|

by Girl Banker Listen to the iTunes podcast instead. As an eager banker-wannabe whenever I heard the term "back-office" I imagined a category of overworked and underpaid workers toiling away in a windowless room at the back of a building! Personally, I find the term a little derogatory. In banking, the terms: back, middle and front office refer to how closely connected you are to the money train.  Front office Front office workers make the money. Their actions lead directly to more or less money being added to the bottom line of the bank. Front office workers will earn the highest bonuses because they essentially make the money and as such expect a higher cut. In theory, the more money you earn for the bank, the higher your expected bonus is. In a recession, bonus expectations will be lower overall but front office workers will still expect more than those further down the chain. Front office does not have to be client-facing e.g. traders usually do not see clients but if you are client-facing you will need to look smart and dress well for meetings. If you hate suits, this is not the best job for you! Front office includes:

Middle office Middle office workers are an integral part of making money. They directly support a deal but their actions have to be instigated by a front-office worker. A middle office worker cannot as a result of their own actions increase bank profits. Middle office includes:

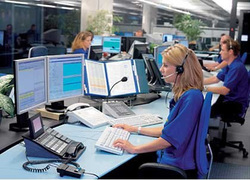

Back office Back office includes any process-orientated roles. An efficient back office is vital because if clients don't get statements and confirmations on time they will hate your bank and could, on that basis, exclude your bank from deals. How can back office impact front office deals? Imagine you work on a company's small corporate finance team; you have ten bank relationships to manage. One bank consistently sends statements late. The statements frequently have errors and you have to call many times to get issues sorted - if it can be helped you're going to avoid doing business with that bank, aren't you? Back office includes:

So there you have it. When you're applying for jobs it can be a little challenging to decipher whether a role is front-office or not. This is especially true if you're applying off-cycle to a bank that has both a retail bank and an investment bank. Use the above guidelines to help you decide how close you are to the money train. You want to get as close as possible.

16 Comments

Hanuma Reddy

11/8/2016 07:40:07 am

Nice Expalnation..now i am clear about it..

Reply

Heather as "Girl Banker"

11/8/2016 07:40:47 am

Thanks!

Reply

dalu

11/8/2016 07:41:51 am

All the way from nigeria..I love the clear explaination. Good job

Reply

Heather as "Girl Banker"

11/8/2016 07:42:30 am

Thanks ! :)

Reply

ddb

11/8/2016 07:43:01 am

Where does Finance/Accounting fit in?

Reply

Heather as "Girl Banker"

11/8/2016 07:43:25 am

Middle office

Reply

Heather as "Girl Banker"

11/8/2016 07:44:29 am

p.s. some people will call finance and accounting back office because they don't contribute to deals in any way; however, that is not strictly correct.

NewToBanking

11/8/2016 07:45:04 am

My apologies...It is a fairly good article.. But I have to say (to DDB's question date Jun-09-2013... "Where does Finance/Accounting fit in?").. The answer is not Middle Office.. Its Back Office... Back office - "Administration and support personnel in a financial services company. They carry out functions like settlements, clearances, record maintenance, regulatory compliance, and "ACCOUNTING".-- Investopedia.

Reply

Manny

11/8/2016 07:46:20 am

Hi Heather, please where does IB risk/Credit Risk fit in? Front or Back office??

Reply

Heather as "Girl Banker"

11/8/2016 07:46:44 am

100% middle office.

Reply

michael

11/8/2016 07:47:10 am

Great job with the explanation! thanks(:

Reply

SV

11/8/2016 07:47:33 am

If you are targetting a Front office posiiton, never ever a take a back or middle office position, hoping that one day that will take you into front office positions. That never happens. Once you have taken middle/back office role, industry immediately brand you as tier 2 person and that will back fire in your search towards front office role. Positions for Fron office always filled directly.

Reply

Anish

11/8/2016 07:47:59 am

I just read the article, can you tell me were does the process of executing the payment,receipts and transfer lies aswell as initiating the FX (not the actual movement).

Reply

sachin

11/8/2016 07:48:29 am

HI,

Reply

Paul

11/8/2016 07:48:53 am

Hey! I read on weekpedia that equity and research constitute part of FO roles.what can you say about it because these can't generate revenue.

Reply

Bill Young

11/8/2016 07:49:18 am

"They directly support a deal but their actions have to be instigated by a front-office worker"

Reply

Leave a Reply. |

Girl Banker®I created my investment banking blog in 2012 as soon as I resigned from i-banking & published my book, To Become An Investment Banker.

Initially published at girlbanker.com, all posts were later subsumed into my personal website under katsonga.com/GirlBanker. With 7 years of front office i-banking experience from Goldman Sachs and HSBC, in both classic IBD (corporate finance) and Derivatives (DCM / FICC), the aim of GirlBanker.com was to make it as straight-forward as possible to get into a top tier investment bank. I'm also a CFA survivor having passed all three levels on the first attempt within 18 months - the shortest time possible. Categories

All

Archives

August 2017

|

Heather Katsonga-Woodward, a massive personal finance fanatic.

** All views expressed are my own and not those of any employer, past or present. ** Please get professional advice before re-arranging your personal finances.

RSS Feed

RSS Feed