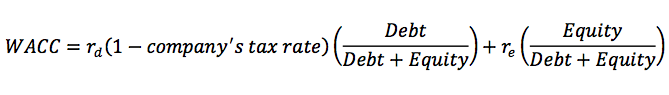

by Girl Banker Listen to the iTunes podcast instead. The cost of debt is very easy to calculate if the company has debt liabilities on its balance sheet. Because interest is tax deductible (in most countries) this tax benefit has to be subtracted from the cost of debt. Most companies do hold debt on their balance sheet so this is by far the most common route. If you were unfortunate enough to find yourself with a company that had completely no debt on its balance sheet, the next best route would be to use a proxy. A reasonable proxy would be the cost of debt of very similar companies. Hopefully you would have a sufficient sample of similar companies that have issued debt instruments recently from which to calculate such a proxy. If no similar companies were available then an assumption would have to be made in collaboration with your debt syndicate team based on the current economic environment. However, this would likely lead to your using a higher cost of debt than is necessary to keep your numbers realistic. It's not the best way of coming up with a cost of debt number but it would be the best you could do in the circumstances. As a reminder, this is the formula for WACC, the Weighted Average Cost of Capital: Where r(d) is the average cost of debt and r(e) is the cost of equity.

You might also like: What is WACC, the Weighted Average Cost of Capital? What is the Capital Asset Pricing Model, CAPM?

0 Comments

Leave a Reply. |

Girl Banker®I created my investment banking blog in 2012 as soon as I resigned from i-banking & published my book, To Become An Investment Banker.

Initially published at girlbanker.com, all posts were later subsumed into my personal website under katsonga.com/GirlBanker. With 7 years of front office i-banking experience from Goldman Sachs and HSBC, in both classic IBD (corporate finance) and Derivatives (DCM / FICC), the aim of GirlBanker.com was to make it as straight-forward as possible to get into a top tier investment bank. I'm also a CFA survivor having passed all three levels on the first attempt within 18 months - the shortest time possible. Categories

All

Archives

August 2017

|

Heather Katsonga-Woodward, a massive personal finance fanatic.

** All views expressed are my own and not those of any employer, past or present. ** Please get professional advice before re-arranging your personal finances.

RSS Feed

RSS Feed