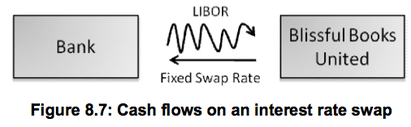

by Girl Banker Listen to the iTunes podcast instead. The interest rate on money borrowed at a variable rate of interest, e.g. LIBOR, rises as the rate rises and falls as the rate falls. If interest rates are expected to rise, it is possible to hedge against the rise by entering into an interest rate swap (IRS) so that the floating rate is converted to a fixed rate. An interest rate swap (IRS) is an agreement between two parties to exchange interest flows. One party pays a variable rate (normally LIBOR, but it can be another rate, e.g. a government base rate) whilst the other party pays a fixed rate as set on the date that the IRS is executed (i.e. when it is entered into). The LIBOR payments are referred to as the ‘floating leg’; the fixed rate interest payments are referred to as the ‘fixed leg’. The diagram below shows an interest swap between a book seller, Blissful Books United (BBU) and a bank. BBU pays a fixed rate to the bank and receives LIBOR. The maturity of interest rate swaps varies widely, they can be very short-dated e.g. 3 or 6 months or very long dated e.g. 30 or even 60 years. Very short-dated IRS and very long-dated ones are not very common. Maturities of 3-, 5- and 7 years are common amongst corporate entities.

The amount on which interest is calculated is called the ‘notional’ amount because this value isn’t paid upfront by either party involved in the swap. What would be the point of exchanging the same amount of the same currency? Payment dates occur periodically, typically every 3 or 6 months. On each payment the amount of interest due to be paid by each party is calculated and only the net amount is paid. For example, assume the fixed rate that Blissful Books United pays on the IRS is 1.50% and that Libor turns out to be 1.725% for a given period, who pays and how much do they pay? Assume a notional amount of $10m:

Normally, no upfront payment is required from either the bank or the non-bank counterparty to enter into an interest rate swap. Any costs and profits to the bank are incorporated into the periodic payments. To Become an Investment Banker goes into a little more detail on how the rates are arrived at, terminology and what an IRS term sheet looks like. If you want one-on-one coaching on interest rate swaps, please book a coaching package. In the week of June 25th 2012, the UK's financial services regulator the FSA claimed that some banks had mis-sold interest rate swaps to small businesses. Apparently, some small business claimed that they did not understand the risks that IRSs poised.

0 Comments

Leave a Reply. |

Girl Banker®I created my investment banking blog in 2012 as soon as I resigned from i-banking & published my book, To Become An Investment Banker.

Initially published at girlbanker.com, all posts were later subsumed into my personal website under katsonga.com/GirlBanker. With 7 years of front office i-banking experience from Goldman Sachs and HSBC, in both classic IBD (corporate finance) and Derivatives (DCM / FICC), the aim of GirlBanker.com was to make it as straight-forward as possible to get into a top tier investment bank. I'm also a CFA survivor having passed all three levels on the first attempt within 18 months - the shortest time possible. Categories

All

Archives

August 2017

|

Heather Katsonga-Woodward, a massive personal finance fanatic.

** All views expressed are my own and not those of any employer, past or present. ** Please get professional advice before re-arranging your personal finances.

RSS Feed

RSS Feed