Sales" "Investment Bank" + "Credit Trading" "Investment Bank" + "TMT" "Investment Bank" + "Leveraged Finance" "Investment Bank" + "Healthcare" Normally, this only yields a name but not an email address. That said, read through the person's details and you might find their email included in their job summary. This is especially true for people that are actively trying to fill a role at the firm.  What information can you get on LinkedIn?

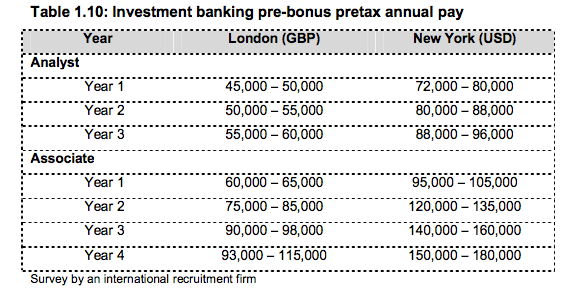

What do you do if the name is partly hidden? If you are completely unconnected to the industry you might find LinkedIn a little useless. Here are two workarounds: a) Over time, as you attend networking events make sure you add people you meet to your LinkedIn profile. I only joined LinkedIn in 2011 for the sole reason of building up a network and data access. I actively added people I know to my network and that allows me to see more information. b) Take whatever information you find to Google.  3. Google You can repeat the above searches on Google. In addition, a) Search for phone numbers: you're unlikely to get a direct number so just look for a reception number; b) Search for emails: it's easy if the person has a basic name. Most investment bank emails follow the format [email protected]. Some investment banks have abbreviated emails i.e. @gs.com not @goldmansachs.com. Google what you think the email might be then email your contact. If the email you deduce is correct, it won't bounce back. c) Search the web for any information available on the person: to get a better picture of who the person is. It gives you more to talk about when you call/write. What do you do once you have a name, department and some basic details? 4. Call or write You can call via reception. Seriously, if you call the reception at most banks and ask to be connected to "So and So" they will put you straight through! I would say email is better than a physical letter in this case. Most people in an investment bank are extremely busy. Helping someone get a job doesn't yield anything for them (usually); any mail received will quickly be forgotten about and it will not be actioned. A letter followed by an email or a phone call might be more memorable. If you have a very creative idea in terms of how to wow them with a physical letter - do it!  by Girl Banker Listen to the iTunes podcast instead. This is the one question that everyone wants answered. Investment bankers' compensation is made up for two parts - base pay and a bonus.

Base pay is very transparent so let's start with that: What about VPs and MDs?

Base pay for VPs and MDs doesn't rise hugely above the levels you see in the above table. Their compensation varies a lot more because of their bonus. Which banks pay the most? American banks tend to pay more than UK banks. UK banks tend to pay more than European banks. This is partly because big American banks make more but it's also cultural. The American dream is a capitalist one: make as much money as you can. Making money is synonymous with hard work in America. As you move towards the UK strong socialist ideals start coming into play. This is even more true for the rest of Europe. So what about the bonus? Bonuses are very variable especially during a recession. The bonus is more fixed at junior levels with larger differences between people at more senior levels. Bonuses can range from 0% to several hundred percent of base pay. Some websites will try to correlate pay with years in the industry but this is one industry where tenure matters very little. I have seen Associates earning much more than VPs because they are adding more to the bottom line. That's how it works. Whether you're an MD or a department head is of little consequence compared to how much your department or team earned for the bank. What does the structure of bonuses mean for you?

What does the structure of bonuses mean for your bank?

by Girl Banker Listen to the iTunes podcast instead. As an eager banker-wannabe whenever I heard the term "back-office" I imagined a category of overworked and underpaid workers toiling away in a windowless room at the back of a building! Personally, I find the term a little derogatory. In banking, the terms: back, middle and front office refer to how closely connected you are to the money train.  Front office Front office workers make the money. Their actions lead directly to more or less money being added to the bottom line of the bank. Front office workers will earn the highest bonuses because they essentially make the money and as such expect a higher cut. In theory, the more money you earn for the bank, the higher your expected bonus is. In a recession, bonus expectations will be lower overall but front office workers will still expect more than those further down the chain. Front office does not have to be client-facing e.g. traders usually do not see clients but if you are client-facing you will need to look smart and dress well for meetings. If you hate suits, this is not the best job for you! Front office includes:

Middle office Middle office workers are an integral part of making money. They directly support a deal but their actions have to be instigated by a front-office worker. A middle office worker cannot as a result of their own actions increase bank profits. Middle office includes:

Back office Back office includes any process-orientated roles. An efficient back office is vital because if clients don't get statements and confirmations on time they will hate your bank and could, on that basis, exclude your bank from deals. How can back office impact front office deals? Imagine you work on a company's small corporate finance team; you have ten bank relationships to manage. One bank consistently sends statements late. The statements frequently have errors and you have to call many times to get issues sorted - if it can be helped you're going to avoid doing business with that bank, aren't you? Back office includes:

So there you have it. When you're applying for jobs it can be a little challenging to decipher whether a role is front-office or not. This is especially true if you're applying off-cycle to a bank that has both a retail bank and an investment bank. Use the above guidelines to help you decide how close you are to the money train. You want to get as close as possible.  by Girl Banker Listen to the iTunes podcast instead. The very word "derivative" makes some people start running for the hills. It sounds scary, complicated, brain numbing. However, if you take the time to read a little about them, the majority of derivatives are easy to understand, particularly derivatives that are designed to hedge specific financial risks. Speculative derivatives can get a lot more complicated. A derivative is a financial product whose value depends on the change in the value of some other underlying product. Derivatives are primarily used for:

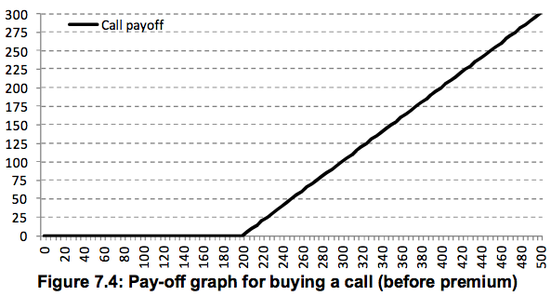

In the equity capital markets, the simplest derivative is an equity call option and in the debt capital markets the simplest derivative is an interest rate swap. So read: What is LIBOR? (it's an important variable in derivatives pricing) What is an interest rate swap (or IRS)? What is a call option or an equity call option?  by Girl Banker Listen to the iTunes podcast instead. An equity call option gives the buyer the right to buy a given number of shares in a given company at a given price on a given date (European-style option) or at any point with a given period of time (American-style option). Only the option buyer can exercise the option. To buy a call option is called going long a call and selling a call option is going short a call. Example Whilst Apple shares are trading at about $80 a share in late 2006 you decide to buy a call option that gives you the right to buy 1,000 shares in Apple Inc. at $200 anytime between 1 Jan 2010 and 31 Dec 2010. Buying out-of-the-money call options is much cheaper than actually paying the money to buy the shares outright. The call options are referred to as being out-of-the-money because the strike price, $200, is higher than the current share price of $80. If you buy this contract, you would be expressing the view that you believe in the company so much that you expect the share price to more than double over a four year period. This view would be the basis for buying the right to buy the shares at $200 in four years time, though the current value is only $80. If at any point in 2010 Apple shares exceeded the option strike price of $200, you could exercise your right to buy the shares at $200 and immediately sell them to lock in a profit. Let’s say each option cost you $1, this means you would pay a premium of $1,000 for this option contract. In Dec 2010, the Apple share price went over $320.

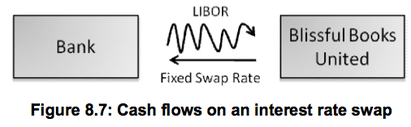

by Girl Banker Listen to the iTunes podcast instead. The interest rate on money borrowed at a variable rate of interest, e.g. LIBOR, rises as the rate rises and falls as the rate falls. If interest rates are expected to rise, it is possible to hedge against the rise by entering into an interest rate swap (IRS) so that the floating rate is converted to a fixed rate. An interest rate swap (IRS) is an agreement between two parties to exchange interest flows. One party pays a variable rate (normally LIBOR, but it can be another rate, e.g. a government base rate) whilst the other party pays a fixed rate as set on the date that the IRS is executed (i.e. when it is entered into). The LIBOR payments are referred to as the ‘floating leg’; the fixed rate interest payments are referred to as the ‘fixed leg’. The diagram below shows an interest swap between a book seller, Blissful Books United (BBU) and a bank. BBU pays a fixed rate to the bank and receives LIBOR. The maturity of interest rate swaps varies widely, they can be very short-dated e.g. 3 or 6 months or very long dated e.g. 30 or even 60 years. Very short-dated IRS and very long-dated ones are not very common. Maturities of 3-, 5- and 7 years are common amongst corporate entities.

The amount on which interest is calculated is called the ‘notional’ amount because this value isn’t paid upfront by either party involved in the swap. What would be the point of exchanging the same amount of the same currency? Payment dates occur periodically, typically every 3 or 6 months. On each payment the amount of interest due to be paid by each party is calculated and only the net amount is paid. For example, assume the fixed rate that Blissful Books United pays on the IRS is 1.50% and that Libor turns out to be 1.725% for a given period, who pays and how much do they pay? Assume a notional amount of $10m:

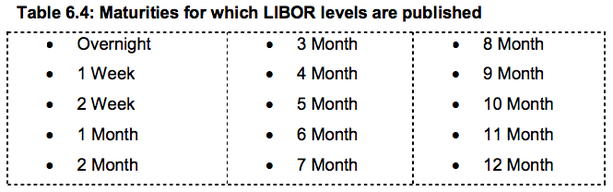

Normally, no upfront payment is required from either the bank or the non-bank counterparty to enter into an interest rate swap. Any costs and profits to the bank are incorporated into the periodic payments. To Become an Investment Banker goes into a little more detail on how the rates are arrived at, terminology and what an IRS term sheet looks like. If you want one-on-one coaching on interest rate swaps, please book a coaching package. In the week of June 25th 2012, the UK's financial services regulator the FSA claimed that some banks had mis-sold interest rate swaps to small businesses. Apparently, some small business claimed that they did not understand the risks that IRSs poised.  by Girl Banker Listen to the iTunes podcast instead. Libor is a very important concept if you want to work in the capital markets. You could easily be asked to define LIBOR in an interview. What is LIBOR or Libor? LIBOR is the London Inter-Bank Offered Rate. It is the rate of interest that banks charge to lend money to each other, i.e. it is an interbank interest rate.

If a LIBOR rate is needed for an intermediate point, simple linear interpolation is normally used.

If LIBOR rates are plotted on a graph with time on the x-axis, the result is a LIBOR curve. The LIBOR curve is a type of yield curve, that is, a curve showing interest rates against time. Historical LIBOR levels are freely available from the BBA website. In the week of Jun 24th 2012 news broke that some banks had been manipulating LIBOR rates in order to look more secure during the financial crisis (dates range from as early as 2005 to 2009). Barclays was notably fined £290m ($450m) for its involvement in rate fixing. |

Girl Banker®I created my investment banking blog in 2012 as soon as I resigned from i-banking & published my book, To Become An Investment Banker.

Initially published at girlbanker.com, all posts were later subsumed into my personal website under katsonga.com/GirlBanker. With 7 years of front office i-banking experience from Goldman Sachs and HSBC, in both classic IBD (corporate finance) and Derivatives (DCM / FICC), the aim of GirlBanker.com was to make it as straight-forward as possible to get into a top tier investment bank. I'm also a CFA survivor having passed all three levels on the first attempt within 18 months - the shortest time possible. Categories

All

Archives

August 2017

|

Heather Katsonga-Woodward, a massive personal finance fanatic.

** All views expressed are my own and not those of any employer, past or present. ** Please get professional advice before re-arranging your personal finances.

RSS Feed

RSS Feed