|

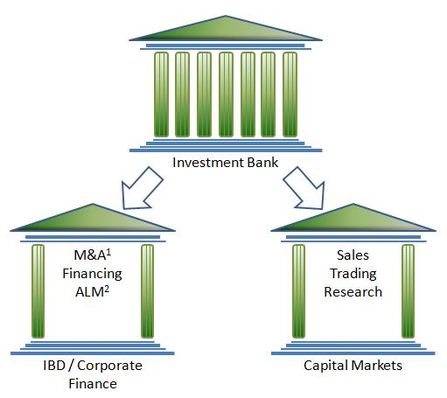

by Girl Banker Listen to the iTunes podcast instead. This is a possible investment banking interview question. Many investment banks are composed of two key divisions: 1. Corporate Finance. Frequently referred to as the (Classic) Investment Banking Division or simply (Classic) IBD in many banks. 2. Debt and Equity Capital Markets. This frequently includes Sales, Trading and Research functions. Many investment banks now also have large asset management divisions including private wealth management; however, this book focuses only on corporate finance and capital markets. The term ‘investment banking’ is sometimes used as a catch-all phrase for both corporate finance and the capital markets (sales and trading jobs) i.e. in referring to the industry as a whole or it could refer to the corporate finance division within an investment bank.

This is the quick answer. You can expand upon it by adding: Investment Banking 101 What is corporate finance or the investment banking division (IBD)? What are the capital markets/what is sales and trading? What is the difference between an investment bank and a commercial bank?

4 Comments

Stock Tips

11/8/2016 08:40:06 am

An impressive share! I’ve just forwarded this onto a coworker who has been conducting a little research on this. And he in fact bought me breakfast due to the fact that I stumbled upon it for him… lol. So allow me to reword this…. Thanks for the meal!! But yeah, thanks for spending the time to talk about this matter here on your web page.

Reply

Heather as "Girl Banker"

11/8/2016 08:41:17 am

Always happy to provide lunch! I hope you both purchase a copy of the book!

Reply

Ankit

11/8/2016 08:42:50 am

Hello Girl Banker . I wanna ask that i have sucessfully completed 2 levels of CFA . And now iam thinking of CMT ( chartered market technician) will it be good combination for me to be an investment banker .

Reply

30/4/2019 01:54:35 pm

Well, investment banking is a key division of the bank. It serves different corporations by providing underwriting financial raising, and M&A consultative services. An investment bank basically acts as an intermediary between speculators and corporations. An investment banker is a professional who manages the merger and acquisition process from start to finish. I would like to tell that investment banking is a very special segment of banking operation which can help new ventures to go public. Thanks for sharing this handy enlightenment.

Reply

Leave a Reply. |

Girl Banker®I created my investment banking blog in 2012 as soon as I resigned from i-banking & published my book, To Become An Investment Banker.

Initially published at girlbanker.com, all posts were later subsumed into my personal website under katsonga.com/GirlBanker. With 7 years of front office i-banking experience from Goldman Sachs and HSBC, in both classic IBD (corporate finance) and Derivatives (DCM / FICC), the aim of GirlBanker.com was to make it as straight-forward as possible to get into a top tier investment bank. I'm also a CFA survivor having passed all three levels on the first attempt within 18 months - the shortest time possible. Categories

All

Archives

August 2017

|

Heather Katsonga-Woodward, a massive personal finance fanatic.

** All views expressed are my own and not those of any employer, past or present. ** Please get professional advice before re-arranging your personal finances.

RSS Feed

RSS Feed