by Girl Banker® Listen to the iTunes podcast instead. In Sep-2006, as a second-year Goldman analyst one of my Associates text me to ‘show-off’ that he had just passed level 3 of the Chartered Financial Analyst program, CFA. I was kind of jealous! I knew it was a definite plus on his CV because I’d heard that it was extremely challenging. I thought, ‘If he has the time to study for the CFA, I can make time too!’ It was September already but I still applied for the Dec-2006 Level 1 exam. I passed. I passed the next two levels in Jun-2007 and Jun-2008 respectively. What is on the CFA curriculum? There is a little bit of everything finance-related. The beauty of Level 1 is that it is very broad, immensely interesting and really not that difficult. It was through Level 1 I developed an interest in derivatives. I started trying to move from IBD to the capital markets a few months after I completed the exam– the better working hours were also a huge lure for me. Level 2 is generally accepted to be the hardest level. It was, for me, also the most boring. There is so much nitty gritty detail on accounting – not my favourite topic. Level 3 is very focused towards asset/portfolio management. There is lots of in depth information about how to look at asset portfolios, how to choose between different asset classes and how to manage other people’s money.  HOW COULD THE CFA HELP YOU? 1. It will stand out on your résumé/CV The CFA qualification is well regarded because its modules are highly relevant to different areas of banking and because CFA Institute only allows the best 35-45% to pass any sitting. 2. Your chances of getting invited to interviews may rise Case in point: one of my colleagues did his first degree in Lebanon followed by a Master’s degree at a good UK university. When it came to looking for a job, he says he didn’t get a single response after sending out his résumé/CV so he decided to sign up for CFA Level 1. When he sent his résumé/CV out again he started getting interview invitations. He’s one of the best derivative salespeople I know so it just goes to show that banks can have trouble sifting through the many applications. 3. It may help you to decide where in an investment bank you would best fit Some bankers think the CFA qualification looks a lot better if you did it whilst you were working rather than when you were in university or looking for a job; however, I would argue that it adds a lot of value to your résumé/CV no matter when you do it. It’s not easy. 4. Your chances of ever becoming unemployed (apparently) fall Of the 100,000 current full CFA Charterholders globally (i.e. people who completed and passed CFA exams 1, 2 and 3) and according to the CFA Institute’s own figures only 4% of them are unemployed at any time. You can read a full piece on this on eFinancialCareers.  DO YOU HAVE TO TAKE A TAUGHT COURSE TO PASS THE CFA? I didn’t and I still passed all 3 levels the first time. For me, paying someone to teach me would have been a big waste of dosh. When I am around other people I usually want to chat. For the same reason, I also didn’t join any study groups. What was my strategy? Time was limited. I didn’t read the CFA’s own materials, they’re too thick. I ordered self-study materials (five books, Audio CDs, QuickSheets and Practice exams) from Schweser. I studied properly on weekends (both days); during the week I listened to the audio CDs on my way into work. I was always too tired to do any revision after work. I took exactly one week off prior to each exam. By this time, I had been through all the study material once. Each time, I created a schedule to ensure this was the case. So what did I do in this one week? Exam practice! One exam per day. As I went through the practice exams, the areas I needed to work on jumped out at me, so I re-read just these modules. What about my social life? What social life? I killed it. I went out to dinner like a couple of times per month. However, when the CFA was over ‘freedom’ felt so much sweeter. I wrote the last exam in Jun-2008 but even today, four years later, the idea of combining a full-time job with the CFA still gives me the hibby jibbies.

50 Comments

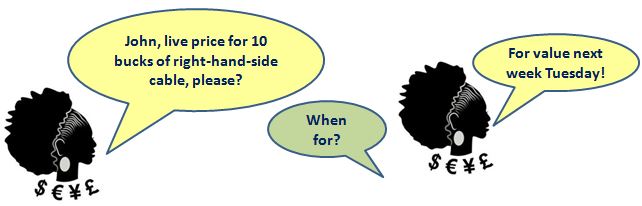

by Girl Banker® Listen to the iTunes podcast instead. Simple answer: university. I get asked this question time and time again by prospective investment bankers. Should I choose this university or this other one? I know this university is lower in the league tables but the course that I have been accepted onto is more closely related to finance - that will make my chances of getting into an investment bank higher, right? As I have mentioned before, investment banking is not a vocational career: you do not need to study finance in order to get into i-banking. Why? Because whatever desk you land on in an investment bank, the required knowledge will be so specific and so practical that your university will not have covered all or most of it. Importantly, it is all stuff that can be quickly learnt on the job. Certainly within about 18 months you can go from knowing nothing about finance to being very proficient. Indeed, you can graduate with a finance-related degree and still struggle to learn all the on-the-job stuff. People who have come from a non-finance background frequently over-compensate with weekend work and post work-hours reading. Whatever your degree, even if it's finance-related, you should be doing extra reading after work (that is, if you get home at a 'decent' hour) and during weekends. Why does the university matter so much? Investment bankers ultimately want to hire the smartest people that they can. It impresses clients and the quality of work produced by smart people is higher. Like it or not, the university system is seen as a sorting ground: the crème de la crème get into the best universities. This is why investment banks tend to have hiring programs at the top universities and nothing at the lower tier ones. If, unfortunately, you didn't manage to get into the best universities do not despair. Apply directly to investment banks and differentiate yourself with your extra curricular activities. Any questions? by Girl Banker® When you see an exchange rate on a trading screen there will be two prices: one for buying a currency and one for selling it.  Example exchange rates: GBPUSD: 1.6000 / 1.7000 (the mid-point = 1.6500) EURUSD: 1.2900 / 1.3000 (the mid-point = 1.2950) EURGBP: 0.8000 / 0.8100 (the mid-point = 0.8050) First, understand what the ‘base' is: For simplicity, I will use the mid-point of the above exchange rates to explain the base. When you see GBPUSD = 1.6500, it means £1 buys or sells $1.6500. GBP is the base. The currency that you are buying or selling “1” of is the base. If EURUSD = 1.2950, it means that €1 buys or sells $1.2950; EUR is the base. If EURGBP = 0.8050, it means that €1 buys or sells £0.8050; EUR is the base. What’s up with this notation?

In text books you will normally see USD per GBP or USD/GBP and written like this it is easy to see that GBP is the base. However, all trading screens will show this relationship as GBPUSD. You might be thinking, I could never get used to this, but trust me, you will get used to the notation in no time at all. Once you understand the base you will know whether you are on the right or the left hand side of an FX transaction: If you - as the client - are buying the base, you are on the right hand side (RHS). So, for GBPUSD: 1.6000 / 1.7000 If you - as the client - want to buy GBP and sell USD you are on the RHS so you get the price that you see on the right (the higher price), 1.7000. If you want to buy GBP100,000, you would need to pay USD170,000. If you - as the client - are selling the base, you are on the left hand side (LHS). So, for GBPUSD: 1.6000 / 1.7000 If you want to sell GBP and buy USD you are on the LHS so you get the price that you see on the left (the lower price), 1.6000. If you want to sell GBP100,000, you would receive USD160,000. So, you receive USD10,000 less when you sell GBP than when you buy GBP. The difference in price between buying and selling exists because the trader needs to make money to cover the risk involved in trading as well as to make a profit. What does the request in the picture at the top mean? “Cable” is FX markets lingo for the exchange rate between GBP and USD, GBPUSD. “10 bucks” is markets lingo for USD10 million. So, if you hear, “John, live price for 10 bucks of right-hand-side cable value next Tuesday please?” John (the trader) is being asked to provide a price to a client that is selling USD10 million and buying GBP next week Tuesday. A live price is one that the client might accept and transact on. The opposite would be an “indicative”. If a client just wants an indication, it doesn’t have to be as accurate. We’ll chat more about live prices and indications in a later blog. To become an investment banker, you will need to know a little about FX. by Girl Banker® Listen to the iTunes podcast instead. What, you googled me? I was aghast when a fellow intern went home and googled everyone he wanted to know more about. Armed with that knowledge, he came to day 2 of a training session asking personal questions. When he started asking me stuff about my family I felt violated; that was 2004.  Today, you should expect to be googled by your employer. Information is power and the more an employer can find out about you the better equipped they are to determine whether or not you fit in with the investment bank’s culture. Your silly tweets could be the reason no one is inviting you for an interview. It may well have been funny when you were sharing it but it’s going to be a lot less humorous when all your friends are hooked up with a cushy job and you’re not. The headline test – before you post anything think: “Would I be proud to see this shared on the front cover of The Wall Street Journal or The Financial Times?

Anger backtrack – if you’re angry, annoyed or irritated do not tweet, blog or post anything. Feel free to rant and rave about it in your personal word processor but leave it be until you are not angry and you’ll find that it was going to be one of those posts you later regretted. De-connect – if you tweet a lot of random stuff, do not connect your twitter to your LinkedIn. You know employers and headhunters officially trawl LinkedIn profiles to find out stuff, right? Close up – so you’re mr or ms popular: you’re the entertainment organizer at your school or university. Good for you, but that doesn’t mean you need to have an open Facebook profile. If people are actually interested in what you have to say they will friend you or subscribe to your public tweets. Go through your personal info and carefully select what is viewable by the public. It should only be stuff that adds positive value to your employability. Choose your friends carefully – Facebook didn’t always have the subscription button so people used to accept friends willy nilly. Personally, I don’t friend anyone that I don’t actually know. Decide what criteria people need to satisfy to be your “friend” on Facebook and only friend those. Everyone else can subscribe to your public posts. The funny test – the biggest temptation is to share stuff that makes us laugh. Once you’ve had a good laugh you always want to share. Making people laugh makes them like us and everyone loves to be liked. Unfortunately, a lot of funny stuff is funny because it’s taking a stab at a certain segment of society. Before you share funny stuff, think about whether it makes you look like a misogynist, a racist, a homophobe, a pervert or whether it is persecuting a given religious group. I know a guy who had a nice job that he could have stayed in for years but ended up having to resign because he was sharing inappropriate material. Pseudonym – you don’t have to use your real name. Even if you use a real photo of yourself if you create a pseudonym you’re going to be hard to find with google searches. If you’re working under an alias you have a lot more leeway in terms of what you tweet and share, however, keep in mind that someone in the ‘inner circle’ could betray your confidence. Social networking is fun but we all get carried away sometimes and forget just how public cyberspace is. I am not that personal a person and I am happy to share a reasonable amount but I am extremely careful with what I post. Nonetheless I have experienced tweeter’s remorse and by the time I do, it’s already hit my LinkedIn and my Facebook because they are all connected. I not only have to delete the tweet but I have to rush and delete in all those other places also. If the post has already been shared by friends, it’s a losing battle. Be wise to your social network.  by Girl Banker To Become an Investment Banker is now available for sale on Amazon or off this website. All your questions on the application and interview process, possible interview questions and the dos and don'ts of banking have been fully answered in this book. Get your copy now. Please subscribe to receive info that will help you get into investment banking directly to your inbox AND you will get Chapter 1 of To Become an Investment Banker for FREE! by Girl Banker® Listen to the iTunes podcast instead. I get asked this question very frequently by people that want to become investment bankers. Investment banks hire candidates from all degree disciplines. Investment banking is not a vocational career like law or medicine where you actually need to study that subject to get a job in that field. Investment banks handle a very broad client base and because of that they like the people that they hire to reflect the diversity of that client base. Every team in an investment bank focuses on a very narrow field of finance and it is unlikely that any one degree will cover everything you need to know to function efficiently on a given team in an investment bank. Most of your learning will happen on the job. That said, the majority of investment bankers will have done finance-related degrees. Doing a finance-related degree shows that you do have an innate interest in finance so when you're asked, "Why do you want to be an investment banker?" You can point at your degree as one of the reasons.  Economics Economics is probably the best degree you can do to maximize your chances of getting into an investment bank. This is because it gives you a broad appreciation of how the economy works; it includes modules on finance and it develops quantitative skills. More than anything it also gives you practice in thinking up out-of-the-box solutions to random problems. Accounting Accounting is very specific. People who work in the capital markets section of an investment bank don't need to learn all that much about accounting. They need to understand financial reports and to be honest it doesn't take all that long to learn that. Corporate finance bankers (classical investment banking) do need highly developed accounting skills but not nearly as much as what an accountant needs to know. Corporate financiers also need to appreciate other areas of finance. Accounting does develop quantitative skills but does not provide as broad an appreciation of how the economy works at the macro- and micro- level like economics does.  Finance Like accounting, finance is very specific. Whilst a degree in finance will go much deeper than the financial modules in an economics degree you won't use most of that knowledge when you go into investment banking. The team you join will only be focusing on a very small segment of your finance degree and they will take that knowledge to a deeper level. E.g. You might learn about how an interest rate swap works on a finance degree but likely won't learn how to build different types of swap pricing models. Finance does develop quantitative skills but, again, does not provide as broad an appreciation of how the economy works at the macro- and micro- level like economics does. Business

Economics folk view people that do business as people who wanted to do economics but failed to get onto an economics degree....hmmm? Business is less quantitative than economics. It includes some accounting which would be useful on a classical investment banking team and it helps one to understand the concerns of people that run businesses a lot better. However, it won't tend to include any deep finance modules. Maths Develops analytical and of course, quantitative skills but much of that knowledge will not be applied in an investment bank unless you're a quant. However, I would personally rate maths as the second-best degree to do (after Economics) if you want to become an iBanker. If you're in the US you might want to double major in Economics and another finance-related subject. So, there you have it. You can do any degree that you want and still become an investment banker. I have met investment bankers that did Art History, Sports Science, Engineering and even Medicine and they turned out to become fabulous investment bankers. by Girl Banker® Listen to the iTunes podcast instead. It depends. If you have no investment banking work experience a hedge fund probably won't even look at you. Hedge funds prefer people to get trained up by the big investment banks before they hire them; they want someone who is more ready to add value. They are generally quite small operations and don't have training resources.  If you do have some good quality work experience in investment banking, then the chances of getting hired by one or the other are 50-50. You can always start your own hedge fund Have you heard of James Mai and Charlie Ledley? They started Cornwall Capital with USD110,000 whilst they were in their early 20s and made over USD100 million when the credit crunch happened because they bet against subprime securities. One might argue that they were lucky but this is only one of a string of astute option trades that reaped them great rewards. If you think you have a knack for the markets then making money out of trading is as easy as setting up a brokerage account and getting started! Please subscribe to receive info that will help you get into investment banking directly to your inbox AND you will get Chapter 1 of To Become an Investment Banker for FREE! by Girl Banker® Listen to the iTunes podcast instead. If you want to succeed in getting an investment banking job, you need to stay up-to-date with the news. There is a lot of free news out there.  Twitter For very current updates, follow respectable news providers on Twitter. I suggest starting off with: @BloombergNews, @dealbook, @Reuters, @WSJ, @zerohedge and @GirlBanker. Have a look at who each of these Tweeters follows and decide whether you want to add those news providers to your own list. Ensure that you yourself tweet responsibly! Free newspaper

If you are in London, try to get CITY A.M., a free and condensed version of current financial news. They also have a free daily newsletter that summarizes their top headlines. Free RSS feeds and newspapers To get news sent to your inbox or RSS feed, sign-up to: The Wall Street Journal, The FT and CITY A.M. Paid-for news providers Each of the above will probably have news services, online or paper, that they charge for. If you are in university, check if your careers service or the students union has deals on leading newspapers. When I was in Cambridge the FT retailed at £1 per day and a little more for the weekend edition but I used to receive an entire week's series of papers for just £1 because the students' union had a good deal. It was all delivered to my pigeon hole too, you can't get better than that. Any suggestions that you want to add to the above? Please comment.

by Girl Banker® Some cold calls and cold emails do result in a job. If you can get hold of some quality contacts in an investment bank try putting in a call. 1. Be informed. Know at least the name and the team of the person that you are calling. Calling a random person is of no use to you.

2. Do your research.

LinkedIn is a great place to start. You can search for stuff e.g. "Head of equity trading at ABC Investment Bank" and you would be surprised what comes up. You might have to upgrade your subscription to see the details you need, however. If you Google "position and bank" the most amazing stuff comes up. You might find that the Head of HR comes up in YouTube videos and all sorts. In addition, ask any connections you have to the banking industry for people's names. 3. Don't waffle. Keep your call brief and to the point 4. Know your objective. You should have one or both of two objectives in mind: to get a job on the team you are calling or to use the influence of the person that you are calling to get your CV in front of someone else that can get you the job that you want 5. Perfect your timing. There is an appropriate time and day of the week to call. Read my blog on the best time to cold call or cold email an investment banker for more detail. 6. Know the banking cycle. If it is recruitment season, i.e. November to March and you are close to graduating your time is better spent applying through the standardized programs that the bank offers. As a student, the time you have available for job hunting is probably limited, use it wisely. If you are an experienced hire, your cold call will be more effective if you are in a job already but just want greener pastures.

7. Call strategy.

State your name. If you can, say how you came to know of the person. I found your details on LinkedIn is not a good line, you'll sound like a stalker. Mention a person that you know in common, it will help to keep them on the phone longer State what you need help with. If you have done decent research on the person you might have found out interesting things about them, think about how you can spin their experiences to make yourself sound like a knowledgeable person on their industry and their job function and why you would be a good addition to the team or bank. 8. Get a promise. Before you get off that phone try to get some kind of a promise e.g. permission to call again, a promise that they will forward your CV to someone and, highly unlikely - but an agreement to meet or be interviewed. If you're not getting anywhere say something like: you sound very busy, I am so sorry to have called you at an inconvenient time, can I call you back at a better time? If they say, yes, ask when. Get the person's email if you do not already have it! 9. Follow up. If you failed to get anywhere on the first call, see what a second call might unveil. A third call is also okay but if that doesn't prove successful, that's where you need to stop. People in banking know each other and if you're branded a stalker it's not going to bode well for your job hunt. 10. Don't feel discouraged. Cold calling will not amount to anything most of the time. With all the information people are bombarded with nowadays they forget calls almost as soon as they come off them. This does not necessarily say anything about your worth as an a employee. The job market is currently very tough. Brushing rejection off is very important. Don't dwell on failure, there's no point. Importantly, if you did manage to get your CV looked at they might have it flagged on file and if there is something they liked about you, they may think of you when an opening comes. Call or email? I would say if you can get hold of someone a call, followed by an email, is the best way around. To Become an Investment Banker is jammed with advice on the whole process. Don't forget to get a copy. |

Girl Banker®I created my investment banking blog in 2012 as soon as I resigned from i-banking & published my book, To Become An Investment Banker.

Initially published at girlbanker.com, all posts were later subsumed into my personal website under katsonga.com/GirlBanker. With 7 years of front office i-banking experience from Goldman Sachs and HSBC, in both classic IBD (corporate finance) and Derivatives (DCM / FICC), the aim of GirlBanker.com was to make it as straight-forward as possible to get into a top tier investment bank. I'm also a CFA survivor having passed all three levels on the first attempt within 18 months - the shortest time possible. Categories

All

Archives

August 2017

|

Heather Katsonga-Woodward, a massive personal finance fanatic.

** All views expressed are my own and not those of any employer, past or present. ** Please get professional advice before re-arranging your personal finances.

RSS Feed

RSS Feed