|

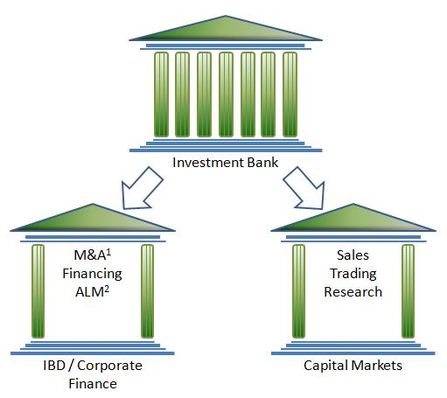

by Girl Banker Listen to the iTunes podcast instead. This is a possible investment banking interview question. Many investment banks are composed of two key divisions: 1. Corporate Finance. Frequently referred to as the (Classic) Investment Banking Division or simply (Classic) IBD in many banks. 2. Debt and Equity Capital Markets. This frequently includes Sales, Trading and Research functions. Many investment banks now also have large asset management divisions including private wealth management; however, this book focuses only on corporate finance and capital markets. The term ‘investment banking’ is sometimes used as a catch-all phrase for both corporate finance and the capital markets (sales and trading jobs) i.e. in referring to the industry as a whole or it could refer to the corporate finance division within an investment bank.

This is the quick answer. You can expand upon it by adding: Investment Banking 101 What is corporate finance or the investment banking division (IBD)? What are the capital markets/what is sales and trading? What is the difference between an investment bank and a commercial bank?

4 Comments

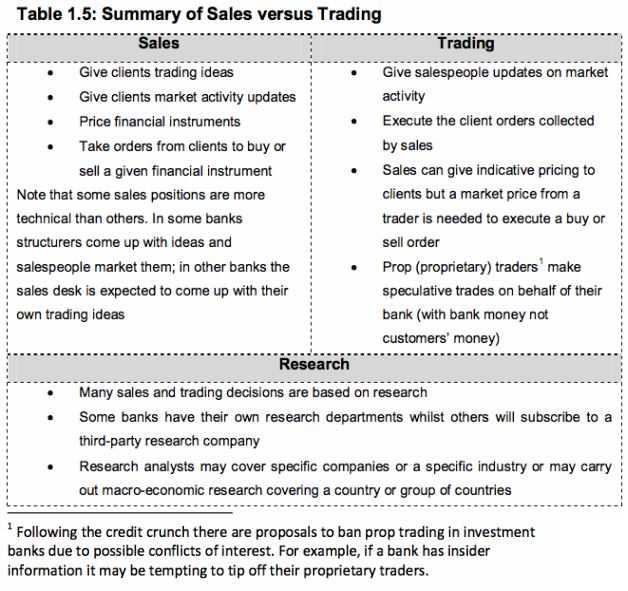

by Girl Banker Listen to the iTunes podcast instead. This is a very likely interview question. The purpose of a capital markets division is to provide a range of financial products to investors and companies. The sales force specializes by product and will be the first point of contact for clients. Any buy or sell orders are passed on from sales to a trader, who executes and manages the risk associated with such a purchase or sale. Many traditionally advice-only investment banks have incorporated capital markets activities to their offering because they wanted to offer a fuller suite of products to their clients. Excerpt from To Become an Investment Banker by Heather Katsonga-Woodward. The capital markets tend to be less hierarchical than corporate finance. Why?

Some view capital markets as more meritocratic than corporate finance. Why?

Please see these related interview questions: What is corporate finance or the investment banking division (IBD)? What is the difference between an investment bank and a commercial bank? by Girl Banker Simon Dixon got into investment banking via a non-standard route. Hear what he has to say.  by Girl Banker Listen to the iTunes podcast instead. This is a possible interview question. You know, I find it surprising that some people come to interview for a role in corporate finance but they don't really understand the structure of a corporate finance departrment. So below, I give you a brief overview. I go into more depth in To Become an Investment Banker but the below should still give you a good idea. Within corporate finance, you will find two key categories of bankers: 1. Mergers & Acquisitions (M&A) bankers: provide strategic and valuation advice on mergers, acquisitions and company restructurings: o Buy-side: advise a company that wants to buy another company o Sell-side: advise a company on selling its assets or its entire operation (divestments) o Defense advisory: advise a company on how it can protect itself from a hostile takeover 2. Financing bankers: provide advice on raising money (using equity, debt or some combination thereof); they also provide advice on managing any risks associated with these instruments. Corporate finance tends to be very hierarchical compared to the capital markets. Why?

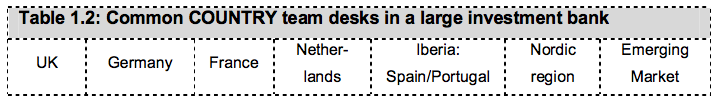

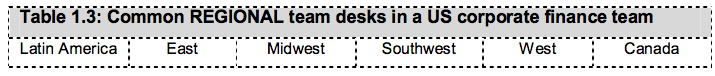

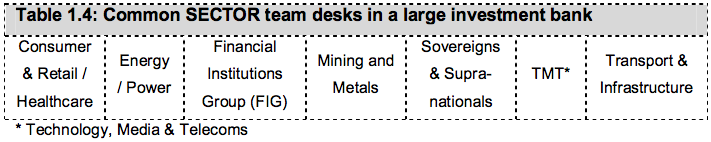

People working in corporate finance normally specialize according to a country team or sector: It’s important to have country teams because local, country specific knowledge, including language, may be necessary to do business, e.g. people working on a ‘German Team’ normally speak German and have good knowledge of German culture and regulations. o It is common for London offices to have a lot of country teams because of its central geographic location and its relatively friendly business environment compared to Europe. o Economies of scale also mean it’s cheaper to service some European clients from London because the client base in that country is too small for a dedicated office. Regional teams that may be found in a US based corporate finance team: It’s important to have sector teams because some industries have so much sector-specific knowledge that it would be difficult or confusing for someone to work across too many different sectors. Different banks will have a slightly different variation on the above sector themes, e.g. Mining and Metals in one bank may be called Natural Resources in another. Boutique investment banks may focus only on one sector.

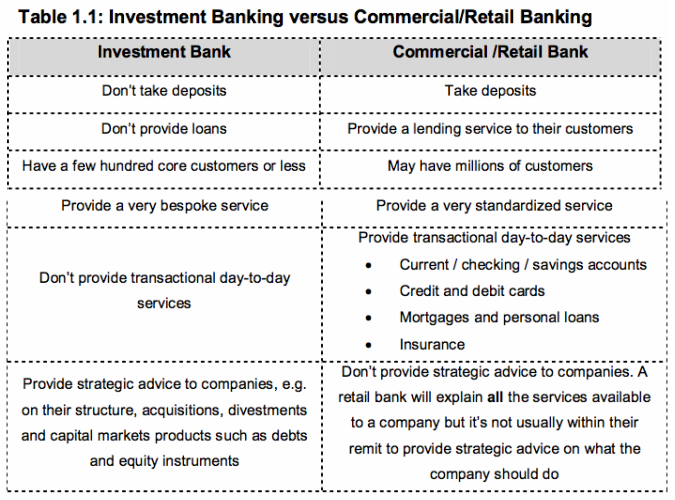

Finally, remember that when people refer to "investment banking" they could either be referring to the corporate finance division or to the industry as a whole. The industry as a whole includes the capital markets, i.e. sales and trading.  by Girl Banker When it comes to including women in their business, some investment banks are more serious than others; RBS is on the more serious side. I just met up with the Jessica Chu the Global Director of Diversity and Inclusion for Markets and International Banking (M&IB) at RBS; she explained their current views on women in banking and all the initiatives that they have in place to try to reach 50:50 at the graduate level. This is a hard goal to achieve. For one thing, very few women apply. In the 5 years that I spent on a derivatives desk, I can only think of a handful of women ever applying whilst we were inundated with job requests from guys. Indeed, the current trend across the industry is that a lot of women might come in but as they reach the Vice President (VP) level their numbers start declining rapidly. The reasons are manifold but a key one is obviously having children and going for a lifestyle that allows for more flexibility to fit in childcare. To cater to the problem of retaining and motivating women, RBS has created an internal network, Compass, with the support of M&IB CEO John Hourican. The network aims to support women through their career by meeting, sharing ideas and implementing those strategies that foster a flexible and inclusive workplace. What's more, RBS are currently contemplating donating copies of To Become an Investment Banker to target schools. You can read more on how RBS is investing in women here and you can apply to RBS here. by Girl Banker Listen to the iTunes podcast instead. This could easily be asked as an interview question. To help you understand investment banking, it’s best to differentiate it from the type of banking that you have experience with: commercial or retail banking – the banks that you see on the street. The bank where you maintain your current (UK), checking (USA) or savings account is a commercial or retail bank. Some investment banks have a commercial banking unit, others do not. Example

A Loan Structuring team in an investment bank can give a company advice on how to structure a loan; however, even if the investment bank has a commercial banking unit, it does not necessarily follow that they will provide that loan. When the loan is fully structured (i.e. the most achievable terms are determined) the borrowing company can show it to a variety of banks and select the bank that commits to the best terms. This may not be the structuring bank. The structuring bank gets a fee for their advice and the loan provider receives whatever fees they are due for actually providing the loan. Of course, the lending arm of the structuring bank is likely to provide the best lending terms in many cases as they can account for the fees received by their structuring team. That is, a bank providing several products to a client can afford to charge a little less for each product than would be the case if they were selling just one. by Girl Banker The annual motorexpo is on in Canary Wharf and because not everyone can make it, I took some pictures for you. Enjoy.

by Girl Banker

Sitting on your butt the whole day. I thought to write about this after reading Born to Run by Christopher McDougall. I was the type of girl who found every excuse not to go to PE (physical education) in high school. By the time I got to A-level, I had convinced the school's director of studies that as I was reading four A-levels rather than the standard three, I should be permitted to attend PE only when my schedule allowed. He agreed. I was never seen on the sports field again. I really underrated the value of moving about. That said, even when I studied, I wasn't sat still for more than an hour or two at a time. After that, I would go to find my friends and we would hang out and have a laugh. I was slim and sexy; 'why would you want to run and sweat when you're body's already got it going on?', I thought. I only started to appreciate the need for exercise when I came to cold wet England. For the first time, the weather was so poor that going out for a walk did not appeal in any way, shape or form. And the food? God knows what they put in it because whereas I ate to my heart's content and didn't gain weight in Malawi, just looking at English food added an inch to my waist. Then came the banking years. Now it got really bad. I was not only gaining weight but my back was having aches and pains that it had hitherto not encountered. Sitting at your desk is painful. By year five of banking, I couldn't sit at my desk for more than twenty minutes without having to stand up to give my back a rest. Yes, standing was resting and sitting culminated in a sore back. When I was deciding to go into banking, I didn't pay any consideration to the health impacts at all.

Don't want to go into banking anymore?

Hold on, this problem is not unique to banking. All sedentary jobs will have the same impact on you. Lucky are those that get to move about a lot as part of their occupation: doctors especially. People were designed to run. As hunter-gatherers all men and women were running all the time. "Human bodies are designed for performance and the human brain for efficiency" (Born to Run). The brain is always searching for ways to conserve energy and in our days as hunter-gatherers it was mostly correct: if you saw an opportunity to sit down you took it because there was no telling when you would get to sit down again. However, now, whilst your body might say run, you brain still says sit, conserve your energy for when you need to run. The result? The brain seems to be winning and we're literally sitting (and eating) ourselves to death. Half of today's diseases - obesity, high BP, various cancers - were unheard of in the hunter-gatherer days. As you devise your strategy for getting into banking devise your physical regimen too. Change your diet, perhaps. Cut out processed foods and make a dedicated commitment to visiting a gym: your health and longevity depend on it. How can you be more active at your desk? 1. Stand when you are on the phone 2. Keep weights at your desk and use them when you're on the phone 3. Sit on a balancing ball, it forces you to workout your core 4. Walk up the stairs or the escalator 5. Stretch whenever you feel stiff. I did this a lot. 6. Walk to people instead of emailing them. You might save time too. It' crazy how I used to email people who were sat two rows away just because I couldn't be bothered to walk over. 7. Request a stand-up desk or an ergonomic chair. Stand up desks are very expensive but I have seen people be allowed them due to unique circumstances. The desk has a button that allows you to lift the whole thing up, computer and all so you can work on two feet. Stand up desk are the future, I truly think they'll will help with health issues. 8. Track your weight using the Fat Creep™ app on iPhone or Android to ensure your weight stays within a desirable range. It's designed by yours truly.

Read my brief review of Born to Run here.

by Girl Banker® Listen to the iTunes podcast instead. It is true that investment banks recruit a disproportionate number of people from the very top universities. Many people believe this is totally unfair, however, consider why it might make sense: Do you agree? All businesses want to hire the smartest people they can. No one can argue with this. If you had a business, you would obviously want it to succeed and it makes sense that hiring top performers will increase the likelihood of achieving such success. Do you agree? The entry requirements for top performing universities are extremely high, on average. In addition to having supersonic grades, the best universities want to see a dashing set of extracurricular activities especially in sport, drama or music. I say, on average, because we all know that some wealthy people get in regardless of mediocre grades due to their connections and "donations". That said, their hefty donations go a long way towards improving labs and other resources. Do you agree? Most people have to work very hard to get top grades. Some people seem to do no work at all, enter an exam room and ace it. Good for them. The vast majority of us aren't so lucky. I am going to use myself as an example here: I worked my African butt off to get into Cambridge. I had no reason to expect to get in but all that I knew is that I really wanted to go there. It wasn't that I did a stupid number of hours of work, I just structured my time extremely well. Let me explain. I went to a Malawian boarding school at the age of 11 and for the next 6 years, every single term, I wrote a study timetable and I more or less stuck to it. At times I even missed the weekend's entertainment to catch up on things I didn't manage to cover. By the time I reached GCSE, I was going through the entire curriculum for every subject every two weeks. In the 6 years that I was in high school my grades went from strength to strength. I improved every single year just because I had this blazing desire to go to the best university in the UK. Did anyone make fun of me? Of course they did but with me, you always get as good as you give so it wasn't much of a problem. A friend of mine put it best when I was telling her about something I was working on, she said, "Heather I completely believe that you'll do what you are saying because when we were in high school and you said you wanted to go to Cambridge, we all thought you were mad!"  Does this then follow? People who work hard get top grades, people who get top grades get into top schools, people who get into top schools get the best paying jobs? It should but it doesn't necessarily. Some people can work as hard as they like but they simply have more obstacles to jump over - a lack of resources (e.g. a bad school, no room of your own to work in, no money for good books or private tutors) or they're surrounded by teachers (and parents) that don't believe in them. State secondary schools need to find a way to help people with obstacles achieve better grades. Yes, a disproportionate number of students in top universities come from private schools. And a disproportionate number of those are from wealthy households. The cornucopia of resources in fee-paying institutions means pupils have less of a challenge to achieve fantastic grades and as such they find it easier to get to the top. In conclusion, I didn't set out to discuss the need for a more egalitarian school system. My point is that any business, investment banks included, is justified in using the university system to help them sift through candidates. No matter what your background is, if you were born in a developed country your chances are probably way better than mine were coming from one of the 10 poorest countries in the world. I never thought about what I didn't have, ever, I only thought about what I wanted and I focused all my energy on that goal. I didn't care about looking uncool or geeky, all I knew is that even if I failed I wanted to have tried my very best. Try your best and you might surprise even yourself. by Girl Banker® Listen to the iTunes podcast instead. Having worked in both corporate finance and in the capital markets, I think the skill set needed is slightly different in each. That said, there are some universal requirements: 1. Learn quickly - no one is going to tolerate persistent mistakes; 2. Be personable - so that people enjoy working with you; 3. Have charisma - so that clients prefer you over your competitors. Let's look at the two divisions in turn:  CAPITAL MARKETS 1. Analytical + super assimilator of information Whether you're a trader or a salesperson, you need to take in a lot of information and process it to either relay to clients or to make a trade. A customer can call at anytime to ask random questions like, "What's 6-month LIBOR been doing in the last two weeks and where do you expect it to go now? Is 3-month LIBOR doing the same? Is that your bank's take or your personal opinion?" Trust me, there will be days when you get asked a question so random that you have to blag your way off the phone to find the answer!! 2. Multi-tasker If you like to work on something and finish it off completely before moving onto something else, you'll hate the capital markets. You are always working on several jobs at the same time and just as you start getting into the project at hand, you'll need to move onto a more urgent task. 3. Thick-skinned It's a stressful environment. People will swear and shout at you - so what? - dust yourself off and forget about it. If you're very emotional you'll struggle. Don't take things personally. It's entirely normal to have a shouting match one minute and be laughing with that same person five minutes later.  CORPORATE FINANCE 1. Analytical + highly structured Model building requires you to be decent with numbers and to think in a highly structured way. More often than not you will not be building a model from scratch but the better your understanding of financial statements, accounting rules and how the different line items relate to each other, the quicker you'll be able to sort out any modelling problems. 2. Diplomatic All corporate finance deals are based on a team unlike in the markets (sales & trading) where once you have learnt enough you often work on your own. You will, of course, want your contribution to be valued but if you are aggressive about it you will turn your peers off. With tact and diplomacy your individual contribution will shine through without putting others off. 3. Low sleep requirements The long hours you hear about in banking are not just rumours. You will work very long hours and what's more, you will not only get used to it but you'll start to think of it as "normal". A year into my role as an analyst at Goldman Sachs I got home around at 5:00 p.m. one day and I actually felt strange. I had become so accustomed to my long day that I thought, "What do people do with all this time?" I kid you not. Fun fact: did you know that the longest recorded period without sleep is a gobsmacking 33 years, endured by Thai Ngoc, a 64-year old Vietnamese man. Apparently, after an illness in the 1970s he lost his need for sleep!?! Jealous? Yes I am. I need 8 hours of shuteye to feel normal. I can get by on 7 but less than that on a regular basis and you don't want to be near me! Jokes aside, the hours are long and the less sleep you need, the easier life will be for you. |

Girl Banker®I created my investment banking blog in 2012 as soon as I resigned from i-banking & published my book, To Become An Investment Banker.

Initially published at girlbanker.com, all posts were later subsumed into my personal website under katsonga.com/GirlBanker. With 7 years of front office i-banking experience from Goldman Sachs and HSBC, in both classic IBD (corporate finance) and Derivatives (DCM / FICC), the aim of GirlBanker.com was to make it as straight-forward as possible to get into a top tier investment bank. I'm also a CFA survivor having passed all three levels on the first attempt within 18 months - the shortest time possible. Categories

All

Archives

August 2017

|

Heather Katsonga-Woodward, a massive personal finance fanatic.

** All views expressed are my own and not those of any employer, past or present. ** Please get professional advice before re-arranging your personal finances.

RSS Feed

RSS Feed