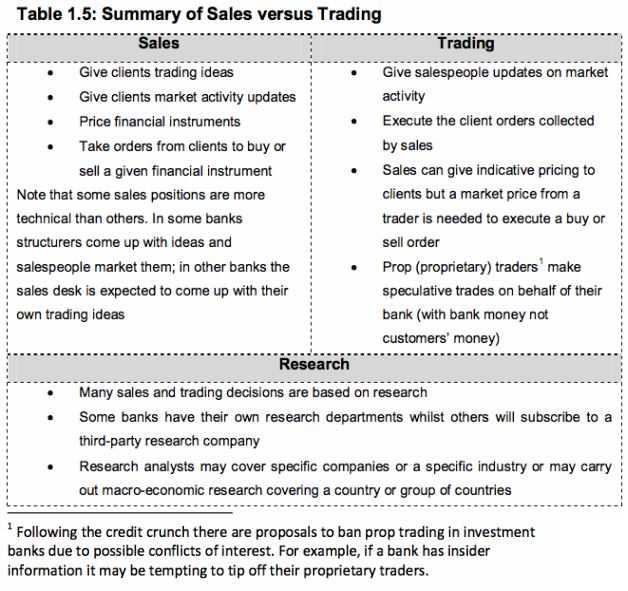

by Girl Banker Listen to the iTunes podcast instead. This is a very likely interview question. The purpose of a capital markets division is to provide a range of financial products to investors and companies. The sales force specializes by product and will be the first point of contact for clients. Any buy or sell orders are passed on from sales to a trader, who executes and manages the risk associated with such a purchase or sale. Many traditionally advice-only investment banks have incorporated capital markets activities to their offering because they wanted to offer a fuller suite of products to their clients. Excerpt from To Become an Investment Banker by Heather Katsonga-Woodward. The capital markets tend to be less hierarchical than corporate finance. Why?

Some view capital markets as more meritocratic than corporate finance. Why?

Please see these related interview questions: What is corporate finance or the investment banking division (IBD)? What is the difference between an investment bank and a commercial bank?

3 Comments

Bruce

11/8/2016 09:50:42 am

I was the senior risk Arbitrage trader for 30 years at GSCO. Our area was comprised of tradiing and reserch arms. We were located centrally in the Equities trading room.

Reply

Heather as "Girl Banker"

11/8/2016 09:51:11 am

Thanks for the comment Bruce. It's very insightful. GB

Reply

mahenra

11/8/2016 09:51:37 am

how can i get into investment banking sales ?

Reply

Leave a Reply. |

Girl Banker®I created my investment banking blog in 2012 as soon as I resigned from i-banking & published my book, To Become An Investment Banker.

Initially published at girlbanker.com, all posts were later subsumed into my personal website under katsonga.com/GirlBanker. With 7 years of front office i-banking experience from Goldman Sachs and HSBC, in both classic IBD (corporate finance) and Derivatives (DCM / FICC), the aim of GirlBanker.com was to make it as straight-forward as possible to get into a top tier investment bank. I'm also a CFA survivor having passed all three levels on the first attempt within 18 months - the shortest time possible. Categories

All

Archives

August 2017

|

Heather Katsonga-Woodward, a massive personal finance fanatic.

** All views expressed are my own and not those of any employer, past or present. ** Please get professional advice before re-arranging your personal finances.

RSS Feed

RSS Feed