by Girl Banker Listen to the iTunes podcast instead. This is a possible interview question. You know, I find it surprising that some people come to interview for a role in corporate finance but they don't really understand the structure of a corporate finance departrment. So below, I give you a brief overview. I go into more depth in To Become an Investment Banker but the below should still give you a good idea. Within corporate finance, you will find two key categories of bankers: 1. Mergers & Acquisitions (M&A) bankers: provide strategic and valuation advice on mergers, acquisitions and company restructurings: o Buy-side: advise a company that wants to buy another company o Sell-side: advise a company on selling its assets or its entire operation (divestments) o Defense advisory: advise a company on how it can protect itself from a hostile takeover 2. Financing bankers: provide advice on raising money (using equity, debt or some combination thereof); they also provide advice on managing any risks associated with these instruments. Corporate finance tends to be very hierarchical compared to the capital markets. Why?

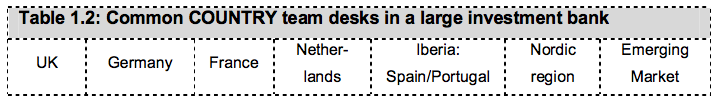

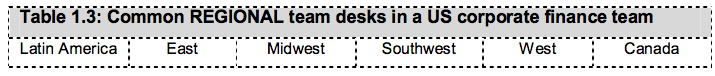

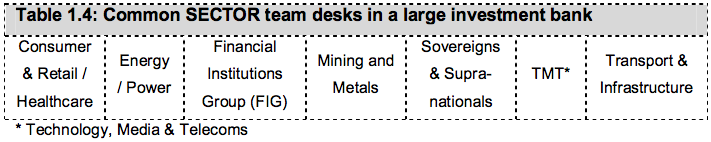

People working in corporate finance normally specialize according to a country team or sector: It’s important to have country teams because local, country specific knowledge, including language, may be necessary to do business, e.g. people working on a ‘German Team’ normally speak German and have good knowledge of German culture and regulations. o It is common for London offices to have a lot of country teams because of its central geographic location and its relatively friendly business environment compared to Europe. o Economies of scale also mean it’s cheaper to service some European clients from London because the client base in that country is too small for a dedicated office. Regional teams that may be found in a US based corporate finance team: It’s important to have sector teams because some industries have so much sector-specific knowledge that it would be difficult or confusing for someone to work across too many different sectors. Different banks will have a slightly different variation on the above sector themes, e.g. Mining and Metals in one bank may be called Natural Resources in another. Boutique investment banks may focus only on one sector.

Finally, remember that when people refer to "investment banking" they could either be referring to the corporate finance division or to the industry as a whole. The industry as a whole includes the capital markets, i.e. sales and trading.

1 Comment

1/5/2020 09:30:29 pm

if the most appropriate types of financing are secured, and finally, if it can determine the proper proportion between how much gets plowed back into operations versus how much will be distributed as profit, the firm will build higher value than firms that make poor decisions in these areas.

Reply

Leave a Reply. |

Girl Banker®I created my investment banking blog in 2012 as soon as I resigned from i-banking & published my book, To Become An Investment Banker.

Initially published at girlbanker.com, all posts were later subsumed into my personal website under katsonga.com/GirlBanker. With 7 years of front office i-banking experience from Goldman Sachs and HSBC, in both classic IBD (corporate finance) and Derivatives (DCM / FICC), the aim of GirlBanker.com was to make it as straight-forward as possible to get into a top tier investment bank. I'm also a CFA survivor having passed all three levels on the first attempt within 18 months - the shortest time possible. Categories

All

Archives

August 2017

|

Heather Katsonga-Woodward, a massive personal finance fanatic.

** All views expressed are my own and not those of any employer, past or present. ** Please get professional advice before re-arranging your personal finances.

RSS Feed

RSS Feed