What is a spring internship in investment banking? How is it different to a summer internship?31/8/2012  by Girl Banker In addition to their summer program, some banks now take in interns over the Easter period for two or three weeks for a more informal introduction to investment banking. Key differences between a spring internship and summer internship: 1. Summer internships are typically 10 to 12 weeks whilst spring internships are only 2 to 3 weeks. 2. London seems to be the only financial region that is currently popularising spring internships into a regular program. 3. Banks expect less of you in a spring internship than they do in a summer one which means it's easier to impress. 4. A spring internship gives you a very basic overview of several desks whilst a summer internship gives you a much more in-depth experience of one to three desks in an investment bank. 5. A summer internship can lead to a full-time job, a spring internship does not lead to a full-time offer  Advantages of doing a spring internships 1. It qualifies as work experience and will increase your chances of getting interviews when you start applying for full-time positions and summer internships. 2. It can help you to decide whether or not investment banking is for you. 3. It can help you decide which teams in corporate finance or the capital markets are more fun and interesting. Note that spring internship schemes if available are very limited. If you can get onto one this will definitely make you look more passionate about banking.

1 Comment

by Girl Banker At junior levels all banks want just one thing: someone with the right attitude. They will train you to ensure you have the technical skills but underlying all that they want a go-getter, someone who is hungry to excel. That is the fundamental requirement. In addition to having the right attitude, they look for:

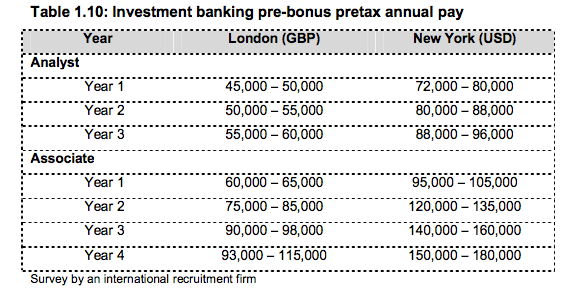

Investment banks vet their applicants with extreme care. The majority of their hiring needs are satisfied through their annual recruitment of new graduates. The vast majority of new hires are recruited after completing an eight to twelve week internship the year before they embark on full time employment. Many universities don’t emphasize this point hard enough: if you want to become an investment banker, do an internship a year before you graduate. That said, a résumé/CV looks more interesting if you have a variety of different experiences: one solid banking internship plus two or three other out-of-the-box experiences (charity work, other industry or business experience) will do much more for you than three banking internships.  by Girl Banker Listen to the iTunes podcast instead. This is the one question that everyone wants answered. Investment bankers' compensation is made up for two parts - base pay and a bonus.

Base pay is very transparent so let's start with that: What about VPs and MDs?

Base pay for VPs and MDs doesn't rise hugely above the levels you see in the above table. Their compensation varies a lot more because of their bonus. Which banks pay the most? American banks tend to pay more than UK banks. UK banks tend to pay more than European banks. This is partly because big American banks make more but it's also cultural. The American dream is a capitalist one: make as much money as you can. Making money is synonymous with hard work in America. As you move towards the UK strong socialist ideals start coming into play. This is even more true for the rest of Europe. So what about the bonus? Bonuses are very variable especially during a recession. The bonus is more fixed at junior levels with larger differences between people at more senior levels. Bonuses can range from 0% to several hundred percent of base pay. Some websites will try to correlate pay with years in the industry but this is one industry where tenure matters very little. I have seen Associates earning much more than VPs because they are adding more to the bottom line. That's how it works. Whether you're an MD or a department head is of little consequence compared to how much your department or team earned for the bank. What does the structure of bonuses mean for you?

What does the structure of bonuses mean for your bank?

by Girl Banker Listen to the iTunes podcast instead. As an eager banker-wannabe whenever I heard the term "back-office" I imagined a category of overworked and underpaid workers toiling away in a windowless room at the back of a building! Personally, I find the term a little derogatory. In banking, the terms: back, middle and front office refer to how closely connected you are to the money train.  Front office Front office workers make the money. Their actions lead directly to more or less money being added to the bottom line of the bank. Front office workers will earn the highest bonuses because they essentially make the money and as such expect a higher cut. In theory, the more money you earn for the bank, the higher your expected bonus is. In a recession, bonus expectations will be lower overall but front office workers will still expect more than those further down the chain. Front office does not have to be client-facing e.g. traders usually do not see clients but if you are client-facing you will need to look smart and dress well for meetings. If you hate suits, this is not the best job for you! Front office includes:

Middle office Middle office workers are an integral part of making money. They directly support a deal but their actions have to be instigated by a front-office worker. A middle office worker cannot as a result of their own actions increase bank profits. Middle office includes:

Back office Back office includes any process-orientated roles. An efficient back office is vital because if clients don't get statements and confirmations on time they will hate your bank and could, on that basis, exclude your bank from deals. How can back office impact front office deals? Imagine you work on a company's small corporate finance team; you have ten bank relationships to manage. One bank consistently sends statements late. The statements frequently have errors and you have to call many times to get issues sorted - if it can be helped you're going to avoid doing business with that bank, aren't you? Back office includes:

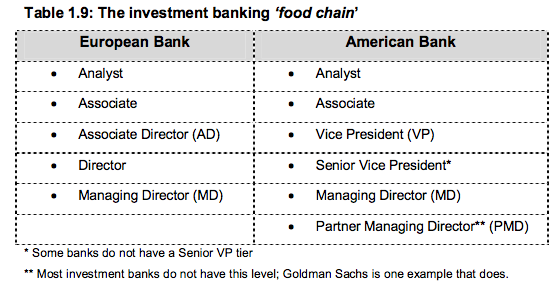

So there you have it. When you're applying for jobs it can be a little challenging to decipher whether a role is front-office or not. This is especially true if you're applying off-cycle to a bank that has both a retail bank and an investment bank. Use the above guidelines to help you decide how close you are to the money train. You want to get as close as possible. by Girl Banker® Listen to the iTunes podcast instead. Having worked in both corporate finance and in the capital markets, I think the skill set needed is slightly different in each. That said, there are some universal requirements: 1. Learn quickly - no one is going to tolerate persistent mistakes; 2. Be personable - so that people enjoy working with you; 3. Have charisma - so that clients prefer you over your competitors. Let's look at the two divisions in turn:  CAPITAL MARKETS 1. Analytical + super assimilator of information Whether you're a trader or a salesperson, you need to take in a lot of information and process it to either relay to clients or to make a trade. A customer can call at anytime to ask random questions like, "What's 6-month LIBOR been doing in the last two weeks and where do you expect it to go now? Is 3-month LIBOR doing the same? Is that your bank's take or your personal opinion?" Trust me, there will be days when you get asked a question so random that you have to blag your way off the phone to find the answer!! 2. Multi-tasker If you like to work on something and finish it off completely before moving onto something else, you'll hate the capital markets. You are always working on several jobs at the same time and just as you start getting into the project at hand, you'll need to move onto a more urgent task. 3. Thick-skinned It's a stressful environment. People will swear and shout at you - so what? - dust yourself off and forget about it. If you're very emotional you'll struggle. Don't take things personally. It's entirely normal to have a shouting match one minute and be laughing with that same person five minutes later.  CORPORATE FINANCE 1. Analytical + highly structured Model building requires you to be decent with numbers and to think in a highly structured way. More often than not you will not be building a model from scratch but the better your understanding of financial statements, accounting rules and how the different line items relate to each other, the quicker you'll be able to sort out any modelling problems. 2. Diplomatic All corporate finance deals are based on a team unlike in the markets (sales & trading) where once you have learnt enough you often work on your own. You will, of course, want your contribution to be valued but if you are aggressive about it you will turn your peers off. With tact and diplomacy your individual contribution will shine through without putting others off. 3. Low sleep requirements The long hours you hear about in banking are not just rumours. You will work very long hours and what's more, you will not only get used to it but you'll start to think of it as "normal". A year into my role as an analyst at Goldman Sachs I got home around at 5:00 p.m. one day and I actually felt strange. I had become so accustomed to my long day that I thought, "What do people do with all this time?" I kid you not. Fun fact: did you know that the longest recorded period without sleep is a gobsmacking 33 years, endured by Thai Ngoc, a 64-year old Vietnamese man. Apparently, after an illness in the 1970s he lost his need for sleep!?! Jealous? Yes I am. I need 8 hours of shuteye to feel normal. I can get by on 7 but less than that on a regular basis and you don't want to be near me! Jokes aside, the hours are long and the less sleep you need, the easier life will be for you.  by Girl Banker® Listen to the iTunes podcast instead. This blog is designed to help those with 3 to 7 years of experience in a non-financial institution plan their strategy for moving into banking. What does an MBA involve? One or two years of dedicated learning and networking. An MBA class at a top school is composed of ex-Bankers as well as people with several years of experience from many other industries. After the MBA, when these people apply to investment banks, they are considered on an equal basis for investment banks' MBA programs. MBA-hires normally start as first year Associates and some as third-year Analysts: it depends on the value of work experience that they bring with them. Some investment banks will not even consider people with MBAs for Analyst roles. So if, relative to the rest of the MBA class, your work experience does not stand out, you could still struggle to get a job. US business schools typically offer a two year course whilst in the UK they are usually one year. London Business School is the only UK school I know of that offers a two year MBA. There is some perception, that two year MBAs offer a more in-depth education. What does the CFA involve? Three exams done over 18 or 24 m. The fastest you can complete the CFA program is 18 months: Level 1 in December, Level 2 in June the following year and Level 3 the June after that. If you miss the December sitting for Level 1 then the CFA would have to be done over two-years. And that's assuming you pass all levels the first time - only 35-45% are allowed to pass any one sitting. This means the probability of passing all three exams the first time is 4.3%-6.4%. Eek! Don't worry, if I can do it, so can you. 1. What is the level you want to enter banking at? Ex-bankers that leave banking to do an MBA normally come back as Associates. If you have valuable non-banking industry experience and CONTACTS alongside your MBA, you too will enter as an Associate. If the investment bank doesn't value your pre-MBA experience you will find it challenging to enter as an Associate. You would have better luck applying as an Analyst - the bottom rung - but keep in mind that some investment banks won't allow you to do this: they will insist on putting you up against other MBAs. In this case you would need to find a bank which accepts MBAs entering as Analysts. If you do the CFA you will still enter as a first year analyst but doing the CFA will make your CV stand out.  2. How much money are you able to spend? MBA US Business Schools: Costs are relatively similar at top US business schools, give or take $5-10k. I'll use Harvard as an example. The cost of tuition, insurance and living per year is estimated to be: $87,200 for a single person $101,800 for a couple $113,500 for a couple with one child $121,200 for a couple with two children Assuming you're single, that's $174,400 (£109,000) in MBA costs over the 2 years (GBPUSD=1.6). UK Business Schools: Tuition at London Business School is £57,500 for their full 15-21 month program. With £15-20k per annum in living costs you're looking at a total of £85-100,000 ($136-160,000) over the 2-year period. Cambridge's Judge Institute charges £36,000 and Cass Business School costs £34,500 for tuition. Both have a 1-year course. Again, add £15-20,000 for living and you're looking at a total of £50-60,000 ($80-96,000). CFA Schweser self-study materials (which most candidates use) cost $350-600 per exam. The cost of each exam is $1,125-$1,500 depending on how early you enrol and register. This means that over the three levels, assuming you go for the more expensive study materials but register for the exam early the cost would total c.$5,175 ($1,725 times 3). However, you never have to fork out more than a couple of grand at any one time. Indeed, as it's done alongside your day job you don't need to set aside living costs. Note that you will fork out more than the above if you decide to go on a taught course. 3. How much time are you willing / able to dedicate to getting into banking? Personally, I think it would be challenging to do an MBA part-time. MBAs are not just about the learning material, they are about networking. Half the reason of doing an MBA is to develop a cache of contacts that will help to progress your career. If you go to business school and come out with just a certificate, you haven't made the most of that opportunity. The CFA program on the other hand is designed to be done part time. Level 1 can only be written in June or Dec. Levels 2 and 3 can only be taken in June. If you fail level 2 or 3, you have to wait a whole year to re-write. In summary, Note that MBAs are much more part of US culture than they are in the UK. Here in London, they are less of an expectation. Both the MBA and the CFA are valuable, however, the MBA is a bigger commitment in terms of time and money. With the current recession, neither can guarantee a job in investment banking but they can help to differentiate you.  by Girl Banker® Listen to the iTunes podcast instead. I'll give you the standard textbook answer and then I'll tell you a little about the variations that I have seen. All newbie front-office investment bankers in both corporate finance and the capital markets start life off as analysts. The table below sets out the different career stages in an investment bank; the terminology used in European banks is slightly different to that used in American banks. You may find further differentiation in specific banks, e.g. splitting the VP category into junior VP and senior VP, but broadly speaking the below applies. 'Analyst' is usually a three year stage, 'Associate' is normally a three to four year stage depending on progress and internal politics. 'Associate Director' in a European bank is normally two to three years. 'VP'/'Director' can be as short as two years, or indefinite! Some people never make it to MD. Your emotional quotient (people skills) and your ability to master corporate politics can be critical in making that jump from VP to MD. Does anyone move up the chain faster than this? Of course. If you are a star performer you can zoom right up to the top in no time. I know a really smart guy who joined the trading floor as a Ph.D. from the University of Chicago (you know, the same place where Milton Friedman went); he jumped from Associate to VP to MD to Partner in roughly two year stints. He was super, super bright. He paid me the biggest compliment I have ever been given: he said, 'I think you're special,' and coming from such a bright spark, I still feel good when I think about it today :) Can one get demoted?Unfortunately, yes! I have seen two types of demotion:

1. An actual demotion. I know a PMD at Goldman who wasn't making enough money to warrant the coveted title so he was recrowned just an MD. 2. Role change. If someone isn't producing the results that the firm wants, they just make them join another team. Especially in the UK, firing people is expensive and management would rather just send them hints so that they quit themselves.  by Girl Banker® Listen to the iTunes podcast instead. In Sep-2006, as a second-year Goldman analyst one of my Associates text me to ‘show-off’ that he had just passed level 3 of the Chartered Financial Analyst program, CFA. I was kind of jealous! I knew it was a definite plus on his CV because I’d heard that it was extremely challenging. I thought, ‘If he has the time to study for the CFA, I can make time too!’ It was September already but I still applied for the Dec-2006 Level 1 exam. I passed. I passed the next two levels in Jun-2007 and Jun-2008 respectively. What is on the CFA curriculum? There is a little bit of everything finance-related. The beauty of Level 1 is that it is very broad, immensely interesting and really not that difficult. It was through Level 1 I developed an interest in derivatives. I started trying to move from IBD to the capital markets a few months after I completed the exam– the better working hours were also a huge lure for me. Level 2 is generally accepted to be the hardest level. It was, for me, also the most boring. There is so much nitty gritty detail on accounting – not my favourite topic. Level 3 is very focused towards asset/portfolio management. There is lots of in depth information about how to look at asset portfolios, how to choose between different asset classes and how to manage other people’s money.  HOW COULD THE CFA HELP YOU? 1. It will stand out on your résumé/CV The CFA qualification is well regarded because its modules are highly relevant to different areas of banking and because CFA Institute only allows the best 35-45% to pass any sitting. 2. Your chances of getting invited to interviews may rise Case in point: one of my colleagues did his first degree in Lebanon followed by a Master’s degree at a good UK university. When it came to looking for a job, he says he didn’t get a single response after sending out his résumé/CV so he decided to sign up for CFA Level 1. When he sent his résumé/CV out again he started getting interview invitations. He’s one of the best derivative salespeople I know so it just goes to show that banks can have trouble sifting through the many applications. 3. It may help you to decide where in an investment bank you would best fit Some bankers think the CFA qualification looks a lot better if you did it whilst you were working rather than when you were in university or looking for a job; however, I would argue that it adds a lot of value to your résumé/CV no matter when you do it. It’s not easy. 4. Your chances of ever becoming unemployed (apparently) fall Of the 100,000 current full CFA Charterholders globally (i.e. people who completed and passed CFA exams 1, 2 and 3) and according to the CFA Institute’s own figures only 4% of them are unemployed at any time. You can read a full piece on this on eFinancialCareers.  DO YOU HAVE TO TAKE A TAUGHT COURSE TO PASS THE CFA? I didn’t and I still passed all 3 levels the first time. For me, paying someone to teach me would have been a big waste of dosh. When I am around other people I usually want to chat. For the same reason, I also didn’t join any study groups. What was my strategy? Time was limited. I didn’t read the CFA’s own materials, they’re too thick. I ordered self-study materials (five books, Audio CDs, QuickSheets and Practice exams) from Schweser. I studied properly on weekends (both days); during the week I listened to the audio CDs on my way into work. I was always too tired to do any revision after work. I took exactly one week off prior to each exam. By this time, I had been through all the study material once. Each time, I created a schedule to ensure this was the case. So what did I do in this one week? Exam practice! One exam per day. As I went through the practice exams, the areas I needed to work on jumped out at me, so I re-read just these modules. What about my social life? What social life? I killed it. I went out to dinner like a couple of times per month. However, when the CFA was over ‘freedom’ felt so much sweeter. I wrote the last exam in Jun-2008 but even today, four years later, the idea of combining a full-time job with the CFA still gives me the hibby jibbies.  by Girl Banker® Listen to the iTunes podcast instead. Simple answer: university. I get asked this question time and time again by prospective investment bankers. Should I choose this university or this other one? I know this university is lower in the league tables but the course that I have been accepted onto is more closely related to finance - that will make my chances of getting into an investment bank higher, right? As I have mentioned before, investment banking is not a vocational career: you do not need to study finance in order to get into i-banking. Why? Because whatever desk you land on in an investment bank, the required knowledge will be so specific and so practical that your university will not have covered all or most of it. Importantly, it is all stuff that can be quickly learnt on the job. Certainly within about 18 months you can go from knowing nothing about finance to being very proficient. Indeed, you can graduate with a finance-related degree and still struggle to learn all the on-the-job stuff. People who have come from a non-finance background frequently over-compensate with weekend work and post work-hours reading. Whatever your degree, even if it's finance-related, you should be doing extra reading after work (that is, if you get home at a 'decent' hour) and during weekends. Why does the university matter so much? Investment bankers ultimately want to hire the smartest people that they can. It impresses clients and the quality of work produced by smart people is higher. Like it or not, the university system is seen as a sorting ground: the crème de la crème get into the best universities. This is why investment banks tend to have hiring programs at the top universities and nothing at the lower tier ones. If, unfortunately, you didn't manage to get into the best universities do not despair. Apply directly to investment banks and differentiate yourself with your extra curricular activities. Any questions?  by Girl Banker To Become an Investment Banker is now available for sale on Amazon or off this website. All your questions on the application and interview process, possible interview questions and the dos and don'ts of banking have been fully answered in this book. Get your copy now. Please subscribe to receive info that will help you get into investment banking directly to your inbox AND you will get Chapter 1 of To Become an Investment Banker for FREE! |

Girl Banker®I created my investment banking blog in 2012 as soon as I resigned from i-banking & published my book, To Become An Investment Banker.

Initially published at girlbanker.com, all posts were later subsumed into my personal website under katsonga.com/GirlBanker. With 7 years of front office i-banking experience from Goldman Sachs and HSBC, in both classic IBD (corporate finance) and Derivatives (DCM / FICC), the aim of GirlBanker.com was to make it as straight-forward as possible to get into a top tier investment bank. I'm also a CFA survivor having passed all three levels on the first attempt within 18 months - the shortest time possible. Categories

All

Archives

August 2017

|

Heather Katsonga-Woodward, a massive personal finance fanatic.

** All views expressed are my own and not those of any employer, past or present. ** Please get professional advice before re-arranging your personal finances.

RSS Feed

RSS Feed