by Girl Banker Listen to the iTunes podcast instead. Competency-based questions are designed to elicit your key qualities, e.g. your experience with working with others (team work), being a leader, taking initiative, overcoming obstacles, making quick decisions and so on. Here are some common questions: 1. What do investment banks do? How are investment banks different to commercial or retail banks? 2. Why do you want to work in corporate finance / sales / trading / asset management? Why do you think you would be good at corporate finance / sales / trading / asset management? 3. Why do you want to work for this bank? 4. Why should this bank hire you? What do you think distinguishes you from other candidates that have applied for this position? 5. Do you know this bank’s key competitors? What do you know about other investment banks? 6. Run me through the key aspects of your résumé/CV? 7. Describe yourself This is a very open-ended question so you should ask if there is anything the interviewer particularly wants you to talk about, e.g. your work experience or your ambitions, your degree and why you chose it, your university and why you landed there, your extracurricular activities etc. 8. You’re currently doing a non-financial course in university. Given this fact, what attracted you to investment banking? With so little financial knowledge, how would you be useful to us? 9. Would you describe yourself as hard-working? 10. What are your key strengths? 11. How would someone that knows you well describe you? 12. What do you like the most about yourself? 13. What is your biggest achievement? 14. Do you have any weaknesses? What would you classify as your key weaknesses? 15. Have you ever failed? Have your plans ever not worked out? Tell me about a time when something went wrong. How did you resolve it? 16. What is the biggest failure you have ever had? 17. The grades on your résumé/CV are not the best I have seen today. Why should I hire you over someone with a better academic profile? 18. Which other firms have you applied to? Which other firms are you interviewing with? Have you received any internship / job offers yet? 19. Are you only applying for positions in investment banks or are there other sectors you are considering? 20. How did you prepare for this interview? 21. Are there any questions you would like to ask me? If you can fully prepare just the above questions for your competency based interview, you will be more than prepared. To Become an Investment Banker provides guidance on how to answer each one of these questions effectively. Book a mock interview to ace that interview!

0 Comments

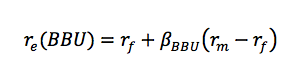

by Girl Banker Listen to the iTunes podcast instead. You cannot go to a corporate finance or asset management interview without knowing the CAPM. The CAPM model shows that the return to equity is a positive function of risk: BBU (Blissful Books United) is the fictional book store created in my book To Become an Investment Banker.

o US Government bond yields are relatively easy to get a hold of online. Some portals will even allow you to download historical data into Excel. o The downgrading of the US Government rating from AAA to AA+ by Standard & Poor's rating agency makes the usual text book assumption that the US Government is risk free debatable.

o If BBU is less volatile than the market, on average, β(BBU) will be less than 1. o If BBU is more volatile than the market, on average, β(BBU) will be more than 1.

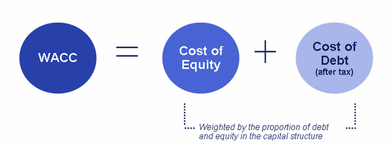

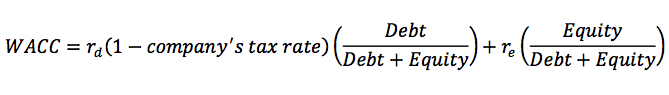

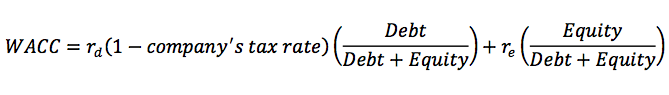

You might also like: What is WACC, the Weight Average Cost of Capital? Where can you get the cost debt used to calculate WACC?  by Girl Banker Listen to the iTunes podcast instead. WACC represents the combined cost of debt and equity The free cash flows in Discounted Cash Flow (DCF) Analysis are normally discounted using the weighted average cost of capital, WACC. Where:

r(d)(1 - company's tax rate) is the post tax cost of debt. E.g. If:

You simply can't go to a corporate finance or asset management interview without knowing this formula. It is basic and fundamental. You might also like: Where can you get the cost debt used to calculate WACC? What is the Capital Asset Pricing Model, CAPM?  by Girl Banker Listen to the iTunes podcast instead. The cost of debt is very easy to calculate if the company has debt liabilities on its balance sheet. Because interest is tax deductible (in most countries) this tax benefit has to be subtracted from the cost of debt. Most companies do hold debt on their balance sheet so this is by far the most common route. If you were unfortunate enough to find yourself with a company that had completely no debt on its balance sheet, the next best route would be to use a proxy. A reasonable proxy would be the cost of debt of very similar companies. Hopefully you would have a sufficient sample of similar companies that have issued debt instruments recently from which to calculate such a proxy. If no similar companies were available then an assumption would have to be made in collaboration with your debt syndicate team based on the current economic environment. However, this would likely lead to your using a higher cost of debt than is necessary to keep your numbers realistic. It's not the best way of coming up with a cost of debt number but it would be the best you could do in the circumstances. As a reminder, this is the formula for WACC, the Weighted Average Cost of Capital: Where r(d) is the average cost of debt and r(e) is the cost of equity.

You might also like: What is WACC, the Weighted Average Cost of Capital? What is the Capital Asset Pricing Model, CAPM?  by Girl Banker Listen to the iTunes podcast instead. Totally swamped? Don’t know how to cope with your current work load never mind making investment bank internship applications? Well, as important as getting top grades is, getting a job is just as important. In fact, I recently had a similar work load problem. I signed up to do an online course on building informational apps and I simply couldn’t fit it in. The solution? An hour a day! As busy as I am, I decided that I could dedicate an hour every day to the cause as it was important enough. By sticking to that commitment I have managed to finish the course within two weeks. You can do the same for your job applications. You don’t have to do everything in one go. Split the investment banking application process into one-hour batches and spread it over the next three or four weeks. I personally wouldn’t wait until the Christmas holidays to make applications because some banks are reading applications as they come through and not only inviting people for interviews but making internship offers. This means the pool of internships available is shrinking every week. Here is how you can organise yourself: 1. The first application is the most crucial, it sets the trend for the rest. I wouldn’t submit an application for the first week to ten days. Week one is ‘research week’. You need to figure out:

At this point, I am of course going to do like any self-respecting author and plug my book, To Become an Investment Banker (spare yourself the reading and get the audiobook). It contains all the above and much more! The audio book is just over 9 hours long. 2. Research done, it’s time to log onto investment bank sites and draft your first answers. In order to get access to the questions, you’ll need to enter some personal details into an online application form. Enter whatever details you need to give to gain access to the application form, then copy and paste the questions into a word processor. Do this for two or three banks. 3. Draft some answers. Read through your answers. Ensure all claims are validated with a relevant example. 4. Get an independent opinion on your application form. If you can’t afford professional help get a friend to do it. If your friend’s feedback is very brief or overly complimentary get another friend to check your answers. Keep in mind that friends can find it hard to give constructive feedback. I had one guy send me one if his friend’s cover letters and ask what I thought of it. I thought it was rubbish, he did too but he didn’t know how to tell his friend so he just left it at that! 5. When you are happy with one application, send it off. Getting happy with the first application will probably take 5 to 6 one-hour slots. 6. Move on to application two. This will take 3 to 4 one-hour slots. Once you have the hang of it and there is sufficient overlap between questions you will get it done even faster. An hour a day is all you need to get all your applications done in 3 to 4 weeks. Get on with it!  by Girl Banker Listen to the iTunes podcast instead. I get asked a question related to this topic every single week! The answer is yes but even from target universities they are looking for the best of the best. First off, let's define what we mean by "target universities": Every major investment bank has an annual hiring cycle. The human resource department has a limited budget to spend on recruitment and as such will choose a handful of universities to focus their recruitment efforts on. These form their "target universities". As a target university, that institution will get:

Students from target universities do not get their applications looked at in preference to students from non-target universities. That said, because of the extra effort in recruiting from a specific campus the investment bank will receive more applications from their target universities. Fewer students from non-target universities have the relevant information and as such will apply in smaller numbers. The top investment banks will have the very top universities on their target list. Mid-ranking investment banks are realistic and will include mid-ranking universities on their target list because they have lower potential to attract students from top institutions. Here are three example emails that I have received in relation to recruitment from non-targets: Email 1 - a high potential candidate from a non-targetHeather, Thank you very much for your time! I recently purchased your book and I absolutely love it; it was the exact kind of information I was looking for! With that being said, I have recently become interested in pursuing a career in investment banking. However, I am worried that my current/past experience will prevent this from happening. Without sparing too much of your time, I went to a mediocre school for my undergraduate degree (University of [Blah], USA). I majored in engineering and economics, the former being my original career goal and the latter a result of going back to school because of the economic crisis. My GPA was 3.0 due to a lack of effort on my part. I did not participate in many clubs or extracurriculars in school, which of course I regret now. Anyways, I have worked in both fields since graduating in 2010, and have concluded that engineering just isn't for me. So I am considering changing careers into finance, specifically investment banking. FYI, the extent of my experience in finance was getting FINRA Series 6 & 63 licensed and working at a company that manages retirement plan accounts. I would deal with all account information, withdrawal requests, deferral changes, plan inquiries, trade requests, etc. I am concerned that my school, my mediocre GPA and my lack of experience will completely prevent me from getting any kind of job in this field. I view my engineering degree as an advantage in the sense that it shows technical and time/project management expertise, but the more I read about IB the more I am realizing that I would be competing with people that have gone to top tier schools, gotten excellent grades, participated in all relevant social groups and school orgs, and hooked an internship at a big bank while in school. How am I supposed to compete with this?! Is there any hope? I know you offer consulting, and I was hoping such a simple question wouldn't fall under that. I guess I am just looking for an answer to this question from an IB so that I know how to move forward or at the very least don't waste my time trying! Thank you again! Best Regards, [American Guy] Email 2 - a low potential candidate from a non-targethi I am emailing you regarding the coaching sessions you give to students who trying to get a foot in to the IB industry. i would like put a strong point forward i know the competition is tough out there in this disastrous period we are seeing in the economy but for stuudents who do not come from the top target universities, dont stand a chance in this industry espcially if we are looking for roles in sales and trading its more about the univeristy reputation these days to those applying to bulge bracket banks as i have noticed from yourself who went to cambridge all i see is all top universities which is when i look at the people who have been offerd interhsips. Its very unlikey to catch a non target school who gained a internship. The reason i say this is that i am extremely passionate about working in the financial markets as i am stuyding my degree in investment banking banking and finance at a school who specifically teach you the detail knowledge of the financial markets ,but i am being held back by the reputation of the school as its not a target and the HR don't think these days will invite students from a non target school for an interview i am currently going into my third year so what do i do ? how can you help me ? i know what i have just stated is quite negative but i think if i am so passionate i should given a chance thank you h [UK Student] Email 3 - a 15 yr old with major Ivy League potentialHi Ms. Katsonga, my name is [ ]. I am a 15 year old independent equities and bond trader. I am intrigued by investment banking. I am ordering your book on Amazon and would like to ask a few extra tips from you directly. What degree do you recommend to be well prepared for banking? Will it help a great deal in my application process the fact that I have a trading track record since I was 15 with high returns? Or with your experience is that easy to come across by and not something investment banks value. When should I do my CFA? After my degree, during work? And what else stands out on a resume for investment banks? Your book might answer these already when I receive it but it's not always the same as speaking directly to a person. I really appreciate your expertise. I really love your videos because they are very concise and 'to the point'. I would extremely appreciate and value a response. Sincerely, [Boy in Canada] EMAIL ANALYSISI thought this sample of three emails is adequate to get my point across.

Part of the reason that students from the best universities stand a better chance is that they are taught or they find out for themselves "the rules of the game"; in addition to going to a top university they: a) Get coaching (I did too) b) They seek out services for mock interviews c) They make sure their application is written in great English with no grammatical errors and d) They do A LOT of research. For instance, let's take a look at email 2 - it's full of grammar errors and even has some spelling errors. There was no subject on the email; it didn't address me directly and it was not signed off properly etc. Investment bank recruiters are VERY critical and they would reject an application for as small a transgression as not capitalising the "i"s. Do you see where I am going? Now look at email 1: it's very well written, has a great structure, addresses me correctly and conveys the keenness of the writer perfectly. Similarly, email 3 is extremely polite and one can immediately tell the writer is a high achiever. The young man in email 3 actually thought there are many people his age dabbling in share dealing. I was so intrigued that I wrote back to find out more about him. He's the type of guy you really want to help get in front of the right people and that is the crux of getting a job in an investment bank: you need to portray yourself in a way that makes people immediately want to help you! Students from target universities do not get in just because of the institution they are from. If you are serious about getting into an investment bank you need to be at the top of your game. |

Girl Banker®I created my investment banking blog in 2012 as soon as I resigned from i-banking & published my book, To Become An Investment Banker.

Initially published at girlbanker.com, all posts were later subsumed into my personal website under katsonga.com/GirlBanker. With 7 years of front office i-banking experience from Goldman Sachs and HSBC, in both classic IBD (corporate finance) and Derivatives (DCM / FICC), the aim of GirlBanker.com was to make it as straight-forward as possible to get into a top tier investment bank. I'm also a CFA survivor having passed all three levels on the first attempt within 18 months - the shortest time possible. Categories

All

Archives

August 2017

|

Heather Katsonga-Woodward, a massive personal finance fanatic.

** All views expressed are my own and not those of any employer, past or present. ** Please get professional advice before re-arranging your personal finances.

RSS Feed

RSS Feed