A bloody good story. At the end of every chapter, I immediately wanted to read the next. This book has even the subtle nuances of banking down to a T and not only that, it makes them exciting! Seriously, I want to see the movie.

I have one rule when it comes to reading, if my interest hasn't been piqued after the first 20 pages then I won't bother. There wasn't a single chapter in the books that didn't leave me wanting to read on. It was a very engaging story and what made it even better is how realistic it really is - small things like Nick not being able to navigate the Deal Team folders are so typical. I also liked small bits of knowledge like the connection between maths and music or the arts, most people don't know that - I certainly learnt something new here. There's lots of clever writing and dialogue in the story; for instance, I loved the analogy between reading Ryan and a nursery school book in extra large print. That was very clever. I also loved the balance that Jamie brought to the whole Ryan saga. The one thing I thought was incorrect was the statement about Vice Presidents being a low position in banks. VP at Goldman Sachs, for instance, is a reasonably high position and the sort of work that Alfred was doing would typically be done by Associates. However, I did see that they didn't have Associate as a position in the book. Overall, I enjoyed this book.

0 Comments

by Girl Banker Reading Amazon kindle books on Windows XP, Vista and 7 is easy peasy. Log into your Amazon account and download the software: Amazon.com or Amazon.co.uk. This is essentially the "app" for Windows. When you buy kindle books off the Amazon website, you can have them wirelessly delivered to this or any other device that you own. If you download a book to one device it will be in the Archives on the other devices so you can simply reload it to an alternative gadget at no additional cost. Happy days. This is how you can read kindle books on iPhone, iPad or Mac.  by Girl Banker You don't need to own a kindle tablet in order to read kindle books! Here is how you can read kindle books on any apple device: 1. Go to the app store 2. Search "kindle" and you can download the kindle app 3. The app allows you to read any kindle books that you've bought on the Amazon store In the early days, you could buy the books directly through the app but as usual Apple got greedy and wanted a cut of book sales so nowadays you have to buy the books directly from the Amazon website. No worries, you can still do that using your phone. The best bit is that you can have the Amazon kindle app on multiple platforms. I have it on three iThings. When I open any book on one gadget or the other it knows the last point to which the book was opened on another device and asks if I want to go there. Neat, huh? When you buy kindle books off the Amazon website, you can have them wirelessly delivered to this or any other device that you own. If you download a book to one device it will be in the Archives on the other devices so you can simply reload it to an alternative gadget at no additional cost. Happy days. This is how you can read kindle books on Windows XP, Vista or 7.

by Girl Banker®

Rating: 5/5 This is probably the best business book that I am going to read all year, seriously. It’s way better thanThe Lean Startup, a book I reviewed two weeks ago.

Rework is crisp and to the point. It’s written by the founders of 37signals.com, a very successful tech company that’s produced productivity tools for small businesses such as Basecamp, Highrise, Backpack and Campfire.

Over and above what they say in the book there was one overriding message that I sensed: they always go with their base instincts and adapt to changing circumstances as they arise. On business plans, they say they are a waste of time and lead to inflexibility and inaction. I agree. They do not disagree with having a rough plan but they think you shouldn’t get bogged down in it. Every number is a guess that won’t materialize anyway. On failure, they say people who fail are just as likely to fail again as people who haven’t embarked on anything before. It’s success, not failure, that leads to success. On being a workaholic, they say go home and get some sleep! You’ll be more creative and work more productively after. Consistently working late is not a badge of honor, it’s a mark of inefficiency. I agree but in the wonderful world of investment banking face time matters. You can change things on your team when you're an MD but if you want to make it to MD, you're going to put in as much face time as the biggest face timer on your team! On starting a business, they say scratch your own itch, create a product that you yourself need, you will be better able to market it. I so agree on this point. I have a friend who’s built a website on healthy eating and weight loss but he has never had a weight issue himself nor is he interested in the subject in itself. On seed money, they say using other people’s money is plan z. Don’t resort to it until you really have to. Once you have external investors they start to control you. Are you going into business to be your own woman (or man) or to be a slave to someone else’s short term profit goals?

On constraints or limited resources, they say these are good things. Having limitations force you to think outside the box. Startups with endless cash end up spending money poorly because it is oh-so-easy to spend someone else’s dough.

On an exit strategy, they say do you go into a marriage with divorce in mind? What’s the point of going into a business if you are already thinking about how you are going to get out? I so agree. On quitting, sometimes it’s a good thing. Don’t flog a dead horse. On large tasks, break them into small bite-size pieces. I have been living by this principle myself since high school. On one-upping the competition: a waste of time. Dare to be different. On the competition: don’t obsess over what they may or may not be doing. On drug dealers, imitate them. They know their wares are sooo good that they’re willing to give some away for free. LOL! On marketing, ignore New York Times, Wall Street Journal and all the other Big Girls, they have no time for you! Target niche bloggers and publications. The big players usually go surfing for new stories in these niche places. They also talk about the benefits of saying NO; the efficiency of creating long uninterrupted periods for work; building an audience; teaching your fans things rather than just selling to them; doing everything yourself first before you delegate so that you know how hard it is; apologizing sincerely; looking beyond potential employees’ formal education and valuing their other experiences; test driving employees first and giving cover letters more weight than résumés and CVs. I say: buy buy buy!

by Girl Banker®

Listen to the iTunes podcast instead. This is a 5* book. It’s very difficult to write a non-fiction, financial saga and actually make it interesting and readable but Michael Lewis has managed to do just that in The Big Short. The book tries to grapple with why the financial crisis of 2007-2009 happened, who saw the crisis coming and what might happen now.

THE CAUSE OF THE FINANCIAL CRISIS

Michael Lewis goes through how the creation of financial instruments composed of money lent to people who could never afford to pay the credit back eventually led to the crisis: subprime mortgage bonds and collateralized mortgage obligations, CMOs. Mortgages were made irresistible with low ‘teaser’ rates, no need for a down-payment and, as though that wasn’t enough, no requirement for proof of income. Credit rating agencies on their behalf overrated the securities. They didn’t have access to the underlying mortgage data and were ‘too scared’ that ‘excessive’ demands for more information would lead banks to go to another rating agency taking away their fees. The rating agency models, too, were riddled with nonsensical assumptions.

THE CLEVER GUYS THAT SAW THE CRISIS COMING

Dr Michael Burry Michael Burry, founder of Scion Capital was the first person with a strong enough opinion of how crap subprime mortgage bonds were to buy insurance against them in the form of CDS (credit default swaps). I have written a separate blog about Michael Burry. Greg Lippmann at Deutsche Bank and his quant Eugene Xu Greg Lippmann ‘bought’ Mike Burry’s view and Michael Lewis likens him to patient zero in an epidemic. He’s the guy responsible for spreading the news that subprime mortgages were going to ‘blow-up’. Their ratings and their pricing didn’t make any sense. They were illogical, based on the wrong assumptions. Greg Lippmann reinforced the view with numbers run by his quant, Eugene Xu, described in the book as the second smartest guy in China. I loved Lippmann’s line: “I don’t have any particular allegiance to Deutsche Bank, I just work there.” Classic. Most investors who heard Lippmann’s spiel weren’t comfortable enough with the idea to short (gamble against) subprime. Lippmann, Xu and a few others have since started their own hedge fund, Libremax Capital, LLC.  Steve Eisman Steve Eisman

Frontpoint Capital: Steve Eisman, Vincent (Vinny) Daniel and Danny Moses

In many ways these were my favorite characters in the book. They, after much persuading and analysis agreed with Lippmann’s view that subprime asset backed securities were overrated and overpriced so they put their money where their mouths were and bet on their demise. I found Eisman especially amusing because he said the most random things. In addition, whenever he encountered anyone who he thought was stupid he shorted whatever they were invested in. He shorted Wing Chau (who is now suing Michael Lewis for character defamation) and a host of top Wall Street entities: Moody’s, B of A, Citi and Merrills to name a few. His reason for shorting Merrills was that whenever something goes bad Merrill is always there. Cornwall Capital: Jamie Mai and Charlie Ledley These guys started a hedge fund, Cornwall Capital, with only USD110,000. They came to the realization of subprime products quite late. However, they did something different: whilst the first movers bet on the very worst BBB subprime mortgages, they were the first to bet on the better-rated AA layer because by that point it was clear that even that layer would fail. The bet paid off by tens of millions.

WHO WERE THE BIG SUCKERS THAT WERE BLIND TO THE FOLLY OF SUBPRIME?

Notable characters identified by Michael Lewis as failing to see the extent of the pending crisis in addition to rating agencies are Howard Hubler who lost Morgan Stanley a shed load of money and the CEO of AIG, Joe Cassano who ruled the company like a dictator. Overall I had two main disagreements with this book: Lewis tarnished every banker with the same brush. It’s true that desks dealing in subprime took massive risks but they account only for a very small number of people that work in investment banks. You can’t blame every single banker for subprime because bankers that didn’t deal in subprime probably knew as little as a layman about the asset subclass. You can blame the CEOs of these banks because they are meant to maintain oversight. You can also blame the individual traders that made these investment decisions. I also disagreed with Lewis’s conclusion that allowing investment banks to list publicly led to excessive risk taking and hence their downfall. Personally, I think current incentive structures are the ultimate issue. Short-term profits are desired and pursued over long-term gains. Once people are incentivized to account for the long-haul performance of the financial industry should improve. My recommendation? If you want to understand the 2007-2009 financial crisis: buy, buy, buy!

by Girl Banker®

Mother Teresa, CEO: Unexpected Principles for Practical Leadership Rating: 4.5* out of 5 One of the things I love about investment banking is that you very quickly become self-employed. In the capital markets, once your manager gives you a budget to reach it's pretty much up to you how you get to the target revenue. In IBD, once you get to senior associate or junior VP you need to start showing your business acumen. I like to read business books because although there is a lot of overlap between books, I find that occasionally I discover something completely new and many times I am forced to ponder something more deeply or to experience someone else’s take on a common business principle. In Mother Teresa, CEO, the authors explain the principles Mother Teresa lived by and how these can be translated into business life.

When I think of Mother Teresa I think of a little, old lady going around Calcutta feeding and loving the dispossessed. I do not think of a high-powered business woman. The concept of Mother Teresa as a business woman is almost alien to me, yet, she did start the organization, Missionaries of Charity, which at the time of her death had 594 missions in over 100 countries.

Mother Teresa was a doer. She had a vision and she followed it through. She was authentic and she lived the values that she preached. The eight principles that the book elaborates are:

There were two principles that I particularly liked: 4 & 8.

You would never believe it was true but even Mother Teresa had doubts. She never doubted her vision of helping the poorest of the poor but apparently her personal diaries talk about the moments of doubt that she had in God; as well as the loneliness that she faced as a result of dedicating her whole self to the mission. The book talks about using doubt to question yourself and to avoid paralyzing fear. I feel encouraged by Mother Teresa’s belief that we may feel that what we are doing is just a drop in the ocean but that the ocean would be less without that drop. The second important thing I discovered was using the power of silence. This is something I hardly do or don’t do enough. I do, however, agree that stepping away from the hustle and bustle of daily life, meditating and just being you have to be good for you. Overall, I would recommend this book. I used the audio version from Audible which is a mere 2 hours and 7 minutes long. It’s a very short book, only 144 pages, so you should be able to get through it in no time at all. by Girl Banker® Apr-2012 rating: 4.6 out of 5 I read this book in the one month of garden leave that I had between moving from Goldman Sachs to HSBC back in 2007.  Aug-2007 review: I loved it, loved it, loved it. Their thoughts on the bidet had me ROFLOL: Troobie and Rolfe wonder why Europeans won’t take a bath but insist on having the cleanest asses in the world! Very good explanantion of what the world of banking is like. Read this book before going into investment banking. It will really help you understand what is going on in that world. I recommend Monkey Business in To Become an Investment Banker. by Girl Banker® Apr-2012 rating: 3.8 out of 5 I read this book in the one month of garden leave that I had between moving from Goldman Sachs to HSBC back in 2007. From my clipped review I must have thought that this was a book worth reading because it was good to know rather than being 'unputdownable'.  Aug-2007 review: Shows what happens when you get too greedy and you think you are too clever. Recommend it to those who are getting too confident in their own abilities. Reads very much like an account of a historical event but is a compelling read nonetheless. I recommend When Genius Failed in To Become an Investment Banker. by Girl Banker® Apr-2012 rating: 4.5 out of 5 I read this book in the one month of garden leave that I had between moving from Goldman Sachs to HSBC back in 2007. I have seen an abridged version of it on Audible.com so I might re-read it to see whether my view of it remains the same today.  Aug-2007 review: Very good read. Very informative regarding the world of investment banking and what a dominant force Salomon Brothers was in the 1980s / 1990s. I liked the character of John Meriwether in this book. When he’s approached by John Gutfreund for “one hand, one million dollars, no tears” and he replies, “no John, if we’re going to play for those kind of numbers, I’d rather play for real money. Ten million dollars. No tears.” I thought he was the DON. But by the time I read When Genius Failed, I don’t think he is portrayed as such a God. I was much more spell bound by Meriwether in Liar’s Poker than in When Genius Failed. Fantastic in explaining how mortgage backed securities developed. Very well worth a read. I thoroughly enjoyed it. I recommend Liar's Poker in To Become an Investment Banker. |

Girl Banker®I created my investment banking blog in 2012 as soon as I resigned from i-banking & published my book, To Become An Investment Banker.

Initially published at girlbanker.com, all posts were later subsumed into my personal website under katsonga.com/GirlBanker. With 7 years of front office i-banking experience from Goldman Sachs and HSBC, in both classic IBD (corporate finance) and Derivatives (DCM / FICC), the aim of GirlBanker.com was to make it as straight-forward as possible to get into a top tier investment bank. I'm also a CFA survivor having passed all three levels on the first attempt within 18 months - the shortest time possible. Categories

All

Archives

August 2017

|

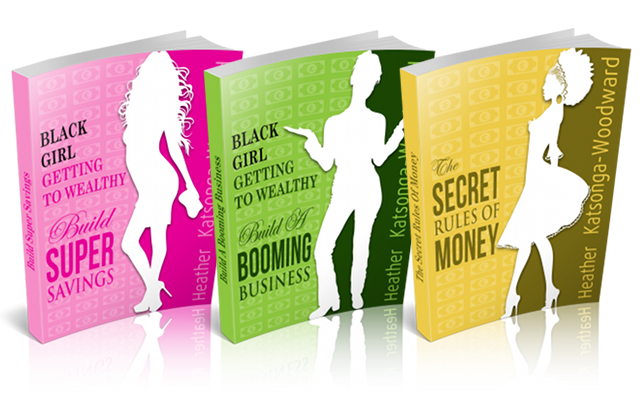

Heather Katsonga-Woodward, a massive personal finance fanatic.

** All views expressed are my own and not those of any employer, past or present. ** Please get professional advice before re-arranging your personal finances.

RSS Feed

RSS Feed